What payment is guaranteed by law?

If an employee goes on a business trip, the employer, that is, the head of a budgetary institution, must provide such a specialist with compensation for his expenses.

Such expenses are associated not only with the purchase of tickets or renting a hotel room. Additionally, the payment for a business trip includes expenses that are aimed at compensating for the inconveniences associated with living outside the place of the main residence, that is, daily allowances. This is not a definitive list of guarantees. According to Article 168 of the Labor Code of the Russian Federation, the employer must guarantee the preservation of the workplace and payment according to the average earnings of the business trip.

Composition of travel expenses:

- Average salary for days spent on a business trip. Calculated based on the average for the 12 months preceding the month of business trip.

- Daily allowance. The organization must have a limit for payment. There are no legal restrictions; the size depends on the financial capabilities of the enterprise. The amount depends on the number of days of the business trip.

- Fare. Includes payment for tickets, commissions, insurance, and other types of expenses. For example, compensation for fuel and lubricants for an employee using a personal car on a business trip.

- Living expenses. It is acceptable to include payment for a hotel room, payment for a bed or room in a dormitory, or payment for renting an apartment on a daily basis.

- Other expenses agreed with the employer. For example, an employee uses personal transport for a work trip. The cost of maintaining the car while on the road can be paid by the employer.

IMPORTANT!

Not all trips and trips of specialists can be classified as business trips. The article “Which trips are considered a business trip” will help you understand the situation.

Payment for business trips and travel expenses

From the article you will learn:

1. How to pay an employee for business travel days and calculate daily allowances.

2. In what order are travel expenses reimbursed?

3. How to reflect travel expenses in tax and accounting.

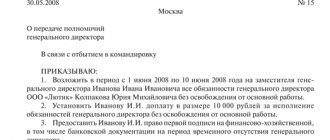

The need to send an employee on a business trip can arise for a variety of reasons: participation in negotiations, concluding an agreement with a counterparty, purchasing property, etc. You can read more about which employee trips are recognized as business trips and the procedure for documenting them in the previous article. However, correctly filing a business trip is only half the battle: for an accountant, the “expenses” component of a business trip is of particular interest. The fact is that any business trip is inevitably associated with additional costs, which include, for example, travel and accommodation costs for the employee at the place of business trip. In addition, during a business trip, the employee is entitled to payment calculated in a special manner. This article will focus on payments related to business trips, their accounting reflection and taxation.

An employee sent on a business trip is entitled to the following payments:

- payment for days spent on a business trip;

- daily allowance;

- reimbursement of expenses incurred during a business trip (travel, accommodation, etc.).

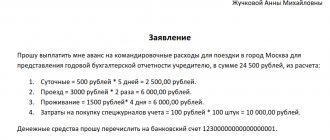

Based on the order to send an employee on a business trip, he is given an advance in the amount of daily allowance, as well as upcoming travel expenses. The advance can be issued either in cash from the cash register or by transfer to the employee’s bank card. Upon returning from a business trip, within three working days, the employee submits to the accounting department an advance report with supporting documents, on the basis of which the previously issued advance is adjusted: either the employee is reimbursed for the overexpenditure, or he pays the balance of the unspent advance.

Wages for days of business travel are accrued to the employee based on the results of the corresponding month, together with wages for days worked, and are paid on the next day scheduled for payment of wages.

This is how settlements with an employee sent on a business trip look in general. However, all payments have their own characteristics related to the calculation procedure, as well as the calculation of personal income tax and contributions. Therefore, we will dwell in more detail on each type of payment.

Payment for business trip days

For working days spent on a business trip, the employee is accrued an average salary (clause 9 of the Regulations on the specifics of sending employees on business trips). Average earnings during a business trip are calculated in accordance with the Regulations on the specifics of the procedure for calculating average wages using the following formula:

SZ = ZP rp / Day rp x Day com

Where:

- SZ – average earnings for working days of a business trip;

- ZP rp - payments taken into account for calculating average earnings accrued to an employee in the billing period (the list of these payments is established in clause 2 of the Regulations on the specifics of the procedure for calculating average wages);

- Day rp – number of days worked in the billing period;

- Day com – the number of working days falling on business trip days.

The billing period is taken to be a period equal to 12 calendar months preceding the month of the start of the business trip. If an employee has worked for the organization for less than a year, then the pay period for him will begin from the first day of work and end with the last calendar day of the month preceding the month the business trip began.

! Please note: Weekends or non-working holidays spent on a business trip are subject to payment if the employee worked on such days or went on a business trip, returned from a business trip, or was on the way to or from the business trip. Payment for weekends or non-working holidays spent on a business trip is made in the amount of at least double the daily (hourly) tariff rate (part of the salary) or in the amount of a single daily (hourly) tariff rate (part of the salary) with the provision of time off (Article 153 of the Labor Code of the Russian Federation , clause 5 of the Regulations on the specifics of sending employees on business trips). Read more about this in the article “Working on weekends and holidays: how to apply and pay.”

***

An example of calculating payment for a business trip

Alpha LLC sent its employee Ivanov A.V. on a business trip from February 8 to 14, 2015, with February 8 (the day of departure on a business trip) and February 14 (the day of return from a business trip) falling on Sunday and Saturday, respectively. Alpha LLC has a 5-day work week. During the billing period (from February 1, 2014 to January 31, 2015) Ivanov A.V. was on vacation from August 4 to 17, 2014, as well as on sick leave from December 8 to 12, 2014, the remaining months of the billing period were fully worked. Ivanov A.V. The salary was set at 30 thousand rubles, there were no additional payments in the billing period.

- Salary for months not fully worked was: For August 2014: RUB 15,714.29. (30,000 rub. / 21 days x 11 days)

- For December 2014: RUB 23,478.26. (30,000 rub. / 23 days x 18 days)

- RUB 339,192.55 (RUB 30,000 x 10 months + RUB 15,714.29 + RUB 23,478.26)

- 230 days (245 – 10 – 5)

- RUB 7,373.75 (RUB 339,192.55 / 230 days x 5 days)

- RUR 6,315.79 (RUB 30,000 / 19 days x 2 x 2 days)

- RUB 15,164.29 (RUB 7,37.75 + RUB 6,315.79)

***

Personal income tax is withheld from amounts paid for days spent by an employee on a business trip , and insurance premiums are also calculated in the same manner as from wages.

Daily allowance

When sending an employee on a business trip, the employer is obliged to reimburse him for additional expenses associated with living outside his place of permanent residence - daily allowance (Article 168 of the Labor Code of the Russian Federation). Daily allowances are paid for each calendar day of being on a business trip, including weekends and non-working holidays, as well as days spent on the road (clause 11 of the Regulations on the specifics of sending employees on business trips). How the actual duration of a business trip is determined, and what documents confirm it, is discussed in the article “Business trips of employees: we process them correctly.”

Each employer sets the specific amount (standard) of daily allowance paid to posted workers independently in the relevant local regulations (for example, in the Regulations on Business Travel). It is advisable to separately indicate the amount of daily allowance for business trips within the Russian Federation and separately for business trips abroad. At the same time, for foreign business trips the daily allowance is paid:

- for the day of departure from the Russian Federation - according to the norms for business trips abroad;

- per day of entry into the Russian Federation - according to the standards for business trips within the Russian Federation.

The date of departure from the Russian Federation and entry is confirmed by border crossing marks in the international passport or travel documents (for CIS countries).

! Please note: When sending an employee on a one-day business trip (when the day of departure on a business trip and the day of return coincide), the daily allowance is:

- are not paid if the business trip is carried out within the Russian Federation (clause 11 of the Regulations on the specifics of sending employees on business trips);

- are paid in the amount of 50% of the norm for business trips abroad, if the business trip is carried out outside the Russian Federation (clause 20 of the Regulations on the specifics of sending employees on business trips).

Personal income tax is not withheld from daily allowance amounts not exceeding 700 rubles. for each day of a business trip in the Russian Federation and 2500 rubles. for each day of a business trip abroad (clause 3 of Article 217 of the Tax Code of the Russian Federation). Insurance premiums are not charged for the entire amount of daily allowance within the limits established by the local regulatory act of the organization (Part 2 of Article 9 of Law No. 212-FZ).

Reimbursement of expenses related to business travel

According to Art. 168 of the Labor Code of the Russian Federation, the employer is obliged to reimburse an employee sent on a business trip for the following expenses:

- on the way;

- for renting residential premises;

- other expenses incurred by the employee with the permission or knowledge of the employer.

As in the case of daily allowances, the procedure for reimbursement of expenses incurred by an employee on a business trip must be enshrined in local regulations. So, for example, in a local act regulating business trips, it can be stated that travel expenses to the place of business trip and back are reimbursed in the amount of actual costs incurred, but not more than the cost of travel by transport of a certain class or category (for example, in an economy class cabin in the case of use of an airplane). Thus, employees will not be tempted to spend a lot of money on a business trip at the expense of the organization, and the employer will protect itself from unjustified expenses.

To justify the expenses incurred, upon returning from a business trip, the employee submits an advance report with supporting documents . Such documents can serve, for example:

- for travel expenses: travel tickets, printing of an electronic ticket or boarding pass (in case of purchasing an electronic ticket); cash register receipts (if taxi services were used); documents confirming the use of the employee’s personal transport (if travel on a business trip was carried out on the employee’s personal transport), etc.;

- for expenses for renting residential premises: cash register receipt and hotel invoice; apartment (room) rental agreement; an agreement with a real estate agency (if the search for housing was made through it), a receipt for a cash receipt order or a cash register receipt indicating payment for the services of a real estate agency, etc.

- for other expenses: documents confirming payment for communication services, lists of telephone calls indicating dates and times (for expenses for communication services); baggage receipt (for luggage storage costs), etc.

In the Labor Code, the list of expenses that the employer compensates for a posted employee is open, that is, among other expenses, almost any expenses provided for by the local act on business trips or made with the permission of the employer can be reimbursed. In addition, the employer may provide for a procedure for reimbursement of expenses incurred on a business trip for which there are no supporting documents. However, not all travel expenses that the employer pays to employees are exempt from personal income tax and insurance contributions.

are not subject to personal income tax and insurance contributions (clause 3 of Article 217 of the Tax Code of the Russian Federation, clause 2 of Article 20.2 of Federal Law No. 125-FZ, clause 2 of Article 9 of Federal Law No. 212-FZ):

- for travel to and from your destination,

- airport service fees, commission fees,

- expenses for travel to the airport or train station at places of departure, destination or transfers,

- for baggage transportation,

- living expenses,

- expenses for communication services,

- fees for issuing (receiving) and registering a service foreign passport,

- fees for issuing (receiving) visas,

- costs of exchanging cash or a bank check for cash in foreign currency.

As you can see, this list is closed. Thus, if an employer reimburses an employee for expenses not listed in the list, for example, for parking a car on a business trip, then personal income tax will have to be withheld from the amount of these expenses and contributions will be charged (Letter of the Ministry of Finance of Russia dated April 25, 2013 No. 03-04-06/14428, Letter of the Ministry of Health and Social Development of Russia dated May 26, 2010 No. 1343-19).

Payments to employees to reimburse these business travel expenses are exempt from personal income tax and insurance premiums only if they are documented. If there are no supporting documents , then travel expenses are subject to personal income tax and contributions in full. Expenses for renting residential premises in the absence of documentary evidence are subject to insurance contributions in full, and personal income tax - in the part exceeding:

- 700 rub. per day for business trips within the Russian Federation;

- 2500 rub. per day for business trips abroad.

! Please note: In some cases, travel and accommodation expenses for an employee on a business trip, upon closer examination, are not recognized as such, and, accordingly, are subject to personal income tax and insurance contributions:

- expenses for food, the cost of which is separately allocated in the hotel bill (clause 1 of the Letter of the Ministry of Finance dated October 14, 2009 No. 03-04-06-01/263);

- travel expenses if the dates of the tickets and the dates of the business trip do not coincide (for example, if the employee took vacation at the place of business trip) (clause 2 of the Letter of the Ministry of Finance dated September 3, 2012 No. 03-03-06/1/456).

Tax accounting of payments for business trips and travel expenses

In order for expenses on official business trips of employees to be taken into account when determining the taxable base for income tax and the simplified tax system with the object “income - expenses”, such expenses must be documented and economically justified (clause 1 of Article 252 of the Tax Code of the Russian Federation). Documentary evidence of travel expenses includes: personnel documents used to document the business trip, documents on recording working hours and wages, accounting certificates (for calculating daily allowances), documents confirming the employee’s expenses on a business trip. Expenses are considered economically justified if the business trip is carried out as part of an activity aimed at generating income, which is confirmed by the purposes of the business trip established in the order.

For the purpose of calculating income tax, as well as under the simplified tax system (“income - expenses”), taxpayer expenses associated with business trips of employees are taken into account in the following order:

- The labor costs (clause 6, clause 1, Article 346.16, Article 255 of the Tax Code of the Russian Federation) include payment based on average earnings during the business trip, as well as payment for days off during the business trip;

- As part of other expenses associated with production and sales (clause 13, clause 1, article 346.16 of the Tax Code of the Russian Federation, clause 12, clause 1, article 264 of the Tax Code of the Russian Federation) - the following expenses for business trips: daily allowance (in the full amount provided for by the local regulatory act);

- travel of the employee to the place of business trip and back to the place of permanent work;

- rental of residential premises, including costs for additional services provided in hotels (except for costs of service in bars and restaurants, costs of room service, costs for the use of recreational and health facilities);

- registration and issuance of visas, passports, vouchers, invitations and other similar documents;

- consular, airfield fees, fees for the right of entry, passage, transit of automobile and other transport, for the use of sea canals, other similar structures and other similar payments and fees.

The specified business trip expenses are accepted for tax accounting for the calculation of income tax on the date of approval of the employee’s advance report, and under the simplified tax system:

- on the date of approval of the advance report - if the expenses are paid from the advance payment issued to the employee;

- on the date of payment of compensation to the employee - if the expenses were paid by the employee at his own expense and are reimbursed to him after approval of the advance report.

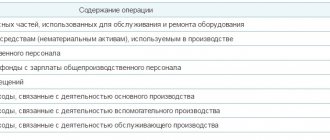

Accounting for travel and travel expenses

| Account debit | Account credit | Contents of operation |

| 26 (08, 20, 25, 23, 44) – depending on the purpose of the trip and the nature of the organization’s activities | 71 “Settlements with accountable persons” | Travel expenses were accepted for accounting on the date of approval of the advance report (without VAT on the OSN, with VAT on the simplified tax system) |

| 71 “Settlements with accountable persons” | 50 (51) | An advance was paid (overexpenditure on the advance report was reimbursed) to the employee for travel expenses |

| 26 (08, 20, 25, 23, 44) | 70 “Settlements with personnel for wages” | The employee is paid for the days spent on a business trip |

| 70 “Settlements with personnel for wages” | 50 (51) | Salary paid to employee |

If you find the article useful and interesting, share it with your colleagues on social networks!

If you have any questions, ask them in the comments to the article!

Normative base

- Labor Code of the Russian Federation

- Tax Code of the Russian Federation

- Regulations on the specifics of sending employees on business trips (approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749)

- Regulations on the specifics of the procedure for calculating average wages (approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922)

- Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund”

- Federal Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases”

- Letter of the Ministry of Health and Social Development of Russia dated May 26, 2010 No. 1343-19

- Letters from the Russian Ministry of Finance:

- dated 04/25/2013 No. 03-04-06/14428

- dated 10/14/2009 No. 03-04-06-01/263

- dated 03.09.2012 No. 03-03-06/1/456

Find out how to read the official texts of these documents in the Useful sites section

How is a business trip paid in 2021?

All expenses of an employee on a business trip must be compensated. But legislators have made a number of recommendations to limit such expenses. What does it mean? A specialist may qualify for compensation, but not more than the established maximum amount of expenses. This rule applies mainly to daily allowances. But some government agencies have also limited spending on hotel accommodations.

The institution determines and regulates limits independently, based on its own financial capabilities. For example, for some federal civil servants the maximum daily allowance is 100 rubles per day, and the standard payment for a hotel room is 1000 rubles per day, while in commercial firms there are no restrictions at all.

In accordance with Art. 168 (Labor Code - business trips) payment (its amount) is not limited. This is solely the decision of the institution. Such limits must be approved by a separate order or local management order.

Travel expenses are paid in advance. Upon return, the specialist draws up an advance report and documents the costs. Attaches invoices, checks, tickets, contracts and receipts to the report. The accountant or responsible person checks the statements and then submits them to management for approval.

Read about the procedure for processing expenses in the separate material “How to process travel expenses in 2021.”

Option number 2. No limits

If the institution does not provide restrictions on who. expenses, estimates can be drawn up for a larger amount. However, you should not escape reality. All the same, the costs will have to be documented. In addition, a luxury hotel room and a business class flight are unlikely to be paid for using budget money.

How to plan costs correctly:

- Check the cost of tickets (train, bus, plane, etc.). Include the best travel option to your destination in your travel cost estimate.

- Book your hotel room. When making a reservation, immediately check the cost per day. Take this price into account in your calculations.

- Daily allowance. The amount of such costs should be agreed with management. Let us remind you that there are no restrictions in the legislation. However, if the amount exceeds 700 rubles per day when traveling within Russia and 2,500 rubles per day for foreign business trips, then the difference is subject to taxation (personal income tax and insurance contributions).

IMPORTANT!

To eliminate problems with supervisors, develop and approve a travel policy in the institution. And also establish in a separate local order the norms of expenses for business trips.

If this is not done, then some of the institution’s costs may be considered inappropriate. As a result, the manager will be fined and forced to return the money to the budget. When approving standards, follow the recommendations and orders of higher ministries and departments.

Calculation of average earnings for travel allowances

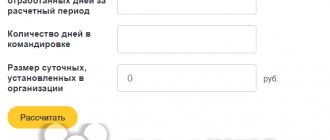

To correctly calculate the amount of payment for the period of an employee’s business trip, follow the current Government Decree No. 922 of December 24, 2007. We present the basic rules in the form of instructions:

- We determine the billing period. For such payments, the calculation period is 12 calendar months preceding the month in which the employee is sent on a trip. For example, a business trip in April 2021, therefore, the billing period: February 2021 - March 2021.

- We calculate the basis for the calculation. We collect information about all accruals and income of the specialist. Then we exclude payments that are named in paragraph 5 of Resolution No. 92. For example, sick leave benefits, maternity leave and similar cases.

- We calculate the number of days actually worked. The indicator does not include days that fell during illness and vacation, as well as other periods that fell on excluded payments (Article 5 of Resolution No. 922).

- Now we divide the calculation base into the days actually worked. The resulting amount of average daily earnings is due to the specialist for each day he is on a business trip.

Legal regulation of business trip payments

When starting to consider the issue of payment for a business trip, it should be noted that the total amount of payments to the employee in this case consists of several parts:

- the target part - payment of expenses associated with a business trip - paperwork, travel, baggage, etc.;

- non-targeted part - daily allowance - a fixed amount intended to compensate for living away from home;

- direct payment of labor.

The legal basis for remuneration during a business trip is laid down by the Labor Code - Art. 167 of the Labor Code guarantees to hired employees all the above-mentioned compensations and remunerations, as well as preservation of their job during absence. Particularly notable among these guarantees (perhaps due to a fairly clear specification already at this stage) is remuneration at the average salary.

The employer pays the posted worker expenses for travel and rental housing, daily allowances and the labor itself.

Separate rules regarding payment are also contained in the main specialized document regulating business trips - the Regulations on the peculiarities of sending employees on business trips (approved by Government Decree No. 749 of October 13, 2008). In this document you can find answers to some narrower questions - how to pay for work on weekends, and which days can be classified in this category, whether travel time, sick leave, etc. are paid.

Directly, the rules for calculating the average salary for the purpose of paying for business trips are established by the Regulations on the peculiarities of calculating average earnings (approved by Government Decree No. 922 of December 24, 2007).

Calculation example

Travelers Eduard Antipovich was sent on business for 20 calendar days in April 2021.

Its calculated data for the period February 2021 – March 2021:

| Indicators | Periods, days | Charges, rubles |

| Total number of days | 254 | 900 000,00 |

| Sick leave | 41 | 150 000,00 |

| Annual leave | 28 | 90 000,00 |

| Total | 185 | 660 000,00 |

Average daily earnings: 660,000 / 185 = 3,567.57 rubles.

Payment for a business trip based on average earnings: 3567.57 × 20 days. = 71,351.40 rubles.

For information about which accounting entries to reflect these transactions in accounting, read the article “How to keep records of travel expenses in a budget organization.”

Overtime work on a business trip

The question of how overtime hours are paid on a business trip is not regulated at the legislative level. Overtime work is considered to be work outside the normal working hours. However, when employees are sent on business, records of the time they worked during the trip are not kept. Consequently, there are no standards for determining normal working hours on a business trip.

The issue also concerns forms of payment. After all, during the days of a business trip, an employee receives an average salary. This is a guaranteed type of compensation, but not a type of remuneration. Consequently, the provisions of Article 99 of the Labor Code of the Russian Federation are inapplicable in such a situation. But what should an employer do, since not one of his subordinates will agree to work for free, especially beyond the established standards.

Procedure:

- Set standards. The procedure and amount of overtime payment should be specified in the regulations on business trips. For example, establish that for the first two hours of overtime, payment is 1.5 times the average earnings. For the rest of the overtime work - 2 times the amount. But additional payments may be higher, depending on the financial capabilities of the company.

- Obtain the employee's consent. To do this, send a written notice to the employee with a proposal for overtime work. In your application, be sure to include information about the increased payment. There is no unified proposal form; prepare a document in any form.

- Place an order. Having received the written consent of the subordinate, it is necessary to issue an order to engage in overtime work during the business trip.

- Ensure time is tracked. This is necessary for payment in full. Use a unified form of working time sheet or develop and approve your own, which the employee will fill out to record overtime and overtime.

IMPORTANT!

If duties on a business trip occur at night, then similar actions must be taken. Set the amount of payment in the business trip regulations.

Please note that if travel time falls during the night hours, from 00:00 to 06:00, then no additional payments or surcharges are due. For example, if an employee returns on a night flight, there is no need to pay for night hours.

Business trips on weekends and holidays

How days on a business trip that fall on holidays and weekends are paid depends on whether the subordinate worked or not.

If an employee did not work on a weekend or holiday, then there is no need to pay for the days according to average earnings. For example, a specialist is sent on a business trip for 10 days, including 1 holiday and 2 days off. Calculate the average earnings only for the 7 working days of your stay on a business trip.

IMPORTANT!

You pay per diem for all days, regardless of whether the specialist worked or not. Include in the calculation working days, holidays, weekends, travel and downtime days, departure and return days.

If an employee worked on a weekend or holiday while on a business trip, then pay for this time in the following amount:

- at least one time from the tariff rate (official salary), if the employee requested additional rest time;

- no less than twice the tariff rate (official salary), if the employee decides to refuse time off.

IMPORTANT!

When calculating payment for work on weekends and holidays, take into account not only the official salary, but also compensation and incentive payments, allowances and additional payments provided for by the current remuneration system. For example, regional coefficients, additional payment for experience, bonus for qualifications.

A similar payment procedure applies if an employee goes on a business trip on a weekend or holiday. Or returns from it. For example, a specialist goes on a trip on May 1. This is a holiday. Therefore, the employer must offer double pay or time off and pay in a single amount.

What is average earnings and how to calculate it in relation to business trip payments

The average salary of an employee is a value that is used when calculating many indicators of remuneration - vacation pay, compensation for it, sick leave, severance pay, etc. At the same time, the rules for calculating this value, depending on the specific goal, can vary significantly.

Resolution No. 922 regulates two procedures for calculating the average salary: the first of them is universal (it is suitable for the total mass of payments, including remuneration for work on a business trip), the second is specialized (for calculating payment for vacations and compensation for them). Another procedure for calculating the value under consideration is established for disability benefits - it is regulated by a separate document.

The fundamental difference between calculating average earnings for business trips and calculating the same amount for vacations is that in the first case the calculation is made in working days, while in the second - in calendar days.

The law prescribes payment for work on a business trip according to average earnings

The ultimate goal of the calculation itself is to calculate the average daily earnings - the conditional amount of wages per day of work. Subsequently, this value will be multiplied by the number of business trip days.

The algorithm for calculating the average salary consists of several stages:

- establishing the period of time for which information will be included in the calculation;

- establishing the range of payments that will be included in the calculation;

- directly calculating average daily earnings.

Selecting a period for calculating the average salary

According to the general rule (clause 4 of Regulation No. 922), for the calculation under consideration, 12 full calendar months should be selected - those of them that precede the beginning of the period for payment of which the manipulation is carried out.

In order to correctly calculate average earnings, you will need to refer more than once to the production calendar

Example 1. HR specialist S.I. Peacock has been sent on a business trip since January 22, 2021. The month preceding January 2018 is December 2021. This month will be the final month in the calculation period, and should be counted 12 months ago. Thus, the period taken into account in calculating the average salary for Pavlin’s travel payments is from 01/01/2017 to 12/31/2017. Starting February 5, 2021, Pavlin is planned to be sent on a work trip again. To pay for this business trip, a new payment period must be selected - from 02/01/2017 to 01/31/2018.

The goal of the procedure at this stage is still not only the period, but also the number of days actually worked by the employee during this period. And in almost 100% of cases, the stage of determining the 12-month period is followed by the stage of subtracting the days to be excluded from it. Thus, clause 5 of Regulation No. 922 requires the exclusion from the calculation of all time periods when payments to the employee were made based on the same average salary, and among them:

- days of temporary inability to work (sick leave);

- days of labor (paid) leave;

- days falling on various social holidays;

- days of downtime, as well as strikes in which the employee himself did not participate;

- business travel days;

- all other time intervals (except for those intended for feeding the child), paid “on average”.

The total number of working days for the selected 12-month period should be determined in accordance with the production calendar. After summation, all working days falling within the above excluded periods should be subtracted.

Example 2 (for source data, see example 1). To calculate the total number of working days for the period from 01/01/2017 to 12/31/2017, you should sum up their number for each month of this period:

17 for January + 18 for February + 22 for March + 20 for April + 20 for May + 21 for June + 21 for July + 23 for August + 21 for September + 22 for October + 21 for November + 21 for December = 247 days .

For the period taken into account S.I. Peacock:

- was on labor leave - from 06/19/2017 to 07/17/2017 (according to the production calendar, this time corresponds to 21 working days);

- was on business trips - from 02.13 to 15.02.2017, 09.4.2017 (these periods account for 4 working days);

- was sick - from May 22 to May 26, 2017 (5 working days);

- calculation of the total number of working days for the period: 247 days – (21+4+5) days = 217 days.

It often happens that in a certain clause 4 of Regulation No. 922 of the 12-month period, the employee actually worked only part of it. In such a situation, it is necessary to determine the number of working days for the period actually worked and, accordingly, take into account payments only for this time.

Example 3. Manager S.I. Amilavskaya has been sent on a business trip since January 15, 2021. In accordance with Regulation No. 922, the 12-month period that is taken into account when calculating her average earnings is from 01/01/2017 to 12/31/2017. However, Amilavskaya got a job in the organization (immediately after graduating from the institute) only on 08/01/2017. Thus, only the period from 08/01/2017 to 12/31/2017 will be taken into account when calculating the period.

Calculation of the number of working days in the period: 23 days for August + 21 days for September + 22 days for October + 21 days for November + 21 days for December = 108 days.

During this period, Amilavskaya:

- was on sick leave - from November 13 to November 15, 2017 (3 working days);

- was on a business trip - December 11, 2017 (1 working day).

Total number of days in the period: 108 days – (3+1) days = 104 days.

An even more rare, but valid situation is that the employee did not work at all in the 12-month period defined in accordance with paragraph 4. In this case, you should proceed in accordance with one of the following options:

- if in an even earlier period there are actually days worked, this period should be taken for calculation;

- if the employee did not previously work, but worked in the current month, the current month should be taken into account;

- if the employee did not work this month (for example, he goes on a business trip immediately after being hired), the average salary is calculated based on his salary.

Example 4. On January 18, 2021, cashier A.N. Simonov. with her consent, she is sent for an internship in another city, as an employee who has returned from maternity leave to gain the necessary work experience. Meanwhile, from July 1, 2021, Simonova actually did not work, being on maternity leave. Thus, the period from 01/01/2017 to 12/31/2017 is excluded from the calculation, and the period from 01/01/2016 to 12/31/2016 will be taken into account in the actually worked part (to 06/30/2016). Further manipulations will be carried out by analogy with those described in example 3.

If we assume that Simonova was hired in January 2018 (a date earlier than January 18), then only the days she worked in that month can be included in the calculation. And if the reception took place on January 18, the average earnings will be equal to Simonova’s salary divided by the average number of working days in a month.

Establishment of the payment circle for calculation

Once the counting period and the number of days included in it have been determined, it is time to determine the circle of payments. Clause 2 of Regulation No. 922 outlines it quite clearly - these are all payments included in the wage system. So, this does not include:

- all one-time incentive payments - bonuses, awards, etc.;

- financial assistance (including vacations, health benefits, etc.);

- all types of compensation and social payments (payment of utilities, travel, etc.);

- vacation pay, other types of pay “on average”.

For each employee, the average salary changes every month

On the contrary, the following should be included in the calculation:

- wages (time-based or piece-rate, in cash or in kind);

- all bonuses paid (for length of service, for professional excellence, for category, etc.);

- monthly bonuses (for production results);

- bonus based on the results of work for the year - the so-called “13th salary”, regardless of the time of payment.

Regarding the accounting of bonuses such as the “13th salary”, clause 15 of Regulation No. 922 contains special conditions. Thus, the bonus applies to the month according to the results of which it was paid and in that part of it that falls on this month.

Example 5 (see source data in examples 1, 2). Payments according to the list of clause 2 of Regulation No. 922 to Pavlin for the period from 01/01/2017 to 12/31/2017 amounted to 540,000 rubles. The calculation of an employee’s average daily earnings will look like this:

540,000 rub./217 days = 2,488.5 rub.

Calculating the amount of travel allowances

Having the amount of the average daily salary, you can quite simply calculate the amount of remuneration for the period of the business trip. It is enough just to multiply it by the number of business trips.

Example 6 (for source data, see examples 1, 2, 5). Duration of S.I.’s business trip Pavlina – 3 working days. Calculation of wages for these days (excluding daily allowance and reimbursement of expenses):

RUR 2,488.5 × 3 days = 7,465.5 rub.

Calculation example

Morkovkin Stepan Igorevich was sent on a business trip for 15 days. - from April 17 to May 1 inclusive. He worked for 11 days. (10 on weekdays and 1 on weekends). Average earnings for the billing period are 2000 rubles. The tariff daily rate is 2500 rubles. For work on days off, double pay is due; Morkovkin did not take time off.

Standards for reimbursement of travel allowances by organization:

- daily allowance - 1000 rubles per day;

- travel: tickets - 5000 rubles one way;

- accommodation: hotel - 2000 rubles per day.

The accountant accrued the following travel payments:

- daily allowance: 1000 × 15 days. = 15,000 rubles.

IMPORTANT!

There is a limit for personal income tax on daily allowances. In Russia - 700 rubles per day and 2500 rubles. - abroad. Withhold personal income tax from the difference and charge insurance premiums.

- Personal income tax: 15,000 - (700 × 15 days) × 13% = 585 rubles;

- insurance premiums: 15,000 - (700 × 15 days) × 30.2% = 1359 rubles;

- transportation costs: 5000 × 2 = 10,000 rubles;

- living expenses: 2000 × 14 days. = 28,000 rubles;

- average earnings: 10 workers. days × 2000 rub. = 20,000 rub.;

- payment for work on holidays and weekends: 2500 × 2 size × 2 days. = 10,000 rub.

Why do we pay for two days at an increased rate? After all, the employee only worked on one day off? The fact is that Morkovkin was returning home on the May 1st holiday. He didn't take time off. Therefore, a specialist is entitled to payment of no less than double the tariff rate or official salary, taking into account incentives and compensation allowances.

Option No. 1. Limits approved

If the institution has limits on business travel expenses in separate local regulations, then ask to provide this information. Calculate the amount of the requested advance using the formula:

Cost rate = number of days × limit per day.

Transport costs are rarely limited, since tickets (travel) are paid upon delivery. However, it should be borne in mind that the employer has the right to refuse reimbursement of expenses for travel on certain types of transport. For example, a taxi ride when there are regular flights (train, bus). They may also refuse to pay for a premium seat (business or first class ticket).

Example.

The employee is sent to Tver for 11 days. The institution has the following limits:

- daily allowance - 200 rubles per day;

- accommodation - 700 rubles per day;

- actual travel.

Therefore, a specialist has the right to claim:

Daily allowance - 2200 (11 × 200 rubles), accommodation - 7000 (10 × 700) and 2000 for tickets at actual cost (1000 one way).