Basic moments

In case of production necessity, the employer has the right to involve the employee in additional work. The Labor Code of the Russian Federation provides three ways for an employee to perform additional work without exemption from the main one:

- combination of positions;

- increase in the volume of work;

- fulfilling the duties of a temporarily absent colleague.

Additional duties are performed under the following conditions:

- without interrupting your main job;

- during the established working hours (Part 1, Article 60.2 of the Labor Code of the Russian Federation).

To issue an order to assign additional work to an employee under Art. 60.2 of the Labor Code of the Russian Federation, consider several rules:

- the employee provided written consent;

- the activity relates to a different or similar position;

- labor is paid additionally.

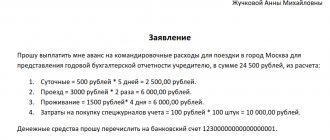

The employee’s consent can be formalized as follows:

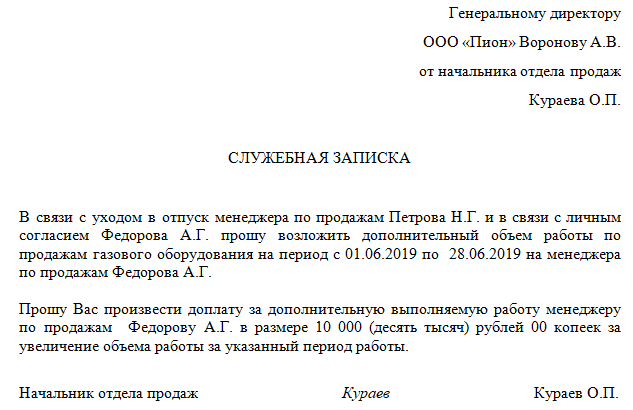

But first, the employee’s immediate supervisor sends a notice to the director of the enterprise about the situation that has arisen and the need to temporarily transfer responsibilities to one of the employees.

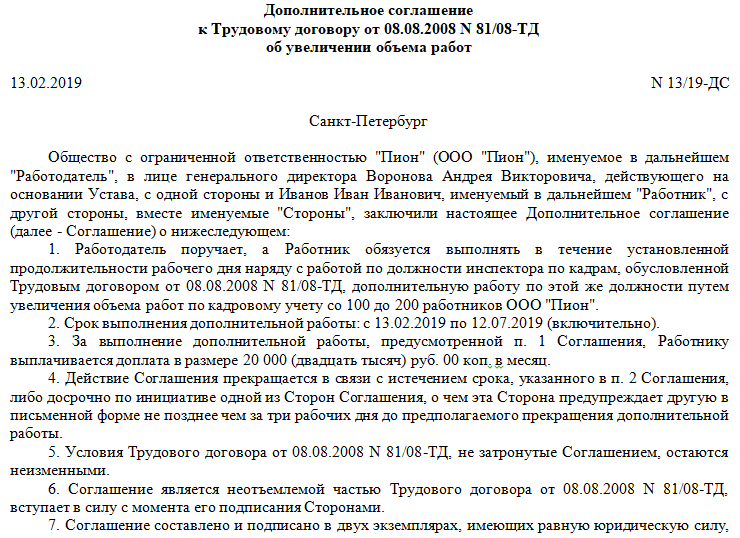

If the employee agrees to additional work, not only a sample order to increase the volume of work for the same position is drawn up, but also an additional agreement to his employment contract. It states:

- what needs to be done and for what period;

- amount of surcharge;

- the period during which a citizen works under new conditions.

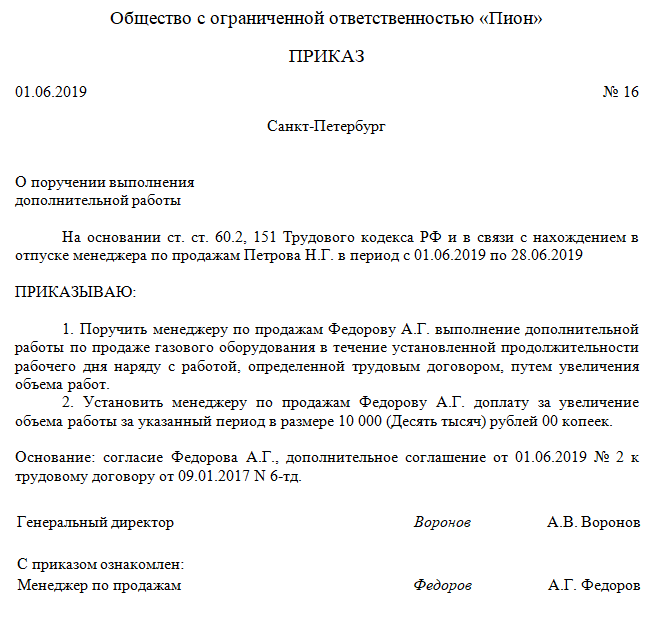

Based on the concluded agreement, using a sample order for additional payment for additional work, the employer issues an order for the temporary performance of additional duties. The employee must be familiarized with the document and signed.

We suggest taking our sample order for additional payment for an increase in the amount of work as a basis and modifying it to suit your needs.

Order on salary increase

Types of salary supplements.

When preparing documentation, you must adhere to precise wording. If we talk about allowances, they are sometimes called surcharges. The fact is that allowances according to their functionality are divided into:

The latter are more often called additional payments. This is due to the fact that additional payments are compensation to the employee for harmful working conditions, especially hard work, and performing their duties beyond the norm. In most cases, these are payments required by law that the employer has no right to ignore.

Incentive bonuses are another matter. They are a voluntary expression of gratitude to an employee or employees for their responsibility and work. Bonuses of this kind affect the motivation of individual employees. Such payments include bonuses and other incentive payments.

Related publications

There is no such concept as a personal allowance in legislative acts, but a conclusion about its legality can be drawn from Article 135 of the Labor Code of the Russian Federation, which allows employers to establish any allowances and additional payments to their employees.

Personal salary increase: justification

Personal allowances to the basic salary may be provided for in the following documents:

In local regulations, as a rule, allowances are prescribed without reference to a specific person. They are established for specific work or merit. If a personal allowance is specified in the employment contract of a particular employee, then it applies only to him.

How to issue an order for additional payment to an employee

Sample order to increase the volume of work performed / Quantity 0 / Average score 0 with new duties. 3. Establish from June 1, 2006 a monthly additional payment to the official salary of O.V. Parkhomenko. in the amount of 500 rubles for increasing the volume of work performed. 4.

Bring this order to the attention of all employees of the organization. The order has been familiarized with the SIGNATURE of O.V. Parkhomenko, June 2006. Details in the materials of the Personnel System: 1.

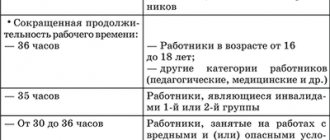

When combining positions, a person works during his main working hours, but his schedule is more tightly scheduled.

After all, in addition to your duties, you need to have time to work for another employee. Combination can be carried out if the work process does not deteriorate: the quality of products and service remains at the same level. Additional payment for combining positions of the Labor Code of the Russian Federation 2021, amount.

How is combined work paid? Additional work is paid. The amount of additional payment for combination is negotiated by the parties.

The amount of additional payment depends on the scope of duties performed and the rate. The rule was approved by Part 2 of Art. 151 of the Labor Code. Management determines how serious work to entrust to a specialist and how to pay for it.

It is considered how busy a person is in his main and additional positions.

I order:

To establish for Alexander Igorevich Orlov, head of the department of personnel policy and protection of state secrets, who has 5 years of work experience in units for the protection of state secrets, a monthly percentage increase to the official salary for work experience in units for the protection of state secrets in the amount of 15% of the official salary.

Reason: conclusion of the department of personnel policy and protection of state secrets on the work experience of A.I. Orlov. in units for the protection of state secrets.

I ORDER:

1. Establish __________________________________________________________ (indicate the position, structural unit, full name of the employee) personal allowance to the official salary in the amount of __________ rubles monthly (quarterly, for a period of up to _____________) from “___”________ ___ 2. Calculate accounting _____________________________________________ (FULL NAME.

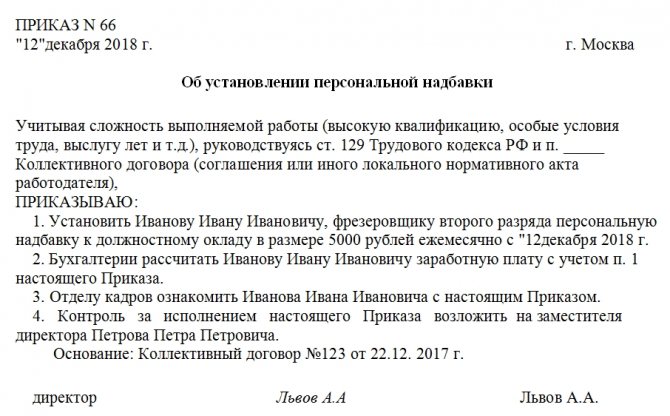

Order on establishing a personal allowance

Attention

Labor Code of the Russian Federation, the management of any enterprise has the right to take the initiative and stimulate its employees with salary bonuses in connection with their certain personal achievements.

As an example, consider a situation where for employees with higher qualifications, the management of an enterprise sets a bonus for high professionalism and skill, while keeping the staffing table unchanged.

In this case, how can we legally formalize this fact and labor relations? From the book you will learn everything about the internal labor regulations, and you will find instructions on personnel records management that will make your work easier. You will also find out what errors in the PVTR the inspector will pay attention to first and how to draw up a regulation on remuneration.

Important

The reason for changing the form (system) of remuneration in this case does not need to be explained or justified in the employment contract. To comply with the established procedure for issuing an allowance, an employee’s management should:

The employee’s signature in the additional agreement will mean his agreement with the new proposed conditions;

- length of service (length of service);

- for performing work that is classified as particularly important for a certain period of time;

- knowledge and use in work of one or more foreign languages;

- for high achievements in work;

- as personal allowances for the employee.

Allowances and surcharges allow you to:

- create incentives to improve quality and increase the intensity and responsibility when an employee fulfills his work obligations;

- increase the objectivity of assessing the labor qualities and skills of specific specialists;

- optimize the system of material incentives for employees who have fulfilled and exceeded the production standards established for them.

Read on the topic in the electronic magazine How to correctly apply for a salary increase So, following Part 2 of Art. But since this is still part of the remuneration, it must be documented.

To do this, you need to regulate the personal bonus in a collective agreement or in the Regulations on remuneration and be sure to refer to this document in the text of the employment agreement (Article 57 of the Labor Code of the Russian Federation).

Order for additional payment

Important

The order can be signed by the chairman of the meeting. In another case, no matter how absurd it may sound, the manager himself must sign, and put a second signature in the “acquainted” line.

7 All documents are transferred to personnel employees, and then to the accounting department, where they make accruals.

Like any other employee, vacation payments to the general director must be issued three days before leaving for the required rest.

Sources:

- general director's leave order

When an employee is hired for a job, an employment contract is drawn up, which specifies the salary regulated by Article 135 of the Labor Code of the Russian Federation, and all working and rest conditions. Any changes in wages are documented in a clear sequence specified in the Labor Code.

Order to establish a salary increase

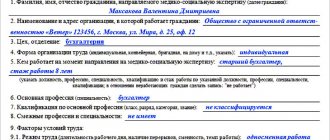

Nina Kovyazina, Deputy Director of the Department of Education and Human Resources of the Ministry of Health of the Russian Federation

1. Conclude additional agreements with employees, which will reflect the change in the form of remuneration (new salary). Moreover, by signing, the employee agrees with the changed criteria.

In relation to municipal and city institutions, this means that the approximate provisions on remuneration approved by authorities in relation to subordinate institutions cannot provide for certain amounts of additional payment for combining professions (positions).

How does the salary increase work?

A salary supplement is an additional payment for professional activities, calculated on the basis of:

- established tariff rates;

- official salaries;

- piece rates.

Attention! Information about the employee’s bonus must be reflected in the employment contract as conditions for payment for work activities.

Salary supplements are of two types:

Mandatory bonuses are additional payments established for the performance of certain job duties. For example, additional payment for a shift work schedule or work in an area with a special climate.

If an employer wishes to establish a bonus for an employee in the absence of conditions for establishing a mandatory additional payment, then such a bonus will be considered personal and is established on an individual basis.

A personal allowance can be established for employers for:

- employee's work experience;

- professional excellence;

- working with trade secrets;

- knowledge of a foreign language;

- academic degree;

- work results.

The bonus can be set as a fixed amount (for example, 1000 rubles to the salary) or as a percentage (for example, 15% of the salary).

In any case, the amount of any additional payment must be reflected in the employment contract. In some cases, it is permissible to refer to a document defining the procedure for calculating a personal bonus to an employee’s salary.

Unique order to change (increase) official salary

A change in an employee's salary can be initiated by a memo indicating the reasons for the change in salary. If the salary is subsequently reduced, the wishes of the line manager will not be taken into account.

Reasons for increasing the salary may be:

- systematic overfulfillment of the plan;

- training;

- successfully completed certification;

- extensive work experience.

In addition, salary increases may be initiated as a result of changes in job responsibilities.

To raise the issue of a salary increase:

- The employee's manager must provide his superiors with a memo containing information about the reasons for increasing the salary of his subordinate.

- Subsequently, the document must be agreed upon with an authorized person or director of the organization.

- After the salary increase is approved, the HR department employee must prepare a unique order to adjust the salary portion of the employee’s salary, as well as to make adjustments to the staffing table.

- In addition, all changes must be reflected in the employment contract. To do this, it is necessary to prepare an additional agreement, which will subsequently be signed by both parties.

- If an agreement of any kind is reached, a unique order is drawn up to change the official salary and an additional agreement to the employment contract.

When to use individual payments

Quite often a situation arises when, within the existing remuneration system, there is no mechanism or way to establish special payment conditions for one employee (or several).

The need for such increased pay usually appears when one of the employees shows outstanding results and the employer wants to “fix” such a person in the company.

Another option may be that the employee has some unique knowledge and skills, some know-how in his work. And they are the ones who give some very tangible competitive advantage to a business.

Source: https://ark-product.ru/sudebnaya-zashhita/6514-prikaz-o-nadbavke-k-zarabotnoy-plate.html

How does the surcharge work?

According to Part 2 of Art. 151 of the Labor Code of the Russian Federation, the amount of additional payment for additional work is determined by agreement of the parties. When determining the amount, the employer must take into account:

- content and (or) scope of duties performed (Article 151 of the Labor Code of the Russian Federation);

- qualifications of the employee, complexity and conditions of the work performed, quantity and quality of labor expended (Article 129, Article 132 of the Labor Code of the Russian Federation);

- the employer’s obligation to provide equal pay for work of equal value (paragraph 6, part 2, article 22 of the Labor Code of the Russian Federation).

The Labor Code of the Russian Federation does not define either the minimum or maximum amount, but as an example of additional payment for additional work, use:

- the agreed amount of money;

- interest on the employee’s salary / tariff rate.

All payments are made officially with the execution of the relevant documents. Any discrimination in establishing and changing wage conditions is prohibited.

Results

The employer is obliged to pay an employee additionally if the salary accrued to him for the month (taking into account all compensation and incentive payments) turns out to be below the minimum wage and at the same time the employee worked the standard working hours and fulfilled his job duties. To pay such an additional payment, an order or other administrative document is drawn up.

Sources:

- labor Code

- Law “On the minimum wage” dated June 19, 2000 No. 82-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Increasing the volume of work without additional payment

The job descriptions of some employees state that during the absence of another employee with similar job responsibilities from the workplace, they perform the functions of absent colleagues. The specified provisions of job descriptions are an integral part of contracts, and no additional payment is due for the performance of additional duties. An indication of this is contained in the Letter of the Ministry of Health and Social Development of Russia dated March 12, 2012 No. 22-2-897. Therefore, if, according to the job description and employment contract, one employee is not authorized to completely replace another, additional payment is possible.

What they rely on

The additional amount that is paid to employees allows the employer to increase their level of productivity. Therefore, the employer independently determines the basis for calculating the premium and its amount. Basically, these payments are assigned to employees who:

- They train trainees.

- Received a category or improved your professional qualifications.

- Received a title or degree.

- They have certain useful knowledge (speak foreign languages, understand some scientific field, etc.).

- They perform their job responsibilities efficiently over a long period of time.

- They put a lot of effort into completing the task.

In some cases, bonuses are mandatory (upgrading a category, obtaining a title, degree, etc.). In such a situation, the amount of additional payments is determined by regulations. The amount of mandatory payments depends on the employee’s length of service, the amount of his salary, professional achievements, field of activity and region.

Thus, the amount of the bonus for medical workers can be 80% of the salary, but only if their experience exceeds 5 years. If the employer does not pay the mandatory increase, the employee has the right to appeal his actions by filing an application with the trade union, labor inspectorate or court.

Who gets credit and who doesn't?

Absolutely all officially employed persons who live and work in the Russian Federation have the right to receive additional payments. This right is not affected by the field of activity, age, or length of service of employees. However, the person who is a party to the labor relationship can receive payments. To do this, he must be officially hired.

Citizens who were not officially employed cannot count on the bonus. Even if a civil contract (contract, paid services, etc.) was concluded between the employer and them.

Since such agreements give rise to civil legal relations, and they are regulated by the Civil Code. However, the parties can independently determine the procedure for calculating and assigning allowances, and indicate this in the contract or in an additional agreement.