Home / Labor Law / Payment and benefits / Wages

Back

Published: 03/03/2016

Reading time: 8 min

2

12665

Forced collection of part of an employee’s wages is regulated by Articles 137-138 of the Labor Code of the Russian Federation.

One of the grounds allowing such deductions is an executive document received by the accounting service of the enterprise.

The legislation regulates the procedure for working with such documentation by Federal Law No. 229-FZ of October 2, 2007 “On Enforcement Proceedings”.

- Types of executive documents

- When should it not be used?

- Amount of deductions from wages

- Deduction order

- Several writs of execution: how the debt is retained Writs of execution of one turn

- Writs of execution of different priority (alimony and credit)

Types of executive documents

The executive documentation that is mandatory for implementation in relation to an employee includes:

- writs of execution issued on the basis of decisions of courts of general jurisdiction;

- court orders issued at the request of creditors;

- voluntary agreements on the payment of alimony for the maintenance of children or disabled relatives, notarized;

- protocols and acts of administrative bodies, penalties for which are provided for by federal legislation;

- orders of a notary or bailiff;

- certificates and acts issued by the Pension Fund authorities in relation to an employee who has the status of an individual entrepreneur.

According to the category of requirements, writs of execution are divided into:

- requiring compensation for harm to health or compensation for material damage caused as a result of an offense committed;

- prescribing the payment of an administrative fine;

- obliging to pay alimony for the maintenance of minor children;

- claims for repayment of debts in favor of financial institutions or utility companies.

Income from which deductions are not made

According to the law, not all types of payments can be withheld in one or another amount. Collection cannot be applied to the following categories of income of an individual (Article 101 of the Federal Law of the Russian Federation “On Enforcement Proceedings”):

- monetary compensation for damage (health, due to the loss of a breadwinner),

- compensation payments made within the framework of labor law (travel allowances, financial assistance in connection with the birth of a child, death of relatives, etc.),

- compulsory social insurance payments,

- maternal capital,

- child benefits,

- one-time financial assistance from the state,

- travel compensation paid by the employer.

When should it not be used?

The Law “On Enforcement Proceedings” contains a list of cases when deductions from wages under enforcement documents are impossible:

- social payments made at the expense of the Social Insurance Fund (pregnancy benefits, child care benefits up to one and a half years old) or at the expense of the employer (in connection with the death of close relatives, marriage registration and the birth of a child). At the same time, temporary disability benefits (sick leave payments) are not included in this list, i.e. they may be subject to deduction in the usual manner;

- all types of compensation payments - when sending an employee on a business trip, when compensating for harm to health or when losing a breadwinner;

- amounts sent by the employer for full or partial payment of vouchers for sanitary and resort treatment of employees.

What income cannot be subject to withholding?

Some employee income cannot be deducted. Such income, in particular, includes:

- payments to employees injured while on duty;

- compensation payments established by Russian labor legislation (travel expenses, compensation related to the transfer of an employee to work in another location, etc.);

- benefits for citizens with children, reimbursed from the funds of the Federal Social Insurance Fund of Russia.

All payments from which funds cannot be withheld under executive documents are listed in Article 101 of Law No. 229-FZ of October 2, 2007.

In addition, it is impossible to collect alimony from the income of citizens in one-time transactions for the sale of real estate (apartment, land, garden house, etc.). This is stated in Chapter VI of the Methodological Instructions of the FSSP of Russia dated June 19, 2012 No. 01-16.

Let's talk separately about hospital benefits. It is important not to get confused here. The fact is that funds cannot be recovered from any benefits for citizens with children according to executive documents (subparagraph 12, paragraph 1, article 101 of the Law of October 2, 2007 No. 229-FZ). At the same time, sick leave benefits are not directly mentioned in Article 101 of Law No. 229-FZ of October 2, 2007. But in paragraph 2 of the list, approved by Decree of the Government of the Russian Federation of July 18, 1996 No. 841, it is clearly stated: alimony is withheld from benefits for temporary disability, unemployment only by a court decision and a court order for the collection of alimony or by a notarized agreement on payment alimony.

Thus, funds can be withheld from hospital benefits under any executive documents.

An example of determining the composition of payments from which deductions are not made under executive documents

Based on the received writ of execution, the organization recovers from the income of economist A.S. Kondratieva alimony for two children.

Payments to Kondratiev for January amounted to 21,200 rubles, including:

- salary – 7000 rubles;

- average earnings during a business trip – 4200 rubles;

- monthly bonus based on work results - 1000 rubles;

- rent for the use of employee property – 5,000 rubles;

- reimbursement of travel expenses – 4000 rubles.

Alimony is withheld from the first four payments accrued to Kondratiev. Deductions cannot be made from the amount of reimbursement of travel expenses.

The total amount of Kondratyev’s income, from which the accountant withholds alimony, is: 7,000 rubles. + 4200 rub. + 1000 rub. + 5000 rub. = 17,200 rub.

Amount of deductions from wages

The amount of monthly deduction from wages is prescribed in the text of the writ of execution by the bailiff. This can be a fixed amount of money or a certain percentage of earnings.

When the amount of deduction is indicated in the writ of execution, this amount is deducted from the accrued wages and transferred to the address of the claimant. If there is a debt for the employee’s unpaid obligations, then the deduction is made in the maximum amount, up to the repayment of the debt.

As a general rule, upon receipt of a writ of execution, no more than half of the amount remaining after deducting personal income tax can be withheld from the employee’s earnings.

The limit on the amount of deductions of 50% applies even in cases where several writs of execution have been received for one employee.

The following situations are exceptions to this rule:

- when collection is made for the maintenance of minor children (alimony);

- when the writ of execution contains a claim for compensation for harm to health, death of the breadwinner or damage caused as a result of the commission of a crime.

In such cases, the maximum percentage of salary deductions increases to 70%.

Regulatory base of deductions

The procedure for making deductions from an employee’s salary is regulated by the following regulations:

- Labor Code of the Russian Federation - cases in which an employer can recover certain amounts from an employee’s salary, as well as the maximum amounts of such penalties, are described in Art. 137-138.

- Tax Code of the Russian Federation - in Chapter. 23 describes the procedure for withholding personal income tax on income received by an individual.

- Criminal Executive Code of the Russian Federation - the specifics of deductions from wages are described in Art. 44.

- Federal Law of the Russian Federation “On Enforcement Proceedings” - the conditions for foreclosure on the debtor’s income are described in Art. 98-99.

Deduction order

When receiving two or more writs of execution, where the debtor is one individual, the employee responsible for making deductions must comply with the order of transfers of money to the recoverer. If the collected amount is not enough to pay off all obligations, deduction is made in the following order:

- alimony and compensation for harm (including moral);

- claims from individuals who were in contractual relations with the debtor;

- obligatory payments to the budget, the Pension Fund and other extra-budgetary funds; other collectors (loans, fines, etc.).

In the writ of execution, in addition to the principal debt, the amounts of fees required to be withheld are indicated. When distributing the collected amounts, the following procedure is observed:

- satisfaction of the claimant's requirements in full;

- reimbursement of expenses for enforcement proceedings;

- performance fee of 7%;

- fines imposed by the bailiff service.

Ways to reduce penalties from an employee’s salary

When an employee does not agree with what he has been ordered to pay, he has the right to appeal to the appellate court with objections. A citizen will be able to submit an application within 10 days. The result can be either a positive decision in favor of the plaintiff or a negative one.

This is important to know: How to transfer alimony according to a writ of execution

If the writ of execution has already been issued and is in the bailiff service, then there are also two options for action that the employee can take:

- Make an appointment with the senior bailiff of the unit where the enforcement proceedings in the specified case are being carried out;

- File an appeal to the court where the decision was made. Here you can send requests to change the collection procedure and also need to be changed.

In some cases, the court completely or partially cancels payments. What may influence the court's decision:

- Health problems. Moreover, it is not necessarily the health of the debtor; problems with family members can also influence the decision;

- Living with the defendant's dependents.

Also, the presence or absence of an official place of work may have a significant impact on the court’s decision.

Several writs of execution: how the debt is held

When one employee receives several enforcement documents, the accounting official must strictly follow the rule of order of deductions. For each subsequent phase, deductions can be made only after the debt for the previous one has been fully repaid. In this case, the maximum amount of deductions should not be exceeded.

Writs of execution of one stage

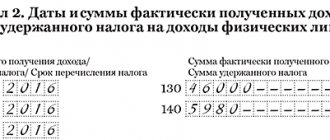

The employee received two writs of execution for the collection of alimony - one in the amount of 33% of earnings and the second, for the maintenance of his wife, who is on maternity leave, in a fixed sum of 6,000 rubles. When calculating wages, the accountant, first of all, withholds income tax in the amount of 13%, and, after that, must withhold alimony under writs of execution.

Example

The employee was credited 35,000 rubles. Personal income tax on this amount will be 4,550 rubles. Collection under two writs of execution cannot exceed 70% of income, i.e. 21315 rubles.

The deduction for the first writ of execution (33%) should be:

(35000 – 4550) x 33% = 10048.50 rubles.

According to the second writ of execution, the collection of a fixed amount is determined - 6,000 rubles. The total amount of deductions is:

10048.50 + 6000 = 16048.50 rubles.

Since the calculated amount of alimony under two writs of execution “fits” into the maximum limit of deductions, it can be recovered in full.

If the maximum amount of possible deductions is not enough to satisfy all demands, then collection is made in proportion to the amounts specified in the writs of execution.

The employee given in the above example received another writ of execution - for compensation for harm to health. The monthly withholding amount under this document is 9,000 rubles.

Deductions for the first two writs of execution amount to a total of 16,048.50 rubles. According to the third document, 9,000 rubles are withheld. A total of 25,048.50 rubles is subject to recovery. Considering that the maximum deduction amount for this line cannot exceed 21,315 rubles (70% of earnings), it is impossible to withhold all the required amounts.

The accounting department will make the following calculation:

- The total amount of deductions is 25,048.50 rubles, the limit is 21,315 rubles;

- 1st writ of execution: 30450 x 33%: 25048.50 x 21315 = 8550.76 rubles;

- 2nd writ of execution: 6000: 25048.50 x 21315 = 5105.69 rubles;

- 3rd writ of execution: 9000: 25048.5 x 21315 = 7658.54 rubles.

The balance of debt on all writs of execution in the amount of 3,733.50 rubles will be transferred to the next month.

Writs of execution of different priority (alimony and credit)

If the accounting department receives enforcement documents of varying priority, then when calculating deductions the principle of proportionality and compliance with the maximum amount of deductions must also be observed.

Employee A received a writ of execution for alimony in the amount of ¼ of his salary. In the same month, enforcement proceedings were initiated on the outstanding loan and the accounting department received a second document for the recovery of 10,000 rubles. Employee A's salary was 50,000 rubles.

The amount that can be deducted is:

50,000 – 6,500(13%) = 43,500 rubles.

First of all, it is necessary to withhold alimony:

43500 x 25% = 10875 rubles.

When paying a credit debt under a writ of execution, there is a limit - deductions should not exceed 50% of the basic income (21,750 rubles). Since part of this limit is already used to calculate alimony, to repay the loan the following calculation is performed:

21750 – 10875 =10875 rubles – the remainder of the possible deduction.

Since, with simultaneous collection under both writs of execution of different priority, the principle of the maximum amount of deductions is not violated, the requirements for obligations can be satisfied in full.

If there is a writ of execution for alimony, which prescribes a deduction of 50% (if there is an existing debt, for example), collection under other writs of execution, which provide for a different priority, is not possible.

How to get maternity leave - we have all the information you need! You can find out how to get paid sick leave after dismissal in this article!

Salary deductions are a very unpleasant thing! But you can figure it out if you read our material.

How much percent is withheld from wages under a writ of execution?

In accordance with the labor law of the Russian Federation, deductions from an employee’s salary cannot be unlimited. The law sets certain limits that the employer must comply with.

Limitations on the amount of deduction from wages

Each type of deduction has its own limits. Current restrictions:

- A reduction in salary by the amount of payments in favor of the employer can be made by no more than 20% (for any type of deduction).

- Tax payments are 13% for residents and 30% on the income of persons who are not residents of the Russian Federation.

- Deductions within the framework of executive documents - their total amount cannot exceed 50% of accrued wages. The only exceptions are those cases when it comes to collecting alimony or compensation for damage. In this case, the salary can be reduced by 70%.

- Agreement on payment of child support – up to 70%.

- Deductions at the request of the employee himself - the amount is not limited.

For clarity, the above restrictions on deductions from an employee’s income can be presented in the form of a table.

| Type of retention | Maximum size |

| At the initiative of the company | 0.2 |

| Tax payments | 13% (residents) or 30% (foreigners) |

| Performance list | 50%-70% |

| Agreement on payment of alimony | 0.7 |

| Employee initiative | no limits |

Questions and answers

In the process of implementing enforcement proceedings, the debtor and employers have many questions. Answers to some of them are presented below in the text.

The writ of execution arrived at work - what should the debtor do?

When a writ of execution is received by the company where the debtor works, its management must also become aware of this. However, there is no need to worry.

The initiation of enforcement proceedings cannot become a reason for termination of an employment contract or the application of any other sanctions by the employer. Moreover, this option is more convenient for the employee, since he does not need to make transfers on his own every month.

What is the maximum percentage of deductions for writs of execution?

The amount of deductions from an employee’s salary depends on the basis for which they are made.

In general, the maximum limit is 70%. However, it is valid only for certain types of deductions (alimony, including an agreement on its payment, compensation for damage).

Costs for transferring money under writs of execution

When transferring money monthly in favor of the claimant, the employer incurs additional expenses, namely: bank commission, payment for postal order, etc.

In accordance with paragraph 3 of Art. 98 of the Federal Law of the Russian Federation “On Enforcement Proceedings”, these types of expenses also fall on the shoulders of the debtor.

What percentage of income is written off if there is only one debt?

The exact amount of deductions made from the employee's wages is determined by a court decision. The law only sets maximum limits for it (from 20% to 70%).

Sometimes individuals are faced with a situation where bailiffs withhold an amount that is several times greater than the legal limit. This is a violation and grounds for filing a complaint.

How much can a salary card be withheld by law?

Another way to enforce a court decision is to seize the debtor’s bank accounts and cards. As soon as any amount gets here, it will be immediately written off to pay off the debt.

In this regard, many debtors are wondering whether the entire salary will be written off if the salary is seized?

For such a situation, the Federal Law of the Russian Federation “On Enforcement Proceedings” provides a special rule (Article 99), according to which the recovery in this case is applied to all receipts on the card with the exception of the last periodic payment.

Is deduction made according to a writ of execution upon dismissal?

In the event of dismissal, the amount under the writ of execution is also withheld from the last payment accrued in favor of the departing employee.

After this condition is met, the employer must send to the FSSP a notice of termination of deductions in connection with the debtor’s transfer to another place of work.

Is the writ of execution withheld from the advance payment?

The law does not prohibit making deductions within the framework of a writ of execution from an advance accrued in favor of an employee. Therefore, this option is also acceptable.

The order of payment according to the writ of execution to bailiffs in the payment order

When filling out a payment order, the employer must also indicate the order of payment (column No. 21).

The priority for deductions made within the framework of writs of execution should be indicated in accordance with the provisions of Art. 111 Federal Law of the Russian Federation “On Enforcement Proceedings”.