Home/Salaries/Salary payments from July 1, 2021

Regulation of wages is one of the main issues in labor relations between employer and employee. From July 1, 2021, legislative changes became valid in the Russian Federation, according to which a new remuneration procedure will apply. All innovations will affect only municipal and budgetary organizations. Federal Law No. 88-FZ dated May 1, 2017 obliges employers to pay employees according to the rules that came into force on July 1, 2021. As part of the new legislative framework, changes also affected funds whose financing does not come from the state budget.

Attention

From July 1, 2021, employers of municipal enterprises do not have the right to pay funds to VISA and Master Card payment systems.

New salary payment rules

Within the framework of the law, from July 1, 2021, Federal Law No. 88 dated May 1, 2017, new wage calculation criteria began to apply:

- All payments to workers are made only to the card of the MIR state payment system. Using cards with any other system will be illegal.

- If an employee does not have the opportunity to receive earned funds on a plastic card, then they can receive money at a bank cash desk.

These changes also apply to all government payments:

- pensions;

- scholarships;

- payment of sick leave;

- maintenance and financial remuneration of persons serving in public positions.

From July 1, 2021, new rules for paying overtime hours have been introduced:

- When going to work on a holiday or on their day off, the employee will receive double pay once. Previously, these hours had to be taken into account and paid twice: as time spent at the workplace in excess of the norm established by law. Moreover, the first 2 hours were paid at one and a half rates, and all subsequent hours at double rates.

- If on a weekday an employee worked 2 hours above normal, then this time is paid at double the rate.

- When going to work on a day off, the employee is paid at a double rate based on the number of hours worked.

- In case of a part-time working week or a shortened working day, the employer does not have the right to establish irregular working hours.

Deadlines for salary payments in 2021 according to the Labor Code of the Russian Federation

Changes to the Labor Code of the Russian Federation in the timing of salary payments in 2021 affected Art. 136 of the Labor Code, which determines the terms of payment of wages in Russia. Until now, this article has not established specific dates for the payment of salaries. The only obligation that this article placed on the employer was to pay wages at least once every half month.

The timing of salary payments in 2021 is strictly regulated. In accordance with Art. 136 of the Labor Code of the Russian Federation, as before, wages will have to be paid at least once every two weeks. At the same time, the article now contains a clarification that the payment of salaries should occur no later than the 15th of the next month.

Specific terms for payment of wages in 2021 must be specified in labor and collective agreements and internal labor regulations.

It must be said that according to statistics, most employers already issue salaries before the 15th of the next month. However, the local regulations of the enterprise (IP) and contracts listed above may not contain these conditions. Therefore, if necessary, employers should make appropriate changes to them.

Normative base

Payments to employees who work in the budgetary, municipal sector and extra-budgetary funds are regulated by the Labor Code of the Russian Federation and Federal legislation:

- Federal Law No. 272 of 2021. This regulates the liability of organizations to an employee in case of non-compliance with payment deadlines. The employer's responsibilities are described, according to which he must specify the dates for the transfer of funds.

- Federal Law No. 125 of 2021. Amendments have been made to the Labor Code of the Russian Federation that regulate the accrual of wages to employees in accordance with Federal Law No. 125.

- Article 5.27 of the Code of Administrative Offenses of the Russian Federation, part 6, regulates the obligations of the employer in case of non-compliance and incorrect execution of wage laws.

- Labor Code of the Russian Federation Art. 136. The terms and dates for the accrual of funds to workers in an institution that is funded by the state are directly indicated here.

- Federal Law dated May 1, 2017 No. 88-FZ.

Regulatory acts

All employers should check local regulations that relate to labor law. In these acts, many employers specify the time for issuing salaries to employees. This is permitted by law, but in this case the timing of payments must necessarily comply with this. If local acts do not comply with the changes, the necessary amendments should be made and employees should be familiarized with them. If the date for payment of wages is correctly indicated, the employer does not need to take any additional actions.

What has changed with the innovations on July 1, 2021?

| How was the PO issued earlier? | Changes from July 1, 2021 for organizations financed from the state budget and extra-budgetary funds |

| Employees had the right to use cards with other payment systems, such as Visa and Master Card. |

|

| The employer had to pay double the rate for weekend work and count the same hours as overtime. | With a shortened week or day, additional irregular working hours cannot be established. Remuneration for work on a day off is doubled once. |

New legal norms

Previously, the rules of the Labor Code were in force, according to which salaries must be paid at least once every half month (Article 136). There were no specific deadlines.

On October 3, 2021, new legislative provisions came into force providing for specific aspects of the remuneration procedure. Now wages must be paid no later than the 15th day of the month following the period worked.

Article 136. Procedure, place and terms of payment of wages

Labor relations are of particular importance to both parties. Therefore, both employers and their subordinates try to strictly observe legal norms. Amendments to legislation are being made in order to reduce the number of controversial issues regarding the payment of monetary remuneration for the use of hired labor, and to establish clarity in the procedure and timing of payment of wages.

Russian law provides for the liability of employers for violating the legally defined deadlines for payment of monetary remuneration to staff for their work. Naturally, enterprises have no need for legal proceedings with employees and CTS, so their responsible persons must know and apply all current legislative norms in their work.

Sometimes employers are faced with the question of whether early payment of wages will be a violation. Such actions do not violate the law, so there is nothing to fear for them. For delays in earnings, employees are subject to financial liability (Article 236 of the Labor Code of the Russian Federation). Establishing deadlines for paying employees provides an additional guarantee of protecting their rights.

Article 236. Financial liability of the employer for delay in payment of wages and other payments due to the employee

Terms and criteria for transfers of earned funds under the Labor Code from July 1, 2021

From October 3, 2021, the rules and procedure for transferring earned funds have changed. In July 2021, there were no innovations in this area. Therefore, the payment terms and criteria will remain the same.

IMPORTANT

As part of changes in legislation in 2021, payment of earned funds and advance payments to municipal, state institutions and extra-budgetary funds must be issued once every 15 calendar days.

Organizations must pay the remaining share of the salary in full no later than 15 calendar days from the end of the month for which funds are accrued. Consequently, the employer has no right to transfer the advance portion on the 20th of the current month, and the remaining share of the salary on the 15th of the next month. Because between the 20th and 15th there will be approximately 25 calendar days, and this is contrary to the new legislation. If the specified deadlines are not met, the organization will be fined.

Thus, when transferring salary to an employee, the employer must comply with two key criteria:

- The temporary break between the advance payment and the rest of the payment is no more than 15 days.

- Full payment of earned funds is carried out no later than fifteen days from the end of the month for which wages are transferred.

Please note:

It is possible to set the dates for issuing the PO in the following way: 20th and 5th, 23rd and 7th, 25th and 10th. It is important for managers to take into account that each month has a different number of days: from 28 to 31. Here, any organization is obliged to independently calculate the time frame from the advance to the full transfer of earned funds.

What part and when to pay

Closely related to the salary payment deadline in 2021 is the question of the size of the advance. To protect yourself from possible violations of the law, you should make the first part no less than 43.5% of the total wages. Although paying 40% will not be considered a gross violation.

As a general rule, organizations can issue an advance in accordance with a specified percentage of the employee's salary. But it is important that this percentage is not less than half a month’s salary.

Thus, every month employees receive the amount of the salary established by the contract, excluding income tax. This means that they are entitled to 87% of the salary. And half of this amount is 43.5% of the salary.

To avoid disputes with employees, it is better to pay at least 43.5% of the salary. Provided that all working days before the 15th were worked by the employee in full. Failure to comply with this rule may result in a fine.

Also see “What percentage of salary can or should an advance be made up.”

The procedure for issuing wages in 2021 from July 1 for government agencies

Municipal institutions and organizations financed from the state budget, from July 1, 2021, as part of changes in Federal legislation dated May 1, 2017 No. 88-FZ, must pay wages to employees in accordance with the following points:

- Payment is made only to the national payment system - the MIR card. The organization is obliged to enter into appropriate contracts with banks for issuing salary cards to employees. But the employee has the right to independently determine the bank in which the salary account will be located. The employee must notify about the choice of bank no later than 5 days before the date of the next advance or salary. And draw up a corresponding application, which will indicate all bank details.

- The employee has the right to receive funds through the cash register.

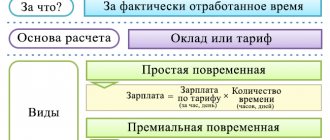

How to set your salary

The salary is determined by the administration and the employee as a result of negotiations and the conclusion of an employment contract between them. If a company advertises a vacancy, it already announces wages for this profession.

At the same time, the administration of the company is guided by the current staffing schedule in the organization, which establishes the forms and systems of remuneration in a particular organization. In addition, the employee must sign the Regulations on remuneration, bonuses, and, if available, the Collective Agreement.

How has the procedure for paying wages changed since July 1, 2018 for individual entrepreneurs?

Attention

: If the organization is not financed from the municipal or state budget, or is not an extra-budgetary fund, then the innovations introduced into the legislation from July 1, 2021 will not affect private sector employees.

The terms, dates of issuance of the advance share and full payment of labor are established by the employer. Individual entrepreneurs have the right to transfer wages to a card with any payment system (Visa, Master Card or MIR). The boss independently determines the dates for issuing the advance payment and the full part of the payment.

According to Art. 136 of the Labor Code of the Russian Federation, an employee of the private sector has the right to receive payment on any card, including “MIR”. An individual entrepreneur does not have the right to refuse transfers to the national card of the Russian Federation. Regardless of whether the organization is financed from the state budget or by private individuals. The employee is required to submit an application to change payment details no later than 5 days before the issuance of the salary or its advance part.

Employer's liability for late payment of wages

Adjustments have also been made to the article on the employer's financial liability. For violation of payment deadlines, individual entrepreneurs and organizations are now required to pay interest amounting to at least 1/150 of the key rate in force in the Bank of Russia. Previously, this percentage was usually 1/300 of the key rate.

Penalties have also been added for late payment or non-payment of wages.

Officials guilty of this violation must pay a fine of 10 to 20 thousand rubles.

The organization must pay from 30,000 to 50,000 rubles for violating the deadlines for paying wages.

An individual entrepreneur will be fined from 1,000 to 5,000 rubles for a violation.

For repeated violation of payment terms for employees, the penalties will be as follows.

Failure to comply with payment deadlines by legal entities - from 50,000 to 100,000 rubles.

For repeated violations, the fine for officials will be from 20,000 to 30,000 rubles or removal from office for a period of 1 to three years.

An individual entrepreneur must pay a fine of 10 to 30 thousand rubles for repeated delays in wages.

In addition, there was an increase in penalties for employers’ evasion from concluding employment contracts and errors in them. Therefore, it is very important to correctly calculate and issue advance payments and salaries in accordance with the new rules.

The procedure for transferring wages for legal entities

If a legal entity is financed from the state or municipal budget, then from July 1, 2021, the following procedure for transferring salary to employees is established for the institution:

- The payment period must be clearly stated in the employment and collective agreements, as well as in the regulations on the payment of salary.

- All financial payments must be transferred to a card with the domestic MIR system. An employee has the right to independently choose the bank in which his salary account will be registered. He must notify the employer of his decision 5 days before the advance payment or payday.

If the legal entity is a non-budgetary institution, the payment of funds is carried out in the following order:

- An individual entrepreneur has the right to make transfers to Visa or Master Card. But refusing to choose a bank is illegal. Employees also have the right to receive salaries on the card of the MIR state payment system. The employee must provide management with the details 5 working days before receiving wages.

- The terms, amount of advance payments and wages are specified by the employer.

Withholding and transfer of personal income tax

The calculation and issuance of advances and salaries according to the new rules are closely related to the transfer of personal income tax. Accountants often have a question about whether it is necessary to adjust the amount of the salary advance by the amount of deductions, or rather personal income tax, which currently amounts to 13% in the Russian Federation.

Tax transfers should be made no later than the next day after the payment of wages. Tax payment must be made twice a month: when transferring salaries and advance payments. The regulatory authorities explain that the withholding and transfer of personal income tax to the budget must be made upon final payment to the employee for the month.

How is the advance paid?

There is no clear definition of the concept of “advance” in the legislation of the Russian Federation. On October 3, 2021, new criteria came into law, within the framework of which an employee has the right to receive earned money at least once every six months. There will be no changes in 2021. The rules affect municipal and state institutions, as well as funds not financed from the state budget.

Payments of the advance share in 2021 are made in the following order:

- The advance payment is issued strictly until the 30th day of the current month. The employing organization has the right to transfer earned funds to employees more than 2 times in one month. Every 10 days or every seven days.

- The dates of advance payments are clearly stated by the employer in regulatory documents, collective agreements, and regulations on the payment of wages. Payment periods cannot be set. For example, “...from the 25th to the 27th” or “...from the 3rd to the 7th.”

Additional information

Employers should note that salary payment deadlines set for the 15th and 30th are not a safe option due to the need to pay personal income tax.

Are vacation pay issued along with salary or not?

By law, vacation payments must be made no later than 3 days before the start of the vacation.

An amount is issued calculated in accordance the employee’s average monthly income The employer has 3 options for transferring money to the employee in this situation:

- for the period of time worked along with vacation pay. Optional;

- according to the established schedule;

- do not provide wages during vacation, but make payments after the end of this period on the next payday.

Further payment of wages is proceeding as usual.

What should an employee do if he doesn’t yet have a MIR card?

If an employee has not issued a card before July 1, 2021, and money from the budget has been deposited into the account, then the bank will define it as funds of “unexplained purpose.” The bank is obliged to notify the client about the presence of money in his account, and also offer two ways of developing events:

- Open an account and link a MIR plastic card to it.

- Open a simple account without a card, and then receive funds from it in cash.

Attention

If the client does not open a new account and does not appear at the bank within ten working days, the money will be returned to the payer.

Is it possible to transfer

It is not possible to postpone the payment of salaries in 2021. This is unacceptable even at the request of a subordinate who has expressed his desire to receive remuneration at another time or once a month. Otherwise, if a controversial situation arises, the employer will have to prove in court that the violation was not his fault and, accordingly, there are no grounds for penalties (Article 1.5 of the Administrative Code).

The demands of labor inspectors to compensate an employee for interest for late payment of labor will not stand aside (Article 236 of the Labor Code of the Russian Federation). They are accrued regardless of the reasons for the delay.

It happens that a subordinate simply did not come for his salary. And when transferring funds to the card, I submitted an application for the issuance of earnings in cash, for example, due to the loss of a plastic card. The employer will pay the employee all amounts due, and he will contact the cashier to receive them whenever he pleases. In such a situation there will be no violations.

Funds not received by the employee on the day the salary is issued must be deposited. This way the employer will reduce risks to a minimum.

You can do the same if the day the salary was paid fell during the vacation period. If a vacationer does not want to receive transfers of wages during his vacation, he should submit the same application for payment of funds from the company’s cash desk. He will be able to receive them upon returning from vacation.

Payroll - Postings

The generation of entries for payroll for employees depends on what type of employees the calculation is made for.

| Debit | Credit | Operation |

| 20 | 70 | Salary for workers in main production |

| 23 | 70 | Salaries for auxiliary workers |

| 25 | 70 | Salary for general production workers |

| 26 | 70 | Salaries for employees with administrative functions (director, accountants and others) |

| 44 | 70 | Salaries of workers involved in trade |

| 91 | 70 | Salaries of employees who do not participate in production activities |

Payroll entries can be made in a single amount, or for each employee separately. For payments for vacations and sick leave from the organization’s funds, exactly the same entries are made.

Other types of accruals can also be performed:

| Debit | Credit | Operation |

| 96 | 70 | Vacation was accrued from reserve funds |

| 69 | 70 | Sick leave accrued from social insurance funds |

| 84 | 70 | The employee received financial assistance |

Along with the accruals, you must show the postings for deductions from wages:

| Debit | Credit | Operation |

| 70 | 68 | Personal income tax is withheld from the salary amount |

| 70 | 76 | Other deductions have been made (for example, alimony) |

Responsibility for non-payment of salaries and advances

If an employer does not pay wages to its employees, the law provides for several types of liability for this:

- Material. This amount is determined based on the amount of debt and the exact period for which the payment was delayed. Such a fine is calculated as 1/150 of the amount of unpaid wages for each day of delay. Such compensation must be calculated in any case, regardless of the reasons why the payment was not made.

- Administrative. It is imposed on the responsible persons, individual entrepreneurs or the entire company. The largest amount of such punishment is 50 thousand rubles, but it can be increased in case of repeated similar violations.

- Criminal. The most serious form of liability depends on the length of the delay. Awarded to the director of a company or entrepreneur. The maximum penalty is a fine of 500 thousand rubles or imprisonment for up to 3 years.

Features of setting wages

Let's consider the features of determining wages and its dependence on the minimum wage and other indicators.

Can it be less than the minimum wage or subsistence level?

The law specifically defines the minimum wage indicator so that the company administration cannot pay its employees less than this level if they have worked the full working time. This takes into account not only the minimum salary, but also various additional payments.

If the accrued salary is lower than the minimum wage, then it must be raised to this level, otherwise administrative measures will be applied to the company.

In addition, regional authorities have the right to set their own minimum wage, but not lower than the federal value.

Attention! If an employee does not work at full time, then he may receive an accrual amount less than the minimum wage. The most important thing is that when recalculated for the entire bet size, the value corresponds to or is higher than the minimum.

At this time, the Government is gradually increasing the minimum wage to the subsistence level, so that this is consistent with the provisions of the Labor Code of the Russian Federation. The figures are expected to be equal to May 1, 2021.

You might be interested in:

Business trip on a weekend - what you need to know before sending employees

In the future, the minimum wage will be taken at the cost of living, which was in effect in the 2nd quarter of the previous year. If this indicator decreases, the value of the minimum wage will remain at the same level.

If there is a regional coefficient

An employee can work in territories where special allowances are accepted for working in difficult conditions. They are determined using pre-approved regional coefficients. The list of such territories is fixed by law.

When calculating the amount of earnings, company management must take into account whether a separate minimum wage is applied in this territory or not.

If a separate minimum wage indicator has been adopted for a given region, then employee salaries must be compared with it.

If a separate minimum wage has not been established for this territory, then it is necessary to use the federal value, but adjusted by the regional coefficient. Then the salary of any employee should not be lower than this figure.

Calculation of personal income tax and minimum wage

The law determines that an employee should not be paid a salary lower than the current minimum wage.

However, when paying it, the employer, as a tax agent, is obliged to calculate and withhold personal income tax. After this operation, the actual amount in hand will be slightly less than the minimum wage.

The law does not define any additional benefits, other than standard deductions, due to the fact that the employee’s salary is equal to the minimum wage. It must be subject to personal income tax in the standard manner.

Is it possible to link wages to the staffing table?

The organization of remuneration at the company must be done so that the staffing table contains all positions with an indication of their salary. This also applies to those who work on a piece-rate payment system - for such, the planned earnings values must be indicated in the document.

However, when hiring a new employee, the amount of his earnings must be reflected both in the employment agreement and in the hiring order. And this should only be done digitally.

If the contract states that salaries are paid according to the staffing schedule, then this will be a reason to invalidate it. This is because salary information is mandatory for this document.

This kind of formulation can only be applied to additional payments - bonuses, additional payments, etc. However, in this situation, it is necessary to familiarize the employee with the documents, which stipulate the procedure for their payments (for example, the bonus regulations), against signature.

Is it possible to calculate wages in foreign currency and pay in rubles?

The Labor Code establishes that the labor agreement concluded between an employee and an organization in Russia must indicate the amount of remuneration in the national currency - rubles.

But in what currency the accrual should be made is not specified anywhere in the law. Therefore, he can make payments in foreign currency.

However, there is a pitfall here. The fact is that the salary is the amount of the employee’s earnings for the month, clearly indicated in the employment agreement. If the exchange rate falls, which will entail a decrease in the amount of wages paid, this may be regarded by the inspection authorities as a deterioration in working conditions, with management being held administratively liable.

When are payments made?

The Labor Code stipulates that the administration must pay salaries to its employees at least twice a month. At the same time, the exact dates on which this will happen must be fixed in internal documents. The period between issues cannot be more than 14 days.

bukhproffi

Important! Also, the deadline for issuing the advance should not be later than the 30th day of the month, and the second part of the salary - no later than the 15th day of the month following the settlement month.

Is it possible not to pay an advance?

The law determines that an employee must be paid a salary at least every 2 weeks. For violation of this provision, fines of up to 50 thousand rubles may be imposed.

This is precisely the employer’s obligation, and he has no right to violate it, even if the employee personally fills out an application with a request to give him earnings in one amount once a month.

In 2021, the Ministry of Labor issued a letter in which it indicated a case when an advance payment may not be paid to an employee. If he was absent from the workplace for the first 15 days (for example, he was on annual leave or sick), then the organization does not have to make the transfer, since only the time actually worked is taken into account.

Attention! However, if at least one day was worked in this period, then payment for it will need to be issued.