The employee, in addition to mandatory deductions for taxes or alimony, has the right to transfer money for any purposes he needs and pay other bills. It’s more convenient for him not to waste time paying on his own if his employer can do everything for him. When writing an application, an employee indicates any amount within the limits of his monthly salary and other income, since the legislation of the Russian Federation does not impose restrictive barriers. The employer has the right, but not the obligation, to consider and make a positive decision on deductions from the employee’s earnings.

Types of deductions based on an employee’s application

In most cases, deductions from wages at the initiative of the employee are used for the following purposes:

- repaying a loan from a credit institution;

- payment of annual taxes - on property, land, transport tax;

- deductions for voluntary health insurance;

- deduction of a fine from the employee’s salary;

- transfers to the Non-State Pension Fund.

The employee indicates in the application from which income deductions will be made, prohibiting, for example, making deductions from sick pay.

Rules for writing an order to deduct money from an employee’s salary

Follow these rules when placing an order to withhold funds from an employee’s salary:

- The name of the organization or individual entrepreneur is written at the top of the sheet.

- Next comes the title of the document. It is better to describe what order is being drawn up.

- Next to the word Order, enter its number and the date of signing.

- The content of the document begins with the grounds and reasons why funds should be deducted.

- It must be indicated from whom the funds will be withheld and in what amount.

- Rely on legal norms when approving requirements. For example, you can indicate the articles of the Labor Code of the Russian Federation: Art. 136 and art. 138.

- Then the requirements are written down. These include the clause on the deduction of funds, as well as clauses on notifying the employee and monitoring the execution of the order.

- If there are documents confirming the grounds for the deduction, then the name of the document and its brief content are indicated. If there is an employee’s consent or an application to deduct funds from the salary, then this is also written down. We wrote in another article how to fill out an application to withhold money from your salary.

- At the end of the document the boss’s signature is placed, and it is deciphered next to it.

- The signatures of the employees affected by this order are also required.

The procedure for deductions from wages - types of deductions, different situations and rights of the parties

The order must be recorded in the order log.

If you do not familiarize the employee with it, then you will violate his rights, which is why the employee’s signature at the end of the document is very important.

Nuances of retention

When making a positive decision on an employee’s application, an enterprise must proceed from the order of deductions established by the laws of the Russian Federation. First, personal income tax is paid on the employee’s income, then the requirements for alimony payments, payments to the person who suffered health damage, criminal fines, and compensation for slander are satisfied. Then the FSSP writs of execution are considered, and the financially responsible person compensates for the damage to his enterprise.

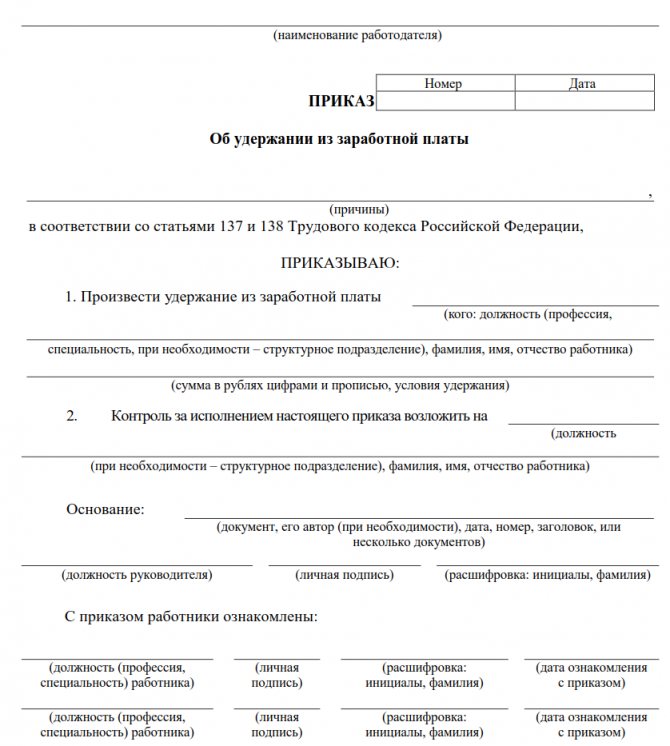

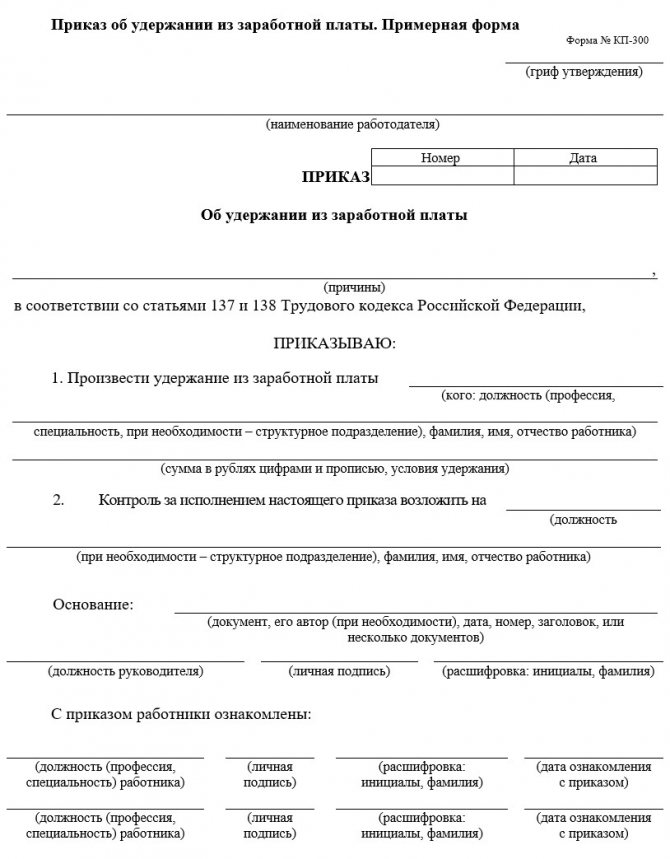

Order on deduction from wages. Form

.

- Home Personal settings

- Free HR Help Desk

- Large HR reference database

- Free HR reference database

- Login for subscribers

- Subscription to the magazine “HR Practitioner”

- Our contacts

- home

- Help base

- Magazine

- Online store

- Forums

- Newsletters

- Tests

- Contacts

Authorization

88 (917) 338-98-99

Authorization

When you subscribe to the HR Practitioner magazine!

— free months and access to ICS. Subscribe >>

Home

Materials on personnel

Samples of HR documents

Authorization

Basket

Cart0 items worth 0 rub.

- Free HR Help Desk

- Step-by-step instructions for personnel operations

- Samples of personnel documents

- Work records

- Teaching aids and books (electronic versions)

- Regulations

- Explanations of Rostrud, GIT, Plenum of the Armed Forces of the Russian Federation

- Questions and answers and articles on personnel

- HR administration from scratch: a step-by-step guide

- Restoring personnel records: step-by-step instructions

- Professional standards and qualification reference books

- Storage periods for personnel and related documents

- Review of the latest changes in the Labor Code of the Russian Federation

- Production calendars

- Tables and diagrams

- Information stand of the HR department

- Polls

- Problem book for personnel officer

Latest publications

05/31/2021 The employee agreed with the director on the removal of additional duties from tomorrow. The director ordered the preparation of relevant documents. And the law says three days. What should I do?

05/31/2021The organization's local network broke down at the end of the working day. To restore it, all employees of the infocommunication technology department were involved in overtime work. It was not possible to fix it quickly, and the workers asked to continue early in the morning...

05/31/2021Additional leave before maternity leave

05/31/2021Advance or salary?

All publications

News

05/31/2021 The Labor Code of the Russian Federation plans to establish restrictions on the use of irregular working hours

05/28/2021 A new issue of the HR Practitioner magazine for May 2021 has been published

05/28/2021The deadline for accepting applications for participation in the experiment with electronic personnel documents has been extended until May 30

All site news All labor legislation news

Poll of the day

All site surveys

a payroll deduction order

in your personnel collection . Approximate form (sample, form, template). Complies with labor laws as of 2021.

Collection of 170 sample orders >>

Samples of orders, personnel and non-personnel, on personnel and main activities >>

Other sample documents for HR services >>

Reference database for personnel records >>

Reproduction of this material on other websites and in other media without the written permission of our editors is not permitted. Get permission >>

The “Personnel Package” includes 3,000 samples of HR documents >>

Personnel self-auditSurveysProblem bookInformation stand of the HR departmentPhoto wallpaper

Personal accountSitemapWrite a review or suggestion

About the companyCooperationReviews

88 (917) 338-98-99

Write a letter from the site

2021 All rights reserved. © Consulting

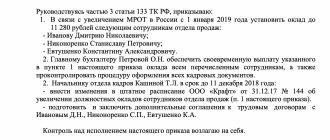

Drawing up an order

Deductions from wages are made at the request of the employee to the management of the enterprise. If the review is positive, an order is issued and one copy is sent to the accounting department.

There is no unified form of the order, and it is not a mandatory document for deductions.

In practice, when compiling it, you need to adhere to a certain form:

- document header with organization details and title;

- amount collected, basis (employee’s application), employee data;

- directions for transferring money, indicating the voluntariness of deductions;

- number and date of compilation, signature of the manager.

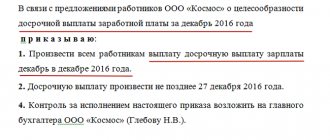

Sample order for deduction from wages

Order form

Form of order for deduction from wages

The law does not provide for a uniform order form. It must be approved by the company's management and issued in accordance with the internal rules of the organization.

Ready-made application form for deduction from wages for downloading - rules for document execution

Sample form for an order to deduct from salary:

A ready-made order form for deduction from salary is available for free.

You can use this sample and enter data into it, but remember that it must be approved by the company’s management.

How is salary deduction carried out?

The transfer of funds from the employee’s income is carried out by the accounting department on the basis of an order. The accountant first pays the necessary payments described above, then transfers funds from the personal account of the subordinate. Deductions are made on the days of issuance of an advance, salary or other receipts to the employee’s account.

Restrictions on deductions from an employee’s salary, according to Art. 138 of the Labor Code of the Russian Federation do not apply to voluntary deductions, since this article indicates cases of mandatory deductions from wages.

Labor Code of the Russian Federation on deduction from wages

The list of grounds on which it is possible to withhold a debt to an organization from an employee’s salary is listed in Art.

137 Labor Code of the Russian Federation. Withholding is made in cases where the employee, for some reason, received more funds than he was owed. For example, when an employee did not pay off the advance payment that was given to him towards his salary. The grounds for withholding wages may be contained in other federal laws, in addition to the Labor Code of the Russian Federation. Within a month, the company can return the discovered debt. To do this, you must obtain written consent from the employee to deduct from your salary. If the month for returning the money is missed or the employee is against the terms of the withholding, he will have to go to court.

There are no established forms of employee consent and retention orders - these documents are created in any form.

In Art. 138 of the Labor Code of the Russian Federation limits the amount of deductions of accumulated debts from wages:

- The general rule is no more than 20% of the salary after deducting personal income tax.

- If deductions are made on the basis of writs of execution, and there are several of them, up to 50% of the payment (letter of the Ministry of Health and Social Development of the Russian Federation dated November 16, 2011 No. 22-2-4852). This applies, for example, to compensation for moral damage, severance pay, taxes, fees, duties, fines, and property damage.

- Up to 70% - in case of correctional labor, imprisonment, collection of alimony debt, compensation for damage to health, due to the death of the breadwinner, during a crime.

We draw up an order

Before issuing an order to deduct from wages, it makes sense to draw up an act of damage to the organization’s property, recording in it the relevant fact and the amount of the loss caused (for more information, see “Drawing up an act of damage to the organization’s property (sample)”).

All events in the life of an organization must be documented in primary documents, and an order to withhold the amount of material damage from wages is no exception. You can collect money from an employee based on an order from the manager. Since there is no unified form for such an order, it can be drawn up in any form. Especially for our readers, our specialists have prepared a completed sample order to withhold amounts of material damage from wages.