The procedure for paying sick leave is regulated in detail by law. But sometimes employers have difficulties with calculations.

For example, how is sick leave paid during vacation, after dismissal, during downtime, or sick leave for a part-time employee? What to do if an employee brings two sick days? You will find answers to these questions in the article.

A certificate of incapacity for work is a document certifying the temporary disability of an employee and is the basis for the assignment of temporary disability benefits. Its form was approved by Order of the Ministry of Health and Social Development of the Russian Federation dated April 26, 2011 No. 347n.

The procedure for issuing certificates of incapacity for work was approved by Order of the Ministry of Health and Social Development of the Russian Federation dated June 29, 2011 No. 624n.

Who issues it and how?

A certificate of incapacity for work is issued by:

- attending physicians of medical organizations;

- paramedics and dentists of medical organizations;

- attending physicians at clinics of research institutions (institutes), including research clinics

- institutions (institutes) of prosthetics or prosthetics.

Sick leave is issued in the following cases:

- diseases, in particular professional ones, injuries, including those received as a result of an industrial accident, poisoning;

- referrals for medical and social examination;

- the need to care for a sick family member;

- quarantine of an employee, his child under 7 years of age attending a preschool educational organization, or another family member recognized as legally incompetent in accordance with the established procedure;

- implementation of prosthetics for medical reasons in a hospital specialized institution;

- follow-up treatment in sanatorium-resort organizations located on the territory of the Russian Federation, immediately after the provision of medical care in a hospital setting;

- if the illness or injury occurred within 30 calendar days from the date of termination of the employment contract (service contract);

- when the illness or injury occurred during the period from the date of conclusion of the employment contract until the day of its cancellation;

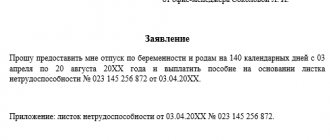

- pregnancy and childbirth.

The employer pays a temporarily disabled employee disability benefits in accordance with federal laws, which also establish the amount of these benefits and the conditions for their payment (Article 183 of the Labor Code of the Russian Federation).

In accordance with Art. 12 of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”, benefits for temporary disability are assigned if the application is made no later than 6 months after its onset.

The employer assigns temporary disability benefits within 10 calendar days from the date of application and pays them on the day closest to the date established for payment of earnings. The amount of the benefit depends on:

- on the duration of the insurance period;

- from the amount of salary for the last 2 years preceding the year in which temporary disability occurred;

- from the basis for payment of benefits;

- on the duration of temporary disability.

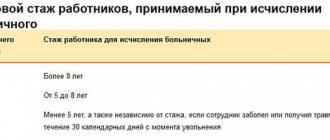

The benefit amount is set as a percentage of the employee’s average earnings. In case of loss of ability to work due to illness or injury, during quarantine, prosthetics and after-care in sanatorium-resort organizations immediately after medical care in a hospital, the values are as follows:

| Insurance experience | Benefit amount |

| 8 or more years | 100 % |

| From 5 to 8 years | 80 % |

| Up to 5 years | 60 % |

If, for periods of incapacity for work from April 1 to December 31, 2020 (inclusive), the amount of the benefit determined according to Law No. 255-FZ per full calendar month is less than the minimum wage, the benefit is calculated based on the minimum wage.

If the insured person is working part-time at the time of the insured event, the amount of temporary disability benefits calculated on the basis of the minimum wage is determined in proportion to the length of the insured person's working hours. This provides for taking into account regional coefficients applied to wages (Article 1 of Federal Law No. 104-FZ dated April 1, 2020 “On the specifics of calculating temporary disability benefits and making monthly payments in connection with the birth (adoption) of the first or second child”) .

Labor Code sick leave article 183

This document is fundamental along with federal laws and other regulatory legal acts and is subject to constant changes in connection with changing conditions of labor relations. On our website you have the opportunity to familiarize yourself with the new Labor Code of the Russian Federation 2021 with comments, and also download it for free in Word or PDF format. Articles of the Labor Code of the Russian Federation (formerly called the Labor Code) define the rights and obligations of the parties, however, violations of labor legislation are quite common, and almost every citizen of working age has at least once in his life encountered a situation requiring the advice of a professional lawyer in the field of labor law. On our website you can read the articles you need of the new Labor Code of 2021 and use the services of a competent specialist by filling out the application in the form below.

2. An application for the issuance of a duplicate of a writ of execution may be submitted before the expiration of the period established for presenting the writ of execution for execution, except in cases where the writ of execution was lost by the bailiff - executor or other person carrying out the execution and the claimant became aware of this after the expiration of the period established for the presentation of a writ of execution for execution.

What to do if an employee takes sick leave after the end of the working day?

Since simultaneous payment of earnings and temporary disability benefits is not provided for by law, the employee must choose what payment he wants to receive for the first day of illness.

Moreover, according to the law, citizens who seek medical help after the end of working hours (shift), at their request, the date of release from work on the certificate of incapacity for work can be indicated from the next calendar day. If the employee has chosen the benefit, he will have to make appropriate changes to the working time sheet.

Since the first 3 days of temporary disability due to illness or injury must be paid at the employer’s expense (if the employee has worked the first day of disability and is paid a salary for that day), the period paid at the employer’s expense is shifted. That is, the second, third and fourth days of incapacity will be paid.

Labor Code 2021 sick leave

The Labor Code of the Russian Federation contains provisions providing for differentiation of working conditions. For example, significant importance is attached to the regulation of the labor of women, persons with family responsibilities, workers under the age of 18, and persons performing part-time work.

Federal Law No. 116-FZ dated May 5, 2014 introduced Chapter 53.1. “Features of regulation of the labor of workers sent temporarily by the employer to other individuals or legal entities under an agreement on the provision of labor for workers (personnel). The provisions of this chapter are effective from 01/01/2019.

The employee brought sick leave after dismissal

If sick leave is opened on the day the employee is dismissed or before this date, pay temporary disability benefits as if the employee had not resigned. In such a situation, sick leave must be paid for in any case of incapacity for work (due to illness or injury of the employee, caring for a sick child or other relative, etc.).

At the same time, the amount of the benefit depends on the employee’s insurance experience ( Parts 1, 2, Article 5, Part 1, Article 7, Part 1, Article 13 of Law No. 255-FZ).

If the employee has already quit, sick leave is paid only in case of illness or injury that occurs within 30 calendar days from the date of termination of work under the employment contract.

The benefit amount is 60% of average earnings, which is calculated, as usual, for the 2 previous calendar years.

The basis for payment of benefits after dismissal is sick leave. The dismissed employee must submit it no later than 6 months from the date of restoration of working capacity or establishment of disability (Part 1 of Article 12 of Law No. 255-FZ).

The first 3 days of sick leave due to illness or injury of a dismissed employee are paid at the expense of the organization, the subsequent days - at the expense of the Social Insurance Fund (clause 1, part 2, article 3 of Law No. 255-FZ).

When filling out a certificate of incapacity for work, the code “47” is indicated in the “Calculation conditions” line of the sick leave certificate (clause 66 of the Procedure). The line “Insurance experience” indicates the number of full years and months of work on the date of dismissal from the organization, despite the fact that the amount of benefits in such a situation does not depend on the insurance experience and is 60% of average earnings.

We pay sick leave to a former retired employee

For information , retirement age is the legally established age at which a person participating in state pension insurance can count on receiving an old-age pension. Currently, the retirement age in Russia is (Article 8 of the Federal Law of December 28, 2003 No. 400-FZ):

These age limits for retirement were established back in 1932, when the state pension system was created in the USSR. Over the past few years, the Government has been talking about raising the retirement age. First of all, the increase in the age limit is due to the lack of sufficient money for the Pension Fund to fulfill its obligations to pensioners.

We recommend reading: Gratuitous transfer of property taxes

If sick leave is issued during downtime

According to the law, benefits are not assigned for the periods:

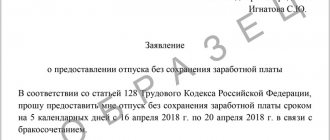

- releasing an employee from work with full or partial retention of salary or without payment in accordance with the legislation of the Russian Federation, with the exception of cases of loss of ability to work due to illness or injury during the period of annual paid leave;

- suspension from work in accordance with the legislation of the Russian Federation, if wages are not accrued for this period;

- detention or administrative arrest;

- conducting a forensic medical examination;

- downtime (except for cases established by Part 7 of Article 7 of Law No. 255-FZ).

If temporary disability occurred before the downtime period and continued during its period, benefits for the downtime period are paid in the same amount as wages are maintained during this time, but not more than the temporary disability benefit that the employee would receive according to the general rules. To calculate the amount of the benefit, you first need to calculate the benefit in the usual manner, compare the result with the amount of the employee’s salary saved during the idle period, and select the lower value.

If an employee falls ill after the start of the downtime, then disability benefits are not paid for days of illness falling during the downtime period.

If temporary disability, which began during the period of downtime, continues after its end, then for its days the employee is paid benefits, it is calculated in the general manner. The first 3 days of illness after idle time are paid by the employer.

If an employee falls ill before the downtime begins, sick leave is paid as usual. For days of illness coinciding with downtime, benefits are paid in the amount of no more than:

- 2/3 of the salary (tariff rate), if downtime arose for reasons beyond the control of the employee and the employer;

- 2/3 of average earnings if the downtime was due to the fault of the employer.

Registration of sick leave after dismissal under the Labor Code in 2021

- If an employee falls ill before resigning, then this period is compensated based on general principles.

- If health problems arise after termination of the employment relationship, payment for the entire period is 60% of the average salary for the past 2 years.

- Calculate the employee's salary for his two-year period of work.

- Divide the above figure by the number of calendar days.

- Multiply the resulting figure by the number of days that the employee was in a state of disability.

- Multiply the total by 60% (or 0.6).

We recommend reading: How to Find Out What I Own Through the Internet

How is sick leave paid for an external part-time worker?

The general rule for taking into account earnings when calculating benefits for an external part-time worker is this: if the employee applied for benefits not only from you, but also from other employers, you take into account only your payments (that is, payments for part-time work), and if only to you - then payments from all employers for the billing period, including payments for work at the main place of work and part-time work in all organizations.

The place of work at which an employee can receive temporary disability benefits depends on the organizations in which he worked during the billing period:

- If during the billing period he changed jobs or was employed by the same employers for both years, but in the current year he does not work for at least one of them, then to receive benefits he can choose any employer for whom he currently works ( Part 2.1, 2.2 Article 13 of Law No. 255-FZ).

- If during the billing period an employee worked for the same employers with whom he is currently employed, then he must apply to all employers at the same time to receive benefits (Part 2 of Article 13 of Law No. 255-FZ).

Depending on where the external part-time worker worked and what documents he provided, the calculation will be different.

So, if an external part-time worker worked in the organization during the billing period (worked the billing period in full or part of it) and provided sick leave, the benefit is calculated by each employer to whom the employee applied. In this case, only your payments are taken into account. Certificates from other places of work stating that benefits were not accrued or paid there are not needed.

Earnings based on certificates from employers for whom the employee worked during the billing period are not taken into account (if the employee provided such certificates earlier).

If the part-time worker has provided the following documents:

- sick leave;

- certificates from other current places of work stating that benefits were not paid there;

- certificates of earnings from other employers for whom the employee worked during the pay period (including former ones) -

payments for all places of work are taken into account, including those where the employee no longer works. The benefit is paid by one of the employers chosen by the employee.

An employee can confirm temporary incapacity for work with other employers with a copy of the certificate of incapacity for work, certified by the employer paying the benefit.

The benefit is not accrued if the employee has not provided certificates from other current places of work stating that the benefit was not accrued or paid.

If an external part-time worker did not work part-time for the employer during the billing period and provided him with sick leave and certificates, payments for all places of work in which the employee worked in the billing period can be taken into account. The benefit is paid by one of the current employers chosen by the employee.

Payment of benefits is carried out depending on the specific situation: either for all places of work, or only for one of them at the employee’s choice, taking into account earnings from other employers.

If an employee falls ill on vacation at his own expense, on maternity leave or on parental leave, he will only be paid for sick days at the end of these vacations, if he has not yet recovered by that time: for days of illness coinciding with such vacation, he should not be given sick leave, since temporary disability benefits are not paid for the days of such vacation. Therefore, the employee must notify the doctor that he is on such leave.

If a certificate of temporary incapacity for work was nevertheless issued for periods of leave without pay, leave to care for a child under 3 years of age, for which the doctor should not have issued this document, but the employee did not warn him, then formally the FSS may not accept offset the amount of benefits paid under such sick leave. The best option is to replace such a sheet with a duplicate.

In any case, the benefit must be paid to the employee from the day when he was supposed to start work at the end of his vacation at his own expense.

Payment of sick leave labor code

Payment of sick leave Unfortunately, during the period of employment, an employee repeatedly encounters health problems and is forced to open a certificate of incapacity for work. Is there an employer's obligation to pay sick leave? How much are payments made? Are there any grounds for an employer not to pay for sick leave? Is the employer obligated to pay for employee sick leave?

Sick leave and dismissal. Features of calculating benefits The employee’s right to terminate an employment contract with the employer at his own request is secured by the provisions of Article 80 of the Labor Code. To exercise this right, the employee must notify the employer in writing of his desire to resign no later than two weeks*. *The specified period begins the next day after the employer receives the employee’s resignation letter. By agreement between the employee and the employer, the employment contract can be terminated even before the expiration of the notice period for dismissal. In cases where an employee’s application for dismissal on his initiative is due to the impossibility of continuing his work (enrollment in an educational organization, retirement and other cases), as well as in cases of violation by the employer of labor legislation and the terms of the employment contract, the employer is obliged to terminate the employment contract on time specified in the employee’s application. At the same time, before the expiration of the notice period for dismissal, the employee has the right to withdraw his application at any time.

Documentation

If the deadlines for calculation and payment of wages are violated, the employee has the right to appeal to the labor inspectorate with a complaint.

The body of such a statement must contain the essence of the situation with the attachment of evidentiary documentation:

- Copy of BL;

- Copy ;

- Calculation sheet displaying the calculated amount;

- A copy of the statement or an invoice statement (when making non-cash payments).

How is sick leave paid in 2021? According to the Labor Code of the Russian Federation, each employee is guaranteed payment according to the BC. Payment for the first three days on a certificate of incapacity for work is carried out by the employer himself, the remaining days are paid by the Social Insurance Fund , which makes regular deductions from the employee’s salary. If the BL sheet is issued for child care, then the BL is paid in full with funds from the Social Insurance Fund.

Part-time work gives a person additional income. But even such an employee may have situations in which to issue a BL, which means he is concerned about the issue of paying for the BL. Which employer will pay? As is already known, official employment involves, among other things, the calculation and payment of a salary for each employee who has submitted the necessary document. Let's look at how part-time BL is paid: by submitting a certificate confirming the fact of incapacity for work to each of the employers, on the basis of which sick leave will be calculated.

Let's look at an example of how an external part-time worker is calculated:

The employee's total work experience is 10 years. His income for 2016 was 53,415 rubles, income for 2021 was 61,218 rubles. The BC was issued in January 2021.

What will be my next steps:

- Average daily earnings are calculated: (53415 + 61218) / 730 = 157.03 rubles.

- The amount of compensation for days of sickness according to BC (17 days) is calculated: 157.03 * 1 * 17 = 2669.51 rubles. (1 = 100% of earnings based on work experience over 8 years);

- The amount paid by the employer (the first three days) is calculated: 157.03 * 3 = 471.09 rubles.

- The remaining amount for 14 days will be compensated by the Social Insurance Fund = 157.03 * 14 = 2198.42

Thus, the person will receive payment according to the BL.

Any officially employed woman is entitled to sick leave for pregnancy and childbirth (B&C). Its registration is provided for a period of 30 weeks (despite the fact that she can continue to work). Payment for disability during the final stage of pregnancy and the recovery period after childbirth is made according to almost the same rules as in a regular BC. Payment is made based on 100% of average daily earnings, which includes any type of income. Exceptions are payments for benefits, for BL, payment of financial assistance of less than 4,000 rubles, payments at the birth of a child.

If the insurance period is less than 6 months, payment for sick leave according to the BiR is based on the minimum wage. In case of complications after childbirth, as well as in the birth of twins, and based on the issued additional BC, a recalculation is made.

Results:

To summarize the above, let us define the concept of sick leave - this is a document of strict accountability, numbered, recorded in the register and has an official status. Falsification of this document is considered a violation of the law.

The registration and issuance of a bulletin is carried out for the officially working population by a medical institution, in case of temporary disability. The received ballot becomes the basis for receiving a payment guaranteed by the state.

Types of ballots and their payment:

- the first type - according to BiR is provided for a period of 140 days. 100% payment regardless of the woman’s length of service;

- the second type - child care, is provided to any relative. Payment depends on the length of service of the employee who received the certificate;

- the third type - part-time work, is provided to those working in several positions at once. Payment depends on the employee’s length of service and can be paid one at a time or for each workplace, at the discretion of the employee.

Benefits

basic information

The legislation defines sick leave as a basis for obtaining assistance during a period of temporary disability due to health reasons. This document is issued by a doctor who determines the presence and nature of the disease and sets a time limit for treatment. The day you see a doctor becomes the date the sick leave starts. The deadline for processing a document does not exceed 30 days, although the initial issuance corresponds to 10 days. After which, the doctor makes a decision on its closure or extension.

It is worth noting that issuing sick leave is not available to every medical institution. Such an institution must have a special license confirming the right to conduct medical activities, as well as provide services for determining temporary disability. The design of the disability certificate in 2021 has not undergone any changes. But, the calculation of payments must be carried out taking into account a number of clarifications made.

Legislation

- Law No. 323 of November 21, 2011;

- Order of the Ministry of Health of the Russian Federation No. 624 dated June 29, 2011;

- Resolution No. 375 of June 15, 2007;

- Labor Code of the Russian Federation Art. 124, 183;

- Tax Code of the Russian Federation (Articles 217, 255);

- clause 1 art. 7 of Law No. 255-FZ of December 29, 2006;

- Decree of the Government of the Russian Federation No. 375;

- No. 255-FZ Art. 12, art. 7