Workers hired to perform seasonal work (according to Article 293 of the Labor Code of the Russian Federation) have the same social guarantees as full-time employees. They have the right to sick leave, vacation and vacation compensation upon dismissal. An employment contract is concluded with seasonal employees for a period of work, which usually does not exceed 6 months according to generally established rules, but in some industries a longer duration of seasonal work is possible. Most often, workers from agriculture, road transport and construction infrastructure, geological exploration, etc. are hired for seasonal work.

Features of leave for a seasonal worker

A contract for seasonal work is essentially a type of fixed-term employment contract. Therefore, when concluding it, the same rules and regulations apply as for vacations under fixed-term contracts, but with some features.

The main difference between the leave of seasonal employees is that it is calculated and provided in working days (Article 295 of the Labor Code), and not in calendar days, as with annual leave for other employees.

For each month worked, 2 working days are provided. However, employees engaged in seasonal work are provided with paid leave on a general basis: after 6 months of work. Therefore, there are 3 options for providing leave:

1. In advance, before the expiration of the 6-month period.

2. In the form of monetary compensation for unused vacation at the end of the contract.

3. The application for leave is written at the very end of the fixed-term contract, and then the last working day and the expiration date of the employment contract is the last day of leave.

The calculation of vacation periods, the duration of which is calculated in working days, also takes into account working days, not calendar days. The average daily earnings are determined by dividing all payments accrued to a seasonal worker for the period of his work by the number of working days within a given period of time according to the calendar of a 6-day working week, even if the employee works on a “five-day” basis (Article 139 of the Labor Code). This means that Sundays are not included in the number of vacation days and are not paid.

Remuneration of seasonal workers: examples from practice

Features of the practical application of the norms of the current legislation on the organization of labor relations require a detailed consideration of specific situations regarding wages, incentives and compensation payments to seasonal workers.

We calculate vacation pay

Continuing the topic we started in issue No. 10 of the Economist's Handbook magazine, let us turn to examples from economic practice.

Let's calculate the duration of vacation and the amount of vacation pay for tractor driver A. N. Goryunov, an employee of the Podmoskovny state farm, whose work is seasonal. Duration of work - 6 months (from April 1 to September 30, 2010). Salary - 20,000 rubles. per month.

For each month of work, a seasonal worker is entitled to two working days of vacation. Goryunov A.N. worked for 6 months. Accordingly, the duration of the main vacation should be 12 working days (6 months × 2 working days).

The billing period includes wages accrued from 04/01/2010 to 09/30/2010.

The amount of accrued wages in the billing period is 120,000 rubles. (RUB 20,000 × 6 months).

According to clause 11 of the Regulations on the specifics of the procedure for calculating average wages, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922 (as amended on November 11, 2009; hereinafter referred to as the Regulations), the average daily earnings for paying for vacations provided in working days, as well as for payment of compensation for unused vacations is calculated by dividing the amount of actually accrued wages by the number of working days according to the calendar of a six-day working week .

The calculation of the number of working days according to the six-day working week calendar for the season from April to September 2010 is presented in the table.

Calculation of the number of working days according to the calendar of a six-day working week for the season from April to September 2010.

| Index | April | May | June | July | August | September | Total |

| Number of calendar days in a month | 30 | 31 | 30 | 31 | 31 | 30 | 183 |

| Number of Sundays and non-working holidays in a month | 4 | 7 | 5 | 4 | 5 | 4 | 29 |

| Number of working days in a month according to the six-day working week calendar (page 1 – page 2) | 26 | 24 | 25 | 27 | 26 | 26 | 154 |

In this case, the billing period includes 154 working days according to the six-day working week calendar.

Accordingly, the average daily earnings will be 779.22 rubles. (120,000 rubles / 154 days), and the amount of vacation pay is 9350.64 rubles. (RUB 779.22 × 12 working days).

Vacation pay with additional paid leave due

Let's supplement the conditions of the situation we considered at the beginning of this article and consider another example.

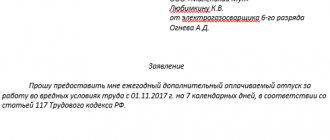

Since tractor driver A. N. Goryunov works under irregular working hours, he is entitled to additional paid leave. The organization’s collective agreement stipulates the following condition: each employee who is assigned irregular working hours has the right to 6 additional calendar days of vacation per year if he has worked for a whole year. Additional payment for irregular working hours - 3000 rubles. per month. Let's calculate the duration of the vacation and the amount of vacation pay.

For your information. When additional leave is granted in calendar days, non-working holidays (Article 112 of the Labor Code of the Russian Federation) falling during the period of additional leave are not included in the number of calendar days of vacation (Part 1 of Article 120 of the Labor Code of the Russian Federation).

In this case, 3 calendar days of additional leave for irregular working hours will be added to the duration of the main vacation, equal to 12 working days, since A. N. Goryunov worked in this organization for six months. In accordance with clause 9 of the Regulations, the amount of vacation pay is determined by multiplying the average daily earnings by the number of vacation days to be paid.

In other words, the amount of vacation pay for additional vacations provided in calendar days is calculated according to the general rules.

The amount of accrued wages in the billing period is 138,000 rubles. ((RUB 20,000 + RUB 3,000) × 6 months).

Calculation of vacation pay in working days

The average daily earnings for calculating vacation pay in working days will be 896.10 rubles. (RUB 138,000 / 154 days).

The amount of vacation pay for the vacation period in working days is 10,753.20 rubles. (RUB 896.10 × 12 working days).

Calculation of vacation pay in calendar days

The billing period is the same. The accrued salary is 138,000 rubles. ((RUB 20,000 + RUB 3,000) × 6 months). The average daily earnings is 782.31 rubles. (RUB 138,000 / 6 months / 29.4).

The amount of vacation pay for the vacation period in calendar days will be 2346.93 rubles. (RUB 782.31 × 3 calendar days).

The duration of vacation in this case will be 12 working days and 3 additional calendar days, and non-working holidays will not be included in the number of calendar days of vacation.

The total amount of vacation pay accrued to the employee is 13,100.13 rubles. (RUB 10,753.20 + RUB 2,346.93).

Vacation pay for “harmful” employees

According to Art. 116 of the Labor Code of the Russian Federation, additional paid leave is provided not only to employees with irregular working hours, but also to employees employed in work with harmful and (or) dangerous working conditions; employees working in the Far North and equivalent areas, as well as in other cases provided for by labor legislation or other laws.

Thus, in addition to the additional leaves established by law, provided on a general basis, persons working in the northern regions of Russia are also provided with annual additional leave as compensation (according to the Law of the Russian Federation of February 19, 1993 No. 4520-1 “On state guarantees and compensation for persons working and living in the Far North and equivalent areas" (as amended on July 24, 2009)) duration:

- in the Far North - 24 calendar days;

- in equivalent areas - 16 calendar days;

- in other regions of the North, where the regional coefficient and percentage increase in wages are established - 8 calendar days (as amended by Federal Law No. 122-FZ of August 22, 2004). This procedure also applies to workers traveling to perform work on a rotational basis to the regions of the Far North and equivalent areas from other regions (Article 302 of the Labor Code of the Russian Federation).

In addition, employers can independently establish additional leaves for employees. The procedure and conditions for granting these leaves are determined by collective agreements or local regulations, which are adopted taking into account the opinion of the elected body of the primary trade union organization.

How to calculate

An employee engaged in seasonal work in an area where additional leave of 8 calendar days per year is established was hired on 04/01/2010. The employment contract expires on September 30, 2010. It is necessary to calculate the amount of vacation pay accrued to the employee under the following conditions.

The employment contract with the employee provided for a work schedule of a six-day work week with a day off on Sunday. The employee has fully worked the period before dismissal. During this period, the salary established by the employment contract was 20,000 rubles. per month, a percentage increase of 20% of wages was paid from the first day of work in the organization (regardless of length of service), no other payments were made to the employee.

The amount of accrued wages in the billing period is 144,000 rubles. ((RUB 20,000 + RUB 20,000 × 20%) × 6 months).

Calculation of vacation pay in working days

The average daily earnings for calculating vacation in working days will be 935.06 rubles. (RUB 144,000 / 154 days).

The amount of vacation pay for the vacation period in working days is 11,220.72 rubles. (935.06 rubles × 12 working days).

Calculation of vacation pay in calendar days

The billing period is the same. The accrued salary is 144,000 rubles. ((RUB 20,000 + RUB 20,000 × 20%) × 6 months). The average daily earnings is 816.33 rubles. (RUB 144,000 / 6 months / 29.4). The number of additional vacation days is 8 calendar days per year, and for the period of seasonal work (6 months) - 4 days.

The amount of vacation pay in calendar days will be 3265.32 rubles. (RUB 816.33 × 4 calendar days).

The duration of vacation in this case will be 12 working days and 4 additional calendar days, and non-working holidays will not be included in the number of calendar days of vacation.

The total amount of vacation pay accrued to the employee is 14,486.10 rubles. (RUB 11,220.78 + RUB 3,265.32).

Calculations upon termination of an employment contract

Plant grower I. M. Kashcheeva received a notice from her employer (Zelenaya Dacha LLC) about the liquidation of the organization and, in connection with this, termination of the employment contract with her ahead of schedule. She was informed that she would be dismissed effective July 27, 2010. Since Kashcheeva I.M. is a seasonal worker, she is entitled to severance pay in the amount of two weeks’ average earnings. In addition, she must be paid wages for time worked and compensation for unused vacation. The employee's salary is 15,000 rubles. per month with a five-day work week. She is not entitled to tax deductions. The organization’s contribution rate in case of injury is 0.2%.

Let's calculate how much I.M. Kashcheeva will receive upon dismissal and what taxes and contributions will be accrued.

First, let's calculate the amount of wages for hours worked in July 2010.

According to the production calendar for 2010, the standard working time for a 40-hour workweek in July is 22 working days. Accordingly, Kashcheeva I.M. will receive a salary for July in the amount of 12,272.73 rubles. (RUB 15,000 / 22 work days × 18 work days).

Now let's determine the amount of compensation for unused vacation.

According to Art. 295 of the Labor Code of the Russian Federation, a seasonal worker is entitled to 2 working days of vacation for each month of work. Kashcheeva I.M. worked for 4 months (from April 1 to July 26, 2010). She is entitled to a vacation of 8 working days (4 months × 2 working days).

The average daily earnings in this case are determined by dividing the amount of accrued wages by the number of working days according to the calendar of a six-day working week.

The calculation period for calculating average earnings is from April 1 to June 30, 2010.

According to the six-day workweek schedule in April 2010, there are 26 working days, May - 24, June - 25. A total of 75 working days.

The average daily earnings of a female worker will be 600 rubles. ((RUB 15,000 × 3 months) / 75 work days). The amount of compensation will be 4800 rubles. (600 rubles × 8 working days).

Now let's determine the amount of severance pay.

Severance pay is paid in the amount of two weeks' average earnings.

Note! According to clause 9 of the Regulations, the average daily earnings, except in cases of determining the average earnings for paying vacations and paying compensation for unused vacations, is calculated by dividing the amount of wages actually accrued for days worked in the billing period by the number of days actually worked during this period .

In other words, to calculate the amount of severance pay, the average daily earnings are determined as the amount of actual payments for the pay period divided by the number of days actually worked in the pay period.

According to the production calendar of a five-day working week in the billing period from April 1 to June 30, 2010, there are 62 working days (April - 22 days, May - 19 days, June - 21 days).

The average daily earnings for calculating severance pay are 725.81 rubles. (RUB 15,000 × 3 months / 62 work days).

The first day after dismissal is July 27. From this date, within two weeks according to the five-day production calendar, there are 10 working days.

Thus, the employee was accrued severance pay in the amount of 7258.10 rubles. (RUB 725.81 × 10 working days).

Salaries and compensation for unused vacation are subject to personal income tax in the amount of 2,219 rubles. ((RUB 12,272.73 + RUB 4,800) × 13%).

According to the established insurance tariffs for 2010, wages and compensation for unused vacation are subject to insurance contributions in the total amount of 4,438.91 rubles. ((RUB 12,272.73 + RUB 4,800) × 26%).

Wages are also subject to contributions for compulsory social insurance against accidents at work and occupational diseases in the amount of 24.45 rubles. (RUB 12,272.73 × 0.2%).

In this case, the plant grower I. M. Kashcheeva will receive 22,111.83 rubles. ((RUB 12,272.73 + RUB 4,800 + RUB 7,258.10) – RUB 2,219).

Thus, in cases where the activities of an organization are determined by the seasonal nature of the work performed, labor relations with employees are regulated by special norms of the current legislation and have a number of specific features, the main ones of which were discussed in this article.

In conclusion, it should be noted that nowadays many organizations are faced with the need to hire employees for a certain period of time. The use of such forms of labor organization allows employers to facilitate the solution of temporary personnel difficulties for the period of seasonal work, plan the use of labor resources in the most optimal way and ensure the effective use of funds for wages.