Receive documents on the topic for free In order to conscientiously fulfill the duties of a tax agent in relation to employees, the employer needs to be aware of the deadlines for transferring personal income tax to the budget established by law in relation to various situations.

According to paragraph 6 of Article 226 of the Tax Code, personal income tax calculated and withheld from the taxpayer must be transferred to the budget no later than the day following the day the income is paid to the taxpayer.

The exception is income in the form of vacation pay and temporary disability benefits. The tax withheld when paying the specified income is transferred no later than the last day of the month in which the payments were made.

Thus, the average organization has two deadlines for paying personal income tax during the month:

- the day following the day of payment of wages - for transferring personal income tax from wages;

- the last day of the month - for transferring personal income tax on vacation and sick leave.

In 2021, with any method of paying wages, the employer is obliged to transfer personal income tax to the budget no later than the day following the payment.

What should be paid to a resigning employee?

It happens that a company finds an error in personal income tax when an employee quits.

In this case, it will not be possible to deduct tax from the employee’s salary, and the tax office must be notified about this before March 1 of the next year. In 2021, the company incorrectly paid personal income tax to Anatoly. But the mistake was discovered when Anatoly left to work elsewhere. This means that you must notify the tax authorities about the error before March 1, 2019.

https://www.youtube.com/watch?v=ytcopyright

The plan is:

- Inform the tax office in writing that it will not be possible to withhold tax from your salary. To do this, you need to fill out a 2-NDFL certificate with the sign “2” and send it to the tax office.

Sign “1” is indicated in the certificates of employees for whom the company paid personal income tax. Sign “2” - for employees from whose income it was not possible to withhold personal income tax.

- At the end of the year, submit 2-NDFL tax certificates for all employees with attribute “1” and 6-NDFL declaration for the year before April 2 of the next year.

The tax office will notify the employee that he must pay personal income tax himself. He will receive a letter by email; the company does not need to control this.

If the company corrects the error with personal income tax before March 1 of the next year and sends corrected tax documents, there will be no fine or other penalties.

On the last day of working with the employee, the final payment must be made. On this day he must be paid:

- salary, bonuses, allowances until the last day of work;

- compensation for unused vacation;

- severance pay by law or in accordance with the employment contract.

In addition, if an employee is dismissed due to layoffs, then he retains income for the duration of his employment in the second, and in exceptional cases, the third month after termination of the employment contract.

Compensation upon dismissal is not subject to personal income tax

Question from Clerk.Ru reader Svetlana (Chelyabinsk)

The head of the municipal unitary enterprise was dismissed on the basis of clause 2 of article 278 of the Labor Code of the Russian Federation. According to Article 279 of the Labor Code, the director must be paid compensation in the amount of three times his monthly salary and compensation for unused vacation. According to the employment contract, the director was entitled to financial assistance in the amount of one salary during annual leave. Is compensation in the amount of 3 average salaries subject to personal income tax? And is there financial assistance available? Or does the municipal property management have the right to refuse to pay financial assistance that was previously assigned and paid when going on regular leave?

Clause 2 of Art. 278 of the Tax Code of the Russian Federation provides that, in addition to the grounds provided for by the Labor Code of the Russian Federation and other federal laws, an employment contract with the head of an organization is terminated in connection with the adoption by an authorized body of a legal entity, or the owner of the organization’s property, or a person (body) authorized by the owner of a decision to terminate the employment contract. The decision to terminate an employment contract on the specified basis in relation to the head of a unitary enterprise is made by the body authorized by the owner of the unitary enterprise in the manner established by the Government of the Russian Federation.

According to Art. 279 of the Labor Code of the Russian Federation, upon termination of the employment contract with the head of the organization in accordance with paragraph 2 of Art. 278 of the Labor Code of the Russian Federation, in the absence of guilty actions (inaction) of the manager, he is paid compensation in the amount determined by the employment contract, but not less than three times the average monthly salary.

In accordance with paragraph 3 of Art. 217 of the Tax Code of the Russian Federation, all types of compensation payments established by the current legislation of the Russian Federation (within the limits established in accordance with the legislation of the Russian Federation) related to the dismissal of employees, with the exception of compensation for unused vacation, are not subject to taxation (exempt from personal income tax).

It follows from this that the compensation paid to the head of a municipal unitary enterprise upon dismissal on the basis of clause 2 of Art. 278 of the Tax Code of the Russian Federation, not subject to personal income tax. A similar position was expressed by financiers in letters dated June 20, 2011 No. 03-04-06/6-144, dated May 23, 2011 No. 03-04-06/6-118.

Regarding the payment of financial assistance to the dismissed head of a municipal unitary enterprise, which is due when going on leave, you need to pay attention to the following.

If the manager took a vacation, and financial assistance was not paid to him, then the organization would be obliged to pay it.

Since the leave was not provided, then, in my opinion, the issue of payment of this financial assistance upon dismissal should be decided based on the terms of the collective, labor agreement and local regulations, which stipulate whether the employee is subject to payment of financial assistance if he did not go on vacation and, if so, then in what order this payment is made.

The presence of this procedure will allow you to avoid disputes with the dismissed employee, as well as tax risks.

It’s very easy to get a personal consultation with Vladimir Nikitin online - you just need to fill out a special form. Several of the most interesting questions will be selected daily, the answers to which you can read on our website.

What is the problem

Employers act as tax agents for personal income tax for employees and pay this tax for them. They deduct personal income tax from the salary amount and send the payment to the tax office. According to the rules, this must be done no later than the next working day after payday.

Sometimes salaries are paid, but personal income tax is forgotten, the tax is calculated incorrectly, or the tax is paid using incorrect details. Then the tax office sends a fine or blocks the account.

An entrepreneur from Tula paid personal income tax on each salary of his employees. But the payment details changed, but he didn’t know and paid according to the old ones. A year later, the tax authorities blocked his account and demanded that he pay 200,000 rubles in personal income tax. Everything ended well. The personal income tax was found, the account was unblocked, but the entrepreneur spent three days to resolve all this.

We suggest you read: How to pay child support if you don’t work? How is child support calculated?

Amendments to declarations in the Tax Code

The good news is that if you find the error yourself and report it to the tax office, you won’t have to pay a fine. How to proceed depends on the situation:

- the company found an error regarding personal income tax in the same tax period, and the employee continues to work for the company;

- the error was found after the tax period, but the employee is still working;

- the employee quit.

It's easier with an example.

Anatoly Kalabushev is a manager at Tula Zhamki LLC. In July, some accountants were on vacation, others went out for training several times. Therefore, they paid him his salary, but forgot to withhold personal income tax.

- The first situation: in September the accounting department notices an error, and Anatoly works for the company.

- Second: the error pops up in July next year, but Anatoly is still working at Zhamki.

- Third: the company found an underpayment of personal income tax, but Anatoly quit.

We have made a plan for every eventuality.

Personal income tax for an interest-free loan to an employee

A fairly common situation is when an organization provides an interest-free loan to an employee.

In this case, the date of receipt of income in the form of material benefits in the form of savings on interest is recognized as the last day of each month during the period for which the borrowed funds were provided (clause 7 of paragraph 1 of Article 223 of the Tax Code of the Russian Federation). In our article, we examined the most common situations in which the taxpayer needs to transfer personal income tax to the budget within a certain period. However, the cases in which employers have obligations as a tax agent for personal income tax are quite varied. You can always count on our help in resolving any issues. The SPS Consultant Plus system is your reliable support in the most complex legal issues.

Which payments are taxable and which are not?

Salaries for the last month of work are taxed as usual. If the employee is a resident, then the deduction should be made at a rate of 13%, if not, at a rate of 30%.

A special taxation procedure has been established for severance pay and retained earnings during employment. Such compensation upon dismissal is subject to personal income tax if it exceeds the employee’s three-month average earnings. For employees of organizations in the Far North and equivalent territories, this limit is six average monthly earnings.

Leave compensation upon dismissal is subject to personal income tax in full, regardless of the grounds for termination of the employment contract (clause 3 of article 217 of the Tax Code of the Russian Federation).

Important: Is it necessary to transfer personal income tax from the salary advance at the time of its payment?

According to the official position of the Ministry of Finance of Russia, when paying wages for the month in two parts, personal income tax must be withheld and transferred to the budget once during the final calculation of the employee’s income in the form of wages at the end of the month within the time limits established by paragraph 6 of Article 226 of the Tax Code.

(Letter of the Ministry of Finance of Russia dated April 10, 2015 N 03-04-06/20406) The tax authorities are of a similar opinion. The date of receipt of income in various cases is determined on the basis of Article 223 of the Tax Code.

The employee continues to work

The salary was paid, but personal income tax was forgotten. But the employee continues to work on staff. In this case, you will have to recalculate personal income tax and deduct it from the employee’s future income: wages, sick leave, vacation pay. That is, he will receive less money than he expected.

By law, personal income tax can only be withheld in the current tax period. For example, for 2021 - until April 1, 2021. After this date you will have to pay a fine.

Here is the procedure step by step:

- Recalculate the personal income tax for the employee for the quarter and understand how much you need to pay extra.

- Warn the employee that he will receive less money because he received more by mistake last time.

- Transfer the missing tax amount by the end of the quarter.

- Correct form 6-NDFL for the quarter in which there was an error.

- Correct the 2-NDFL certificate for the employee by the end of the year.

In the corrective report on Form 6-NDFL, you must indicate the adjustment number and the correct amounts:

- if you are correcting a mistake for the first time, it will be about;

- the second is “002” and so on.

You can report on Form 6-NDFL in different ways: for a quarter, six months, nine months or a year. If a company submits Form 6-NDFL quarterly and discovers an error for the first quarter at the end of the year, all forms will have to be corrected.

https://www.youtube.com/watch?v=ytcreators

We suggest you read: Proper plaintiff in civil proceedings

certificate number (field “N___”) - certificate number with an error;

certificate date (field “from __.__.____”) - date of the corrective certificate. This is the date when you draw up a new certificate;

correction number—correction number. If you are correcting for the first time, write 01.

Calculation of taxes by tax agents in the Tax Code

If personal income tax was calculated incorrectly or was not paid for several months, it will not be possible to correct the error in one go. By law, you cannot take more than half of an employee’s salary or vacation pay for taxes. Therefore, you will have to draw up several corrective certificates 2-NDFL and 6-NDFL.

Regulations for the payment of tax on individuals

In 2021, the deadline for paying personal income tax upon dismissal of an employee has changed slightly. Now income tax is transferred no later than the next day after the day the calculation is received. The method and type of payments do not matter: additional earnings, vacation compensation, certificate of incapacity for work. The actions of the administration of an enterprise with personal income tax upon dismissal are as follows:

- Determine the amount of tax on the amount due to the employee.

- Withhold the fee when issuing the final payment.

- Fill out a payment order and transfer the money to the budget through the appropriate Federal Tax Service inspection on the day the employee who wishes to resign receives the funds due to him. This can be done over the next 24 hours.

- At the end of the tax period (calendar year), fill out a declaration form 2-NDFL and reflect in it the amount withheld from the dismissed employee. In accordance with the Tax Code and Art. 229, the document is received by the inspectorate from March to the end of April.

It is possible to delay the issuance of a full payment to an employee beyond one day, but only at his own request or fault, for example, if due to some circumstances the dismissed citizen did not come to receive the money. Funds due to the employee are deposited, and final payment occurs on the day the employee actually applies.

Tax legislation determines the general terms for transferring fees to the budget. And it doesn’t matter how the citizen received the payment: in person, on a card, in kind. In case of simultaneous employment in the parent company and a structural unit, the tax is paid separately for each section of the employee dismissed from both places. There is also a report to the inspectorate twice for one person.

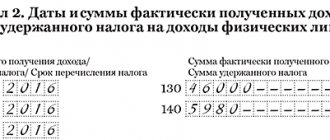

Below is a matrix updated by the timing of personal income tax payment upon dismissal of an employee, which clearly indicates the dates of accrual, withholding and payment of tax for different types of income. The table contains links to the regulatory document.

| Profit form | When the fee is calculated - Art. 223 NK | Subtraction time - paragraph 4 of Art. 226 Tax Code of the Russian Federation | The deadline for entering into the budget is clause 6 of Art. 226 NK |

| Salary and bonuses established by the standard | Month of service, end day | Payout number | No later than the day following the issuance of the amount |

| Non-production incentives | Award date | Same | ―″― |

| Dismissal - compensation for remaining days of rest and salary | Last working day | ―″― | ―″― |

| Disability subsidies and holiday pay | When issued in cash or by transfer to a card | ―″― | No later than the final date of the month of payment |

The timing of the transfer of personal income tax upon dismissal must be linked to the dates of receipt and payment of other remuneration. The matrix shows that in terms of benefits and vacation pay, tax payments can be made not immediately, but before the end of the current month.