General scheme for taxation of personal income tax and insurance premiums

The object of taxation on personal income tax is specified in Art.

209 of the Tax Code of the Russian Federation, and the breakdown of income is provided for in Art. 208 Tax Code of the Russian Federation. Also the legislator in Art. 217 of the code indicates income that is exempt from taxation. Accordingly, tax authorities look to these items to determine whether the payment will be taxable or not. This approach is prescribed in all explanatory letters, as well as court cases. The tax rate depends on whether the employee is a tax resident or not, as well as on the type of income. In connection with the termination of Federal Law 212-FZ of July 24, 2009 and the appearance in 2021 of a new chapter on insurance contributions in the Tax Code of the Russian Federation, most of the practice of considering disputes by courts and clarifications of departments have lost their relevance, as they refer to an ineffective law. However, the logic of reasoning set out in them can serve as the basis for understanding how the tax authority will treat a particular payment.

In Art. 420 of the Tax Code of the Russian Federation specifies payments subject to contributions, Art. 422 of the Code - cases in which contributions are not charged. The amount of contributions is determined by Articles 425, 427 - 429 of the Tax Code of the Russian Federation.

However, if everything were so simple, acts with additional assessments of taxes and contributions, as well as legal disputes, would not arise. Let's figure out whether it is necessary to pay personal income tax and calculate insurance premiums in the following situations.

Reimbursement for travel to work place

Compensation for travel to the place of work can be caused either by necessity (distance from populated areas, lack of public transport) or by the employer’s desire to improve working conditions.

And this circumstance directly affects the obligation to calculate personal income tax. In accordance with Art. 41 of the Tax Code of the Russian Federation, economic benefit is recognized as income. It can be expressed in cash or in kind. In Art. 210 of the Tax Code of the Russian Federation states that income in kind is taxed, and the base for calculating the tax is established as the market price of a similar product or service.

The key point in determining whether a benefit arises or not (and the tax itself) is the ability of the employee to independently get to the place of work.

In the event that an employee can arrive at his place of work by public transport, payment for organized transportation or compensation for travel will be subject to personal income tax.

This position is reflected in many letters from the Ministry of Finance of the Russian Federation, including letter dated October 12, 2011 No. 03-04-05/6-728. To calculate the tax, you will need to keep personalized records of employees who used the passage. Accordingly, if the organization is geographically remote from populated areas, there is no public transport, then the centralized delivery of workers to the place of work does not create economic benefits for the person, therefore, there is no subject to personal income tax (for example, letter of the Ministry of Finance of the Russian Federation dated April 21, 2014 No. 03-03- 06/1/18198).

The above-described practice of calculating personal income tax was in effect for quite a long time and was reflected in judicial acts. However, in 2021, two letters from the Ministry of Finance of the Russian Federation have already been issued, which do not consider the specifics of calculating personal income tax depending on the inaccessibility of personalized accounting, but indicate that personal income tax must be paid in any case (Letter of the Ministry of Finance of the Russian Federation dated April 30, 2019 No. 03-04- 06/32414).

Regarding the calculation of insurance premiums, the position is clear: such compensation or organized travel is subject to the calculation of insurance premiums. The list of payments not subject to contribution is named in Art. 422 of the Tax Code of the Russian Federation. Since the payments in question are not included in Art. 422 of the Tax Code of the Russian Federation, then compensation will be subject to contributions in accordance with the general procedure.

About taxes on personal income

Personal income tax is the main type of direct taxation. It is calculated as a percentage of the total income of individuals minus expenses (documented) in accordance with the provisions of the law.

Taxpayer is an individual. The purposes of taxation are divided into two broad categories:

- Individuals who act as tax residents of the Russian Federation (that is, are actually in Russia for at least 183 calendar days within 1 year).

- Persons who are not tax residents of the Russian Federation, however, receiving income in the territory of the state.

Income that is subject to personal income tax is:

Who is entitled to two pension payments and how to receive the bonus?

- from the sale of real estate that was owned for at least 36 months;

- from renting out an apartment/house;

- from funds received outside the Russian Federation;

- winnings;

- Other income.

But in addition to the listed income, personal income tax may be levied on pension payments, which is worth talking about in more detail.

Gifts for the employee and his children

Giving gifts is a common practice, and the gift can be either cash or material things.

As a rule, gifts can be dedicated to some official holiday (New Year, anniversary of the organization) or to the birthday of the employee himself. The main rule of donating property is gratuitousness. The essence of the gift is that ownership of the transferred property is transferred, and this has nothing to do with the employee’s performance of work duties, incentives or compensation of expenses, and does not depend on the length of service and position held. For tax purposes, a gift is recognized as income received in kind (regardless of whether it is money or an item). According to paragraph 1 of Art. 210 of the Tax Code of the Russian Federation, when calculating personal income tax, all income of the taxpayer is taken into account: in cash and in kind. That is, the gift is the employee’s income, from which the employer is obliged to withhold personal income tax. However, not every gift is subject to tax. In paragraph 28 of Art. 217 of the Tax Code of the Russian Federation states that gifts worth up to 4,000 rubles. are not taxed. This non-taxable amount is established for the calendar year. That is, several gifts can be issued during the year, and if their total value exceeds 4,000 rubles, then the tax will be calculated on the excess amount.

Insurance premiums are calculated in the case when the payment is made within the framework of labor or civil law relations (clause 4 of article 420 of the Tax Code of the Russian Federation). Under a gift agreement, property is transferred. Consequently, when donating, there is no object subject to insurance premiums. That is why, to confirm the fact of transfer of property, it is necessary to conclude a written gift agreement (regardless of the amount). Let us recall that the Civil Code of the Russian Federation provides for the obligation to draw up a gift agreement in writing in the case when the transferred amount exceeds 3,000 rubles. (Clause 2 of Article 574 of the Civil Code of the Russian Federation).

Another important point: in order for the gift not to be recognized as a way to evade insurance premiums and personal income tax, it must be paid to all employees of the organization in the same amount. A situation where a director receives a gift many times larger than an ordinary employee can lead to the gift being reclassified as incentive payments, that is, payments related to work responsibilities. This will entail additional contributions and taxes on the entire amount/value of the gift. This practice is contained in the Ruling of the Supreme Court of the Russian Federation dated September 10, 2014 No. 309-ES14-520.

Personal income tax on employee compensation (clarifications from the Ministry of Finance)

In accordance with the court decision, the organization reimburses the individual for the legal expenses incurred by him. Are the amounts of this compensation subject to personal income tax?

Paragraph 1 of Article 210 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation) establishes that when determining the tax base, all income of the taxpayer received by him, both in cash and in kind, is taken into account. In this case, income is recognized as an economic benefit in monetary or in-kind form, taken into account if it is possible to assess it and to the extent that such benefit can be assessed, and for individuals determined in accordance with Chapter 23 “Income Tax on Individuals” (Article 41 of the Tax Code of the Russian Federation).

As for the reimbursement of legal expenses, according to Part 1 of Article 98 of the Civil Procedure Code of the Russian Federation (hereinafter referred to as the Code of Civil Procedure of the Russian Federation), the court awards the party in whose favor the court decision was made to reimburse the other party for all legal expenses incurred in the case, except for the cases provided for in Part 2 Article 96 of the Code of Civil Procedure of the Russian Federation.

Clause 3 of Article 217 of the Tax Code of the Russian Federation establishes an exhaustive list of compensation payments established by the current legislation of the Russian Federation, legislative acts of the constituent entities of the Russian Federation, decisions of representative bodies of local government that are not subject to personal income tax.

Payments made by an organization as compensation for legal expenses incurred by an individual are not included in the above list. Consequently, such payments are subject to personal income tax in accordance with the generally established procedure.

An employee uses his car for business purposes, for which the organization pays him compensation. To what extent are the specified amounts of compensation exempt from personal income tax? Does it matter that an employee drives a car under a power of attorney?

All types of compensation payments established by the legislation of the Russian Federation, legislative acts of the constituent entities of the Russian Federation, decisions of representative bodies of local self-government (within the norms), related, in particular, to the performance of labor duties by the taxpayer (clause 3 of Article 217 of the Tax Code of the Russian Federation) are not subject to personal income tax.

Since Chapter 23 of the Tax Code of the Russian Federation does not contain compensation standards for the use of an employee’s personal property for official purposes and does not provide for the procedure for establishing them, one should be guided by the provisions of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation).

According to Article 188 of the Labor Code of the Russian Federation, when an employee uses personal property with the consent or knowledge of the employer and in his interests, the employee is paid compensation for the use, wear and tear (depreciation) of tools, personal vehicles, equipment and other technical means and materials belonging to the employee, as well as reimbursement of expenses, associated with their use. The amount of reimbursement of expenses is determined by agreement of the parties to the employment contract, expressed in writing.

Thus, the amounts of compensation payments, including reimbursement of expenses in connection with the use of the employee’s personal property in the interests of the employer when performing his job duties in accordance with the agreement of the parties to the employment contract, are subject to exemption from personal income tax. In this case, there must be: documents confirming that the property used is owned by the employee, calculations of compensation and papers confirming the actual use of the property in the interests of the employer, expenses for these purposes; documents confirming the amounts of expenses incurred in this regard.

Taking into account the provisions of Article 188 of the Labor Code of the Russian Federation, employee expenses associated with the use of exclusively personal property in the interests of the company are subject to reimbursement. The Labor Code of the Russian Federation does not provide for reimbursement by the employer of employee expenses related to the use of property that does not belong to him.

Since a vehicle driven by an individual under a power of attorney is not his personal property, the provisions of paragraph 3 of Article 217 of the Tax Code of the Russian Federation do not apply in this case. Amounts of reimbursement by an organization for expenses associated with the use of such property in the interests of the employer are subject to personal income tax in the prescribed manner.

The company rents cars and buses with drivers. The agreement states that providing meals to the employees of the lessor organization is the responsibility of the tenant. Thus, the organization provides the vehicle crew with food. The cost of the meal is then reimbursed to her by the landlord. Is the cost of food subject to personal income tax, and which organization is the tax agent in relation to this income?

According to subparagraph 1 of paragraph 2 of Article 211 of the Tax Code of the Russian Federation, income received by a taxpayer in kind, in particular, includes payment for it by organizations for goods (work, services) or property rights, including food in his interests. The tax base in this case is determined as the cost of these goods.

Thus, the cost of food paid by the tenant organization for the employees of the lessor company is subject to personal income tax in the prescribed manner.

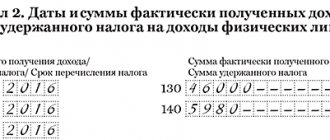

According to paragraph 1 of Article 226 of the Tax Code of the Russian Federation, Russian organizations from which or as a result of relations with which the taxpayer received income are required to calculate, withhold from the taxpayer and pay the amount of personal income tax.

These organizations are generally recognized as tax agents.

If employees of the lessor organization receive income in kind in the form of payment for food for them by the lessee organization, the latter is recognized as a tax agent and is obliged to calculate, withhold and transfer personal income tax to the budget.

The organization pays its employees the cost of travel by public transport to their place of work. Are amounts of such payment subject to personal income tax?

Payment for a taxpayer by organizations for goods in his interests in accordance with subparagraph 1 of paragraph 2 of Article 211 of the Tax Code of the Russian Federation is recognized as income received by the taxpayer in kind.

Thus, payment by an organization for the travel of its employees, provided that the employees have the opportunity to get to the place of work on their own, is recognized as their income received in kind.

Accordingly, the cost of this payment is subject to personal income tax in the prescribed manner.

An employee of the organization, while on a business trip, used a taxi to travel from the airport to the hotel and back. These amounts were reimbursed by the organization. Are travel reimbursement amounts subject to personal income tax? How should documents confirming the cost of travel be prepared?

Article 168 of the Labor Code of the Russian Federation stipulates that in case of being sent on a business trip, the employer is obliged to reimburse the employee for travel expenses. In this case, the procedure and amount of reimbursement of expenses associated with business trips are determined by a collective agreement or local regulations of the organization.

In accordance with paragraph 3 of Article 217 of the Tax Code of the Russian Federation, reimbursement of travel expenses is not subject to personal income tax. When an employer pays expenses for business trips both within the country and abroad, taxable income does not include actually incurred and documented targeted expenses for travel to the destination and back, expenses for travel to the airport or train station at the place of departure , destinations or transfers, for baggage transportation.

Neither the Labor Code of the Russian Federation nor Article 217 of the Tax Code of the Russian Federation contain restrictions on the types of means of transport used by an employee to travel to and from their destination.

Thus, reimbursement of an employee’s expenses for a taxi on a business trip is one of the compensation payments related to the employee’s performance of work duties. On this basis, these amounts are exempt from personal income tax.

At the same time, the organization must have appropriate supporting documents drawn up in such a way as to confirm the use of a taxi for trips carried out for business purposes.

The organization reimburses its employees for the cost of health resort vouchers for their children. Is income received exempt from taxation, given that in some cases children are adopted?

According to paragraph 9 of Article 217 of the Tax Code of the Russian Federation, income exempt from personal income tax includes, among other things, amounts of full or partial compensation (payment) by employers to their employees for the cost of vouchers for children under 16 years of age, on the basis of which these persons are provided with sanatorium and resort services and health organizations located in Russia.

This norm contains a closed list of persons whose compensation or payment for the cost of vouchers is not subject to personal income tax. This list, among other things, includes family members of the organization’s employees, regardless of their age (including children), as well as children under the age of 16, regardless of their relationship with the organization’s employees.

Thus, amounts of compensation and payment for the cost of vouchers for adopted children of employees are exempt from personal income tax.

Stay up to date with the latest changes in accounting and taxation! Subscribe to Our news in Yandex Zen!

Subscribe

Payment of medical expenses for an employee's family member

An employer can motivate an employee not only by salary or position, but also by various social guarantees.

For example, pay for the treatment costs of an employee or his family members. In Art. 217 of the Tax Code of the Russian Federation names all payments that are not subject to personal income tax. In particular, clause 10 provides for tax exemption from payment by the employer for treatment of an employee or members of his family (parents, husband/wife, minor children and wards). There may be several options for an organization to pay expenses:

- cash withdrawal from the cash register;

- transfer to the employee’s personal account;

- bank transfer to the bank account of a medical organization.

Accordingly, if the specified conditions are met, payment for the treatment of a family member is not subject to personal income tax.

There is no limit on the amount of payment exempt from tax. To determine whether such a payment is subject to insurance premiums, we again turn to Art. 422 of the Tax Code of the Russian Federation. The payments in question are not specified in it, therefore, compensation for the costs of treatment of an employee’s family member will be assessed in accordance with the generally established procedure (letter of the Ministry of Finance dated 04/01/2019 No. 03-15-05/22335).

Compensation for the use of a personal car

Often, the employer pays not only for the work performed, but also compensates for expenses that arise when using the employee’s property in the interests of the organization to make a profit.

One common example is the use of personal transport. What requirements must be met for such a payment to be recognized as unearned? According to Art. 164 of the Labor Code of the Russian Federation, compensation refers to monetary payments established to reimburse employees for costs associated with the performance of their labor or other duties. They are not included in the wage system. By virtue of Art. 188 of the Labor Code of the Russian Federation, when an employee uses personal property in the interests of the employer, the employee is paid compensation for the use, wear and tear of transport, and also reimbursed for expenses associated with use. The amount of reimbursement of expenses must be determined by agreement of the parties to the employment contract, expressed in writing (expressly provided for in the employment contract or an additional agreement to it).

According to paragraph 3 of Art. 217, all compensation related to the performance of labor duties is exempt from personal income tax. Moreover, there are no restrictions on the amount of compensation. Compensation paid to an employee for the use of a personal car for business purposes is also not subject to insurance premiums within the amount established by the agreement between the organization and the employee, based on paragraphs. 2 p. 1 art. 422 of the Tax Code of the Russian Federation. Thus, this compensation is completely exempt from both tax and insurance premiums.

In order to confirm during tax audits that the payment was of a compensatory nature, the following actions must be taken:

- Develop internal rules for compensation payments.

- Specify the amount of compensation in employment contracts. Here it is important to establish a compensation amount that would be comparable to payment at the market price for similar services. Otherwise, the tax authorities may recognize the amount of compensation that is inflated in their opinion as part of the salary and charge additional taxes and contributions.

Also, to exclude claims from inspectors, the employer must have documents confirming the employee’s ownership of the property used, as well as its operation in the interests of the organization.

Current labor relations practice provides for many different payments to employees, some of which were discussed in the article. The procedure for their taxation with personal income tax and insurance premiums depends on the nature of the payments, as well as on the documentation. To understand whether taxes and contributions arise, it is important to refer not only to the Tax Code of the Russian Federation, but also to explanatory letters and judicial practice, which spell out the nuances.

How issues of technical support for a remote worker are resolved

Employers in the employment contract with a remote worker must indicate how issues of technically equipping the employee with the equipment necessary to perform work or pay him compensation in the event of using personal property for business purposes are resolved.

Thus, the employment contract must reflect:

- the procedure and timing for providing remote workers with the equipment, software and hardware necessary for remote work, information security tools and other means;

- the amount, procedure and timing of payment of compensation for the use by remote workers of equipment owned or leased by them, software and hardware, information security tools and other means;

- procedure for reimbursement of other expenses associated with remote work.

The need to resolve these issues in an employment contract with a remote worker is established by Article 312.3 of the Labor Code.

The concept of compensation related to the performance of labor duties by an individual, as well as cases of their provision, are defined by the Labor Code.

Thus, Article 164 of the Labor Code stipulates that compensations are monetary payments established to reimburse employees for costs associated with the performance of their labor or other duties.

More on the topic:

Remote worker: possible problems