Extra-budgetary funds in organization accounting

Any organization is always supervised by regulatory authorities. Some look at the correct payment of taxes, others at the correct transfer of contributions from employee salaries.

State extra-budgetary funds were created to ensure the rights of citizens to pension, medical and social insurance. The funds' budget is formed from funds received from employers.

In 2021, the controlling bodies - funds for us are the Federal Tax Service and the Social Insurance Fund. In the first, we report on calculated and paid insurance premiums, contributions to pension, medical and social insurance, in the second, we submit calculations for the calculation of social security contributions.

Let us recall that in 2021 the Funds transferred the administration of contributions to the Federal Tax Service. Find out what to do if the Funds provided the tax authorities with an incorrect calculation balance in ConsultantPlus. If you don't already have access to the system, get a free trial online.

Insurance contributions, which are paid by employers to extra-budgetary funds, are designed to provide social support to the country's population - both able-bodied people and retirees. Therefore, control over these payments is quite high. Accordingly, there is a high risk of fines being assessed for incomplete transfer of funds or untimely provision of documents for the implementation of this control. This is why accounting in this area is so important.

There are several types of accruals:

- pension;

- medical (contributions to the Federal Compulsory Medical Insurance Fund);

- contributions for compulsory social insurance in case of sick leave and in connection with maternity;

- accident insurance premiums.

Contributions are paid by organizations and individual entrepreneurs that pay benefits to individuals (salaries to employees, fees for providing services to individuals).

IMPORTANT! If the employer is an individual entrepreneur, then he is obliged to pay contributions separately for himself and separately for his employees!

What payments are subject to contributions:

- Payments to employees under concluded employment contracts (salaries, bonuses, vacation pay, etc.)

- Payments under civil contracts. These may be concluded contracts for the performance of any work, provision of services, etc.

For more information about the taxation of payments under civil and civil construction agreements, read our article “Contractor agreement and insurance premiums - nuances of taxation.”

There is also a closed list of payments that are not subject to insurance premiums and “injury” contributions. For example, these are payments to an individual not related to his work activity - that is, payments outside of the employment relationship or within the framework of a GPC contract - a repayable loan or financial assistance to family members of a deceased employee.

Read more about such payments in our article “What is not subject to insurance premiums.”

Transfer of personal income tax and contributions

On the payday, the organization is obliged to pay personal income tax and insurance premiums for injuries. The remaining insurance premiums are paid by the 15th of the next month. Payment is made from the current account (account 51), the debt to the Federal Tax Service and funds is closed (accounts 68 and 69). Postings:

D68 K51 - personal income tax paid

D69 K51 – fees paid

Example of payroll with postings

Employees were paid salaries for January 2021, personal income tax was withheld, and insurance premiums were calculated. Accounting for account 70 is carried out without analytics for employees, for account 69 - with subaccounts for each contribution. Expenses for salaries and contributions are included in account 20.

02/10/2018 - salary was paid, personal income tax and insurance contributions to the Social Insurance Fund for injuries were paid,

02/15/2018 - insurance contributions to the Pension Fund, Federal Migration Service, and Social Insurance Fund were paid.

Contributions:

- to the Pension Fund of Russia - 16,500 rubles

- to the Federal Migration Service - 3,825 rubles

- FSS - 2,175 rubles

- FSS injuries - 150 rubles

Postings for all operations:

date Wiring Sum Contents of operation 31.01.2018 D20 K70 75 000 Salary accrued D70 K68.NDFL 9 750 Personal income tax withheld Insurance premiums charged: D20 K69.pfr 16 500 - to the Pension Fund of Russia D20 K69.fms 3 825 - to the FMS D20 K69.fss1 2 175 - in the Social Insurance Fund (temporary disability) D20 K69.fss2 150 — in the Social Insurance Fund (injuries) 10.02.2018 D68.NDFL K51 9 750 Personal income tax listed D69.fss2 K51 150 FSS contributions transferred (injuries) D70 K50 65 250 Employees' salaries were paid from the cash register 15.05.2018 Insurance premiums listed: D69.pfr K51 16 500 - to the Pension Fund of Russia D69.fms K51 3 825 - to the FMS D69.fss1 K51 2 175 — FSS (temporary disability)

Keeping accounting records in the online service Kontur.Accounting is convenient. Quick establishment of a primary account, automatic payroll calculation, collaboration with the director.

Making payments to extra-budgetary funds is the responsibility of every employer. What are extra-budgetary funds, what transfers are made to them, how to reflect transactions on them in accounting - we will answer all these questions in our article.

An extra-budgetary fund is a government body whose financial resources are generated outside the state budget. The source of financing for extra-budgetary funds is mandatory contributions made by legal entities in order to realize the social rights of citizens. That is why extra-budgetary funds are also called social funds.

Currently, there are 3 main social extra-budgetary funds in the Russian Federation: Pension, Social Insurance Fund (FSS) and compulsory health insurance FFOMS).

Payments to extra-budgetary funds are required to be transferred. The basis for calculating payments is the employee’s income paid by the employer. Such income includes:

- salary;

- allowance, surcharge;

- payment under a contract, author's agreement;

- severance pay.

Insurance premiums are charged by the employer for payments received by an employee within the framework of an employment relationship, a contractor under a contract, or an author's contract. Also, accrual is carried out on remuneration paid to the head of the organization if he is its only participant.

According to changes in legislation that came into force in 2015, contributions to extra-budgetary funds (PFR) are also charged on the income of employees who are foreign citizens and stateless persons. In this case, the period of conclusion and validity of the employment contract does not matter.

Accounting for settlements with the budget

Account 68 “Calculations for taxes and fees” in organizations is used to record information on taxes paid. Account 68 “Calculations for taxes and fees” summarizes information about settlements with budgets for taxes and fees paid directly by the organization.

The procedure for calculating and paying taxes and fees is regulated by laws and other regulations.

Analytical accounting on account 68 “Calculations for taxes and fees” is carried out by type of tax.

Account 68 is credited for income tax amounts in correspondence with account 99 “Profits and losses”.

The accrual of taxes and fees that must be paid to the budget in accordance with tax returns or calculations of the enterprise is reflected in the credit of the corresponding subaccounts of account 68 and can be made at the expense of:

- production and sales costs;

- financial results of the enterprise;

- income paid to individuals and legal entities.

In the first case, the following entry is made in accounting:

D 20, 23, 25, 26, 29, 44 K 68.

In the second case, the following entry is made in accounting:

D 91 K 68.

Corporate income tax due for payment to the budget is reflected in accounting records as follows:

D 99 K 68.

In the third case, taxes are reflected in the debit of settlement accounts. For example, personal income tax withholding is reflected in accounting:

D 70 K 68.

The accrued amount of penalties for late or incomplete payment of taxes and fees is reflected:

D 99 K 68.

The actual transfer of taxes and fees to the budget in accounting is reflected by the entry:

D 68 K 51.

The debit of account 68 reflects the amounts paid to the budget, as well as the amounts of value added tax written off from account 19 “Value added tax on acquired assets.”

Analytical accounting for account 68 “Calculations for taxes and fees” is carried out by type of tax.

The company pays taxes by bank transfer from its current account. To do this, the company's accountant submits a payment order to the bank to pay the tax.

Sometimes a company has a situation where it overpays taxes. An overpayment may occur if, at the end of the tax period, the amount of advance tax payments exceeds the amount calculated in the tax return. In addition, you can overpay tax if the accountant made a mistake when calculating the tax amount or filling out a payment order.

If an error occurs in tax calculation, the chief accountant submits an additional declaration for this tax to the tax office. It indicates the amount overpaid to the budget.

If a company has debts to the budget (non-budgetary fund), to which the tax was overpaid, only the amount remaining after the overpayment is offset against debt repayment can be returned.

In order to offset or refund the tax, a free-form application is submitted to the tax office.

The application can be submitted no later than three years from the date of the overpayment.

Within five days from the date of receipt of the application, the tax office must make a decision on the offset. Tax authorities are required to inform the organization about the offset made no later than two weeks after receiving the application.

You will have to wait longer for your tax refund - the tax office has been given a month to do so from the date of receipt of the application. Moreover, a month is the period no later than which the money must appear in the organization’s account.

Accounting for accrual and payment of wages in accounting

The accrual of contributions is reflected in the credit of account 69, and their payment in the debit. The credit balance of account 69 shows the enterprise's debt to state extra-budgetary funds for social insurance and provision of its employees (that is, the amount of insurance payments accrued for payment, but not yet transferred for the intended purpose).

Entries for calculating insurance premiums are drawn up immediately after the accrual of wages, bonuses and other established payments in favor of the employee, the amount of which is the basis for determining the amount of insurance payments.

Insurance premiums are NOT WITHDRAWN FROM SALARY,

a ARE INCLUDED IN THE COST OF PRODUCTS.

When calculating contributions, account 69 is credited, and those accounts on which the accrual of income in favor of employees was reflected are debited.

For example:

D 26 – wages accrued to the management personnel of the organization

K 70

and at the same time:

D 26 – insurance premiums are calculated from the salaries of management personnel

K 69

When calculating insurance premiums, that part of them that is subject to transfer to the Social Insurance Fund of the Russian Federation must be reduced by the amount of payments made by the organization in favor of employees at the expense of the fund. It can be:

– temporary disability benefits;

– maternity benefits;

– monthly child care allowance until the child reaches the age of one and a half years;

– one-time benefit for the birth of a child;

– social benefit for funeral, etc.

The amount of these benefits reduces the amount of insurance premiums due for payment to this fund, therefore the accrual of such amounts is reflected in the debit of account 69. For example,

D 69 – temporary disability benefits accrued at the expense of the Federal Social Insurance Fund of the Russian Federation

K 70

The amount of insurance premiums is calculated and paid separately to each state extra-budgetary fund. Contributions are paid monthly no later than the 15th day of the calendar month following the month for which the monthly obligatory payment is calculated.

Extra-budgetary funds: functions

In order for the state to coordinate cash flows in certain social areas, several insurance funds were created. The most famous of them are the Pension Fund, the Social Insurance Fund and the Federal Compulsory Medical Insurance Fund.

The peculiarity of these 3 state formations is that money is deposited into their accounts without fail by all organizations and individual entrepreneurs paying income to citizens of the Russian Federation. In the future, these funds are distributed according to social programs: for the issuance of pensions, maternity capital, payment of sick leave, etc.

The activities of the funds are regulated by the legislation of the Russian Federation, in particular:

- Budget Code of the Russian Federation dated July 31, 1998 No. 145-FZ;

- Federal Law “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund” dated July 24, 2009 No. 212-FZ.

Calculation of penalties: postings

It is an amount intended for payment in special cases and calculated as a percentage of the overdue amount. As a rule, the amount is one three hundredth of the refinancing rate for each day.

But from October 2021, for legal entities, the calculation schemes for this payment have changed and, depending on the period of formation of the debt, its size can range from 1/150 to 1/300 SR for arrears. The total size will be determined by simply adding up.

Payment of such an accrual is possible by the company either voluntarily or upon receipt of a notification provided by the Federal Tax Service. To reflect penalties in transactions, subaccounts are added to the main account 69.

Postings for account transactions look like this:

- Accrual/additional accrual – 99; 69

- Payment – 69; 51

If during the transfer it was established that in addition to penalties there is an arrear, the payer must pay it off. In the event of an initially incorrect calculation of the amount, the arrears are accrued according to the usual payment calculation algorithm: debit of the cost account - Kt 69.

There are special rules for recording the time of operations:

- In case of voluntary payment, the posting is dated in the same way as the prepared statement of payment

- When paying after verification, the date becomes according to it

accrued FSS must be guided by the explanations of the Ministry of Finance of the Russian Federation. The wiring itself looks like this:

- Accrual of penalties – Dt 26/44, Kt 69

- Payment from a current account – Dt 69, Kt 51

The period of delay for calculating the penalty payable in, under insurance. contributions are calculated starting from the day after the established payment date. The period ends on the date preceding the actual payment.

For traumatic contributions, the number of days of delay is counted from the day on which the payment deadline is set until the date of deposit of funds, inclusive.

Insurance rates and basis for calculating premiums

For each individual, an organization or individual entrepreneur calculates contributions individually depending on the income received. The assessment base is calculated as a cumulative total during the calendar year. For some types of income, the tax base is limited. See the current limits for 2021 here.

The final amount of contributions is the taxable base multiplied by the corresponding insurance tariff (rate).

The following rates are currently in effect:

| Taxable base | Pension Fund | FSS | FFOMS | Total |

| Does not exceed the established limit value, % | 22 | 2,9 | 5,1 | 30 |

| More than the established limit, % | 10 | 5,1 | 15,1 |

For other tariffs, see the material “Insurance premium tariffs in the table”.

ATTENTION! From 01.04.2020 President of the Russian Federation V.V. Putin reduced insurance premium rates for small businesses to the widow. See here for details.

Tariffs for contributions “for injuries” depend on the occupational risk class assigned to the organization or enterprise.

These tariffs are described in detail in this material.

What insurance premiums are charged on wages?

After calculating wages, insurance premiums must be calculated. Their number and volume depend on the type of activity of the economic entity, the applied taxation system, and the amount of payments. Insurance premiums include the following payments:

- Transfers to pension insurance - 22% (tariff valid until the end of 2021).

- Payments for compulsory health insurance - 5.1%.

- Social security contributions - 2.9%.

- Contributions to the Social Insurance Fund for insurance against accidents at work - from 0.2% to 8.5%.

Above are the basic payroll insurance rates. However, rates may vary depending on the type of activity of the employer. Organizations and individual entrepreneurs who are on the simplified tax system and are employed in a certain production area, as well as in the field of healthcare, construction, sports development and others can apply for preferential payments in a reduced amount. In addition, it is allowed to charge contributions in a reduced amount for payers whose activities meet the criteria of Art. 427 Tax Code of the Russian Federation. We are talking about entities working in technological, scientific fields and others.

Contributions for injuries to the Social Insurance Fund also depend on the type of work. The higher the hazard class for employees, the larger the amount of deductions.

Accounts and transactions

Account 69 is intended for keeping records of settlements with extra-budgetary funds. To separate insurance premiums by type, sub-accounts are introduced:

- for calculations within the framework of social insurance, subaccount 69.1 is used;

- Account 69.2 has been introduced for contributions to the compulsory or voluntary pension insurance system;

- 69.3 reflects the status of settlements with the Compulsory Medical Insurance Fund;

- through subaccount 69.11, calculations for contributions for injuries and accident insurance are disclosed (the interest rate for employers is set in relation to the risk class assigned to them).

FOR YOUR INFORMATION! Transactions for the calculation of all types of insurance premiums are shown as credit turnover in account 69. Repayment of the employer's obligations is carried out by debiting subaccounts of account 69.

Typical correspondence in the field of settlements with funds:

- D20 (25 or 26) – K69 – in a production organization, contributions have been accrued on the income of the working personnel;

- D44 – K69 – contributions accrued by a trade organization;

- D08 – K69 – the value of insurance premiums adjusts the cost of the asset under construction (the wages of the involved personnel and insurance premiums from it are added to the total cost of the object);

- D69 – K51 – funds were transferred from the current account to repay obligations on insurance premiums;

- D91 – K69/Fine – reflects the accrual of penalties on insurance premiums;

- D69/Fine – K51 – the accrued penalty for late payment of insurance premiums was repaid from the bank account of the business entity;

- D69 - K70 - reflects the amount of benefits subject to reimbursement from the Social Insurance Fund (accrual of part of the sick leave, which is payable by the social insurance fund).

Typical accounting entries for account 69

Debit entries:

D69 K50 – vouchers issued from the cash desk to employees paid by the Social Insurance Fund.

D69 K51 – the amounts of insurance contributions to funds from the current account are transferred.

D69 K70 – payments to employees are accrued from social insurance funds.

Loan transactions:

D20 K69 - contributions payable to the funds for employees of the main production for compulsory medical insurance, compulsory social insurance and compulsory health insurance are accrued.

D23 K69 – contributions were accrued to employees of auxiliary production.

D25 K69 – contributions payable to shop workers.

D26 K69 – contributions payable to management employees.

D44 K69 – contributions are accrued for payment for employees of trade organizations and those involved in the sale of products.

D99 K69 – amounts of penalties and fines were accrued to the Pension Fund, Social Insurance Fund and Compulsory Medical Insurance Fund.

D51 K69 – the funds returned the overpaid amounts of insurance payments.

D70 K69 – the amount of the voucher is withheld from the employee’s salary, received at the expense of the Social Insurance Fund.

Working with account 69 involves paying contributions to the Pension Fund, Social Insurance Fund and Compulsory Medical Insurance Fund. Click and read: Payments of individual entrepreneurs to the Pension Fund and the Compulsory Medical Insurance Fund. Registration of individual entrepreneurs in the Social Insurance Fund and TFOMS.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Accounting for settlements with extra-budgetary funds

For accounting of settlements with extra-budgetary funds, account 69 “Settlements for social insurance and security” is provided. Sub-accounts are opened for each type of payment.

Let's look at typical transactions for calculating contributions to funds:

| Account Dt | Account name | CT | Contents of operation |

| 20,25,26 | "Primary production" | 69.01 “Settlements with the Social Insurance Fund for contributions in case of temporary disability and maternity” 69.02 “OPS” 69.03 “Settlements with the Federal Compulsory Medical Insurance Fund” 69.11 “Calculations for compulsory social insurance against accidents at work and occupational diseases” | Calculation of contributions depending on the type at a manufacturing enterprise |

| 44 | "Sale expenses" | Calculation of contributions in a trade organization | |

| 08 | "Fixed assets" | Calculation of contributions during construction, when the salaries of workers form the initial cost of the object | |

| 69 | 51 “Current account” | Payment of contributions (by subaccounts) | |

| 69 "Penny" | 51 “Current account” | Payment of fines | |

| 69 | 70 “Wages of employees” | Benefit reimbursed from the Social Insurance Fund |

As a rule, on a monthly basis we pay all contributions calculated according to the above formula. But if you have accrued sick leave or an employee went on maternity leave, the situation will change.

Accounting for settlements for social insurance and security is reflected by posting Dt 69 “Contributions” Kt 70 “Calculations for wages”. With this posting you will accrue sick leave (for those days paid by the Social Insurance Fund) - accordingly, the payment at the end of the month will not be the insurance premium calculated from the salary, but the account balance 69 at the end of the month. Here you have two options:

- You pay the fully calculated contributions, submit documents to the Social Insurance Fund and, after the money arrives in the current account, you formalize this by posting Dt 51 Kt 69.

- Or you immediately, within one calendar year, reduce the amount of accrued insurance premiums by the amount of calculated sick leave.

Find out how to offset and refund insurance premiums in ConsultantPlus. Get trial access to the system and get expert explanations for free.

How benefits are paid from 01/01/2021 as part of the general pilot project of the Social Insurance Fund, read here.

Features of taxation

Back in 2021, the insurance coverage of citizens has undergone significant reforms. Thus, the Federal Tax Service became the single administrator of revenues. Let us recall that previously payments for insurance coverage were credited directly to extra-budgetary funds (PFRF, FFOMS, Social Insurance Fund).

Now the main regulatory act regulating the taxation procedure and tariffs for insurance premiums (IC) is Chapter 34 of the Tax Code of the Russian Federation. Generally established tariffs are the same for all economic entities:

- Mandatory pension insurance - 22%.

- Compulsory health insurance - 5.1%.

- Temporary disability and maternity insurance - 2.9%.

However, officials have provided benefits for some categories of taxpayers. These privileges are expressed in reduced tariffs for SV. Read more: “Who is eligible for reduced SV tariffs in 2021.”

Please note that insurance against industrial accidents and occupational diseases (injuries) should also be transferred to the Social Insurance Fund. That is, contributions for injuries were not transferred to the jurisdiction of the Federal Tax Service. The amount of payments varies from 0.2 to 8.5% depending on the hazard class of the company’s main activity.

Typical wiring

Let's consider the key algorithm for calculating CBs and reflecting them in accounting using a specific example.

VESNA LLC is an OSNO company that applies generally established tariffs for insurance coverage for citizens. The contribution rate for injuries is 0.2%. In January 2021, salaries of key personnel were accrued in the amount of 1,000,000 rubles. The accountant recorded the following actions:

| Operation | Debit | Credit | Amount, in rubles | Note |

| Salaries of key personnel accrued | 20 | 70 | 1 000 000,00 | Basis document: salary slips for January |

| Accounting entry if insurance premiums from wages are calculated for temporary disability and maternity | 20 | 69.1/1 | 29 000,00 (1 000 000 × 2,9%) | |

| Accrual of SV on OPS | 20 | 69.2 | 220 000,00 (1 000 000 × 22%) | |

| SV reflected on compulsory medical insurance | 20 | 69.3 | 51 000,00 (1 000 000 × 5,1%) | |

| Accounting entry if contributions are accrued to extra-budgetary funds for injuries (in the Social Insurance Fund) | 20 | 69.1/2 | 2000,00 (1 000 000 × 0,2%) | |

| The money was transferred to the Federal Tax Service and funds: | ||||

| VNiM | 69.1/1 | 51 | 29 000,00 | Basis document: payment orders, extract from a banking organization on the status of the current account |

| OPS | 69.2 | 220 000,00 | ||

| Compulsory medical insurance | 69.3 | 51 000,00 | ||

| NS and PZ | 69.1/2 | 2000,00 |

In February 2021, VESNA LLC received from the Federal Tax Service a requirement to pay arrears in the amount of 5,000 rubles and a penalty in the amount of 135.55 rubles. The accountant made the following entries:

| Operation | Debit | Credit | Amount, rub. | A document base |

| Penalty accrued | 99 or 91 (depending on the method specified in the accounting policy) | 69 (according to the corresponding subaccount) | 135,55 | Requirement of the Federal Tax Service |

| Penalty payment reflected | 69 (according to the corresponding subaccount) | 51 | 135,55 | Payment order |

| Arrears accrued | 20 - if the arrears were accrued for the current year; 91.2 - if the arrears were billed for previous reporting periods | 69 (according to the corresponding subaccount) | 5000,00 | Requirement of the Federal Tax Service |

| Payment of arrears | 69 (sub-account) | 51 | 5000,00 | Payment order |

Fix the method of reflecting penalties in accounting in your accounting policy. It is permissible to assign penalties to 91 or 99 accounts. We talked about which account to choose in the article

"Tax penalties: postings"

.

Accounts

To reflect the transaction “insurance contributions for wages have been accrued,” the entry is drawn up using a special accounting account 69 “Calculations for social insurance and security” (Order of the Ministry of Finance No. 94n).

To detail the data for each type of insurance coverage, the chart of accounts provides special subaccounts:

- 69.1 - to reflect operations on social security of citizens (VNiM and NS and PZ).

IMPORTANT!

It is necessary to provide additional analytics for subaccount 69.1, for example:

- 69.1/1 - accruals in favor of VNiM;

- 69.1/2 - data on payments to the Social Insurance Fund in favor of insurance against accidents and occupational diseases.

- 69.2 - for calculating SV in terms of compulsory pension insurance;

- 69.3 - information on accrued SV under compulsory medical insurance.

The credit of these accounting accounts reflects the accrual of SV, and the debit reflects their payment.

It is worth noting that the employer accrues IC only to the payroll, that is, from the amount of taxable payments and remuneration for labor. No deductions are made from citizens' earnings when calculating SV.

Let us remind you that when creating a vacation reserve in the budget, it is necessary to provide for similar deductions to the reserve fund, transactions and calculation features - in the article “How to calculate the vacation reserve in 2021.”

Accounting for calculations of insurance premiums: features of postings

Social contributions to insurance funds are made from employee salaries. At the same time, benefits, social benefits, financial assistance, etc. are not subject to contributions. Today, the following established tariff rates apply:

- 22% for the Pension Fund;

- 5.1% for FFOMS;

- 9% for Social Insurance Fund.

Postings (account assignments) are formed at the time to which calculations for social insurance and security relate. Typical entries for crediting insurance fees look like this:

| Type of transfers | Debit | Credit |

| Contributions to the Pension Fund | 20 (25, 26, 29, 44) | 69.2 |

| Payment to PFS | 20 (25, 26, 29, 44) | 69.1 |

| Charges to the Compulsory Medical Insurance Fund | 20 (25, 26, 29, 44) | 69.3 |

| Late fee | 91 | 69 |

| Fixed amounts transferred to funds | 69 | 51 |

What does the posting of payroll insurance premiums look like?

The amounts of accrued contributions to extra-budgetary funds should be reflected in the debit of the same accounting accounts that reflect the accrual of wages and other income to employees of your organization.

How wages are calculated, see the situation “Payroll Accounting” (section “Basic Salary”).

After accruing wages, immediately reflect the accrual of insurance premiums on the credit of subaccounts of account 69:

DEBIT 20 (23, 25, 26, 29, 44, ...) CREDIT 69-1-1

– contributions are calculated from employees’ wages and are subject to transfer to the Social Insurance Fund;

DEBIT 20 (23, 26, 26, 29, 44, ...) CREDIT 69-2

– contributions from employees’ wages have been calculated and are subject to transfer to the Pension Fund to finance the insurance part of the labor pension;

DEBIT 20 (23, 25, 26, 29, 44, ...) CREDIT 69-3

– contributions have been calculated from employees’ wages and are subject to transfer to the Federal Compulsory Health Insurance Fund.

If your organization carries out construction for its own needs or reconstructs fixed assets, then reflect the calculation of contributions from the wages of employees engaged in these works in correspondence with account 08 “Investments in non-current assets”:

DEBIT 08 CREDIT 69-1-1 (69-2, 69-3)

– insurance premiums are calculated from the wages of workers involved in the construction of fixed assets.

If your organization carries out work, the income from which is considered as other, then the amounts of accrued wages to employees engaged in such work are also subject to insurance contributions to extra-budgetary funds:

DEBIT 91-2 CREDIT 69-1-1

– insurance premiums are calculated to be paid to the Social Insurance Fund from the wages of employees employed in the process of receiving other income;

DEBIT 91-2 CREDIT 69-2

– contributions from employees’ wages have been calculated and are subject to transfer to the Pension Fund to finance the insurance part of the labor pension;

DEBIT 91-2 CREDIT 69-3

– contributions from employees’ wages have been calculated and are subject to transfer to the Federal Compulsory Health Insurance Fund;

Transfer of insurance contributions to extra-budgetary funds

During the year, you must pay mandatory contributions on a monthly basis.

The transfer of mandatory monthly payments to extra-budgetary funds should be taken into account in the debit of account 69:

DEBIT 69-1-1 CREDIT 51

– insurance contributions to the Social Insurance Fund are transferred;

DEBIT 69-2 CREDIT 51

– contributions were transferred to the Pension Fund of the Russian Federation to finance the insurance part of the labor pension;

Date added: 2015-01-13; ; Does the published material violate copyright? | Personal data protection |

Didn't find what you were looking for? Use the search:

Insurance for individual entrepreneurs

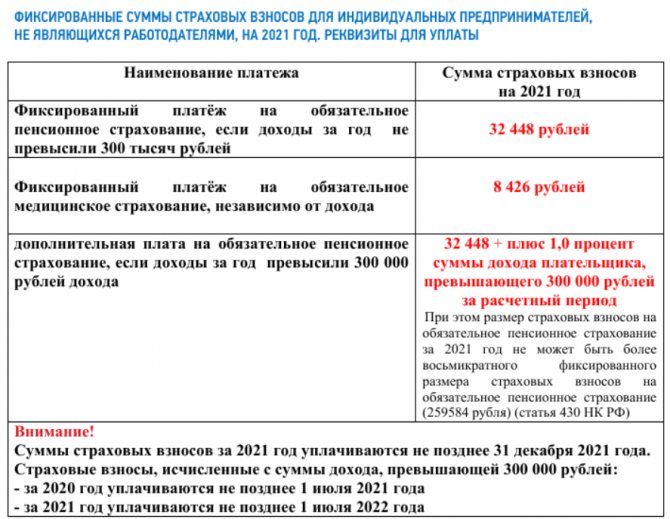

Insurance coverage for individual entrepreneurs (in relation to themselves) differs significantly from the norms provided for employers. So, for 2021, a businessman is obliged to transfer fixed payments to the budget:

- 32,448 rubles - for OPS;

- 8426 rubles - for compulsory medical insurance.

However, if his income exceeds 300,000 rubles per year, then from the excess amount he will have to additionally transfer 1% to the Federal Tax Service for compulsory pension insurance. More information about mandatory payments of individual entrepreneurs for themselves: Individual entrepreneurs: insurance premiums in 2021.

How to make postings? If the individual entrepreneur does not resort to hiring employees, then there is no need to reflect the accrual of insurance premiums. Small businesses are exempt from the obligation to maintain accounting records according to general rules. SMEs have the right to keep simplified, complete, or completely abandon accounting. Therefore, it is not necessary to reflect the SV with postings.

However, if the individual entrepreneur decided to conduct accounting according to generally accepted standards and consolidated such a decision in his accounting policy, then the accrual of fixed payments to the individual entrepreneur is reflected in the accounting using account 69 and the corresponding subaccount to it.

Postings for transfer of contributions

The responsibilities of employers include not only the timely calculation of contributions. It is also required to transfer the amounts received on time. The deadline for payment of insurance premiums is no later than the 15th day of the month following the accrual. Delay will entail penalties, and in some cases may lead to additional fines.

Payment of insurance premiums is made through the organization's current account. When the debt is repaid, the following entry appears in the accounting records:

Dt 69 - Kt 51 - insurance premiums are listed, posting uses the corresponding subaccounts.

Answers to pressing questions

Question No. 1 : To which accounts are social contributions calculated?

Answer : In accounting, insurance premiums are charged to the same expense accounts as salaries.

Question No. 2 : What should an accountant focus on when filling out settlement documents about the Pension Fund or Compulsory Medical Insurance Fund?

Answer : The procedure for filling out settlement documents for the transfer of fund contributions is stipulated by letter of the Pension Fund No. 30/187 dated 12/08/09.

Question No. 3 : What are the consequences of incorrectly filling out the KBK code in a payment order?

Answer : Insurance premiums are considered unpaid (Federal Law No. 212 of July 24, 2009, Article 18, Part 6, Clause 4).

Question No. 4 : When do you need to submit calculations when liquidating an individual entrepreneur or organization?

Answer : Calculations are submitted from the moment of filing an application for liquidation of an organization or termination of business activities by an individual (Federal Law 212, Article 15, Part 15). A calculation of the payment and accrual of insurance premiums from the beginning of the billing period is presented.

Question No. 5 : What is the current health insurance rate?

Answer : From January 1, 2012, a tariff of 5.1% was established (Federal Law No. 272 of October 16, 2010).

Question No. 6 : How can I change or supplement the calculation of insurance premiums with incomplete information?

Answer : In such circumstances, the payer must make the necessary changes or additions and submit the updated document to the regulatory authorities (Federal Law No. 212, Article 17).

Question No. 7 : What is the maximum contribution per employee for health insurance?

Answer : The maximum limit is 624 thousand rubles. in year. If the employee's annual income exceeds the specified limit, contributions from the excess amount are not paid.

Contributions listed: what kind of postings are made?

Insurance premiums are transferred monthly no later than the 15th day of the month following the month of accrual (Clause 5, Article 15 of Law No. 212-FZ). When transferring funds to pay contributions, indicate the subaccount number of the corresponding fund in debit, and account 51 in credit, which reflects the current accounts of the company. The posting for payment of contributions (using the example of a pension fund) is as follows: Dt 69.2 Kt 51. Postings are made similarly for other subaccounts of each fund.

Transfer of insurance premiums for each fund must be carried out in separate payment orders (Clause 8, Article 15 of Law No. 212-FZ). When paying contributions to funds, you need to pay special attention to the timing of their payment. For late payment of insurance premiums, organizations are charged penalties. Penalties are calculated for each day of late payment from the day following the payment due date (clause 3 of Article 25 of Law No. 212-FZ) until the day of payment inclusive. The amount of the penalty interest is taken at the rate of 1/300 of the Central Bank refinancing rate (clause 6 of Article 25 of Law No. 212-FZ). From 2021, the refinancing rate is equal to the key rate, and its value has become larger.

If the organization has not also provided a calculation of contributions to the relevant fund, then an additional fine will be issued. It will be 5% (clause 1 of Article 46 of Law No. 212-FZ) for each month of delay. It is calculated from the amount of accrued contributions for the last 3 months. The maximum fine is 30% of this amount, the minimum is 1,000 rubles.

The entry when calculating a fine or penalty will be Dt 91 Kt 69.1. Account 91 “Other income and expenses” is used here. True, there is another opinion that in this case you need to use account 99. The choice of account depends on the accounting procedure for such expenses adopted in accounting, which is enshrined in the accounting policy of the organization.

This material will help you figure out which account should be used to calculate penalties on contributions.

Accrued penalties and fines do not reduce taxable profit (clause 2 of Article 270 of the Tax Code of the Russian Federation).

For information on what sanctions and fines are provided for non-payment of contributions, see the material

When an accountant needs to calculate temporary disability benefits from the social insurance fund, they use the entry: Dt 69.1.1 Kt 70 (for regular sick leave) or Dt 69.1.2 (69.11) Kt 70 (for benefits due to an industrial injury).

Since 2011, the procedure for calculating this benefit has changed. The first 3 days are paid for by the organization, the rest - by the Social Insurance Fund. For the calculation, data on earnings for 2 years before the occurrence of the insured event is used. The benefit amount for a calendar month should not be less than the minimum wage (RUB 6,204 in 2021).

The amounts transferred to the Social Insurance Fund by the company can be reduced by payment costs:

- benefits for temporary disability at the expense of the Social Insurance Fund;

- vouchers for the treatment of workers employed in harmful or dangerous working conditions.

These employees are paid for travel at the expense of the Social Insurance Fund on the basis of subclause. 5 p. 1 art. 7 of Federal Law of December 3, 2012 No. 219-FZ. The organization pays for the vouchers and then reduces contributions to the Social Insurance Fund by this amount. In this case, payments should not exceed 20% of the amount of contributions for the past year.

All employers pay insurance contributions for pension, health and social insurance. Part of the contributions (pension, medical and social benefits in case of illness and maternity) is paid in different payments to the tax office. And only social contributions for social insurance against accidents and occupational diseases are still transferred to the Social Insurance Fund. In this article we will tell you how to calculate contributions, what transactions to create and take them into account in tax accounting.

Calculation of insurance premiums: postings, features

Insurance premiums in accounting are calculated monthly by employing organizations in the month to which the contributions relate. Insurance premiums from vacation pay are calculated along with them. According to the Labor Code of the Russian Federation, vacation pay must be issued to the employee no later than three days before the start of the vacation. This means that insurance premiums for the entire amount of vacation pay must be accrued simultaneously with vacation pay, even if the vacation began in one reporting period (billing period) and ended in another.

To account for insurance premiums, the chart of accounts has 69 accounts and subaccounts to it. Second-order subaccounts are opened for first-order subaccounts in order to separately allocate contributions for pension and health insurance, as well as contributions for illness and maternity and contributions for industrial accidents. Accrued contributions are reflected on the credit of these subaccounts in correspondence with the debit of the cost accounting accounts:

Debit 20 (25, 26, 44 ...) Credit 69 sub-account “OPS” - pension contributions have been accrued;

Debit 20 (25, 26, 44 ...) Credit 69 subaccount “Calculations for medical contributions” - contributions for medical insurance have been accrued;

Debit 20 (25, 26, 44 ...) Credit 69 subaccount “Calculations for contributions in case of temporary disability and maternity” - contributions in case of temporary disability and maternity have been accrued;

Debit 20 (25, 26, 44 ...) Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions from accidents and occupational diseases” - insurance premiums to the Social Insurance Fund of the Russian Federation for accidents at work have been accrued.

Reflection of payment of insurance premiums

Paid contributions are reflected in the debit of subaccounts of account 69 “Calculations for social insurance and security” and the credit of account 51 “Current account”:

Debit 69 sub-account “OPS” Credit 51 “Current account” - contributions to the insurance part of the pension have been paid;

Debit 69 subaccount “Calculations for medical contributions” Credit 51 “Current account” - medical contributions have been paid;

Debit 69 subaccount “Calculations for contributions in case of temporary disability and maternity” Credit 51 “Current account” - contributions in case of temporary disability and maternity have been paid;

Debit 69 “Settlements with the Social Insurance Fund for contributions from accidents and occupational diseases” Credit 51 “Current account” - insurance premiums were paid to the Social Insurance Fund of the Russian Federation for accidents at work.

Tax accounting of insurance premiums

If you work for OSNO, then expenses in the form of insurance contributions for compulsory pension, social and health insurance are taken into account as part of other expenses. The same applies to contributions accrued for payments that are not included in corporate income tax expenses.

If you work for the simplified tax system or UTII, insurance contributions reduce the tax base in the following cases:

- The individual entrepreneur applies the simplified tax system and/or UTII and does not make payments in favor of individuals;

- The company applies the simplified tax system on the basis of “income minus expenses”.

50% of insurance premiums

are accepted to reduce the amount of tax paid in connection with the application of the special regime in the following cases:

- simplified tax system at a rate of 6%,

- UTII.

Insurance premiums do not reduce the cost of a patent.

Payment orders for the transfer of insurance premiums

From March 31, 2014, when transferring current taxes and contributions, field 22 of the UIN is entered as 0. If field 22 is empty, the payment order at the bank will not be executed.

In field 101 of payments for contributions to both the Pension Fund and the Social Insurance Fund, status 08 is entered. In fields 106, 107, 108, 110, when paying insurance premiums, 0 is entered.

There is a special order in field 8 for IP, where the IP address is now indicated via //.

Particular attention should be paid to filling out the “KBK” field. Due to an error in this information, the payment may be returned back to the sender's bank account, or insurance premiums may be credited incorrectly or end up in outstanding payments. In these cases, the deadlines for payment of contributions may most likely be violated.

Fines and penalties for insurance premiums

According to Art. 25 of Law No. 212-FZ of July 24, 2009, if monthly payments for insurance premiums were transferred later than the established deadlines, regulatory agencies may charge the organization a penalty for each day of delay, at the rate of 1/300 of the refinancing rate.

Penalties for insurance premiums are not provided for by law, but the fines are quite significant. Your company may be fined for not registering with extra-budgetary funds on time or for submitting reports on insurance premiums late or in an unspecified form. This is not an exhaustive list of fines to a company that an extra-budgetary fund can impose.

Payment of insurance premiums in 2021

Insurance contributions to extra-budgetary funds are paid no later than the 15th day of the month following the month of accrual. If the payment date falls on a weekend or holiday, the due date is extended to the next working day. From January 1, 2015, calculation and payment of insurance premiums are made in rubles and kopecks (clause 5 and clause 7 of Article 15 of the Federal Law of July 24, 2009 No. 212-FZ).

We will not consider payroll calculations in detail, but will analyze the entries that are generated in accounting after the calculations are completed for each employee.

Stages of work on payroll accounting in an organization:

- payment of personal income tax and contributions.

To record all transactions related to wages, account 70 “Settlements with personnel for wages” is used. The credit of this account reflects accruals, the debit - personal income tax, other deductions and salary payments. Postings for payroll, deductions, personal income tax and insurance contributions are usually made on the last day of the month for which wages are accrued. Postings for salary payments and personal income tax and contributions are made on the day of the actual transfer (issue) of funds.