Accounting under the simplified tax system

Accounting in organizations using the simplified tax system is mandatory.

Most often, they belong to small businesses (SMB), and have the right to carry out accounting in a simplified form. In addition, they keep books of income and expenses, which for this taxation system are tax registers. Read about the nuances of accounting under the simplified tax system in the article “Procedure for maintaining accounting under the simplified tax system (2020)”

An accounting register, which is an attribute of both complete ordinary and complete simplified accounting, is understood as a document in which all transactions are systematized by accounts and recorded in chronological order. For example, in account 51, a register is needed so that it can be seen for what purposes the funds were used.

The register forms are approved by the director of the company (Clause 5, Article 10 of Law No. 402-FZ).

The information summarized in the registers is transferred to the turnover sheet, and then to the financial statements. To record information in full simplified accounting, simplified accounting forms can be used - statement forms (Appendices 2–11 to Order of the Ministry of Finance dated December 21, 1998 No. 64n).

When using abbreviated or simple simplified accounting, instead of registers, they use a book for recording the facts of economic activity (Appendix 1 to the order of the Ministry of Finance dated December 21, 1998 No. 64n), and to record wages - form B-8 (Appendix 8 to the order of the Ministry of Finance dated December 21, 1998 No. 64n).

The report on the simplified tax system is prepared in a declaration in the form approved by order of the Federal Tax Service of Russia dated February 26, 2016 N ММВ-7-3/ [email protected]

For information about when you need to submit a “simplified” declaration, read the article “What are the deadlines for submitting a declaration under the simplified tax system?” .

For the declaration form and a sample of how to fill it out, see the article “Declaration under the simplified tax system for the year - how to fill it out?”

Before calculating tax in an accounting program, it is important to calculate it correctly. ConsultantPlus experts explained in detail how to do this. Full trial access to K+ is available for free. If you apply the simplified tax system “income”, this ready-made solution will help you, and if “income minus expenses” - then this material is for you.

The role of the simplified tax system in enterprise accounting

Businesses are generally required to maintain accounting and tax records. When using the simplified tax system in activities, the reporting procedure is somewhat simplified. Guided by specific regulations, individual entrepreneurs and simplified organizations may not keep accounting records at all. Law No. 129-FZ of 1996 speaks about this.

However, commercial units are not exempt from preparing primary documentation. In practice, this means that it is mandatory to keep records of intangible assets and fixed assets. Accounting is necessary solely to determine the possibility of applying the simplified tax system. That is, the right to use this regime is lost as soon as the amount of fixed assets and assets exceeds a total of 100 million rubles. Accounting also becomes mandatory in the case of combining regimes, for example, UTII and “simplified”.

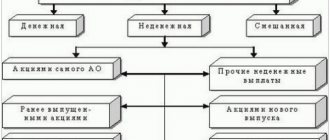

Depending on the chosen tax payment scheme by the base, the following may happen:

- profit - income;

- profit – income minus expenses.

When taxing income, profit is considered to be:

- revenue from the sale of goods or services;

- non-operating income.

Revenue recognition for tax purposes is carried out on a cash basis in some cases. Receipt of money into the cash register is recorded according to KUDiR. Certain types of profit are not taken into account (Article 251 of the Tax Code).

Not considered profit (for tax purposes):

- contributions to the authorized capital;

- pledge (deposit) in monetary or property form;

- earthly means;

- the value of property received for sale under an intermediary agreement.

When using the “income minus expenses” scheme, it is necessary to take into account material expenses. It is most often done by valuing the purchased item at unit price, average price, or first purchase (FIFO).

Costs in this case:

- salary;

- depreciation of fixed assets;

- material needs;

- social needs and so on.

Accounts used in transactions for calculating tax under the simplified tax system

The reliability of the compiled balance sheet depends on the correctness of the reflection of the company’s economic activities in the accounting documents. This is ensured by accounting entries accompanying each financial transaction. Each fact of the company’s economic life must be recorded in its own way. This will create a perfect balance.

To organize using the simplified tax system, you need to correctly reflect costs and income in accounting. To generate transactions for the accrual and payment of income tax (for both options), the following accounts are used:

- account 51 - all transactions on receipt and debit of funds are recorded on it;

- account 68 - accrue income tax, including quarterly advances on it; records for other taxes are also made here;

- account 99 - reflects the amount of accrued simplified tax.

When calculating the simplified tax system, the following posting is used:

Dt 99 Kt 68.

Balance and registers

An enterprise, regardless of the chosen taxation system, draws up a balance sheet in accordance with standard double-entry accounting rules (Article 10 of Law No. 402-FZ).

To have this opportunity, companies register each transaction in the accounting register, including in the form of a transaction for calculating tax according to the simplified tax system on income or income minus expenses. In order to begin applying the simplification, the company must decide on the object of taxation. This could be income or the difference between income and expenses. Before starting to use such a system, the company must submit a corresponding notification to the inspectorate (Article 346.13 of the Tax Code of the Russian Federation).

The tax has been calculated according to the simplified tax system - we make the posting

Upon completion of each business transaction, the accountant reflects this fact with an accounting entry. The accounts used depend on the chart of accounts adopted by the company.

To keep records of various taxes, subaccounts are allocated in account 68. Their list must be specified in the accounting policy, guided by clause 4 of PBU 1/2008.

Account 68 can be divided into several sub-accounts, for example:

68.1 - calculations for the simplified tax system;

68.2 - calculations for personal income tax, etc.

A situation is possible when, at the end of the year, the total income tax turns out to be either more than the actual tax amount or less. In the first case, the tax amount must be added, in the second, it must be reduced. The wiring is as follows:

- simplified tax system accrued (posting for advance tax payment) - Dt 99–Kt 68.1;

- tax advance is transferred - Dt 68.1 - Kt 51;

- for the year, additional tax was accrued to the simplified tax system - posting Dt 99 - Kt 68.1;

- the tax according to the simplified tax system for the year was reduced (the excessively accrued advance was reversed) - reversal Dt 99 Kt 68.1.

The total amount of tax accrued for the year according to the declaration must be equal to the amount reflected in the accruals for the same period in accounts 99 and 68.1. If more advances are transferred than the tax accrued for the year, then the overpayment amount can be returned.

For information on how to write an application for a refund of overpaid tax, read the article “Sample application for a refund of overpaid tax .

How an LLC uses the simplified tax system to keep records of income and expenses, as well as what kind of reporting to submit, read in the Typical situation from ConsultantPlus. And if you are close to losing the right to use the simplified tax system, find out how the limits will change from 2021 by studying the explanations of ConsultantPlus experts. If you do not have access to the K+ system, get a trial online access for free.

The procedure for calculating and paying the simplified tax system

Advance periods for the simplified tax system are 3 months, half a year and 9 months, which are reporting periods. The tax period is a calendar year. In this regard, tax is calculated 4 times a year, at the end of each quarter, and also within 3 months after the end of the year. The tax is transferred for the entire period along with the submission of a declaration to the Federal Tax Service, which reflects the amount of advance payments made and the remaining amount of annual tax to be paid.

If the simplified tax system is applied, the company’s “income” from the beginning of the year sums up the income received by the company from sales, as well as non-operating income. The following sum can be subtracted from the resulting value:

- actually transferred contributions to the Pension Fund, Compulsory Medical Insurance Fund and Social Insurance Fund;

- sick leave benefits paid to employees;

- contributions under compulsory insurance contracts.

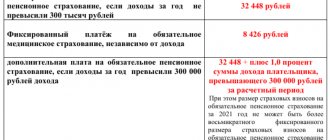

When reducing tax, remember that after all calculations, the tax cannot be reduced by more than 50%. The only exceptions are entrepreneurs without employees, who have the right to reduce the calculated tax by the entire amount of insurance premiums paid. That is, the 50% limit does not apply to them.

from the beginning of the year, all income is summed up, after which expenses are subtracted from them (according to Article 346.16 of the Tax Code of the Russian Federation). For the income minus expenses scheme, there is a certain procedure for confirming transactions, which must be followed.

Results

Reflection in accounting of accrued tax under the simplified tax system is reflected in synthetic accounts 99 and 68. To maintain analytical accounting for synthetic accounts 68, 99, separate sub-accounts are opened, which must be indicated in the working chart of accounts and approved by the head of the organization (clause 4 of PBU 1/2008 ).

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How is the minimum tax applied under the simplified tax system?

When calculating the amount payable to the Federal Tax Service using the simplified taxation system, they check with Article 346.16 of the Tax Code of the Russian Federation. It lists the categories of expenses that are officially included in the expenditure portion.

Such enterprises should receive two calculation results:

- at a standard rate of 5–15%;

- for the minimum simplified value equal to 1%.

This is done to understand which option will satisfy the Tax Service. If the amount calculated using the standard value is greater, they pay a 15% rate. Otherwise, the minimum state fee is paid. This means that all operating companies or individual entrepreneurs, regardless of the success of the business, regularly transfer money to the state budget.

Until the annual report is prepared, it is difficult to understand in which direction tax calculations will go - standard or based on a one-percent rate. As a result, the year is divided into equal time intervals, in each of which an amount calculated at a 5–15% rate is transferred to the Federal Tax Service account. When a company is experiencing difficulties and is not making much profit or is operating at a loss, it results in an overpayment. This money can be returned in the future.

It is not profitable to delay payments. In any case, you will have to pay, and by this time the amount paid will increase in size due to accrued penalties or fines.

Under the simplified tax system at the standard rate, the tax must be paid:

- for legal entities - no later than March 31;

- for individual entrepreneurs – until April 30.

If the amount paid in advance exceeds the estimated value of the tax payment, the excess is carried over to the next reporting period. You can write a statement and get your money back. However, they cannot be returned while there is a debt to the state. This is done only after submitting the declaration and paying the minimum tax possible under the simplified tax system.