What form of calculation of 6-NDFL for 2018 is used?

All employers paying benefits to employees are required to calculate, withhold and transfer income tax to the budget. To monitor the timeliness and correctness of calculation, withholding and payment of personal income tax to the treasury, tax officials developed 2 reports: 2-NDFL and 6-NDFL.

6-NDFL is a calculation that allows you to control the timing of withholding and transfer of income tax to the budget by tax agents. The features of this form that distinguish it from the usual 2-NDFL report include:

- frequency of presentation - based on the results of each quarter;

- lack of personification: the report provides information in general for the tax agent and does not contain data for each employee;

All employers who pay income to “physicists” under employment and civil law contracts are recognized as agents:

- organizations;

- individual entrepreneurs;

- private practicing individuals (lawyers, notaries, etc.).

The calculation includes data on accrued income, withheld and transferred personal income tax, as well as on the planned dates for withholding and transferring tax.

Form 6-NDFL was approved by order of the Federal Tax Service dated 10/14/2015 No. ММВ-7-11/ [email protected] The new form 6-NDFL, valid as amended by the order of the Federal Tax Service dated 01/17/2018 No. ММВ-7-11/ [email protected] , will be relevant and for reporting for 2018.

6-NDFL for the reporting campaign for 2021 can be found here.

Briefly about the main changes

The current form includes two sheets, including the Appendix. Let us remember that previously it consisted of one sheet. By the way, the old form has not disappeared at all - now it is used for issuance to employees of the organization. But you will have to submit 2-NDFL to the tax authority on a form dated October 2, 2021 . This is what we will consider next.

We also made changes to the procedure for submitting forms during reorganization . The “original” company must submit 2-NDFL before reorganization. If she does not do this, then the responsibility for submitting the form falls on her legal successors. It happens that there are several of them - in this case they must choose one legal successor responsible for reporting. A provision regarding this must be included in the transfer deed or separation balance sheet. A similar procedure also applies to Form 6-NDFL and Appendix 2 to the income tax return.

Before we talk about the new form, let's remind the basics. 2-NDFL is drawn up in relation to each individual who works in an organization or individual entrepreneur, and also to whom income was paid in the reporting period in accordance with civil law contracts . The main purpose of the certificate is to confirm the correctness of the calculation of personal income tax on the income of individuals to whom payments are made. Tax agents are also required to submit the form if they were unable to withhold personal income tax.

Download the new 2-NDFL form in .PDF format for review.

Basic requirements for filling out Form 6-NDFL for 2021

Let's look at the algorithm for filling out a report using a small example.

Example:

The accountant of Satis LLC decided to fill out form 6-NDFL for the first time. First of all, she studied the calculation structure. The form consists of:

- title page;

- section 1, filled in with a cumulative total from the beginning of the year;

- Section 2, which contains information only for the reporting quarter.

Next, the accountant read the order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/ [email protected] , which spelled out the calculation algorithm, and found out the basic requirements:

- All cells displaying details and totals must be filled in. If there is no data, fix the value “0”.

- Enter all information from left to right, starting with the first sign. In the remaining ones, put a dash through.

- Continuous numbering starts from the first sheet.

- When filling out the form by hand, you can use black, blue or purple ink.

- Double-sided printing and the use of correction products are prohibited.

The accountant then moved on to designing the title page.

Structure and filling requirements

Despite the fact that the certificate is free-form, the basic structure is the same for all:

- Full name of the employee, length of service in the organization.

- Details of the organization (name, TIN, telephone numbers of the director and chief accountant, actual and legal addresses).

- Employee's salary by month.

- Signature of the manager, chief accountant.

- Seal of the organization.

Approximate type of document:

Filling rules:

- The requirements for the filling method in banks are different. Some allow you to enter information by hand with a ballpoint pen. Others accept only the typewritten version. Information about this can be seen on the form itself.

- Corrections are not allowed. If any information is missing, “Missing” is written in the field or a dash is entered.

- Only reliable information is entered. Any borrower is carefully checked by the credit department and security service. An employee of a financial institution can call the phone numbers of the manager and chief accountant indicated on the form and ask questions about the borrower.

- The signatures of the head of the enterprise or etc. are required. O. manager, chief accountant or etc. O. chief accountant. If the company operates without a chief accountant, then this must be noted when filling out.

- Company seal at the end of the form. If the document is drawn up by an individual entrepreneur, then a seal is required only if it is available.

Nuances of preparing the 6-NDFL calculation

Let's look at different types of payments.

Salary, benefits and vacation pay

Having studied clause 2 of Art. 223 of the Tax Code of the Russian Federation, the accountant found out that the date of receipt of the salary is the last day of the month for which it was assigned.

It is the last day of the month that should be indicated on page 100, even if it falls on a non-working date. And if the deadline for paying personal income tax falls on a weekend, then it is shifted to the next working day (letter of the Federal Tax Service dated December 13, 2018 No. BS-4-11 / [email protected] ).

In the example conditions, 09/30/2018 is the date of receipt of salary for September (Sunday). Despite this, the accountant will record exactly this number on page 100.

Having studied clause 6 of Art. 226 of the Tax Code of the Russian Federation, an accountant at Satis LLC learned that the deadline for paying personal income tax on wages and other income, with the exception of tax on vacation pay and benefits, falls on the day following the date of tax withholding. And for vacation and sick leave - on the last day of the month.

Thus, the tax withheld on Friday, November 9, 2018, should be transferred to the budget no later than Monday, November 12, 2018, since November 10, 2018 falls on a Saturday. And the deadline for paying personal income tax on sick leave benefits is November 30, 2018.

Awards

There is a nuance regarding the dates of receipt of income in the form of bonuses:

- When paying bonuses for a year, quarter or for a specific event, for example, an accountant’s day, the date of receipt of income is considered the day of payment (letter of the Ministry of Finance dated October 23, 2017 No. 03-04-06/69115).

- For a “monthly” bonus, the date of receipt of income is considered to be the last day of the month for which it was accrued (letter of the Ministry of Finance of Russia dated April 4, 2017 No. 03-04-07/19708).

Thus, the date of receipt of the bonus for November will be considered 11/30/2018, and for the bonus for the 3rd quarter - the payment date will be 11/05/2018.

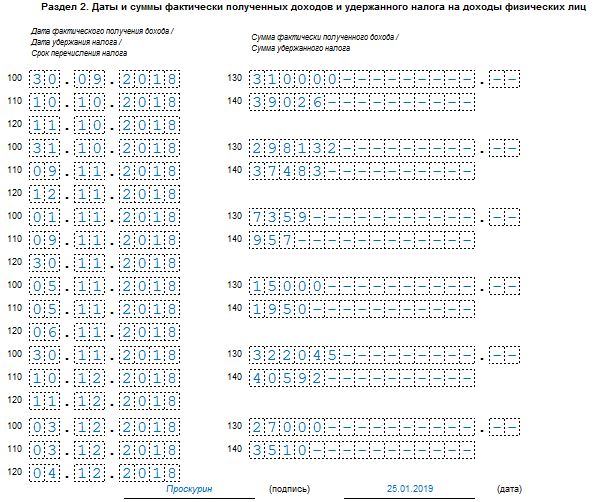

Next, the accountant grouped all payments into a table:

| Section line 2 | Decoding | Accrual | |||||

| Salary for September | Salary for October | Benefit | Prize for 3 sq. | Salary + bonus for November | Payment under GPC | ||

| 100 | Date of receipt of income | 30.09.2018 | 31.10.2018 | 01.11.2018 | 05.11.2018 | 30.11.2018 | 03.12.2018 |

| 110 | Personal income tax withholding date | 10.10.2018 | 09.11.2018 | 09.11.2018 | 05.11.2018 | 10.12.2018 | 03.12.2018 |

| 120 | Tax payment deadline | 11.10.2018 | 12.11.2018 | 30.11.2018 | 06.11.2018 | 11.12.2018 | 04.12.2018 |

| 130 | Amount of income | 310 000 | 298 132 | 7 359 | 15 000 | 322 045 | 27 000 |

| 140 | Amount of personal income tax withheld | 39 026 | 37 483 | 957 | 1 950 | 40 592 | 3 510 |

The accountant transferred all this data to section 2 of the report.

You can fill out form 6-NDFL for 2021 here.

Changes in the new form 2-NDFL in 2018

The new form combines many changes.

Submission of 2-NDFL certificate during reorganization

With the introduction of the new form, a serious gap that existed in the previously valid forms was closed. It concerns the delimitation of responsibilities to submit a report during the reorganization of the company.

The changes made to the Order now establish that the successor, regardless of the type of reorganization, is now required to submit a report for the liquidated organization. This rule applies provided that the latter has not yet managed to do this before closing. The same obligation applies to the submission of updated data.

If there are several legal successors, then the company that will be obliged to perform this action must be established using a transfer deed or a separation balance sheet.

In order for the legal successor to submit a report, two fields have been added to the new form: “Form of reorganization” and “TIN/KPP of the reorganized organization.”

Under simple conditions for submitting a report, these two fields are left blank.

You no longer need to indicate the employee’s residential address

The new form has lost the columns in which it was previously necessary to enter the residential address of the person for whom the report is being drawn up. Now you do not need to enter this information.

No investment deductions

Mentions of investment deductions have disappeared from section 4. Now they are not taken into account when determining the base for calculating tax.

We clarified the methods for submitting the form

All types of media have been removed from the rules for submitting reports to the tax office. Now you can submit it only in two ways - on paper or electronically through a special communications operator.

In practice, eliminating these methods means bringing the rules into line with the provisions of the Tax Code, where only these two possibilities for filing a report have long been established.

New income and deduction codes have been introduced

From January 1, 5 new income codes and 1 deduction code came into effect. In particular, a separate code has now been introduced for compensation for unpaid vacation.

New income and deduction codes for the 2-NDFL certificate for 2021:

| Code | New income codes effective from 2021. |

| 2013 | Amount of compensation for unused vacation |

| 2014 | The amount of payment in the form of severance pay, average monthly earnings for the period of employment, compensation to the manager, deputy managers and chief accountant of the organization in the part exceeding in general three times the average monthly earnings or six times the average monthly earnings for workers dismissed from organizations located in the regions Far North and equivalent areas |

| 2301 | Amounts of fines and penalties paid by an organization on the basis of a court decision for failure to voluntarily satisfy consumer requirements in accordance with the Law of the Russian Federation of 02/07/1992 N 2300-1 “On the Protection of Consumer Rights” <1> |

| 2611 | The amount of bad debt written off in accordance with the established procedure <2> from the organization’s balance sheet |

| 3023 | The amount of income in the form of interest (coupon) received by a taxpayer on traded bonds of Russian organizations denominated in rubles and issued after January 1, 2017 |

| Code | New deduction codes effective from 2021 |

| 619 | Deduction in the amount of positive financial results obtained from transactions accounted for in an individual investment account |

Removed mention of seal

The print field has been removed from the register of certificates if they are submitted to the tax office on paper. There is now no need to certify a document with a stamp, even if the stamp is used by the company.

Procedure for submitting 6-NDFL for the 4th quarter of 2018

Form 6-NDFL can be submitted to the Federal Tax Service:

- independently - a person who has the right to act on behalf of the taxpayer without a power of attorney;

- through a representative acting on the basis of a power of attorney;

- via telecommunication channels, certifying the payment with an electronic signature;

- by sending a letter with a list of attachments via Russian Post.

Only small companies and individual entrepreneurs, the average number of which is 24 employees or less, have the right to submit paper calculations. If you have more than 25 employees, you can send the report only via TKS.

Form 6-NDFL is sent to the Federal Tax Service via:

- place of registration of the taxpayer;

- place of registration of a separate unit (SU) in relation to payments to employees of this SB;

- place of its registration or registration of an OP: for the largest taxpayers;

- place of registration - for individual entrepreneurs;

- place of registration as a payer of tax paid under a special regime - for individual entrepreneurs on UTII or PSN.

Filling out section 1 of the income certificate

| FIELD | HOW TO FILL OUT |

| TIN in the Russian Federation | Identification number of an individual confirming his registration with the tax authority of the Russian Federation. If the tax agent does not have information about the TIN of the income recipient, they do not fill it out. |

| Surname Name Surname | Without abbreviations in accordance with the identity document. The middle name may be missing if it is not indicated in the identity document. For foreign citizens, it is permissible to indicate the last name, first name and patronymic in letters of the Latin alphabet. |

| Taxpayer status | Taxpayer status code:

As you can see, in relation to a non-resident foreigner, you also need to fill out certificates in form 2-NDFL. of how to do this in ConsultantPlus: In October 2021, the organization hired a citizen of Tajikistan, a non-resident of the Russian Federation, under an employment contract with a salary of 45,000 rubles. In total for 2021, RUB 135,000 was accrued. income. The personal income tax rate on the income of non-resident foreigners, as a general rule, is 30% (clause 3 of Article 224 of the Tax Code of the Russian Federation). The calculated amount of personal income tax for 2021 was 40,500 rubles. ((45,000 + 45,000 + 45,000) x 30%). See sample filling. |

| Date of Birth | Date, serial number of month, year - by sequential writing in Arabic numerals. |

| Citizenship (country code) | Numerical code of the country of which the individual is a citizen. According to the All-Russian Classifier of Countries of the World (OKSM) (approved by Resolution of the State Standard of Russia dated December 14, 2001 No. 529-st). If you do not have citizenship, indicate the code of the country that issued the identity document. |

| Identity document code | Taken from Appendix No. 1 to the Procedure:

|

| Series and number | Details of the taxpayer’s identity document – series and number, respectively. The “No” sign is not placed. |

Deadline for submitting form 6-NDFL and sanctions for late submission

The 6-NDFL calculation is submitted to the tax authorities based on the results of each quarter no later than the last day of the month following the reporting period. If the deadline falls on a non-working date, it is moved to the next working day. Based on the results of the 4th quarter of 2021, 6-NDFL should be submitted no later than 04/01/2019.

“Forgetful” taxpayers will face sanctions for late submission of calculations in the amount of 1 thousand rubles. for each full and partial month of delay (clause 1.2 of Article 126 of the Tax Code of the Russian Federation). If the delay exceeds 10 working days, the tax authorities have the right to block your bank accounts (clause 3.2 of Article 76 of the Tax Code of the Russian Federation).

If you provide false or incomplete information, you will face a fine of 500 rubles. But if you independently identify errors and submit corrections, responsibility is removed.

Should I submit a zero form of the 6-NDFL report for 2021?

Some accountants believe that if there were no accruals of income to employees in the 4th quarter of 2021, then it is not necessary to submit a 6-NDFL calculation, because the employer was not a tax agent during this period.

But you need to remember that tax authorities can fine:

- If accruals were made in any of the previous quarters, and the calculation for the 4th quarter was not presented. In this case, the report must be submitted by filling out only the title page and section 1, since 6-NDFL is filled out on an accrual basis.

- If they decide that you forgot to report.

If you did not conduct any activity in 2021 and there were no accruals, we recommend that you notify the tax authorities that you will not submit the 6-NDFL calculation by sending them a written message in free form. If you decide to submit a zero calculation, the tax authorities are obliged to accept it (letter of the Federal Tax Service of the Russian Federation dated May 4, 2016 No. BS-4-11 / [email protected] ).

What happens if the 2-NDFL certificate is filled out incorrectly?

Despite the relatively simple structure of the help, mistakes can be made in almost any part of it. So, common mistakes:

- When filling out the field “Tax amount over-withheld by the tax agent.” The only reasons for excessive tax withholding are an accountant’s error or a software glitch, as a result of which personal income tax is deducted from an individual’s income in a larger amount than it should be. In this case, the excessively withheld amount of personal income tax must be returned to the individual (clause 1 of Article 231 of the Tax Code of the Russian Federation). If such a return was made before submitting the certificate to the Federal Tax Service, then the field in question is not filled in. If not, fill it out and indicate the corresponding amount of personal income tax overpayment. At the same time, as soon as the return is issued, an adjustment certificate 2-NDFL must be sent to the Federal Tax Service without the completed field regarding excessive tax withholding (letter of the Federal Tax Service of Russia dated August 13, 2014 No. PA-4-11/15988).

- When indicating in the certificates the personal data of individuals - passport numbers, full name, INN. Passport numbers and full names tend to change - and it can be difficult for an accountant, especially at a large enterprise, to track this. A person can change his passport due to expiration date, due to its loss, change of name upon marriage, etc. The main tax identifier of an individual - TIN - never changes. But it is important not to mistakenly “attribute” the TIN of one person to another - for example, if they have similar last names and initials.

- When specifying the OKTMO code (in comparison with the code shown in the tax payment order). The certificate shows the OKTMO code: of the municipality where the tax agent-legal entity is located, or of the municipality where the tax agent-individual entrepreneur resides. The code entered in 2-NDFL and the one shown in the tax payment slip (field 105) must match, even if the tax agent has several OKTMOs. The Federal Tax Service, having discovered that the codes in the payment slip and the certificate are different, may classify the payment as uncleared receipts, and it will have to be clarified.

It should be borne in mind that absolutely any inaccuracy in the 2-NDFL certificate can become a reason for tax authorities to charge the tax agent with reporting “untrue information” and fine him 500 rubles for each certificate with an error (Article 126.1 of the Tax Code of the Russian Federation). It does not matter what the error is: its importance is assessed by the tax inspector independently based on significant circumstances (letter of the Ministry of Finance of Russia dated April 21, 2016 No. 03-04-06/23193). The Federal Tax Service honestly admits that there are no universal criteria here, and, indeed, any mistake can be qualified as serious (letters of the Federal Tax Service of Russia dated 08/09/2016 No. GD-4-11/14515, dated 11/16/2016 No. BS-4-11/ [ email protected] ).

However, if errors in 2-personal income tax did not lead to an understatement or non-transfer of personal income tax to the budget, then the tax authorities will most likely not fine the tax agent (letter No. GD-4-11/14515). But the use of such a soft approach is the exclusive right of the tax authorities themselves. There are no guarantees here for the tax agent.

Still, you can avoid a fine if you promptly send an adjustment to the Federal Tax Service according to the certificate.