The abbreviation NDFL means “personal income tax.” Certificate 2-NDFL reflects the income of an individual, the percentage and amount of state tax levied on income. According to the existing law (Article 62 of the Labor Code of the Russian Federation), the employer’s responsibilities include tracking income and informing the employee about it. This certificate can be obtained at any time. Even if you have already quit your job and no longer work there: the labor organization is still obliged to provide this document upon request. If an individual is not employed, then a 2-NDFL certificate can be obtained as follows under certain circumstances:

- students have the right to request a certificate from the dean’s office of the university;

- unemployed individuals - at the employment center;

- Individual entrepreneur - in the tax authorities.

Help 2-NDFL: what it is and what it looks like

Certificate 2 of personal income tax is a report compiled for each specific employee of the enterprise and containing the following information:

- the amount of taxable income paid to the employee: wages, bonus payments, payment of sick leave, other remuneration;

- the amount of accrued, withheld and transferred to the budget personal income tax;

- tax deductions provided to the employee.

Since 2021, an updated format for submitting a certificate has been introduced, which was approved by order of the Federal Tax Service dated October 2, 2018 No. ММВ-7-11 / [email protected] The innovation is that previously a single form 2 personal income tax was used, but now two different forms are used: the first is intended for organizations sending data to the Federal Tax Service (contains two sheets: the main one and the application), the second is issued to the employee upon his request (consists of a one-page form).

Let's give an example: a trade and service company is engaged in refilling cartridges and selling stationery and office products. For 2021, the accountant filled out forms 2 personal income tax certificates for each employee, with a monthly breakdown in the appendix. The completed information for the past year was submitted to the tax office in March 2019. Then, in August, saleswoman Yakimova filed for resignation. During the final payment of her salary, she was provided with personal income tax certificate 2 for the period from January to August 2019.

Note! If an employee requests confirmation of income for several previous years, for example, for 2 years, then certificates are issued in the form that was used during these periods. That is, for 2021 you need to prepare a report using the old form, and for 2021 - using the new form.

The transformations of personal income tax certificate 2, compared to the previous version, are as follows:

| Old form | New form |

| Contains 5 sections. | Consists of 3 sections and an appendix. |

| Document header and section 1. | Replaced by title page. The employer's tax identification number and checkpoint have been added to the header. |

| Section 2 “Data about an individual”. | The data is included in section 1. O. |

| Section 3 “Income taxed at the rate of 13%”. | Paid income and provided deductions, broken down by month, are entered in the application. |

| Section 4 “Standard, social and property tax deductions.” | Replaced by Section 3 of the same title. Descriptions of the type of notification for deductions have been replaced with codes for deductions, and a record has been added confirming the accuracy and completeness of the information specified in the certificate. |

| Section 5 “Total Amounts of Income and Tax.” | Replaced by section 2 with the same name, the indication “based on the results of the tax period” was added. |

Table 1. Differences between the old and new sample of form 2 personal income tax

The new form, intended for sending to the Federal Tax Service, is designed to be machine readable. This will facilitate and speed up the process of checking reports by the tax service.

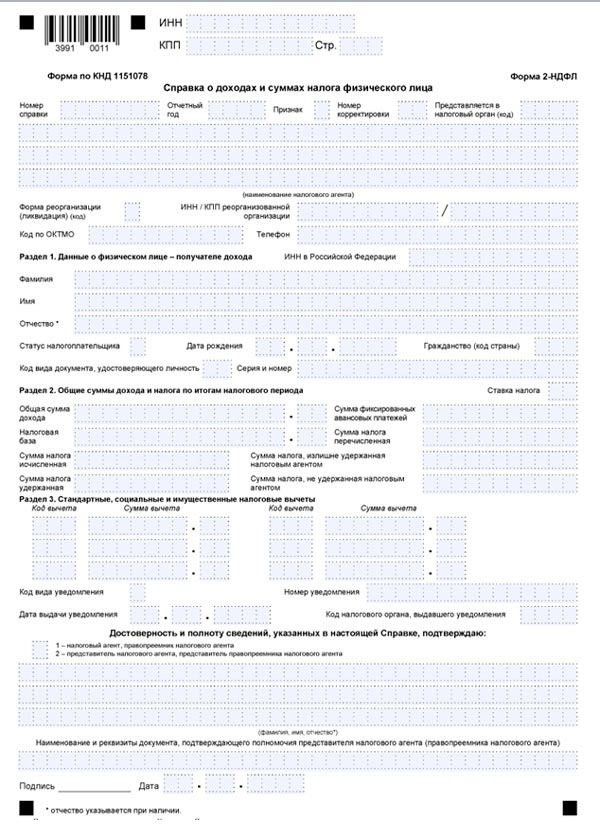

The main sheet of the tax certificate looks like this:

Form 2 personal income tax (1 sheet of form)

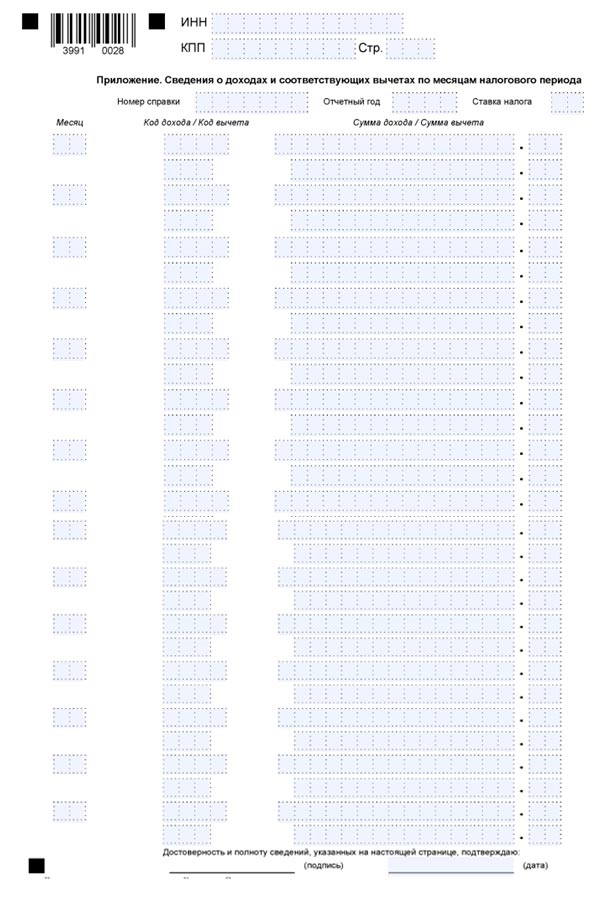

An additional sheet is an appendix to the certificate, reflects the employee’s income received for each month and the deductions provided to him, and the corresponding codes are also indicated.

Form 2 Personal income tax (attachment)

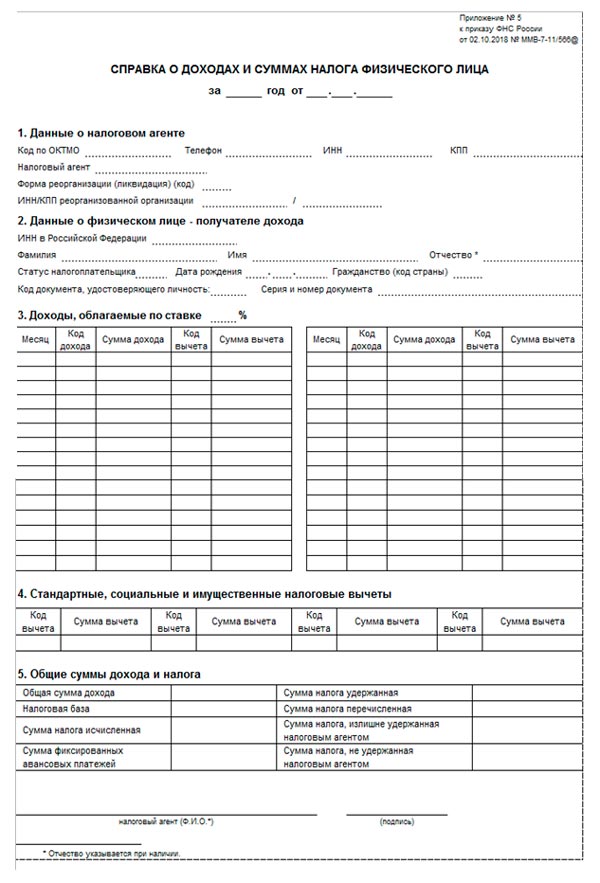

The certificate intended for employees looks like this:

Form 2 personal income tax (for employees)

The name has changed in the new format of the certificate for employees. Now the document is called “Certificate of income and tax amounts of an individual.”

This form has not undergone significant changes; details not required by individuals have been excluded from it.

Sample filling

Declaration 2 of personal income tax is generated in the accounting department for each period, and not only at the end of the quarter.

The following information is reflected here:

- Last name, first name and patronymic of the employee, TIN;

- name corresponding to the statutory regulations of the enterprise, TIN and OGRO;

- the amount of income since the beginning of the calendar year, broken down by month;

- additional payments: payment for sick leave, vacation pay, financial assistance, bonuses and maternity payments;

- deductions;

- personal income tax amount from the beginning of the calendar year.

The declaration is signed by the head or authorized representative. In addition, the certificate will be registered at work and stamped. Otherwise, the certificate is invalid.

If, upon dismissal, personal income tax certificate 2 is not issued, the employee submits a written application to the previous place of employment. The certificate is issued in accordance with the law within three days.

Who needs a 2-NDFL certificate and why, and where it may be required

There are several categories of individuals and legal entities who deal with certificates:

- tax agents;

- individual entrepreneurs (IP);

- working citizens;

- unemployed individuals.

Let's take a closer look at the features of handling Form 2 of personal income tax.

Tax agents

A legal entity or individual entrepreneur acts as a tax agent, which concludes employment contracts with employees, provides the staff with the opportunity to perform their job duties and pays them for their work. At the same time, the tax agent is obliged to withhold personal income tax from the income paid, transfer it to the budget of the Russian Federation, and report this to the tax authorities. Personal income tax certificate 2 serves as such a report.

The process of submitting a certificate to the tax office by a legal entity

Most often, reference data is generated in the accounting program “1C: Salaries and Personnel Management”. Finished documents are uploaded and sent to the tax office in electronic form (for example, using the free software of the Federal Tax Service Inspectorate “Taxpayer of Legal Entities”), or printed and submitted on paper. When submitted in printed form, a special list is attached to the certificates - a register, which indicates information about the employer, the number of certificates submitted, and information about employees. One copy of the register is submitted to the Federal Tax Service along with certificates, the second is returned to the organization.

From January 1, 2021, paper reporting is allowed only to those companies and individual entrepreneurs that pay income to employees of 10 or fewer people. All other enterprises (with more than 10 employees) are required to submit information using electronic document management.

Important addition! The possibility of submitting documents to the Federal Tax Service on electronic media (disks, flash drives, floppy disks) has been cancelled. There are only three reporting options available:

- personally visit the inspection;

- use mail;

- send certificates using the electronic document management system.

Let's continue the example: in March 2021, a trade and service accountant submitted reports for 2021 on Form 2 Personal Income Tax in paper version; this was allowed by the number of employees - 22 people. According to the new rules, since the company has more than 10 employees in 2021, the accountant is required to submit personal income tax certificates for 2021 through electronic communication channels.

What is 2nd personal income tax?

From the abbreviation and name of the certificate, it becomes clear that the income declaration 2 personal income tax discloses information about accrued profit, withholding personal income tax for a specific time period. This is official information, a guide for calculating salaries at the employee’s new job.

Certificate 2 of personal income tax is filled out by the tax agent, which reflects complete information about the employer, details, signed and stamped. Also, the declaration indicates exact information about the employee, TIN, registration address and place of residence.

When submission of a 2NDFL certificate is not necessary

The employer, being a tax agent, may not submit certificates to the Federal Tax Service only if the employee was not paid taxable income during the reporting period.

The employer must understand that if the employee has no income, there is no obligation to submit Form 2-NDFL to him.

There is no need to send information to the tax office in the following situations:

- If employees were paid income that is not subject to taxation by law. These payments are stipulated in Article 217 of the Tax Code of the Russian Federation. These include, for example, benefits for pregnancy and childbirth, alimony payments, and financial assistance in the amount of up to 4,000 rubles.

- When an enterprise cooperates with an individual entrepreneur (pays for his services or buys products from him). In this case, the entrepreneur is obliged to declare his income and pay tax.

- When concluding trade transactions with citizens (including their own employees). For example, the “Your Machine” auto repair shop purchased a Nissan car for 100 thousand rubles from auto mechanic Spitsyn, who works here. The employee himself must report for receiving this income by filling out form 3-NDFL, based on Article 228 of the Tax Code of the Russian Federation. A car service center, when submitting a certificate to the tax office, should not include this amount in the mechanic’s income.

- When presenting gifts to citizens in kind, for example, for advertising purposes. So, at the presentation of a new product, a company gives out small souvenirs to random buyers. In this case, it is impossible to identify the recipients of the income, and it will also not be possible to withhold tax from them.

- If an enterprise sells the principal’s property under a commission agreement. Here, the owner of the property receives income, so the responsibility to report taxes falls on him, and not on the commission agent.

Unemployed

Unemployed people on the stock exchange can also confirm their status. It is enough to contact the labor exchange with a request to issue an appropriate certificate.

Some regional or local multifunctional centers (MFCs) can independently request all the necessary documents and issue you a certificate of residence. If you are much closer to coming to the MFC, we advise you to go to the branch and clarify the possibility of obtaining a certificate through them, then you will no longer have to worry about where to get certain documents.

How long is the 2nd personal income tax certificate valid?

The period during which the received document will be valid is not established by law. Therefore, its duration may vary, and is often specified by the organization where the certificate must be submitted.

For example, to obtain a loan, different banks have different requirements for the validity period of the form - from 7 to 30 days. The period for which the salary must be reflected may also vary. In some credit companies it is 1 year, in others – 3 or 6 months.

Example from life:

The Bulanovs decided to spend their vacation in Turkey, so they took out a consumer loan from Sberbank for 300 thousand rubles. The bank specialist warned that we need a certificate of income for 6 months. Its validity period was announced at 1 month. After vacationing in Turkey and paying off the loan, a year later the family decided to buy an apartment and applied to Sberbank for a mortgage. When preparing the package of documents, the Bulanovs took 2 personal income tax certificates from their place of work for the previous six months. But it turned out that this was not enough. To get a mortgage loan, the spouses had to request new forms with 12 months’ salary, and the document expired not in a month, but in 10 days.

When submitting documents to the Federal Tax Service to return the amount of already paid personal income tax, the certificate is valid for 3 years. That is, in 2020, you can return part of the funds spent on the purchase of real estate, treatment or education for the 3 previous years: 2021, 2018 and 2021.

When applying to a visa center, as a rule, the document is required six months in advance; it is valid for 1 month.

When registering with the Employment Center, a certificate from a previous place of work with salary data for the last 3 months will also be valid for 30 days.

To establish guardianship or adoption, the Department of Guardianship and Trusteeship accepts Form 2 of personal income tax, issued no earlier than a month ago. In this case, it is required to reflect income for 12 months.

If the certificate has expired, the employee can ask for another copy from the accounting department at the place of duty.

Tips for borrowers

Before we begin to describe step by step the process of obtaining a certificate for other situations, I would like to separately provide a number of tips for individuals who need a 2-personal income tax certificate only to obtain a loan.

- Agree with the employer

Unfortunately, in Russia the situation is not very pleasant for those who need to reflect their official earnings (white salary), but who do not receive all the profit officially. Often, employers tend not to reflect the employee’s real earnings in the tax return, as if they do not exist at all - thus saving money that could be deducted to the Pension Fund of the Russian Federation and other authorities.

The salary in the envelope is unofficial and is not reflected in the declaration.

But in most cases, everything is not so sad. And if an employee receives a white salary together with banknotes in an envelope, he will at least have something to prove it with. Try to talk to your boss in advance and find out if it is possible to increase your official income and reduce the share of “black” money in your salary. Also, Russian banks can often take into account black wages; you just need to leave the contact information of your immediate supervisor in the form. We advise you to warn him in advance about the attention from the bank.

Do you receive a white salary, but they refuse to give you a certificate? Remember - this is illegal! The employer or authorized representative acts as a tax agent and is obliged to issue it within 3 working days after the employee’s application. In force majeure circumstances, this period may take up to a week.

- Capture all sources

What if you work for two companies at once and want to reflect your entire combined earnings? Do not forget that in this case you will need to contact two organizations at once. Subsequently, the bank will add up your income from two sources and, based on this amount, will decide whether you can get a loan and under what conditions.

- Check

Even such competent authorities as the tax service of the Russian Federation sometimes make mistakes. In addition, your agent, responsible for providing correct information, can sign a thousand “pieces of paper” a day, and simply miss the wrong document. Check the indicators in the completed certificate with the real state of affairs, and if discrepancies are found, resolve this issue with management before visit to the bank.

A small mistake - and the tax office will not leave you alone!

How to make a 2nd personal income tax certificate yourself (instructions)

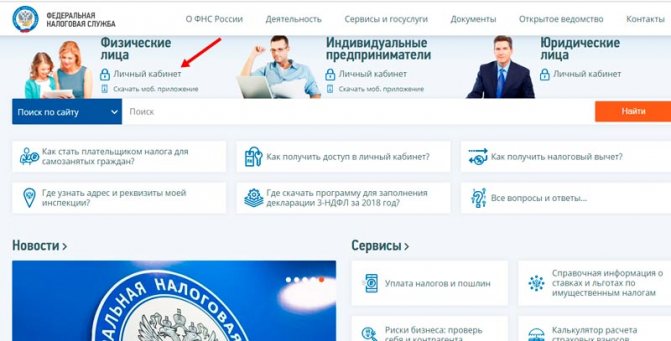

If you don’t have time to wait for a certificate from your employer, you can get it on the website of the Federal Tax Service. To do this you need to take several steps:

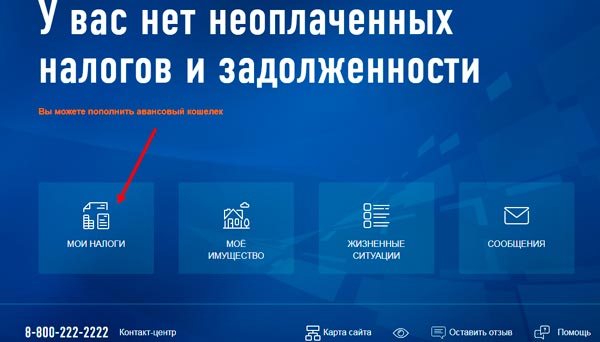

Step 1. Log into the taxpayer’s personal account:

Step 2. Select the “My Taxes” tab:

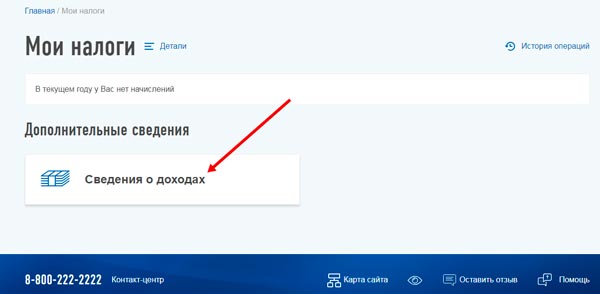

Step 3. Click on the “Income Information” label:

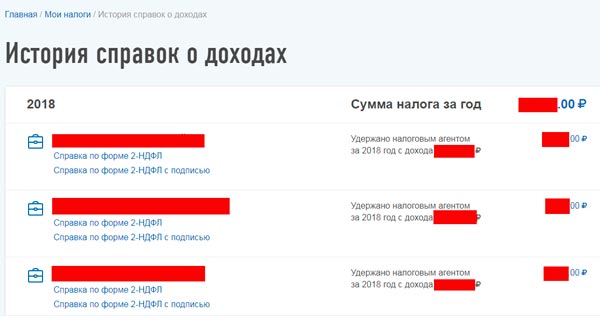

The screen will display the history of income certificates:

Step 4. Save the document to your computer. There are 2 types of certificates available for download: regular and with an enhanced electronic signature of the tax service, which looks like this:

A document with such a signature has legal force and can be sent by email to the bank, lawyers or other authorities.

Important! 2-NDFL certificates on the Federal Tax Service website show income and payment of taxes for the previous year. And to obtain a loan or other purposes, they usually require information about salaries for the last 3-6 months, so, most likely, you will still have to contact your employer.

Do I need a certificate in form 2 personal income tax when applying for a job?

After dismissal from the old place of work and employment in a new company, along with the work book, the accountant will ask the employee to transfer certificate 2 of personal income tax from the previous workplace to the new employer. Sometimes physical the person does not understand why this certificate is needed.

Every profit accrued to an employee is subject to income tax. This is carried out by the accounting service, the person receives the amount minus personal income tax. The tax agent independently withholds and transfers the tax to the treasury.

To calculate personal income tax, the law approves deductions that reduce the tax base. In other words, fixed discounts are taken from the full income, and personal income tax is withheld from the remaining amount.

At work, these deductions are selectively used, it depends on the category of physical. persons and average earnings. Cases of application of benefits are defined and approved by law.

Answers to readers' questions

Where can I get a 2nd personal income tax certificate for an individual entrepreneur?

Nowhere. If an individual entrepreneur carries out only entrepreneurial activities, he does not pay personal income tax, so it is not possible to obtain a document. In the case where an individual entrepreneur additionally works for hire, he can request a certificate from the employer regarding this income.

2 personal income tax and 3 personal income tax, what is the difference?

3 Personal income tax is a tax return submitted to the Federal Tax Service for the purpose of reporting personal income tax. It is submitted not by organizations, but by citizens, if they received income other than from their main activity and are required to pay tax on this income. Also, 3 personal income taxes are filled out in order to return part of the personal income tax already paid to the treasury. And form 2 personal income tax serves as the basis for drawing up a declaration 3 personal income tax.

Who signs the 2nd personal income tax certificate and is a stamp needed?

The form is signed by the director and chief accountant of the company. A stamp is placed if this requirement is put forward by the organization to which the certificate is presented. But even without a seal, the document has legal force. In addition, some employers, for example, many individual entrepreneurs, operate without using a seal. That is, if there is a seal, then it is better to put it, but you can present a certificate without a seal - this is not a violation.

What is the tax base in personal income tax certificate 2?

This is the value from which personal income tax is calculated. The tax base is the difference between the total income and all deductions due to the employee. If the amount of deductions is greater than the amount of income, the tax base is 0.

How much does it cost to get a 2nd personal income tax certificate?

On average, such a service costs 2–3 thousand rubles. But the consequences of its purchase can be much more expensive.

How to issue a certificate through State Services?

An account on the State Services website will allow you to log in and go to the Federal Tax Service website, where you can download the document. The procedure for obtaining a certificate is described above.

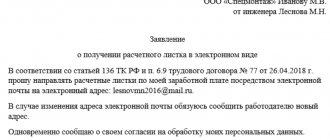

How to request a 2nd personal income tax certificate at work?

Submit your application to the employer in writing, in free form. It is better to register it, this will oblige the accounting staff to issue you a certificate within 3 days.

Certificate 2 personal income tax and income certificate - are they the same thing?

No. 2 Personal income tax is a form regulated by law, which has a special form. In addition to it, an income certificate developed by the company itself may be issued; it is not strictly regulated. A certificate for calculating sick leave, drawn up in form 182n, is also used. These are all different types of certificates.

I am on maternity leave for up to 1.5 years. Can I get a 2nd personal income tax certificate?

If, while on parental leave, you did not receive taxable income, then a tax certificate will not be submitted for you, since if there is no income, no tax is levied. You can receive a free-form certificate confirming your status and reflecting zero income. If taxable income is paid to you during this period, a standard personal income tax certificate 2 is issued.

For what period

The obligation to issue personal income tax certificate 2 upon dismissal applies only to information from the reporting year that affects the use of deductions and the calculation of sick leave or vacation leave.

Upon written request from the employee, information is prepared for each period, for example, a quarter, a number of arbitrary months or years; this is not prohibited by law.

In other words, this year a certificate for a new job is issued for specific months, despite the fact that the declaration is annual and the reporting period has not yet arrived. In addition, such a certificate 2 is suitable for the labor exchange; the information will be needed to calculate benefits.

If physical a person will request a personal income tax certificate 2 for a period of 6 or more years, the organization will refuse him, since the storage period for tax returns is 4 years, and according to the archival list - 5 years. Therefore, a legal entity is not obliged to store such information beyond the stated period.

Summarize

- Certificate 2 Personal income tax is an official document that is drawn up by the employer - tax agent for each of its employees, subject to the payment of taxable income to him.

- The obligation of companies to submit reports in Form 2 of personal income tax is regulated at the legislative level; for violations of the transmission of information to the Federal Tax Service within the established time frame, fines will follow.

- Since 2021, a new certificate format has been introduced: for the tax service and for issuance to employees.

- Individual entrepreneurs with full-time employees are required to submit reports for them on a general basis. An entrepreneur cannot issue certificates for himself or other individual entrepreneurs.

- Employees of enterprises have the right to receive a certificate form at their place of work for presentation to various authorities: banks, social services, judicial services, and other places of demand.

- The Labor Code establishes a 3-day period for issuing a document, from the moment the employee submits the relevant application.

- In case of refusal or delay in issuing a certificate, a citizen has the right to go to court or to the labor dispute inspectorate.

- It is possible to independently obtain a certificate through the website of the Federal Tax Service or using the State Services portal.

- Falsifying a document may result in penalties and criminal prosecution.

Video for dessert: 9 Unusual Glitches of Nature

Features of provision

Tax agents who accrue income in favor of individuals. persons, calculate, withhold and transfer personal income tax from these payments.

Certificate 2 of personal income tax is generated in the following cases:

- At the end of the calendar year no later than April 1, and for information for 2021 due to weekends, the deadline for submitting the report is April 2, 2021;

- if it is impossible to withhold income tax from individuals. persons, the deadline for submitting 2 personal income taxes for such cases is March 1;

- on the day of dismissal from work. to the person along with the work book and final payment;

- upon written request from the individual. faces within three days.

How to get a certificate: instructions for unemployed persons

Table 1. How to get a certificate

| For unemployed people who are studying at the employment service | For individual entrepreneurs | For pensioners receiving a pension from a non-state fund | For military personnel | For students | |

| Place of issue | Employment center or place of previous work | Tax authority | In its division of a non-state fund | Settlement center of the Ministry of Defense of the Russian Federation | Dean's office of a higher educational institution |

| Subtleties | A certificate from the employment center confirming the fact of receiving unemployment benefits will not help you take out a loan, let alone a mortgage. | An individual entrepreneur does not have the right to issue a certificate to himself, so form 3-NDFL is used instead. Except in cases where he is also an employee | It is possible to submit an application by mail or online | If the military unit is located far from the settlement center, you can send the application by mail. The period for sending the certificate to the specified address is 5 days |

Certificate 2-NDFL can be obtained from the employment center