Accounting account 44 is an article that summarizes information about costs associated with the sale of goods, provision of services or performance of work. It is used by various enterprises engaged in industrial and other production activities. Let us consider further the 44th accounting account in detail. Postings and examples of expenses will also be presented in the article.

General information

First of all, you should find out whether accounting account 44 is active or passive? For specialists who have some experience in preparing balance sheets and reporting, this question does not arise. Any competent accountant knows that account 44 is active. It reflects various costs depending on the specifics of the enterprise's activities. Additional items that accounting account 44 may contain are subaccounts for distribution costs:

- Not subject to UTII (44.1.1).

- Subject to distribution (44.1.3).

- Subject to UTII (44.1.2).

In addition, subaccounts are often opened. 44.2 – selling expenses and 44.3 – selling costs.

"Sale expenses"

All costs associated with the sale of goods, performance of work and provision of services are reflected in accounting through “Sale expenses” - account 44 according to the accounting plan approved by Order of the Ministry of Finance No. 94n dated October 31, 2000.

It turns out that accounting account 44 (for dummies) is a position in the plan, which is intended to record the enterprise’s operational data on costs arising in the process of selling goods, works, services (GWS).

To understand “Sales Expenses” which account is active or passive, let’s look at what is reflected in its debits and credits. Receipts of expenses are recorded as debit, and disposals are recorded as credit. This means that the count. 44 - active. It is synthetic and analytical. Subaccounts to account 44 are opened depending on the specifics of the activity and industry of the organization, which must be fixed in the accounting policy. Analytics is carried out by types and cost items, which depend on the type of activity of the enterprise.

What is taken into account in account 44 for institutions directly related to industry and the production process? For non-trading enterprises, the following types of costs are distinguished:

- packaging of manufactured products;

- loading, transportation and delivery costs;

- maintenance of premises intended for storing goods until sale;

- fees and commission payments;

- advertising and entertainment costs.

For organizations that engage in trade, such costs represent:

- employees' wages;

- rent;

- transportation of products;

- maintenance and storage of products;

- representation and advertising costs.

Industrial and manufacturing companies

For such enterprises, accounting account 44 is an article that summarizes information about the costs of:

- Packaging and stocking of goods in finished goods warehouses.

- Delivery of products to the point (pier, station) of departure, loading them into wagons, cars, ships, and other vehicles.

- Maintenance of premises intended for storing products in places of sale.

- Remuneration of sellers of enterprises engaged in agricultural production.

- Advertising.

- Representation.

- Commissions (fees) paid to sales and other intermediary enterprises.

- Other similar events.

Specifics of reflecting costs

To begin with, it should be noted that this category refers to funds allocated to establish communication between the manufacturer and the consumer. This item of costs in its content is classified as current costs. The allocation of these resources takes place annually, and their advances also occur annually.

If the head of the organization manages to increase the efficiency of these costs, then this will give him the opportunity to receive greater profits and direct it to improve the material and technical base, which will lead to an increase in the quality of goods sold and, accordingly, an increase in profits in the future.

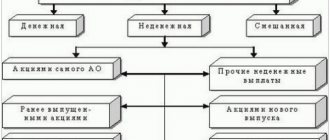

If you try to classify the designated category of costs, you can do it as follows:

By economic content:

- material costs;

- funds allocated for remuneration of personnel;

- accrual of depreciation of fixed assets and intangible assets;

- other costs.

By industry sector:

- costs of selling retail products;

- funds allocated to ensure sales of wholesale products;

- costs of selling agricultural products.

Taking into account such a criterion as the quality of trading service, it is necessary to highlight:

- related to improving the quality of trade service;

- unrelated to him.

Companies procuring and processing agricultural products

Agricultural goods include a variety of products: cotton, wool, vegetables, milk, flax, hides, poultry, livestock, and so on. The most popular expenses reflected in accounting account 44 are the costs of maintaining reception and procurement points and animals in them. The article in question may also reflect information about other costs.

Accounting for sales expenses on account 44

The costs of maintaining and servicing fixed assets (store premises, retail equipment) involved in the process of selling goods are one of the main components of sales costs. Let's look at typical transactions for accounting for these expenses:

| Dt | CT | Description | Document |

| 44 | 02 | Calculation of depreciation on fixed assets (buildings, premises, commercial equipment, vehicles, etc.) that are used by the organization in the sale of goods and products | Depreciation statement |

| 44 | 04 | Calculation of depreciation on intangible assets that are used by the organization in the sale of goods and products | Depreciation statement |

| 44 | 10, 60 | Reflection of the tenant's costs for renovation of the premises (shop, retail outlet, etc.) | Certificate of completion |

| 44 | 97 | Reflection of expenses for repairs of fixed assets used in the implementation process | Certificate of completion |

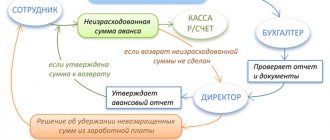

As a rule, the full functioning of the sales process is ensured by employees of the organization, whose job responsibilities are in one way or another related to the sale of goods (services). We are talking about salespeople at retail outlets, loaders, and delivery drivers, whose wages are included in sales expenses.

| Dt | CT | Description | Document |

| 44 | Reflection of the amount of accrued wages of employees who provide the procedure for selling goods | Payroll sheet | |

| 44 | Reflection of the amount of sales expenses incurred by the accountable person | Advance report | |

| 44 | 69.1 | Calculation of the amount of insurance contributions for compulsory social insurance | Payroll sheet |

| 44 | 69.2 | Calculation of the amount of insurance contributions to the Pension Fund of the Russian Federation on the salaries of employees who ensure the implementation process | Payroll sheet |

| 44 | 69.3 | Calculation of the amount of insurance contributions on the salaries of employees who provide the implementation process (compulsory health insurance) | Payroll sheet |

If the production of goods is carried out in-house, then selling expenses can be reflected in the following entries:

| Dt | CT | Description | Document |

| 44 | Attribution of the amount of production costs to the costs of selling goods | Production cost sheet | |

| 44 | Inclusion of the cost of products (works, services) of service industries into sales expenses | Production cost sheet |

The use of additional goods and materials in the sales process is recorded using the following entries:

| Dt | CT | Description | Document |

| 44 | 10 | Reflection of the cost of materials that were used in the process of selling goods | Packing list |

| 44 | 41 | Reflection of the cost of goods used in the process of selling goods | Packing list |

| 44 | Reflection of the cost of finished products that were used in the sale of goods | Packing list |

Account 44 in accounting: closing

The debit accumulates the amounts of expenses incurred by the enterprise in connection with the sale of work, goods, and services. They are subject to full or partial write-off in the DB account. 90. In the latter case, the following are subject to distribution:

- At enterprises that conduct industrial and other production activities, the costs of transportation and packaging. Costs are distributed between individual categories of shipped goods every month in accordance with weight, volume, cost or other indicators.

- For enterprises engaged in trading or intermediary activities, transportation costs. The distribution of expenses is carried out between the goods sold and the remaining goods on the last date of each month.

- At enterprises processing and procuring agricultural products - in DB account. 15, reflecting the amount of costs for the acquisition and procurement of material assets, or account. 11, summarizing information about the costs of procuring poultry and livestock.

Other expenses that are reflected in account 44 in accounting are also subject to write-off. Closing in other, not specified cases, is carried out by transferring amounts to the cost of products, works, and services sold.

Regulatory documents for the use of account 44 in accounting

The use of account 44 “Sales expenses” is regulated in accounting by the Chart of Accounts and Instructions for its application (Order of the Ministry of Finance dated October 31, 2000 No. 94n), PBU 10/99 “Organization expenses” and other regulatory standards, the use of which depends on the industry of the company .

For example, for trade organizations, the State Standard of the Russian Federation GOST R 51303-99 “Trade. Terms and definitions”, approved by Decree of the State Standard of Russia dated 08/11/1999 No. 242-st, and Methodological recommendations for accounting of costs included in distribution and production costs, and financial results at trade and public catering enterprises, approved by Roskomtorg in agreement with the Ministry of Finance of Russia 04/20/1995 under No. 1-550/32-2. The use of these standards in accordance with the requirements of the current accounting legislation is recommended by the letter of the Ministry of Finance of Russia dated April 29, 2002 No. 16-00-13/03. And PBU 5/01 “Accounting for inventories” recommends that a trading company make a choice of the method of accounting for transportation costs and consolidate it in its accounting policy: as part of the cost of purchasing goods (account 41) or as part of distribution costs (account 44).

Account 44 in accounting: postings

At the end of the month, costs may remain for transport services provided by intermediaries. After they are assigned to account 44, no entries are made in accounting. These expenses remain and are carried forward to the next month. The account in question corresponds with the articles:

By debit:

- Depreciation of fixed assets (account 02).

- Settlements with various creditors/debtors (account 76).

- Intangible assets (account 04).

- Depreciation of intangible assets (account 05).

- Materials (count 10).

- Settlements with accountable persons (account 71).

- Deviations in the standard of material assets (count 16).

- Auxiliary proceedings (account 23).

- Settlements with employees regarding wages (account 70).

- VAT on purchased objects (account 19).

- Service farms and industries (account 29).

- Payments for fees/taxes (account 68).

- Goods (count 41).

- Settlements for social security and insurance (account 69).

- Trade margin (account 42).

- Finished products (account 43).

- Settlements with contractors/suppliers (account 60).

- Shortages and losses from damage to valuables (count 94).

- Reserves for future expenses (account 96).

- On-farm settlements (account 79).

- Future expenses (account 97).

By loan:

- Materials.

- Animals for fattening and growing (count 11).

- Acquisition and procurement of material assets (account 15).

- On-farm settlements.

- Shipped goods (account 45).

- Settlements with different creditors/debtors.

- Sales

- Losses and shortages from damage to valuables.

- Losses and profits (account 99).

As you can see, there are quite a lot of corresponding articles. In general, we can say that account 44 is considered universal in accounting. It has been around for a long time and is used by most businesses.

Possible accounting entries

Typical accounting entries for this position are as follows:

1) Dt 44

Kt 02 - depreciation of fixed assets used in the sale of goods and services;

2) Dt 44

Kt 10 and 60 – expenses for repairs of retail premises;

3) Dt 44

Kt 70 – wages of employees providing sales of goods;

4) Dt 44

Kt 23 – accounting for production costs in sales costs;

5) Dt 44

Kt 10 – materials used in the sale of goods, etc.