Scope of application of account 60 in accounting

Suppliers are firms that deliver raw materials, semi-finished products, components, goods, fixed assets and other inventories to other organizations for production and commercial activities.

Settlements with suppliers and contractors require strict accounting

Contractors are individuals and legal entities who perform work under a contract concluded in accordance with the current legislation.

Accounting account 60 aims to summarize information on transactions with specified persons in the following aspects:

- acquisition of inventory items;

- performing certain work;

- provision of service;

- delivery of valuables;

- unpaid deliveries;

- excess inventories and inventories;

- transport services;

- communication services.

Organizations involved in the execution of construction contracts, contracts for the performance of research, development and technological work and other contracts for the functions of a general contractor are also reflected in account 60.

All transactions are reflected in accounting account 60, regardless of the time of payment.

The tasks facing the accounting system for account 60 relate to issues of tracking financial flows operating between the company and suppliers. The account allows you to receive information that performs the following tasks:

- control over the status of amounts due to contractors and suppliers of goods and materials (information is relevant for owners, as well as for the formation of reliable reporting);

- formation of an information base. On its basis, the speed of funds turnover is controlled. The database is used to generate management reports;

- control over compliance with contractual obligations, terms, volumes of supplies and payment for them;

- drawing up a payment plan for suppliers when distributing financial resources;

- eliminating opportunities to violate the law regarding payment issues;

- monitoring of overdue payments.

60 account in accounting is a variant of an active-passive account, regardless of the chosen accounting system and the organizational and legal form of activity. It is designed to generate and collect data about each supplier and counterparty.

The basis for starting accounting are:

- concluding an agreement for the supply of inventory, fixed non-current assets, and intangible assets;

- provision of services of various nature (utilities, repair and maintenance of buildings, structures, machinery and equipment);

- transportation of goods;

- performance of work under the contract, etc.

Important! Accounting under account 60 is called “Settlements with suppliers and contractors.” A synthetic version of accounting is maintained for all organizations. For analytics, sub-accounts are generated for individual counterparties.

To account for transactions between counterparties when delivering goods, account 60 is used

The procedure for writing off receivables and payables on account 60

According to accounting requirements, only true facts must be reflected in accounting data and reporting. If the documents show accounts payable with an expired collection period, then this rule is violated.

You might be interested in:

Account 90 in accounting: what is it used for, characteristics, examples of postings

Thus, the company is obliged to write off accounts payable if the collection period established by law has passed.

In addition, a debt that can no longer be repaid is subject to removal if the counterparty has been deregistered and no longer exists as a legal entity.

The law establishes that the period during which the creditor has the right to demand its coverage is set at 3 years. In this case, it is necessary to correctly determine the beginning of this period.

When concluding a supply or service agreement, this document usually indicates the date for repayment of obligations. From the day following it, you need to start counting the statute of limitations.

However, the law provides for the deadline to be reset and counted from the beginning. This happens if the debtor acknowledges the existing debt in writing, makes partial payment, signs a reconciliation report, etc. In this situation, the limitation period must be counted first from this moment.

Attention! However, this cannot be done indefinitely. When a period of 10 years has been reached from the date of its formation, the debt must be written off unconditionally.

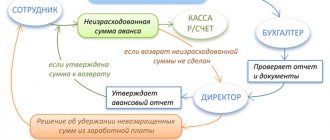

The debt write-off process is carried out in the following order:

- Carrying out an inventory of all payments. This procedure must be performed annually in order to compare the accounting data with the actual amounts of debt. During the inventory, it is also checked on what date the last movement on this debt occurred.

- Registration of an inventory report. There is a recommended form of the INV-17 form, but currently the company has the right to use its own forms. It is necessary to include in the act all the debts the company has, and not just the identified overdue ones. The document is drawn up in two copies, one is transferred to the accounting department, and the second remains with the commission.

- Preparation of accounting certificates. The accountant must analyze the executed act and draw up a certificate based on it. It reflects the counterparty for which there is a debt, the reason for the occurrence, the amount of the debt, as well as the day when the statute of limitations expired. Certificates of all expired debts, together with the act, are transferred to the manager for consideration and decision-making.

- Making an order. If the manager decides to write off, then he gives instructions to draw up an order to write off the debt. This document provides instructions to write off debt in accounting and tax accounting, and also appoints responsible persons. Based on the order, the accountant prepares accounting entries.

Why do you need 60 count?

The account is used to record settlements with counterparties. The company's debt for purchased goods or services is recorded as a loan. For example, a company received raw materials from a supplier, which means the accountant will make the following entry:

Dt 10 Kt 60 - goods received from the counterparty

Thus, the company has increased its stock of raw materials, and its debt to the supplier has increased, since the raw materials have not yet been paid for. By debit, the debt is reduced, for example due to payment of a bill for raw materials. Then the accountant makes the following entry:

Dt 60 Kt 51 - supplier invoice paid

Count 60 - active-passive. At the end of the period there may be a debit or credit balance. The debit amount means that the inventory items were paid in advance and the supplier has not yet transferred them. A loan is a company’s debt to a counterparty.

Count 60: what is it?

The purpose of the account was figured out, and everything seemed to be clear. What about its structure? What is it anyway - count 60, active or passive? Based on the fact that it reflects both receivables and payables, these accounts find their place in both the asset and liability of the balance sheet. Therefore, the account is active-passive. The balance at the end of the month can be formed either as a debit or as a credit. But more often, of course, the second option occurs.

In what cases is the account credited? Regardless of when the right to ownership of goods and materials or services (work) is transferred, the amount that must be paid to suppliers is reflected in account 60 immediately after receipt of goods and materials or services (work) with the relevant accompanying documents. The account is debited when repaying debts to suppliers, as well as for advance payments and deductions when exchanging inventory items.

Characteristics

Active - passive 60 account in accounting is used to combine data on transactions with counterparties.

The main characteristics that answer the question of whether the 60 account is active or passive:

- summarizes information about transactions with counterparties;

- summarizes information on transactions with subcontractors under construction contracts;

- the cost of acquired property is reflected according to Dt: 08.10, 20, 41 and Kt60;

- repayment of obligations is reflected according to Dt 60 and Kt 51,52,55;

- analytical accounting is formed in the context of each supplier, contractor and performer.

Count 60 belongs to the active-passive type:

- a debit balance indicates that the partner has not yet fulfilled his obligations to the company. The supplier company has a debt for the supply of goods, works or services;

- the presence of a credit balance indicates that the company has not yet paid the debt to the supplier or contractor.

Advances provided to suppliers for the upcoming supply of materials, raw materials, advances to contractors for upcoming work and services are taken into account.

Analytical accounting for account 60 is maintained for each accrued amount, for each supplier and contractor. The construction of analytical accounting provides the necessary data on:

- suppliers and accepted documents, the payment deadline for which has not yet arrived;

- suppliers who did not pay documents on time;

- to suppliers in case of unpaid deliveries;

- advances to suppliers;

- when issuing bills whose due date has not yet arrived;

- to suppliers for overdue payments;

- when receiving a commercial loan, etc.

Count 60 is active-passive, which characterizes its main feature

GLAVBUKH-INFO

Account 60 “Settlements with suppliers and contractors” is intended to summarize information on settlements with suppliers and contractors for:inventory items received, accepted work performed and services consumed, including the provision of electricity, gas, steam, water, etc., as well as for the delivery or processing of material assets, payment documents for which are accepted and subject to payment through the bank;

inventory items, works and services for which payment documents were not received from suppliers or contractors (so-called uninvoiced deliveries);

surplus inventory items identified during their acceptance;

transportation services received, including calculations for shortfalls and overcharges of the tariff (freight), as well as for all types of communication services, etc.

Organizations that perform the functions of a general contractor during the execution of a construction contract, a contract for the performance of research, development and technological work, and other contracts, also reflect settlements with their subcontractors on account 60 “Settlements with suppliers and contractors.”

All transactions related to settlements for acquired material assets, accepted work or consumed services are reflected in account 60 “Settlements with suppliers and contractors”, regardless of the time of payment.

Account 60 “Settlements with suppliers and contractors” is credited for the cost of inventory, work, and services accepted for accounting in correspondence with accounts accounting for these values (or account 15 “Procurement and acquisition of material assets”) or accounts accounting for relevant costs. For services for the delivery of material assets (goods), as well as for the processing of materials on the side of the credit entry, account 60 “Settlements with suppliers and contractors” are made in correspondence with the accounts for inventory, goods, production costs, etc.

Regardless of the assessment of inventory items in analytical accounting, account 60 “Settlements with suppliers and contractors” in synthetic accounting is credited according to the supplier’s settlement documents. When the supplier's invoice was accepted and paid before the cargo arrived, and upon acceptance of the incoming inventory items into the warehouse, a shortage was discovered in excess of the amounts stipulated in the contract against the invoiced quantity, and also if, when checking the supplier's or contractor's invoice (after the invoice was accepted ) discrepancies in prices stipulated by the contract, as well as arithmetic errors were discovered, account 60 “Settlements with suppliers and contractors” is credited for the corresponding amount in correspondence with account 76 “Settlements with various debtors and creditors” (sub-account “Settlements for claims”).

For uninvoiced deliveries, account 60 “Settlements with suppliers and contractors” is credited for the cost of incoming valuables, determined based on the price and conditions stipulated in the contracts.

Account 60 “Settlements with suppliers and contractors” is debited for the amounts of fulfillment of obligations (payment of bills), including advances and prepayments, in correspondence with cash accounts, etc. In this case, the amounts of advances issued and prepayments are accounted for separately. Amounts of debt to suppliers and contractors, secured by bills of exchange issued by the organization, are not written off from account 60 “Settlements with suppliers and contractors”, but are taken into account separately in analytical accounting.

Analytical accounting for account 60 “Settlements with suppliers and contractors” is maintained for each submitted invoice, and settlements in the order of scheduled payments are maintained for each supplier and contractor. At the same time, the construction of analytical accounting should ensure the possibility of obtaining the necessary data on: suppliers on accepted and other payment documents for which the payment period has not yet arrived; to suppliers for payment documents not paid on time; to suppliers for uninvoiced deliveries; advances issued; to suppliers on bills issued, the payment period of which has not yet arrived; to suppliers for overdue bills of exchange; to suppliers for received commercial loans, etc.

Accounting for settlements with suppliers and contractors within a group of interrelated organizations, about the activities of which consolidated financial statements are prepared, is maintained on account 60 “Settlements with suppliers and contractors” separately.

Operation

| Source documents | Debit | Credit | |

| Paid to the supplier (for delivered products, as an advance) | bank statement, cash register | 60, 60/Av | 50, 51 |

| Material assets received from suppliers: | |||

| — material assets are capitalized | invoice | 08, 10, 41, etc. | 60 |

| — VAT on received material assets | invoice | 19-1,2 | 60 |

| The costs of services (work) included in costs are reflected: | |||

| — cost of services excluding VAT | agreement, act | 20, 23, 25, 26, 44 | 60 |

| — VAT on services | invoice | 19/Condition | 60 |

| Claims against the supplier are reflected | agreement, deed, invoice | 76-2 | 60 |

Account 60 “Settlements with suppliers and contractors” corresponds with the accounts:

| by debit | on a loan |

| 50 Cashier | 07 Equipment for installation |

| 51 Current accounts | 08 Investments in non-current assets |

| 52 Currency accounts | 10 Materials |

| 55 Special bank accounts | 11 Animals for growing and fattening |

| 60 Settlements with suppliers and contractors | 15 Procurement and acquisition of material assets |

| 62 Settlements with buyers and customers | 19 Value added tax on acquired assets |

| 66 Calculations for short-term loans and borrowings | 20 Main production |

| 67 Calculations for long-term loans and borrowings | 23 Auxiliary production |

| 76 Settlements with various debtors and creditors | 25 General production expenses |

| 79 On-farm settlements | 26 General expenses |

| 91 Other income and expenses | 28 Defects in production |

| 99 Profit and loss | 29 Service industries and farms |

| 41 Products | |

| 44 Selling expenses | |

| 50 Cashier | |

| 51 Current accounts | |

| 52 Currency accounts | |

| 55 Special bank accounts | |

| 60 Settlements with suppliers and contractors | |

| 76 Settlements with various debtors and creditors | |

| 79 On-farm settlements | |

| 91 Other income and expenses | |

| 94 Shortages and losses from damage to valuables | |

| 97 Deferred expenses |

Source: Correspondence of accounts E. Kholodenko, A. Rostovtsev

| < Previous | Next > |

Free admission

Please register the receipt of materials free of charge in the usual manner. The one who gave you the materials for free must provide the same documents as when receiving materials for a fee. The actual cost of materials received free of charge is determined by their market price. That is, at the price at which you can sell the materials. Such rules are established in paragraph 9 of PBU 5/01.

When determining the market price, be guided by the data that you have on the day you received the asset. Information about the level of current market prices must be confirmed by documents or through an examination. This follows from paragraph 10.3 of PBU 9/99.

If you have undertaken the delivery of materials received free of charge, then these costs should be included in the actual cost of materials (clauses 65 and 66 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n).

In accounting, reflect the gratuitous receipt of materials by posting:

Debit 10 (15) Credit 98-2

– materials received free of charge are taken into account.

When writing off materials received free of charge for production (for other purposes), reflect the income:

Debit 98-2 Credit 91-1

– income from the use of materials received free of charge is recognized (the cost of actually consumed materials).

This procedure is established by the Instructions for the chart of accounts.

An example of reflecting gratuitous receipt of materials in accounting

In March, Alpha LLC received free materials with a market value of 100,000 rubles. In April, part of the materials (worth 60,000 rubles) was released into production. In May, the remaining materials were used to renovate the office. The organization accounts for materials on account 10 at actual cost (without using accounts 15 and 16).

Alpha's accountant made the following entries in accounting.

In March:

Debit 10 Credit 98-2 – 100,000 rub. – the receipt of materials is reflected at market value.

In April:

Debit 20 Credit 10 – 60,000 rub. – materials were released into production;

Debit 98-2 Credit 91-1 – 60,000 rubles. – the cost of materials released into production is reflected as part of other income.

In May:

Debit 26 Credit 10 – 40,000 rub. (RUB 100,000 – RUB 60,000) – materials were spent on office renovations;

Debit 98-2 Credit 91-1 – 40,000 rubles. – materials spent on office renovation are reflected as part of other income.

Wiring 60 60

Yes, such posting is possible, but using subaccounts. For example, you have a debt to a supplier. By agreement with him and to pay off this debt, you transfer money to a third party. The postings will be like this:

D 60.02 - K 51 - payment was transferred to a third party for your supplier D 60.01 - K 60.02 - debt to your supplier was reduced.

You can find more complete information on the topic in ConsultantPlus.

Free access to the system for 2 days.

Accountant forum:

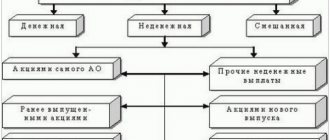

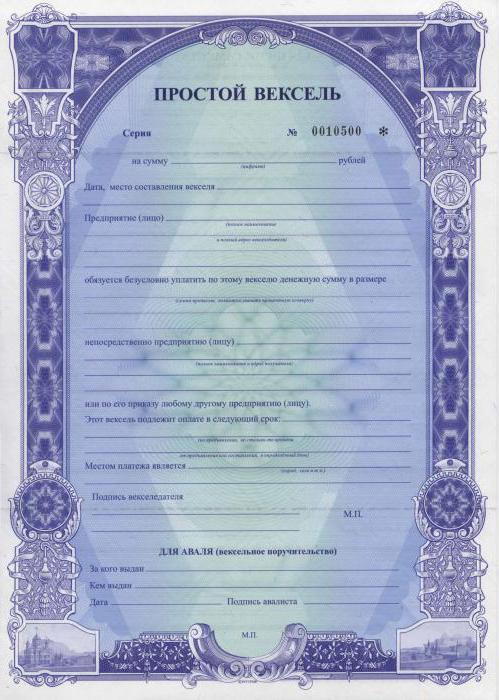

Accounting for bills of exchange issued to suppliers

In addition to the most common methods of payment in fact and in advance, there is also an option to pay for received assets, such as issuing a bill of exchange. Thus, the buyer gains a little time and guarantees that his obligations will be fulfilled on time. Accounting for issued bills is carried out on one of the subaccounts 60 of the account. Let's say this is a subaccount. 60.3. Let's look at the accounting entries that are made when performing this operation:

- Dt asset accounting account Kt “Settlements with suppliers” – received inventory items or completed work (services rendered) are taken into account.

- Dt “Settlements with suppliers” Kt “Bills issued” - a bill of exchange was issued to the supplier in payment of the amount due for the goods.

- Dt “Bills issued” Kt “Current account” – the bill is repaid on time.

Thus, organizing accounting in any of the possible payment methods for delivery is quite simple.

Account 60 is a kind of piggy bank of information on settlements with suppliers and contractors. This is one of the main items of the enterprise’s obligations, which is reflected in the annual reports and significantly affects the economic position of the company. Accounting on account 60 must be organized correctly, structured and provide all the necessary information about fulfilled, deferred, fulfilled and overdue obligations to suppliers.

Which accounts does it correspond with?

The current instructions establish that account 60 can correspond with the following accounts:

By debit:

- With account 50 — Payment in cash.

- With account 51 – Payments are made by non-cash payment.

- With account 52 — When payments are made through a foreign currency account.

- With account 55 – special invoices are used for payment.

- From accounts 60, 62, 76 - under mutual settlement agreements.

- From account 66 - when payment is made using borrowed funds.

- With account 79 - when the parent company pays for organizing the account.

- With account 91 - overdue accounts payable are written off.

- With account 99 – debt write-off in emergency circumstances

By loan:

- With account 07 - purchase of equipment that requires installation.

- With account 08 — acquisition of fixed assets.

- With account 10 - purchase of materials.

- With account 15 - when the receipt of materials is recorded using this account.

- With account 19 - when allocating incoming VAT.

- With account 20,23,25,26, 29, 44 – when works and services are purchased.

- With account 41 - upon receipt of goods that will be resold in the future.

- With account 50,51,51, 55 - upon return of overpaid amounts.

- With account 60, 76, 79 - for mutual settlements.

- With account 91 – when writing off overdue accounts receivable

- With account 94 - when a shortage of supplies from suppliers is identified.

- With account 97 - when recording expenses that are subject to distribution over a certain period (for example, rent, compulsory motor liability insurance, etc.)

Accounting for settlements with suppliers and contractors

The use of account 60 “Settlements with suppliers and contractors” is regulated by the Chart of Accounts, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n. This account is necessary to reflect data on payments for:

- goods, works, services (hereinafter referred to as GWS), which were accepted from the supplier and for which primary documents were received;

- GWS that were accepted from the supplier, but for which primary documents were not received (uninvoiced deliveries);

- surplus capitalized upon receipt of goods;

- work accepted from subcontractors, etc.

Operations to reflect accounts payable are carried out at the moment the obligation arises; the moment of payment does not affect the entry on the credit of account 60 in accounting . When to show a liability in accounting depends on the conditions for the transfer of ownership of the purchased GWS in accordance with the agreement between the buyer and supplier. The reflection of the obligation in accounting occurs at the same time as the reflection of the receipt of goods and services. When capitalizing the goods and services, the accountant records the transaction on the credit of account 60 and on the debit of the accounts of purchased property (as well as account 15) or costs for the amount specified in the supplier’s primary documents. VAT, included in the cost of goods and services, is allocated separately by posting:

Dt 19 Kt 60.

When obligations are fulfilled, that is, payment is made to the supplier, an entry is made for the amount of payment:

Dt 60 Kt 50, 51, 52, 55.

If the buyer makes payment before delivery of goods and materials, the posting is recorded as a debit to account 60 of the “Advances issued” subaccount. Thus, accounts receivable are accumulated in a separate subaccount of account 60, which will be repaid upon receipt of goods and services. At the same time, in the balance sheet, accounts payable for account 60 are shown as a liability, and accounts receivable are shown as an asset, and therefore the collapsed balance of account 60 cannot be shown in the reporting.

If the buyer transfers his own bill of exchange as a guarantee of payment of goods and services, then accounts payable from account 60 are not written off, but are reflected in a separate sub-account, for example, by posting:

Dt 60 subaccount “Settlements for received technical and technical materials” – Kt 60 subaccount “Settlements for bills issued”.

When repaying your own bill, the following posting is made:

Dt 60 subaccount “Settlements on bills issued” – Kt 50, 51, 52, 55.

Postings

The main transactions for account 60 are reflected in the table below.

By debit.

| Debit | Credit | Explanation of the operation |

| 60 | 50.01 | The debt to the supplier is repaid from the cash register |

| 60 | 51 | The debt to the supplier has been repaid from the current account |

| 60 | 52 | The debt to the supplier was repaid in foreign currency |

| 60 | 55.01 | The amount of the used letter of credit is written off for settlements with the supplier |

| 60 | 76.02 | The amount of claims against the supplier is reflected |

| 60 | 91.01 | Accounts payable are included in other income after the statute of limitations expires |

| 60 | 91.01 | Positive exchange rate difference reflected |

Payment for delivery upon receipt

If the contract for the supply of goods or the provision of services states that the amount billed by the supplier must be paid immediately after the goods and materials arrive at the buyer, then the accountant registers the receipt and then pays for the delivery. In this case, the following accounting entries are made:

- Dt of the asset account (08, 10, 20, 41, etc.) Ct “Settlements with suppliers” – the supplier’s invoice has been accepted.

- Dt “VAT” Ct “Settlements with suppliers” – VAT is allocated from the amount and accepted for accounting.

- Dt “Mandatory payments to the budget. VAT" Ct "VAT" - the amount of VAT is sent for deduction.

- DT “Settlements with suppliers” CT “Settlement invoice” – the invoice for the provided inventory and materials has been paid.

It often happens that the buyer and the supplier (contractor) agree on payment in advance. After funds are transferred, delivery is carried out. To do this, open a document marked “Suppliers” (account 60) and the corresponding sub-account, where information on advances issued is collected. The procedure is fixed with three entries:

- Dt “Advances issued” Ct “Current account” – advances are transferred to suppliers.

- Dt asset accounting account Kt “Settlements with suppliers” - inventory items received and accepted for accounting.

- DT “Settlements with suppliers” DT “Advances issued” – the advance issued earlier was offset.