06.06.2019

0

444

6 min.

Each economic entity of the Russian Federation provides various types of reporting to regulatory authorities: based on the results of the month, quarter, half year, for nine months and a year. The article below provides information about the features of filling out and entering data on reflecting contract agreements in the report on Form 6 personal income tax.

Contract agreement and 6-NDFL: basic provisions

A work contract is one of the types of civil law agreements (GPC), in which:

- the contractor (performer) has the obligation to perform the work stipulated by the contract according to the customer’s instructions;

- The customer assumes the obligation to accept the results of the work performed and pay for it.

Payment for “contract” work is income subject to personal income tax for the contractor. For the customer, the payment of such income is associated with the performance of the duties of a tax agent and the reflection of this “contract” payment in 6-NDFL.

Note! As of reporting for the 1st quarter of 2021, a new report form 6-NDFL, approved. by order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected] Now it includes information from form 2-NDFL. 2-NDFL certificates, as an independent report, have been cancelled.

ConsultantPlus experts sorted out the rules for filling out the new form. Sign up for trial demo access to the K+ system and get free expert explanations.

Find out what to pay attention to when concluding a contract in this article.

To reflect “contract” income in 6-NDFL, the following data will be required:

- the cost of “contract” work - it falls on page 100 of section 2 of the report;

- calculated and withheld personal income tax - it is reflected on pages 140 and 160;

- in section 1 of the report, blocks pp. 021-022 are filled in for each date of “contract” payments (they will be discussed in more detail later).

In order for “contract” payments to be reflected without errors in 6-NDFL, you should remember the following tax requirements:

- all payments under the contract (including advances) are subject to reflection in 6-NDFL (clause 1 of Article 223 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated May 26, 2014 No. 03-04-06/24982);

- the data in section 2 of the report is presented on an accrual basis, in section 1 - for the last 3 months of the reporting period;

- the date an individual receives “contract” income is the day it is transferred to the card or money is issued from the cash register, including the date the advance is issued to the contractor. But the date of signing the work acceptance certificate does not matter, which is confirmed by tax authorities (see, for example, letter from the Federal Tax Service for Moscow dated January 16, 2019 No. 20-15 / [email protected] );

- The deadline for transferring personal income tax is no later than the day following each “contract” payment.

Find out the nuances of a contract from the perspective of international standards from the article “IFRS No. 11 Contracts - application features” .

Possible subjects of the contract

The subjects of the contract are the contractor (that is, the one who performs the task for a fee) and the customer (who needs to obtain the result of a certain activity after a specified period of time). The parties to the agreement can be both individuals and legal entities.

Thus, the following entities have the right to enter into a contract between themselves:

- legal companies (individual entrepreneurs - hereinafter referred to as individual entrepreneurs);

- individuals who are not individual entrepreneurs;

- citizen (customer) and organization (contractor);

- a legal entity (customer) and an individual who is not an individual entrepreneur (contractor).

Payment for services and compensation expenses

Under the terms of the contract, in a number of cases, the customer undertakes, in addition to the remuneration indicated therein, to pay the contractor’s expenses incurred when completing the task. For example, expenses for travel or accommodation of contractor employees, for the rental of special equipment or unique devices, and other compensation for actual and justified expenses. These amounts, even if they are provided for within the framework of the concluded agreement, must be taken into account separately. In most cases, they should not be included in the base for calculating the duty on personal income (hereinafter referred to as personal income tax) and insurance premiums and are not accepted for deduction for value added tax (VAT).

Tax withholding

When concluding an agreement, it is important to understand who pays the personal income tax under the contract. For a contractor - a citizen who is not an individual entrepreneur (and only for him) - payment from the customer (company) for completing the task is income, and it must be subject to personal income tax.

Advice! If the customer is a legal entity, then he acts as a tax agent who is obliged to calculate, withhold and pay this tax to the budget, and then reflect these accruals and payments in the appropriate reporting forms: quarterly (in 6-NDFL) and annually (in certificates 2-NDFL).

6 personal income tax under the GPC agreement

Preparing, forming and submitting 6-NDFL for an accountant is a very difficult and responsible task. The report is compiled on an accrual basis from the beginning of the calendar year and is submitted to the Federal Tax Service quarterly via electronic communication channels or on paper (if there are 24 or fewer total recipients of taxable income), within the established time frame:

- for the first quarter - no later than the last day of the month after the expired quarter;

- for the 1st half of the year - no later than the last day of the month following the expired quarter;

- for 9 months - no later than the last day of the month following the expired quarter;

- a year - until April 1, inclusive.

Filling out 6 personal income taxes under a contract with an individual has features, information about which will be discussed below.

Contract agreement: main points

The definition is contained in the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation), in article 702. A contract is an agreement between the customer and the other party, the contractor. It is drawn up in writing and is aimed at fulfilling any order of the customer with the obligation to accept the result of its full or phased implementation for a certain fee within a specified time frame, most often with the help of the contractor’s funds and materials.

Conditions of conclusion

The agreement must be drawn up in accordance with all the rules. When concluding an agreement, the document specifies the general and essential conditions:

- name of the form and date of its preparation;

- details and signatures of the parties to the agreement;

- the subject of the contract, that is, the result of fulfilling the customer’s assignment;

- time interval - the period during which the task is planned to be completed (the exact start and end dates of work/individual stages are specified).

Also, the contract must contain additional conditions that do not require mandatory prior agreement between the parties. They enter into legal force from the moment the agreement is concluded on the basis of the norms of current legislation and include the following points:

- Methods and methods of implementation (unless otherwise specified, they are determined by the contractor, in accordance with Article 703, paragraph 3 of the Civil Code of the Russian Federation).

- From what materials, by whom (contractor - Article 704, 1st paragraph of the Civil Code of the Russian Federation).

- Cost and method of calculating expenses (an approximate cost estimate is attached or a fixed cost of work is indicated; possible cases for revising the prices specified in the contract are articles of the Civil Code of the Russian Federation: 424, 451, 709, 710, 713 and 723).

- The possibility of using subcontracting, that is, the contractor engaging the services of a third party when performing the customer’s assignment (the contractor has the right to do this in accordance with Article 706 of the Civil Code of the Russian Federation).

- Distribution of the resulting savings between the customer and the contractor, if this happens (Article 710 of the Civil Code of the Russian Federation assigns the right to it to the contractor if the customer cannot prove that the result of the service provided or the work performed does not comply with the quality of the result).

- The contractor’s right to receive full payment according to a previously reached agreement for the result of the completed task (Article 711 of the Civil Code of the Russian Federation obliges the customer to make the final payment).

- The procedure for delivery by the contractor and acceptance by the customer of the final result of the work to complete the task (the main provisions are stated in Article 720 of the Civil Code of the Russian Federation).

- The customer’s assistance and assistance to his contractor when he performs the work (by default, the procedure for assistance and its volume are indicated in Article 718 of the Civil Code of the Russian Federation).

- Quality control of execution, in accordance with the specific terms of the contract or general requirements for similar orders (Articles 721 and 722 of the Civil Code of the Russian Federation).

- Further instructions (to the customer from the contractor) on the operation or application of the result of the work performed (Article 726 of the Civil Code of the Russian Federation).

The agreement may also reflect so-called “incidental conditions”, by agreement of both parties to the contractual relationship. Their presence or absence does not affect the validity of the concluded transaction, but only supplements or changes the basic requirements of the regulations.

Tax deductions and payments under GPA in 6-NDFL, delivery to a separate division

In Form 6-NDFL, Section 1 “Generalized Indicators”, indicate the total amount of accrued income, deductions provided, as well as the total amount of accrued and withheld tax. Fill it out with a cumulative total from the beginning of the year (letter of the Federal Tax Service of Russia dated February 18, 2021 No. BS-3-11/650). For example, in section 1 for the half-year, reflect the indicators for the period from January 1 to June 30 inclusive.

Experts from the magazine “Salaries in an Institution” found out where accountants most often make mistakes when filling out the 6-NDFL report. Test your knowledge of the rules for issuing 6-NDFL with a test in the magazine.

In section 2, list all transactions in chronological order. Don't group them by tax rates. In this section, show:

- dates of receipt and withholding of tax,

- deadline for transferring taxes to the budget,

- the amount of income actually received and personal income tax withheld.

Tax deductions in 6-NDFL

In section 1 of the calculation on line 020, reflect all employee income on an accrual basis from the beginning of the year. Focus not on accruals in accounting, but on the date of receipt of income for personal income tax purposes.

In line 030, show the total amount of standard, property and social deductions that you provide to employees. Also reflect deductions for financial assistance, gifts, etc. here.

For example, an employee received several gifts during the year with a total value exceeding the non-taxable limit (RUB 4,000). The deduction amount is 4000 rubles. Write down on line 030, and on line 070 reflect the amount of tax withheld.

If it was not possible to withhold personal income tax, then show it in line 080.

When you fill out section 2, on line 130 indicate the income that was accrued to the employee in the reporting period. There is no need to reduce it by deductions.

Useful material in the article

Form 6-NDFL in 2021

Download

Standard deductions in 6-NDFL

An employee with a child has the right to receive standard deductions until the month in which the employee’s salary, calculated on an accrual basis, does not reach 350 thousand rubles. As soon as the employee’s total income reaches the limit, do not provide a deduction.

If an employee has not been working in an institution since the beginning of the year, then his income from his previous place of work must be taken into account. To do this, ask him to provide a 2-NDFL certificate from his previous employer.

How to reflect deductions for children in 6-NDFL:

Example 1

The teacher receives a standard tax deduction for a third disabled child. Employee salary – 40 thousand rubles. Deduction – 15,000 rubles. (3000 + 12,000). Income from January to May amounted to 200 thousand rubles, and deductions - 75 thousand.

Property deduction in 6-NDFL

An institution has the right to provide a property deduction to an employee according to two documents:

- Application for property deduction;

- Notification from the tax office.

An employee has the right to apply for a deduction at any time. In this case, the tax paid since the beginning of the year must be returned to the employee. Since the right to deduction arises from the beginning of the year, even if the notification is provided in the middle of the year, for example, in June. The question arises, is it necessary to submit an updated 6-NDFL calculation? There is no need to submit updated calculations for previous quarters.

Reflect the deduction for the period in which the employee brought the notice from the Federal Tax Service. There is no need to clarify the form for previous quarters, since there are no errors in them and the calculations were made correctly. Tax officials came to this conclusion in their letter dated April 12, 2021 No. BS-4-11/6925. And indicate the personal income tax that was returned to the employee on line 090 of Section 1 of form 6-NDFL on a cumulative basis from the beginning of the year.

How to reflect a property deduction in 6-NDFL:

Example 2

In May 2021, the employee brought a notice from the Federal Tax Service and his application for a property deduction.

The amount of property deduction is 500 thousand rubles.

The employee's income from January to April 2021 amounted to 240 thousand rubles. Personal income tax was withheld from them in the amount of 31,200 rubles. (240,000 × 13%).

The accountant recalculated personal income tax from the beginning of the calendar year and returned 31,200 rubles to the employee. In May and June, the employee’s income amounted to 70,000 rubles each. In total, the employee received 380 thousand rubles for the period from January to June. (240,000 + 140,000). This amount is less than the declared deduction, so the employer did not withhold personal income tax from the subordinate’s salary (380,000

The accountant did not submit the updated 6-NDFL calculation form for the 1st quarter of 2021. And reflected the deduction in the calculation of 6-personal income tax for the first half of 2018.

Reflect deductions for treatment and education in the same way. But in this case, do not recalculate the tax from the beginning of the year (clause 2 of Article 219 of the Tax Code of the Russian Federation).

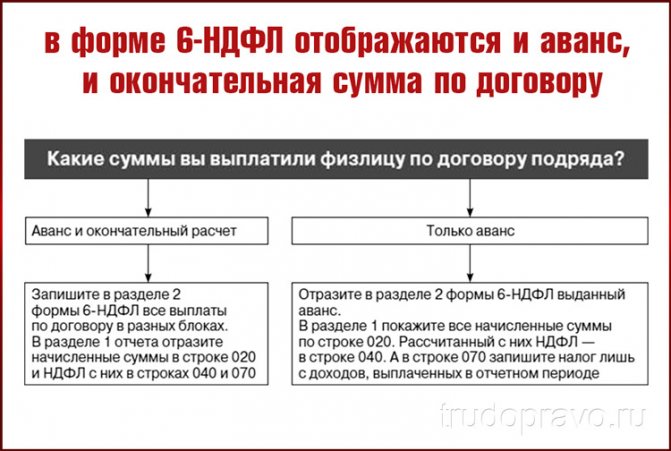

How to reflect remuneration for GPA and GPC in 6-NDFL

Remuneration to the contractor for GPD, GPC is also subject to personal income tax

The date of income for 6-NDFL and the date of tax withholding is the day of actual payment to the contractor, and it does not matter whether it is an advance or a final payment

Examples of formatting a 6 personal income tax report on contract payments

An example and its solution will help in considering the features of filling out the first and second sections of the 6-personal income tax report on contract services:

I. G. (not an individual entrepreneur) entered into a GPC agreement with Afanaskin for the period from December 25, 2021 to the end of the 1st quarter of 2021 for contract work (construction of podiums for the presentation of products in several retail outlets). The total cost under the terms of the agreement was 134,000 rubles.

An advance in the amount of 17,400 rubles (to the card) and personal income tax of 2,600 rubles were transferred on December 28, 2021, and the final payment was made on March 29, 2021 through the organization’s cash desk.

To simplify the situation: no other accruals and payments were made to individuals, and no application for deduction was submitted.

Filling out sections 1 and 2 of the annual report:

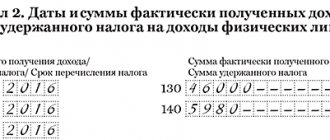

| Field No. | Filling | A comment |

| 10 | 13 | Not an individual entrepreneur, resident (tax rate in%) |

| 20 | 20000 | Total accrued income |

| 40 | 2600 | Calculated personal income tax |

| 60 | 1 | Number of recipients |

| 70 | 2600 | Personal income tax withheld |

| 100 | 28.12.2018 | Date of actual receipt of income |

| 110 | 28.12.2018 | Personal income tax withholding date |

| 120 | 29.12.2018 | Deadline for payment of personal income tax to the IRS |

| 130 | 20000 | Actual income received (including personal income tax) |

| 140 | 2600 | Personal income tax withheld |

The report for the 1st quarter of 2021 must be completed as follows:

| Field No. | Filling | A comment |

| 10 | 13 | Tax rate for a resident, individual entrepreneur is not |

| 20 | 114000 | Total accrued income (final payment under the contract, that is, 134,000 minus the advance payment of 20,000) |

| 40 | 14820 | Personal income tax calculated (13% of 114,000) |

| 60 | 1 | Number of individuals who received accruals |

| 70 | — | Personal income tax withheld (total value for section 2) |

| 100-140 | — | The columns are not filled in, since the deadline for transferring personal income tax to the budget (from payment of income on March 29, 2019) falls on the next reporting period |

For the first half of 2021, the sample for filling out the 6-personal income tax will take the form:

| Line no. | Filling | A comment |

| 10 | 13 | Tax rate for resident |

| 20 | 114000 | Accrual of income from January to June |

| 40 | 14820 | Personal income tax calculated (for half a year) |

| 60 | 1 | |

| 70 | 14820 | Personal income tax withheld (for 6 months of 2021) |

| 100 | 29.03.2019 | Date of actual receipt of income |

| 110 | 29.03.2019 | Personal income tax withholding date |

| 120 | 01.04.2019 | Deadline for personal income tax payment (according to the rules of transfer if the last day of the month falls on a weekend or holiday) |

| 130 | 114000 | Actual income received (including personal income tax) |

| 140 | 14820 | Personal income tax withheld |

The report must show all payments under construction contracts, including advance payments (personal income tax is also withheld from them). Income is considered received (accrued) on the day of actual payment to an individual from a current account or from a cash register (the moment of signing the act of completing the task does not matter).

It is important to know! The personal income tax is transferred no later than the next working day after the payment of income to the contractor - an individual - according to the BCC (budget classification code) corresponding to this tax.

If several GPAs are concluded with an individual during a calendar year, then in line 060 the citizen is counted as one recipient of income. The number of agreements does not matter.

To serve or not to serve?

The LLC was registered in December 2021, but is not operating yet (an employment contract has not been concluded with the general director, there are no employees). Do I need to submit 6-NDFL?

6-NDFL are represented by tax agents when performing their functions (Articles 230, 226 of the Tax Code of the Russian Federation). If there are no accruals in favor of individuals, then there are no grounds for performing the functions of a tax agent. In a situation where there are no accruals in December 2020, there are two options for how to deal with 6-NDFL:

- do not submit the form based on the results of 2021;

- submit a “zero” report.

An individual entrepreneur has retail outlets in different areas and is registered at the place of business with the tax authorities, whose territories have different OKTMO. Do I need to pay personal income tax and submit 6-personal income tax according to different OKTMO?

In accordance with paragraph 7 of Art. 226 of the Tax Code of the Russian Federation, tax agents - individual entrepreneurs who are registered with the tax authority at the place of business, are required to transfer calculated and withheld tax amounts from the income of employees.

Such individual entrepreneurs, according to clause 3 of Art. 230 of the Tax Code of the Russian Federation, provide information on the income of individuals for the past tax period and on the amounts of tax calculated, withheld and transferred to the budget system of the Russian Federation (2-NDFL), as well as the calculation of the amounts of personal income tax calculated and withheld by the tax agent (6 -NDFL), in relation to their employees, to the tax authority at the place of their registration.

That is, the personal income tax withheld from the employees of each of the points is transferred to the tax authority with which you are registered at the place of activity of each of the points (with the corresponding OKTMO). Reporting is presented in a similar manner.

When should remuneration under a GPC agreement be reflected in 6-personal income tax? – all about taxes

Tax legislation establishes the obligation of companies and individual entrepreneurs to reflect in 6-NDFL the amounts of remuneration under civil law agreements (GPC) concluded with an individual who is not an entrepreneur. How to reflect GPC agreements in 6-NDFL is the topic of our publication.

How to reflect GPC in 6-NDFL

Entrepreneurs and organizations have the right to engage individuals to perform certain work under civil law contracts (CPL).

In this regard, the question arises of how to reflect the GPC in 6-NDFL - calculations for calculated and withheld personal income tax.

This question often causes difficulties for accounting department employees and requires additional clarification.

Rules for calculating and withholding personal income tax

According to established standards, payments under a GPC agreement must be reflected in 6-NDFL, since an organization or individual entrepreneur using the services of individuals becomes a tax agent for them. It is the organization in this case that is responsible for withholding and transferring personal income tax to the treasury.

To understand how to reflect GPC agreements in 6-NDFL, you need to understand within what time frame the tax agent is obliged to calculate, withhold and transfer personal income tax to the budget.

The rules say that the date of receipt of income under GPC in 6-NDFL becomes the date of tax calculation. This is the day when an individual receives money for working at the cash register or when it is transferred to his bank account. It is this date that must be reflected in line 100 of the reporting form.

Please note that the date of receipt of income under the GPC agreement in 6-NDFL is also the date of tax withholding: this is the day that must be recorded in line 110 of the form. It must coincide with the settlement date specified in the contract.

Just as in other cases, tax on payments under GPC in 6-NDFL is transferred no later than the next business day after the money is transferred to an individual. This date should be indicated on line 120 of the reporting form.

General features of filling out form 6-NDFL

Reporting form 6-NDFL for GPC in 2021 is filled out taking into account the order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/450. It sets out a number of general mandatory requirements:

| Rule | Explanation |

| The form must be filled out for each OKTMO separately | In this case, organizations indicate the code of the municipality in which the given division of the company is located |

| Payment for GPC in 6-NDFL is not included in separate sections | It is reflected in reporting on a general basis. In the first section, data on income, calculated and withheld tax are entered on an accrual basis for a quarter, half a year, 9 months, and a year. The first section is filled out for each tax rate. The second section records reporting data for the quarter. |

| If during one period the tax agent paid personal income tax at different rates, when entering information about GPC agreements in 6-NDFL in 2021, information on each rate is entered separately | It is necessary to check the correctness of the entered data to avoid penalties from the tax authorities. |

According to these requirements, the reflection of GPC in 6-NDFL requires the submission of calculations for each reporting period no later than the last day of the month that follows the reporting period.

Also see “6-NDFL for the 1st quarter of 2021: sample filling”.

Example of calculation and its reflection in the form

Let's look at an example of filling out 6-NDFL under a GPC agreement.

The organization entered into an agreement with individuals for the provision of services for posting advertisements during the period from October 1 to November 30. The total cost of services provided was 7,500 rubles, and the tax on this amount was 975 rubles. The money was paid on December 5th.

In this example, 6-NDFL for GPC, in line 070, the amount of tax withheld is indicated - 975 rubles. The dates of actual receipt of money and tax deduction coincide - this is December 5th. This information should be reflected in lines 100 and 110.

The total amount of income, amounting to 7,500 rubles, is recorded in line 130.

Also see “How to reflect workers under a contract in SZV-M”.

Source:

How to reflect a GPC agreement in 6-NDFL (a civil law agreement) in 2021 - sample, in section 1

6-NDFL is a new form of tax reporting that was approved in 2021. It must be submitted every quarter.

At the same time, form 2-NDFL remains valid, however, unlike 6-NDFL, it is submitted for each individual employee. 6-NDFL, in turn, contains generalized tax indicators for the organization as a whole.

Next, we will consider how to reflect remuneration under GPC agreements in this certificate.

Definition

From the beginning of 2021, all legal entities and individual entrepreneurs who are tax agents are required to submit reports to the Federal Tax Service in accordance with Form 6-NDFL. The help contains 2 pages, including the title page, as well as two sections.

Next, we will consider how filling is carried out using the example of reflecting cash payments under contract agreements.

A contract agreement is one of the types of GPC contracts, the terms of which provide for:

- that the contractor performs certain duties - performs work or provides a service;

- The customer accepts the work within the terms established by the agreement and pays for it.

To reflect in 6-NDFL all remunerations paid based on the results of acceptance of work, you must have the following information:

| Line | What to indicate |

| 020 | The total amount of remuneration made under GPC agreements in the reporting period |

| 030 | Professional deductions provided to employees |

| 040 | Calculated income tax |

| 070 | Withheld income tax |

This needs to be indicated in section 1, but what in the second?

In the 2nd section there are 5 blocks, each of which is divided into 5 lines - 100, 110, 120, 130 and 140:

- pages 100 and 110 indicate the date of payment of remuneration to the contractor (the same date will also be the date of withholding of the tax fee);

- on page 120 you need to indicate the following. business day after the date of payment of remuneration;

- on page 130 – the total amount of all remunerations under GPC agreements;

- on page 140 – the total amount of tax withheld.

Please see this link for filling out.

Legislation

To reflect all payments under civil contracts without errors, you should remember some legal requirements:

- on the basis of Part 1 of Art. 223 of the Tax Code of the Russian Federation, all payments under GPC agreements, including advance payments, must be reflected;

- in the 1st section of the certificate, all information must be given as a growing total;

- in the 2nd section information is indicated for the last 3 months. reporting period;

- the date of receipt of remuneration by the contractor should be considered the day when the money was transferred to his bank card or issued in cash from the company’s cash desk;

- The deadline for transferring the tax fee in line 120 is the day following the day of making each payment under the GPC agreement.

Rules for drawing up a GPC agreement in 6-NDFL

To understand the specifics of drawing up a GPC agreement in 6-NDFL, you should consider filling it out with an example.

Molpromsbyt LLC entered into a contract agreement with citizen V.P. Anokhin. to carry out finishing works of the milk production workshop. Anokhin performed work in the 2nd quarter of 2021 and received the following amounts of money:

- advance payment in the amount of 7,000 rubles on May 15, 2021;

- final payment in the amount of 15,000 rubles on May 29, 2021.

Fill out the 1st section:

| Field | What to indicate |

| 010 | Tax rate - since Anokhin is a tax resident, 13% is indicated |

| 020 | The total amount of remuneration is written down, that is, 15,000 + 7,000 = 22,000 rubles |

| 030 | Tax deductions were not provided, that is, 0 is placed in the first cell, the remaining cells are dashes |

| 025 | Fill in the same way as line 030 |

| 045 | Same as line 030 |

| 050 | Same as line 030 |

| 040 | The calculated tax is indicated, that is, 22000 * 0.13 = 2860 rubles |

| 060 | Here the number of persons working under GPC contracts in the reporting period is entered. In this case, 1 person |

| 070 | Same as line 040 |

| 080 and 090 | Same as line 030 |

Now let's start filling out the 2nd section. Here you need to fill out 2 blocks out of 5 available, since the hired employee was given both an advance payment and a final payment - that is, separately for each type of deduction.

1st block:

| Field | Meaning |

| 100 | The date of receipt of the advance is indicated, that is, 05/15/2021 |

| 110 | Filled in the same way as line 100 |

| 120 |

Source:

GPC agreement

If companies or individual entrepreneurs engage individuals to perform any work, they enter into civil law agreements (GPC) with them.

Under this agreement, the date of receipt of income is in fact considered the date of payment of funds to the individual. In this case, it will not matter what was paid - an advance or the final amount.

Each payment in 6-NDFL will be reflected in a separate block and under a separate date.

Who is the tax agent under the GPC agreement

Source: https://nalogmak.ru/drugoe/kogda-v-6-ndfl-otrazhat-voznagrazhdenie-po-dogovoru-gph-vse-o-nalogah.html

Tax calculation

To calculate tax, the amount of income of an individual must be determined. Income is considered to be payment in cash and in kind received by the contractor from the customer. The amounts paid by the customer are subject to taxation, but the cost of work and compensation costs should be separated.

As for whether the customer should levy income tax on compensation amounts, the Ministry of Finance has its own opinion, and the Federal Tax Service has its own. The Ministry of Finance believes that compensation paid for housing is a direct benefit of the contractor, that is, income, which means that personal income tax must be withheld from it. This practice is explained in Letter of the Ministry of Finance of the Russian Federation dated March 20, 2012 No. 03-04-05/9-329. The Federal Tax Service, in turn, distinguishes one situation into several related ones; in one situation, an accrual is made, and in the second, no tax is levied. Judicial practice shows that even the calculated tax on compensation amounts can be returned to the executor in court. Therefore, the situation with the calculation of personal income tax from compensation for expenses is a rather controversial practice.

In general cases, personal income tax on the income of individuals is calculated by charging the entire amount of the established amount of income tax.

Filling rules

The document form (KND form 1151099) is filled out for all payments made to individuals during the calendar year. It consists of the following parts:

- Title page with general information: name of the report, codes of the submission period and tax authority, details of the tax agent or authorized person, marks confirming the accuracy of the transmitted information, stamp if available, signature with transcript, date of preparation, records of reception by the controlling organization.

- Section number 1 includes lines: 010, 020, 030, 040, 050, 060, 070, 080 and 090 (reflection of total data from the beginning of the year).

- Section number 2 consists of an unlimited total number of lines: 100, 110, 120, 130 and 140 (detailed breakdown of accrued, withheld and received amounts of income and calculated tax for the quarter), depending on the number of payments during the last three months of the reporting quarter period.

The procedure and rules for filling out 6-personal income tax are specified in detail in MMV-7-11 / [email protected] - Order of the Federal Tax Service dated October 14, 2015, with subsequent additions and changes. In 6 personal income tax, a contract must be reflected if a legal entity has used the services of a citizen (not an individual entrepreneur).

How to reflect a contract agreement in 6 personal income taxes - Business, laws, work

Form 6-NDFL should include not only standard salary payments, but also remuneration under civil contracts for the performance of work (rendering services).

In accounting terms, these are GPC (civil law) agreements or GPA agreements. This is the only way you will fulfill your obligation to fill out “income” reporting.

What “civil” amounts and in what order should be included in 6-personal income tax - read in our article.

Attention! The reporting procedure for 6-NDFL for the 1st quarter of 2021 has changed

In salary reports for the first quarter, take into account the changes that came into force in 2021. Experts from the magazine “Salary” summarized all the changes in 6-NDFL.

Read how inspectors compare report indicators with each other. If you check them yourself, you will avoid clarifications and will be able to explain any figure from the report.

See all the main changes in salary in a convenient presentation and special service.

Main changes in 6-NDFL for the 1st quarter of 2021

Attention: Personal income tax arises under a number of other civil law contracts, in addition to contracts and agreements for the provision of services. For example, when renting from an individual his property (car, phone, laptop, etc.). The algorithm for filling out 6-NDFL will be the same.

How to correctly reflect a contract in 6-NDFL? 2021

Tax legislation establishes the obligation of companies and individual entrepreneurs to reflect in 6-NDFL the amounts of remuneration under civil law agreements (GPC) concluded with an individual who is not an entrepreneur. How to reflect GPC agreements in 6-NDFL is the topic of our publication.

Contract agreement in 6-NDFL example of filling out 2021

Let’s say that on the last working day of March 2021—Friday the 30th—the parties signed an act of completion of work and recognized the GPC agreement as completed. On the same day, remuneration was paid for the work performed.

In total, March 30 is recognized as the day of receipt of income. The accountant withheld tax on this date.

The deadline for transferring the amount to the budget falls on March 31. But this is Saturday, so the deadline is legally postponed to April 2 - working Monday.

The calendar lines in section 2 of form 6-NDFL will be filled out as follows:

- line 100: 03/30/2018;

- line 110: 03/30/2018;

- line 120: 04/02/2018.

However, the operation will fall into section 2 not for the first quarter, but for the first half of the year. Look - the last date in the block is in April. Therefore, the entire operation will be reflected in section 2 of form 6-NDFL for the six months. And the amounts will appear in section 1 in the report for the first quarter. And then they will be shown in all reports for 2021, since the first section is filled in with a cumulative total from the beginning of the year.

Next Personal Income Tax Declaration 4: who must submit

How to reflect GPC agreements in 6-NDFL example of filling out

Form 6-NDFL should include not only standard salary payments, but also remuneration under civil contracts for the performance of work (rendering services).

In accounting terms, these are GPC (civil law) agreements or GPA agreements. This is the only way you will fulfill your obligation to fill out “income” reporting.

What “civil” amounts and in what order should be included in 6-personal income tax - read in our article.

Tax agent for GPA

If your counterparty-contractor (performer) is an individual who does not have the status of an individual entrepreneur, then in relation to the income paid to him you are recognized as a tax agent for personal income tax.

Hence the obligation to include the transactions carried out in such a general tax report of the company as 6-NDFL. Without data on the GPA, the calculation will be incomplete and, in the event of an inspection, the inspectors will simply turn it down.

So an accountant should never lose sight of civil transactions with individuals.

When concluding a GPA with a merchant who officially has the status of an entrepreneur, the customer company does not pay personal income tax for it. This means that the obligation to include the amounts paid in 6-NDFL does not arise here.

Attention! The reporting procedure for 6-NDFL for the 2nd quarter of 2021 has changed

In salary reports for the 2nd quarter, take into account the changes that came into force in 2021. Experts from the magazine “Salary” summarized all the changes in 6-NDFL.

Read how inspectors compare report indicators with each other. If you check them yourself, you will avoid clarifications and will be able to explain any figure from the report.

See all the main changes in salary in a convenient presentation and special service.

Main changes in 6-NDFL for the 2nd quarter of 2021

Attention: Personal income tax arises under a number of other civil law contracts, in addition to contracts and agreements for the provision of services. For example, when renting from an individual his property (car, phone, laptop, etc.). The algorithm for filling out 6-NDFL will be the same.

When to calculate personal income tax according to GPC

“Income” tax under the GPA is calculated on the date of actual receipt of income by an individual, which is the day of actual settlements (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation). In this case, the amounts are considered a cumulative total from the beginning of the year in relation to all income for a given individual (clause 3 of Article 226 of the Tax Code of the Russian Federation).

Let us remind you that the date of receipt of income under the GPC agreement is reflected in line 100 “Date of actual receipt of income” of form 6-NDFL.

Payment according to GPC in 6 personal income tax

Withhold the “income” tax on remuneration under the GPA on the day of direct payment of funds to the performer (contractor) (clause 4 of Article 226 of the Tax Code of the Russian Federation). That is, on one day you need to calculate all payments and make deductions. Line 110 of form 6-NDFL is automatically equal to line 100, which we discussed above.

Depending on the date in lines 100 and 110 of the calculation, another one is determined - the main one, which we will talk about later.

Deadline for transferring personal income tax under civil contracts

The withheld tax is transferred to the budget on the day of withholding or the next business day (clause 6 of Article 226 of the Tax Code of the Russian Federation). If there are weekends or holidays between the two designated extreme points, then in fact, it turns out that the payment period increases (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

To fill out line 120 of section 2 of form 6-NDFL, the last possible date for transferring the tax is indicated as the deadline for transferring the payment to the budget. And it doesn’t matter if you paid the tax immediately on the day the tax was withheld.

This does not change the established deadline for transferring payment in order to complete the calculation. It is your right to pay the state on the last day allotted for this or immediately upon the fact of tax withholding. The main thing is not to pay personal income tax from your own amounts.

After all, you are acting as an agent and must first deduct the required amount of tax from the accrued amount of income.

Filling out section 1 and the title page of 6-NDFL when concluding GPC agreements (contract, provision of services) does not generally have any special features. The tax rate for GPC is the same as for wages.

As a general rule, this is 13%. Therefore, section 1 will be filled out in total for salary amounts and amounts under the GPA. Take all data from existing (consolidated) tax registers.

They should have a complete breakdown of both amounts and time frames.

As for section 2, the dates/terms of salary transactions differ from the dates for “civil” transactions. Even if you paid the salary and closed the settlements with the contractor on the same day.

After all, at least your first date – the day you receive income – will not coincide. In terms of salary, this is the last day of the month worked (clause 2 of Article 223 of the Tax Code of the Russian Federation). And according to the GPA, this will be the day of direct payment (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation). Already a discrepancy.

Therefore, GPA operations need to be separated into a separate block in section 2.

We summarize the dates in the form

Taking into account all the rules for determining dates for 6 personal income taxes, the picture regarding GPA payments in section 2 of the form will be as follows:

- on line 100, the date of actual receipt of income is indicated on the day the remuneration is paid. This may be the issuance of cash from a cash register or a non-cash transfer to a person’s bank card;

- on line 110, the date of payment of remuneration is also indicated as the tax withholding date, that is, lines 100 and 110 are equal in terms of GPA amounts;

- on the final line 120 – the tax payment deadline is the business day following the payment. It is a working one, not a calendar one. In the case of weekends and holidays, be careful in determining this date.

Contract agreement in 6-NDFL example of filling out 2021

Let's say that on the last working day of March 2021 - Friday the 30th - the parties signed an act of completion of work and recognized the GPC agreement as completed. On the same day, remuneration was paid for the work performed.

In total, March 30 is recognized as the day of receipt of income. The accountant withheld tax on this date.

The deadline for transferring the amount to the budget falls on March 31. But this is Saturday, so the deadline is legally postponed to April 2 - working Monday.

The calendar lines in section 2 of form 6-NDFL will be filled out as follows:

Source: https://www.Zarplata-online.ru/art/161034-kak-otrazhat-dogovora-gph-v-6-ndfl

Income of individual entrepreneurs and non-residents: how to reflect in 6 personal income taxes

If a citizen contractor is registered as an individual entrepreneur, then the legal entity has no obligation to withhold and transfer personal income tax, that is, to perform the functions of a tax agent. There is no need to reflect such payments in the 6 personal income tax report. The contractor independently reports to the regulatory authorities about the income he received and the taxes paid on it.

Concluding a contract with a non-resident citizen does not exempt an organization (legal entity or individual entrepreneur) from submitting a report. The only difference from the registration and reflection of financial relationships with a resident individual is the amount of the interest rate at which personal income tax should be calculated. It is 30 percent, indicated on line 010 of the report.

How to correctly reflect a contract in 6-NDFL? 2021

Tax legislation establishes the obligation of companies and individual entrepreneurs to reflect in 6-NDFL the amounts of remuneration under civil law agreements (GPC) concluded with an individual who is not an entrepreneur. How to reflect GPC agreements in 6-NDFL is the topic of our publication.

6-NDFL and GPC agreement

Civil law contracts include contracts for the provision of services on a reimbursable basis (for example, renting property from an individual), etc. They are agreements in which a private person - contractor/contractor/lessor, undertakes to perform a set of works specified in the contract or provide certain services , and the customer must accept and pay for them.

Payment under a GPC agreement is income subject to personal income tax, so the customer has the obligation of a tax agent. He must accrue the payment amount to the contractor, withhold and transfer personal income tax from it, and also notify the Federal Tax Service about the conduct of these operations, i.e. fill out form 6-NDFL.

How to reflect a contract in 6-NDFL

Income from contract work and the transferred tax are reflected in 6-NDFL as follows:

The first section of the report indicates

- in field 010 – tax rate (13 or 30%);

- in field 020 – the amount of payments for work/service performed on an accrual basis from the beginning of the year;

- in field 040 – the amount of accrued tax on an accrual basis from the beginning of the year;

- in field 070 – the amount of personal income tax withheld since the beginning of the year;

The second section of the report indicates:

- in field 130 – payment amount (including personal income tax);

- in field 140 – the amount of tax withheld;

- in field 100 – the date of receipt of the payment;

- in field 110 – the date of personal income tax withholding from the income received;

- in field 120 – the date no later than which the personal income tax must be transferred.

To correctly file 6-NDFL for contract payments, you must remember the requirements of the Tax Code of the Russian Federation:

- each payment, incl. advance or partial payment must be reflected in the report;

- information on them is recorded in the 1st section on an accrual basis, in the 2nd - for the reporting quarter;

- the day the contractor is paid for the work performed (including advance payment) is considered the day the income is received;

- Tax on each payment must be transferred the next day after payment.

The 6-NDFL report reflects only the income received and only in the period in which it was received. For example, if the contractor’s work was completed in March 2021, and the remuneration was paid to him in April 2021, then the tax agent will reflect his income in the report for the 2nd quarter of 2021.

Taking into account all the requirements of tax authorities, we will consider how to reflect a contract agreement in 6-NDFL using examples of the performance of work and the provision of services.

Filling out 6-NDFL for payments under contract agreements

Hello, I just can’t figure out section 1. (Everything is clear with the second section) Please help.

There are no accruals for the first quarter.

The question is: in section 1, line 020 “Amount of accrued income,” what amount should I have?

in line 040 “Amount of calculated tax” what amount of personal income tax should I indicate? in line 070 “Amount of withheld tax” what amount of personal income tax should I indicate?

and whether it is necessary to fill out line 080 “Amount of tax not withheld by the tax agent” and maybe others in this situation.

Personal income tax from payments dated July 13 will go to line 070 in 6-personal income tax for 9 months.

The tax office also told me to show only those amounts under GPC agreements that were paid during this reporting period. Where can I read exactly how to proceed? Where can I find confirmation of your words? I don’t want to submit the correction twice. Help me figure it out.

: Employment contract with a school bus driver

But in an article in the magazine “Simplified” they write differently:

“Question In our organization, in addition to wages, remuneration was accrued every month under civil contracts. Salaries and remuneration under GPC agreements for January 2021 were paid on February 10, 2021, for February 2021 - March 10, 2021,

for March - April 08, 2021

Any use of materials is permitted only with a hyperlink.

How to correctly reflect a contract in 6-NDFL?

How to reflect a contract in 6-NDFL? The answer to this question is not as simple as it seems at first glance. Our material will tell you about the features of “contract” payments.

Contract agreement and 6-NDFL: basic provisions

A work contract is one of the types of civil law agreements (GPC), in which:

- the contractor (performer) has the obligation to perform the work stipulated by the contract according to the customer’s instructions;

- The customer assumes the obligation to accept the results of the work performed and pay for it.

Payment for “contract” work is income subject to personal income tax for the contractor. For the customer, the payment of such income is associated with the performance of the duties of a tax agent and the reflection of this “contract” payment in 6-NDFL.

Find out what to pay attention to when concluding a contract in this article.

To reflect “contract” income in 6-NDFL, the following data will be required:

- the cost of “contract” work - it falls on page 020 of section 1 of the report;

- calculated and withheld personal income tax - it is reflected on lines 040 and 070;

- in section 2 of the report, blocks pp. 100–140 are filled in for each date of “contract” payments (they will be discussed in more detail later).

In order for “contract” payments to be reflected without errors in 6-NDFL, you should remember the following tax requirements:

Source: https://map-expo.ru/dogovor/kak-pravilno-otrazit-dogovor-podrjada-v-6-ndfl.html