What is salary

Perhaps some people, having read the title of our article, will say that this is an uninteresting topic and accountants, and not ordinary workers, should deal with the calculations. But we do not agree with this, because every person who receives a salary must control the amount of his payments. Accountants sometimes make mistakes, and in this case, you may not receive your hard-earned money.

Sometimes it happens that managers deliberately do not pay the necessary bonuses that are due to employees by law. To prevent this from happening, we recommend that you find out how wages are calculated and what their amount depends on.

Salary is a material reward for work performed. Accrued for hours actually worked.

Composition and varieties

In accordance with Art. 129 of the Labor Code of the Russian Federation, salary includes:

- remuneration for work;

- incentive payments;

- compensation.

In this case, the basic salary can be considered precisely the remuneration for the work performed. It can be of several types:

- salary - a certain fixed amount of payment for performing labor duties during a month during working hours;

- basic salary - this term is used along with the concept of “base rate”; it means a certain minimum wage for a state or municipal employee, without taking into account various compensations and allowances;

- tariff rate is a fixed payment for a certain completed standard of labor for a pre-agreed period of time.

In the table we present the main components of the additional salary.

| Type of additional payments | Form of application | Grounds for provision |

| Stimulating | Allowances, bonuses, surcharges | A rule fixed in an employment or collective agreement, a one-time order of the employer. |

| Compensatory | Allowances, surcharges | Art. 129 Labor Code of the Russian Federation:

|

Factors influencing wages

In different regions of the country at different enterprises, the salary of employees is not the same.

The following factors influence this:

- Qualifications of employees. For example, the higher the rank of a mechanic, the higher his tariff rate and the higher his salary.

- Special working conditions. In industries where an employee performs harmful and dangerous work, appropriate bonuses are paid, due to which the amount of monthly payments increases.

- Demand for workers of a certain specialty. For example, if we consider the village, the demand for tractor drivers is much higher than the need for IT specialists.

- Fulfillment of qualitative and quantitative indicators by the enterprise. If the company is doing well, then management gives bonuses to employees.

- Personnel policy of the company. At some enterprises there are some kind of production competitions. The shift that completes the most work at the end of the month receives a monetary reward.

Calculation and payment of additional salary

Payment of additional wages is carried out simultaneously with the transfer of funds at the basic salary or tariff rate, however, its calculation requires taking into account all possible circumstances of assigning additional payments to a specific employee.

For example, Ivanov A.B. works in a hazardous enterprise for a long time. His salary is 62,000 rubles, the work norm is 120 hours per month. At the same time, for each hour of overtime, a bonus is given in the amount of 0.5% of the employee’s salary. During the month, Ivanov worked 32 night hours from 10 pm to 6 am, as well as 101 hours of day shifts.

Based on the above, you can calculate the size of his salary in the current month:

| Wage | Working conditions | Calculation rules | Notes | Total amount | |

| Basic salary | If the standard is met, the employee is assigned a full salary | – | An employer cannot fine an employee or withhold any funds from his salary. The only source of impact is partial or complete loss of bonuses. | 62,000 rubles before taxes | |

| Additional payment for hazardous production | 4% of salary | In accordance with Art. 147 Labor Code of the Russian Federation | 2,480 rubles | ||

| Payment at night | 20% of the cost of one hour of work | Within the framework of Art. 96 Labor Code of the Russian Federation | 3,306.67 rubles | ||

| Overtime surcharge | 0.5% for each hour of processing | In accordance with local regulations of the enterprise | 4,030 rubles | ||

| TOTAL: | 71,816.67 rubles | ||||

The employee will receive 71,816.67 rubles, however, income tax of 13% will be withheld from this amount, and the employer will provide the employee with 62,480.50 rubles.

What is the basic and additional salary?

The basic salary is payment for hours worked or a task completed, and the amount of payments corresponds to established labor standards (for example, tariff rates or salaries).

To learn how to calculate the basic salary, you need to understand what a salary is and what a tariff rate is.

All employees, when hired at a company, sign an employment contract. It is there that it is indicated what form of payment you will receive.

Salary is a fixed amount specified in the staffing table that an employee receives for the monthly number of hours worked.

That is, the amount of the employee’s basic salary with salary will be equal to his salary.

The tariff rate is the cost of an hour of work for an employee.

At the end of the month, calculations are carried out according to the formula:

Tariff rate × Number of hours worked = Basic salary

Additional salary is payment for overtime work, various labor achievements and bonuses for special working conditions.

All salary supplements are prescribed in the Labor Code of the Russian Federation.

They are awarded in a number of cases:

- If an employee works in hazardous work, then he is entitled to a bonus for hazardous work, according to Article 147 of the Labor Code of the Russian Federation in the amount of 4% of the basic salary.

- If job duties have to be performed in special climatic conditions. For example, if the company is located in the North. Payments are made on the basis of Article 148 of the Labor Code of the Russian Federation. And their value depends on the regional coefficients (geographical location of the enterprise).

- According to Article 152 of the Labor Code of the Russian Federation, payment for overtime hours is also considered an allowance. The first 2 hours worked in excess of the monthly norm are paid at one and a half times the rate, and the rest at double.

- If an employee has to go to work on holidays and weekends, then, according to Article 153 of the Labor Code of the Russian Federation, his rate is doubled or paid time off is provided.

- If the employment contract provides for night shifts, then the time from 10 pm to 6 am is paid 20% higher, according to Article 96 of the Labor Code of the Russian Federation.

- If an employee combined several positions or replaced an absent employee, then the amount of his bonus is negotiated individually, in accordance with Article 151 of the Labor Code of the Russian Federation.

Differences between additional salary and basic salary

Basic salary is a fixed or floating amount of payments that is provided to an employee for performing his job duties at a decent level. The amount of payments is most often prescribed in a collective or employment agreement and is subject to change in the event of an employee’s promotion or demotion, as well as when wages are indexed.

Illegal and groundless reductions in payments of basic salaries to employees of private and public institutions are not permitted.

The basic salary can be presented as:

- Salary, which is a certain and fixed amount. It is spelled out both in the employment contract and in the staff schedule. Provided for working the required number of hours in full.

- Tariff rate, which is expressed in the cost of an hour of work by an employee of the organization. Most often, this payment method is used for irregular working hours, since an employee can work 4 hours on one day and 18 on another.

The size of the basic salary at the tariff rate is determined by a special formula:

Cost of Tariff Rate×Number of Hours Worked=Basic Salary

At the end of the month, all hours are counted and directly affect the amount of wages the employee receives. In this case, the salary is not fixed and depends entirely on the time the employee works at the enterprise.

As for the additional salary, it represents various measures of managerial support for employees for:

- special working conditions;

- harmful production;

- danger to life and health during the performance of duties;

- overtime hours of work;

- various positive changes in the organization under the direct influence of the employee, for example, when concluding a serious agreement with investors, etc.

Additional salary payments may be provided for by law, for example, in the case of hazardous working conditions, or by local regulations of the enterprise - for concluding an expensive transaction.

Example calculations and formula

Petrov Ivan Ivanovich has a salary of 10,000 rubles. It is necessary to calculate his salary for the month if it is known that:

- He worked the norm (160 hours);

- Is in a position that involves hazardous working conditions;

- He worked 24 holiday and 40 night hours;

We will make all calculations using a table.

| Salary components | conditions | formula | Bottom line |

| 1 | 2 | 3 | 4 |

| Basic salary | Full salary, because he worked out the norm | — | 10,000 rub. |

| Harmful working conditions | 4% of basic salary | basic salary×0.04 | 400 rub. |

| Holiday hours | *Double tariff | Cost 1 hour×24 holiday hours×2 | 3,000 rub. |

| Night hours | *20% of the cost of each night hour | Cost 1 hour×40 night hours×0.2 | 500 rub. |

| Total salary | Amount according to column No. 2 | RUB 13,900 | |

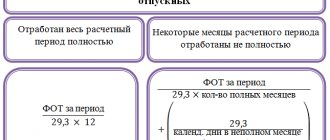

* - to calculate additional payments for holidays and night hours, you must calculate the cost of one hour of work using the formula:

Basic salary divided by the number of hours worked per month. In our case, this is: 10,000 / 160 = 62.5 rubles. hour.

Answer: Ivan Ivanovich Petrov will receive a salary of 13,900 rubles for the month of January. (excluding taxes).

In addition to all kinds of additional payments, additional wages include payment for time during the period when the employee was absent for a valid reason, prescribed in the Labor Code of the Russian Federation.

This:

- Payment for all types of vacations and compensation for unused vacations;

- Payment for working hours when the employee performed socially important or government assignments;

- Payment of preferential hours to minor citizens;

- Payment for additional breaks for nursing mothers;

- Payment for the time that the employee spent undergoing medical examinations, training, etc.;

- Payment for business trips;

- Payment of rent for some employees, etc.

List of additional payments to the salary

Additional payments are both regulated and not regulated by law, since in one case, for example, bonuses, the legislator indicates that the employer has the right to apply or not to apply such incentive measures at the enterprise, and in the other, the employer is obliged to charge various bonuses, for example, for harmful production.

All possible allowances are specified in the Labor Code of the Russian Federation, but not all of them are mandatory in the form in which they are indicated.

Supplements are awarded in the following cases:

- Carrying out work in production that is harmful and dangerous to life and health, in accordance with Art. 147 of the Labor Code of the Russian Federation, such employees are entitled to a bonus of 4% of the basic salary.

- Work in difficult climatic conditions, including in the Far North, Siberia, the Far East, etc. Each region has its own bonus for work, but payments are regulated in accordance with Art. 148 Labor Code of the Russian Federation.

- Carrying out work overtime. So in accordance with Art. 152 of the Labor Code of the Russian Federation, the first two hours of work after the expiration of the established time for performing duties are set at one and a half rates per hour of work, and for hours exceeding this norm - at double the rate.

- Carrying out work on weekends and holidays, if the employee does not work in shifts. In accordance with Art. 153 of the Labor Code of the Russian Federation, such an employee is entitled to double pay for a working day.

- Carrying out work at night. Within the framework of Art. 96 of the Labor Code of the Russian Federation, work hours from 22 to 6 hours are paid at an increased rate of no less than 20%.

- Combining positions or performing work for a temporarily absent employee of the organization, in accordance with Art. 151 of the Labor Code of the Russian Federation, payment for such work is negotiated individually between the employee and the employer, on which an agreement is concluded.

Additional salary should always be provided for in an employment or collective agreement, since in the absence of it, the employer has the right not to pay bonuses. But this situation is illegal if the employee works in hazardous industries, in negative climatic conditions, with irregular working hours, etc.