After concluding an employment contract, the hiring of a chief accountant must be formalized by order of the employer. The execution of this order does not have any peculiarities; it can be issued either on the basis of a unified form of an order for employment (Form T-1) or in a free form. This depends on the HR system adopted by the organization. But in some cases, employers are forced, at the request of the bank in which the organization’s relevant accounts are opened, to also issue an order granting the chief accountant the right to second sign on payment documents. Banks require such an order when issuing a card with sample signatures. It should be said that such a requirement has no regulatory basis. If there is a chief accountant on staff, his signature must be affixed to monetary and settlement documents, which without such a signature are invalid (paragraph 3, paragraph 3, article 7 of the Accounting Law, paragraph 14 of the Regulations on Accounting and Financial Reporting in the Russian Federation13). In other words, the regulatory legal acts directly say not just about granting the right to sign on such documents, but about the direct obligation to affix these documents with the signature of the chief accountant. According to clause 7.6 of Instruction No. 28-I dated September 14, 2006 “On opening and closing bank accounts, deposit accounts,” the right of second signature belongs to the chief accountant of the client - a legal entity and (or) persons authorized to maintain accounting records, on the basis of an administrative act of the head of a legal entity. This means that the right of the second signature by issuing the corresponding order should not be vested in the chief accountant, but in other persons of the organization (for example, the financial director). For the chief accountant, such an order is not required, because he has the right to sign a second signature by virtue of the instructions of the law and the concluded employment contract for this labor function. This position is set out in the letter of the Central Bank dated June 14, 2007 No. 31-1-6/1244 “On confirmation of the powers of persons authorized to sign”: In accordance with clause 7.6 of the Bank of Russia Instruction dated September 14, 2006 No. 28-I “On opening and “closing bank accounts, deposit accounts”, the right of the second signature belongs to the chief accountant of the client - a legal entity and (or) persons authorized to maintain accounting records, on the basis of an administrative act of the head of the legal entity. Thus, Instruction No. 28-I establishes that persons who are not the manager and chief accountant of a legal entity must be granted the right to sign. However, sometimes employers prefer to comply with the bank’s request to issue an order assigning the right of second signature to the chief accountant, despite its obvious legal inexpediency. This will not have any negative consequences. Moreover, the clause on the right of a second signature can also be reflected in the employment contract with the chief accountant. As established in Part 5 of Art. 57 of the Labor Code of the Russian Federation, an employment contract may also include the rights and obligations of the employee and employer established by labor legislation and other regulatory legal acts. Then this provision can be reproduced in the employment order (Part 1 of Article 68 of the Labor Code of the Russian Federation). The legislation of the Russian Federation requires the employer to carry out a certain procedure for hiring employees.

The future employee writes an application, the head of the enterprise endorses this application, after which an employment agreement is signed. It sets out all the conditions for providing a workplace and performing professional duties.

Hiring procedure

The signing of this agreement is not yet sufficient grounds to bring the employee into the workforce. The document that allows this to be done is the appointment order.

Particular attention should be paid to the preparation of these documents when accepting citizens for leadership positions.

It is also important to take the paperwork for hiring financial services employees seriously. One of these services is accounting. The head of such a department is the chief accountant.

This publication will discuss how to correctly draw up an order for the appointment of a chief accountant and its sample.

Hiring a chief accountant

There are mandatory requirements for applicants for this position. First of all, a citizen must have an appropriate education. Namely, it must be either financial or economic.

The next requirement relates to work experience. The job applicant must work in the financial or economic department for at least five years. He must hold a leadership position for part of this period.

The last requirement is not mandatory, but employer enterprises take it into account. The general director of the company has the right to demand other mandatory qualities from the applicant. Employment is carried out only with his signature.

The hiring procedure consists of issuing and signing an order by the general director. In addition, an employment contract and job descriptions must be issued. Familiarization with job descriptions is carried out against signature.

Order on the appointment of a chief accountant, sample filling

The State Statistics Committee of the Russian Federation has developed a unified form of this document. It is an annex to the resolution dated January 5, 2004. This form is abbreviated “T-1”.

It is not necessary to use this form at this time. If you don’t want to develop a draft document yourself, you can use it. After reading this publication, you will be able to download both this form and other sample documents for free.

The next requirement can be considered the need to define a temporary term for the transfer of cases and documentation. This refers to the transfer from a former employee to a new one. This term cannot exceed two weeks. This is due to the fact that the legislation provides a fourteen-day period for a company to completely release a resigning employee.

Below is an order for the appointment of a chief accountant, a sample and a form, a version of which can be downloaded for free.

The chief accountant is the second most important and powerful person in the enterprise after the director. Therefore, when it is replaced, it is necessary to approach drawing up an order for its appointment with special responsibility.

Fundamentally, it is not much different from the template document used to hire full-time employees, but it still has its own nuances that should not be ignored.

When and for what purpose is an order created?

Organizing the work of the accounting department is the responsibility of the head of the enterprise. It can go one of three ways:

- appoint a specialist according to the staffing schedule;

- conclude an agreement on accounting services on an outsourcing basis with a third-party organization;

- assign this function to yourself.

The latter is possible when a company cannot, for some reason, maintain a separate specialist in the position of chief accountant and uses the simplified tax system (USN), a simplified taxation system (the main tax system, due to some of its features and rather high complexity, requires special education and knowledge).

It is necessary to make a choice immediately after the creation of a Limited Liability Company at the very beginning of the enterprise’s activities through the issuance of an appropriate order.

Sometimes this document is also called “Order No. 2” (the first order is on the appointment of a director), because According to the staff of any LLC, two main positions are a priori defined: director and chief accountant.

It should be noted that sometimes the transfer of responsibilities occurs during the period of active activity of the organization: this is not prohibited by law and this procedure does not require any special explanation.

After the order is issued, full responsibility for the financial part of the enterprise’s work, including submission of reports, calculations, payment of taxes, etc. falls on the director. The right to sign payment documents is automatically transferred to him.

Manager's order log

All executed orders of the manager are subject to registration in journals. It is preferable to use separate journals for orders for main activities and orders for personnel. In addition, it is advisable to separate the logs for orders with different storage periods.

There is no legally established journal form. An enterprise can independently develop a journal, having approved its form by internal regulations. It is recommended to use the following columns:

- serial number of the record;

- name and details of the document;

- summary of the document;

- surname of the person responsible for drawing up the order.

Look at the sample journal design in the publication “Journal of registration of orders for personnel - sample.”

The journal can be issued in paper form or filled out electronically. In paper form, the sheets are numbered, the magazine itself is stitched and sealed at the back with the seal of the organization and the signature of the responsible person.

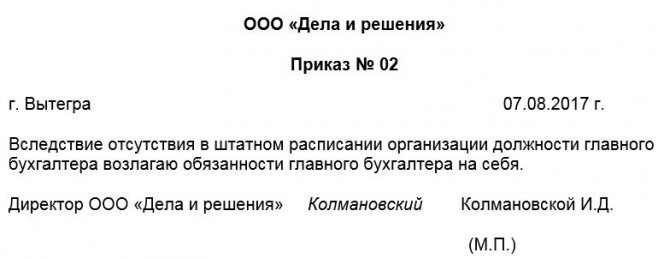

Assigning the duties of the chief accountant to the general director

Assigning the duties of chief accountant to the general director is not such a rare procedure.

This often happens at the time of opening an enterprise, when the staffing table has not yet been approved, but the obligation arises to submit reporting forms to the Federal Tax Service, Social Insurance Fund or Pension Fund of the Russian Federation, and activities have not yet begun.

How to assign the duties of a chief accountant to a director - sample order

Assignment of director's duties to the chief accountant

Acting part-time director

Appointment of an interim CEO

The law provides for the presence of a chief accountant for every legal entity.

But in some cases there are concessions: the manager has permission to act as director.

The General Director can replace the chief accountant not only during periods of absence, but on an ongoing basis in the organization.

To legally formalize the assignment of responsibilities, an additional agreement to the employment contract is issued and an order is issued. The legislation does not approve a single form for such a document. However, it is compiled according to the approved model.

To fulfill the duties of the absent chief accountant, the general director issues a corresponding order from the manager, creates a temporary card with signatures, and a seal imprint. There is no need to specifically notify tax authorities, pension funds, statistical authorities, or social insurance funds. However, it is better to attach a copy of the order to the reporting.

According to Art. 7 in Federal Law No. 402 of December 6, 2011. bookkeeping and storage of accounting documentation must be organized by the head of the company.

The accounting policy must include one of the following options:

- Make a responsible company employee or chief accountant responsible for storing and maintaining accounting records.

- Draw up an agreement for accounting by a third-party organization or specialist.

- Take charge of accounting to the general director.

In case of temporary disability or absence of the chief accountant, two forms of labor organization are possible:

- temporary substitution;

- performance of duties.

When temporarily replaced, the employee must be relieved of his duties at his main place of work. He is paid the difference between the chief accountant's salary and the actual salary.

While performing duties, the employee is not released from his main job. He is paid a percentage of his salary for additional duties. The conditions are determined by order or prescribed in the collective agreement.

The duties of another employee are performed:

- with the consent of the employee;

- on the initiative of the director.

In the first option, the employee signs the draft order agreeing to perform the duties of the chief accountant. You are allowed to write a separate statement. Only after this the manager can issue an order.

In the second option, the director decides unilaterally to assign responsibilities. This will be a significant change in working conditions.

Accordingly, the employee is warned two months before new duties are assigned. For example, they prepare a draft order for the employee to review and sign.

Then, after two months, an order is issued.

You can include a list of duties performed in the order or application. It is not always necessary or justified to entrust all the duties of the chief accountant to another person.

From the first day of absence until the appearance of the chief accountant, the duties are performed by the person specified in the order, including organizational and administrative (management of the accounting department), executive (inventory, primary and cash documents, etc.) functions. At the same time, the employee bears the responsibility of the chief accountant for any violations of the law.

In the absence of a chief accountant, provision of information about the person performing his duties is not required. The application is submitted only when replacing the chief accountant according to form 1-OPP.

Thus, a copy of the transfer of responsibilities order is attached to the tax return.

For electronic reporting, everything is much simpler. Electronic tax reporting is accepted on the basis of an electronic digital signature.

All responsible employees of the organization may have it, who have the right to put it in the absence of the signature of the chief accountant or general director.

It is better to consider the described situation in advance when registering electronic keys.

The situation is similar with the notification of statistical authorities, social insurance funds and pension funds. Like a tax return, a copy of the order is attached to the relevant reports.

The temporary chief accountant deals with bank documentation. A new Card with signatures and a seal imprint are not drawn up for him. The bank is required to issue a temporary card with the signature of the acting official. It is certified by a notary or by the village, city, or district council.

An alternative would be the right of second signature. You only need to provide a signature card with an expiration date and a copy of the order. Such a temporary card is certified by a seal with the signatures of the manager and chief accountant.

The third option would be a pre-arranged second signature right.

The Labor Code of the Russian Federation does not provide for a restriction on combination of positions for directors of an organization. But the effect of the resolution of the famous Council of Ministers No. 1145 has not yet been canceled. It contains a list of employees who have the right to combine positions.

Clause 15 does not apply to directors, their assistants and deputies. In other words, the CEO cannot combine positions. However, there is a determination of the Cassation Board No. KAS03-90 dated March 25.

For heads of organizations, the restriction was not appealed and continues to apply.

There is an important point: the Resolution is valid insofar as it does not contradict the Labor Code. And the Labor Code does not provide for restrictions on the combination of duties by the general director. For this reason, it is believed that the director has the right to combine the duties of the chief accountant with management.

Responsibility for accounting can only be assumed by directors of micro and small enterprises and non-profit organizations using a simplified accounting system. These are organizations with a staff of up to 100 people and an annual turnover of no more than 800 million.

An order to combine the duties of an accountant and a general director by one person can be issued by the heads of an organization with a share of the authorized capital of third parties up to 49%. This is done to avoid “tax optimization” in large businesses.

If the director decides to independently conduct accounting, this is reflected in the order. The presence of a chief accountant on staff is not required.

If the manager independently conducts accounting, but has hired a cashier and an accountant as assistants, then accounting is carried out not only by the director, but also by a registered accountant.

The organization has the right to take advantage of the provisions of paragraph 2a of Art. 6 of Law No. 129-FS: establish an accounting service for their accountant and cashier, which will be headed by an accountant.

Additionally, the manager’s employment contract includes a clause on the performance of the duties of the chief accountant (Article 57 of the Labor Code).

The appointment of a chief accountant must occur immediately after registration of the organization. The order is signed by the general director, and the order is called “order No. 1”.

If there is an accountant on staff, then clause 2b of Art. 6 of the above law: the accepted accountant becomes responsible for accounting. All settlement and monetary documents, credit and financial obligations are considered invalid without the signature of an accountant.

Order No. 1

The first order is the document on the basis of which subsequent orders are issued. It must indicate the person who receives the right to sign subsequent documents.

The order must contain:

- Abbreviated and full name of the organization. The name should not be indicated on the sign, but the legally registered one.

- Compilation time, outgoing number.

- Place of registration of the company.

- Preamble – a brief description of the contents of the order.

- Main text. It is important to indicate the moment it comes into force.

- Stamp and signature.

Examples of orders

Let's consider an example of a director's order, which states that the chief accountant's responsibilities are assigned to himself from the moment of registration of the organization's activities.

LIMITED LIABILITY COMPANY

"FAIRY TALE"

(LLC "FAIRY TALE")

ORDER No. 1 – YES

Moscow March 18, 2021

On the appointment of the chief accountant and general director

- Based on the Minutes of the meeting of the founders of Skazka LLC No. 6 dated March 5, 2021, I assume the position of general director of the company on March 18, 2021.

- Due to the absence of the position of chief accountant on the staff of Skazka LLC, I entrust his responsibilities to myself.

- The order comes into force on March 18, 2021.

- I reserve control over its execution.

General Director of Skazka LLC P.P. Petrov

Place of printing.

If, from the time of registration of a legal entity, an individual person has been appointed chief accountant, then periods of his absence will still occur (vacation, sick leave, unforeseen circumstances). Adjustments will need to be made to the staffing table. The director will need to appoint a person who is responsible for an important area of work.

In such cases, the order to assign duties to the director must be limited to the duration of the order. However, it is not necessary to specify an end date. To cancel the order, you can use any event: leaving sick leave, maternity leave, etc.

"INVESTTORG"

(Investtorg LLC)

ORDER

No. 352-DA March 20, 2021

Moscow

On the temporary performance of duties of the chief accountant

Due to the departure from April 1, 2021 of the chief accountant of Umnaya U.U. on maternity leave, I order that the duties of the chief accountant be assigned to myself, General Director Svetlana Aleksandrovna Fedosenko, until the release of Smart U.U. from maternity leave.

Criminal liability cannot be avoided

According to the provisions of Article 42 of the Criminal Code of the Russian Federation (hereinafter referred to as the Criminal Code of the Russian Federation), a person who has committed an intentional crime in pursuance of a obviously illegal order or instruction bears criminal liability on a general basis.

Crimes for which the chief accountant faces criminal liability relate to the sphere of economic activity.

Criminal cases against the chief accountant can be initiated for the following types of violations:

- evasion of tax payments and insurance premiums (Article 199 of the Criminal Code of the Russian Federation);

- failure to fulfill the duties of a tax agent (Article 199.1 of the Criminal Code of the Russian Federation);

- evasion of payment of social insurance contributions (Article 199.4 of the Criminal Code of the Russian Federation);

- falsification of financial documents and reporting (Article 172.1 of the Criminal Code of the Russian Federation);

- other types of criminal offenses.

On the contrary, failure to comply with a knowingly illegal order or instruction excludes criminal liability.

Thus, a written order from the director will not relieve the chief accountant from criminal punishment.

Therefore, in such a situation, our advice is: it is wiser to resign so as not to end up as part of a group of persons acting by prior conspiracy (clause “a”, part 2 of article 199 of the Criminal Code of the Russian Federation).

Algorithm for transferring cases from the chief accountant to the general director

When entrusting the function of chief accountant to a director, no additional entries need to be made either in the manager’s personal file or in his work book. There is no need to conclude an additional agreement to the employment contract.

If there is a chief accountant in a business entity, but for some reason resigns, the law obliges him to transfer to his successor everything for which he is responsible (in particular, documentation and materiel).

The transfer must be completed by order of the manager.

In practice, the result of the transfer is an act of acceptance and transfer of papers or a special inventory. It should, first of all, include those documents that, according to Art. 29 Federal Law No. 402, are stored for at least 60 months. So, these are Accounting policies, primary records, registers, reporting forms, auditors’ opinions, etc.

Thus, if the business entity is commercial, is not a cooperative and is not associated with jurisprudence, its director has the right to conduct accounting instead of the chief accountant. this is possible after issuing the appropriate order (in any form, but indicating all the required details) and subject to Russian citizenship.

If it is not possible to obtain a written order from the director

When there are no written orders from management, and insisting on their execution is problematic, the chief accountant can protect himself by taking the following steps:

- write a memo to the manager, taking into account the above recommendations for its preparation;

- officially transfer to the secretary of the enterprise with recording of the incoming number. This step must be taken in order for such a note to have any legal force.

Subsequently, a correctly drafted note, if it does not completely relieve the chief accountant from responsibility, will certainly serve as a mitigating circumstance.

| Example of a Service Note to CEO _____________________(FULL NAME.) ____________________________ (Name of the organization) From the Chief Accountant ____________________(FULL NAME.) |

The right to sign when assigning duties

The Labor Code of the Russian Federation does not contain restrictions or prohibitions regarding combination.

Secondly, this is Federal Law No. 402 dated December 6, 2011, which is logical, since the issue is directly related to accounting in an enterprise or company. Familiarization with the fourth paragraph of the sixth article and the third paragraph of the seventh article of this legislative act allows us to assert that at the local level the assignment is possible in the following economic entities:

- non-profit;

- small and medium;

- included in Skolkovo.

That is, the manager’s right to keep records is directly provided for by law.

However, based on clause 5 of Art. 6 of this law, such a procedure cannot be carried out in:

- government organizations;

- organizations whose reporting is subject to mandatory audit;

- housing and credit consumer cooperatives;

- law offices and chambers;

- legal advice;

- political parties.

Instruction of the Central Bank of the Russian Federation dated September 14, 2006 No. 28-I stipulates that when a manager performs the functions of a chief accountant, only one visa must be affixed to the sample signature card - his. In the column “Second signature” it is noted that the person vested with such right is absent.

Assignment of responsibilities to a part-time director

Being an employee, the manager has the right to work part-time. However, Art. 276 of the Labor Code of the Russian Federation stipulates that he can work on a paid basis in other economic entities only after receiving the appropriate permission from the authorized body of the legal entity that is the main employer. To obtain it, you must contact the authority in writing with a request for permission to work part-time.

This request is considered and, if granted, is filed in the manager’s personal file.

Next, he must find a second job. To do this, an employment contract is concluded with him, containing all work aspects. Upon returning to work, he issues an order to take office.

Only after these procedures have been completed can such a manager be assigned the duties of a chief accountant.

Federal Law No. 115 of July 25, 2002 prohibits the implementation of this procedure in relation to foreign citizens temporarily staying in the territory of the Russian Federation.

What to pay attention to when drawing up an order

Today there is no single, unified sample order on assigning the duties of a chief accountant to a director, so representatives of enterprises and organizations can write it in any form, based on their vision of this document.

Some companies have their own order template that is mandatory for use. In any case, when drawing up a document, it is important to adhere to the norms of office work, business documentation and, no matter how trivial it may sound, the rules of the Russian language.

The document must include a number of certain information, without which it will not acquire legal force:

- number, date and place of creation;

- name of the enterprise;

- the reason for creating the order, as well as the essence: assigning the duties of the chief accountant to the director. The whole idea can be expressed in one or two sentences.

If there are any additional documents, they should also be attached to the document, noting them in the main part as a separate paragraph.

Instructions for filling out an order for the appointment of a chief accountant

The first thing that needs to be indicated in this document is the date the order was generated and its number according to internal document flow. The date of creation of the order will be considered the date the new chief accountant takes office, unless otherwise specified in a separate paragraph in the order.

Then you should enter the last name, first name and patronymic (without abbreviations) of the person who is appointed chief accountant. Just below you need to specify on what basis the employee is hired: temporary or permanent.