Employer Responsibilities

Official employment gives the employee a number of guarantees. These include cases of temporary disability, when an employee, for objective reasons, cannot perform his duties. In such a situation, the employee must visit a medical facility, where a specialist will issue a sick leave certificate.

The document provides such guarantees as:

- maintaining the employee’s workplace and position during the period of absence;

- receiving payments for these days.

After the employee recovers, he must present a sick leave certificate to the organization’s accounting department or human resources department. Based on this, a benefit is calculated, which depends on the following factors:

- length of service;

- average monthly earnings;

- duration of temporary disability.

Compensation for being on sick leave must be paid on the date of the next advance or salary. The amount of the benefit depends on the employee’s total length of service:

| from 8 years | from 5 to 8 years | from 3 to 5 years | Less than 6 months |

| 100% | 80% | 60% | Calculation is based on the minimum wage |

When calculating benefits, the employee’s average earnings over the last 2 years of work are taken into account.

Reasons for non-payment of benefits

Federal Law No. 255-FZ provides for cases when an employee may not be paid sick leave benefits. These include situations:

- if the employee is relieved from performing work duties for good reason;

- when an employee is arrested;

- when undergoing a forensic medical examination;

- during plant downtime.

Thus, sick leave benefits are not paid if an employee is on leave without pay during a period of illness. Compensation is not accrued to a woman who is on annual paid leave if she has taken a certificate of incapacity for work to care for a child. Moreover, if she herself fell ill, then sick leave benefits are accrued, and the vacation is extended by the number of days specified in the document.

Compensation is not paid during the period of downtime of the organization. However, if the sick leave is open until the moment it begins, the payment is accrued. Its size is calculated based on the average earnings retained by the employee during this period.

Important

Sick leave benefits are not accrued if the disability occurred due to an intentional crime committed by the employee. Also, compensation is not paid if a person knowingly caused harm to his health.

Legal grounds for refusal to pay sick leave

In Art. 9 Federal Law No. 255, effective as amended and supplemented as amended on December 27, 2019, defines situations in which sick leave is not paid:

- if the employee fell ill during a period when his average earnings were not retained in full or in part (for example, while using the right to free or child care leave for up to three years);

- a child or other relative needed care during annual paid leave;

- a certificate of incapacity for work was issued during the period when, according to labor legislation, the employee was suspended from work (for example, if he did not undergo training and knowledge testing on labor protection and safe work practices);

- the employee was in custody or under administrative arrest during illness;

- time to undergo a forensic medical examination;

- if an injury was sustained or a person fell ill during the downtime of the enterprise (with the exception of cases when the sick leave was opened before the start of the downtime).

In addition, the legislator considers the following to be justified grounds for refusing to accrue benefits for days of incapacity for work:

- intentional infliction of harm to one's health by the insured person (if there is an appropriate court decision);

- temporary loss of ability to work due to the commission of an intentional crime (for example, was wounded, injured while committing a theft or during an attempted robbery).

Reasons for reducing the benefit amount

Sick leave can only be partially paid. A reduced benefit for the period of working ability is accrued in the following cases:

- if the illness occurred as a result of the use of alcoholic beverages or drugs;

- in case of violation of the hospital regime;

- due to failure to attend a regular appointment with a doctor for an unexcused reason.

Important

In the first case, the benefit is reduced from the first day after the certificate of incapacity for work is issued. It is calculated not on the average salary of the employee, but on the minimum wage established in the region. In case of violation of the hospital regime, the benefit is reduced from the date on which this occurred.

Submitting sick leave to the employer

A working person is not immune from illnesses and injuries, but unlike non-working categories, he must comply with a special system when temporarily removed from work. The most important thing is the obligation to document the fact of illness, that the time of absence is justified and was actually used to improve health. In the Russian Federation, special hospital forms have been developed for this purpose, which can be obtained when visiting a doctor at a clinic or hospital.

Initially, the employee informs the employer about the fact of illness or injury by telephone or other means. When the sick leave is closed and permission to work is received, the employee is obliged to provide the employer with a ballot completed in accordance with all the rules. This form allows you to:

- Confirm the reason for absence from work.

- Receive compensation for sick days.

Important

The procedure for accepting and paying for a ballot from a retired employee is established by legislative acts, in particular, Article 183 of the Labor Code of the Russian Federation.

Meeting the deadline

Federal Law “On Compulsory Social Insurance in Case of Temporary Disability and in Connection with Maternity” N 255-FZ dated December 29, 2006, in Article 12, clearly defines the deadlines that must be met when submitting completed sick leave certificates for the calculation of payments. Part one of Article 12 states that the ballot should be submitted no later than six months from the date of its closure. Compliance with the established deadline is mandatory, and if it is exceeded, you cannot count on receiving compensation, since the form will be considered invalid.

The six-month period begins to count from the moment access to work was received or disability was assigned. But in most cases, forms are presented on the first day of going to work. This pattern is due to the fact that the employer has the right to not allow an employee to work who has not brought documents justifying his absence from work. In fact, if sick leave is not brought, all days of absence will be considered absenteeism, and this entails dismissal.

Person paying for sick leave

A citizen can pay compensation for a disability certificate:

- Employer . Paragraph 2 of Article 53 of Law No. 255 states that the first three days of sick leave must be paid by the employer.

- Social Insurance Fund . The above law regulates the receipt of compensation from the fund for sick leave from the 4th day until the end of its validity. There are also cases when payment for a certificate of incapacity for work is made entirely from the insurance fund starting from the first day: receiving sick leave to care for a family member; issuance of a certificate of incapacity for work in case of quarantine, prosthetics according to indications, or after-care in resort organizations; issuance of sick leave in connection with maternity.

- Employment Center . This option is possible if a non-working citizen is registered with the Employment Center and officially has the status of unemployed. In this case, the amount of the sick leave payment will be equal to the amount of unemployment benefits.

Is the employer obligated to pay sick leave, how and when?

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

The main document confirming the temporary loss of ability to work due to an employee’s illness is a certificate of incapacity for work. It is issued to a citizen in cases strictly specified by law:

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

- In case of illness, including professional illness;

- In case of injury (including industrial injuries);

- For the period of undergoing a medical examination;

- For prosthetics;

- During sanatorium-resort treatment;

- During quarantine;

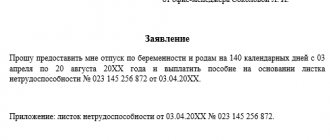

- In connection with pregnancy, childbirth.

Important

The guarantee that involves the calculation and payment by the employer of benefits for a certificate of incapacity for work is enshrined in Art. 183 Labor Code of the Russian Federation.

Deadlines for applying for sick leave payment

An employee has the right to apply for payment for the period of incapacity for work within 6 months from the date of:

- Restoration of ability to work or from the date of disability;

- The end date of the time period associated with caring for a sick relative;

- From the date of completion of quarantine;

- From the date of end of maternity leave.

To calculate and pay the due benefit, the employee provides the employer with a sick leave certificate and, if necessary, a certificate of earnings for the last 2 years from the previous employer. After this, the organization has 10 days to calculate the due amount of hospital payments. The transfer of due benefits must occur on the next payday.

Important

The employer also pays for sick leave due to incapacity for work occurring within 30 calendar days after the employee’s dismissal.

When benefits may not be assigned

There are situations when an employer refuses to pay sick leave on legal grounds. These include:

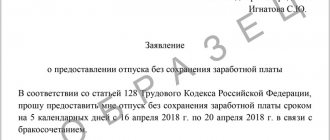

- The onset of illness during the period of release of an employee from work with or without maintaining the average salary (except for sick leave);

- Illness during suspension from work without pay;

- Illness during downtime, the commission of a crime, or as a result of an employee intentionally causing harm to himself or attempting suicide.

Important

Under other circumstances, sick pay cannot be refused.

What amount of benefit should be paid?

The amount of sick leave due depends on the employee’s average earnings and his insurance coverage as an employee. Depending on the length of service, benefits are paid in the amount of:

- 100% of the average salary for over 8 years of experience;

- 80% - with experience from 5 to 8 years;

- 60% if the total operating time is less than 5 years.

This is also important to know:

Injury at work in 2021: what should an employer do?

In general, the amount of the benefit due is determined by the formula:

Important

Payroll for 2 calendar years before the year of the insured event / 730 × sick days × percentage depending on length of service.

Deadlines for paying sick leave

In order for days of incapacity to be paid, after recovery, the employee must provide documentary evidence of seeking medical care, drawn up in accordance with the Procedure approved by Order of the Ministry of Health and Social Development No. 624n (as amended on June 10, 2019).

The documents must be submitted to the employer within a maximum of six months from the day when, for medical reasons, you can return to work.

Within 10 days after receiving the certificate of incapacity for work, the issue of payment is resolved.

Direct payment of sick leave benefits is carried out simultaneously with the next payment of wages.

You need to know in which cases sick leave is not paid:

- if the certificate of incapacity for work is submitted later than the established deadlines;

- There were inaccuracies in the preparation of the document or, for example, the seal of the medical institution or the signature of the attending physician were missing.

For information! It happens that sick leave remains unpaid after receiving a salary. For example, if the documents reached the employer a week, a few days before the payment of the advance or salary. It is quite natural that the benefit will be transferred to the next nearest payment.

When sick leave is not paid on time due to a delay in the transfer of wages, the debt must be repaid with a penalty charged for each day of late payment.

Where to go if sick leave is not paid

A delay in payment of sick leave, in fact, can be equated to non-payment of wages, which gives the employee the right to protect his legitimate interests. If an employee is not paid for sick leave, he has the right to:

- Submit a written claim to the employer demanding payment for the time of incapacity;

- File a complaint with the State Tax Inspectorate;

- Contact the prosecutor's office;

- Initiate legal proceedings in court.

To the employer

The appeal to the employer is made in any form with the obligatory indication of information about the employer and employee, a clear statement of the circumstances of the violation and your requirements for its elimination. The document is drawn up in 2 copies, one of which is given to the head of the company, and the second with a mark of acceptance is kept by the applicant.

To the State Tax Inspectorate or the prosecutor's office

If it is not possible to reach an agreement with the employer, it is necessary to submit an application to the supervisory authorities in order to conduct an inspection and force the employer to transfer sick leave according to the certificate of incapacity for work. In this case, an application is also drawn up in any form indicating the following data:

- Name of the body to which the complaint is addressed;

- Full name and position, contact details of the applicant;

- Detailed information about the employer;

- The circumstances of the violation;

- A clear statement of your requirements;

- Date and signature of the applicant.

Important

The appeal is submitted in person, by registered letter with notification or through an electronic mailbox. As a result, an inspection is carried out within 30 days from the date of filing the complaint and, based on its results, an order is issued to the company.

To court

If after this it is not possible to resolve the conflict, the employee will have to go to court. In this case, you will need to leave the statement of claim in any form and transfer it to the district court at the location of the employer. The claim must indicate:

- The name of the court in which the claim is filed;

- The cost of the claim (the amount of claims submitted to the employer);

- Contact details of the applicant and employer;

- Describe the situation, indicating all the necessary details and important circumstances.

- State your demands on the defendant;

- List of documents attached as evidence.

After the claim is accepted, further procedures will begin:

- A preliminary meeting is scheduled within 5 days;

- After the preliminary hearing, a date for the main hearing is set;

- There may be several hearings, during which the parties will provide evidence of their innocence and argue their position;

- After this, the judge makes a final decision, which the employer has 1 month to appeal. Then it must be executed by the employer voluntarily, or forcibly through bailiffs.

You should not neglect collecting evidence before the start of the process, since the more there is, the greater the chances of winning. These may include: employment contracts, copies of certificates of incapacity for work, extracts from local acts of the company.

Important

An employee has the right to claim compensation for moral damage caused to him through the fault of the employer in connection with the refusal to pay sick leave.

What to do if you have problems with accrual

Payment of temporary disability benefits is accrued to the bearer of the sick leave within 10 days after its delivery to the employer.

This is also important to know:

What to do if the employer does not give the work book

If all the deadlines have passed and you still haven’t received the money, first of all you should ask the appropriate question in the accounting department or the human resources department. Perhaps, for objective reasons, the required amount has not yet reached the recipient.

Important

The next method is to contact the director of the organization with a request to receive a written justification for the refusal of payments. If these actions do not lead to resolution of the conflict situation, proceed to the next step.

Drawing up a complaint

When an employer categorically refuses to pay sick leave in the established form, the employee has the right to file a complaint to appeal to higher authorities to resolve the dispute. The following information must be indicated in the text of the document:

- personal data of the applicant (as a rule, full name, passport data and registration address are sufficient);

- information about the organization providing the work, the period of cooperation with it and the position you hold;

- a brief statement of the current situation and the actions you have taken to resolve it peacefully;

- details of the certificate of incapacity for work for which the payment of benefits was refused;

- It is recommended to attach a copy of correspondence with the employer on this issue and refer to the legislative acts regulating the current issue.

Important

The information provided should be as complete as possible, but it should be presented only on the essence of the conflict, avoiding the expression of unnecessarily negative emotions. This will help expedite the review of the complaint.

Consideration and result

Based on the results of consideration of the complaint received from the employee, depending on the current situation, the authorized body will make a decision either in your favor or in favor of the organization that refused sick pay (if proven legal).

Information: the period for consideration of a complaint by the Labor Inspectorate can be up to 30 days, after which a written response will be sent to the applicant about the results of the inspection and measures aimed at resolving the conflict.

Important

If the law is on the employee’s side, then the employer will be obliged to pay him the due temporary disability benefits, and in some cases also compensation for non-payment of sick leave.

Delay in payment of benefits

If the employer delays payment of benefits, the employee has the right to file a complaint with the labor inspectorate. This is stated in Art. 236 Labor Code of the Russian Federation. The employer is obliged, along with the benefits, to pay his employee compensation in the amount of 1/300 of the Central Bank refinancing rate of the unpaid amounts for each day of delay.

The duration of sick leave does not affect the timing of payment of benefits to the employee. In any case, you must pay him sick leave after providing a certificate of incapacity for work. The duration of a person’s illness depends on his physical characteristics, but it is still worth checking the form for authenticity. Don't be surprised if an employee gives you sick leave for only 3 days. This is a minimum period and you will have to pay for it, without the participation of the Social Insurance Fund. Since, according to paragraph 50 of Ch. 8 of Order No. 624n of the Ministry of Health and Social Development of Russia, the employer must pay for the first 3 days of sick leave.

If the employer delays payment of benefits, the employee has the right to file a complaint with the labor inspectorate.

An individual entrepreneur must pay benefits to his employee no later than 10 days after receiving a certificate of incapacity from him. Any delays in payment of benefits violate the rights of your employee, and he may appeal to the labor inspectorate. Carefully monitor the duration of sick leave and pay it on time, do not create unnecessary problems for yourself or the employee.

Employer's liability

If, as a result of an audit or trial, it turns out that the employer actually delayed and did not pay sick leave, he faces punishment.

There are several types of liability for the employer:

- administrative;

- material;

- criminal

According to the norms of Russian legislation, the employer faces a fine of 30 to 50 thousand rubles if the offense occurs once. In case of repeated violation, the fine increases to 100,000 rubles. Within the meaning of Article 236 of the Labor Code of the Russian Federation, in case of delay in payments, the employer is held financially liable. Each day of delay requires the transfer of a penalty in the amount of 1/350 of the refinancing rate.

As a result, the delay or failure to pay sick leave when the employee fulfills all obligations to provide documents and comply with the regime is illegal. In such a situation, the employee has the right to submit a written request to the management of the organization. However, if this does not bring any results, you can write a complaint to the labor inspectorate or file a lawsuit.

Material liability

In case of delay in transferring sick pay, the employer will have to pay 1/150 of the key rate of the Central Bank of the Russian Federation for each day of delay. The calculation formula will be as follows:

Amount of debt × 1/150 × interest × days of delay.

The time for which payment is made is calculated in days from the date following the due day of transfer of sick leave and ends with the moment of its actual payment.

Administrative punishment for non-payment of benefits

Free legal consultation We will answer your question in 5 minutes!

Call: 8 800 511-39-66

Involvement in fines under the Code of Administrative Offenses of the Russian Federation occurs on the basis of instructions from the State Traffic Safety Inspectorate or court decisions. If facts of non-transfer of disability benefits are discovered, the following measures may be taken by the company:

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

- For an enterprise, a penalty deduction is from 30,000 to 50,000 rubles;

- The entrepreneur will lose from 1,000 to 5,000 rubles;

- To senior officials who committed such a violation from 10,000 to 20,000 rubles.

If the company commits a similar violation again, the amount of administrative penalties will increase significantly. In addition, in this case, the official may be subject to a restriction on the right to occupy leadership positions in companies for a period of 1 to 3 years.

Criminal liability for delay in hospital payments

Criminal prosecution is a last resort and is used only if there is personal mercenary intent on the part of the employer. In addition, the delay must be for part of the amount, more than 3 months, for the full amount of the benefit, more than 2 months. In this case, the employer faces:

- Significant amounts of penalties up to RUB 500,000. or confiscation of part of his income over a period of several years;

- Referral to correctional labor;

- Imprisonment for a term of one to three years.

This is also important to know:

How to make a statement to the prosecutor’s office about non-payment of wages

In addition, deprivation of the opportunity to occupy leadership positions for a long period of time may be applied.

In practice, delays in hospital payments are extremely rare and, as a rule, among small firms that exist semi-legally. In most cases, a conflict with an employer is resolved at the stage of filing a complaint with the labor inspectorate. Therefore, quite often employees solve such problems themselves.

Important

If the matter comes to court, then it would not be superfluous to engage a qualified lawyer to provide assistance, who will help both with the correct preparation of the claim and with subsequent representation in court.

Late payment of sick leave

Yes, the employer must pay monetary compensation in a situation where the payment of temporary disability benefits occurred in violation of the established deadline. Let's tell you in more detail.

Consequences of delay

The rules for paying sick leave are established in Federal Law No. 255-FZ of December 29, 2006 “On compulsory social insurance in case of temporary disability and in connection with maternity” (hereinafter referred to as Law No. 255-FZ). So, according to Part 1 of Art. 15 of this law, the employer assigns temporary disability benefits within ten calendar days from the day the employee brought sick leave. And the payment of benefits is carried out on the day closest to the date of payment of benefits, established for the payment of wages. Moreover, in Part 3 of Art. 15 of Law No. 255-FZ states that benefits not received by an employee in whole or in part due to the fault of the policyholder or the territorial body of the insurer are paid for the entire past time without limitation by any period.

Therefore, the company must release the benefits due to the employee on the payday. Let us remind you that according to Art. 136 of the Labor Code of the Russian Federation, wages are paid at least every half month. In this case, the specific date for settlement with employees for wages is established by internal labor regulations, a collective agreement or an employment contract. But the employer does not have the right to pay wages later than 15 calendar days from the end of the period for which they were accrued. Please note: if the payday coincides with a weekend or non-working holiday, then payments to employees must be made on the eve of this day.

Article 236 of the Labor Code of the Russian Federation provides for the financial liability of the employer for violating the terms of payment of wages in the form of payment of interest (monetary compensation) for days of delay. The procedure established in this norm of the Code also applies in cases where the employer has delayed the payment of other amounts due to the employee. That is, the rules provided for in Art. 236 of the Labor Code of the Russian Federation are also applied in the situation we are considering.

Let us note that the courts also take the position that the rules of Art. 236 Labor Code of the Russian Federation. Thus, in the case considered in the Appeal ruling of the Magadan Regional Court dated 06/09/2015 No. 2-1059/2015, 33-609/2015, the employer believed that relations regarding the payment of maternity benefits are regulated not by the Labor Code, but by Law No. 255 -FZ, which does not provide for the payment of interest. However, the court did not support this conclusion. The arbitrators indicated that the norms of labor legislation, including the provisions of Art. 236 Labor Code of the Russian Federation.

Thus, if the deadline for payment of temporary disability benefits is violated, the employer is also obliged to pay these amounts with interest (monetary compensation). Their size must be no less than 1/150 of the key rate of the Central Bank of the Russian Federation in force at that time of the amounts not paid on time for each day of delay, starting from the next day after the established payment deadline up to and including the day of actual settlement. In case of incomplete payment of benefits, the amount of monetary compensation is calculated from the amounts actually not paid on time.

Please note: the employer may also be held administratively liable for failing to pay benefits to the employee on time. According to Part 1 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation provides for a fine for violation of labor legislation. Its size for companies ranges from 30,000 to 50,000 rubles, and for officials of an organization - from 1,000 rubles. up to 5000 rub. But that is not all. If a manager does not settle accounts with employees due to selfish goals or other personal interests, then he may be subject to criminal liability, including imprisonment (parts 1 and 2 of Article 145.1 of the Criminal Code of the Russian Federation).

Personal income tax and insurance premiums

According to the Ministry of Finance of Russia, monetary compensation provided for in Art. 236 of the Labor Code of the Russian Federation, is not subject to personal income tax on the basis of clause 3 of Art. 217 Tax Code of the Russian Federation. This conclusion is contained in the letter of the Ministry of Finance of Russia dated February 28, 2017 No. 03-04-05/11096. Let us recall that according to clause 3 of Art. 217 of the Tax Code of the Russian Federation, all types of compensation established by current legislation (within the limits of approved standards) are not subject to personal income tax.

As we have already said, violation of the terms of payment of temporary disability benefits falls under Art. 236 Labor Code of the Russian Federation. Consequently, personal income tax is not withheld from the amount of monetary compensation paid.

But with insurance premiums the situation is more complicated. Giving clarifications on the application of the provisions of the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund” (hereinafter referred to as Law No. 212-FZ), specialists from the Ministry of Labor Russia came to the conclusion that monetary compensation paid in accordance with Art. 236 of the Labor Code of the Russian Federation, are subject to insurance contributions. As you know, now the procedure for calculating and paying insurance premiums is regulated by the Tax Code. So far, the financial department has not expressed its position on the issue of calculating insurance premiums for monetary compensation paid to employees for delays in amounts due to them. At the same time, there is a letter dated November 16, 2016 No. 03-04-12/67082, in which financiers recommended that insurance premium payers be guided by the explanations of the Russian Ministry of Labor when resolving controversial issues.

The position of the labor department on the issue under consideration is contained in letters dated July 22, 2016 No. 17-3/В-285, dated April 27, 2016 No. 17-4/ОOG-701, dated August 3, 2015 No. 17-3/В-398, dated January 22 .2014 No. 17-3/B-19. According to experts from the Russian Ministry of Labor, insurance premiums are calculated in accordance with the general procedure for monetary compensation issued by the employing organization for violating the established deadline for settlements with employees. The reasoning is as follows.

Monetary compensation to an employee in case of violation by the employer of the established deadline for payment of wages, vacation pay, dismissal payments and (or) other payments due to the employee refers to measures of the employer’s financial liability for violation of contractual obligations to the employee and is not reimbursement of the employee’s costs associated with the execution them work responsibilities. Law No. 212-FZ does not contain a special rule on including in the list of payments that are not subject to insurance premiums and established by Art. 9 of this law, monetary compensation to an employee for violation of the established payment deadline by the employer organization.

Note that now the list of non-taxable payments is established in Art. 422 of the Tax Code of the Russian Federation and it also does not directly name monetary compensation paid on the basis of Art. 236 Labor Code of the Russian Federation.

As for judicial practice, it is completely on the side of the companies. And at the level of senior referees. Thus, the Presidium of the Supreme Arbitration Court of the Russian Federation expressed its point of view on this issue in Resolution No. 11031/13 dated December 10, 2013. Monetary compensation provided for in Art. 236 of the Labor Code of the Russian Federation, is paid by force of law to an individual in connection with the performance of his labor duties, providing additional protection of the employee’s labor rights. The mere fact of the existence of an employment relationship between an employer and an employee does not constitute a basis for the conclusion that all payments made to the latter constitute payment for his work. Consequently, amounts of monetary compensation for delayed payment of wages are subject to subclause. “and” clause 2, part 1, art. 9 of Law No. 212-FZ and are not included in the base for calculating insurance premiums.

Additional questions

Who is not entitled to sick pay at all?

A certificate of temporary incapacity for work – in common parlance “sick leave” – is issued not only to provide it to the employer for the purpose of calculating payments. In a number of cases provided for by regulations, the days indicated on such a sheet cannot be paid at all, because its holder does not have the right to do so.

According to the legislation of the Russian Federation, a temporary work permit issued by:

- employees working not under an employment contract, but under a civil law one;

- officially unemployed citizens of the Russian Federation;

- with errors and inaccuracies in filling out (only doctors who signed the form can make corrections);

- unlawfully, that is, falsified or invalid, for example, of the old type, with forged signatures, seals (for such management has the right to be held accountable).

Important

An overdue sick leave certificate will not be paid - it can only be presented within six months after the date indicated on it as the day of return to work.

They won’t pay sick leave because they didn’t issue a certificate

An employee should not count on payment for time off work if he cannot provide the document on the basis of which this is done, that is, the sick leave certificate itself. The law provides for refusal to issue a certificate for a number of reasons:

- the doctor, when contacting him for consultation, did not identify the disease as a result of the patient’s error or deliberate simulation;

- sanatorium treatment without appropriate medical direction;

- missed work due to short-term medical procedures performed one-time, such as vaccination, rinsing, inhalation, etc.;

- routine medical examination of employees, required by the requirements of this organization.

Some categories of health workers cannot issue the sheet, so it is pointless to contact them for sick leave:

- ambulance and emergency physicians;

- doctors at blood transfusion stations;

- emergency room doctors;

- workers of medical and preventive institutions.

Important

The law allows you to challenge the non-issuance of a sick leave certificate from a superior manager of the refusing doctor or from the Social Insurance Fund. But you need to be sure that your rights have been violated: a challenge will not always lead to the issuance of the desired certificate.

Disability will not be paid in full

In a number of situations, even a correctly executed and issued sick leave is not “paid for” by the employer, and this is absolutely legal if it falls within the restrictions of Federal Law No. 255:

- Temporary removal from an employee of his duties. During the period when an employee is released from performing duties stipulated by the employment contract, the days of his illness are not subject to payment. Most often this occurs during unpaid leave, including for child care.

- If an employee ruins his normal annual leave by sudden illness, these sick days must be paid. Suspension without pay. Sometimes it is used if, for example, an employee for some reason cannot perform his previous duties, and there is currently no new suitable vacancy. Sick leave is not paid during this period.

- Under custody or arrest. If an employee is taken into custody or under administrative arrest and during this period he had health problems, then, naturally, he will not be paid for these sick leaves.

- Medical examination. When it is carried out, the employee is not guaranteed payment for disability.

- Illness after the start of downtime. An enterprise in idle mode does not pay sick leave to employees, but only “downtime” funds. If an employee fell ill while the enterprise was still operating, and then went into downtime, the “sick leave” money will be calculated for the days while the salary was still being accrued.

Payments are also not due to the following leaflet holders:

- an employee who has become ill because he intentionally committed a crime;

- an employee who has caused conscious harm to his health.

In both cases, the court must confirm intent.

If the disease is longer than the leaf

An employee will receive an incomplete amount even for a completely correctly and legally issued sick leave in another special case, provided for in Art. 6 Federal Law No. 255. The fact is that sometimes the course of the disease turns out to be unpredictable and exceeds the maximum allowed time for payment of compensation for temporary disability. Payments in this case depend on a number of nuances.

- The employee was ill longer than the law provides for sick leave, but the loan fully restored his ability to work and returned to work. In this case, only the maximum permitted period will be paid - a month or its legally authorized extension for another 3 months. Days. Anything beyond this period will not be paid.

- The disease has progressed, the employee has been absent from work for more than 4 months. Such diseases require the assignment of a disability group. The Social Insurance Fund will pay for only 4 working months in a row, and during the year - no more than 5 months.

- The employer himself wants to compensate the employee for sick days. This, although rare, does happen. The employer has the right to pay for sickness periods exceeding the legal maximum, but is not obliged to do so. If this is his good will, he should take funds for this from the property of the organization, and not from funds. Such accruals must be secured by a special order or local regulation.

When sick leave for caring for a relative is not paid

Employees have the right to certificates of incapacity for work not only for themselves, but also for caring for certain categories of relatives:

- for a minor child under 7 years old – no more than 60 days a year;

- for a schoolchild from 7 to 15 years old – up to 45 days a year;

- for a child under 7 years of age with a serious illness (oncological and others specified by law) - up to 90 days a year;

- for a disabled person (not necessarily a child) – up to 120 days during the year;

- for relatives over 15 years of age - up to a week a year or up to a month in case of severe illness (according to the conclusion of the medical commission).

This is also important to know:

What questions can you contact the labor inspectorate about?

The law provides for a number of situations in the event of which payment on such slips will be refused. This is, first of all, exceeding the established periods of sick leave. The employer and the Social Insurance Fund will pay for absence from work during the agreed periods in full, but no payment will be accrued for days in excess of the limit.

Important

If a child falls ill during an employee’s annual leave, separate sick pay for caring for him or her is not required.

What determines the payment of a percentage of the insurance period?

The total amount of insurance experience determines what percentage will be included in the calculation of disability benefits from the employee’s average earnings. Social insurance reimburses only well-founded, error-free calculations for payment of sick leave benefits. Average earnings are calculated from total payments for the last two years of work.

Sick leave, according to the tax code, is subject to personal income tax - 13%

Can the amount received under the BL be less than normal earnings?

Many people are interested in the question of why sick leave payments are sometimes less than wages. This is due to the dependence of the amount of this amount on the employee’s insurance experience (according to Article 7 of Federal Law No. 255 of December 29, 2006, as amended on December 27, 2018):

- a person who has an insurance period of 8 years or more is paid sickness benefits in the amount of 100% of his average earnings;

- if the employee’s insurance experience is from 5 to 8 years - 80%;

- when the insurance period is less than 5 years - 60%.

If the illness or injury occurs within 30 calendar days after termination of employment, the benefit amount will also be equal to 60% of earnings.

If a parent or guardian takes sick leave to care for a child and treatment occurs on an outpatient basis, then in the first 10 days of illness, payments will be accrued according to length of service. On subsequent days - in the amount of 50% of earnings.

Important

When undergoing treatment in a hospital, the amount of payments depends only on the accumulated work experience. For a year of sick leave due to a child’s illness, you can receive payment for no more than 60 days (child’s age is up to 7 years) or 45 days (up to 15 years).

Sick leave payment amount

The amount of the benefit paid depends on the amount of insurance coverage at the time of incapacity and average earnings calculated for the two years of work preceding the insured event.

An ill or injured employee, while undergoing treatment, will receive:

- 100% of the average salary, if the insurance period is 8 years or more;

- disability benefits will be reduced to 80% of earnings when the insurance period is 5–8 years;

- 60% of the average salary is due to individuals, starting from the first day of official registration.

Many questions arise about sick leave, if a person does not work, who pays sick leave after dismissal.

The legislator does not emphasize for what exact reasons an employee must be dismissed in order to pay for sick leave if he becomes ill or injured during a month-long period.

There are some nuances to calculating sick pay:

- if the illness occurred while the employee was in an employment relationship with the employer, even when the certificate of incapacity for work is closed after dismissal, the benefit is calculated according to the general rules;

- Having opened sick leave after the official termination of employment, regardless of the number of years of insurance experience, only 60% of the average earnings calculated for the two-year period of work before dismissal are due.

The amount of sick pay depends on the length of insurance coverage

Attention!

If the sick leave was open while the employee was in an employment relationship with the employer, even if the certificate of incapacity for work is closed after dismissal, the benefit is calculated according to the general rules.

When an enterprise has ceased operations by decision of the owner or is declared bankrupt, you have to contact the Social Insurance Fund regarding payment of sick leave after layoffs.

Similarly, if long-term treatment is necessary, the decision on payment for days of incapacity for work is made by the local authority of the Social Insurance Fund.

In such a situation, the former employer pays for the first three days of illness.

Results

Sick leave is usually paid for by the employer (in general), but can also be paid for by the Social Insurance Fund (in regions where the department’s pilot project operates - in accordance with the norms of Resolution No. 294n, in other regions - in accordance with Law No. 255-FZ). Depending on the party to the legal relationship who is obligated to make payments for sick leave, the maximum period for transferring disability benefits, which is established by law, can be 10 or 15 days. The first 3 days of sick leave are fully paid by the employer; in case of a work-related injury, the costs of payments for all days of sick leave are reimbursed by the Social Insurance Fund.

Subscribe to the latest news

Payment nuances

In Art.

15 of Federal Law No. 255-FZ states that the employer is obliged to provide benefits within 10 days from the date of submission of sick leave. However, sick leave is paid at the time the salary is paid. Art. 136 of the Labor Code of the Russian Federation provides for payment of labor to employees at least 2 times a month, the exact dates are specified in the employment contract. Nuances in paying sick leave:

– If an employee was assigned and not paid timely sick leave benefits, it must be paid, but not more than for the previous 3 years. But if the employer or insurer is to blame for the lack of payments, then this period is not limited.

– If there is an overpayment of benefits due to the fault of the employee (for example, if he provided false salary data), then the excess is deducted either from subsequent sick pay in the amount of 20% of them, or from wages.

– If, through the fault of the employer, the employee was paid excess funds, he (according to Article 15 of the Civil Code of the Russian Federation) must compensate them to the Social Insurance Fund (FSS) in full.

The employer is obliged to assign benefits within 10 days from the date of submission of sick leave.