When arranging an employee’s trip, the manager must take into account some current regulations. You should be aware that not all employees can be sent on a business trip, and certain categories of citizens must give their written consent to the planned activities.

Specialists who are in an employment relationship with an employer can be sent on a business trip to perform production tasks (Article 166 of the Labor Code of the Russian Federation), the solution of which can be done outside the place of permanent work. The lack of mention of another locality in labor legislation often creates the erroneous opinion that the performance of any production task outside the enterprise is recognized as a business trip. Performing duties in the same locality where the organization is geographically located is not such (the employee can return home every day).

When it's needed

A service note is a document confirming the fact of stay and time of stay of a business traveler at the destination.

Its preparation is required if:

- The employee is sent to perform the task in a company, rented or personal car.

- If the employee does not have other documentary evidence indicating the fulfillment of an official task.

The memo acts as the basis document for calculating daily allowance and confirming the amount of employee expenses.

Management response

After the manager makes a positive decision on the need for a business trip, copies of the note are sent to all departments listed in the left corner (above) to take the required measures (preparing orders, ordering tickets if necessary, accruing funds to travelers).

We talked about how to correctly write a response to a memo in a separate article.

Date confirmation

According to changes in legislation, the period spent on a business trip, and therefore the exact dates, are confirmed by means of travel documents, and if they are lost, by duplicates.

However, if the employee went on a work trip using company or personal transport, then the period of his stay on the trip is confirmed by a memo, which he is obliged to draw up and provide to the employer along with supporting documentation for the use of transport immediately upon his return.

How to submit a trip cancellation notice

There are cases when an employee, for good reasons, cannot go on a business trip. Events for which a trip is canceled must be described in the company's rules.

An order form is available.

Main reasons for canceling a business trip:

- weather;

- family circumstances;

- employee illness.

The reason must be stated in the order.

If an employee was given money for a trip, he must return it to the accounting department when canceling the trip. An order to cancel the trip is also issued, which must indicate the reason.

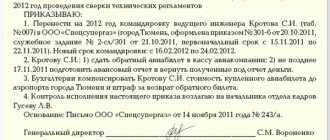

In this episode, an employee is recalled due to completing work early. But the style of the document when canceling a business trip for another valid reason will be the same.

The legislative framework

Data regarding the entire procedure for registering a business trip and the employee’s stay on it are specified in the Regulations approved by Decree of the Government of the Russian Federation of 2014 No. 1595.

In addition, there is Decree of the President of the Russian Federation of 2014 No. 765 on the procedure and conditions for the secondment of persons holding official and government positions.

There was also a cancellation of instructions formed during the existence of the USSR, by Order of the Ministry of Finance of Russia No. 147 and the Ministry of Labor of Russia No. 1044 of 2014.

A new Regulation regarding the process of seconding persons, approved by Decree of the Government of the Russian Federation No. 749 of 2008, has been put into effect.

Shape and structure

For the memo form, it is permissible to take a regular A4 sheet, while the form of the reporting sheet is developed by each enterprise independently, since it does not have a unified template. The employee must subsequently enter all the necessary data into it immediately upon arrival.

The structure of the document is as follows:

- A header is formed in the upper right corner; the full name of the head of the enterprise, the full name of the immediate superior, if there is one, and the full name of the employee are entered into it.

- The name is written in the center of the sheet.

- The body of the document contains a free-form appeal to the employer describing the purpose of the trip, dates of arrival/departure, as well as basic facts. Moreover, if the trip was made through the use of transport, it is necessary to indicate all the identification data of this car.

- List of attached documents.

- Date and signature of the employee.

Sample and filling rules depending on the option

There are two options for service notes related to sending an employee to the required area:

- According to which the order is formed, they are the basis for the employee’s trip.

- Documentation completed by the employee himself after completing the task.

Documents for download (free)

- Sample memo for a business trip

About the direction

This version of the note is the basis for issuing an order and can be drawn up by the immediate superior of the person being sent.

The main thing in this case is the argumentation of the need to send the employee on the trip.

Accounting department of Pion LLC

to the head Gorban O. O.

Service memo

about organizing a business trip

dated 02.02.2018 No. 208/07

Dear Oleg Olegovich!

Due to production needs, I ask you to send junior accountant Alina Sergeevna Golovko, starting from February 5, 2018, in a company car Toyota Mark II, license plate A234 AA546, to the city of Omsk to draw up a balance sheet for a branch of the enterprise.

In addition, in connection with the business trip, I ask you to highlight:

- 6000 rubles for hotel accommodation;

- 6000 rubles as daily allowance;

- 6000 rubles for fuel to refuel the car.

Head of the accounting department Sazonova E. E.

For travel expenses

This reporting documentation is drawn up by the employee himself after completing the task and upon arrival at the enterprise and serves as the basis for reimbursing expenses associated with the trip.

The document also sets out the main facts:

- purpose of the trip;

- date of departure and arrival;

- car data.

In addition, the list contains the details of all supporting documents for expenses.

Accounting department of Pion LLC

to the head Gorban O. O.

Service memo

about travel expenses

02.02.2018 №208/07

Dear Oleg Olegovich!

According to order No. 334 of 02/03/2018, I went on a business trip to the city of Omsk to draw up the balance sheet of a branch of the enterprise in a Toyota Mark II company car, license plate A234 AA546.

I am attaching documents on the basis of fuel consumption for the trip and other expenses.

List of documents: waybill, gasoline coupons, hotel receipts.

Junior accountant Golovko A.S.

About canceling a business trip

It is drawn up with the aim of returning the funds spent on preparatory work and indicating the reason for canceling the event.

Accounting department of Pion LLC

to the head Gorban O. O.

Service memo

about canceling a business trip

dated 02.02.2018 No. 208/07

Dear Oleg Olegovich!

In connection with the preparation of the annual balance sheet by the branch accountant, I ask you to cancel the business trip of the junior accountant A.S. Golovko.

Chief accountant Sazonova E. E.

For report

In this case, the preparation of a memo is carried out in the same sequence as in the case of travel expenses - the employee draws up reports in his own hand and in a free-form list indicates the basic data of the trip, reports on the work done, indicates the expenses incurred and attaches supporting papers, checks, receipts.

What is the deadline for submitting a business trip note?

We will again upset readers with our unclear presentation of the issue of deadlines for submitting a note, but they simply do not exist. Common sense dictates that a memo with a request to be sent on a business trip should be submitted within a period sufficient for:

- preparing travel cost estimates;

- issuing a travel order;

- receiving funds from the cash register;

- purchasing tickets.

In each case, it is necessary to take into account a lot of influencing factors - from assessing the need for such a referral of an employee to the ability to purchase a ticket in a short time. In one case, one day will be enough, in another it will take two weeks. Thus, when planning the timing of submitting a note for a business trip, you should weigh everything carefully.

Office memos are divided into types depending on the purpose of their execution. In any case, each of them contains information that the employee wants to convey to his manager. If you draw up a memo before or after a business trip, you should pay attention to the requirements for its content and accompanying documents.

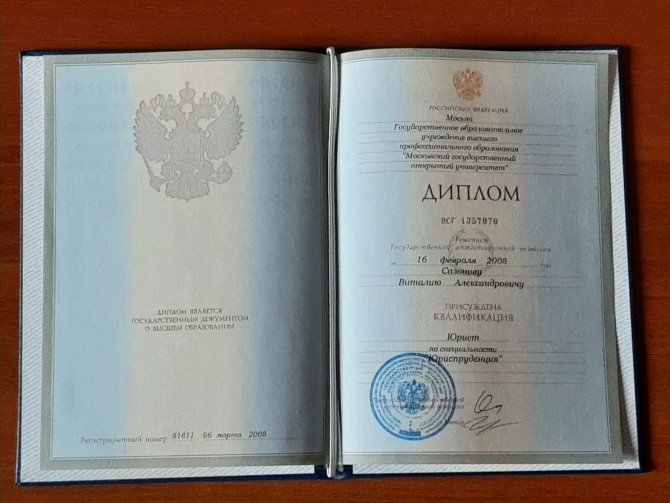

Vitaly Sazonov

Lawyer, author of articles on legal topics. Education: state educational institution of higher professional education "Moscow State Open University".

Nuances of drafting

When creating a note, you also need to take into account the nuances and circumstances under which it is drawn up.

Individual entrepreneur's trip

According to the legislation of the Russian Federation, entrepreneurs are self-employed citizens, which means they cannot send themselves on a business trip, which saves them from the required documentary support for the trip.

However, they have the right to take part of the expenses into account when paying taxes. It is permissible to reduce the tax base by:

- hotel expenses - room rental;

- fuel costs – materials costs.

It is also important to document expenses and justify the need for a business trip, for example, a meeting with suppliers or partners to resolve global issues.

Director's business trip

According to the Regulation of the Government of the Russian Federation No. 749, the director of an enterprise is the same hired worker as other employees, which means that the entire business trip must be documented.

However, Rostrud has a different opinion, according to which the director does not need to draw up documents, since he will still sign them himself, which means he will duplicate them.

To avoid problems in the event of an inspection by regulatory authorities, provisions on the nuances of a manager’s trip on a business trip should be included in the local regulations of the enterprise.

Trip abroad

In case of traveling abroad, the formation of a travel certificate is not required, but it is necessary to draw up a memo.

In this option, reimbursement of travel expenses will be made in foreign currency, and proof of the employee’s presence in the territory of a foreign state will be the mark of customs officials in the passport about crossing the border.

If the trip is planned to the neighboring countries, then travel documents or notes on the travel sheet will be valid.

Use of a company or personal car

In this case, in addition to other supporting documents, the following should be attached to the memo:

- Waybill and papers indicating travel according to the route line.

- Coupons and other receipts indicating expenses associated with servicing and refueling a car.

Business trip on a day off

When an employee is sent on a business trip, it does not matter on what day the manager’s order was carried out, the main thing is the number of hours spent on this task.

So the rules for generating documentation are not affected by the day of the week used.

Should the manager write?

A number of disputes arise regarding the work trips of the director of an organization.

Clause 7 of Regulation No. 749 states that the manager is an employee of the organization, and therefore must draw up an official letter, like any other employee. Rostrud experts say the opposite. The director has the right of chief signature; accordingly, he himself will endorse his own orders and reporting certificates. Therefore, it is not necessary to prepare travel documentation for him.

To resolve this issue, it is necessary to introduce a Regulation on Business Travel into the local regulations of the institution, where the issue of work trips of the head of the organization will be regulated.

With whose signature and approval the document is formed

The head of the enterprise signs and approves all documents related to the future business trip and at its end.

Coordination of the memo is required with the accounting department; in addition, any expenses incurred during the preparation of the trip and during it must be documented for accounting purposes.

According to the legislation, there is no clear date for submitting a report for a business trip for the employee who carried it out, however, there is a requirement for this action to be completed as soon as possible upon returning from the business trip.

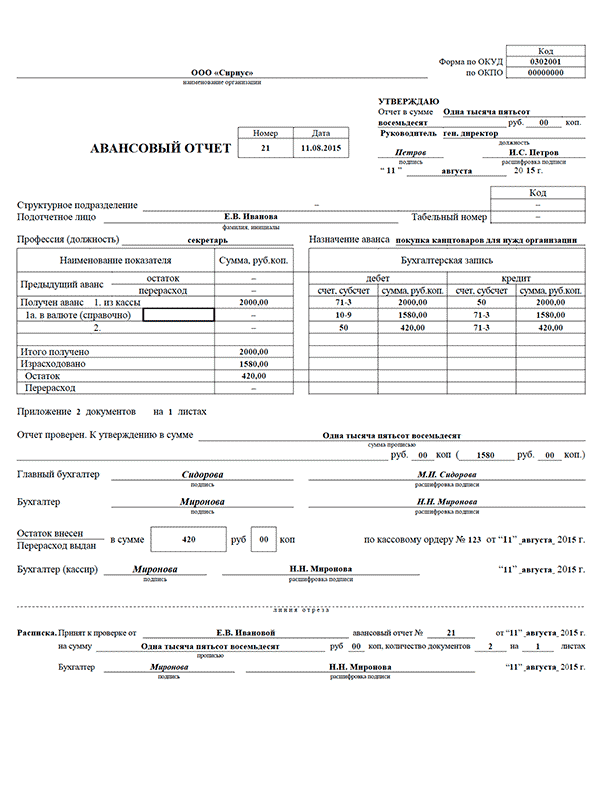

Report

After the employee returns from a trip, the manager must draw up an advance report within 3 days, based on receipts and coupons. Based on this document, the employee is compensated for expenses.

It happens that an employee did not sign an advance report for 3 days, that is, he did not report on the money spent. Then the employer can compensate these expenses from the employee’s salary.

There is no uniform design of an advance report. But they often take the usual state style No. AO-1. The document must have at least 3 signatures: employee, chief accountant, director.

you can follow the link.

If less money is spent than was given out, then the remainder is given back to the cashier. Money is issued according to the details indicated in the report.