The concept of liability

Financial responsibility is a concept in labor legislation.

It implies the obligation of a person to compensate for damage caused to another person. The concept of “material liability” is regulated by the norms of Section 11 of the Labor Code of the Russian Federation and regulations applied to certain categories of parties to an employment contract (for example, the Federal Law “On the financial liability of military personnel” dated July 12, 1991 No. 161-FZ). Financial liability is established for both the employee and the employer. In what cases is financial responsibility assigned to the employer? A work injury or occupational disease is a reason to recover damages in full from the head of the company. The employee has the right to compensation:

- lost earnings;

- additional costs for treatment;

- one-time benefit.

The employee is fully compensated for the violation of his rights:

- illegal removal from work or dismissal;

- delay in issuing a work book;

- failure to pay wages on time.

Delay of wages is classified as a violation of labor laws. At the same time, neither the fall in production volumes nor the general economic crisis in the country is an excuse, when employers sometimes do not have the money to pay employees on time and in full for their work. In the article “Delaying wages is a costly matter,” we will tell managers what awaits them for such a violation of the Labor Code of the Russian Federation, and employees will be able to learn from it about their rights.

However, workers have not only rights, but also responsibilities, one of which is careful handling of company property. Financial liability for an employee occurs regardless of other types of liability. This means that an employee who violates safety rules, resulting in other employees being exposed to danger and the employer’s property being damaged, will be financially liable and subject to disciplinary action.

According to the Labor Code of the Russian Federation, the employee compensates the employer for direct actual damage caused to him. That is, it is impossible to recover lost income from an employee, but a decrease in the quantity or deterioration of the company’s property is a reason to demand compensation for damage from a subordinate.

Important! The employer does not have the right to withhold the amount of damage in full immediately. The maximum amount of deduction is limited to 20% of the amount of wages minus personal income tax.

Financial responsibility is a concept directly related to Labor Legislation. This implies the obligation of persons who have caused damage to others to compensate for the damage and transfer compensation. Section 11 of the Labor Code of the Russian Federation regulates this area of relationships between the parties. But there are also regulations that apply only to certain parties to the agreement.

Financial liability is established equally for subordinates and employers. Moreover, it occurs regardless of other similar circumstances. Only direct property damage is subject to compensation, as the general rules say.

It is unacceptable to recover lost income from the other party. The reason for claims may be a decrease in the total amount of company property, or quality problems.

Grounds for liability

The chief accountant acts as a fully financially responsible person only if there is such a clause in the employment contract. If such a condition is not reflected, then compensation for damage is reimbursed in the amount of average earnings for one month.

ATTENTION! A separate agreement on full financial liability is not concluded with the chief accountant.

Conditions for holding an employee accountable:

- causing damage to the employer, if full liability is determined by the employment contract;

- if after the transfer of valuables a shortage is identified;

- harm to the organization was caused intentionally;

- the damage was caused while intoxicated;

- financial damage occurred as a result of a crime confirmed in court;

- administrative offense;

- disclosure of confidential company information.

Full financial liability of the chief accountant arises in situations described by the Labor Code of the Russian Federation, as well as in other cases reflected in the contract.

Responsibilities of accountants

Labor relations always begin with defining the responsibilities of a specific employee. The situation is exactly the same with the work of the documentation manager. His main responsibilities at work are:

Accounting.- Monitoring the movement of funds in the enterprise.

- Processing of accounting documentation.

- Timely submission of all required financial reports.

- Receipt and transfer of funds.

- Payroll.

- Calculation and timely transfer of all taxes and contributions to funds.

Law No. 402 Federal Law of 2011 regulates the main work that chief accountants must perform. Previously, the responsibilities of such employees included:

- Ensuring legality for any business operations of the enterprise.

- Control of enterprise property.

- Reporting, delivery.

- Accounting.

- Development of accounting policies.

According to the new law, employees have only one main task. This is the preparation of all documents related to accounting. The manager is now responsible for the following issues:

- Providing reporting.

- Formation of documents.

- Control of company assets.

Such changes are considered correct. After all, managers must have expanded powers compared to subordinates. Directors and supervisors should have the final say when conflict situations arise.

Without attracting administrative resources, it is difficult to organize important processes. Including the development of accounting mechanisms and preparation of documents. Directors can delegate only some of the tasks to chief accountants.

Accounting involves continuous recording and reflection in special registers of all transactions related to business activities. This process remains the real prerogative of chief accountants. Based on primary documents, reports are compiled for the following user groups:

- Business partners.

- Banks.

- Government bodies.

- Owners or shareholders.

Tax accounting also becomes an area of responsibility for these subordinates. Sometimes they are given management and statistical data, but much less often.

To maintain records, the manager can also use the services of third-party organizations. Or a situation is acceptable when the director himself deals with such issues. In the case of banks and credit organizations, hiring a chief accountant is a management responsibility that cannot be refused.

Noticed a mistake? Select it and press Ctrl Enter to let us know.

Full financial responsibility of the chief accountant in an employment contract: legal basis

General provisions on financial liability

In labor law, limited (as a general rule) and full financial liability are known. In the absence of conditions on full liability in an employment or separate contract, the chief accountant may be liable for damage caused in total only in the amount of average monthly earnings (Article 241 of the Labor Code of the Russian Federation). Exceptions in which full liability is possible are situations arising as a result of intent, public offense, etc. (Article 243 of the Labor Code of the Russian Federation).

Full financial liability of the chief accountant is possible as a general rule:

- when the employee reaches 18 years of age;

- direct connection between job duties and property maintenance;

- concluding an agreement on full financial liability, provided that such a possibility is indicated in the legislation.

Let's look at what rules apply here.

The Labor Code of the Russian Federation allows the inclusion of a condition on full financial responsibility in the employment contract with the chief accountant by position

The possibility of including conditions on full financial responsibility in an employment contract with a person holding the position of chief accountant is directly mentioned in paragraph. 10 tbsp. 243 Labor Code of the Russian Federation. Note that the remaining accounting positions are not indicated in it, since in accordance with paragraph 3 of Art. 7 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ (hereinafter referred to as Law No. 402-FZ), it is the chief accountant who is entrusted with accounting as a general rule with the granting of special powers specified in paragraph 8 of the same article.

In practice, the question arises about the possibility of concluding an agreement on full financial responsibility with another official who is entrusted with accounting, because such delegation of powers is allowed under Art. 7 of Law No. 402-FZ, and clause 7 of the accounting regulations, approved. by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n.

In addition, paragraph 17 of the Resolution of the Plenum of the Armed Forces of the Russian Federation “On the Practice of Application...” dated December 28, 2006 No. 64 indicates the possibility of applying sanctions for tax crimes to a person who is entrusted with the responsibility for calculating, withholding or transferring taxes, incl. . to the person actually performing the duties of a manager or chief (senior) accountant.

Note! Courts tend to interpret the norm of Art. in a restrictive manner. 243 of the Labor Code of the Russian Federation: if the position is not called “chief accountant”, then contractual full financial liability is impossible (see the cassation ruling of the Perm Regional Court dated January 23, 2012 in case No. 33-174, the decision of the Salekhard City Court of the Yamalo-Nenets Autonomous Okrug dated October 4, 2017 in case No. 2 -1670/2017).

Is it possible to assign financial responsibility to an employee who replaces the chief accountant during his vacation, ConsultantPlus explains in a ready-made solution. If you do not yet have access to the ConsultantPlus system, you can obtain it free of charge for 2 days.

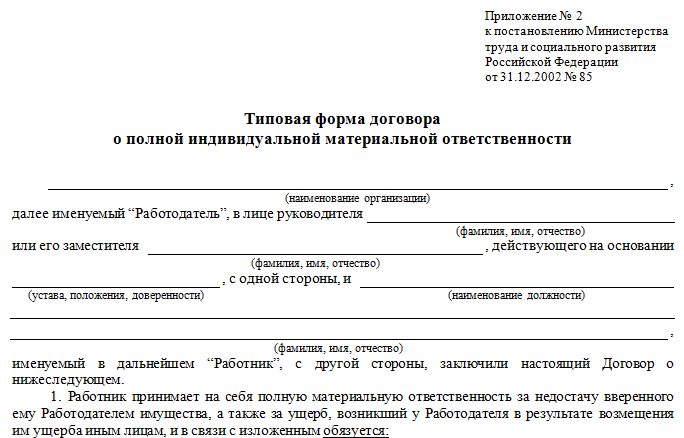

Additional condition regarding work function

There is a point of view based on Art. 244 of the Labor Code of the Russian Federation, according to which a separate agreement with the chief accountant on individual full financial responsibility can be concluded only when he performs the labor functions included in section II of the List of Positions and Works, approved. Resolution of the Ministry of Labor of the Russian Federation dated December 31, 2002 No. 85 (hereinafter referred to as Resolution No. 85), adopted in accordance with Government Resolution No. 823 dated November 14, 2002. These are:

- Registration and implementation of cash payments (paragraph 1).

- Accounting for material values (paragraph 4).

The logic is that the form of agreement used to consolidate the relationship, approved. Resolution No. 85, refers specifically to the functions listed in the list. At the same time, it is necessary to take into account the legal principle of priority of the content of the contract over the form. In paragraph 10 of the Resolution of the Plenum of the Armed Forces of the Russian Federation “On the application by courts...” of November 16, 2006 No. 52 (hereinafter referred to as Resolution No. 52) there is no requirement to include the official duties performed by the chief accountant in the list approved. Resolution No. 85.

The provision on financial liability can be included both in the employment contract and in any annex to it, including those called the contract on financial liability. In the absence of such a document, full financial liability does not apply as a general rule (see the decision of the Minusinsk City Court dated March 6, 2017 in case No. 2-869/2016).

Can a company not demand compensation for damage?

- An employee who discovers that damage has been caused writes a memo to the manager about it;

- The director, by order, creates a commission to clarify the circumstances.

- The commission calculates the amount based on market prices in effect at the time of the inspection, but not lower than the cost of damage according to accounting data. Losses within the limits of natural loss are not taken into account according to the norms. Foreign currency losses are calculated based on its current office. course. Non-monetary currency values are assessed by experts in accordance with No. 41-FZ 03/26/1998.

- Based on the results of the investigation, the commission draws up a report, which is signed by the members of the commission.

If inventories are written off on the basis of their shortage, damage, the VAT previously paid to suppliers is restored and paid in full to the budget, since in this case the condition for their reimbursement by the supplier is not met - they are not used for transactions that are subject to taxation. VAT refund calculations are reflected by the following entries:

- debit 19/credit 68;

- debit 94/credit 19.

Calculations for compensation of damage are reflected in the following entries:

- debit 73/credit 94;

- debit 70/credit 73;

- debit 50/credit 73.

On the 73rd account, the sub-account “Calculations for reimbursement of mat. damage."

If the defendant has evidence that he acted on the direct instructions of his superior, this does not exempt him from liability. Moreover, his complicity will become the basis for the court’s conclusion about an aggravating circumstance in a criminal case.

We invite you to familiarize yourself with: Tolling agreement

However, with regard to guilt in causing material damage, the highest authorities of the company and the court, when filing a recourse claim, have the right to make a different decision.

In controversial cases, it is advisable for the chief accountant to insist each time on receiving written instructions from the boss. If this is an entrepreneur or the owner of a controlling stake, a contribution to the authorized capital of the company, the court will subsequently consider his claims for compensation for damages by the chief accountant to be unlawful.

If he is a hired director or does not have a controlling stake, it is better to immediately officially notify the supervisory board of the business company, the real owner of the enterprise.

Situations when the use of punitive sanctions against an accountant is not appropriate:

- Damage incurred as a result of force majeure circumstances is not recoverable. These include natural disasters, government actions, wars, strikes, actions of terrorists and separatists, changes in legislation, inflation, devaluation, etc. They are considered force majeure circumstances;

- the accounting employee cannot be accused of unnecessary expenses incurred within the normal production risk;

- if the organization, through the fault of the manager or other persons, has not created conditions for accounting employees to perform their duties, the protection of property and documents is not ensured, accountants cannot be held accountable for this;

- when an accounting employee, through his actions, even illegal ones, prevented greater damage to the organization’s property, danger to the life and health of people, he cannot be found guilty.

In all cases, the manager has the right, under his own responsibility, to release the employee from obligations by issuing an appropriate order.

Practice shows that directors, on their own initiative, financially punish chief accountants only in cases of obvious malice or blatant negligence.

Most cases of involving accounting employees in mat. liability stems from the results of external audits, which cannot be avoided.

The position of chief accountant is associated with great risk.

A high salary does not always justify this risk. If the company's management conducts activities in clear violations of the laws, it is better to quit on time.

The Labor Code draws a certain line between ordinary accounting employees and the chief accountant. Responsibility in the latter case may not be mentioned in a separate document when the employee is hired. And already according to the text of the job description developed at the enterprise in advance.

The chief accountant always bears financial responsibility, regardless of whether a separate document on this topic has been drawn up. He is responsible both for the correct preparation of reports on his own, and for each employee under his command.

In this case, it is assumed that the damage caused is compensated in full. But such a scheme is associated with the mandatory drawing up of an agreement, where the parties describe their responsibilities and rights. The main thing is that the employee’s signature is present.

Existing rules indicate that such liability arises under the following circumstances:

- Disclosure of commercial and government secrets.

- Obtaining intentional financial gain, which resulted in damage to the enterprise. Moreover, if collusion with third parties is noticed.

- Intentional damage, including during alcohol or drug intoxication.

To establish the exact amount of damage and compensation, court hearings are scheduled.

The most common form of punishment is a decision by the tax service to hold the employee accountable. The reasons may be different:

- Incorrect calculation of fees.

- Late transfer of money.

- Violation of deadlines associated with the declaration.

- Errors in other documents.

The courts additionally indicate that arrears cannot amount to damage to the company in the usual sense of the word. After all, paying taxes and contributions is the direct responsibility of the taxpayer. That is, it is always a legal payment. The situation is different when it comes to failure of subordinates to fulfill their duties, which is why the company itself was punished.

If the owner of the company has changed, he has to terminate relations with the current management personnel within three months after taking office. Chief accountants were no exception to the rule.

At the initiative of management, such contracts can also be terminated. For example, if decisions were previously made that resulted in losses or unreasonable expenses.

In this case, there are no special requirements for the dismissal procedure. It would be wrong to prolong the stay of the chief accountant in his place, even if management requires an inventory. The staff conducting such events must include an employee handing over inventory items. Then you can make claims of a material nature against the citizen.

Disciplinary penalties can be applied for 2 years, starting from the moment the disciplinary offense was committed or became known. This rule also applies to those who continue to work at a particular enterprise.

The following specific violations can be identified for accountants:

- Incorrect payroll and other errors when paying employees.

- Violation of cash discipline rules.

- Violation of rules related to accounting and reporting.

- Distortion of information reflected in documents.

- Errors in calculating taxes and deductions to extra-budgetary funds.

- The primary documents were prepared incorrectly, but were still accepted for accounting.

Due to each such violation, the enterprise faces real financial losses. Here are just some examples:

- Penalties and penalties from tax authorities.

- Reimbursement to the budget for tax claims from subordinates and contractors.

The chief accountant, according to Chapter 39 of the Labor Code of the Russian Federation, like any other employee, bears a certain financial responsibility. After all, he deals not only with the funds of the enterprise, but also with the assets of the company. But besides this, the chief accountant may be punished in full, as provided for in Article 243 of the Labor Code of the Russian Federation.

Collection forms

From the first day of hiring this employee, all provisions regarding his duties and rights begin to apply. Accordingly, laws on liability in material form are applied to this category of workers, which makes it possible to avoid many violations at work.

Today, labor law defines several types of financial responsibility borne by the employee who manages the documents and finances of the enterprise. This includes:

Limited form of liability. So in Art. 238 and art. 241 of the Labor Code of the Russian Federation describes that in a limited form, the boss does not have the right to recover from his employee an amount greater than his average monthly income. The situation is exactly the same with the limited liability of the chief accountant.- Full form of responsibility. This type of withholding of funds from an employee is much more serious, and the main points are recorded in Art. 243 Labor Code of the Russian Federation. It defines the main points of liability. Moreover, I would like to note the fact that the employer does not have the right to collect this form of damage from the accountant without stipulating this clause in the employment contract.

We invite you to familiarize yourself with: Sample order to remove an employee from work

The main types of offenses for which an accountant may be punished in a limited form of collection of funds.

These include:

- unintentional damage to company property;

- loss of important financial documents of the enterprise;

- incorrect documentation.

It is impossible to recover material damages from an accountant in the event of lost financial benefits.

In the employment contract, each boss must specifically describe the rights of his employee, and at the same time, the responsibilities. Therefore, if an employee does not comply with them, the manager can punish by withholding a certain amount of money from wages.

A full form of withholding may occur in the following cases:

- if the accountant deliberately damaged the company’s documentation or property;

- in case of financial fraud proven in court;

- if he was involved in the disclosure of secrets that are provided for in the laws of the Russian Federation;

- if he did not keep records in good faith, which led to material losses.

Attention! According to clause 2, part 1

Art. 243 Labor Code of the Russian Federation

if there is not enough money in the cash register, then the employer will not be able to punish the chief accountant in material form.

Since clause 7 of the Regulations on Accountants and Accounting dated January 24, 1980 N 59, the chief accountant is prohibited from dealing with the enterprise’s cash. To do this, it is necessary to introduce another unit into the staff, that is, a cashier, who will be responsible for shortages.

His financial liability consists of violating the work rules specified in the employment agreement, which resulted in material losses for the enterprise. This may include:

- damage to property;

- lack of assets;

- costs incurred to pay employees who missed work;

- costs of paying fines for incorrect maintenance of financial statements at the enterprise.

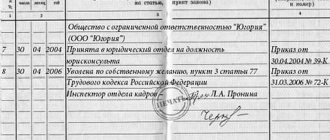

Order on financial responsibility

There is no legally approved sample order for the appointment of financially responsible persons; when drawing up, you can be guided by the generally accepted system of office work. The document is drawn up on company letterhead approved for organizational and administrative documents of the company.

The order contains:

- Name of the organization;

- title of the document (order);

- date and place (city) of publication;

- title (about the appointment of financially responsible persons);

- a preamble describing the purpose and basis of the appointment.

The contents indicate the full name and position of the employee who was appointed financially responsible. If we are talking about a group of people, then a list is drawn up. Next, the property for which compensation is assigned is listed, the full name and position of the employee who will monitor the execution of the order is indicated.

At the bottom, the manager signs with a transcript. Employees in respect of whom the order has been issued must familiarize themselves with it and sign it.

Chief accountant and financial responsibility after dismissal

Administrative liability (related to violation of record keeping).- Disciplinary liability (related to failure to fully fulfill one’s duties).

- Criminal liability (related to non-payment of tax, deliberate distortion of financial statements or incorrect calculation of wages to company employees).

- Material liability (for causing material damage to company property).

Each of the above points can be applied to a resigned or dismissed employee, depending on his misconduct at the time of work at this enterprise.

Rules for drawing up a liability agreement with the chief accountant

The chief accountant is a senior manager, but his employment and dismissal are determined by the Labor Code, and his job functions are determined by the contract and job description. Full financial liability is applied on the basis of Article 243 of the Labor Code of the Russian Federation on a general basis, as for all other employees.

The conclusion of an agreement or the addition of a similar clause to the employment contract of an employee whose position is not included in the list of positions with full responsibility is considered a violation and grounds for canceling the recovery of damages from the employee. It is possible to conclude an additional agreement on partial financial liability.

A sample agreement on the financial responsibility of an accountant can be downloaded here.

Illegality of behavior: about proof

It is necessary to take into account some features when the manager tries to prove that the accountant’s actions were illegal.

The violation must be related to responsibilities or instructions that are expressly set forth in the current documents. For example, an accountant is required to prepare and timely prepare financial statements. This means that he cannot be held accountable for problems related to reporting contributions and other types of tax documentation.

The mere fact of imposing penalties by regulatory authorities is not enough.

It is necessary to organize a full-fledged official investigation in connection with this or that matter. If a violation is identified, then disciplinary action will be the logical conclusion of the process. If there is no appropriate documentation, then the likelihood of satisfying the requirements remains extremely low.

Conditions for the occurrence of financial liability in relation to the chief accountant

General provisions

Some general issues of collecting compensation from an employee are discussed in our article at the link: “Compensation for material damage by an employee to an employer.” The conditions for the occurrence of financial liability are (letter of Rostrud dated October 19, 2006 No. 1746-6-1):

- illegality of the behavior of the damage-causer;

- causation;

- guilt in committing the act.

In paragraph 4 of Resolution No. 52, the following circumstances are also considered to be of significant importance:

- absence of circumstances excluding the employee’s financial liability;

- presence and extent of damage;

- compliance with the rules for concluding an agreement on full financial liability.

Some general issues of proof are covered in the material “Full financial responsibility of the employee (nuances).” In relation to the position of chief accountant, some peculiarities arise in the interpretation of the requirements of regulatory acts.

What damage can be recovered from the chief accountant?

The most common reason for filing a claim for damages from the chief accountant is a decision by the tax authority to bring tax liability for incorrect calculations, late payment of tax payments, late submission of declarations and other documents, as well as additional assessment of taxes (contributions).

When considering such cases, the courts indicate that the arrears presented cannot amount to damage to the organization in the sense contained in Art. 238 of the Labor Code of the Russian Federation and paragraph 15 of Resolution No. 52, since the payment of taxes and contributions is the responsibility of the taxpayer, i.e., a legal payment (see the resolution of the Presidium of the Moscow City Court dated November 16, 2016 in case No. 44g-221/2016). Another thing is fines, penalties and other sanctions imposed on the organization as a result of an employee’s failure to fulfill his duties.

About risks in connection with actions of a criminal nature

You can often find reports in the media about how chief accountants took advantage of their positions for personal gain. The fact that money passes through the hands of these people opens up a lot of opportunities for fraud. Tax evasion is one thing, but when seeking personal gain is another.

It is not easy to identify guilty actions such as embezzlement and forgery of documents, embezzlement of property, and organization of criminal schemes. Evidence for these facts is also quite difficult to find.

Here are some measures that will help protect against such problems in the future:

- When hiring, you must use agreements with the most precise wording.

- It is important to properly organize document flow in an enterprise.

- The powers and responsibilities of the chief accountant require division of powers and appropriate delegation.

- Periodic audits involving external or corporate employees.

- Hiring only subordinates with the appropriate level of qualifications for accountant positions.

- Careful selection of suitable candidates.

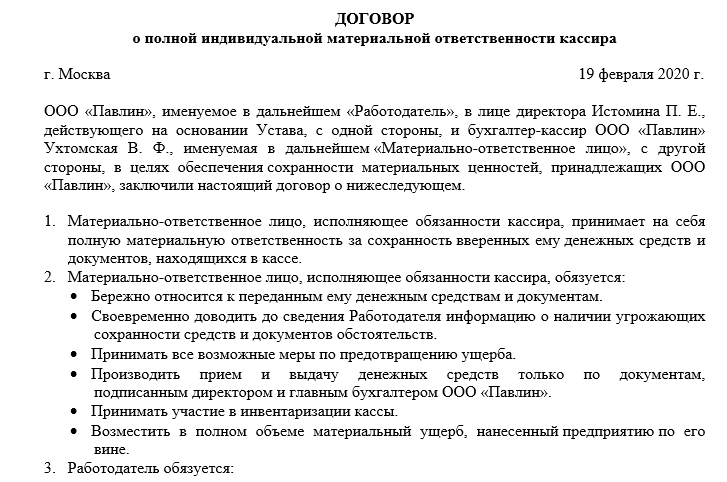

Sample agreements: Agreement on full individual financial responsibility of an accountant

Sample agreement on full individual financial responsibility of an accountant

Agreement on full individual financial responsibility of an accountant

" " ___________ 2015 Novosibirsk

Limited Liability Company "Name", hereinafter referred to as the "Employer", represented by the Director (full name), acting on the basis of the Charter, on the one hand, and a citizen of the Russian Federation _________________________________ (full last name, first name, patronymic), hereinafter referred to as the "Employee" , on the other hand, have entered into this agreement as follows:

1. The Employee assumes full financial responsibility for the shortage of property entrusted to him by the Employer, including: responsibility for the correct formation of payment orders and transfer of payments on behalf of the Employer in favor of third parties through the use of a remote banking system; responsibility for storage, processing, recalculation, acceptance, issuance of cash, in connection with which it undertakes:

1.1. strictly comply with the established rules for transactions with valuables and their storage; 1.2. reimburse amounts of the Employer’s funds unlawfully (including erroneously) transferred by him to third parties through the client bank, as well as shortages caused by him and non-payment and counterfeit banknotes not identified by him; 1.3. not to disclose anywhere, never and to any extent, information about transactions performed by the client-bank, as well as information on the storage of valuables, their dispatch, transportation, security, alarm, and official orders at the cash desk; 1.4. treat with care the property of the Employer transferred to him for the implementation of the functions (responsibilities) assigned to him and take measures to prevent damage; 1.5. promptly inform the Employer or immediate supervisor about all circumstances that threaten the safety of the property entrusted to him; 1.6. keep records, draw up and submit in the prescribed manner commodity-money and other reports on the movement and balances of the property entrusted to him; 1.7. participate in the inventory, audit, and other verification of the safety and condition of the property entrusted to him.

2. The employer undertakes:

2.1. create for the Employee the conditions necessary for normal work and ensuring the complete safety of the property entrusted to him; 2.2. familiarize the Employee with the current legislation on the financial liability of employees for damage caused to the employer, as well as other regulatory legal acts (including local ones) on the procedure for storage, reception, processing, sale (release), transportation, use in the production process and implementation other transactions with the property transferred to him; 2.3. carry out inventory, audits and other checks of the safety and condition of property in the prescribed manner.

3. Determination of the amount of damage caused by the Employee to the Employer, as well as damage incurred by the Employer as a result of compensation for damage to other persons, and the procedure for their compensation are made in accordance with current legislation.

4. Before making a decision on compensation for damage by specific employees, the Employer is obliged to conduct an inspection to establish the amount of damage caused and the reasons for its occurrence. To conduct such a check, the Employer has the right to create a commission with the participation of relevant specialists.

Requiring a written explanation from the Employee to establish the cause of the damage is mandatory. In case of refusal or evasion of the Employee from providing the specified explanation, the Employer draws up a corresponding act.

5. The employee does not bear financial responsibility if the damage is caused through no fault of his own. The obligation to prove the absence of guilt in the event of damage to the Employer’s property or identification of shortages of material assets rests with the Employee.

6. This Agreement comes into force from the moment of its signing. This Agreement applies to the entire period of work with the Employer’s property entrusted to the Employee.

7. This Agreement is drawn up in two copies of equal legal force, one of which is kept by the Employer, and the second by the Employee.

8. Changes in the terms of this Agreement, addition, termination or termination of its validity are carried out by written agreement of the parties, which is an integral part of this Agreement.

DETAILS OF THE PARTIES

Employer: Limited Liability Company “Name” Address: Taxpayer Identification Number/KPP ___________________________, Account __________________________________ in __________________________________ BIC __________________________________.

Employee: _______________________________________________________ passport: series ________ number _________, issued by ____________________________ ____________________ "__"__________ ____, department code ___________, registered at the address: ____________________________________________. Taxpayer Identification Number (if available)___________________________

SIGNATURES OF THE PARTIES

Employer: Employee:

____________/_______________/ ________________________

A copy was received and signed by the Employee on February 2015

Employee's signature: ____________________

Selecting the type of responsibility

By default, the employee bears limited MO. In cases other than those listed in the first paragraph of Article 243 of the Labor Code, damages are recovered in the amount of no more than the average monthly salary in accordance with Articles 241 and 81 of the Labor Code.

If a full mat agreement is concluded. liability or clauses about it are in the employment contract, the chief accountant compensates for losses in full. This is confirmed by the Post. Sun 11/16/2006 No. 52, paragraph 10, appellate decision. courts of the Arkhangelsk region. 05/30/2013, case No. 33-3149/13.

A similar MO in such cases is borne by the accountant-cashier, from whom, in addition to the amount of the shortage, the fines paid by the organization under Articles 14.1, 15.1 of the Code of Administrative Offenses are fully recovered. Other accountants are liable (except for that stipulated in Article 243 of the Labor Code, clause 1) only in an amount not exceeding the average monthly salary.

Judicial practice also recognizes an intermediate option as legitimate, when in the employment or civil contract of the chief accountant the parties independently establish the limit of his liability (resolution of the Volga District FAS 02/26/2010, case No. A06-2797/2009).

When applying for a job in a large business organization, it is logical for an applicant for the position of chief accountant to insist on precisely this version of the agreement.

It makes sense to extend these restrictions to sanctions under the Code of Administrative Offences, which in the practice of a large company can be frequent.

The manager must understand that losses can be recovered from an honest employee only within the limits allowed by his official income for a reasonable period, and sanctions on the enterprise can be imposed in amounts that are unrealistic for an individual.

Everything that is said above in relation to the chief accountant applies to a person working under a civil contract for the provision of consulting services on accounting, including legal (Chapter 39 of the Civil Code).

It is advisable to provide for the limits of liability of such a person in the contract from the moment of its conclusion. The courts consider it legitimate to impose fines on such counterparties for the consequences of their recommendations (Resolution of the Federal Antimonopoly Service of the Moscow District of July 18, 2012, case No. A40-4373/12-27-38).

Types of financial liability of the chief accountant of an organization

There are two types of employee responsibilities:

- on a universal basis;

- complete.

Most employees at the enterprise are responsible for the safety of property in accordance with the job description. If damage is caused, compensation is recovered from the violator according to the first option - in the amount of the average salary, even if the amount of damage caused is greater.

With full liability, the employee compensates the employer for real (direct, actual) losses in full. This condition is initially reflected in the employment contract, but such a clause can only be included in it for certain categories of employees. Among them is the position of chief accountant.

Actual damage occurs under the following circumstances:

- lack of finances or property assets;

- costs of restoring damaged property;

- damage to equipment and materials;

- expenses from downtime or absenteeism;

- fines.

IMPORTANT! Lost profits do not count as damage. For example, if an employer loses profit due to an agreement that was not concluded due to the fault of the chief accountant, it is impossible to compensate for the losses at the expense of the culprit.

Responsibility (both general and full) arises after a special commission has established guilt. The employee is first asked for an explanatory note.

Procedure for compensation of damage caused

- The guilty employee writes an explanatory note to the manager.

- The manager finds out whether the culprit agrees to pay off the losses voluntarily. If the parties agree, they write a corresponding agreement.

- Damage in the amount of up to the average salary, with the consent of the perpetrator, in a larger amount, is recovered by order of the head of the legal entity.

- If the perpetrator does not give consent, the organization files a lawsuit.

- In court, the organization’s representative will have to prove the cause-and-effect relationship between the defendant’s behavior and the sanctions imposed on the company and the damage suffered.