KBK for personal income tax payment

In a situation where the income is wages, the state takes the tax on it not from the employee after accrual, but from the tax agent - the employer, who will issue the employee a salary with taxes already paid to the budget.

Personal income tax is calculated by subtracting documented expenses from the amount of income of individuals and taking a certain percentage of this amount (tax rate). Personal income tax is assessed separately for residents and non-residents of the Russian Federation, but this does not apply to employees. Some income specified in the legislative act is not subject to taxation (for example, inheritance, sale of real estate older than 3 years, gifts from close relatives, etc.) The income declaration gives individuals the right to certain tax deductions.

Budget Classification Codes (BCC) - Personal Income Tax (NDFL)

| Payment Description | KBK |

| Pension contributions at basic and reduced rates | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 1) | 182 1 0200 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 2) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 2) | 182 1 0200 160 |

| Medical fees | 182 1 0213 160 |

| Social contributions | 182 1 0210 160 |

| Contributions for injuries | 393 1 0200 160 |

| Payment Description | KBK |

| Pension contributions at basic and reduced rates | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 1) | 182 1 0200 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 2) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 2) | 182 1 0200 160 |

| Medical fees | 182 1 0213 160 |

| Social contributions | 182 1 0210 160 |

| Contributions for injuries | 393 1 0200 160 |

Individual entrepreneurs pay the BCC on their own. If an individual entrepreneur simultaneously works as an employee, he still must pay contributions for himself - as an individual entrepreneur.

Entrepreneurs are required to pay mandatory contributions to their own pension and health insurance until they are “listed” as individual entrepreneurs and have a Unified State Register of Entrepreneurs (USRIP) entry about them. The age of the entrepreneur and occupation does not matter. And most importantly, contributions must be paid even if the individual entrepreneur does not receive any income.

- KBK for personal income tax in 2021

- KBK for insurance premiums

- Full table of BCC for insurance premiums 2021

- We pay insurance premiums

- We pay personal income tax for employees

- Innovations for 2021

Now, too, the tax agent maintains separate tax bases for each type of income, for which different tax rates are established. In addition, a separate tax base is maintained for income from equity participation (dividends). This means that for income taxed at a rate of 13%, you need to maintain 2 tax bases.

According to the new procedure, the number of tax bases for income taxed at a rate of 13% increases for tax residents of the Russian Federation to 9, and for non-residents - to 8. Here are the tax bases provided for tax residents of the Russian Federation by the new paragraph 2.1 of Article 210 of the Tax Code of the Russian Federation:

- tax base for income from equity participation;

- tax base for income in the form of winnings received by gambling participants and lottery participants;

- tax base for income from transactions with securities and transactions with derivative financial instruments;

- tax base for repo transactions, the object of which are securities;

- tax base for securities lending transactions;

- tax base for income received by participants of the investment partnership;

- tax base for transactions with securities and for transactions with derivative financial instruments accounted for in an individual investment account;

- tax base for income in the form of amounts of profit of a controlled foreign company;

- tax base for other income in respect of which the tax rate provided for in paragraph 1 of Article 224 of this Code is applied (hereinafter in this chapter - the main tax base).

It is clear that many tax agents will not have the majority of such income, so the change will be felt only by those enterprises that pay these incomes.

Please note the new term “basic base”; it will include the majority of employee income: wages, vacation pay, sick leave, financial assistance and others.

Personal income tax on dividends in 2021 rate and BCC

So, first of all, let’s look at the budget codes that must be indicated when issuing payment orders for paying taxes on dividends. BCC for personal income tax on dividends in 2021 is 182 1 01 02021 01 1000 110, and for income tax on dividends 182 1 01 02021 01 1000 110. As for the interest rate, it is 15% for non-residents. But for Russians themselves, as well as foreign citizens who have stayed in Russia for more than 183 days and have a residence permit, the personal income tax rate on dividends in 2021 is only 13%.

Personal income tax on dividends in 2021 rate, KBK (budget classification code), for residents and non-residents, payment order, how to pay and complete information on paying income tax.

How many business projects are born in a cafe over a glass, when a person with organizational skills and ideas scams his friend out of money to open a business. The latter hopes to receive a substantial sum, called dividends, for the rest of his life. It should be noted that there are very few enterprises in Russia that pay dividends to their founders, because it is much easier to register a person as a freelance employee and pay him a salary, with all taxes, without having to add extra reporting. Enterprises try not to show excess profits, but by updating fixed assets and assets, as well as creating additional expenses, reduce them to zero. However, some firms still pay income to their founders. Accordingly, according to the law, this income must be subject to tax, the level of which is constantly changing.

Personal income tax payment from dividends 2021: sample filling

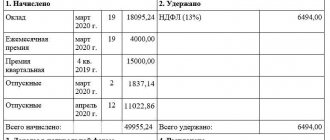

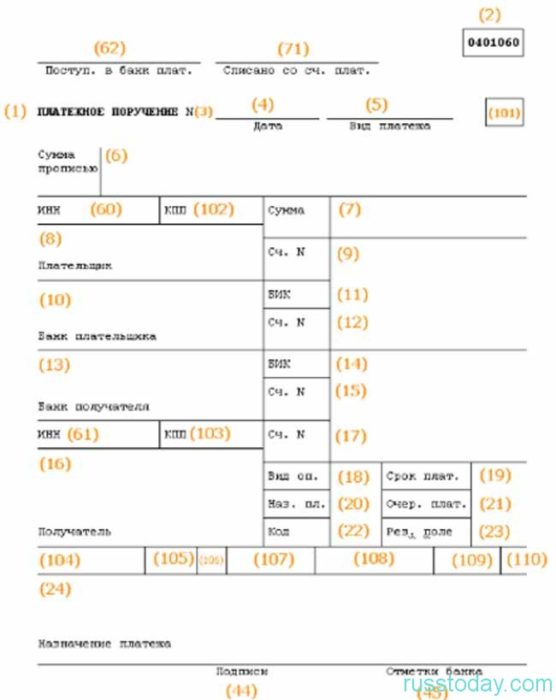

The following example shows a personal income tax payment from employee salaries. The fields marked with numbers are the details of the document about which questions arise. Their decoding can be found in the table below.

Sample of filling out the PP for payment of personal income tax on employees' wages

We suggest you consider a sample of filling out a personal income tax payment slip for 2018, understand the rules for drawing up this document, as well as its purpose. In addition, individuals who need to transfer funds will be able to learn all the intricacies of this procedure.

Payment order

If an individual has opened an account in a bank, deposited a certain amount of money into it and wants to transfer it to another account, then he needs to draw up an appropriate settlement document containing this instruction, which is called a payment order. Most often, employers encounter documentation of this kind when transferring personal income tax from the salaries of their employees to the state budget.

Many taxpayers believe that completing documentation containing reporting data on the personal income tax they have transferred and making the appropriate payment is sufficient.

However, in addition to this, it is necessary to enter data into the payment order form approved by the Federal Tax Service. This will guarantee that the funds allocated for personal income tax will be transferred exactly to the destination address.

In such a situation, the taxpayer will need to check all the details and find out all the information relating to the payment made, which will require additional time and effort.

Since not only the account owner, but also bank employees contribute to the procedure for transferring funds, some lines in the payment slip must be left blank. Blank spaces are intended for marking by individuals who are bank employees.

First of all, this is the direction of the payment, the signature of an authorized employee for its execution and the wet seal of the bank. In addition, two dates are placed at the top of the form. The first of them is the date of receipt of money in the bank of an individual acting as a payer, and the second is the date of its debiting from the account.

In 2021, the form of such a document as a payment order remained practically unchanged compared to the form in force in 2021.

Most of the information required from the taxpayer is numbers (dates, amounts, account numbers, etc.). However, in some places in the document you also need to indicate text (for example, the amount of the money transfer). In order to correctly enter words into a document, write them in printed font.

The payment form contains several abbreviations that most individuals encounter for the first time, and there are also lines that require entering codes that encrypt certain information. In this regard, the parameters that require special attention during the process of processing payment orders are given and explained below:

- Taxpayer status. In a separate square, inside of which there is the designation 101 in brackets, you need to note the status. If an individual is an employee of the tax service and has the right to withhold personal income tax from taxpayers’ profits, then he must indicate code 02, if an individual entrepreneur - 09. However, in most cases, code 13 is used, which is intended for individuals who do not have a special status.

- TIN - identification number is issued not only to individuals, but also to legal entities, including banking organizations. In this regard, in the payment form it is necessary to indicate the TIN of two banks - the sender and the recipient. As a rule, these are numerical ciphers consisting of ten characters and conditionally divided into five blocks of two numbers, each of which carries its own meaning (for example, the first two characters are the subject’s code).

- Checkpoint - since banking organizations are registered simultaneously with several tax authorities, in addition to the TIN, they are also assigned a so-called reason for registration code. This digital code carries information about which tax authorities are responsible for controlling the income of a particular legal entity.

- BIC is a mandatory attribute of any bank, which is needed to record participants carrying out settlement transactions. And this abbreviation stands for bank identification code. Such ciphers consist of nine digits and are used only on the territory of the Russian Federation.

If the head of a company needs to pay personal income tax, the amount of which is 235,000 rubles, from the monthly salary of all his employees, transferred to their bank cards on May 27, 2018, then the following information is entered into the payment slip:

- Document number and date of completion. Next to the name of the form (“PAYMENT ORDER”) you need to put its serial number. Or, in other words, indicate a number reflecting the number of issued payments in a given bank account. After this, the date the form was filled out is written. In this case, this is the next day after employees receive their salaries - May 28, 2021.

- Amount of payment. In order to correctly record the amount that the manager wants to transfer to the state budget, it is necessary to write its amount as follows: “two hundred thirty-five thousand rubles 00 kopecks.”

- Payer details. To indicate which legal entity is the personal income tax payer, you will need to write its identification code, checkpoint, account number, re-enter the amount that will be transferred as a result (only in numerical format), indicate the name of the company, bank and BIC.

- Recipient's bank details. In order to correctly enter data regarding the organization to whose account personal income tax payments will be received after some time, you should also display the TIN and BIC assigned to it. In addition, the account number and name of the bank in which it is opened for the recipient must be written. In addition, you need to indicate the tax service that will receive the money (inspectorate number and city of location).

- Additional information. In a column such as the order of payment, in 2021 the number five is entered, and in the column called “code” a zero is entered if the manager pays material resources on his own initiative, and not in response to a written request for repayment of personal income tax debt from tax officials services.

- Recipient information. Point four described how to correctly enter the details of the recipient’s bank. However, this information is not enough for the payment - information is also required about the tax service itself, which will receive this transfer. You will need to write the budget classification code and the combination of numbers established by the classifier for settlements or municipalities (OKTMO), as well as put additional marks regarding the payment, if any.

The Ministry of Finance has clarified the nuances of difficulties with payment documents this year. Whether all fields on the form are filled out correctly determines whether the banking institution will accept it. Having carefully studied the example of filling out a payment order in 2021, you can fill out payment orders quickly and without errors.

According to established rules, such documents are filled out by private entrepreneurs and companies performing transactions that are subject to taxes. Another category of taxpayers are individuals or legal entities engaged in the supply of goods across the customs border.

Persons and organizations that:

- They are engaged in performing various types of work, selling goods and providing services that are subject to VAT. For example, they sell building materials, renovate premises, and provide consultations.

- Transfers goods without the need to rally them, performs assigned tasks and provides services. In this case, the tax base is the actual market price for the type of services provided and work performed.

- They distribute goods throughout the country that are intended to fulfill their own needs. Such an action is subject to taxes if the company did not take into account the cost of carrying out these operations when calculating income taxes.

- They are engaged in construction work or installation of structures.

All persons carrying out such transactions must pay tax to the state treasury if the amount of money received for the previous trimester is more than 2 million.

rubles (the amount does not include the amount of tax). For entrepreneurs who sell goods subject to excise tax, this rule does not apply - they must pay tax regardless of their revenue.

The procedure for filling out payment orders in 2021

You can obtain tax exemption by filling out a special form that is submitted to the regulatory authority.

Documents confirming the financial transactions carried out by the company or entrepreneur must be attached to the form: companies need to attach extracts from the balance sheet, persons engaged in entrepreneurial activities - books of inputs and expenses, sales, and other internal business transactions.

Next, enter your information. Namely:

- Surname

- Name

- Surname

- TIN

- Registration address

Please note that you need to pay fees on your own behalf. Click the “Next” button and check everything again... After making sure that the data is entered correctly, click on the “Pay” button. If you want to pay in cash, using a receipt, then select “Cash payment” and click on the “Generate payment document” button "That's it, the receipt is ready

- Since we entered KBK 18210202140061110160, we received a receipt for payment of mandatory contributions to the pension insurance of individual entrepreneurs.

- In order to issue a receipt for payment of the mandatory contribution for health insurance, we repeat all the steps, but at the stage of entering the BCC, we indicate a different BCC: 18210202103081013160

- medical insurance for an individual entrepreneur for himself - 182 1 0213 160.

KBK for personal income tax on dividends in 2021

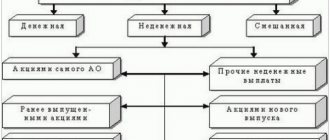

Dividends are accrued to the participants of the organization due to the fact that it has retained earnings. That is, one that is not required to pay expenses, as well as to establish and maintain effective business activities.

We recommend reading: Travel benefits for veterans of military service in the Leningrad region in 2021

The profit that individuals receive as a result of equity participation in organizations and companies is called dividends. It is paid directly by organizations to individuals. This situation, along with other payments intended to individuals from organizations, is accompanied by tax payments. One of which is personal income tax. The organization itself has the responsibility to calculate this amount, withhold it from the individual, and also transfer it to the budget - also lies on the shoulders of the tax agent, which this organization is. At the same time, in order to transfer the payment, you will definitely need to know the exact BCC for personal income tax on dividends in 2021.

How personal income tax is calculated

Since payments are made by a legal entity, that is, an organization, it essentially acts as a tax agent, which means its responsibilities include:

- Calculation of payments according to shares

- Calculation of taxes that must be paid to the budget from these amounts as an income tax for an individual

- Withholding amounts calculated above

- Transfer of tax money in the right direction of the state budget

The tax agent will have to deal with the KBK personal income tax on dividends at the last stage, but for now, it is necessary to make the correct calculations.

Personal income tax rate on dividends in 2021

It is necessary to pay attention to the fact that in the process of determining the amount of tax on accrued dividends of resident founders, one must take into account whether the legal entity itself received a share of payments from another company in the current or previous reporting tax period.

Initially, it is necessary to pay attention to the payment of personal income tax by entrepreneurs under the simplified tax system. I do not take into account the fact that when using the simplified taxation regime, companies are exempt from accounting; when dividends are accrued to participants in the authorized capital, an obligation is automatically formed.

Loan to the founder personal income tax accrual deadline 2021

For LLCs, the following rule has been established for determining the deadline for paying personal income tax: the tax must be transferred no later than the day following the day of payment of dividends. It does not matter where the money was issued from, from the cash register or transferred to the founder’s card.

We recommend reading: Contributions to the Pension Fund in 2021 for employees, what percentage

Home For business A loan to the founder from an LLC is a common form of lending today, which is practiced by large business projects in order to support start-up entrepreneurs. The principle of such a loan is that a company employee can borrow a certain amount of money from the account of the company where he works.

KBK for payment of personal income tax on dividends in 2021

Profit is divided between participants in accordance with the procedure reflected in the charter of the legal entity. Most often this distribution is made in proportion to the share of participation. Newly admitted participants can also count on payment of dividends according to their available share.

The profit received by the enterprise after taxation can be distributed among the participants of the company. Dividends recognize not only income from the distribution of remaining profits received by the participant, but also other similar payments to the participants (letter of the Ministry of Finance of the Russian Federation dated May 14, 2021 No. 03-03-10/27550). Dividends are also recognized as receipts outside the Russian Federation, recognized as such by the legislation of other countries (Clause 1, Article 43 of the Tax Code of the Russian Federation).

KBK for personal income tax on dividends in 2021: sample payment order

When a company passes through many payments with different budget classification codes, it is very easy to make a mistake in writing the BCC for personal income tax on dividends. Fortunately, the error can be corrected without significant damage to the organization if the right steps are taken.

In December 2021, the company received and distributed profit in the amount of RUB 200,000. Now you need to calculate personal income tax on dividends. Since both company participants are residents of the Russian Federation, a 13% rate is applied to their income.

CBC personal income tax on non-resident dividends in 2021 in Russia

Russian companies are considered tax agents for dividend income of participants - individuals, therefore they withhold and transfer tax to the budget. To make the payment correctly, the accountant of a JSC or LLC needs to follow the following algorithm.

We recommend reading: Request information about employer contributions

If organizations (LLC or JSC) pay dividends to their participants (founders or shareholders) based on the results of their activities, then they are required to withhold income tax from this amount. In the article, we will consider at what rate personal income tax should be withheld from dividends in 2021 and when to transfer the tax to the budget.

Changes in budget classification codes

The sample KBK personal income tax payment order for dividends in 2021 is practically no different from a payment order with a different purpose. All numbers, codes, signatures and seals remain unchanged. The minor differences are the BCC (when filling out electronically, it is selected from the list) and the purpose of payment (indicated manually).

This is important to know: New rules and procedures for paying personal income tax in 2021

All existing codes are indicated in the articles of the Tax Code. Their changes are supported by relevant orders. At the moment, the BCC has not changed for payments:

- Personal income tax on income from a tax agent (except for the cases described in Articles 227 and 228 of the Tax Code);

- Personal income tax from citizens whose methods of obtaining income are described in Article 227 of the same code;

- Personal income tax on citizens’ income, which is described in Article 228 of the Code.

Payment of penalties for personal income tax in 2021, a sample payment order of which is given below, will be charged depending on the category to which it belongs:

- Personal income tax penalties from Russian organizations that received dividends from domestic organizations;

- Penalties from foreign organizations that received dividends from Russian ones;

- Penalty for personal income tax from domestic organizations that received dividends from foreign organizations.

The BCC is different for each type of penalty. In 2021 you must indicate:

In fact, the BCC of each type differs by one number. You should be extremely careful when filling out.

Read with this news:

Some important points regarding payment of fines:

- The recipient's details are identical to the details of the tax office to which standard payments are made;

- If the request for payment of penalties does not indicate the UIN (UIP), you should indicate “0”;

- The BCC should be indicated for the period in which the penalty is paid (for example, the penalty is accrued until 2021, and payment is made in 2021. Then the payer indicates the BCC for the current period).

Procedure for filling out documentation

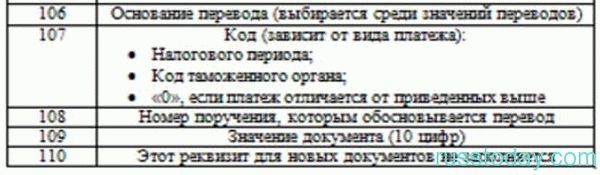

The procedure for filling out a personal income tax payment order in 2021, the sample of which is standard, boils down to filling out the document details one by one. The table describes the purposes of each attribute.

Fig.1. Table of field assignments in a document

KBK for personal income tax in 2021: table

After the budget receives personal income tax transferred by tax agents, these funds are distributed between the budget of the constituent entity of the Russian Federation and the budgets of municipalities (settlements, municipal districts, urban districts) according to the standards established by budget legislation.

What budget classification codes for personal income tax have been approved for 2021? Which BCCs should I pay personal income tax on salaries, vacation pay and other payments in 2021? Here is a convenient table with the BCC for personal income tax for 2021 (for legal entities). Also in the article you can see a sample payment order for personal income tax payment.

Payment order for personal income tax for employees from salary: sample 2021

Article 230. Ensuring compliance with the provisions of this chapter Tax service specialists provide clear explanations that tax agents carrying out transactions with shares and other specialized instruments cannot be subject to the general procedure for providing information on the income of individuals to the inspectorate in the format of certificates in Form 2 -NDFL.

Field 110 in the payment order

Field 109 in the payment order

Numbering of payment orders

Payment order in electronic form

Income code “material assistance” in the payment order

To make non-cash payments to counterparties, pay taxes to the budget and other transfers from their current account, enterprises and individual entrepreneurs use a payment order - a document whose form is approved by the Central Bank. Payment orders must be filled out in compliance with the established rules, indicating all the necessary details strictly in the document fields provided for them. We will tell you about filling out a payment order and provide a breakdown of the fields in the payment order in 2021.

When filling out the payment form, payers should be guided by Regulation No. 383-P, namely, Appendix 1, which provides a list and description of all document details. Let's consider which field in the payment order is intended for what, and how to fill it out.

- Fields 3 and 4 - payment number and date.

Numbers are listed in chronological order and should not contain more than six digits. The date is indicated in the format “DD.MM.YYY”.

- Field 5 “Type of payment”.

It may have the meaning “urgent”, “telegraph”, “mail”, or something else established by the bank, or not be indicated at all. For electronic payments, indicate the code set by the bank.

- Fields 6 “Amount in words” and 7 “Amount”.

In field 6, the amount is indicated in words with a capital letter, without abbreviating the words “ruble” and “kopeck” in the corresponding case. In this case, kopecks are indicated in numbers, for example, “One hundred rubles 21 kopecks.” Field 7 is intended to indicate the amount in numbers, with rubles separated from kopecks by a “dash” (for example, “258-60”). When the amount is expressed in whole rubles, kopecks may not be reflected in field 6, and in field 7 a “=” sign is placed between rubles and kopecks (for example, “258=00”).

In this field you should specify one of the identifiers, consisting of 20-25 digits:

- UIN (unique accrual identifier) - for settlements with the Federal Tax Service and funds for debts, fines, penalties. The code is assigned by the department in the corresponding payment request. If the code is not assigned or the payment to the budget is not made upon request (for example, when paying current taxes), “0” is indicated in the UIN field in the payment order;

- UIP (unique payment identifier) – for settlements of non-budgetary payments. The code is assigned by the organization receiving the payment and is communicated to the payer if such a condition is provided for in the contract. When the UIP is not assigned, the value “0” is also indicated in field 22 in the 2021 payment order.

You cannot leave the code field empty in the 2021 payment order.

- Field 23 “Reserve field” - not filled in.

Sample personal income tax payment order in 2021

A payment order is used when transferring funds to another account to pay taxes, pay dividends, wages, etc. Productions that are single or medium-sized in terms of output can issue an order through a bank. Large organizations can generate and send any order via Internet banking.

- Personal income tax penalties from Russian organizations that received dividends from domestic organizations;

- Penalties from foreign organizations that received dividends from Russian ones;

- Penalty for personal income tax from domestic organizations that received dividends from foreign organizations.

Payment order for payers 2021

An approved sample of filling out a payment order for personal income tax in 2021 is shown in Figure 2.

Fig.2. Sample payment order

The complex term “payment order” can be interpreted as an order to transfer a certain amount to the account of the tax system to pay tax. This order is used in all types of settlements. This fact is especially convenient for large organizations, because non-cash money transfers significantly save working time.

One of the points that is often overlooked is field 4 “date of completion”. Filling out this field is easy. In order to correctly enter the date, you need to know the exact deadlines for paying the tax for which the order is being drawn up. Below are the main date formats.

A typical example of filling out field No. 4:

- The date is set in the usual order (month, day, year) if we are talking about paying personal income tax as a tax agent. This is due to the absence of strict payment deadlines (specific dates) in the legislation;

- When it comes to transferring premiums (insurance), the date format remains the same. The exception is a transfer that is associated with injuries (in this case, instead of the date, you must indicate “0”).

The completion date may look like this:

MS.(KV.; PL.; GD.)XX.YYYY, where:

- MS – corresponds to the serial number of the month;

- KB - quarter number;

- PL - first or second half of the year;

- GD - reporting year.

Often, people who are responsible for working with documents have a question about what will happen if there is an error in the above field. Nothing bad will actually happen. All funds will be transferred to the specified details. In this case, each representative has the right to clarify the date on the payment slip. To do this, you must submit a corresponding application.

Personal income tax rate on dividends in 2021

If a company pays dividends to individuals, it must withhold personal income tax from them. The tax rate can be 13% or 15%. This depends on the status of the income recipient. The tax is calculated using a special formula if the company received dividends from its affiliates. The deadline for paying personal income tax differs for LLCs and JSCs. Also, what kind of reporting needs to be submitted for withheld tax depends on the legal form.

The founders decided to distribute profits for 9 months of 2021. Dole Ivanova S.M. corresponds to an amount of 350,000 rubles. The payment was made on November 1, 2021. Based on the results of the period from November 2021 to October 2021, Ivanov S.M. is a resident. When paying dividends, it is necessary to withhold 45,500 (350,000 x 0.13) rubles.

KBK 2021 - Personal Income Tax (NDFL), transcript

| Name of tax, fee, payment | KBK |

| Corporate income tax (except for corporate tax), including: | |

| — to the federal budget (rate — 3%) | 182 1 0100 110 |

| — to the regional budget (rate from 12.5% to 17%) | 182 1 0100 110 |

| VAT | 182 1 0300 110 |

| Property tax: | |

| - for any property, with the exception of those included in the Unified Gas Supply System (USGS) | 182 1 0600 110 |

| - for property included in the Unified State Social System | 182 1 0600 110 |

| Personal income tax (individual entrepreneur “for yourself”) | 182 1 0100 110 |

| Name of tax, fee, payment | KBK |

| Personal income tax on income the source of which is a tax agent | 182 1 0100 110 |

| VAT (as tax agent) | 182 1 0300 110 |

| VAT on imports from Belarus and Kazakhstan | 182 1 0400 110 |

| Income tax on dividend payments: | |

| — Russian organizations | 182 1 0100 110 |

| - foreign organizations | 182 1 0100 110 |

| Income tax on the payment of income to foreign organizations (except for dividends and interest on state and municipal securities) | 182 1 0100 110 |

| Income tax on income from state and municipal securities | 182 1 0100 110 |

| Income tax on dividends received from foreign organizations | 182 1 0100 110 |

| Transport tax | 182 1 0600 110 |

| Land tax | 182 1 06 0603х хх 1000 110 where xxx depends on the location of the land plot |

| Water tax | 182 1 0700 110 |

| Payment for negative impact on the environment | 048 1 12 010x0 01 6000 120 where x depends on the type of environmental pollution |

| MET | 182 1 07 010хх 01 1000 110 where хх depends on the type of mineral being mined |

| Corporate income tax on income in the form of profits of controlled foreign companies | 182 1 0100 110 |

Depending on what kind of legal entity the organization is and for whom personal income tax is paid, three cases are distinguished. So, when paying personal income tax for employees, the tax agent uses the code for taxes (not penalties or fines!) from the first row of the table. The same code is used for the tax agent paying personal income tax on dividends paid. The third case is a payment from an individual entrepreneur for himself, in which the tax BCC from the second line is used.

In a number of cases, individuals are forced to file an income statement in form 3-NDFL and enter the correct BCC into it. Here are some of the most common cases:

- Selling a car less than 5 years old

- Receiving income from renting out an apartment/car

- Receiving dividends (from which personal income tax was not withheld by tax agents)

- Winning the lottery

All these cases use the BCC from the third row of the table and are regulated by Art. 228 Tax Code of the Russian Federation. It is worth noting that the KBK of personal income tax differs for individuals who are tax residents and non-residents of the Russian Federation. Codes for non-residents are indicated in the last row of the table. Let us remind you that in order to obtain the status of a tax resident of the Russian Federation, an individual must stay in the territory of the Russian Federation for at least 183 days in total for 12 consecutive months.

- Pension contributions. Decoding codes for the budget classification of pension contributions for 2021.

- Contributions to compulsory social insurance. Decoding codes for the budget classification of contributions to compulsory social insurance for 2021.

- Contributions for compulsory health insurance. Decoding codes for the budget classification of contributions for compulsory health insurance for 2021.

- Value added tax (VAT). Decoding the budget classification codes for value added tax (VAT) 2021.

- Income tax. Decoding the 2021 income tax budget classification codes.

- Excise taxes. Decoding the codes for the budget classification of excise taxes for 2021.

- Organizational property tax. Decoding the codes of the budget classification of property tax for organizations 2021.

- Land tax. Deciphering the codes for the budget classification of land tax for 2021.

- Transport tax. Deciphering the transport tax budget classification codes for 2021.

- Single tax with simplification. Decoding the codes of the budget classification of the single tax during simplification for 2021.

- Unified tax on imputed income (UTII). Decoding codes for the budget classification of the single tax on imputed income (UTII) 2021.

- Unified Agricultural Tax (USAT). Decoding the codes of the budget classification of the Unified Agricultural Tax (USAT) 2021.

- Mineral extraction tax (MET). Deciphering the budget classification codes for mineral extraction taxes (MET) 2021.

- Fee for the use of aquatic biological resources. Decoding the budget classification codes of the fee for the use of aquatic biological resources for 2021.

- Fee for the use of fauna objects. Deciphering the codes of the budget fee for the use of wildlife objects in 2021.

- Water tax. Decoding the codes of the budget classification of water tax for 2021.

- Payments for the use of subsoil. Decoding codes for the budget classification of payments for the use of subsoil for 2021.

- Payments for the use of natural resources. Decoding codes for the budget classification of payments for the use of natural resources for 2021.

- Gambling tax. Deciphering the budget classification codes for the gambling tax for 2021.

- Government duty. Decoding the codes of the budget classification of state duty for 2021.

- Income from the provision of paid services and compensation for state costs. Decoding codes for the budget classification of income from the provision of paid services and compensation for state expenses in 2021.

- Fines, sanctions, payments for damages. Decoding codes for the budget classification of fines, sanctions, payments for damages in 2021.

- Trade fee. Decoding the codes of the budget classification of trade tax for 2021.

- News. All news on changes in (KBK) budget classification codes for past and current years.

| Payment Description | KBK |

| Income tax, which is charged to the federal budget (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| Income tax, which is charged to the budgets of constituent entities of the Russian Federation (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| Income tax, which is charged to the federal budget (for consolidated groups of taxpayers) | 182 1 0100 110 |

| Income tax, which is charged to the budgets of the constituent entities of the Russian Federation (for consolidated groups of taxpayers) | 182 1 0100 110 |

| VAT, excluding import | 182 1 0300 110 |

| Tax on property not included in the Unified Gas Supply System | 182 1 0600 110 |

| Tax on property included in the Unified Gas Supply System | 182 1 0600 110 |

| Simplified tax with the object “income” | 182 1 0500 110 |

| Simplified tax with the object “income minus expenses”, including the minimum tax | 182 1 0500 110 |

| UTII | 182 1 0500 110 |

| Unified agricultural tax | 182 1 0500 110 |

| Personal income tax for a tax agent | 182 1 0100 110 |

| Transport tax | 182 1 0600 110 |

| Land tax from plots of Moscow, St. Petersburg, Sevastopol | 182 1 0600 110 |

| Payment Description | KBK |

| Pension contributions at basic and reduced rates | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 1) | 182 1 0200 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 2) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 2) | 182 1 0200 160 |

| Medical fees | 182 1 0213 160 |

| Social contributions | 182 1 0210 160 |

| Contributions for injuries | 393 1 0200 160 |

| Payment Description | KBK |

| Pension contributions at basic and reduced rates | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 1) | 182 1 0200 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 2) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 2) | 182 1 0200 160 |

| Medical fees | 182 1 0213 160 |

| Social contributions | 182 1 0210 160 |

| Contributions for injuries | 393 1 0200 160 |

Individual entrepreneurs pay the BCC on their own. If an individual entrepreneur simultaneously works as an employee, he still must pay contributions for himself - as an individual entrepreneur.

Entrepreneurs are required to pay mandatory contributions to their own pension and health insurance until they are “listed” as individual entrepreneurs and have a Unified State Register of Entrepreneurs (USRIP) entry about them. The age of the entrepreneur and occupation does not matter. And most importantly, contributions must be paid even if the individual entrepreneur does not receive any income.

| TAX | KBK |

| Personal income tax on income the source of which is a tax agent (personal income tax for employees of individual entrepreneurs, LLCs and JSCs) | 182 1 01 02010 01 1000 110 |

| PENALIES, INTEREST, FINES | KBK | |

| Penalties, interest, personal income tax fines on income the source of which is a tax agent (personal income tax for employees of individual entrepreneurs, LLCs and JSCs) | penalties | 182 1 01 02010 01 2100 110 |

| interest | 182 1 01 02010 01 2200 110 | |

| fines | 182 1 01 02010 01 3000 110 | |

For individual entrepreneurs

| TAX | KBK |

| Personal income tax on income received by citizens registered as: individual entrepreneur; private lawyers; notaries; other persons engaged in private practice (personal income tax for individual entrepreneurs for themselves) | 182 1 01 02020 01 1000 110 |

KBK personal income tax on dividends in 2021

The tax is paid no later than the day following the day of transfer of dividends. This rule is specified in paragraph 6 of Art. 226 of the Tax Code of the Russian Federation. For example, if the transfer of dividends was made on April 13 (the payment was sent to the bank), the tax must be paid on April 14.

The tax rate is 13%. It has not changed since 2021. If the individual is not a resident of the Russian Federation, the rate increases to 15%. Responsibility for the correctness and timeliness of tax remittance lies with the organization.

Payment of personal income tax on annual dividends: how to correctly fill out field “107” of a payment slip

The rules for filling out payment orders were approved by Order of the Ministry of Finance dated November 12, 2013 No. 107n. According to these rules, the value of the tax period indicator is indicated in field “107” of the payment. This field consists of 10 characters, eight of which have semantic meaning, and two are separating characters and are filled with a dot. In this case, the first two characters are intended to determine the frequency of tax payments:

- “MS” - monthly payments;

- "Q" - quarterly payments;

- “PL” - semi-annual payments;

- "GD" - annual payments.

The next two characters contain the two-digit number of the month (01 to 12), quarter (01 to 04), half year (01 or 02) or year (00). The last four digits indicate the year for which the tax is paid. Accordingly, field “107” can be filled, for example, as follows: “MS.02.2019”; "KV.01.2019"; "PL.02.2019"; “GD.00.2019”, etc.

Thus, when paying personal income tax on salary amounts, the frequency of payment is set as a month (the first 2 digits of requisite 107 take the value “MS”), since personal income tax on wages transferred monthly is also paid to the budget monthly.

As for dividends, the frequency of their payment is established by the owners of the organization. Such payments can be made quarterly, semi-annually or once a year.

How to fill out field “107” of a payment slip if the decision on the distribution of net profit between participants (shareholders) is made once a year?

The Ministry of Finance believes that in such a situation, the payment order is filled out according to the general rules. That is, when paying personal income tax on dividends transferred once a year, detail “107” of the order for the transfer of funds must be filled out in the format “GD.00.2019”. At the same time, officials remind that the tax amount must be transferred no later than the day following the day the taxpayer pays income (clause 6 of Article 226 of the Tax Code of the Russian Federation).

Note that when filling out payment slips for paying taxes and contributions, those who generate payment orders using web services feel most comfortable. All necessary updates, including current BCCs, new codes for payer status, recipient details, etc. are installed in them in a timely manner without user intervention. When filling out the payment form, the required values are entered automatically. If an accountant makes a mistake (for example, leaves a field blank or indicates an invalid value), the service reports the error and tells you how to fill out this field.

Tax on dividends of non-resident individuals

- Income can be paid either in cash or in kind (property).

- A tax agent obligated to withhold and transfer tax to the budget is a company that pays funds to its participants in cash.

- When paying income to a participant with property, the obligation to pay tax passes to the recipient of this property.

We recommend reading: Benefits for widows of military veterans in 2021

Since 1995, the Czech Republic has been a member of the Organization for Economic Cooperation and Development (OECD), and since 2021 it has been part of the European Union (EU). At the moment, the Czech Republic is a stable, prosperous country in central and eastern Europe, which attracts foreign investors, including from Russia. Many Russians consider the Czech Republic as a country for permanent residence. In this regard, it seems relevant to consider the legal regulation of taxation of individuals in the Czech Republic.

KBK personal income tax on dividends in 2021

We emphasize that a resident of Russia is considered a person who lives on its territory for at least 183 days over the next twelve months in a row. As an exception, the state allows short-term trips (not exceeding six months in a row) necessary for citizens to receive education or medical care, as well as work trips for the purpose of extracting hydrocarbon resources from fields in the seas. Absence from the country for more than a year without loss of resident status is permissible for three categories of payers:

Codes are used only when financial transactions are related to the state budget, that is, the country is the second party involved or the recipient of the payment. Payers enter the BCC in the appropriate fields of payment orders, not only when they are going to make a payment, but also to reimburse penalties imposed due to late or non-payment of taxes.

Kbk for personal income tax on dividends to the founder in 2021

The profit that individuals receive as a result of equity participation in organizations and companies is called dividends. It is paid directly by organizations to individuals. This situation, along with other payments intended to individuals from organizations, is accompanied by tax payments. One of which is personal income tax. The organization itself has the responsibility to calculate this amount, withhold it from the individual, and also transfer it to the budget - also lies on the shoulders of the tax agent, which this organization is. At the same time, in order to transfer the payment, you will definitely need to know the exact BCC for personal income tax on dividends in 2021.

In this case, the calculation procedure will be as follows: personal income tax = D x 13%, where D is the dividends accrued to the resident. 13% is the tax rate. The calculation will be more complicated if the organization is the founder of another company from which it received any amounts for participation in the current or previous year.

Accrual process

So, first of all, the organization accrues dividend amounts to its investors.

For example, Vasilenko P.P. and Tereshchina T.V., organized an LLC and invested shares of 60% and 40% in the authorized capital, respectively. Retained earnings, which were formed as a result of effective business activities, are equal to 1,000,000 rubles per quarter. It was during this period that the decision was made to pay dividends to investors. So, Vasilenko will receive 600 thousand rubles, and Tereshchina 400 thousand, according to the contributions they made.

Now the LLC, as a tax agent, must calculate and withhold personal income tax amounts from income. Both investors are residents of the Russian Federation, and for residents the interest tax rate is 13%. This means that with Vasilenko the personal income tax will be equal to 78,000, and with Tereshchina it will be 000. It is these amounts that the tax agent undertakes to withhold from the income of an individual.

This can be done at the time of paying dividends in person or transferring them to a bank card or personal current account. That is, Vasilenko will receive an amount of 522 thousand, and Tereshchina 348 thousand.

The personal income tax amounts must be transferred to the tax agent the next day after the amount is withheld. To do this, you will need to fill out a payment order, field 104 of which is intended to indicate the BCC. KBK for personal income tax on dividends in 2021 182 1 0100 110. The organization will use the same code to transfer personal income tax from other income of individuals, for example, salaries, sick leave benefits, vacation pay.

KBC dividends in 2021 personal income tax to the founder

Dividends are part of the profit remaining after taxation, which is distributed among participants, shareholders. Within the framework of tax legislation, dividends are recognized only as income accrued to the founder (participant, shareholder) when distributing profits in proportion to his share in the authorized capital (Clause 1, Article 43 of the Tax Code of the Russian Federation). If the founder (participant, shareholder) receives a part of the organization’s profit that is not proportional to his share, this payment is not recognized as dividends for tax purposes. Tax residents always pay personal income tax to the Russian budget (clause

1 tbsp. 224 of the Tax Code of the Russian Federation). At the same time, financiers noted that this rate applies to all dividends paid after 01/01/2021, regardless of the period for which they were accrued (letter of the Ministry of Finance of Russia dated 02/01/16 No. 03-04-06/4275).