If we reveal the meaning of this word using a translation from Latin, then a deposit is the storage of a specific thing. In the modern concept, such an object must necessarily be a value: cash or securities. One of the most common types of deposit is a deposit, hence the name “deposit”.

Deposits can be placed in the form of investments in banking institutions and commercial organizations. Depositors (investors) are both ordinary citizens and enterprises.

The main characteristics of any deposit are:

- It must return to its owner and this right must be guaranteed by contract.

- During the placement of a deposit, its owner must necessarily receive benefits in the form of interest accrual on the use of valuables.

The legislation of the Russian Federation considers all deposits under the guise of deposits, therefore the adopted laws and regulations use this name and decide:

Deposit (or deposit) – securities, funds, in foreign or national currency, placed for the purpose of maintaining or making a profit. At the first request of the depositor, the deposit must be returned in accordance with the concluded agreement.

Only Russian banks that have a license for this type of activity and participate in the all-Russian deposit insurance program have the right to accept deposits for storage.

Therefore, only banking institutions can guarantee the return of investments and timely implementation of agreements. Partnerships with non-banking institutions are considered quite risky; in this case, no one can fully guarantee the return of funds to the investor.

Accounts for deposits

A sum of money or deposit transferred to a bank account is considered a financial investment. When placed, these investments are reflected by postings in their original amount, which is equal to the amount of funds credited to the deposit account.

All funds that were placed for safekeeping in the form of a deposit can be displayed on the debit side of the following accounts:

- No. 55, special bank accounts;

- No. 55.03, deposit accounts;

- No. 58, deposit investments.

Accounting accounts for deposits and interest

The deposit account in accounting is assigned to a special account, which is recorded on “Account-55” of the chart of accounts.

“Account-55” “Special accounts in banks” is intended to summarize information on the availability and movement of funds in the currency of the Russian Federation and foreign currencies located on the territory of the Russian Federation and abroad in letters of credit, check books, and other payment documents (except bills of exchange) , on current, special and other special accounts, as well as on the movement of funds for targeted financing in one or another part that is subject to separate storage.

Sub-accounts can be opened for “Account-55”; for deposit funds, sub-account 55.3 “Deposit accounts” is provided.

Subaccount 55.3 takes into account the movement of funds invested by the organization in bank and other deposits.

In addition to account 55.3, deposits can be accounted for in account 58 “Financial investments”, since these deposits are recognized as financial investments in accordance with paragraph 3 of “PBU-19/02”, in this case a corresponding sub-account is opened for “Account-58” 58.5-“Bank deposits (deposits)”.

Please pay attention! Accounting for deposit funds is fixed in the company's accounting policy.

Accounting for interest on deposits in transactions

Interest on the deposit, which is accrued every month, is included in the section of other income of the organization. They must also be displayed in accounting on a monthly basis until the term of the banking agreement expires. According to the accounting regulations, “organizational income”:

- The accrual of interest on the deposit is reflected in the debit of account No. 76 “settlements with various creditors and debtors”.

- When creating a posting, account credit No. 91 “other expenses, income” or No. 91.01 “other income” is used.

For tax purposes, the amount placed in a deposit bank account will not be considered an expense of the enterprise, just as it will not be considered income when the money is returned to the depositor.

“Short” deposits and their reflection in 1C: Enterprise Accounting 8

Published 05/15/2019 11:51 Author: Administrator “Less is always better than nothing.” Many organizations experience periods of temporarily free cash flow. Effective management involves the efficient use of resources. Deposits are investments or financial investments of an organization. The peculiarity of deposits is that funds are placed for a specific period and on pre-agreed conditions (at interest). “Short deposits”, for example, on weekends and holidays, may not provide enormous income, but they are a source of “passive” income for the organization in the amount of interest received.

In accounting, they can be reflected in the Debit of the following accounts:

– 55.03 account (Deposit accounts),

— 58.02 account (Debt securities).

Let's consider the mechanism for reflecting deposits in the 1C program: Enterprise Accounting 8, edition 3.0.

For example, the following agreement has been concluded with a bank:

Let's reflect the following operations in the program:

1. Placing available funds on deposit on holidays.

It is convenient to attach the supporting document to a bank statement.

2. Return of the deposit amount within the terms established by the agreement.

3. Accrual of interest on the deposit on the date of return.

4. Receipt of interest on the deposit.

In the financial statements, the income received is reflected as follows:

“Acquiring knowledge is not enough for a person; one must be able to give it away.” (Johann Goethe)

Author of the article: Irina Kazmirchuk

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

-1 Irina Kazmirchuk 05/24/2019 02:40 Dear Anna! You are right, to reflect the placement and return of the deposit amount, you can also use account 55 “Deposit accounts” (see the second paragraph of the article). In this case, this is accounting only for the organization’s deposit accounts, i.e. one of the possible types of financial investments. An organization can also invest in stocks, bonds, issue loans to other organizations, etc. In this case, it is convenient to keep records on account 58 “Financial investments” in the context of types of investments and counterparties. What is it for? This information is required by potential investors (including banks), founders and other interested parties. Such information is easily analyzed using the Cash Flow Statement. What does a working 58th account “tell” potential investors? The fact that the business is creative in its approaches and directions, tries different methods of work, the investor’s money works. Now about reflecting interest received from the bank on 91 accounts at once. For the purpose of calculating income tax, deposits require the frequency of interest accrual, and therefore the uniformity of their reflection. Alternatively, interest can be transferred by the bank in a lump sum upon expiration of the contract. Regardless of the date of transfer of interest by the bank, the organization on OSNO is obliged to reflect the accrued interest as part of non-operating income in the NU, and as part of other income - in the accounting account. If the organization applies the simplified tax system, then the date of reflection will be the date of payment, i.e. in this case, your method works quite well, Anna.

Quote

+3 Anna 05/21/2019 18:00 Good afternoon! Why is it so difficult? Why can’t it be done immediately after count 55? And the interest should be reflected immediately in the bank statement D51 K91.1. This is how we reflect.

Quote

Update list of comments

JComments

Displaying the return of the deposit to the depositor

If the deposit period has come to an end, the bank is guaranteed to return the deposit amount back to the owner of the funds. In this case, an entry is made opposite to the receipt of money when opening a deposit, that is:

- debit () credit 55.03.

Deposit agreements may differ in terms and conditions. There are also deposits on which interest is paid after the expiration of the contract, upon return of the principal amount of funds. In this case, the accounting entries will differ from those when payments are made every month.

Account No. 55.03 is accounted for individually for each deposit. Since the deposit is recognized as an investment, accounting can also be kept in account No. 58 (“financial investments”).

Deposits of legal entities: main nuances and features

A deposit is an amount of money that is placed by a depositor in a bank for a certain period of time. The bank puts the depositor's funds into circulation, and for this pays the depositor interest on the deposit. The bank is obliged to return the funds (deposit) to the depositor upon expiration of the deposit period.

When concluding a contract, it is important to consider the following points:

- The period for placing the deposit is a long-term financial investment or a short-term financial investment (clause 1 of Article 837 of the Civil Code of the Russian Federation);

- Type of deposit – replenishable deposit or non-replenishable deposit;

- Conditions for early termination of the contract (clause 3 of Article 837 of the Civil Code of the Russian Federation);

- The procedure for calculating deposit interest: monthly capitalization or accrual of interest at the end of the deposit term;

- The procedure and terms for paying interest on the deposit (clause 1 of Article 839 of the Civil Code of the Russian Federation).

Postings when placing a deposit, calculating interest and returning the deposit

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 55.03 | () | Transfer of funds from the main or foreign currency account for storage | Deposit size | Bank statement |

| 76 | 91.01 | Accrual of bank interest for the use of deposit funds | Amount of accrued interest | Bank statement |

| () | 76 | Actual receipt of interest on deposit | Amount of accrued interest | Bank statement |

| () | 55.03 | Refund from deposit account | Deposit size | Bank statement |

| Postings for accrual of interest on deposit | ||||

| 55.03 | 76 | Transfer of funds from the main or foreign currency account for storage | Deposit size | Bank statement |

| () | 55.03 | Receipt of interest from placing a deposit in a foreign currency or current account | The amount of accrued interest for the entire storage period | Bank statement |

| () | 55.03 | Refund of a deposit | Deposit size | Bank statement |

Deposits in 1C “Trade Management 11.1”

Bank deposit (or bank deposit) is an amount of money transferred by a person to a credit institution in order to receive income in the form of interest generated during financial transactions with the deposit.

The single tax for simplification is levied on:

- income from the sale of goods (work, services) and property rights, determined under Article 249 of the Tax Code of the Russian Federation;

- non-operating income determined under Article 250 of the Tax Code of the Russian Federation.

This procedure is provided for in paragraph 1 of Article 346.15 of the Tax Code of the Russian Federation.

Non-operating income includes the organization's income received in the form of interest received under loan agreements, credit agreements, bank accounts, bank deposits, as well as on securities and other debt obligations. A deposit account is a special bank account. In accounting, the movement of money in deposits is reflected in account 55-3 “Deposit accounts in banks.”

Reflect the transfer of funds to the deposit by posting:

Debit 55-3 Credit 51 (52) – funds were transferred to a special deposit account.

When the bank returns the deposit amount, make a reverse entry.

When calculating and paying interest on a deposit, make the following entries in your accounting:

Debit 76 Credit 91-1 – interest accrued on the deposit;

Debit 51 Credit 76 – interest on the deposit was credited to the current account.

The bank deposit agreement may provide for the payment of the entire amount of interest on the deposit upon expiration of the period of storage of funds on deposit. In this case, interest accumulates in the deposit account during the entire period of storage of the money, and then the bank transfers it to the settlement (currency) account of the organization. Reflect such transactions in accounting with the following entries:

Debit 55-3 Credit 76 – interest on the deposit was credited to the deposit account;

Debit 51 (52) Credit 55-3 – interest on the deposit was credited to the current (currency) account.

Analytical accounting for account 55-3 “Deposit accounts” is maintained for each deposit separately.

Since deposits are recognized as financial investments (clause 3 of PBU 19/02), they can be accounted for in account 58 “Financial investments”. The organization establishes the method of accounting for the movement of money on deposit in its accounting policy.

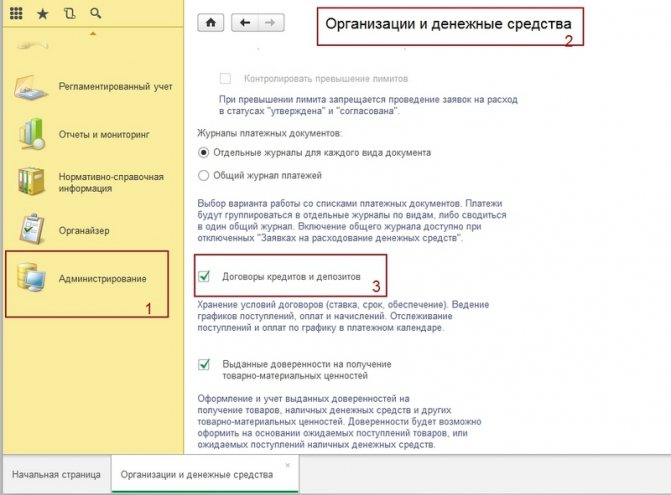

This is what accounting is all about. But how can these operations be reflected in operational accounting, namely in the 1C “Trade Management 11.1” configuration (hereinafter referred to as UT11)? Below I will show an approximate procedure for how to do this.

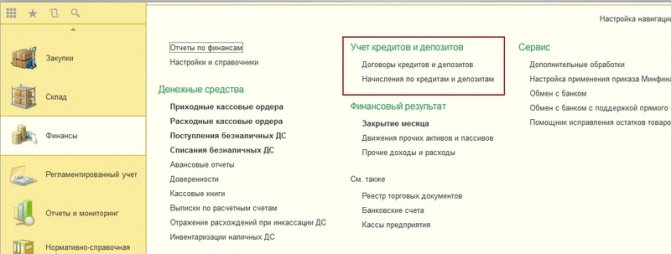

First, let's check whether we have the option for keeping records of financial agreements enabled in UT11. Let's go to the Administration section, select the Organizations and funds item and check whether the Loan and deposit agreements flag is checked.

Accordingly, if it is not installed, install it. There is no need to restart the program; the functionality will immediately be available in the Finance section, Loan and deposit agreements item

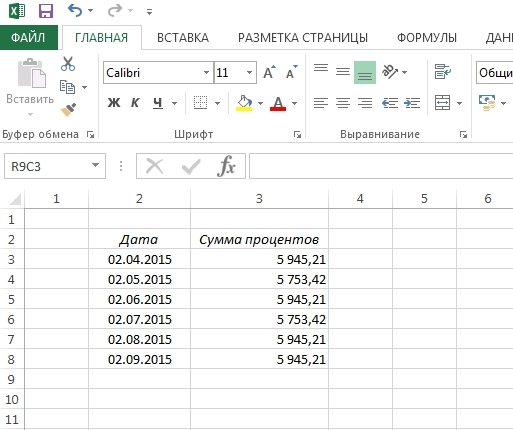

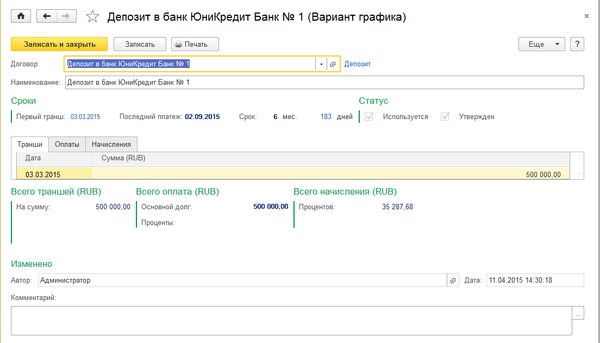

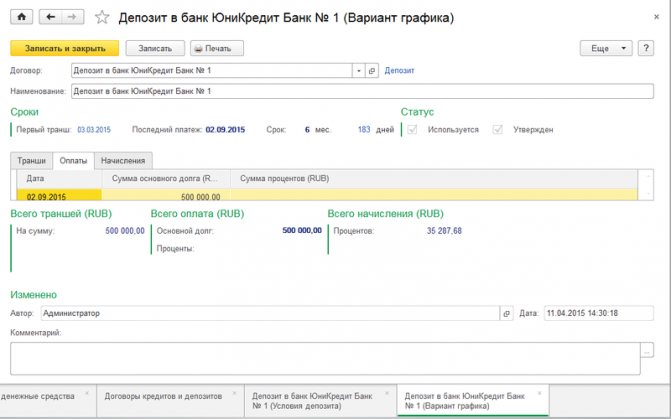

For example, let's create a new deposit agreement between an organization and a bank. Let’s assume that the organization contributed on 03/02/2015. a deposit of 500,000 rubles for a period of 6 months, at 14% per annum, the frequency of payments will be once a month on the day of the deposit. Our payout table looks like this:

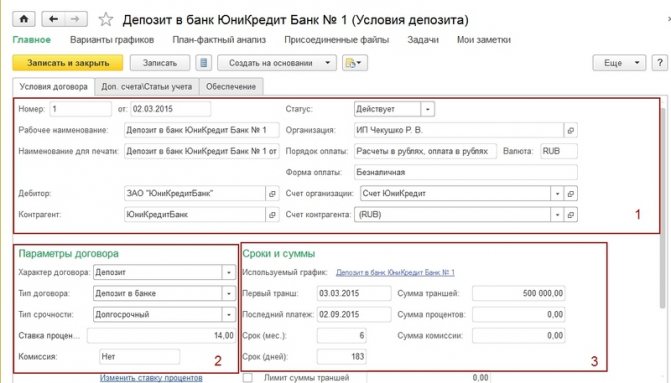

So let's get started. Let's create a new deposit agreement. Filling out this document can be divided into 4 blocks: the header of the document, contract parameters, payment schedule and accounting accounts.

I won’t comment much on the header of the document, the details are standard - Agreement number, conclusion date, Working name of the agreement, Organization that makes the contribution, Debtor where we contribute, invoices, etc. which is typical for many documents.

The second part, the actual parameters of the contract and the schedule of tranches and payments. We will select the “Nature of the agreement” detail Deposit, “Type of agreement” Long-term or short-term (it is assumed that deposits up to 1 year are considered short-term, more than 1 year - long-term).

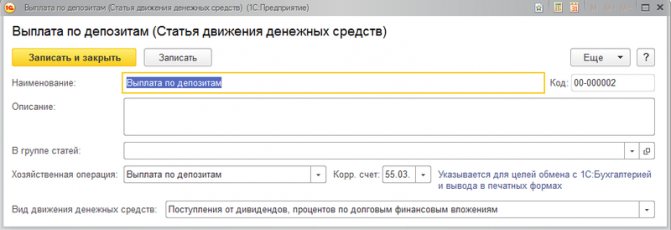

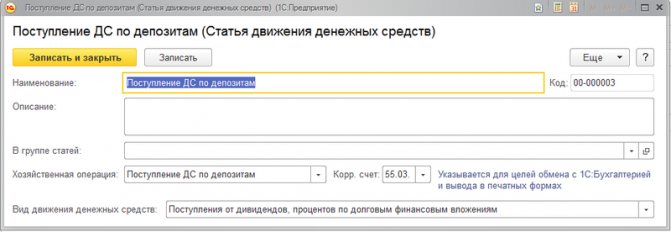

Let's go to the "Additional" tab. AccountsAccounting Items” and fill in the cash flow items.

Perhaps like this:

Payment details:

Props Principal debt:

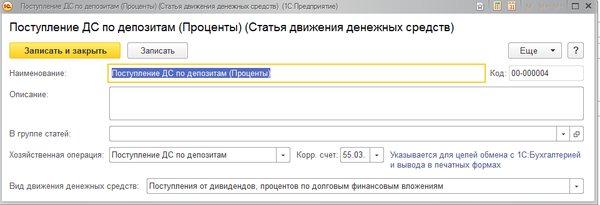

Details Percentage:

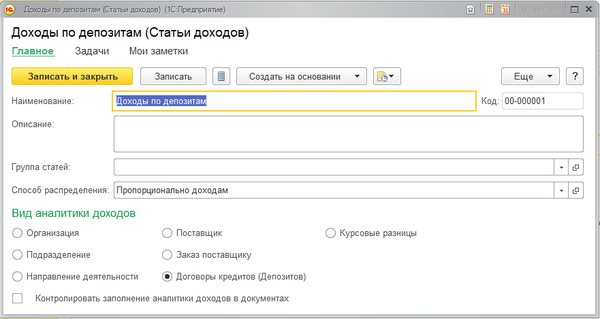

And details of the group Income items Interest:

Naturally, the way the income item is distributed or the type of movement in any of the three cash flow items may differ from yours. It all depends on your accounting policy.

Let's return to the Contract Terms tab and enter a schedule of tranches and payments. Click on the link Used chart. A new window will open.

On the Tranches tab, enter the date and amount transferred to the bank.

On the Payments tab, enter the amount of return of the tranche on September 2, 2015 in the amount of 500,000 rubles:

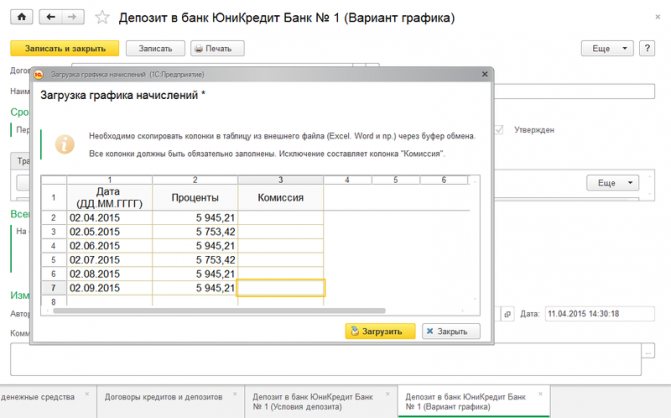

On the Accruals tab, click the Load button and in the table that opens, enter the interest payment schedule

Reflection in reporting

Income statement

Interest on the deposit is reflected in the statement of financial results:

- page 2320 “Interest receivable.” PDF

Cash flow statement

The cash flow statement reflects the deposit amount: PDF

- p. 4210 “Receipts - total”: p. 4213 “from the repayment of loans provided...” — return of the deposit by the bank;

- p. 4214 “dividends, interest...” - interest received.

- p. 4223 “in connection with the acquisition of debt securities...” - placing a deposit;

Income tax return

In the income tax return, interest accrued by the bank is reflected in non-operating income:

- Sheet 02 Appendix No. 1: page 100 “Non-operating income”. PDF

See also:

- From January 1, 2019, does deposit insurance for small businesses apply only to deposits or to funds in a current account as well?

- How to reflect in the program transactions on special bank accounts of procurement participants in accordance with 44-FZ and 223-FZ under the simplified tax system

- How to reflect in the program transactions on special bank accounts of procurement participants in accordance with 44-FZ and 223-FZ

If you haven't subscribed yet:

Activate demo access for free →

or

Subscribe to Rubricator →

After subscribing, you will have access to all materials on 1C Accounting, recordings of supporting broadcasts, and you will be able to ask any questions about 1C.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- The long-term deposit ends in January, how to reflect in the balance sheet for last year in 1SD long-term bank deposit opened by our organization in 2021. ends 01/31/2021

- How to reflect the contribution to the deposit, its return and accrued interest in 1С Enterprise Accounting, edition 3.0 (3.0.88.22), USN income Good afternoon, Tell me.

- Accounting for interest if a bank deposit is closed earlyHello! The organization had a bank deposit with interest payments.

- Deposit in foreign currency, when to accrue interest and exchange rate differences Good afternoon! We placed a deposit in foreign currency. When interest is calculated.

Publication card

| Sections: | |

| Heading: | 1C Accounting 8.3 / Receipt / Other income / Expense |

| Objects / Types of charges: | |

| Last change: | 12.11.2020 |

ID is set and contains the ID of the post $termini = get_the_terms( $post->ID, 'post_tag' ); // since the function returned an array, it would be logical to loop through it through foreach() foreach( $termini as $termin )name . ”; > /* * You can also use: * $termin->ID – element ID, of course * $termin->slug – element label * $termin->term_group – term group value * $termin->term_taxonomy_id – ID of the taxonomy itself * $termin->taxonomy – taxonomy name * $termin->description – element description * $termin->parent – ID of the parent element * $termin->count – number of posts it contains */ –>

( 3 ratings, average: 5.00 out of 5)

Add a comment Cancel reply

You must be logged in to post a comment.

Accounting entries for the deposit when opening and closing it

In accordance with PBU 19/02 (clauses 2, 3), deposit funds in accounting are shown as financial investments. They are registered at their original cost, which is the amount of money deposited in a bank account.

To account for the deposit, according to the Chart of Accounts, two accounts can be used:

- account intended for financial investments 58;

- Account 55 reflecting funds in special accounts in banking institutions.

Subaccounts are opened for these accounts: 58-5 “Bank deposits (deposits)” and 55-3 “Deposit accounts”. The method of accounting for the movement of money on a deposit chosen by the enterprise must be fixed in the accounting policy.

When opening a bank deposit and returning money from it, you must use the following transactions:

Attention! Regardless of the chosen option for accounting for deposits (on account 55 as cash or on account 58 as part of financial assets), they must be reflected in the reporting as financial investments (clause 41 of PBU 19/02).