general characteristics

Depending on the type of settlements, the corresponding subaccounts 76 of the accounting account for a separate type of operation are opened. Each of them is intended for grouping and further analysis of the economic processes of the enterprise in monetary terms. Among the accounts for certain types of obligations and settlements with debtors, you can find categories for accounting for unpaid wages for various reasons, insurance of property of the organization and employees, receivables from employees for the use of housing and communal services and other transactions not mentioned in accounts 60-75.

Characteristics of account 90 “Sales”

To systematize information about the level of profitability and the size of the cost part when carrying out ordinary activities, the enterprise uses account 90 in the accounting department. It is classified as a matching type of account and is characterized by the absence of a closing balance. In relation to the sections of the balance sheet, account 90 is active or passive, depending on the turnover of a specific subaccount; in the Chart of Accounts it is listed as active-passive.

Account 90 “Sales” reflects the total amount of revenue with the formed cost of:

- all types of finished products;

- work with services for various purposes;

- purchased products to form a complete set of manufactured products;

- account 90 in accounting is also necessary to reflect work related to construction and installation;

- product groups;

- transportation services;

- loading and unloading operations;

- sch. 90 is used in cases of leasing one’s property;

- transfer of rights to patented inventions on a paid basis.

The debit of account 90 “Sales” reflects the formed set of expenses for the production of a specific product in the form of cost. When reflecting this loan transaction, accounts 41, , , 20 may be involved in correspondence. Account credit 90 shows the total amount of revenue received during the reporting period. Debit turnovers pass through account 62.

For enterprises specializing in the production of agricultural products, the cost price is reflected according to planned values. The difference between the planned indicators and the calculated actual data based on the results of the annual calculation is recorded as a separate debit amount. 90 account is not reflected in the balance sheet, since it is subject to reset upon closing at the end of the reporting period.

The 90 counting scheme looks like this:

| Debit 90 | Credit 90 |

| Expenses in the form of product costs including VAT, including sales costs | Income part in the form of proceeds from sales, including VAT |

| Total expenses | Total income |

| The balance indicates a loss | The balance shows profit |

Main subaccounts of account 76

The accounting policy regulates the use of the following subaccounts of type 76.00:

- 76.01 - for accounting for settlements based on court documents;

- 76.02 - for accounting for amounts not received by employees for labor;

- 76.03 - for accounting for settlements with debtors for housing and communal services;

- 76.04 - for accounting for trade union dues and payments;

- 76.05 and 76.06 - for accounting for settlements with subsidiaries and dependent organizations, respectively;

- 76.07 - for calculations for payment of income;

- 76.08 - for settlements with individuals who do not work in the organization;

- 76.09 - for settlements on received and submitted claims;

- 76.10 - for settlements on insurance matters;

- 76.11 - to account for targeted fees for housing and communal services;

- 76.12 - for accounting for undetected amounts;

- 76.13 - for settlements with the state. organs;

- 76.80 - for other settlements with debtors and creditors.

Additionally, accounting account 76 is opened “VAT on advances and prepayments” and accounting account 76 “VAT on advances and prepayments issued”, which correspond to account 68. The use of VAT accounts is mandatory and important for all tax payer companies.

Subaccount 76.01

In settlements based on enforcement documents, it is implied the withholding of funds from the amounts of remuneration for the labor of employees for the account of individuals and legal entities, based on court decisions and documents.

Let's consider possible types of correspondence of subaccount 76.01 with other accounts: Typical transactions using account 76.01

| Dt | CT | Characteristics of an accounting transaction |

| 70.01 | 76.01 | amount due due to court order withheld |

| 76.01 | 51 | the amount was paid according to the court decision from the current account |

| 76.01 | 50 | the amount of the court order was paid from the cash register |

| 50 or 51 | 76.01 | the previously transferred amount was returned to the cash register/account according to a court decision |

| 76.01 | 91.01 | writing off debts under court documents for enterprise income |

Subaccount 76.01 is debited with accounts 50 or 51 when the company makes the payment of the amounts required by executive documents. After the expiration of the limitation period for the documents, the debt amount is written off to the income of the enterprise and debited from 91.01 “Other income and expenses.”

The first entry in accounting for such a situation will be the correspondence of accounts 70 and 76.01, which reflects the process of withholding the amount payable. Subaccount 76.01 is credited with accounts 50, 51, 55 in the event that the organization returns amounts under executive documents.

What subaccounts are used?

The following sub-accounts can be opened for account 76:

- 76.1 Personal and property insurance - accounting of insurance transactions here occurs only in relation to the listed types of insurance; other accounts are used for compulsory pension, medical, social insurance. This subaccount is used both to record insurance premiums and to collect information on insurance claims. Transactions on life and health insurance of company employees are also recorded here. Analytics is carried out by type of insurance and insurers.

- 76.02 Claims - this sub-account summarizes information about emerging claims regarding the quality of the goods supplied, claims for violation of the terms of concluded contracts in relation to timing, volume, etc. Accrued fines and penalties provided for in agreements are taken into account here. Analytics is carried out on debtors and submitted claims.

- 76.3 Dividends - here is a generalization of information about accrued income due to the organization as a founder, as well as their payments. Analytics is carried out for each source of such income. See step-by-step instructions: how to pay dividends to the founder.

- 76.4 Deposited salary - is intended to account for wages not received on time, which are sent by the enterprise to the current account marked “Deposited”. Analytics is carried out on employees who did not receive their salaries on time.

- Calculations based on writs of execution - designed to summarize information on deductions made by an employee based on documents received from bailiffs - alimony, other deductions, etc. Analytics is carried out on debtor employees and received writs of execution.

- Settlements with other buyers and customers - this account records transactions that are not included in the main activities of the company. For example, payment of duties, settlements with a notary, etc. may be reflected here.

You might be interested in:

Account 90 in accounting: what is it used for, characteristics, examples of postings

Depending on the specifics of conducting transactions, on account 76, in addition to the main sub-accounts recommended by the standard Chart of Accounts, similar ones can be opened, but for accounting for transactions in foreign currency.

For example, 76/6 - Settlements with other buyers and customers in rubles and 76/26 - Settlements with other buyers and customers in foreign currency.

Attention! If the list of subaccounts to be opened differs from the standard one, then it must be indicated in the adopted accounting policy of the organization.

Subaccount 76.02

Account 76.02 in accounting is used for deposited wages that were not received on time by the company's employees for various reasons.

Typical transactions using account 76.02

| Dt | CT | Characteristics of an accounting transaction |

| 70.04 | 76.02 | the amount of the deposited salary is transferred |

| 51 | 76.02 | unpaid funds are transferred to a bank account |

| 76.02 | 50 | deposited salary was paid from the organization's cash desk |

| 76.02 | 91.01 | debt on deposited wages is written off to the organization’s income |

The amount not received for wages is debited from account 70.04 and reflected in credit 76.02. Funds can be issued to the employee, which is described by posting Dt 76.02/Kt 50. If the statute of limitations expires, the amount of the deposited salary is written off to the income of the enterprise.

Subaccount 76.03

Account “Settlements with residents for housing and utility sales” (sub-account “Revenue”).

Typical transactions using account 76.03

| Dt | CT | Characteristics of an accounting transaction |

| 76.03 | 90.01 | amount due for utility bills |

| 86.01 | 76.03 | the amount of compensation from the budget for housing and communal services was transferred |

| 70.01 | 76.03 | money from tenants transferred |

| 76.03 | 73.80 | the amount payable due to the subsidy has been repaid |

Citizens who are entitled to government benefits may be transferred amounts of compensation for payment of housing and communal services. Budget funds are accounted for in account 86.01. Receipt of payment for the use of housing and communal services of the organization from employees is reflected in the credit of account 76.03 and in the debit of account 70. In the case when payment for housing is made through subsidies provided by the organization, subaccount 73.80 is used.

Analytical accounting for account 90

Analytics is carried out on sub-accounts, which are closed at the end of the month and their balances are transferred to the profit and loss account. The score card 90 can have the following turns:

- 90.1 in relation to revenue;

- 90.2, showing the cost of production with operating expenses;

- 90.3 for VAT amounts;

- 90.4, intended for accounting for excise taxes;

- 90.5, allocated for export duties;

- account 90 “Sales” for summing up its subaccounts has a subaccount 90.9.

Amounts accumulated during the month on accounts 90.1 – 90.4 are subject to write-off to 90.9. Next, account 90 is reset by posting with account 99. For the purposes of analytical accounting, a separate reflection of each type of commodity item is typical.

Settlements with trade unions

Accounting for contributions by members of the trade union organization and the use of accumulated funds is carried out in account 76.04 “Settlements with trade union organizations”. Contributions are withheld from the amounts of remuneration for the labor of the enterprise's employees at the established rate and are displayed in the debit of account 70.01, then transferred to the organization's bank account. The process of transferring funds can be described by posting Dt 76.04/Kt 51.

Payment of amounts received from trade union organizations is made using accounts 50, 51, 55 and settlements with employees. The accounting entries for such an operation look like this: Dt 76.04 / Kt 70.01 or Dt 76.04 / Kt 50. When paying for vouchers to an employee of an organization from trade union contributions, account 76.04 corresponds with account 73.

How to determine the financial result of a company's activities

The interim financial result must be determined at the end of each month or other period specified in the accounting policy. For example, small businesses are allowed to perform this operation once per quarter, or even once per year.

At this moment, a comparison of turnovers in the subaccounts of account 90 should be made. The financial result is determined as the difference between debit and credit turnover for the selected period and is written off to profit and loss account 99, while such an operation will only affect account 90/9. The balances on the remaining subaccounts will be retained until the end of the year, when the final determination of the result will be made.

Attention! That is, the financial result is determined by subtracting from the amount of revenue in account 90/1 the amounts accumulated in cost subaccounts 90/2-90/5.

If the results of the calculations result in a positive value, it will indicate a profit for the reporting month. If the result is negative, this indicates a loss from the activity. After this, the determination of the intermediate result is made using postings - D 90/9 K 99 in case of profit, and D 99 K 90/9 in case of loss.

Subaccounts 90 of account, with the exception of 90/9, accumulate the amounts of revenue and expenses incurred, as well as the amount of taxes, throughout the year. At the end of the year, the final result for each of them is written off to subaccount 90/9 in one amount. Since during the year the amounts of the financial result were written off from it, if the account is closed correctly, there should not be a balance of 90.

Dividend calculation

To record settlements with individuals and legal entities regarding income, accounting account 76 is used. This is subaccount 76.07 “Calculations for due dividends and other income.” The funds that need to be paid are reflected in the debit of subaccount 76.07 and in the credit 91.01.

Intangible assets transferred to the organization as income are listed in the debit of asset accounting accounts and credit 76.07. Patents, copyrights, brands, and licenses for the production of a certain type of product can be transferred as intangible assets.

Payments to individuals

Subaccount 76.08 is intended for conducting transactions between the organization and former employees. For example, to issue a voucher to a pensioner, the following entries are made: Dt 76.08/ Kt 60-01, Dt 76.08/ Kt 90.01, Dt 76.08/ Kt 91.01. If part of the funds allocated to pay for the trip is transferred to the Federal Social Insurance Fund of the Russian Federation, then account 69.01 is used. The amount transferred by the fund is shown in debit 69.01. In cases where the organization takes on part of the payment for the trip, the following correspondence is generated: Dt 91.02 / Kt 76.08.

Subaccount 76.08 is also used to calculate income tax for an individual who is not a current employee of the organization. The operation is carried out if the value of the gift due exceeds the established value. Account 76.08 corresponds with 68.02.

Claims and insurance settlements

76.09 an accounting account was created to reflect settlements of claims made against suppliers and contractors and fines awarded. Cash requirements are reflected in the debit of account 76.09. Only those claims that are made on the basis of a concluded agreement between the companies are considered justified.

In this case, the following accounts are credited: 60, 20, 50, 51, 55 and a group of accounts payable for loans. Bills not paid on time lead to the accrual of interest, which is charged to account 91.01. Posting Dt 79.02 / Kt 76.09 or Dt 51 / Kt 76.09 describes the process of receiving funds in favor of the enterprise.

Subaccount 76.10 reflects transactions for the calculation of insurance of property and employees of the organization.

This does not include Social Security and Medicare payments. Typical transactions using subaccount 76.10

| Dt | CT | Characteristics of an accounting transaction |

| 20 44 | 76.10 76.10 | amount of insurance payments accrued |

| 70.01 | 76.10 | the insurance premium is deducted from the employee’s salary |

| 76.10 | 51 or 79.02 | the amount of insurance payments is transferred to the insurance organization |

| 76.10 | 99.03 | insurance compensation accrued |

| 51 | 76.10 | insurance payment received in case of emergency |

Characteristics of subaccounts 76.11, 76.12, 76.13, 76.5

Account 76.11 “Calculations for target fees for housing and communal services” is used to calculate payments for the use of utility services.

Account 76.12 “Settlements for unclear amounts” is used to carry out operations in cases where it is not possible to find documents for transferring amounts to the appropriate accounts. If the recipients of funds for debts are not identified, the amounts are written off from account 76.12 in favor of the organization.

Account 76.13 “Settlements with government agencies” is used to carry out operations to pay fines and debts to the state administration.

In the course of a company's activities in the production and sale of products or services, account 76 is widely used in accounting.

Postings using subaccounts 76.11, 76.12 and 76.13

| Dt | CT | Characteristics of an accounting transaction |

| 76.03 | 76.11 | accrued amount of payments for utilities |

| 76.11 | 51 or 55 | funds were transferred to utility service providers |

| 51 or 55 | 76.12 | Unidentified amounts were credited to the current account/special bank account |

| 76.12 | 91.01 | writing off outstanding debts to the organization's income |

| 91.02 | 76.13 | a fine was imposed on the company |

| 76.13 | 51, 50 or 79.02 | the amount of the fine is transferred to the relevant government agency |

| 97.03 | 76.13 | expenses for issuing a license are reflected |

| 76.13 | 51 | the debt for the issued license has been repaid from the bank account |

Account 76.5 in accounting is used for settlements with other suppliers and contractors. Do not forget that the main account for settlements with suppliers is 60, a subaccount 76.5 exists to pay for additional services not included in it. Here the amounts of the cost of packaging, the work of transport companies, and VAT for importing products can be recorded.

Examples of accounting entries for account 76

The following transactions can be made with this account:

| Debit | Credit | Name |

| 76 | 20, 23, 29 | Write-off of part of the costs of main, auxiliary or servicing production to other debtors or creditors |

| 76 | 21 | Sales of our own semi-finished products |

| 76 | 28 | Write-off of losses from marriage |

| 76 | 41 | Returning defective goods to the supplier |

| 76 | 43 | Reflection of the debt of other debtors for shipped commercial products |

| 76 | 50 | Payment of accounts payable in cash from the cash register |

| 76 | 50 | Return of funds from the cash register to the buyer (other creditor) |

| 76 | 51, 52, 55 | Payment of accounts payable with money from a current account, foreign currency account or from special accounts |

| 76 | 60 | Accounts payable for other transactions are reflected |

| 76 | 68/VAT | Reflection of VAT debt |

| 76 | Unpaid wages have been deposited | |

| 76 | 86 | Targeted funding received from the budget |

| 76 | 86 | Membership (entrance) fees have been charged to the partnership |

| 76 | 91 | Interest accrued on bonds |

| 76 | 08 | Writing off work that did not bring the desired result |

| 76 | 91/1 | Reflection of income from other sales |

| 76 | 91/2 | Write-off of receivables that are not collectible |

| 04 | 76 | The company's positive business reputation is reflected |

| 08 | 76 | Reflection of costs for exclusive copyright of a computer program |

| 76 | Materials purchased from another supplier | |

| 15 | 76 | Reflection of costs for procurement of materials |

| 19 | 76 | Reflection of input VAT on work (services) of another creditor |

| 20 | 76 | Inclusion of costs for other operations in production costs |

| 23 | 76 | Inclusion of costs for other operations as part of costs for auxiliary production |

| 41 | 76 | Receipt of goods from other creditor |

| 44 | 76 | Inclusion of costs for other operations as part of sales expenses |

| 50 | 76 | Received payment from other debtor in cash to the cash desk |

| 51, 52, 55 | 76 | Payment received from another debtor to a current account, foreign currency account or special account |

| 57 | 76 | Reflection of a transfer that has not yet been received from another debtor |

| 58 | 76 | The purchase of shares and securities is reflected |

| 76 | Settlement of debt | |

| 91/2 | 76 | Reflection of other expenses |

| 97 | 76 | Reflection of deferred expenses |

You might be interested in:

Account 71 in accounting: what is it used for, correspondence, subaccounts, main entries

Deduction of VAT on advances received

Accounting account 76 is not only settlements with debtors and creditors, but also payment of VAT for advance payments. Advance is the amount received by the supplier before the goods are shipped. Upon receipt of an advance payment, the taxpayer is obliged to transfer the amount of VAT to the budget.

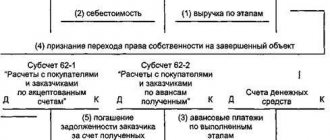

76-av accounting account is used to calculate VAT on advances received. Within 5 days, the supplier issues an invoice, one copy of which is sent to the buyer. VAT can be paid only after the sale of goods, then a 76-account is opened. The entries for calculating VAT on the advance received are as follows: Dt 51/ Kt 62, Dt 76-av/ Kt 68. When terminating the contract and returning the advance to the buyer, the manufacturer may require a deduction of the VAT amount. In this case, the reverse operation occurs: Dt 68/ Kt 76-av.

Account 90 in accounting: postings

Subaccounts 90.3-90.5 are not used in practice by all enterprises. Their presence is determined by the taxation system of the organization and the specifics of the chosen area of economic activity. Typical transactions for account 90 are presented in two blocks - debiting and crediting the sales account.

Postings to account 90 when reflecting revenue:

- D76 – K90.1 from organizations considered other debtors and creditors;

- D50 (55, 51, 52) – K90.1 upon receipt of proceeds from the sale transaction into the accounts of the selling company;

- D79 - K90.1 - in this case, correspondence from account 90 shows the amount of income from subsidiaries and branch divisions;

- D98 - K90.1 when attributing part of the proceeds to deferred income in the case of making advance payments.

Additional postings to account 90 “Sales”:

- D90.2 – K43, 41, 40 when writing off goods or categories of finished products at discount prices;

- account 90 in accounting, when reflecting trade margins, forms a posting between D90.2 and K42;

- D90.3 – K68 at the time of issuing VAT on products sold.

VAT on listed advances

Accounting account 76 is used to calculate VAT on the listed advances. After receiving the goods, the organization debits account 76 with account 68, after which the invoice is reflected in the purchase book.

If the company paying the advance to the manufacturer is a VAT payer, it can deduct VAT. The buyer has such a right only after receiving an invoice for products sold and meeting the following conditions:

- the supplier has issued a VAT invoice;

- the advance was paid for the upcoming supply or provision of services;

- there is documentary evidence of payment;

- an invoice has been issued for the advance payment;

- an agreement on the use of the advance was signed.

Compliance with all points guarantees the buyer the opportunity to deduct VAT and reduce the total amount of tax payable to the budget.