Payment procedure

Payments for VNIM (compulsory insurance in case of temporary disability and in connection with maternity), compulsory pension insurance, compulsory medical insurance) are paid according to the details of the Federal Tax Service, each indicating its own BCC. The payment deadlines for all these payments are the same for payers making payments to individuals. For example, in 2021:

- for January - 02/15/2018;

- for February - 03/15/2018;

- for March - 04/16/2018;

- for April - 05/15/2018;

- for May - 06/15/2018;

- for June - 07/16/2018;

- for July - 08/15/2018;

- for August - 09/17/2018;

- for September - 10/15/2018;

- for October - November 15, 2018;

- for November - December 17, 2018;

- for December - 01/15/2019.

For payers who do not make payments to individuals, payment deadlines are different:

- until December 31 of the reporting year - from the amount of income up to 300,000 rubles;

- until 01.07 of the year following the reporting year, from an amount of income exceeding 300,000 rubles.

For organizations and individual entrepreneurs making payments to individuals, accrual is carried out according to the tariffs established in Chapter 34 of the Tax Code of the Russian Federation, which have not changed compared to the tariffs for 2017. For organizations and individual entrepreneurs making payments to individuals, the maximum base has changed for 2021, subject to change annually for calculating payments for VNIM and OPS (clause 6 of Article 421 of the Tax Code of the Russian Federation). There is no maximum base for deductions for injuries and compulsory medical insurance, so they are accrued for the entire amount of payments to the employee during the year.

For 2021, the maximum base is (clause 1 of Resolution No. 1378 dated November 15, 2017):

- for OPS - 1,021,000 rubles If this limit is exceeded by payers at a reduced rate, such payers do not charge contributions in excess of the established limit. If the limit is exceeded by payers at the basic tariff, deductions for each employee in the part exceeding the limit are calculated according to the formula:

- at VNiM - 815,000 rubles. No accruals are made to the base above this amount.

The procedure for reflecting accruals and paying deductions in accounting:

- Dt 20, 26, 44 Kt 69 - insurance premiums accrued (posting);

- Dt 69 Kt 51 - insurance premiums (postings) have been paid.

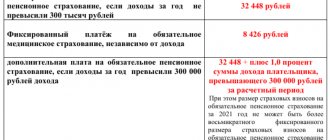

Entrepreneurs who do not make payments to individuals pay:

- fixed payment, its size does not depend on the amount of income. For 2020, its amount is 32,385 rubles, including contributions to compulsory pension insurance in the amount of 26,545 rubles. and for compulsory medical insurance in the amount of 5840 rubles;

- additional deductions in the amount of 1% on income over 300,000 rubles, the maximum amount of which for 2021 is 185,815 rubles.

Accordingly, the maximum amount of payments for OPS for individual entrepreneurs “for themselves” for 2021 will be 212,360 rubles.

Reporting

Calculation of insurance premiums, both in paper and electronic form, is submitted to the Federal Tax Service within the time limits established by Chapter. 34 Tax Code of the Russian Federation:

- persons making payments to individuals no later than the 30th day of the month following the quarter (clause 1, clause 1, article 419, clause 7, article 431 of the Tax Code of the Russian Federation);

- heads of peasant and farm enterprises report until January 30 of the calendar year following the reporting year (clause 3 of Article 432 of the Tax Code of the Russian Federation).

In addition, it is necessary to submit accounting reports to the Pension Fund of the Russian Federation.

You must pay contributions for injuries and report in Form 4-FSS to the FSS (Letter dated August 17, 2016 No. 02-09-11/04-03-17282).

The amount of fines on insurance premiums in 2021

Late payment will result in a fine, and for intentional non-payment the company will be fined double. You will also have to pay additional fees for late submission of reports.

Fines are imposed in the following cases:

- non-payment of accrued amounts, gross violations in accounting for income and expenses, which resulted in an underestimation of the calculation base - 20% of the unpaid amount (clause 3 of Article 120 of the Tax Code of the Russian Federation, clause 1 of Article 122 of the Tax Code of the Russian Federation, Article 26.29 of Law No. 125-FZ );

- intentional non-payment and underestimation of the base - 40% of the amount (clause 3 of article 122 of the Tax Code of the Russian Federation, article 26.29 of Law No. 125-FZ);

- failure to provide payment of insurance premiums on time - 5% of the unpaid amounts due on time for the last three months, for each full or partial month of delay (clause 1 of Article 119 of the Tax Code of the Russian Federation) plus a fine of 300 to 500 rubles for violation of deadlines under Article 15.5 of the Code of Administrative Offenses of the Russian Federation;

- submitting a calculation in paper form instead of electronically - 200 rubles (Article 119.1 of the Tax Code of the Russian Federation). Electronic payments are submitted by companies with more than 100 employees;

- untimely submission of SZV-M or submission of false (incomplete) information - 500 rubles for each insured person (Article 17 of Law No. 27-FZ). For large companies the amount will be significant;

- submission of SZV-M in paper form instead of electronically - 1000 rubles (Article 17 of Law No. 27-FZ). SZV-M is submitted electronically by organizations that employ more than 25 people;

- failure to provide, including within the prescribed period, information to the Pension Fund or its provision in incomplete (distorted) form - from 300 to 500 rubles (Article 15.33.2 of the Code of Administrative Offenses of the Russian Federation);

- failure to submit 4-FSS - 5% of the amount of deductions for injuries accrued for payment on a late payment for the last three months, for each full or partial month of delay (clause 1 of Article 26.30 of Law No. 125-FZ) plus a fine of 300 to 500 rubles for violating the deadlines for submitting 4-FSS under Article 15.33 of the Code of Administrative Offenses of the Russian Federation;

- filing a 4-FSS calculation in paper form instead of electronically - 200 rubles (clause 2 of Article 26.30 of Law No. 125-FZ).

Types of existing penalties

To display the costs incurred that arise when fines and penalties are calculated, account 99 Profit and loss is used. For convenience, it is divided into two subcontos - penalties and fines. The debit of this account corresponds with the corresponding tax payment, which is displayed on the credit of accounts 68 and 69.

There are opinions in accounting circles that account 91 Other expenses can also be used to display accrued penalties and fines. However, in this case, a permanent tax liability arises, which somewhat complicates the process of accounting for them.

In addition, if accrued penalties and fines are displayed on 91 accounts, this will lead to a decrease in the tax base and will violate the authenticity of the information provided in the financial indicators of the organization.

Before considering the question of how to post a fine or penalty in accounting, let’s figure out what sanctions of this kind may be. They are divided into two groups:

- Accrued by counterparties to each other in connection with violation of contractual obligations.

- Arising in case of non-compliance with tax legislation.

Sanctions of the first group are provided for in the texts of agreements concluded between counterparties as mutual and can equally arise for each of the parties. For example, penalties are usually established for the buyer for late payment, and for the supplier for failure to meet the delivery deadline. More serious sanctions (in the form of a fine) are intended to ensure the fulfillment of obligations that seriously affect the very fact of the functioning of the counterparty or lead to significant losses for it (incl.

Situations in which penalties and fines are assessed for violations of tax legislation are given in the Tax Code of the Russian Federation; there are also indications of their specific amounts, and, in necessary cases, calculation algorithms. Here, taxpayers usually become the payers of sanctions, although in a number of cases (for example, a delay in the return of overpaid tax to the budget or the amount of VAT to be refunded), the same kind of responsibility is established for the tax authorities.

Thus, a specific legal entity may turn out to be both a payer and a recipient of payments from both groups, and accounting entries for fines and penalties will arise not only when accounting for expenses on them, but also when reflecting income.

We suggest you read: How to check loan debts and how to find out if you have a debt to the bank?

The basis for making entries for penalties or fines assessed for payment to the budget are documents with the amounts of these payments issued by the tax authority:

- decisions based on the results of the audit;

- requirements for payment of taxes (contributions).

For the taxpayer, they represent an expense, which the Chart of Accounts recommends reflecting on account 99. However, it will not be a violation to use account 91 for this purpose (allowing for expansion of the list of other expenses listed in the Chart of Accounts) provided that they are separated in the analytics from penalties, accrued in favor of counterparties.

The accrual of sanctions in favor of the tax authorities will thus be reflected by the entry Dt 99 (91) Kt 68, and the entry for payment of fines or penalties will look like this: Dt 68 Kt 51.

If the payer of sanctions against a legal entity turns out to be a tax authority, then the accounting entries in this case will be similar to those used when calculating similar payments arising under contractual relationships with other counterparties:

- Dt 76 Kt 91 - accrual of income under sanctions;

- Dt 51 Kt 76 - receipt of funds for their payment.

The Chart of Accounts does not provide for the attribution of such income to account 99. The use of account 91 in this posting indicates the preference for reflecting tax sanctions paid by the taxpayer through account 91, since this provides a more convenient comparison of income and expenses.

Tax fines and penalties: accounting and postings

Almost every company has at least once received from the Federal Tax Service a demand to pay a fine for late submission of a declaration or to pay penalties for late payment. We will tell you in this article how to independently calculate the amount of penalties and check the calculations of the tax service and what transactions to reflect tax sanctions.

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| Accounting for fines and penalties on taxes on the account. 99 | ||||

| 99-1 | 68-4 (68-2, 68-1) | 19 000,00 | A fine was assessed for non-payment of tax (95,000.00*20%) | Buh. reference |

| 99-2 | 68-4 (68-2, 68-1) | 574,75 | A penalty has been charged for late payment of taxes. The delay was 22 days | Buh. reference |

| 68-4 (68-2, 68-1) | 51 | 19 574,75 | Payment of accrued fines and penalties for taxes | Plat. order |

| Accounting for fines and penalties on taxes on the account. 91 | ||||

| 91 | 68-4 (68-2, 68-1) | 574,75 | A penalty has been charged for late payment of taxes. The delay was 22 days | Buh. reference |

| 99-1 | 68-4 (68-2, 68-1) | 19 000,00 | A fine was assessed for non-payment of tax (95,000.00*20%) | Buh. reference |

| 68-4 (68-2, 68-1) | 51 | 19 574,75 | Payment of accrued fines and penalties for taxes | Plat. order |

| Accounting for fines and penalties on insurance premiums on the account. 99 | ||||

| 99-1 | 69 | 8 000,00 | A fine was assessed for non-payment of the insurance premium (40,000.00*20%) | Buh. reference |

| 99-2 | 69 | 275,00 | A penalty has been charged for late payment of the insurance premium. The delay was 25 days | Buh. reference |

| 69 | 51 | 8 275,00 | Payment of accrued fines and penalties on insurance premiums | Plat. order |

| Accounting for fines and penalties on insurance premiums on the account. 91 | ||||

| 91 | 69 | 275,00 | A penalty has been charged for late payment of the insurance premium. The delay was 25 days | Buh. reference |

| 99-1 | 69 | 8 000,00 | A fine was assessed for non-payment of the insurance premium (40,000.00*20%) | Buh. reference |

| 69 | 51 | 8 275,00 | Payment of accrued fines and penalties on insurance premiums | Plat. order |

| Imposition of a fine identified during an inspection | ||||

| 99 | 76 | 30 000,00 | Accrual of an administrative fine for non-use of cash registers for cash payments | Protocol |

| 76 | 51 | 30 000,00 | Payment of an administrative fine | Plat. order |

| Additional assessment of taxes and social contributions, payment of taxes and penalties | ||||

| 99 | 68-4 | 10 000,00 | Additional income tax accrual | Buh. reference |

| 90 (91) | 68-2 | 25 000,00 | Additional charge of underestimated VAT | Buh. reference |

| 20 (26, 44, 91) | 69 | 30 000,00 | Additional payment of insurance premium | Buh. reference |

| 91 (20, 26) | 68 | 15 000,00 | Additional assessment of property tax, land tax, transport tax | Buh. reference |

| If VAT is not restored | ||||

| 19 | 68-2 | 25 000,00 | Additional charge of underestimated VAT | Buh. reference |

| 91 | 19 | 25 000,00 | Inclusion of recovered VAT in expenses | Buh. reference |

| Input VAT was incorrectly accepted (reporting not signed) | ||||

| 68 | 19 | 47 000,00 | Additional VAT calculation | Buh. reference |

| 20 (26, 44, 90, 91) | 19 | 47 000,00 | Writing off input VAT on expenses | Buh. reference |

| 01 (04, 10, 41) | 19 | 47 000,00 | Inclusion of input VAT in the cost of the object | Buh. reference |

| 20 (26, 44) | 02 (05) | 7 000,00 | Additional depreciation charge for the amount of input VAT | Amor. statement |

| Input VAT was incorrectly accepted (the reporting was signed) | ||||

| 19 | 68 | 4 700,00 | Additional VAT calculation | Buh. reference |

| 91 | 19 | 4 700,00 | Writing off input VAT on expenses | Buh. reference |

| 01 (04, 10, 41) | 19 | 4 700,00 | Inclusion of input VAT in the cost of the object | Buh. reference |

| 20 (26, 44) | 02 (05) | 700,00 | Additional depreciation for the current year for the amount of input VAT | Amor. statement |

| 91 | 02 (05) | 320,00 | Additional depreciation for the past year in the amount of input VAT | Amor. statement |

We invite you to read: Fictitious marriage to obtain Russian citizenship: is it legal?

Previous procedure for calculating penalties

The procedure for calculating penalties is determined by Article 75 of the Tax Code.

For debts incurred before October 1, 2021, penalties were calculated based on the refinancing rate of the Bank of Russia using the following formula. The amount of tax not paid on time was multiplied by 1/300 of the refinancing rate of the Bank of Russia during the period of delay and by the number of days of delay.

For debts incurred since October 1, 2021, a different calculation applies, which is still used today. Penalties are calculated based on 1/300 of the current refinancing rate of the Bank of Russia only if the delay in taxes or contributions is up to 30 calendar days inclusive. For late payment of taxes or contributions over 30 calendar days, the interest rate of the penalty is taken equal to 1/300 of the refinancing rate of the Bank of Russia, valid for the period up to 30 calendar days (inclusive) of such delay, and 1/150 of the rate, valid for the period starting from the 31st th calendar day of such delay.

The number of days of delay in taxes and contributions is determined from the day following the due date for payment of the tax until the day of its payment.

Before the new rules came into force, only the start date for accrual of penalties was directly stated in the Tax Code. This is the day following the due date for tax payment. And the actual day of payment of taxes or contributions was not taken into account when calculating penalties (letter of the Ministry of Finance of Russia dated July 5, 2021 No. 03-02-07/39318).