Compensation for unused vacation: income code in 2-NDFL

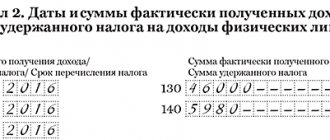

Compensation must be paid on the employee's last working day. Accordingly, personal income tax from such a payment must be transferred to the budget no later than the day following the day the employee is dismissed. The company will reflect information on the amount of compensation for unused vacation in favor of the employee in two documents.

submitted to the tax office:

- in the 2-NDFL certificate at the end of the year, indicating the income code for compensation for unused vacation.

- in the 6-NDFL report for the reporting period in which the employee was dismissed;

Topic: 2-NDFL: what is the income code for compensation for unused vacation upon dismissal?

According to the Federal Tax Service of Russia, payment for unused vacation should be reflected in the Certificate of Income of Individuals in Form No. 2-NDFL, indicating code 4800 of the “Codes” directory of Appendix No. 2 to Form No. 2-NDFL. I am an individual entrepreneur on UTII (special regime) The tax office requires that I designate compensation for vacation upon dismissal with code 4800. I designated 2012. According to the reference book of codes in ZiK, this is vacation. I also set in the Reference Types of calculations Compensation for unused vacation upon dismissal code 2012 - compensation payment subject to personal income tax and non-taxable in compulsory pension insurance.

For organizations applying special tax regimes, i.e.

Income code for compensation for unused vacation upon dismissal in 2021

If in a situation where the vacation period falls within the framework of one month, everything is clear, then what to do with “rolling” vacations, the end date of which does not fall in the month when they were paid? The answer to this question has been repeatedly given by both tax authorities and the Ministry of Finance, including in the letters that we mentioned earlier: regardless of the start and end dates of the vacation, the period for receiving income will be the month in which the vacation pay was actually paid. Read about reducing the tax base for individuals in the article “Main types of tax deductions for personal income tax in 2017.” Results In the 2-NDFL certificate, payments to vacationers must be separated from wages and accounted for under a separate income code. This will allow you to comply with the requirements of tax legislation regarding the procedure for tax accounting and filling out reports.

What income code should be indicated for vacation pay in the 2-NDFL certificate?

The difference between payments for time worked and for the period of annual rest is significant, since they provide for different points for calculating the taxable base for personal income tax: earnings for days worked - the last day of the month of its accrual or the day of termination of the working relationship (clause 2 of Article 223 of the Tax Code RF); vacation pay - the day of the expense transaction for their payment (sub.

What income code to put in the 2-NDFL certificate for compensation for unused vacation

The second is code 2012 (vacation payments).

The third is code 4800 (other income). The Federal Tax Service of the Russian Federation advises using the last, third, option (letter dated August 8, 2008 No. Therefore, if you want to avoid claims, indicate this value.

Income code from renting out non-residential premises, from renting out a printer, renting out a vehicle without a crew 1400 - non-residential premises and all others, except vehicles; 2400 - motor transport - rent and any other use; Tax-free payments are not reflected in the 2-NDFL certificate. An example of filling out the 2-NDFL certificate 2015 is given.

Income code for personal income tax in 2018 when receiving compensation for dismissal

Attention

The difference between payments for time worked and for annual rest is significant, since they provide for different points for calculating the taxable base for personal income tax:

- earnings for days worked - the last day of the month of its accrual or the day of termination of the working relationship (clause 2 of Article 223 of the Tax Code of the Russian Federation);

- vacation pay - the day of the expense transaction for their payment (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation).

That is, the tax agent is obliged to calculate and withhold personal income tax at the time of payment of vacation pay, and he has the right to transfer the withheld amount to the budget until the last day of the month in which the payment was made. This judgment was officially confirmed by the Russian Ministry of Finance in its letter dated January 17, 2017 No. 03-04-06/1618. Thus, a separate reflection of the vacation pay code in the 2-NDFL certificate is required so that tax authorities can monitor compliance with the deadlines and amounts of tax transfers.

Why was the deduction code 620 introduced?

Other income that reduces the base for fiscal taxation based on the provisions of Chapter. 23 of the Tax Code of the Russian Federation are recorded in the citizen’s personal certificate using deduction code 620. These amounts include:

- additionally paid insurance contributions for the labor pension, or rather for its funded part;

- total costs of financial transactions with derivatives instruments not put into circulation on the stock market;

- the amount of a negative result formed in the reporting period on transactions with securities put into circulation on the organized securities market.

How are deduction data reflected in the declaration?

To correctly enter data using deduction code 620 in the reporting document in Form 3-NDFL, you first need to determine what kind of transactions are reflected under this item:

- If code 620 reflects additional total contributions to the pension in its funded part, then the data is entered in the “Social fiscal deductions” section in the tab on voluntary life insurance documents and pensions.

- If code 620 reflects the total expenses for transactions with financial transaction instruments not used in the securities market, or a negative result from economic activity with securities traded on the organized stock market, then the information in the tax return under code 4800 is reflected minus these amounts . The explanatory letters of the Federal Tax Service of Russia indicate that non-taxable income is not subject to declaration.

Legal entities and individual entrepreneurs are required to provide c.

Profit and loss statements reflect the financial results of an organization.

The procedure and deadlines for filing tax returns are subject to regular changes.

The current account is blocked.

An individual entrepreneur on the simplified tax system of 6% (income) switched to UTII from the beginning of the year with a refusal.

How can an individual entrepreneur submit a zero VAT return on OSNO if it is missing?

I have an apartment. Belongs only to me, there are corresponding documents. I am renting this apartment. Designed with.

A few years ago I bought an apartment with a mortgage. No documents to obtain.

When selling securities, the tax base for personal income tax is determined from them.

At the beginning of October last year, an individual entrepreneur was opened, there were no activities, a current account.

I bought an apartment a long time ago, more than 10 years have already passed. Earlier declarations to the tax office for refund.

I received a fine for not submitting a declaration on time. Why are penalties charged? For late delivery.

My husband and I bought an apartment under a shared construction agreement. This was done the year before last. At the end.

I recently bought myself an apartment. The transaction was completed on credit.

Where to include this or that deduction in the personal income tax return is a question that often arises.

The organization must submit one more report - a profit and loss report. Recommended

Who indicated code 2012 for vacation compensation?

— In the 2-NDFL certificate, income and deductions are reflected according to codes approved by the Federal Tax Service (Section I of the Filling Out Procedure - Appendix No. 2, approved by Order of the Federal Tax Service dated October 30, 2015 No. ММВ-7-11 / [email protected] ). Code 2012 reflects the amount of vacation payments, and code 4800 – Other income (Appendix No. 1 to the Order of the Federal Tax Service dated September 10, 2015 No. ММВ-7-11 / [email protected] ).

The Tax Service clarified that if for some income an income code is not provided in the order, then such income must be reflected using code 4800 (Letters of the Federal Tax Service dated September 19, 2016 No. BS-4-11/17537, dated July 6, 2016 No. BS-4 -11/12127). In particular, this applies to compensation for unused vacation paid upon dismissal of an employee.

On the one hand, the fact that the compensation was included in the certificate with code 2012, and not with code 4800, does not matter for the correct calculation of personal income tax. After all, the date of receipt of these two incomes is the same - the day the money is paid to the employee (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation). And personal income tax on these amounts is transferred to the budget in one time - the next day after the payment of income.

At the same time, for false information in 2-NDFL certificates, a fine of 500 rubles is provided. for each “defective” certificate (clause 1 of article 126.1 of the Tax Code of the Russian Federation). And by false information, the Federal Tax Service also understands incorrect income codes (Letter of the Federal Tax Service dated 08/09/2016 No. GD-4-11/14515 (clause 3)).

Therefore, in order to definitely avoid a fine, submit corrective 2-NDFL certificates to the Federal Tax Service (clause 2 of Article 126.1 of the Tax Code of the Russian Federation). Since your program fills out the certificates incorrectly, you will have to do everything manually. They must indicate (Sections I, II of the Filling Out Procedure - Appendix No. 2, approved by Order of the Federal Tax Service dated October 30, 2015 No. MMV-7-11 / [email protected] ):

— in the “N_” field – the number of the previously submitted certificate;

— in the field “from __.__.__” – the new date of preparation (date of the corrective certificate);

— in the “Adjustment number” field – 01, if this is the first corrective certificate;

- according to code 2012 - the amount minus compensation upon dismissal;

- according to code 4800 - the amount of compensation upon dismissal;

— and transfer all other correct amounts without changes.

advant24.ru

When filling automatically, the time payment is calculated for the days worked by the employee in the month of dismissal. Then you need to go to the “Accruals” tab and click on the “Add” button to enter a new line in which to indicate the employee, the created calculation type “Vacation Compensation” and the amount of compensation, calculated manually. The columns “hs”, “deduction code” and “deduction amount” are not filled in in our case. Pay attention to the “Payment date” column; this parameter is very important for filling out form 6-NDFL, so we check and adjust the date if necessary. We navigate and close the document. To check the accruals made, we will generate a “Payslip” by clicking the link in the lower left corner: the employee was accrued salary for 6 days worked and vacation compensation. Now you can pay the employee the amount due and transfer the withheld personal income tax to the budget.

Vacation compensation upon dismissal in 1s 8.3 accounting

- 1 Compensation for unused vacation in 1C 8.3 Accounting 1.1 Creating a new type of accrual

- 1.2 Accrual and calculation of vacation in 1C 8.3 upon dismissal

- 2.1 Compensation for unused vacation in 1C 8.3 Accounting

I would like to immediately upset our reader: there is no special document for processing compensation for unused vacation upon dismissal in 1C 8.3 Accounting. There is also no automation for calculating the amount; you will have to count it manually.

Compensations and payments from the company

Certain material compensation for unused vacation of the personal income tax code 2021 is due not only to the current, but also to the dismissed employee of the company.

Upon termination of an employment contract, the management of the enterprise must pay the employee in full. The full payment includes the payment of wages for days worked and other material incentives established by the enterprise. In addition to the salary, the citizen must receive severance pay. Along with compensation, the dismissed employee is returned his work book and other documents related to employment. Certificates or orders are issued in person or, with the employee’s consent, sent by email. Issuing leave compensation upon dismissal (personal income tax code 2017) and other documents is the final stage of dismissal of an employee.

Help 2 - personal income tax

Receiving compensation for unused vacation is possible only if you have a special document, namely a 2-NDFL certificate.

According to Article 230 of the Tax Code of the Russian Federation, such a document must be issued to all employees of the company once a year. It indicates the employee’s income for a certain period (in this case, 12 months). Not only wages are taken into account, but also income tax. The “other income” clause specifies additional compensation due to a citizen. Vacation payments are designated by a unique number. The compensation code for unused vacation in certificate 2 personal income tax 2021 is four-digit - 4800.

Vacation and salary

Upon dismissal, vacation payments are taken into account separately.

The provided compensation is not part of the basic salary. This form of social guarantee is provided for by the Labor Code of the Russian Federation. Holiday pay and wages are calculated differently. Additional compensation is paid in accordance with the day of the expense transaction. Salaries are paid for all days worked. Basic income can be accrued on the last day of the month or upon termination of the employment relationship. Separate calculation and calculation of depreciation compensation allows tax authorities to control the process of processing additional payments to dismissed employees. In particular, the transfer of taxes on time. The amount of compensation provided is determined taking into account the average earnings of an employee of the enterprise. Income is taken for one month , regardless of the start and end date of the vacation. Unlike other types of compensation, payments for unused vacation are subject to personal income tax.

A dismissed employee must have a 2-NDFL certificate in hand. You will need it when registering at the labor exchange. According to it, the unemployed citizen will be accrued a special allowance. The certificate will also be useful when receiving other government payments, when applying for a loan, as well as in the process of obtaining a visa.

Calculation of compensation for unused vacation in 1s accounting 8

We work in Moscow and the region. ASK in the comments! you need to uncheck the Included in the accrual base of the regional coefficient B Accounting 3.0 in the Vacation document does not allow you to select any Accruals Very useful article. Thank you By using this site, you agree to the use of cookies in accordance with this cookie type notice. If you do not agree to our use of this type of file, you should set your browser settings accordingly or not use the site.

Compensation for unused vacation in 2021

This position is reflected in the Certificate of Income of Individuals. Calculation of compensation The Tax Code of the Russian Federation does not specify what the grounds for dismissal should be in order to exempt compensation payments from tax.

The Ministry of Finance of the Russian Federation draws attention to the fact that it does not matter for what reasons the employee was dismissed. Most often, termination of a contract occurs by agreement of the parties

Personal income tax on vacation pay - when to pay in 2021 The employer’s consent is not required for an employee to go on vacation

It is important to notify the employer six months before making a decision

First of all, this applies to women who plan to go on maternity leave, minors, citizens who have adopted a child or children under the age of three. According to Article 122 of the Labor Code of the Russian Federation, only a statement from the employee is sufficient.