Goals and objectives of accounting for receipt of goods

The main purposes of accounting for receipt of goods:

- Control over the safety of incoming valuables, prevention of theft and loss.

- Possibility of providing information about the company's gross income and inventory status.

Receipt accounting faces these tasks:

- Establishment of material responsibility for valuables.

- Possibility of confirming the accuracy of registration of commodity transactions.

- Detection of stale products.

- Establishing timeliness of capitalization.

- Assistance in taking inventory.

- Determination of gross income.

- Pricing management.

Accounting for receipt of goods is carried out in accordance with these principles:

- Unity of all meanings.

- Ability to quickly retrieve credentials.

- Maintaining accounting in accordance with the liability agreement.

- The same assessment for capitalization and write-off.

Based on accounting, an audit of financially responsible persons is carried out. If accounting is not organized correctly, the risk of theft of valuables increases. Information chaos blocks the ability to successfully manage trading processes.

Concept and types of trade

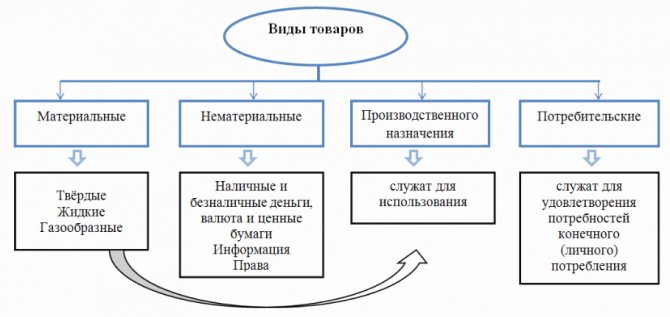

Trade is a separate branch of the economy associated with the process of transferring inventory, initially purchased for subsequent resale, for a fee from the seller to the buyer and includes a set of specific operations performed in this case.

There are 2 types of trade: wholesale and retail.

Wholesale trade is the transfer of goods and materials for a fee from the manufacturer (seller) to another seller for subsequent retail sale. Carried out in large quantities, usually at a lower price than retail.

Retail trade - single (piece) transfer of goods and materials for a fee to the end consumer.

Accounting in trade, retail and wholesale, differs both in its legislative approach and in the algorithm for reflecting business transactions. Let's look at these differences in more detail.

How to close 41 posting accounts

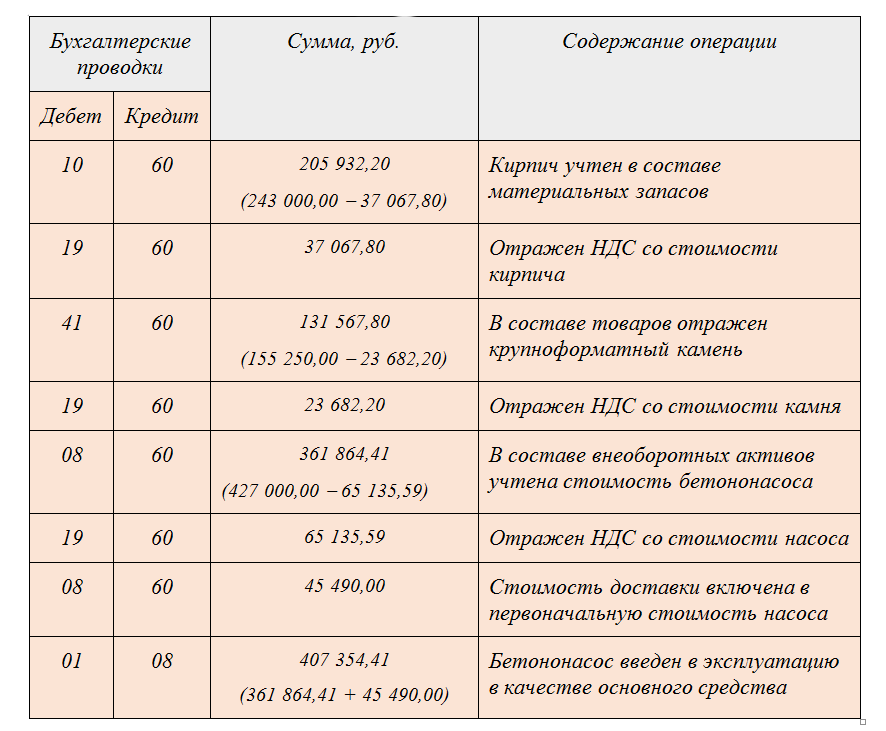

Accounting account 41 is the active “Goods” account, designed to accumulate data on the availability and movement of inventory items purchased as goods for sale. In commercial activities, it plays a major role, since all work processes are built on the basis of data about its presence and movement in the organization.

Account 41 Goods - postings in the 1C 8.3 program - accountant courses accounting for goods

Source: https://f-52.ru/kak-zakryt-41-schet-provodki/

Accounting in wholesale trade

Wholesale trade involves selling large quantities of goods at a low cost. Typically, products are sold to retail companies. As part of accounting, ongoing transactions must be reflected: receipt of inventory, their sale, movement within the company.

Receipt of goods and materials

Postings are used to record the receipt of goods. The receipt of valuables is reflected using these entries:

- DT41 KT60. Admission.

- DT19 KT60. Reflection of incoming VAT.

Postings must be confirmed by an invoice in the TORG-12 form, or an invoice. PBU 5/01 states that direct expenses for the purchase of valuables are included in the cost price. Direct expenses include these expenses:

- Delivery of valuables.

- Duty paid at customs.

- Payment for the services of intermediaries and consultants.

- Income that is not reimbursed.

- Insurance.

Direct expenses must be recorded using this posting: DT41 KT60.

ATTENTION! If the company maintains simplified accounting, direct expenses can be taken into account as part of expenses for the main areas of activity. This is only possible if there are no significant balances in the warehouse.

Movement of valuables within a retail facility

Once the values are accepted, they can be moved to other departments. Expenses for internal movement and storage of inventory items are recorded in the cost structure for the main areas of activity. Let's look at the wiring used:

- DT44 KT60. Cost of third party services.

- DT19 KT60. Reflection of incoming VAT.

Postings must be confirmed by contracts with third-party companies, notes on the movement of valuables.

Realization of values

When selling consignments of goods, these postings are used:

- DT62 KT90/1. Sale of valuables.

- DT90/3 KT68. Allocation of VAT on sales.

- DT90/2 KT41. Write-off of sold assets at their actual cost.

Transactions are confirmed by checks and contracts with customers.

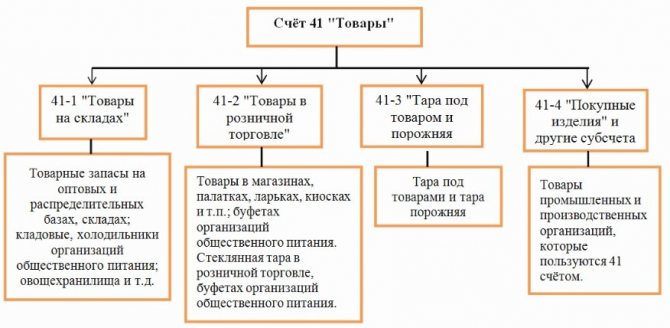

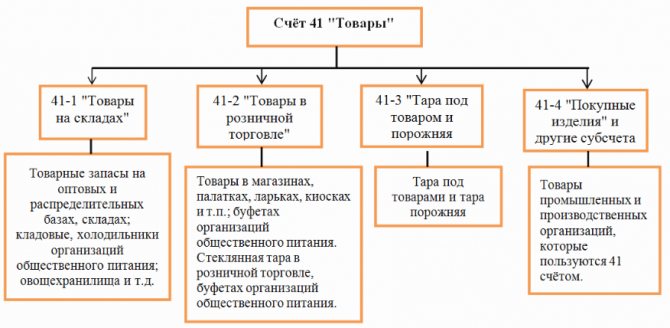

Existing subaccounts of account 41

According to the order approving the Chart of Accounts for the account. 41 you can open at least 4 sub-accounts for product classification:

- Account 41-01 - the subaccount takes into account products that are in the warehouse, base, or pantry.

- 41-02 - this subaccount reflects the presence and movement of material assets (including glassware) that are directly put up for sale in a store, kiosk, tent or stall.

- 41-03 - this subaccount takes into account all containers: currently occupied or empty, standing separately (except for glassware).

- 41-04 - this subaccount is used in organizations that conduct industrial or production activities. At 41-04, they take into account products that are purchased specifically for sale or when the cost of components for finished products is not included in the cost of the final product, but is reimbursed separately by buyers.

Accounting has the right to open other, additional sub-accounts to the account. 41 taking into account the specifics of the enterprise’s operations, if the need arises for more detailed account details.

Note! For account 41 analytical accounting can be maintained in the accounting department in the context of product names, places of their storage, as well as persons responsible for it.

Subaccounts 41

Accounting: admission

In accounting, goods can be capitalized after their acceptance and verification of quantity has been completed (clause 2.1.13 of the Methodological Recommendations, approved by letter of the RF Committee on Trade dated July 10, 1996 No. 1-794/32-5).

The procedure for reflecting received goods in accounting depends on:

- method of receiving the goods;

- terms of the contract governing the procedure for transferring ownership of the goods from the seller to the buyer;

- the applied taxation system;

- methods of accounting for goods enshrined in the accounting policy for accounting purposes.

The accounting policy of the organization must include, at a minimum, the following points:

- the method of forming the cost of goods (including or without the costs of their acquisition);

- method of reflecting the cost of goods in accounting;

- method of accounting for trade margins.

If there is a need to keep records of goods according to a specially developed nomenclature, also indicate this in the organization’s accounting policy for accounting purposes. Note that the names of goods in receipt documents and accounting registers used in the organization may not match, and describe the technology for processing accounting information that comes from suppliers of goods. The legitimacy of this approach is confirmed by the letter of the Ministry of Finance of Russia dated October 28, 2010 No. 03-03-06/1/670.

Situation: how to reflect in accounting the receipt of goods and materials, some of which are intended for resale, and some for use in production? The amount of inventory items that will be used in different types of activities is unknown in advance.

If inventory items are purchased for further sale, then they must be credited to account 41 “Goods”. If inventory items were purchased for use in production (administrative activities), then they must be capitalized on account 10 “Materials”.

However, regardless of the account in which inventory items are capitalized, in the future the organization will be able to either write them off for production or sell them.

If all received goods and materials are capitalized as goods, then when using them further as materials, make the following posting:

Debit 10 Credit 41

– part of the goods has been capitalized for use as materials.

If all received goods and materials are capitalized as materials, then upon further resale of these goods and materials, the appearance of other income and expenses must be reflected in accounting (paragraph 6, paragraph 7, PBU 9/99, paragraph 5, paragraph 11, PBU 10/99). In accounting, reflect the sale of materials with the following entries:

Debit 62 (76, 73...) Credit 91-1

– sales of materials are reflected (as of the date of transfer of ownership);

Debit 91-2 Credit 10

– the cost of materials sold is written off;

Debit 91-2 Credit 68 subaccount “VAT calculations”

– VAT is charged on sales (if the transaction is subject to this tax).

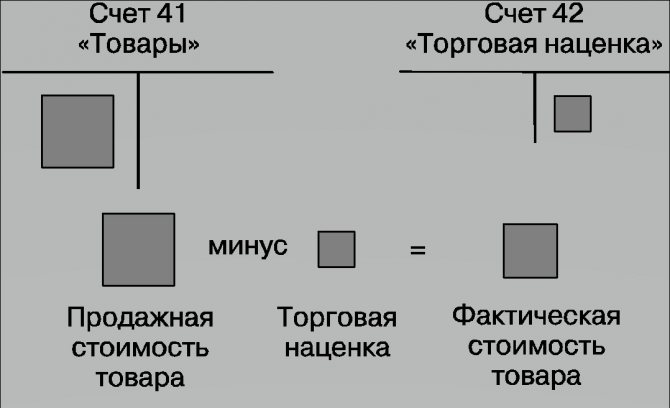

Accounting for goods at sales prices

If an organization keeps records of goods at sales prices, then when writing off the cost, account 42 “Trade margin” is used. When purchasing the goods, this account reflected the value of the trade margin (Instructions for the chart of accounts). For more information, see How to reflect the purchase of goods in accounting.

To reflect the sale of goods in accounting using account 42:

– write off the cost of goods sold in sales prices;

– reflect the reversal of the trade margin.

This procedure is provided for in the Instructions for the chart of accounts.

To determine the amount of the markup related to goods sold (or disposed of for other reasons), determine the average percentage of the markup related to the balance of goods at the end of the month. Its size is determined by the formula:

Next, calculate the amount of markup attributable to the balance of goods at the end of the month:

| Trade margin attributable to the balance of goods at the end of the month | = | Balance at the end of the month on the debit of account 41 | × | Average percentage of markup related to the balance of goods at the end of the month |

Then calculate the amount of trade margin attributable to the goods sold:

| Trade margin attributable to goods sold | = | Balance at the beginning of the month on account 42 | + | Credit turnover on account 42 | – | Trade margin attributable to the balance of goods at the end of the month |

This procedure follows from the Instructions for the chart of accounts.

Make the following entries in accounting:

Debit 90-2 Credit 41

– the cost of goods sold is written off at sales prices;

Debit 90-2 Credit 42

– the reversal of the trade margin is reflected.

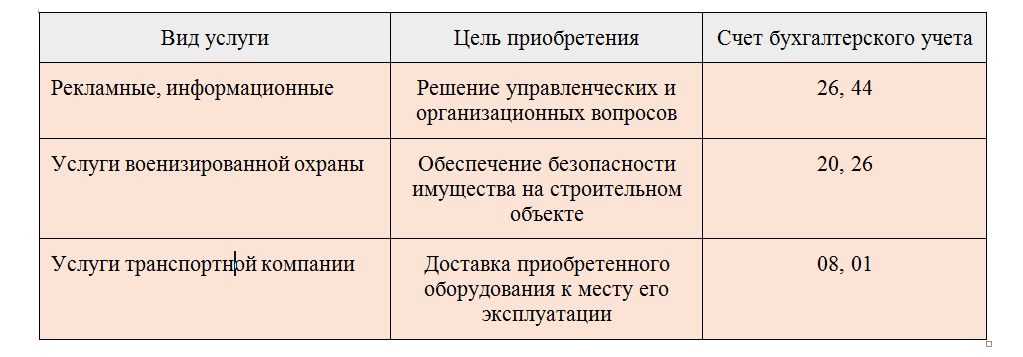

What nuances affect the reflection of goods and services in accounting?

In the business activities of any company, the need regularly or periodically arises to purchase goods and (or) services from third-party sellers (performers, suppliers). If material assets are purchased in a retail chain, from the seller’s point of view they are all goods. However, when posting a purchase to the company (buyer) accounts, it is necessary to correctly classify it as:

- goods for resale (account 41 “Goods”);

- fixed assets (accounts 08 “Investments in non-current assets”, 01 “Fixed assets”);

- MPZ (accounts 10 “Materials”, 15 “Procurement and acquisition of material assets”, 16 “Deviation in the cost of material assets”).

The situation with the purchase of services is also ambiguous. The determining factor here is the purpose of their acquisition. For example:

In each case, the transactions for the purchase of goods and services will be different.

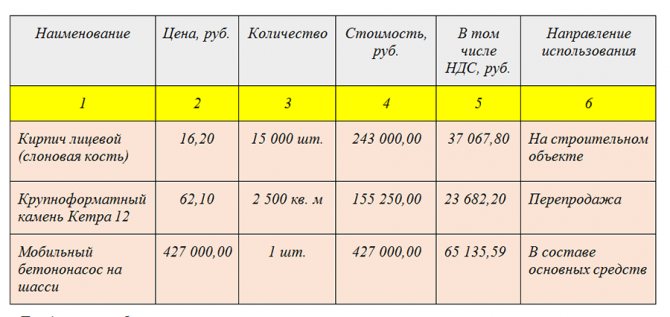

Basic accounting entries for the purchase of goods and services (example)

An example will help us understand the transactions for the receipt of goods and services.

Manufacturing Company LLC purchased the following goods from its supplier (a large retail chain):

To deliver the concrete pump, the company used transport services. Taking into account the range of movement and the large size of the cargo, its cost was estimated at 45,490 rubles. (without VAT).

The accountant of Production Company LLC took into account the planned uses of purchased assets (column 6) and made the following accounting entries for the receipt of goods and services:

What is account 41 in accounting

41 account “Goods” is an account that shows the cost reflection of the material assets available to the organization, and their movement - receipt and write-off. 41 accounting accounts are used when maintaining accounting records for organizations engaged in the resale of various products (food, non-food stores), and catering establishments.

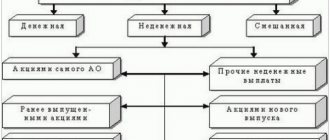

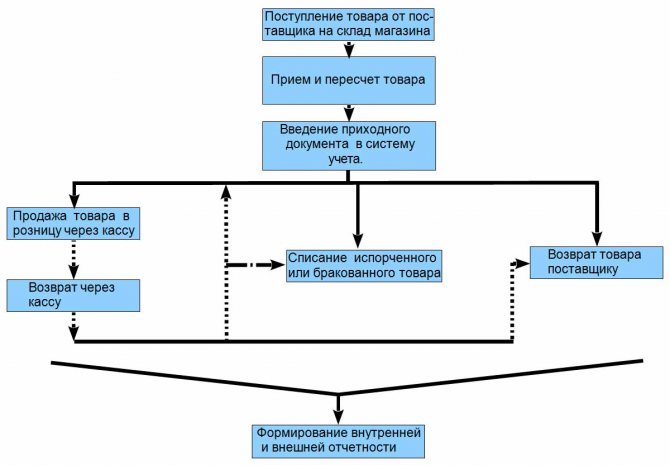

Scheme of goods movement at the enterprise

However, its use is possible in enterprises that carry out production activities. In this case, one of the subaccounts 41 is opened to account for products purchased for the purpose of sale, as well as for accounting for components, the cost of which is compensated separately by the buyer.

Specifics of accounting in retail trade

Accounting in retail trade is somewhat different from accounting for wholesale goods. This is due not only to the fact that sales are carried out in small batches or individually, but also to the predominance of cash payments.

Accounting for receipt of goods and materials

Retail organizations have the right to keep records of inventory items both at purchase prices and at sales prices with a separate accounting of markups (clause 13 of PBU 5/01).

IMPORTANT! The chosen accounting option should be recorded in the accounting policy.

If the store has accounting programs and special equipment, then records are kept for each type of inventory, and the program automatically writes off the cost of inventory at purchase prices (that is, quantitative and total accounting is maintained).

Well, for small shops and retail outlets that are not equipped with a software product, it is more convenient to keep records at selling prices, since this method is less expensive.

In this case, the markup is reflected on account 42 at the time of receipt of the goods.

Let's consider how transactions will differ when goods are received depending on the selected accounting price method.

| Accounting type | ||||

| At purchase prices | Content | At selling prices | ||

| Dt | CT | Dt | CT | |

| 41 | 60 | The goods have arrived | 41 | 60 |

| 19 | 60 | VAT allocated | 19 | 60 |

| Extra charge taken into account | 41 | 42 | ||

The entire amount of cash proceeds received is collected per day and recorded with the entry: Dt 50 Kt 90.1 - receipt of proceeds to the cash desk..

Sales accounting

The entire amount of revenue received is collected per day and in account 90.1 “Revenue” and is recorded as follows: Dt 50 Kt 90.1 - receipt of revenue to the cash desk.

Many stores install payment terminals for paying customers using bank cards. This type of settlement is called acquiring and is recorded by posting: Dt 51 (57) Kt 90.1.

After registering the revenue, it is necessary to show the disposal of the goods. This fact is reflected by the entry: Dt 90.2 Kt 41.

Since inventory items are listed on account 41 at selling prices, it turns out that the amount of revenue and the amount of write-off of goods are equal, so it is necessary to additionally take into account the sold margin. This is done by wiring: Dt 90.2 Kt 42 (reversible). The realized markup is the gross income of the business and is called the realized overlay.

Let's look at the differences in postings depending on the chosen price accounting method.

| Accounting type | ||||

| At purchase prices | Content | At selling prices | ||

| Dt | CT | Dt | CT | |

| 50 (51, 57) | 90.1 | Revenue received | 50 (51, 57) | 90.1 |

| 90.3 | 68 | VAT charged on revenue | 90.3 | 68 |

| 90.2 | 41 | Cost of goods sold written off | 90.2 | 41 |

| Realized markup written off | 90.2 | 42 (reversible) | ||

According to clause 12 of the Methodological Recommendations for accounting and registration of operations for the receipt, storage and release of goods in trade organizations (letter of Roskomtorg dated July 10, 1996 No. 1-794/32-5), the realized overlay is determined by calculation when accounting for inventory items at selling prices.

Calculation is carried out in 4 ways:

- Based on total trade turnover.

- Assortment of commodity turnover.

- Average percentage

- Assortment of remaining inventory items.

The selected calculation option must be reflected in the company's accounting policies.

The most convenient and frequently used method is the average percentage calculation.

The implemented overlay is calculated, usually at the end of the month, using the following formulas:

Mon = (Nstart + Npost – Nset) / (Tob + Remaining) × 100%,

Where:

Mon—percentage of realized margin;

Nnach - opening account balance 42;

Npost - the amount of the received markup (credit turnover of account 42);

Nvyb - the amount of discounts, markdowns and other operations that reverse account 42;

Tob - revenue;

Residual — balance of inventory items at the end of the billing period.

Рн = Mon × Tob,

Where:

Рн — implemented overlay.

The amount received is recorded as follows: Dt 90.2 Kt 42 (reversal).

For each sale, the seller is required to enter a cash receipt. This document reflects the amount of VAT, and it eliminates the need to issue an invoice (clause 7 of Article 168 of the Tax Code of the Russian Federation). And a cash register report for the shift is entered into the purchase book.

This rule applies exclusively to cash payments. If the money is credited to the current account, the seller is obliged to draw up an invoice within 5 days (clause 3 of Article 168 of the Tax Code of the Russian Federation).

You will find more nuances regarding VAT in retail trade in the Ready-made solution from ConsultantPlus, having received free trial access to the system.

Correspondence of account 41 with other accounts in accounting

Account 41 by debit corresponds with the accounts of the following sections:

- Section 2 - 15.

- Section 4 - 41, 42, 43.

- Section 6 - 60, 66, 67, 68, 71, 73, 75, 76, 79.

- Section 7 - 80, 86.

- Section 8 - 90, 91, 98.

For loan 41, correspondence goes through the following sections:

- Section 2 - 10.

- Section 3 - 20, 29.

- Section 4 - 41, 44, 45.

- Section 6 - 76, 79.

- Section 7 - 80.

- Section 8 - 90, 94, 97, 99.

Receipt of goods from the supplier

Goods are material assets that an organization purchases from a supplier (seller) for the purpose of their further resale. Moreover, the sale of goods refers to the usual activities of the enterprise. Let's take a closer look at how to accept goods for accounting, at what cost they should be received and to what account.

Goods may be received at the enterprise warehouse by:

- Purchase price

- Sales price

- Registration prices

Moreover, wholesale trade enterprises can only use the first and third methods. Retailers can use any of the three presented.

Accounting for goods at purchase price

If a trade organization chooses this method of accounting for goods, then its decision must be reflected in the order on accounting policies.

The purchase price includes the direct cost of the goods indicated in the supplier’s documents, minus VAT. In addition, this includes all associated costs associated with the receipt of goods at the warehouse (transportation costs, procurement costs, etc.).

Transportation and procurement costs (TZR) can either be included in the purchase price of the goods or be allocated separately to the account for accounting expenses for sales.

To reflect all transactions related to goods, there is account 41 “Goods”, this is an active account, the debit of which reflects the receipt of goods, and the credit their write-off (disposal).

When accepting goods for accounting, the accountant performs posting D41 K60. The cost of this transaction does not include VAT. That is, if the supplier presented an invoice with a allocated amount of value added tax, then VAT is allocated from the cost of the goods by posting D19 K60, after which it is sent for reimbursement from the budget D68/VAT K19.

If transportation and procurement costs are also included in the purchase price of the goods, then posting D41 K60 (76) is reflected, VAT on TZR is also allocated separately by posting D19 K60 (76).

Postings upon receipt of goods:

| Debit | Credit | the name of the operation |

| 41 | 60 | Goods are accepted for accounting at supplier cost (excluding VAT) |

| 19 | 60 | The amount of VAT charged by suppliers has been highlighted |

| 41 | 60 | The cost of equipment and equipment is reflected (if these costs are included in the purchase price) (excluding VAT) |

| 19 | 60 | VAT is allocated from the amount of TZR |

| 68.VAT | 19 | VAT is deductible |

| 44.TR | 60 | The cost of equipment and materials is reflected as part of sales expenses (if these expenses are allocated separately) |

| 60 | 51 | Payment for transport services has been transferred |

| 60 | 51 | Payment for the goods has been transferred to the supplier |

Accounting for goods at sales price

This method of accounting for goods is used only by retail enterprises. Its essence lies in the fact that commodity values are accounted for in account 41, taking into account the trade margin. For these purposes, additional account 42 “Trade margin” is introduced.

First, goods are debited to the account. 41 at the purchase price (posting D41 K60) excluding VAT, after which a trade margin is added using posting D41 K42.

When the goods are sent for sale, the trade margin will be deducted from the credit account 42 using the “reversal” operation (entry D90/2 K42). In this case, the amount of write-off of the trade margin must be proportional to the goods shipped.

If goods are sent for other needs, then the trade margin is written off to the account to which the goods are written off.

Postings to account 41:

| Debit | Credit | the name of the operation |

| 41 | 60 | Goods are accepted for accounting at supplier cost (excluding VAT) |

| 19 | 60 | The amount of VAT presented by the supplier is highlighted |

| 41 | 60 | The cost of equipment and equipment is reflected (if these costs are included in the purchase price) (excluding VAT) |

| 19 | 60 | VAT has been allocated from the TZR system |

| 68.VAT | 19 | VAT is deductible |

| 44.TR | 60 | The cost of equipment and materials is reflected as part of sales expenses (if these expenses are allocated separately) |

| 60 | 51 | Payment for transport services has been transferred |

| 60 | 51 | Payment for the goods has been transferred to the supplier |

| 41 | 42 | Trade margin reflected |

Accounting for goods at discount prices

This method involves the use of pre-established discount prices. When goods arrive, they are debited to the account. 41 already at the discount price. In order to reflect the difference between the accounting value and the purchase value, two additional accounts are introduced: 15 “Procurement and acquisition of material assets” and 16 “Deviation in the cost of material assets”.

At the purchase price, goods are debited to the account. 15 using wiring D15 K60 (excluding VAT). After which the goods are credited to the account. 41 at discount prices using wiring D41 K15.

On account 15, a difference has formed between the debit and credit values (purchase and accounting prices), this difference is called a deviation and is written off to the account. 16.

If the purchase price is greater than the accounting price (debit is greater than credit), then the entry for writing off the deviation has the form D16 K15. Posting is carried out exactly for the difference between the book value of the goods and the purchase price.

If the purchase price is less than the accounting price (credit is greater than debit), then the posting looks like D15 K16.

After the manipulations on the account. 16 reflects the deviation in debit or credit, which at the end of the month is written off as selling expenses. If the deviation is reflected in the debit of account 16, then the posting for writing off the deviation looks like D44 K16. If the deviation is reflected on credit account 16, then the “reversal” operation is performed - posting D44 K16.

Postings upon receipt of goods at accounting prices:

| Debit | Credit | the name of the operation |

| 15 | 60 | The cost of goods is reflected according to the supplier’s documents (excluding VAT) |

| 19 | 60 | The amount of VAT presented by the supplier is highlighted |

| 15 | 60 | The cost of TZR is reflected (excluding VAT) |

| 19 | 60 | VAT is allocated from the amount of TZR |

| 68.VAT | 19 | VAT is deductible |

| 60 | 51 | Payment for transport services has been transferred |

| 60 | 51 | Payment for the goods has been transferred to the supplier |

| 41 | 15 | Goods are capitalized at accounting prices |

| 16 | 15 | The deviation between the accounting and purchase price is reflected |

What is it used for?

41 accounting accounts are used to reflect the cost of products intended for sale. The following types of expenses may be included:

- the cost of purchasing goods from the supplier;

- paid customs duties for clearing products at customs (if they crossed the state border);

- transport costs;

- payment to intermediaries;

- other expenses that are directly related to the purchase of goods.

Also, VAT may be included in the cost if the company operates under the simplified tax system.

When retailing goods, they are taken into account in accounting in various ways:

- At purchase prices. In this case, the cost of the product includes its price minus indirect tax (VAT) and all expenses that the company incurred in purchasing it. These could be, for example, procurement costs or transport costs.

- At the selling price. In this case, the goods are recorded in accounts at cost, including trade margins. Only enterprises engaged in retail trade can keep records using this method. The trade margin is reflected in the account. 42 and is written off from there when the goods are sold.

Selling price

- At discounted prices. All goods are accepted at certain discount prices. The difference between the purchase price and the accounting price is reflected in the account. 15, and the goods are written off through the account. 16.

Important! The accounting method must be reflected in the accounting policy of the enterprise.

Accounting for the receipt of products at the warehouse

The receipt of goods is taken into account in account 41. Its debit reflects the receipt, and its credit reflects the disposal. There are several accounting methods:

- At cost of sale.

- At book value.

- At cost.

Cost accounting is relevant for wholesale and manufacturing entities. In retail companies, accounting is carried out either at cost or at cost of sales.

Accounting at actual cost

If accounting is kept at cost, you need to record the cost that is written down in the papers from the supplier. If the supplier has calculated VAT and presented an invoice, the amount of tax deductions is placed in a separate sub-account. Capitalization occurs at cost, which does not include VAT. However, the price may include transportation costs. Sometimes these expenses are separately accounted for on the debit of account 44. Let's consider the entries used:

- DT41 KT60 (76). Receipt of products to the warehouse.

- DT19 KT60 (76). Allocation of VAT.

- DT60 KT51. Transfer of funds to the supplier.

Products can be purchased using a loan. In this case, interest on the loan may be included in the cost. In this case, they are recorded on the debit of account 41.

Example of accounting at actual cost

The company took out a loan to purchase goods. Interest is charged on borrowed funds, which is included in the structure of operating expenses. The received goods were later sold. Let's look at the wiring used:

- DT51 KT66. Obtaining borrowed funds.

- DT41 KT60. Posting of goods.

- DT19 KT60. Allocation of tax.

- DT68 KT19. VAT tax deduction.

- DT91/2 KT66. Calculation of interest on the loan.

- DT90/2 KT41. Write-off of the cost of products for sale.

- DT62 KT90/1. Revenues from sales.

- DT90/3 KT68. VAT accrual on products sold.

- DT51 KT62. Receiving payment for goods sold.

The transaction for obtaining a loan must be confirmed by an agreement with the banking institution.

Accounting at cost of sales

If goods are accounted for at the cost of their sale, you will need invoice 42. The trade margin is recorded on it. It includes VAT. To fix the markup, this wiring is used: DT41 KT42. When the goods are sold, the markup is reversed, which is why this posting is needed: DT90/2 KT42.

The seller can discount his products. In this case, the amount of the markdown is written off against the markup. If the size of the markdown is greater than the markup, the difference is included in the structure of other expenses. In this case, this wiring is used: DT91/2 KT41.

If products are written off for the needs of the company, the markup must also be written off for needs. These wirings are required: DT44 KT41, DT44 KT42. If products are disposed of due to spoilage, this entry is used for write-off: DT94 KT41. The extra charge will be written off in DT account 94 . The corresponding account is KT42.

Example of accounting at cost of sales

The company purchased products in the amount of 12,000, the price included VAT in the amount of 2,000 rubles. The VAT rate on sales is 18%. The markup is 30%. Accounting is preceded by these calculations:

- (12,000 – 2,000) * 30% = 3,000 rubles (markup amount).

- (10,000 + 3,000) * 18% = 2,340 rubles (VAT on sales).

- 3,000 + 2,340 = 5,340 rubles (total markup).

The following entries are used in accounting:

- DT41 KT60. Capitalization in the amount of 10,000 rubles excluding VAT.

- DT19 KT60. Allocation of tax on purchased valuables in the amount of 2,000 rubles.

- DT68 KT19. Tax deduction for VAT in the amount of 2,000 rubles.

- DT60 KT51. Transfer of funds to the supplier in the amount of 12,000 rubles.

- DT41 KT42. Trade margin in the amount of 5340 rubles.

- DT90/2 KT41. Write-off of the value of valuables in the amount of 15,340 rubles.

- DT90/2 KT42. Reversal of the markup in the amount of minus 5,340 rubles.

- DT62 KT90/1. Proceeds from the sale in the amount of 15,340 rubles.

- DT90/3 KT68. VAT accrual on goods sold in the amount of 2,340 rubles.

- DT51 KT62. Transfer of payment for goods from the buyer.

Cost and sales value accounting are the most common accounting methods.

D 41 to 60 primary document

When an organization engaged in retail trade records goods at sales prices, simultaneously with this entry, an entry is made to the debit of account 41 “Goods” and the credit of account 42 “Trade margin” for the difference between the acquisition cost and the cost at sales prices (discounts, markups). Transport (for delivery) and other costs for the procurement and delivery of goods are charged from the credit of account 60 “Settlements with suppliers and contractors” to the debit of account 44 “Sales expenses”. The receipt of goods and containers can be reflected using account 15 “Procurement and acquisition of material assets” or without using it in a manner similar to the procedure for accounting for corresponding transactions with materials. When recognizing revenue from the sale of goods in accounting, their value is written off from account 41 “Goods” to the debit of account 90 “Sales”.

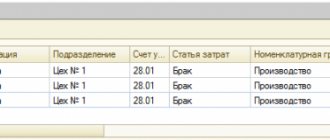

VAT accrued on sales; The following entries were made in tax accounting: D90.02 K41.02 2000 rub. — the book value of goods is written off; in tax accounting this is the purchase price. DPV K90.01.2 2500 rub. — income received from sales is reflected. The document also formed movements in the following registers:

- VAT accrued;

- VAT on inventory lots;

- VAT accounting of distributed payments from buyers;

Please note that the document forms movements on account 50 - that is, it reflects the receipt of revenue at the cash desk.

Based on the Retail Sales Report document, you can enter a Cash receipt order with the transaction type Reception of retail revenue.

It should be noted that this PKO, when carried out, does not generate movements in registers - cash book entries are generated on its basis, so we must generate it.

Account 41 - goods

Before the document was carried out, this type of price for one package of wallpaper glue, which we bring to the warehouse, was set at 590 rubles. That is, 10 packages of glue will cost 5,900 rubles.

And we capitalized 10 packages at an actual cost of 4,000 rubles. 5900 - 4000 = 1900. It is for this amount that the posting D41.11 K42.01 was made. The following entry was generated in tax accounting: D41.

02 KPV 4000 rub.

- VAT presented;

- VAT settlements with suppliers;

- VAT on stock lots.

After the goods have been received, we can continue our example - we will sell them at retail.

On February 17, 2009, 5 packs of wallpaper paste were sold at retail at a price of 590 rubles. per package.

Lesson 12.6

Attention

Subaccount 41-1 “Goods in warehouses” takes into account the presence and movement of inventory located at wholesale and distribution bases, warehouses, storerooms of organizations providing catering services, vegetable storehouses, refrigerators, etc.

Subaccount 41-2 “Goods in retail trade” takes into account the availability and movement of goods located in organizations engaged in retail trade (in shops, tents, stalls, kiosks, etc.) and in buffets of organizations engaged in public catering.

The same sub-account takes into account the presence and movement of glassware (bottles, cans, etc.) in organizations engaged in retail trade and in buffets of organizations providing catering services.

Inventories, goods, finished goods

Data on retail sales of goods is entered upon the fact of sale using the document Retail Sales Report (Sales Retail Sales Report). Let us remind you that the goods sold were stored in the warehouse Warehouse in the store, which has the Retail type.

Sales of goods stored in such a warehouse are carried out using cash register equipment. Therefore, when creating the Retail Sales Report document, we select the document type as cash register.

This document can be created by selecting one of two types of operation:

- KKM - to reflect sales made using cash registers;

- NTT - to reflect sales made at a manual point of sale.

In the figure below you can see the completed document form. Let's consider the features of filling it out: Organization: Furniture maker; Cash account: 50.01; Report to tax.

D41.goods in retail trade k41.goods in warehouses

RETURN OF GOODS FROM CUSTOMERS Posting: Account D. 90 “Sales” — Account Account 41 “Goods” We arrive at the cost of goods Amount Reversal: (-1)* calculated amount (depends on the method of calculating the amount of write-off of goods, see below) Posting date: date in the invoice from the client for the sale of goods.

Note: this is one of the entries that is reflected at the time of sale of goods, its essence is to reflect the cost of products that are sold. Documents that accompany invoice 41 “Goods”: 1. Agreement of material liability with the employee.2.

An act of acceptance of goods (form N TORG-1) is drawn up in cases where there are no documents in form Torg-12 from the supplier (example: the goods were delivered from abroad or if it was brought by a transport company and only gives you a piece of luggage).3.

Act on the established discrepancy in quantity and quality when accepting inventory items (Form N TORG-2).

D 60 to 51

Amount: calculated amount (depends on the method of calculating the amount of write-off of goods, see below) Posting date: date in the invoice for the transfer of goods to the promotion Note: WE WILL write off goods transferred to departments for our own needs Posting: D.account 26 “General business expenses” - TO.

accounts 41 “Goods” If you sell household chemicals, then for example you can use soap for your own needs.

Amount: calculated amount (depends on the method of calculating the amount of write-off of goods, see below) Posting date: date in the invoice for the transfer of goods for our own needs Note: WRITTEN OFF the cost of goods upon sale Posting: Account D. 90 “Sales” (Cost) - K .

account 41 “Goods” We write off the cost of goods that were sold to the buyer Amount: calculated amount (depends on the method of calculating the amount of write-off of goods, see below) Posting date: date in the invoice for the sale of goods.

41 “goods” account

In accordance with the instructions for the chart of accounts given in the order of the Ministry of Finance of Russia “On approval of the chart of accounts for accounting financial and economic activities” dated October 31, 2000 No. 94n (hereinafter referred to as the chart of accounts), Dt 41 Kt 41 is used by organizations operating in the field of:

- catering;

- trade;

- production.

Depending on the type of activity in the chart of accounts, the following recommendations are given for the use of subaccounts to account 41:

- 41.01 - to reflect information about inventory items in a warehouse or catering storerooms;

- 41.02 - for goods and materials in retail trade and public catering;

- 41.03 - for information on containers for catering and trade;

- 41.04 - for inventory items in production.

At the same time, the organization can approve its own sub-accounts that are unique to it, the use of which may differ from those recommended. Above, we looked at the scheme of entries in accounting accounts for the sale of goods at retail. You may notice that the Retail Sales Report document does not generate a reversal entry of the type D90.02 K42.

Important

This posting can be made by the document Closing the Month (Operations Regular Operations Closing the Month). As a rule, trade margins are written off at the end of the month for all goods sold.

As you can see, the document item Calculation of trade margins on goods sold is responsible for generating records for writing off trade margins. After execution, the document generated the following accounting entry: D90.02.1 K42.01 - 950 rubles. In 1C:Accounting, the reversal entry is made with a negative amount.

D41 K66) 67 Settlements for long-term loans and borrowings (D41 K67) 68 Settlements for taxes and fees (D41 K68) 71 Settlements with accountable persons (D41 K71) 73 Settlements with personnel for other transactions (D41 K73) 75 Settlements with founders (D41 K75) 76 Settlements with various debtors and creditors (D41 K76) 79 On-farm settlements (D41 K79) 80 Authorized capital (D41 K80) 86 Targeted financing (D41 K86) 91 Other income and expenses (D41 K91) On the loan 10 Materials (D10 K41 ) 20 Main production (D20 K41) 41 Goods (D41 K41) 44 Selling expenses (D44 K41) 45 Goods shipped (D45 K41) 76 Settlements with various debtors and creditors (D76 K41) 79 On-farm settlements (D79 K41) 80 Authorized capital (D80 K41) 90 Sales (D90 K41) 94 Shortages and losses from damage to valuables (D94 K41) 97 Deferred expenses (D97 K41) 99 Profits and losses (D99 K41) Chart of accounts Section I. Dt 41 Kt 41 may have type: Dt 41.05 Kt 41.01 (account 41.01 “Inventory in warehouse”, 41.05 “Inventory in processing”). What type of postings does account 41 involve? In order to understand the meaning of entries using posting Dt 41 Kt 41, let's look at a few examples.

Example 1 On March 10, 2016, Luna LLC purchased goods from Zvezda LLC worth RUB 283,200. (including VAT RUB 43,200). On March 14, Luna LLC transferred the payment.

Luna LLC is engaged in retail trade. Zvezda LLC sells goods wholesale. Let's consider how the implementation of Zvezda LLC will reflect:

- Dt 62 Kt 90 - revenue from the sale of goods in the amount of 283,200 rubles.

- Dt 90 Kt 68 - VAT is charged on revenue of 43,200 rubles.

- Dt 90 Kt 41 - the cost of goods sold is taken into account: 200,000 rubles.

- Dt 51 Kt 62 - payment received for goods in the amount of 283,200 rubles.

Let's look at the accounting of Luna LLC.

Source: https://advokat-na-donu.ru/d-41-k-60-pervichnyj-dokument/

Reduced tax payments

In some cases, enterprises can use the definition given in the Tax Code to minimize tax deductions. For example, a 10% VAT rate is used for the sale of certain types of food products. Their list is given in Art. 164 Tax Code (clause 2). These include, but are not limited to, baked goods and bread. To apply the specified rate, the object must act as a product. Many organizations not only produce, but also sell various pies, buns, etc., related to bakery products. According to the definition given in the PBU, they do not act as goods. And in accordance with the interpretation of the Tax Code, they act. This means that when selling, an enterprise can charge a 10% VAT rate (not 20).

Account 41: accounting for the receipt of goods at the enterprise warehouse. example, wiring

Info

The accounting records are reflected by the following entries: Dt 44 “Sales expenses” Kt accounting for production costs and materials (10 “Materials”, 23 “Auxiliary production”, 70 “Settlements with personnel for wages”, 69 “Calculations for social insurance and security” etc.) - for the amount of costs for repairing container equipment; Dt 44 “Sales expenses” Kt 60 “Settlements with suppliers and contractors” - for the amount of costs for transporting containers. If these costs are borne by the buyer (sender of the packaging equipment), he attributes them to transportation and procurement costs associated with the acquisition of inventories received in the specified containers. Buyers (recipients) of goods reimburse the supplier (owner of packaging equipment) for costs associated with depreciation, repair of packaging equipment, and other expenses in the amounts specified in the relevant supply agreements (purchase and sale, etc.).

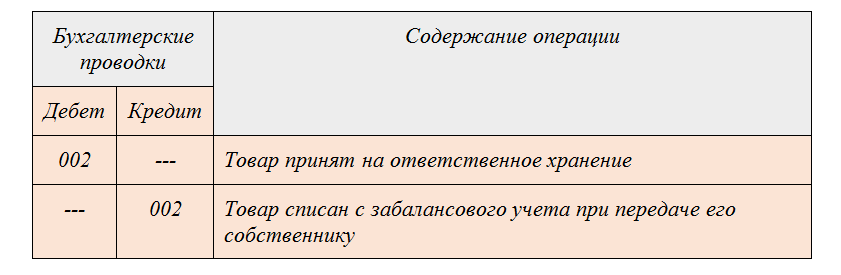

Special conditions for transfer of ownership

The agreement may provide for a special procedure for the transfer of ownership (Clause 1, Article 223 of the Civil Code of the Russian Federation). For example, the contract may state that ownership of the goods passes from the seller to the buyer only after payment.

If an organization has received goods for which ownership has not yet been transferred to it, they must be taken into account on the balance sheet:

Debit 002

– goods are accepted for safekeeping, the ownership of which has not been transferred to the organization.

Once ownership of the goods has transferred to the organization, make the following entries:

Credit 002

– goods are written off from off-balance sheet accounting;

Debit 41 (15) Credit 60 (76...)

– goods are received into the organization’s warehouse.

This procedure is established by the Instructions for the chart of accounts (accounts 60, 76).

Situation: when should the buyer reflect in accounting the purchase of goods received outside the location of the organization? According to the contract, ownership passes at the moment of acceptance and transfer.

Received goods must be capitalized at the moment the ownership of them transfers to the buyer. The fact of transfer of ownership must be documented. Therefore, if the buyer has correctly executed shipping documents, he can accept the received goods to be taken into account in the contractual valuation. After the actual cost has been generated (transportation and procurement costs are included), the cost of goods in accounting needs to be clarified (if it differs from the contractual one). This conclusion can be made by paragraph 26 of PBU 5/01, part 2 of article 9 of the Law of December 6, 2011 No. 402-FZ.

Wiring Dt 41 and Kt 41, 60 (nuances)

Dt 41 Kt 41 - such posting is accompanied by accounting in all trade organizations that sell goods both retail and wholesale. Our article will help you understand the features of using the debit and credit of account 41, as well as the contents of some transactions involving this account.

What is reflected in the score 41

When is the entry Debit 41 Credit 41 applied?

What typical transactions does account 41 involve?

Results

What is reflected in the score 41

Posting Dt 41 Kt 41 shows information about the movement of inventory items (hereinafter referred to as goods and materials) associated with:

- with their acquisition;

- moving;

- sale;

- other movements both within the organization and outside it.

In accordance with the instructions for the chart of accounts given in the order of the Ministry of Finance of Russia “On approval of the chart of accounts for accounting financial and economic activities” dated October 31, 2000 No. 94n (hereinafter referred to as the chart of accounts), Dt 41 Kt 41 is used by organizations operating in the field of:

- catering;

- trade;

- production.

Depending on the type of activity in the chart of accounts, the following recommendations are given for the use of subaccounts to account 41:

- 41.01 - to reflect information about inventory items in a warehouse or catering storerooms;

- 41.02 - for goods and materials in retail trade and public catering;

- 41.03 - for information on containers for catering and trade;

- 41.04 - for inventory items in production.

At the same time, the organization can approve its own sub-accounts that are unique to it, the use of which may differ from those recommended. They will need to be recorded in the organization's working chart of accounts.

You will learn more about the chart of accounts from the article “Working chart of accounts - sample 2015”.

When is the entry Debit 41 Credit 41 applied?

The debit of account 41 according to the instructions for the chart of accounts is often used with the following accounts:

- 15 “Procurement and acquisition of material assets”;

- 60 “Settlements with suppliers and contractors”;

- 91 “Other income and expenses”, etc.

The credit of this account is often in correspondence with the accounts:

- 10 "Materials";

- 20 “Main production”;

- 90 “Sales”, etc.

In addition, account 41 can correspond with itself, then the posting will look like this: Dt 41 Kt 41 . For example, an organization sent purchased goods for processing.

It will reflect this action in accounting as follows: Dt 41 Kt 41. If the organization uses subaccounts, then the posting Dt 41 Kt 41 may look like: Dt 41.05 Kt 41.01 (account 41.01 “Inventory in the warehouse”, 41.

05 “Inventory and Materials in Processing”).

When should goods be taken into account off balance sheet?

There are situations when there are valuables of other persons on the company’s territory. For example, when accepting a product, a defect is detected - until the supplier picks up the product, the buyer is obliged to ensure its safety (Clause 1, Article 514 of the Civil Code of the Russian Federation). Or the company provides goods storage services. In such cases, material value not related to the company's own property is subject to off-balance sheet accounting.

The postings for posting goods to the balance sheet will be as follows:

Tax accounting

The nuances of recognizing expenses and profits are stipulated in Chapter 25 of the Tax Code of the Russian Federation.

Expense recognition criteria

Within the framework of accounting, only financially justified expenses are recognized. The latter are distinguished by these characteristics:

- Related to the main work of the company.

- Required to make a profit in the future.

- Confirmed by documents.

These criteria are established by Article 252 of the Tax Code of the Russian Federation. If expenses are determined using the accrual method, they must be recognized in the period in which they occur. If the cash method is used, expenses are recognized when payment for the item is received.

Including the purchase price of products in the list of expenses

The list of costs does not include the purchase price of valuables. It must be taken into account in the cost structure at the time of sale of the goods. The corresponding rule is stipulated by paragraph 1 of Article 268 of the Tax Code of the Russian Federation. The cost of products for tax purposes can be established using these methods, at the average cost, at the price of a piece of product, at the cost at the time of purchase.

Costs

Costs also need to be taken into account for tax purposes. But first they need to be counted. This is done in several stages:

- Attribution of costs to one or another area of the company's work.

- Expenses related to taxable profit are divided into production, sales and non-operating expenses on the basis of paragraph 2 of Article 252 of the Tax Code of the Russian Federation. If the company uses the cash method, this will be the last step.

- If the company has adopted a method for establishing expenses and profits by accrual, production and sales expenses are divided into direct and indirect expenses on the basis of paragraph 2 of Article 252 of the Tax Code of the Russian Federation.

The rules for classifying expenses into any group are contained in Article 218 of the Tax Code of the Russian Federation. Trading companies must keep in mind a number of nuances that are set out in Article 320 of the Tax Code of the Russian Federation. The Tax Code of the Russian Federation also states that direct costs will include the purchase price of valuables and delivery costs. Other costs are considered indirect. They are written off as expenses for the period. Direct expenses partially reduce taxable profit for the reporting period. However, profits are not reduced by expenses associated with storing valuables in a warehouse.

Accounting for wholesale trade: basic entries, practical examples – Business Idea

Accounting for wholesale trade transactions in most cases is carried out in the following sequence:

- receipt of products from the supplier, mutual settlements according to the agreement;

- sale of goods to a buyer who is purchasing it not for personal use (for example, for resale); mutual settlements with the customer;

- determining the financial results of the transaction, monitoring the results in order to maximize profits.

Wholesale trade refers to a type of trading activity that is associated with the purchase and further sale of goods intended for use in business activities (including resale) or for other purposes that are not related to personal consumption.

Note from the author! The sale of products to the final consumer - an individual - refers to retail trade, the accounting of which includes the possibility of additional use of account 42.

A feature of wholesale trade is the need to draw up basic documentation: a supply agreement (indicating delivery dates, payment procedures for goods), closing documents (TORG-12 and invoice, UPD).

The goal of any business activity is to maximize profits. To assess the financial results of an enterprise, it is necessary to correctly draw up accounting entries for the main business transactions and analyze the account. 90.

Basic entries in accounting for wholesale trade:

- Purchasing goods from a supplier:

Dt41 Kt60 – posting of received products in the warehouse;Dt19.03 Kt60 – input VAT from the supplier has been accepted (more about accounting for input VAT);

Dt60 Kt50.51 – payment to the supplier for purchased products.

- Sales of goods to customers:

Dt90.02 Kt41 – transfer of products, write-off of cost;Dt62 Kt90.01 – display of revenue received;

Dt90.03 Kt68 – VAT charged;

D51 Kt62 – receiving payment for goods sold.

- Determination of the financial result of the transaction:

Dt90 Kt99 – profit;Dt99 Kt90 – loss.

Case Study

Limited Liability Company "Domtechno" is engaged in the wholesale resale of goods.

The organization purchased a batch of 500 incubators. in the amount of 100 thousand rubles, incl. VAT 18% - RUB 15,254.24. Delivery of goods was carried out by a transport company at the expense of the buyer (delivery cost - 600 rubles, including VAT 18% - 91.53). According to the supply agreement, payment for the purchase is made after the shipment arrives.

Within a week, the entire previously purchased batch was sold to two large wholesale buyers (1 purchased 240 units at a price of 250 rubles/piece, the second - 260 units). Delivery contracts provide for prepayment.

For these transactions, the accountant of Domtechno LLC made the following entries:

- Purchase of goods:

Dt41 Kt60 - 84745.76 - goods from the supplier were capitalized;Dt19.03 Kt60 – 15254.24 – input VAT is displayed;

Dt41 Kt60 – 508.47 – receipt of additional expenses (delivery of goods);

Dt19.04 Kt60 – 91.53 – input VAT is displayed;

Dt60 Kt51 – 100 thousand – money transferred to the supplier;

Dt60 Kt51 – 600 – delivery paid.

- Transaction with 1 wholesale buyer:

Dt62 Kt51 – 60 thousand rubles – funds received from the customer;Dt90.02 Kt41 – 40922.40 rubles – the cost of products sold is written off;

Note from the author! Cost is the total value of all procurement costs incurred (recorded in Dt41 when products arrive at the warehouse and additional costs arise).

Dt62 Kt90.01 – 60 thousand – the company’s revenue is displayed;

Dt90.03 Kt68 – 9152.54 – VAT accrued for payment to the budget.

- Transaction with 2nd customer:

Dt62 Kt51 – 65 thousand rubles – funds received from the customer;Dt90.02 Kt41 – 44332.60 rubles – the cost of products sold is written off;

Dt62 Kt90.01 – 65 thousand – the company’s revenue is displayed;

Dt90.03 Kt68 – 9915.25 – VAT accrued for payment to the budget.

To determine the financial result, an analysis of the account is carried out. 90:

Balance of beginning DT Balance beginning CT 40 922,409 152,5444 332,609 915,25 60 00065 000 Revolutions 104,322.79 RPM 125,000 Balance Balance 20,677.21 Since the revenue exceeded the cost of purchasing products, the limited liability company Domtechno made a profit from the sale of this batch.

- Display of financial results on the account.

99: Dt90 Kt99 – 20677.21 – profit.

Features of accounting for the purchase of goods from foreign suppliers

According to the accounting rules, all incoming funds and emerging obligations of Russian enterprises are reflected in the accounting records in terms of Russian rubles on the account. 52.

Recalculation is carried out based on the exchange rate of the Central Bank of the Russian Federation on the date of capitalization of assets or repayment of liabilities. In foreign exchange transactions, exchange rate differences may arise, which are accounted for separately at the enterprise.

Wholesale trade accounting: postings

Accounting rules apply to organizations of any field of activity, any form of ownership.

However, each industry has its own characteristics of reflecting the state of funds and their sources, calculating taxes and preparing financial statements.

What nuances should an accountant of a wholesale trade enterprise take into account? Is accounting different for businesses using different tax systems? We will tell you in this article about accounting for wholesale trade at an enterprise.

Differences between wholesale and retail

Civil and tax legislation does not contain a specific definition of wholesale trade. This means the sale of goods in large quantities. The main document is the supply agreement. Wholesale trade is carried out on a non-cash basis.

Unlike wholesale, retail is the sale of goods in small quantities for personal consumption. A retail buyer purchases goods for non-commercial purposes. At retail, goods are sold both for cash and by transfer. The basis for the sale is the purchase and sale agreement.

Accounting in wholesale trade organizations

Accounting in wholesale trade organizations should cover the following points:

- reflection of inventory receipts;

- internal movement of goods and materials;

- sale of goods.

Receipt of inventory to the warehouse

When inventory is received at a wholesale trade enterprise, the following entries are made:

| Account 41 “Goods” accounting chart of accounts is collected informationabout goods for saleowned by the organization. We consider a product to be any property that is planned for sale, regardless of the value of this property. Goods can be buildings, warehouses, and expensive equipment. If we need to find out all the information about goods (balances for a specific product, movement volumes of a specific product for a period), which were basically purchased as goods for sale, then we can safely study account 41 using basic reports in the 1C program (turnover balance sheet, account analysis , account cards). Corresponding accounts by debit (Debit 41 - Credit 60 ) Corresponding accounts by credit (Debit 90, 44, 26 - Credit 41) Analytical accounting (analytics) for account 41 “Goods” in the 1C 8 program is carried out according to: - by nomenclature - by location of goods Why you need “account analytics” read in the accountant’s course “Creating your first accounting account” Postings to account 41 ItemsWE ARRIVE goods from the supplier Posting: D. account 41 “Goods” - K. account 60 “Settlements with suppliers” We reflect the cost of goods that were received at the warehouse. Amount: the amount WITHOUT VAT is indicated in the supplier's invoice Posting date: the date of the invoice or the date of actual acceptance of the goods Note: usually documents are posted with the date indicated in the invoice, it is easier to look for this invoice, but according to the rules it is necessary to post on the fact of acceptance and put the date of acceptance of the goods on the invoice. We receive goods from an individual Posting: D.account 41 “Goods” - K.account 76 “Settlements with various debtors and creditors” We reflect the cost of goods that were received at the warehouse. Amount: the amount agreed upon with an individual. Posting date: date of invoice or date of actual receipt of goods Note: We write off goods as expenses for advertising or samples Posting: D. account 44 “Sales expenses” - K. account 41 “Goods” We write off the goods that were included in the promotion or distributed as samples. Amount: calculated amount (depends on the method of calculating the amount of write-off of goods, see below)

We write off goods transferred to departments for our own needs Posting: D.account 26 “General business expenses” - K.account 41 “Goods” If you sell household chemicals, then for example you can use soap for your own needs. Amount: calculated amount (depends on the method of calculating the amount of write-off of goods, see below) Posting date: date on the invoice for transfer of goods for own needs Note: | |||

| Account correspondence | operations | Primary document | |

| Debit | Credit | ||

| 41 | 60 | capitalization of inventory items | Consignment note f. Torg-12 |

| 19 | 60 | VAT on capitalized inventories | Consignment note f. Torg-12 |

| 60 | 51 | transfer to supplier for goods | Invoice, payment order |

When a wholesale trade organization receives inventory, it is necessary to include in its cost the costs associated with delivery, insurance of inventory items, customs duties, services of intermediary organizations, payment for information and consulting services provided by third-party companies.

https://www..com/watch?v=Ng4Ifp0Mgog

For the amount of such costs:

Dt 41 Kt 60.

Source: https://tlc80.ru/idei/buhgalterskij-uchet-optovoj-torgovli-osnovnye-provodki-prakticheskie-primery.html