Description of the account “Retirement of fixed assets”

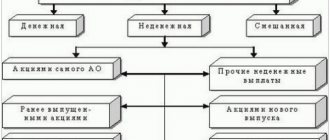

Fixed assets can be written off from the property of the enterprise as a result of: write-off of a product due to the impossibility of its further operation; sales to other businesses; gratuitous transfer; transfers to the account of the authorized capital of any company; when putting an asset for temporary use or leasing, as well as when implementing an exchange agreement, and so on.

The price value of OC property that is written off or is not capable of generating income for the organization in future periods is subject to write-off.

Postings to account “01.09”

By debit

| Debit | Credit | Content | Document |

| 01.09 | 01.01 | Write-off of the initial cost of an item of fixed assets upon write-off (liquidation) | Decommissioning of OS |

| 01.09 | 01.01 | Write-off of the initial cost of an item of fixed assets upon transfer (sale) | OS transfer |

By loan

| Debit | Credit | Content | Document |

| 02.01 | 01.09 | Write-off of the amount of accrued depreciation on a fixed asset upon transfer (sale), if the transaction for the transfer of a fixed asset is subject to state registration | Preparing for OS transfer |

| 02.01 | 01.09 | Write-off of the amount of accrued depreciation on a fixed asset item upon write-off (liquidation) | Decommissioning of OS |

| 02.01 | 01.09 | Write-off of the amount of accrued depreciation on a fixed asset upon transfer (sale) | OS transfer |

| 76.02 | 01.09 | Write-off of fixed assets at residual value, seized by decision of judicial authorities through arrest, seizure, confiscation, nationalization, etc. (in accordance with Articles 235, 237, 243 of the Civil Code of the Russian Federation) | Operation |

| 91.02 | 01.09 | Write-off of the residual value of transferred (sold) fixed assets | OS transfer |

| 91.02 | 01.09 | Transfer of fixed assets (equipment) free of charge | Operation |

| 91.02 | 01.09 | Write-off (liquidation) of fixed assets as a result of natural disasters, fires and other emergency circumstances | Decommissioning of OS |

| 91.02 | 01.09 | Write-off of the residual value of written-off (liquidated) fixed assets | Decommissioning of OS |

| 91.02 | 01.09 | Write-off of the residual value of transferred (sold) fixed assets, if the transaction for the transfer of fixed assets is subject to state registration | Preparing for OS transfer |

| 94 | 01.09 | Shortage of fixed assets | Decommissioning of OS |

Sale of fixed assets. Accounting and tax accounting

General procedure for accounting for fixed assets

| PBU 6/01 approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n |

A fixed asset is considered to be property whose service life is more than one year. In accounting, such property is reflected in the manner established by the Accounting Regulations “Accounting for Fixed Assets” (PBU 6/01). The initial cost of fixed assets, at which they are reflected in accounting, includes the costs of their purchase or creation. During the useful life of a fixed asset, depreciation is charged on it. The company sets this deadline independently. The approximate useful life of fixed assets is approved by Decree of the Government of the Russian Federation of January 1, 2002 No. 1. This document establishes the procedure for calculating depreciation, which is taken into account when taxing profits. However, as the Russian Ministry of Finance explained, this document can also be used when calculating depreciation for accounting purposes (letter of the Russian Ministry of Finance dated March 20, 2002 No. 16-00-14/98).

| The company sets its own useful life |

Please note: the useful life of fixed assets purchased before January 1, 2002 cannot be changed.

True, there are exceptions to this rule. For fixed assets that have been modernized or reconstructed, the useful life may be increased (letter of the Ministry of Finance of Russia dated March 6, 2002 No. 16-00-14/80). Thus, if you buy fixed assets in 2002, then it is best for you to charge depreciation on them using the straight-line method based on their useful life specified in the mentioned resolution. In this situation, the amount of depreciation in accounting and tax accounting will not differ. For fixed assets purchased before this date, the procedure for calculating depreciation in accounting will not change. Therefore, in most cases, depreciation for such fixed assets for accounting purposes and for tax purposes will be calculated differently. Sale of fixed assets

When selling a fixed asset, you need to write off its original cost and the amount of depreciation accrued on it from the balance sheet. This is reflected in accounting by the entries: Debit 91-2 Credit 01

— the original cost of the sold fixed asset is written off;

Debit 02 Credit 91-1

- the amount of depreciation accrued on the sold fixed asset is written off.

Reflect the proceeds from the sale of a fixed asset by posting: Debit 76 Credit 91-1

- the proceeds from the sale of a fixed asset have been accrued.

Proceeds from the sale of fixed assets are subject to VAT. Accrue this tax by posting: Debit 91-2 Credit 68 subaccount “VAT Calculations”

- VAT accrued.

| Expenses for writing off fixed assets are accounted for in account 91 |

All expenses for the disposal of fixed assets (for example, wages of workers involved in dismantling the fixed asset, the cost of materials used for dismantling, etc.) are written off to account 91 “Other income and expenses” subaccount 2 “Other expenses”: Debit 91 -2 Credit 10 (20, 23, 29...)

- expenses for disposal of fixed assets are written off. To record transactions for writing off fixed assets to account 01 “Fixed assets”, you can open an additional subaccount “Retirement of fixed assets”. This is necessary in situations where the process of disposal of property lasts a long time (for example, if production equipment is dismantled before it is transferred to the buyer). The debit of the subaccount “Disposal of fixed assets” reflects the original cost of the property, and the credit shows the amount of accrued depreciation. After disposal of a fixed asset, its residual value is written off to account 91 subaccount 2 “Other expenses”.

Example 1. Aktiv LLC sold a machine for 600,000 rubles. (including VAT - 100,000 rubles). The initial cost of the machine is 700,000 rubles. The amount of depreciation accrued on it is 250,000 rubles. The cost of dismantling the machine amounted to 15,000 rubles. The Asset accountant must make entries: Debit 76 Credit 91-1

— 600,000 rub.

— revenue from the sale of the machine is reflected; Debit 51 Credit 76

- 600,000 rub.

— money has been received from the buyer; Debit 91-2 Credit 68 subaccount “VAT calculations”

- 100,000 rubles.

— VAT charged; Debit 01 subaccount “Disposal of fixed assets” Credit 01

- 700,000 rub.

— the original cost of the machine has been written off; Debit 02 Credit 01 subaccount “Disposal of fixed assets”

- 250,000 rubles.

— the amount of depreciation accrued on the machine is written off; Debit 91-2 Credit 01 subaccount “Disposal of fixed assets”

- 450,000 rubles.

(700,000 - 250,000) - the residual value of the machine is written off; Debit 91-2 Credit 10 (20, 23...)

- 15,000 rubles.

— expenses for dismantling the machine were written off; Debit 91-9 Credit 99

- 35,000 rub. (600,000 - 100,000 0) - the profit from the sale of the machine is determined.

Calculation of profit from the sale of fixed assets

Let us recall that until 2002, profit from the sale of a fixed asset was determined as the difference between its sale price and residual value. Moreover, the residual value of the fixed asset for tax purposes increased by the inflation index (IIP), approved by the State Statistics Committee of Russia. Since January 1, 2002, when determining profit from the sale of property, the inflation index is not used. Therefore, the Goskomstat of Russia stopped publishing it (see the message of the Goskomstat of Russia, published on April 5, 2002).

| From January 1, 2002, when determining profit from the sale of a fixed asset, the deflator index is not used |

According to Article 286 of the Tax Code of the Russian Federation, income from the sale of a fixed asset is reduced: - by the amount of expenses associated with its sale; - to the residual value of the fixed asset. The residual value of a fixed asset is the difference between its original cost and the amount of depreciation accrued on it. Moreover, the amount of depreciation deducted from the original cost of the fixed asset is determined according to Article 259 of the Tax Code of the Russian Federation. As follows from the Tax Code, this procedure should be applied when selling fixed assets purchased both before January 1, 2002, and after this date. Thus, when selling fixed assets purchased after January 1, 2002, you will not have any problems. For most organizations, the amount of depreciation for them in accounting and tax accounting will be the same. If you sell a fixed asset purchased after this date, then, in our opinion, to determine taxable profit you will have to recalculate depreciation according to the norms of the Tax Code of the Russian Federation. The Tax Code of the Russian Federation provides for two methods of depreciation - linear and non-linear. When determining taxable income from the sale of property, depreciation can be recalculated using any of them. In such a situation, the easiest way is to use the linear method. Using this method, the monthly depreciation amount is determined by the formula: K = (1/n) x 100%,

where K is the monthly depreciation rate as a percentage; n is the useful life of the property in months. As we indicated above, the approximate useful life of fixed assets was approved by Decree of the Government of the Russian Federation of January 1, 2002 No. 1.

Example 2.

A machine is listed in the accounts of Passiv JSC.

The initial cost of the machine is 35,000 rubles. The machine was purchased in December 1999. Its useful life was set at 10 years. In May 2002 the machine was sold. Its sale price was 48,000 rubles. (including VAT - 8,000 rubles). According to the agreement with the buyer, JSC Passiv delivers the machine at its own expense. Delivery costs amounted to 900 rubles. (without VAT). For the period from January 2000 to May 2002, depreciation in the amount of 8,458 rubles was charged on the machine. (29 months of operation). The Liability accountant must make the following entries: Debit 76 Credit 91-1 - 48,000 rubles.

— revenue from the sale of the machine is reflected; Debit 51 Credit 76

- 48,000 rub.

— money has been received from the buyer; Debit 91-2 Credit 68 subaccount “VAT calculations”

- 8000 rubles.

— VAT charged; Debit 91-2 Credit 01

- 35,000 rub.

— the original cost of the machine has been written off; Debit 02 Credit 91-1

- 8458 rub.

— the amount of accrued depreciation is written off; Debit 91-2 Credit 26

- 900 rub.

— the costs of delivering the machine to the buyer are written off; Debit 99 Credit 91-9

- 12,558 rubles.

(48,000 - 8000 - 35,000 + 8458 - 900) - profit from the sale of the machine is reflected. In order to determine taxable profit, the amount of depreciation on the machine must be recalculated according to the new rules. Let us assume that its useful life according to Decree of the Government of the Russian Federation of January 1, 2002 No. 1 is 15 years (180 months). The monthly depreciation rate for the machine will be: (1/180) x 100% = 0.55%.

Over the entire service life of the machine, depreciation will be charged on it in the amount of:

RUB 35,000.

x 0.55% x 29 months. = 5583 rub. The residual value of the machine, recalculated according to the standards of the Tax Code of the Russian Federation, will be:

35,000 rubles.

— 5583 rub. = 29,417 rub. Taxable profit from the sale of the machine will be:

RUB 48,000. — 8000 rub. — 29,417 rub. — 900 rub. = 9683 rub.

| Loss from the sale of fixed assets reduces taxable profit |

If the residual value of the fixed asset and other expenses associated with its sale are greater than the income received, then taxable profit can be reduced by the amount of the loss.

However, such a loss is not taken into account immediately. It reduces the profit monthly in equal shares during the time remaining from the moment of sale of the property until the end of its useful life. The amount of loss from the sale of a fixed asset is indicated in a special tax register - Accounting for deferred expenses. Example 3.

CJSC Aktiv sells a VAZ-2108 car.

The car was purchased in 2002. The selling price of the car without VAT is RUB 45,000. The initial cost of the car is 90,000 rubles. The amount of accrued depreciation is 9,000 rubles. In accounting and tax accounting, “Asset” calculates depreciation on fixed assets in the same way. The cost of selling the car amounted to 3,000 rubles. (without VAT). The useful life of the car is five years. Before the sale, it belonged to Aktiv for six months. The residual value of the car will be: 90,000 rubles. — 9000 rub. = 81,000 rub. The loss from the sale of the car will be:

45,000 rubles.

— 81,000 rub. — 3000 rub. = 39,000 rub. The resulting loss is written off over four years and six months (54 months).

Every month “Aktiv” can write off the amount of loss in the amount of: 39,000 rubles. : 54 months = 722 rub.

| Features of tax accounting of fixed assets are set out in Article 323 of the Tax Code of the Russian Federation |

For tax accounting of transactions for the sale of a car, you need to fill out three registers: - accounting for transactions on disposal of property; — calculating the financial result from the sale of depreciable property; — accounting for future expenses. These registers will be filled like this:

Accounting for property disposal operations

Taxpayer: CJSC "Aktiv" INN: 7701234567 Period from 07/01/2002 to 07/31/2002

| Date of operation | Conditions for disposal of property | Type of income | Reasons for disposal (operation details) | Name of the disposal facility | Amount (rub.) | Quantity |

| 24.07.2002 | Sale | Proceeds from the sale of fixed assets | Agreement dated May 22, 2002 No. 1, invoice dated May 24, 2002 No. 25 | Car VAZ-2108 | 45 000 | 1 PC. |

Calculation of the financial result from the sale of depreciable property

Taxpayer: CJSC "Aktiv" INN: 7701234567 Period from 07/01/2002 to 07/31/2002

| Date of operation | Object name | Sale price (RUB) | Initial cost (RUB) | Amount of accrued depreciation (RUB) | Expenses associated with the sale of the object (rub.) | The total amount of expenses associated with the implementation of the object (4 - 5 + 6) | The amount of loss from sales related to deferred expenses (7 - 3) |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 24.07.2002 | Car VAZ-2108 | 45 000 | 90 000 | 9000 | 3000 | 84 000 | 39 000 |

Accounting for deferred expenses

Taxpayer: CJSC "Aktiv" INN: 7701234567 Period from 01.08.2002 to 31.08.2002

| Date of operation | Type of expense (loss) | Object name | Amount (rub.) | The period during which expenses can be included in other expenses | Amount of expenses per month to be included in other expenses (4: 5) | Start date of accounting as other expenses | Number of months of actual write-off of the monthly amount of expenses as other expenses |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 24.07.2002 | Loss from the sale of fixed assets | Car VAZ-2108 | 39 000 | 54 months | 722 | 31.08.2002 | 53 months |

T. AMITOVA, chief accountant Material provided by the magazine “Practical Accounting”

PRACTICAL ENCYCLOPEDIA OF AN ACCOUNTANT

Complete information about accounting rules and taxes for an accountant. Only a specific algorithm of actions, practical examples and expert advice. Nothing extra. Always up-to-date information.

Connect berator