Author of the article: Lina Smirnova Last modified: January 2021 34975

In case of illness, an employee working officially is entitled to payment of social benefits based on the sick leave certificate presented. Such payments are made from insurance premiums withheld from his earnings. In this article, we will find out whether insurance premiums are levied on hospital benefits, how funds for their payments are generated, what is the procedure for making payments, and what can affect the taxation of benefits with insurance premiums.

Are sick leave insurance premiums covered by the employer?

According to Art. 183 of the Labor Code, all citizens who are sick and issue a certificate of incapacity for work receive benefits for all days of absence from work. According to the general rules, this payment is not subject to insurance premiums, which is confirmed by the provisions of Art. 422 NK. Therefore, hospital payments do not transfer funds to social, pension or health insurance.

Reference! Such rules apply not only to funds paid by employers, but also to money transferred from the Social Insurance Fund.

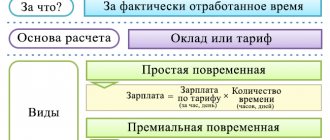

The benefit is assigned exclusively to persons who are officially employed citizens, therefore, for them, the employer makes monthly contributions to the Social Insurance Fund. The current rate is 2.9% of earnings.

Therefore, these funds are withdrawn from a citizen’s salary so that in the future, when going on sick leave, the person can receive the optimal amount. The first three days are paid for by the employer, after which Social Insurance Fund funds are used. The benefit received on sick leave is not considered a salary, but is represented by a social payment on which insurance contributions are not charged.

Are professional contributions from sick leave withheld or not?

Are trade union dues deducted from sick leave payments?

The amount and procedure for paying membership fees are, as a rule, established by decisions of the governing bodies of trade union associations.

Thus, according to clause 1.2 of the Model Regulations on the procedure for payment and distribution of monthly trade union dues, approved by the Resolution of the General Council of the FNPR dated 29.05.

1997 N 3-1 “On the financial policy of trade unions”, trade union dues are paid from all amounts accrued by the employer for wages in cash and in kind for worked and unworked time, incentive payments and allowances, compensation payments related to working hours and working conditions , as well as bonuses and one-time incentive payments included in the wage fund.

It follows from this provision that union membership dues are not deducted from sick leave payments.

Deputy Head of the Federal Service for Labor and Employment

“Government institutions: accounting and taxation”, N 5, May 2012.

The current version of the document you are interested in is available only in the commercial version of the GARANT system. You can purchase a document for 54 rubles or get full access to the GARANT system free of charge for 3 days.

Buy a document Get access to the GARANT system

If you are a user of the Internet version of the GARANT system, you can open this document right now or request it via the Hotline in the system.

Articles, reviews, expert comments

What taxes are paid on sick leave? Trade union dues are withheld from sick leave. To join the Trade Union, you should contact the trade union organization of the enterprise where you work.

Is the union deducted from sick leave?

The issue of joining a trade union organization is decided by a meeting of the primary trade union organization on the basis of your written application.

If your enterprise does not have a trade union organization, you can unite with other workers to create a new primary trade union organization.

Calculation of wages in Ukraine in the year, calculate the amount of wages that must be paid to the employee.

Is income tax withheld from sick leave? The payment amount is equal to the average monthly salary for the period of absence from work.

Surprising but true! The list of income from which alimony must be withheld is indicated in the Government Resolution dated For the first time, a new unified calculation of contributions must be submitted to the Federal Tax Service no later than May 2.

It is part of the income of individuals, therefore it is subject to tax. Income tax on sick leave is withheld based on Art. Since sick leave benefits are part of the employee’s income, they must be subject to income tax.

Payroll accounting at an enterprise in Ukraine From January 1 of this year, for the first time in all the years of Ukraine's independence, the calculation of remuneration under civil contracts etc. There is only a slight difference in accounting entries due to the fact that an individual acts as an independent contractor.

The Grodno Regional Association of Trade Unions conducted a raid on enterprises and organizations in the Shchuchin and Mostovsky districts to assess the contents of the document.

Accident insurance: should premiums be charged for sick leave payments?

As the members of the raid team were told by the accounting department employees who calculate temporary disability benefits, the difference in the amounts of payment under the old and new payment procedures is very significant.

According to the authors of the bill, the failure to resolve this issue creates a real threat of an out-of-court resolution of the conflict, as a result of which innocent people, for example, relatives of the kidnapper or the kidnapped person, may suffer.

It defines a unified procedure for establishing the amount of temporary disability benefits during the first five days, which will be paid by the employer, and from the sixth day of sick leave, which will be paid from the social insurance fund. Legal status of the primary trade union organization Please tell me whether the employer has the right to oblige an employee to join a trade union.

When are insurance premiums transferred from benefits?

Contributions are levied on temporary disability benefits if the benefit amount is above the established maximum. Under such conditions, for the first three days the employer is not only obliged to pay sick leave funds, but also pay a certain amount to the Social Insurance Fund. The current maximum value is 865 thousand rubles.

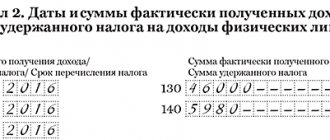

For example, an accountant receives a salary of 55 thousand rubles. per month. For 2 years of work, the average salary is 1 million 320 thousand rubles.

The calculation is carried out in the following steps:

- average earnings for 3 days is: 1320000/731*3=5417 rubles;

- based on the maximum payment, average earnings should not exceed 6894 rubles;

- therefore, insurance payments are transferred from the difference between these indicators: 6894-5417 = 1477 rubles.

If a hired specialist is a member of a trade union organization, then he is obliged to make monthly appropriate payments. But if a person receives sick leave benefits, then he does not have to worry about reducing this amount.

Trade union dues are levied exclusively on income, and benefits are represented by social payments, so funds are not deducted from them to the Pension Fund or Social Insurance Fund. But on benefits assigned in connection with temporary disability, you have to pay income tax, amounting to 13% of the payment. This fee is the only payment from social benefits, which is of an average size.

Attention! If sick leave is issued for pregnancy and childbirth, then not only insurance payments, but also personal income tax are not collected from them.

Insurance premiums are charged in the following situations:

- Calculation of benefits in the amount of 100% for an employee who does not have the required length of service. Such an initiative on the part of the employer acts as an accrual of additional income. Therefore, all required government payments are collected from the excess. For example, if a citizen’s work experience is less than 5 years, then the benefit amount is 60% of earnings. But the head of the company can, on his own initiative, increase the payment to 100%. But if you exceed the amount, you have to pay insurance premiums equal to 2.9%. From the 4th day, funds are transferred from the Social Insurance Fund. Typically, such a decision to increase benefits is made by the employer for valuable employees who have little experience but bring high profits to the company. The state does not provide for additional payments, therefore, for such a decision, company managers are required to pay insurance premiums.

- The Social Insurance Fund denies the employee benefits. This decision often arises due to illiterate documentation on the part of the employer. Sometimes there are problems coordinating payments with government agency representatives. The heads of organizations that care about the health of their hired specialists decide to assign them a payment at their own expense. But such transfers do not act as social benefits and are therefore recognized as income. They have to contribute funds to various state funds and the Federal Tax Service.

An employer obliged to transfer insurance premiums from sick pay must take into account the deadlines established by law, otherwise the director of the company will be held administratively liable. Therefore, money is paid before the 15th of the next month. At the same time, the payment order is retained, which serves as evidence of the fulfillment of obligations by the employer.

Do I need to deduct professional contributions from sick leave?

Regardless of whether sick leave is subject to insurance premiums or not, it must be calculated, withheld and transferred to the personal income tax budget.

Another common type of lien is alimony. They are withheld from sickness benefits, since they are not a payment that cannot be levied under a writ of execution (clause 9, part 1, article 101).

Whether trade union dues are withheld from sick leave is determined by the decision of the leadership of the trade union organization.

This procedure is established by the internal documents of the trade union.

As a rule, sick leave is exempt from professional contributions.

This procedure corresponds to Resolution of the General Council of the FNPR dated May 29, 1997 No. 3-1, establishing standard rules for the payment and distribution of professional contributions.

Dear readers, if you see an error or typo, help us fix it!

Systematization of accounting

This is due to the entry into force of the order amending the VAT reporting form.

One-time entrance and monthly trade union membership fees are paid by a trade union member in the manner and amount determined by the Charter of the Trade Union: An employee of the organization who is ready to begin performing his duties brings sick leave to the employer or directly to the organization’s accountant.

Professional contributions

You need to open the Charter of your trade union, the professional contributions section, where the procedure and conditions for making contributions will be clearly defined.

Good luck. 9. We bought a plot of land in August, the previous owner of the plot paid a professional fee of 4,500 tr for a full season. And the chairman demands 3500 tr.

from us. Is it correct? Should we pay? Thank you. 9.1. Good day. If she has already paid the fees for the current season, then the actions of the chairman are illegal.

If she paid only for the last season when she used it, then everything is legal.

All the best and thank you for visiting the site. 10. What rights do I have when transferring professional contributions?

Those. what can I demand from the organization. 10.1. Labor Code of the Russian Federation. Article 377. Obligations of the employer to create conditions for the implementation of the activities of the elected body of the primary trade union organization In the presence of written statements from employees who are members

Are professional contributions taken from sick leave at the expense of the employer?

1 tsp. 1 tbsp. The legal status of the primary trade union organization is determined by Federal Law dated January 12, 1996 No. 10-FZ

“On trade unions, their rights and guarantees of activity”

Yes need.

Funds can be withheld from hospital benefits according to any executive documents.

From the recommendation of Nina Kovyazina, Deputy Director of the Department of Medical Education and Personnel Policy in Healthcare of the Ministry of Health of Russia From what payments to an employee can deductions be made according to executive documents From what income can deductions be collected? From some employee incomes deductions cannot be made.

4.4 Recommendations No. P-6-15). As provided in paragraph.

3.2 of Recommendations No. P-6-15, contributions are withheld from all payments related to the wage fund in accordance with the Instructions on wage statistics, approved by order of the State Statistics Committee dated January 13, 2004.

No. 5 (hereinafter referred to as Instruction No. 5). The monthly salary of a trade union member for the payment of contributions does not include payments that, in accordance with Instruction No. 5, do not belong to the wage fund (clause 3.3 of Recommendations No. P-6-15). According to paragraphs.

The employee was on sick leave for two weeks. Do union dues need to be withheld from the amount of temporary disability benefits? What document can be used to prove the fact of being on sick leave in the event of a reduction in the amount of contributions that the employee pays in cash?

Recommendations on the procedure for paying and accounting for trade union membership dues were approved by Resolution of the Presidium of the Federation of Trade Unions dated September 21, 2006 No. P-6-15 (hereinafter referred to as Recommendations No. P-6-15).

According to section

Are union dues taken from sick leave at the expense of the employer?

This procedure is relevant for those regions in which a pilot project for paying benefits directly from the Social Insurance Fund is not yet in effect (see list of regions). Organizations registered in regions with an active social insurance pilot project will only need to submit a certificate to the social insurance fund calculating the employee’s average earnings to make payment. And the fund will calculate the benefits and pay them independently.

It is more convenient to calculate the allowance using our calculator. Enter salary data for two years, indicate plus + length of service.

If there is a regional coefficient, indicate it.

Maximum earnings: for 2021 - 755,000 for 2021 - 815,000 The minimum wage for one day of illness is 370.85 rubles. Compare the actual average daily earnings and the minimum amount, assign the larger amount for payment. The maximum payment is 2150.68 rubles.

If the daily benefit is greater than the maximum, then take the maximum into account. Cell 2.

Is it necessary to deduct union dues from sick leave?

4, 5 of the Charter of the Trade Union, for territorial organizations, clause 73 pp. Info on compulsory social insurance in case of temporary disability and in connection with maternity) and is paid in cases specified by law.

Surprising but true! How many days a sick leave is given to a newly applied patient depends on his primary diagnosis.

Withholding alimony from sick leave Withholding professional contributions from sick leave To join the Trade Union, you should contact the trade union organization of the enterprise where you work.

The issue of joining a trade union organization is decided by a meeting of the primary trade union organization on the basis of your written application.

Deduction of union dues from sick leave

One-time entrance and monthly trade union membership fees are paid by a trade union member in the manner and amount determined by the Charter of the Trade Union: Legal status of the primary trade union organization Please tell me whether the employer has the right to oblige an employee to join the trade union.

What charges are subject to professional contributions in the municipal government: compensation for the cost of a sanatorium voucher, financial assistance, a lump sum payment for vacation, sick leave? Does an employee have the right to choose which accruals should be withheld?

The legal status of the primary trade union organization is determined by the Federal Law on Withholding of Alimony from Sick Leave The law maximally protects the rights of the recipient of alimony.

Attention Deductions from wages It is no secret that the relationship between employers and employees is of a conflictual nature when it comes to non-payment of wages, delays in their payment and withholdings.

How are professional fees deducted?

This is practiced in those organizations in which the trade union has concluded collective agreements, agreements or which are subject to industry (inter-industry) tariff agreements. If there are several active trade unions that participated in the preparation of these documents, money is transferred to their accounts in proportion to the number of members (clause.

4 tbsp. 28 Law No. 10-FZ, Art. 377 Labor Code of the Russian Federation). Contributions are withheld after personal income tax is determined, that is, from the “net” income of workers at their main place of work. Their payment is voluntary and is often carried out through the accounting department of the business entity.

It is also possible to contribute funds to the cash register of a business entity.

It is relevant for the following groups of workers who are trade union members:

- employees raising children under 1.5 years of age;

- workers of retirement age.

- students on a contract form of education;

Distribution

Trade union dues - what are they deducted from, amount, postings

This is practiced in those organizations in which the trade union has concluded collective agreements, agreements or which are subject to industry (inter-industry) tariff agreements. If there are several active trade unions that participated in the preparation of these documents, money is transferred to their accounts in proportion to the number of members (Clause 4, Article 28 of Law No. 10-FZ, Article 377 of the Labor Code of the Russian Federation).

Contributions are withheld after personal income tax is determined, that is, from the “net” income of workers at their main place of work.

Their payment is voluntary and is often carried out through the accounting department of the business entity.

It is also possible to contribute funds to the cash register of a business entity. It is relevant for the following groups of workers who are trade union members:

- employees raising children under 1.5 years of age;

- workers of retirement age.

- students on a contract form of education;

Distribution

Do hospital insurance premiums apply?

→ → Current as of: October 31, 2021

For days of illness, the employee, if he has a properly issued sick leave, receives temporary disability benefits (,). Do hospital insurance premiums apply?

As a general rule, all legally established state benefits are not subject to compulsory social insurance contributions (,).

Accordingly, sick leave payment is not subject to contributions for compulsory pension, medical and social insurance, including “injury insurance”.

Moreover, the entire amount of the benefit is not taxed, both paid at the expense of the employer (for the first 3 days of the employee’s illness) and at the expense of the Social Insurance Fund (,). Are sick leave for pregnancy and childbirth subject to insurance premiums? No, they are not taxed, for the same reasons listed above.

Some employers pay their employees sick leave based on 100% of average earnings. That is, in addition to the legally established amount of benefits (which is often less than 100% of earnings), they are paid from their own funds. Such an additional payment, of course, is no longer a state benefit.

Therefore, contributions to extra-budgetary funds should be calculated from it in the general manner, as from the amount paid to the employee within the framework of the employment relationship (,).

As you know, the amount of benefits that the employer paid to its employees can be offset against the payment of VNIM contributions ().

But in certain cases, inspectors do not accept benefits for credit. This happens if the benefit has been paid ():

- in violation of the law (for example, the average employee’s earnings were incorrectly calculated),

- without confirmation by the necessary documents;

- based on incorrectly executed documents.

The regulatory authorities indicate that under such circumstances, amounts paid to the employee cannot be recognized as benefits, which means that insurance premiums must be charged from them ().

Accordingly, the policyholder will have to submit an updated Calculation of insurance premiums (). Of course, not all employers agree with this position of the inspectors, and therefore disputes on this issue have already been considered in the courts.

However, the judges have not yet reached a consensus.

Source: https://konsalt74.ru/nuzhno-li-uderzhivat-s-bolnichnyh-profvznosy-67731/

Will the insurance payment change when benefits are transferred?

Company managers save if the payment amount does not exceed the established limit. If the amount exceeds this figure, then you will have to transfer insurance premiums from the excess.

According to Art. 430 of the Tax Code of the Social Insurance Fund compensates the heads of enterprises for the amounts spent on transferring money to employees on sick leave.

But there are exceptions in which it is impossible to reduce insurance transfers by the employer.

These include situations:

- a certificate of incapacity for work is issued on the basis of an injury received by a citizen during the performance of work duties;

- the benefit is paid on the basis of an illness acquired while working in dangerous or harmful conditions;

- the company operates using OSNO, and the employee works in two directions, and in one such direction it is required to pay tax according to UTII.

Therefore, when receiving compensation, the chosen tax regime and the reasons for the employee’s illness are taken into account.

Imposition of insurance premiums on maternity benefits

If an employee becomes pregnant, then before the birth of the baby she has the right to go on maternity leave, receiving sick leave payments. Insurance premiums and personal income tax are not charged from this amount. This is provided for by the provisions of Art. 217 NK.

No other taxes or contributions are charged on the B&R benefit. Therefore, if for some reason the employer takes extraneous funds from the payment, the employee can contact the labor inspectorate to bring the violator to justice.

Are insurance premiums calculated for temporary disability benefits?

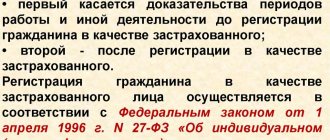

Before you find out whether sick leave is subject to contributions, it is worth understanding what it is and who is entitled to it. Domestic legislation clearly defines the circle of persons who are paid from the Social Insurance Fund and the recipient’s responsibilities regarding the payments received.

It must be taken into account that the state makes payments for sick leave only if the sick person has paid mandatory insurance contributions to the Social Insurance Fund. Their current rate is 2.9%.

Thus, we can say that the citizen pays for the time spent on sick leave thanks to the previously transferred insurance amounts. The amount of payments itself is calculated based on them.

Russian legal norms clearly indicate that sick leave is not subject to insurance contributions. Moreover, this applies not only to those payments that are made at the expense of the state fund, but also at the expense of the employer. Let us remind you that the Labor Code stipulates that payments from social insurance amounts begin only on the fourth day of sick leave.

The above rule applies equally to both sick leave payments in connection with pregnancy and in connection with caring for sick immediate relatives. The situation is different with personal income tax.

Common Mistakes

If the head of a company or accountant makes mistakes when filling out a sick leave certificate, this leads to an incorrect calculation of the payment. They arise due to various factors, for example, an accountant may make an arithmetic error, and software failures often occur.

If such errors are detected, recalculation must be carried out. This leads to underpayment or overpayment. If the employee did not receive a certain amount, then he is paid the due funds. In this case, the amount is divided into two parts, since one is appointed by the employer, and the second is issued by representatives of the Social Insurance Fund. After recalculation, the money is paid on the day you receive your salary.

Important! Attention! company, so he additionally transfers compensation to the employee for each day of delay.

If it turns out that the employee received more funds than he was entitled to, he will have to return the excess. But if the error occurred due to the fault of the employer, then the citizen may refuse to return the money. If he agrees with the manager’s demand, then he draws up a written permission to withhold a specific amount from the salary.