Features of returning money to the cash desk by an accountable person

Organizations (IP) can issue funds on account in two ways:

- transfer to an employee’s account or corporate card (letter of the Ministry of Finance of the Russian Federation dated October 5, 2012 No. 14-03-03/728);

- issuing cash (directive of the Bank of Russia “On the procedure for conducting cash transactions...” dated March 11, 2014 No. 3210-U).

If an employee has not used all the accountable money issued to him, he must return it within the time period established for this by the employer (clause 6.3 of instruction No. 3210-U).

The amount of the refunded amount is determined based on the results of verification and approval of the advance report on the amounts spent. Such a report must be drawn up no later than the number of working days approved by the organization from the expiration date for which the money was issued (clause 6.3 of instruction No. 3210-U).

ATTENTION! From November 30, 2020, the requirement to submit a report within 3 working days has been canceled.

From November 30, 2020, other changes to reporting and cash register came into effect. ConsultantPlus experts spoke in more detail about the innovations. Get trial access to the K+ system and go to the review material for free.

The issuance period is fixed in the application drawn up by the employee for the issuance of an advance, or in the employer’s administrative document on the issuance of money on account. From 08/19/2017 (instruction of the Bank of Russia dated 06/19/2017 No. 4416-U), the completion of an application by an employee is no longer a mandatory condition for the payment of accountable amounts. It can be carried out on the basis of an administrative document of the head of the legal entity (or individual entrepreneur).

You will find an example of such a document in ConsultantPlus. Trial access to the legal system is free.

IMPORTANT! Directive No. 3210-U applies its rules only to the rules for issuing and returning funds in cash. For non-cash payments for accountable amounts, its provisions do not apply, and an employer using this method must approve the procedure for settlements with accountables by an internal document.

Do not give out money from prohibited sources

You can issue money on account only from cash proceeds. The new rules for cash payments prohibit the issuance of money to accountants from other sources (Central Bank Directive No. 5348-U dated December 9, 2019). For example, due to borrowed funds received at the cash desk, and even due to returned accountable amounts. They must first be handed over to the bank.

Previously, returned accountable amounts could be given to another employee for reporting purposes and even as a salary. Now the advance returned by the accountant must be handed over to the bank. If you do not do this, you will violate the rules of cash payments (see letter of the Central Bank dated July 9, 2021 No. 29-1-1-OE/10561). Violation entails a fine of 40,000 to 50,000 rubles. under Part 1 of Article 15.1 of the Administrative Code.

It is allowed to issue loans only to microfinance and some other specialized organizations, for example, consumer cooperatives (clause 1 of the Guidelines).

Issue cash on account only from revenue. If it is not there, you need to withdraw money from your bank account. You can also switch to non-cash payments with subordinates.

Is it possible to return accountable funds to a current account?

Current legislation does not prohibit employees from returning accountable amounts to the employer’s bank account. However, in order to avoid disputes with tax authorities, it is necessary to establish in an internal regulatory document the possibility of reporting persons returning unspent funds to the company’s current account or to record such a return option in an application (order) for the issuance of advance amounts.

To identify the transfer, the employee making the transfer must indicate in the payment purpose that he is returning the accountable amounts.

And yet, the optimal way to return accountable funds, eliminating any disagreements with controllers, is to the enterprise’s cash desk.

The transfer fee

When returning a transfer report, a fee may apply. Its reimbursement or acceptance as expenses of the joint-stock company depends on what is stated in the collective agreement (act) of the company. This document establishes the procedure for reimbursement of travel and other expenses related to the activities of the enterprise by wire transfer.

If the management of the organization has not recorded in the act the possibility of returning the balance of the account using Internet banking, incl. refund of the commission for such transactions, then no one is obliged to return these funds to the employee.

In the collective agreement (act), the manager establishes:

- amounts, types of reimbursable expenses;

- options for transferring advances;

- a list of documents that can be submitted to confirm expenses;

- the procedure for reimbursement of the commission charged by a financial credit organization for non-cash transfer of an advance to the current account (c/c) of the company.

The local act establishes the procedure for reimbursing employees for all types of expenses that are carried out at the direction of the employer. Possible reimbursement of commissions when returning advance funds through Internet banking is pre-agreed and must be documented.

According to Art. No. 264/1/49 of the Tax Code of the Russian Federation, the employing company has the right to take into account commissions of a banking institution charged for non-cash transfers in tax payments from income and other expenses that are associated with the activities of the enterprise (for example, production, sales of products).

How is the amount of return of funds taken into account reflected in accounting?

The company, having received accountable amounts from the employee, reflects the following entries in accounting:

- Dt 50 Kt 71 - return of cash to the cash desk;

- Dt 51 Kt 71 - return of accountable amounts to the ruble bank account of the enterprise;

- Dt 52 Kt 71 - return of the sub-report to the company’s foreign currency account;

- Dt 94 Kt 71 - reflection of the debt of the accountable in case of non-repayment of the amounts issued by him.

For information on what to do if an employee does not have enough accountable funds, read the article “ What to do if an accountable person has spent his money? "

Money in customs - what happens to unused funds?

In order to understand how unspent money remains in customs accounts, let’s remember how it gets there. The bulk of funds comes directly from foreign trade participants. These may be advance payments intended to pay future duties, taxes, special fees, as well as cash deposits that act as security. In cases where importers ignore notifications sent to them about the need to repay debts on duties and taxes or violate payment deadlines, customs authorities enforce the collection of the necessary amounts. Unused balances arise for various reasons, for example: - the amount transferred to pay customs duties turned out to be more than necessary, since money is usually transferred in advance and currency exchange rate fluctuations make their own adjustments; — funds were constantly deposited into advance accounts due to the cyclical nature of import supplies, which suddenly stopped; — adjustment of the HS code by an inspector, for example, based on new decisions on classification by the EAEU Commission, as a result of which the amount of customs duties became smaller; - the decision on which the customs carried out the recovery was canceled, and the court decided to return the money to the foreign trade participant, etc. If we consider the unspent funds of the importer located in the customs accounts from the point of view of the issue of return, they can be divided into three categories: - overpaid or overcharged amounts; — cash collateral; — other funds (we will tell you more about them below). Let us remind you that on September 4, 2018, the new law “On Customs Regulation” in the Russian Federation No. 289-FZ came into force, the text of which implies significant changes in the rules for the return of funds. The provisions of the articles regulating this issue will come into force after amendments are made to the Treaty on the EAEU Union, regarding the procedure for distributing payment amounts between the member countries of the union. Refund of overpaid or overcharged funds Previously, the refund of the specified amounts was made at the request of the payer to the account specified in this application, with a package of documents attached. At the same time, a participant in foreign trade activities could find out about the fact of an overpayment a month after the discovery of unspent money by customs officers. According to the new federal law (Article 67), surpluses in accounts are identified during post-customs control (after the release of goods). Their presence is confirmed by documents such as an adjustment to the declaration of goods, an adjustment to a customs receipt order (payment) and other documents confirming that the foreign trade participant has paid more than what was required of him. These documents must necessarily contain notes from customs officers, especially regarding the registration date. From this point on, customs authorities have three working days to credit the detected surplus to the advance payment account. The funds are returned either to the payer or to the person from whom they were collected. The issue of the payer deserves special mention in this matter. This may be a declarant or another person who has an obligation to pay duties and taxes (Article 50 of the EAEU Labor Code). The customs broker can make these payments if the conditions of the selected customs procedure and the agreement signed with the owner of the cargo allow it. He is jointly and severally liable with the declarant in the event of a recovery. However, according to the explanations of the Federal Customs Service of Russia, the customs representative does not have the “status” of the payer, therefore, in the event of a refund, the money will be transferred to the declarant’s advance account, but only with the written consent of the broker. Within a day after the transfer, customs officers are required to inform the payer about the offset of funds by an electronic document sent to the personal account of the foreign trade participant. In case of written declaration, this period increases to 5 working days. If the surplus in the accounts was formed as a result of a collection that was subsequently cancelled, interest is charged on this amount in the amount of 1/360 of the key rate of the Central Bank of the Russian Federation, starting from the day of collection until the day of return. Within 10 days after the principal amount of the collection is offset against advance payments, customs officers inform the payer about the amount of accumulated interest. They, at the request of the interested party, are transferred either to an advance account or to any other bank account. If the collected amount was used as collateral (for example, during transit), no interest is charged. The return of funds accumulated in advance accounts is carried out on the basis of the payer’s application, executed electronically or in writing, to the account selected by the foreign trade participant. The application is supported by a package of documents, the list of which is specified in Article 36 289-FZ, and must be submitted no later than 3 years from the date of the last use of the amounts on advance. The form of the document is enshrined in the order of the Federal Customs Service No. 2520 dated December 22, 2010. Return of a cash deposit According to Article 5 289-FZ, a cash deposit is funds contributed to ensure the fulfillment of the obligation to pay duties, taxes, as well as other obligations of a legal entity participating in foreign trade activities. The return of the deposit to the advance account is carried out by the customs authorities within 5 working days from the date of occurrence of circumstances in which the presence of this monetary guarantee is no longer required for the foreign trade participant (for example, other security has been provided), but only if this deposit must be used for payments. If no obligation to pay duties and taxes has arisen, these funds are transferred to advance payments at the request of the payer, which must be submitted within 3 years from the day the deposit was paid. If we are talking about a pledge-general security, then it is transferred to the account of advance payments only at the request of a foreign trade participant, and only if the importer or customs office has not reserved the funds necessary to carry out one or another customs operation for this security. The application period is 3 years from the date of the last reservation or from the date of payment of the deposit, if it has not been used during this entire period. Other funds This category includes amounts that accumulate on the accounts of a foreign trade participant in the process of activity, for example: - funds transferred to accounts, but not identified for customs authorities - as what payments and for what goods can they be used for customs clearance? registration; - money previously paid as payment of duties and taxes and returned back in connection with the refusal to issue, revocation or cancellation of the declaration; - funds arising during the implementation of customs procedures for re-import or re-export; — surplus money accumulated in accounts from amounts paid as payments during periodic customs declarations. Some of these funds are already in the advance account, the rest are returned to this account by customs within three days from the moment, for example, the declaration was canceled or the importer submitted a full declaration during the periodic declaration, and so on. The features of the process for each type of monetary amount are described in detail in art. 68 289-FZ. As we can see, the main points in the process of returning unused funds are two points: timely contacting the customs authorities and competent collection of the package of documents necessary for the return. Our company’s specialists have extensive experience in working with the return of collateral paid as collateral and will help carry out this process as quickly as possible for the foreign trade participant.

How to return funds from the account if an employee no longer works for you

If the current employee does not return the accountables, you will find recommendations for further actions in ConsultantPlus. Get trial access to the system for free and go to the Ready-made solution.

In a situation where the employee did not return the accountable money and quit, you can do the following:

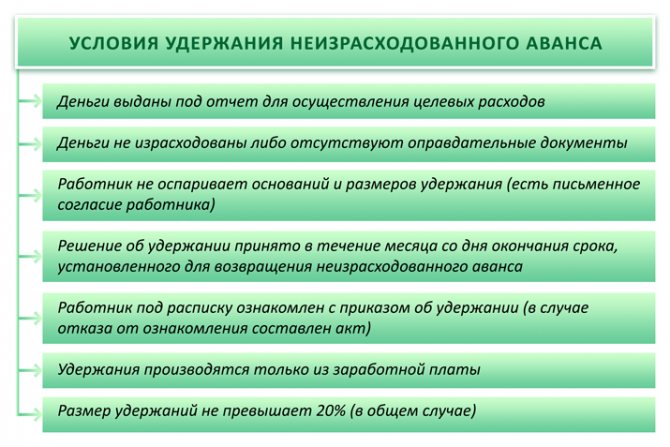

- If the employee has not yet been paid, then the debt can be withheld from his salary, subject to the decision of the manager and the consent of the employee. In this case, the withholding should not exceed 20% of the salary (Article 138 of the Labor Code of the Russian Federation).

- If all settlements with the employee are terminated or he does not agree with the amount of withheld amounts, the debt can only be collected through legal proceedings.

To find out whether it is possible to delay the payment of funds due to an employee upon dismissal if he has not returned the accountable amounts, read the material “What payments are due to an employee upon dismissal”.

Personal income tax and contributions from accountable amounts without an advance report

If the trustees discover that the accountable person has not reported on the accountable amounts, you will have to pay additional personal income tax and insurance premiums.

There will also be a fine - 20% of the arrears.

Even the Armed Forces of the Russian Federation will not help (see Determination of February 3, 2021 No. 310-ES19-28047).

In addition, if the bank requests advance reports and there are none, it may block your Bank-Client system, as it will suspect prohibited transactions.

Therefore, if advance reports of accountable persons are not received on time, it is better to play it safe. Within a month after the expiration of the refund period, issue an order to withhold money, familiarize the employee with it and obtain his consent to return.

General information

The employee must be officially notified of the formation of receivables and their amount. The defendant can either agree with the verdict presented or try to refute it.

The balance of unused accountable amounts is returned no later than 3 days from the end of the period established for the return of the advance on account (according to UBR No. 3210-U, clause 6.3). This rule only applies to cash refunds. For non-cash payments, the head of the institution is obliged to establish a settlement procedure with accountable persons independently. In addition, both processes are recorded in the regulatory documents of the enterprise.

The money received from the responsible employee is reflected in the accounting records in the following entries:

- Debit account 50, credit account 71 - return of funds to the institution's cash desk.

- Debit 52, credit 71 – return in excess of issued finances to the organization’s foreign currency account.

- Debit 94, credit 71 – a record of the debt of the accountable person in the event of non-repayment of unspent funds.

- Debit account 51, credit account 71 – return of the excess amount issued to the company’s bank account.

Issuing an advance for a business trip

The procedure for issuing funds from the cash desk of an enterprise is determined by the Regulations on the procedure for conducting cash transactions, which was approved by the Bank of Russia No. 373-P dated October 12, 2011 (hereinafter referred to as the Regulations).

The advance is issued from the following funds:

- Receipts to the organization's cash desk for the sale of goods (Services, works).

- Received from the current account.

An advance is not issued from money received from citizens for payment in favor of third parties (for example, under an agency agreement in payment for communication services).

Important! A person who has no debt on previously received advances can receive money for a business trip on account.

Travel allowances are issued on the following grounds:

- If there is an order drawn up in form T-9 (collective form T-9a).

- Statements from the employee regarding the amount of the advance and the period of issue with the director’s visa.

Money is issued according to a cash receipt order, which is issued in one copy. In the “consumables”, the employee must write down the amount of money received by hand (rubles are written in words, and kopecks in numbers, for example, five thousand rubles 38 kopecks), and then sign the receipt. The money must be counted in the presence of the cashier, otherwise claims for missing amounts will not be accepted.

The amount is credited to the resigned employee

If an employee who did not return the accountable amounts was fired, then after the expiration of the statute of limitations, the organization may recognize his debt as uncollectible and write off as expenses in the amount in which it was reflected in the organization’s accounting records (clause 14.3 of PBU 10/99 ).

Debt with an expired statute of limitations must be written off:

- or through the reserve for doubtful debts (if the organization created such a reserve). In this case, a posting is made to the debit of account 63 and the credit of account 71;

- or on the financial results of the organization’s activities with an accounting entry on the debit of account 91 and the credit of accounts 71.

Then such debt is subject to reflection on the balance sheet in account 007 “Debt of insolvent debtors written off at a loss” within five years from the date of write-off (clause 77 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n).

Please note that the limitation period for accountable amounts that the employee has not returned begins to count at the end of the period for which the money was issued. This follows from paragraph 2 of Article 200 of the Civil Code. The limitation period is three years (Article 196 of the Civil Code of the Russian Federation). If there are grounds for interrupting the limitation period, the said period begins to count anew (Article 203 of the Civil Code of the Russian Federation).

Example 3

Yarilo LLC issued 3,000 rubles for reporting on May 18, 2011 to office manager Shorkina. for the purchase of household equipment. Let us recall that, according to the order of the head, in the specified organization, cash on account for the named purposes is issued for a period equal to 21 calendar days, starting from the day of issue.

May 25 M.A. Shorkina quit, did not report on the accountable amounts, and did not return the funds to the company’s cash desk.

Yarilo LLC began to count the limitation period for accountable amounts that the employee did not return at the end of the period for which the money was issued - from June 8, 2011.

On June 8, 2014, Yarilo LLC will finish counting the limitation period if there are no reasons for its interruption.

Establishing deadlines for which cash can be issued on account

Figure 1. ORDER FOR APPROVAL OF DEADLINES FOR ISSUING CASH ON ACCORDANCE

| Limited Liability Company "Yarilo" ORDER No. 4 On approval of the terms for which they can be issued cash on account Yaroslavl 01/11/2011 For the purpose of carrying out business expenses by employees of the enterprise I ORDER: Approve for 2011 the following terms for which cash can be issued on account: Purpose of issuing money | Deadlines in calendar days |

| Purchase of household equipment | 21 days from the date of issue |

| Purchasing office supplies | 7 days from the date of issue |

| Payment for minor repairs of office equipment | 28 days from the date of issue |

| Payment of postal and telegraph expenses | 7 days from the date of issue |

General Director A.A. Veselov Veselov

In addition to the order on employees who have the right to receive money on account, it makes sense for the head of the enterprise to issue an order approving the deadlines for which cash can be issued on account. After all, it is possible that one of the accountable persons will delay reporting on the amounts spent and making the final payment for them. And if the employee has not reported on the previously received advance, then, according to the above-mentioned paragraph 11 of the Procedure, he cannot receive the next amount of cash on account. This order helps organize work with cash and discipline the workforce.

Please note that the time period for which an employee can be given cash on account is determined by the head of the enterprise at his own discretion. There are no restrictions in the legislation.

Establishing the period for which employees are given accountable money is the right, and not the responsibility, of the head of the enterprise. However, if the specified period of time is not determined, then the employee must report on the day the accountable amounts are received. This follows from the letter of the Federal Tax Service of Russia dated January 24, 2005 No. 04-1-02/704.

Example 1

The head of JSC "Perun" did not establish the period for which the company's employees are given cash for business expenses.

On May 12, 2011, office manager of Perun CJSC V.P. Lastochkina received money to buy stationery. On the same day, she is obliged to complete the task, submit an advance report and return the unspent balance of accountable money to the cashier.

For organizations that do not review during the year the deadlines for which cash can be issued on account for business expenses, it is advisable to specify these deadlines in their accounting policies.

Return deadlines

As already written above, the employee must report for receiving the accountable funds no later than three days after the period for which this money was issued expires. To do this, he must provide the chief accountant and the accountant with a report (and if they are not there, then the manager) an advance report with documents confirming the expenses. From what date this period should be accounted for depends primarily on the specific purposes for which the accountable money was provided.

- If the funds were provided for reporting to the household. needs, then he is obliged to pay for them within three days from the end of the period for which he was provided with money.

- If the funds were provided for reporting on travel expenses, then he will have to report within three working days after returning from the business trip.

The process of checking the expense report, as well as its approval by the management, and in addition the full payment for it, is carried out within the time limit set by the manager himself. This means that the employee must return this amount within a period determined and established by the manager himself.

Accountable person's responsibility

According to the current labor code (clause 2 of article 243), the employee must bear financial responsibility for accountable funds and, in particular, for unspent residual money. If a shortage or non-return of money to the cash desk is detected:

- The company's accountant must admit the fact of the shortage;

- The employee ceases to be a responsible, accountable person.

After a shortage is discovered in the organization, an inspection must be carried out and the reasons for its occurrence must be clarified. The employee himself must provide an explanation in writing regarding the non-refund of the remaining funds. If for some reason the accountable person refuses to explain the shortage that has occurred, then, in accordance with Article 247 of the Labor Code, a special act is drawn up.

Management should be aware that the return of unspent accountable funds is described by the corresponding entries. This is necessary in order to avoid troubles from the tax office. In addition, it is worth remembering that an employee’s statement may be the basis for withholding funds from the employee’s salary. If this document is not available, then the management of the organization does not have the right to withhold funds from wages. Otherwise, the organization itself may be punished for this.

Distinctive features of the return

There are several different options available:

- Standard cash refund;

- Return to ruble or foreign currency accounts;

- A refund to the company's bank account is possible.

In order for the latter to become possible, it is necessary to make an advising entry in the regulatory documents stating that the return of funds to the current account is acceptable. In addition, the authorized employee is obliged to indicate the return of accountable funds as the purpose of payment when transferring. This will save you from unwanted difficulties with the tax office.

Situations are also possible when the accountable person simply resigns at the same time, forgetting (or deliberately) to return the funds to the company’s cash desk. If settlement with this employee has not yet been made, you can withhold part of the money from his salary. But this procedure must be specified:

- As with the employee himself;

- And so with the consent of management.

Only after this is a deduction possible. The employee’s consent to the transaction must be recorded in a statement drawn up by the reporting employee. This statement will have legal force from the moment of its preparation. It is during this period that the manager must finally make a decision on withholding funds from the employee. If the decision was not made within the prescribed period, then it will be possible to recover the unreturned funds only through the court.

The process of withholding money must be reflected in accounting using entry D 70 K 71. But the amount written off cannot exceed 20 percent of the employee’s salary. Otherwise, this contradicts Article 137 of the Labor Code.

If the accountable person quit and has already received payment, then it will be possible to demand the return of the accountable amounts to the cash desk only through the court. The same applies if the employee does not agree with the amount of deduction.

Determining the amount of advance for a business trip

The amount of the advance is determined independently by the organization, taking into account the duration of the business trip, the norms of expenses for renting housing, daily expenses, as well as the cost of travel to the destination and back. The amount of daily allowance and standards must be specified in a collective agreement or in the local regulations of the organization.

Currently, the daily allowance is set at 700 rubles for trips within Russia and 2,500 rubles for trips abroad. Please note that the organization has the right to set the amount either less or more than the established amounts. The question is about additional taxes on daily allowances, so if these amounts are exceeded, income tax will be charged to the employee.

What happens if the daily allowance is less than 700 rubles? Daily allowances can be set in a smaller amount; the organization has such a right. The established norms do not oblige them to be adhered to; the established value affects taxation. However, you should take a reasonable approach to determining the amount of daily allowance, because an employee leaves on a train to perform the organization’s tasks, and not of his own free will, and setting small amounts means that he will have to spend his personal money on food, travel, etc.

Read more about how to send an employee on a business trip under the new rules here.