What is reconciliation of settlements with the Social Insurance Fund?

Specialists of the Social Insurance Fund may invite the payer of insurance premiums to conduct a joint reconciliation of the relevant payments to the budget. At the same time, the law does not prohibit such a reconciliation also on the initiative of the payer himself.

Most often, the initiation of reconciliation by the employer company is due to its desire to avoid disagreements with the Social Insurance Fund regarding the amount of transferred contributions, as well as to clarify the presence of overpayments (debt) during the liquidation or reorganization of the business.

The frequency of this reconciliation is determined by the employer himself - in principle, it can be initiated at any time. In practice, many companies reconcile payments with the Social Insurance Fund quarterly or once a year - after sending reports in Form 4-FSS.

If, as a result of the reconciliation, you have discovered an overpayment of contributions to the Social Insurance Fund, the recommendations of ConsultantPlus experts will help you manage it correctly. Get trial access to the system for free, go to the Ready-made solution and you will be able to see the procedure for crediting/refunding overpaid amounts.

What is settlement reconciliation?

Clause 9 of Article 18 of Federal Law No. 212 “On Insurance Contributions” states that the Social Insurance Fund can initiate reconciliation of settlements with the payer. This procedure is carried out on the basis of the rules established by the same law - Federal Law No. 212. It is carried out on the initiative of both the body itself and the payer. The frequency of the event can be any. Reconciliation can be initiated on any date. However, the procedure is usually carried out every quarter. In particular, it is planned after sending the report in Form 4-FSS.

NOTE! In connection with current changes in legislation, from January 1, 2021, control over the timeliness and completeness of payment of insurance contributions and fees to the Social Insurance Fund is transferred to the Federal Tax Service.

Since the payment of insurance premiums is now the responsibility of the fiscal service, they should be paid to the accounts of the Federal Tax Service (for reporting periods after January 1, 2021). Until this date, payments were made to the FSS accounts. To avoid confusion, until the end of 2021 you could continue to pay on your usual accounts, but in 2021 you will have to pay according to the new requirements.

Features of the reconciliation report

The reconciliation report is the primary documentation. On its basis, you can verify the quality of the accounting department’s activities. It allows you to timely detect and eliminate financial offenses. The act indicates not only the obligations, but also the items for which debts arose. For example, these could be debts due to penalties.

Application to the Social Insurance Fund for reconciliation of calculations: structure of the document

As a guideline when forming this application, you can use any similar document, for example, an application form on the status of settlements with the Federal Tax Service of the Russian Federation for taxes. The corresponding document is given in Appendix No. 8 to Order No. 99n of the Ministry of Finance of the Russian Federation dated July 2, 2012 (as of May 5, 2020, this Regulation has become invalid, but the form can still be taken as a sample).

The application, which can be drawn up on the basis of a form developed by the Federal Tax Service, reflects:

You can view a sample request form to the Social Insurance Fund for reconciliation of calculations on our website.

The legislation does not regulate the period within which the FSS must respond to the application. But taking into account the fact that within 10 days from the moment of detection of overpayments on insurance premiums, the fund is obliged to inform payers about this, it is legitimate to expect a response from the Social Insurance Fund on the application under consideration within a comparable time frame.

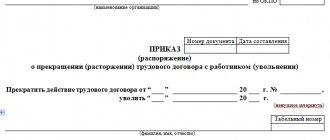

The FSS response is drawn up in the form of a settlement reconciliation report, which is drawn up in the form approved in Appendix No. 1 to the FSS order No. 457 dated November 17, 2016.

How does the policyholder know about the overpayment?

The policyholder is obliged to keep records of accrued and transferred insurance premiums (clause 17, clause 2, article 17 of the Federal Law of July 24, 1998 No. 125-FZ). Therefore, the policyholder can obtain information about the amount of “injury” contributions that can be returned from his accounting data.

On the other hand, the territorial body of the Social Insurance Fund, where the policyholder is registered, must inform the policyholder about each fact of excessive payment of insurance premiums that has become known to the Social Insurance Fund and the amount of overpayment within 10 days from the date of discovery of such a fact (clause 3 of Article 26.2 of the Federal Law of July 24 .1998 No. 125-FZ).

This is interesting: Lifetime annuity agreement - sample form 2021

In this case, the FSS body may invite the policyholder to conduct a joint reconciliation of calculations for insurance premiums, penalties and fines. The results of such a reconciliation are documented in an act in the form approved by the Order of the Social Insurance Fund dated November 17, 2016 No. 457 (Appendix No. 1 to the Order).

How to submit a 4-FSS report through State Services?

The need to submit a report to the Social Insurance Fund in Form 4-FSS may arise for both individuals and legal entities. In the case of a legal entity, before receiving the service, you must log in as a company. Otherwise, a verified user account will be required.

To send a report you need to go through the following branches:

However, it will be easier to find this item directly through the department. After selecting a service, the user will see a form to fill out. There is no need to manually rewrite data about each employee. It is necessary to ensure that the blocks with details for the organization and personal data for individuals are filled out correctly. The report itself with a list of employees and contributions is attached as a separate file to the application and sent for consideration. Please note that the company may be fined for late submission of the report.

How to send an application for confirmation of the type of activity to the Social Insurance Fund?

At State Services you can also send an application for confirmation of your main economic activity to the Social Insurance Fund. This is done to set special rates for insurance premiums. Organizations where employees may be injured as a result of an accident or in hazardous work, where there is a high risk of contracting an occupational disease, are primarily interested in this.

An application for confirmation of the main economic activity is sent only from the account of a legal entity. In the upper left corner of the portal, you need to change the standard assignment “For individuals” to “For legal entities”.

And then go through the branches:

Next, you will need to fill out the form and also attach as an attached document a certificate confirming your economic activity along with an explanatory note from the accountant. The application will be reviewed within 2 weeks. In some cases, this period can be extended to almost 2 months. However, a significant increase in the period is usually associated only with large companies that have several branches and send a separate confirmation form from each.

Working with the Social Insurance Fund through the State Services portal requires attaching documents confirming the actions and powers of the applicant. Therefore, when sending documents, they are certified by the electronic signature of the enterprise. In some cases, an application may be rejected if the forms are not followed.

Documents for desk audit via www.gosuslugi.ru

To do this, you need to create a personal account on the website www.gosuslugi.ru. To receive services, you need to fill out an application form and send it with the necessary list of documents through the Unified Portal of Public Services, and then monitor the progress of your application.

Based on the results of the decision, the applicant is provided with the result in the form of an electronic document.

Currently, in the area of responsibility of the Fund’s branch there are 17 public services that can be obtained through this service. The portal's capabilities are open to individual entrepreneurs, individuals and legal entities.

For example, during desk audits, specialists from the Fund’s regional office are increasingly requesting from policyholders the documents necessary to conduct a desk audit.

After registering as a manager

Creating documents in Kontur.Extern

You must click on the “Create a new document” button.

In the window that opens, select the type of benefit, mark the desired employee in the list and click “Create document”.

The list of employees in the “FSS Benefits” service is common with the service for preparing reports to the pension fund Kontur-Otchet PF.

If the required employee is not in the list, then click the “Add new employee” button.

In the window that appears, fill in your full name and SNILS and click “Add employee.” The added employee will appear in the list and will be selected by default, and will also appear in the PF Contour-Report service.

Next, you should start filling out the form in the window that opens.

How to check with the Social Insurance Fund for payments electronically

Interaction of the policyholder with the Federal Social Insurance Fund of the Russian Federation and the Federal Tax Service of Russia regarding insurance premiums for compulsory social insurance in case of temporary disability and in connection with maternity (VniM) for legal relations arising from January 1, 2021.

— submits to the Federal Tax Service of Russia a calculation of insurance premiums no later than the 30th day of the month following the billing (reporting) period (subclause 1 of clause 1 of Article 419, clause 7 of Article 431 of the Tax Code of the Russian Federation).

The calculation form and the procedure for filling it out are approved by the Federal Tax Service of Russia in agreement with the Ministry of Finance of Russia; — pays insurance premiums for VNIM to the Federal Tax Service of Russia for the new KBK opened by the Federal Tax Service of Russia from January 1, 2021; — submits an application to the Federal Tax Service of Russia for a refund of overpaid insurance premiums (in cash); — reconciles settlements with the Federal Tax Service of Russia for accrued and paid insurance premiums for obligations arising from 01/01/2018;

We are writing a statement

The Federal Tax Service must begin a reconciliation with the company in response to a taxpayer’s appeal received to it. This obligation for the tax authority is established by the Tax Code (subclause 11, clause 1, article 32 of the Tax Code of the Russian Federation). An application for reconciliation of tax calculations can be submitted to the inspectorate in the following ways:

- personally or through a representative. In this case, you need to prepare two copies of the application. One will remain with the Federal Tax Service, the second will be returned to the taxpayer with a note on acceptance of the document (clause 3.4.1 of the regulations, approved by order of the Federal Tax Service dated September 9, 2005 No. SAE-3-01/444);

- by mail. An application for reconciliation of calculations is sent by a valuable letter with a list of the attachments;

- through the Reports service.

Upon receiving the application, inspectors must initiate a reconciliation. A reconciliation report must be drawn up within 5 working days from the date of receipt of the application. This document is signed by representatives of the tax authority and representatives of the organization. The next day, the act is sent to the organization by registered mail or electronically via telecommunication channels (subclause 11, clause 1, article 32, clause 6, article 6.1 of the Tax Code of the Russian Federation).

This is interesting: Lease agreement for specialized residential premises (sample)

If during the reconciliation the tax authorities discovered errors that arose due to the fault of the company, then they will inform the organization about this fact in a special notification (clause 3.4.3-3.4.6 of the regulations, approved by order of the Federal Tax Service dated 09.09.2005 No. SAE-3-01/ 444).

When making an application you must indicate:

- organizational and legal form of the organization;

- the period for which the reconciliation is carried out;

- taxes for which reconciliation is carried out;

- budget classification code.

Especially for readers, we have prepared a statement on reconciliation of calculations with the tax authorities. You can visit the website via a direct link.

If you find an error, please select a piece of text and press Ctrl+Enter.

Reconciliation of settlements with the Social Insurance Fund

It is usually initiated by the payer when there is a likelihood of a conflict with the fund regarding the volume of transferred contributions. It is also needed to detect overpayments as part of liquidation or reorganization.

Reconciliation is usually carried out in the presence of these circumstances:

At the end of the event, a reconciliation report is issued. It is an essential document within the financial activities of the enterprise.

Every month the legal entity must make contributions to the fund. If they don't exist, debt will form.

Services of the Social Insurance Fund through State Services

This can only be done by the head of the company or another person who has the right to act without a power of attorney on behalf of the legal entity.

How to request a reconciliation report of mutual settlements with the Social Insurance Fund (SIF)?

It is this format of working with the Social Insurance Fund that makes it possible to identify and eliminate the recording of serious financial violations. Preparation of reconciliation acts reduces the fiscal burden on the enterprise in the form of fines and penalties for arrears.

It is worth noting that the application form as such is not established by law.

Reconciliation with FSS

This makes it possible to control outgoing deductions and ensure that debts do not form. Reconciliation with the Social Insurance Fund can be carried out for the following reasons:

The reconciliation report is an important document when conducting economic activity.

The legislation establishes the procedure for monthly contributions to various structures. If money from the company does not go to the budget, this can lead to serious consequences.

The resulting debt affects many things.

How to request a reconciliation report from the FSS

Interaction of the policyholder with the Federal Social Insurance Fund of the Russian Federation and the Federal Tax Service of Russia regarding insurance premiums for compulsory social insurance in case of temporary disability and in connection with maternity (VniM) for legal relations arising from January 1, 2021.

— submits to the Federal Tax Service of Russia a calculation of insurance premiums no later than the 30th day of the month following the billing (reporting) period (subclause 1 of clause 1 of Article 419, clause 7 of Article 431 of the Tax Code of the Russian Federation). The calculation form and the procedure for filling it out are approved by the Federal Tax Service of Russia in agreement with the Ministry of Finance of Russia; — pays insurance premiums for VNIM to the Federal Tax Service of Russia for the new KBK opened by the Federal Tax Service of Russia from January 1, 2021; — submits an application to the Federal Tax Service of Russia for a refund of overpaid insurance premiums (in cash); — reconciles settlements with the Federal Tax Service of Russia for accrued and paid insurance premiums for obligations arising from 01/01/2018;

Reconciliation of insurance premiums in 2020

Since 2021, the fiscal service has assumed responsibilities for monitoring the accrual and payment of insurance premiums, and therefore the amounts of contributions accrued for reporting periods after 01/01/2017 are subject to payment to the accounts of the Federal Tax Service.

We suggest you familiarize yourself with How to fill out an application for a Czech visa

The FSS bodies retained the right to control the repayment of debt on contributions accrued for reporting periods up to December 31, 2017 inclusive. Also, fines and penalties accrued for debts before 01/01/2017 should be paid to the Social Insurance Fund accounts.

If the payer is reconciling payments accrued for the period from January 1, 2017, then to obtain a reconciliation report, the organization should contact the Federal Tax Service at the place of registration.

For a sample of filling out a reconciliation report for insurance premium payments, see below.

If discrepancies arise based on the results of the reconciliation, their reasons must be clarified. If the organization agrees with the differences, you can sign a reconciliation report for calculations of insurance premiums without disagreement and adjust the data in the accounting. If you do not agree, you should make a note in the act.

- Insurance premiums from 2021: all changes

The debt that was discovered as a result of the reconciliation of insurance premiums should be repaid as soon as possible. Otherwise, penalties will be charged for each day of delay. But, if there are actually no arrears, they can be canceled.

For example, due to an incorrect BCC, payments were stuck in the unknown. The payment should be clarified, and if the fund does not reset the penalty, a recalculation can be achieved in court (resolution of the Ninth Arbitration Court of Appeal dated March 6, 2014 No. A14-9859 /2013).

The Fund will credit contributions within 10 working days from the date of receipt of the application in Form 22-FSS. But if the company submitted applications before the reconciliation of insurance premiums, then the fund has the right to initiate it itself. Then the fund will offset the amounts within 10 working days after the act is signed by both parties.

If the company does not agree with the fund’s data, it should be noted in the reconciliation report that it agrees “with the disagreements.” For example, if the company does not agree with penalties. After reconciliation, it is necessary to find out the reasons for the discrepancies and eliminate them. For example, if the arrears arose due to an error in the payment order, then it will need to be clarified by submitting an application in free form.

Sample of filling out the act of joint reconciliation of calculations for insurance contributions to the Social Insurance Fund