To directly move on to accounting for product returns, you must first understand the basic concepts associated with product return operations. So let's get started.

In accordance with paragraph 1 of Article 454 of the Civil Code, the seller is obliged to transfer the ownership of the goods to the buyer, and the latter is obliged to accept these goods and pay a certain amount of money for them. The transfer by the seller to the buyer of goods of inadequate quality means that the seller improperly fulfilled his terms under the purchase and sale agreement (Clause 1 of Article 469 of the Civil Code of the Russian Federation).

When delivering goods of inadequate quality, the buyer has the right, in accordance with paragraph 1 of Article 518 of the Civil Code, to present to the supplier the requirements provided for in Article 475 of the Civil Code, which establishes the consequences of transferring goods of inadequate quality. In the event of a significant violation of the requirements for the quality of the goods, the buyer has the right, at his choice:

- refuse to fulfill the purchase and sale agreement and demand the return of the amount of money paid for the goods;

- demand the replacement of goods of inadequate quality with goods that comply with the contract (Clause 2 of Article 475 of the Civil Code of the Russian Federation).

note

Returning a quality product is actually a reverse sale.

It is possible to return both high-quality and low-quality goods to the supplier. Returning a quality product is actually a reverse sale. The Civil Code allows the parties to include in the contract any condition that does not contradict the law (clause 4 of Article 421 of the Civil Code of the Russian Federation). The supply agreement may provide for the buyer’s right to return goods of proper quality and completeness to the supplier, for example, due to a lack of demand for it. Such a return of goods to the supplier is actually a reverse sale. As a result, the buyer becomes a seller and reflects this transaction as a sale of goods. We will not consider such operations in this article.

The return of low-quality goods (defective) is not a separate transaction, since it is made within the framework of the original supply agreement (Article 518 of the Civil Code of the Russian Federation), i.e. The operation of returning a defective product is not considered a return sale of goods. In our article we will pay attention to such operations.

Situations when the buyer has the right to refuse such goods are listed in Chapter 30 of the Civil Code.

note

The operation of returning defective goods is not considered a return sale of goods.

Return of defective goods from the buyer

In the buyer's accounting, the procedure for recording the return of low-quality goods depends on whether the defect was discovered immediately upon acceptance of the goods or after it was accepted for accounting.

When returning goods before they are accepted for accounting, the contract is terminated unilaterally, the goods are not accepted for registration by the buyer, and the ownership of it is retained by the seller. The buyer notifies the seller of the violation of the terms of the contract (Article 483 of the Civil Code of the Russian Federation) and accepts the goods for safekeeping. Defective goods are accepted for accounting in off-balance sheet account 002 “Inventory assets accepted for safekeeping” in the assessment according to shipping documents (by a simple debit entry to account 002). When the goods are returned to the supplier, the cost of the goods is written off from off-balance sheet accounting by a simple entry on the credit of account 002.

A separate transaction reflects the receipt of funds from the supplier for the submitted claim:

DEBIT 51 CREDIT 76 subaccount “Settlements for claims”

- funds received from the supplier for a claim.

Accounting for the return of goods before acceptance for accounting and receipt of funds requires the completion of only three business operations:

- an invoice for receipt of goods is registered;

- an invoice for writing off the goods is registered;

- The bank statement showing the receipt of funds is reflected.

If a defect is discovered after acceptance of the goods, the buyer makes a claim to the supplier for the value of the defective goods. Settlements on claims are recorded in account 76.6 “Settlements with various debtors and creditors”, subaccount “Settlements on claims”.

Typically, examples are used to consider operations for returning goods with payment after receipt of the goods.

We will look at an example of returning a product, complicating it by paying an advance to the supplier. Example 1

Riviera LLC bought a batch of nails from StroyBarier LLC (120 boxes of 3 kg each) for 25,000 rubles.

Before accepting the goods, Riviera transferred fifty percent of the cost for the goods in advance. After the goods arrived at the warehouse and were registered, it was discovered that almost all the nails were missing heads - the goods were rejected. The nails were returned to the supplier, and a claim was sent to him for the return of the previously paid advance. The accountant makes the following accounting entries: DEBIT 60 subaccount “Advances” CREDIT 51

- 12,500 rubles.

— paid to the supplier for goods (advance); DEBIT 68 CREDIT 76

- 1906.78 rub.

— VAT deduction on advance payment issued to the supplier is reflected; DEBIT 41 CREDIT 60

- 25,000 rub.

— goods received from the supplier are accepted for accounting; DEBIT 19 CREDIT 60

- 3813.56 rubles.

— input VAT is taken into account; DEBIT 60 CREDIT 60 subaccount “Advances”

- 12,500 rubles.

— the advance payment has been credited against the previously received prepayment; DEBIT 68 CREDIT 19

- 3813.56 rub.

— the supplier’s invoice is registered; DEBIT 76 CREDIT 68

- 1906.78 rub.

— VAT on advances issued has been restored; DEBIT 76 CREDIT 41

- 25,000 rub.

— goods are returned to the supplier; DEBIT 76 CREDIT 68

- 3813.56 rubles.

– VAT accrued is taken into account; DEBIT 51 CREDIT 76

- 12,500 rub. — funds were returned according to the reconciliation report.

How are production defects taken into account?

A manufacturing defect should be considered a product that was processed during the production process, but does not meet the established criteria.

At the same time, products that, according to their characteristics, have higher values of the criteria provided for by the relevant documentation cannot be considered defective. This product will be considered better than standard. Downgrading of products from a high grade to a lower grade is not considered a defect. For example, premium flour and 1st grade flour.

The decision to recognize a product as defective is made by the technical control department. At the same time, an act is drawn up. The technical control department identifies and determines whether the defect can be corrected, or whether it should be written off as an enterprise expense. Hence it is divided into correctable and incorrigible.

In this case, defects detected at the manufacturer are called internal. If it was found by consumers, then it should be classified as external.

If technical control recognizes the product as defective, its cost from account 20 should be written off to account 28 manufacturing defects.

After making a decision about the possibility of correcting the defect, the same account reflects information about all the costs incurred by the enterprise to correct it - the cost of materials, wages with deductions, services of third-party companies, etc. These costs are reduced by amounts reimbursed by the guilty parties.

Attention! When a defect is recognized as irreparable, its cost is written off to the appropriate accounts of other costs, minus the amounts of materials that can be used after disassembling the product, taking into account the reimbursement of costs by the guilty parties.

In this case, an act for writing off defective products is drawn up. Typically, those parts of the original product that have retained their usefulness come into stock and can be separated from the main product without loss of properties and reused in the production of new products. The cost of such materials is determined based on the price of their possible use.

If a company produces products for which it sets a strictly defined warranty period, then it is obliged to create a reserve for warranty repairs on account 96. In this situation, losses from external defects are compensated for by it.

The perpetrators of defects can be both internal (employees) and external (suppliers of low-quality material). If the supplier is to blame for the defect, then a claim is made to him, and the amount of compensation received is counted towards reducing the cost of correcting the defect.

Attention!

If an employee is found guilty of committing a marriage, then the amount of expenses that must be covered from his

wages

. The law establishes that it is allowed to withhold no more than 20% of the salary each month.

Return of defects from the supplier

Particular attention should be paid to accounting for the return of goods from the supplier, taking into account advance payments, because The situation under consideration is complicated by the accrual of VAT on the advance and the reflection of the deduction of VAT on advances received, which involves the implementation of the following business transactions.

Let's consider this as a continuation of example 1.

Example 2

The accountant of StroyBarier LLC makes the following entries:

DEBIT 51 CREDIT 62 subaccount “Advances”

- 12,500 rubles.

— received funds to the bank account from the buyer (advance); DEBIT 76 CREDIT 68

- 1906.78 rub.

— an invoice for the advance payment has been issued; DEBIT 62 CREDIT 90.1

- 25,000 rub.

— revenue from the sale of goods is reflected; DEBIT 90.3 CREDIT 68

- 3813.56 rub.

— VAT is charged on the shipment of goods; DEBIT 90.2 CREDIT 41

- 20,000 rub.

— reflects the cost of goods sold; DEBIT 62 subaccount “Advances” CREDIT 62

- 12,500 rub.

— the advance payment previously received from the buyer is offset; DEBIT 68 CREDIT 76

- 1906.78 rub.

— VAT deduction on advances received is reflected; DEBIT 62 CREDIT 90.1

- 25,000 rub.

— adjustment of sales (reversal); DEBIT 90.2 CREDIT 41

- 20,000 rub.

– adjustment of write-off of goods sold (reversal); DEBIT 90.3 CREDIT 19

- 3813.56 rub.

— adjustment of accrued VAT (reversal); DEBIT 62 subaccount “Advances” CREDIT 62

- 12,500 rub.

— adjustment of the offset advance (reversal); DEBIT 68 CREDIT 19

- 1906.78 rub.

— VAT has been accepted for deduction (registration of an invoice for refund); DEBIT 62 subaccount “Advances” CREDIT 51

- 12,500 rub. — money was returned to the buyer.

If the sale and return of defective goods are made in different tax periods

When a defective product is returned by the buyer, the procedure for recording transactions in the seller’s accounting differs depending on the period in which the defective product was returned (during the sales period or the next year after sale).

In accordance with paragraph 6 of PBU 9/99 “Income of the organization”, revenue is accepted for accounting in an amount calculated in monetary terms equal to the amount of receipts of cash and other property and (or) the amount of accounts receivable.

If the buyer returns a product of poor quality, the purchase and sale agreement is considered terminated in part of this product; it is considered that the ownership of the defective product has not passed to the buyer.

Based on clause 80 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n, a decrease in revenue as a result of the return of low-quality goods identified in the next year is reflected as a loss identified in the reporting period. year (clause 12 of PBU 10/99 “Expenses of organizations”). In this case, corrections and (or) clarifications are not made to the financial statements of the previous year.

Let's consider the operation of returning goods sold in the previous reporting period from the supplier's perspective.

Let’s use the previous data and just imagine that the shipment and return of the defective items occur in different tax periods. Example 3

The accountant of StroyBariera must make the following entries:

DEBIT 91.2 CREDIT 62

- 25,000 rubles.

— the return of goods sold in the previous calendar year is reflected as other expenses of the reporting period; DEBIT 41 CREDIT 91.1

- 20,000 rub.

— the previously written-off cost of goods returned by the buyer was restored; DEBIT 68 CREDIT 91.1

- 3813.56 rubles. — VAT has been accepted for deduction (registration of an invoice for return).

Typical transactions for account 28 “Defects in production”

Typical entries for correctable defects on account 28:

| Dt accounts | CT account | Operation description |

| 28 | 10 (70;69;25;26) | Written off material (wages; insurance premiums; general production expenses; general business expenses) expenses for correcting defects |

| 73.02 | 28 | The amount recovered from the culprit of the marriage is reflected |

| 20 (23) | 28 | Expenses to correct defects are written off to the cost of production |

Typical postings for irreparable defects on account 28:

| Dt accounts | CT account | Operation description |

| 28 | 20 | The cost of defective products is written off |

| 41 (21) | 28 | Defective products (semi-finished products) are accepted for accounting |

| 73.02 (76.05; 60) | 28 | The amount recovered from the culprit of the defect (suppliers of defective material) is reflected. |

| 20 (23) | 28 | Losses from defects are written off to the cost of production |

Returning goods from an individual

The procedure for returning goods purchased under a retail purchase and sale agreement is regulated by Chapter 30 of the Civil Code and the Law of the Russian Federation of February 7, 1992 No. 2300-1 “On the Protection of Consumer Rights.”

The list of goods that cannot be returned was approved by Decree of the Government of the Russian Federation of January 19, 1998 No. 55. Such goods include perfumes, textiles, jewelry, cars, etc.

In cases of lawful return of goods, the seller is obliged to accept the sold goods back and return the money to the buyer.

Example 4

Tekstil LLC sold a dress to citizen O.G. Ivanova.

at a price of 2500 rubles. The next day Ivanova returned the dress - a defect was discovered. The defective goods were returned to the store, and citizen Ivanova was reimbursed. The accountant makes the following entries in the accounting: DEBIT 76 CREDIT 90.1

- 2,500 rubles.

— revenue from the sale of goods returned by the buyer (reversal); DEBIT 90.2 CREDIT 41

- 2000 rub.

— the purchase price of the goods returned by the buyer (reversal); DEBIT 90.3 CREDIT 68

- 381.36 rub.

– VAT on the returned goods is taken into account (reversal); DEBIT 76 CREDIT 50

- 2500 rub.

— the buyer’s money was returned; DEBIT 41 CREDIT 76

- 2,000 rub.

— the goods are capitalized at the sales price; DEBIT 90.2 CREDIT 42,500

rub. — The trade markup has been restored.

How to document the return of goods?

Peculiarities of document flow and exchange of goods can be enshrined in a purchase and sale or supply agreement. For example, the contract may stipulate that the return of goods is carried out on the basis of a claim, which is sent by email, fax or other accessible method; the contract may establish specifics of the costs of returning the goods, the accrual of penalties, etc.

Returning goods from the buyer requires the preparation of the following documents:

- act on the discovery of defects in the goods;

- claim.

Documents are drawn up in free form. You can use some standard acts that were previously approved by the State Statistics Committee - the form of an act on the established discrepancy in quantity and quality when accepting inventory items No. TORG-2 (for imported goods - form No. TORG-3).

If the act is drawn up in any form, then the mandatory details should be indicated in the act in accordance with Article 9 of Law 402-FZ “On Accounting”.

The act is signed by representatives of both parties (unilateral drawing up of the act is possible with the consent of the supplier or in its absence), it serves as the basis for filing claims and lawsuits. The claim to the product is signed by the buyer.

The seller must prepare the following documents:

- register the returned goods;

- issue an adjustment invoice to the buyer;

- transfer the invoice with corrections to the buyer.

If a product is returned, a correction invoice will be issued. In accordance with Article 169 of the Tax Code, it is issued when the cost of goods shipped (work performed, services provided) or transferred property rights changes. In particular, it is issued in the event of a change in price (tariff) and (or) clarification of the quantity (volume) of goods supplied (shipped) (work performed, services rendered), property rights.

The buyer must issue a delivery note to the seller for the shipment of goods received from him. This is stated in paragraph 2.1.9 of the Methodological Recommendations for accounting and registration of operations for the receipt, storage and release of goods in trade organizations, approved by the letter of Roskomtorg dated July 10, 1996 No. 1-794/32-5 (hereinafter referred to as the Methodological Recommendations of Roskomtorg). It is advisable to make a note “Return of goods” on the delivery note (form No. TORG-12).

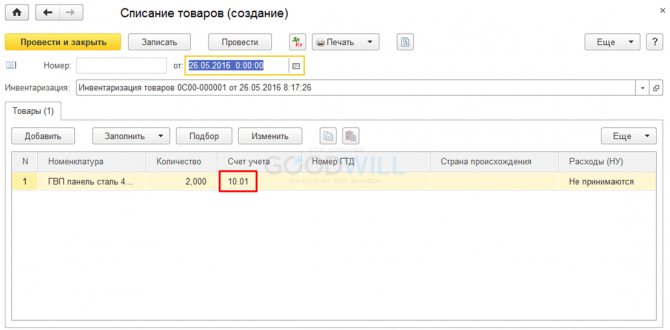

Document Write-off of goods

Now let's create a write-off document. Click on the button in the inventory “Create based on” and select “Write off goods”:

The “Write-off of goods” document window will open:

The program itself will determine that this is material (account 10.01) (according to the account in which it was stored) and will insert it into the tabular section. Click on the “Post” button, then in 1C 8.3 we look at the postings for writing off the goods:

As you can see, we have written off two pieces of material to account 94.

Expert opinion

Makarov Igor Tarasovich

Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

The same could be done manually by creating the “Write-off of goods” document yourself and filling it out. It’s just more convenient through the “Inventory” document.

Our video about preparing documents for writing off and posting goods based on inventory:

An organization, in the course of its activities, may encounter situations when it is necessary to write off goods in 1C: Accounting 8: due to damage, loss, shortage, serious breakdown, or for some other reason. To register the write-off of goods in 1C, the document “Write-off of goods” is used.

It should be noted that a write-off can be made on the basis of an inventory sheet when the actual quantity of goods is less than the balance in the information system. And you can also create a write-off document directly.

Let's take a closer look at both design options.

Let's set up your 1C. We have been working since 2000. We are among the TOP 10 partners of 1C. Read more →

For example, an inventory was taken at the warehouse of the “Main” organization LLC Trading House “Complex”, and a corresponding document was created. To open it, go to the “Warehouse” section of the program and select the “Inventory of goods” item.

Documentation of goods from the seller in retail trade

When returning goods on the same day, that is, before the Z-report is taken at the checkout, the seller must:

- collect the cash receipt from the client and sign it from the manager;

- draw up a money return act in the KM-3 form;

- issue an invoice for the returned goods;

- return the money.

The invoice can be drawn up in the TORG-13 form (invoice for internal movement, transfer of goods, containers). The check signed by the manager is presented to the operating cash desk, and the money is returned to the buyer.

The check received from the buyer is attached to the act (in the KM-3 form) and submitted to the accounting department. Amounts paid for returned customers and unused cash receipts are reflected in the cashier-operator's journal in column 15. The amount of revenue for a given day is reduced by these amounts.

If the goods are returned to the seller later than the day the goods were purchased, the following documents are drawn up:

- the buyer draws up an application and attaches a cash receipt or sales receipt to it;

- the seller issues an invoice for the returned goods in two copies (one is attached to the product report, and the second is given to the buyer and is the basis for receiving a sum of money for the returned goods);

- the seller gives the buyer money and draws up a cash order;

- the seller makes accounting corrections.

VAT accounting for the seller

According to the Russian Ministry of Finance, when returning goods that were not accepted for registration by the buyer, the seller issues an adjustment invoice for a decrease in value due to a decrease in the number of goods shipped. He registers this invoice in the purchase book during the period when the right to deduction arises (clause 12 of the Rules for maintaining the purchase book, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137). Adjustment invoices are applied only if the buyer returns to the seller part of the goods not accepted by him for accounting. If the buyer refuses to accept the entire shipment, then the seller, in order to claim a tax deduction, registers in the purchase book his own invoice issued upon shipment of goods (see letter of the Federal Tax Service of Russia dated April 11, 2012 No. ED-4-3/6103) .

Accounting for VAT from the buyer

The buyer notifies the seller of the violation of the terms of the contract (Article 483 of the Civil Code of the Russian Federation) and accepts the goods for safekeeping. The return of goods not accepted for registration is not a sale, therefore the buyer does not prepare an invoice (clause 1 of Article 39, subclause 1 of clause 1 of Article 146, clause 3 of Article 168, clause 3 of Article 169 of the Tax Code of the Russian Federation) .

If the buyer refuses to accept the entire consignment of goods, then VAT on the invoice received from the seller is not claimed for deduction (clause 2 of Article 171, clause 1 of Article 172 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated March 7, 2007 No. 03 -07-15/29). The invoice received from the seller is not registered in the purchase book (clause 2 of the Rules for maintaining the purchase book, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

If the goods are returned partially, then the buyer claims VAT on the shipping invoice only for the part of the goods actually registered. The buyer receives an adjustment invoice from the seller for the change in price. Such an invoice is not registered by the buyer in the sales book, since there is no obligation to restore VAT under subparagraph 4 of paragraph 3 of Article 170 of the Tax Code.

T. Lesina,

accountant, for the magazine “Regulatory acts for accountants”

Help in solving practical situations

Since 2001, the Practical Accounting magazine has published articles with specific solutions and recommendations. The publication is now also available in electronic form. Get full access to all materials >>

If you have a question, ask it here >>

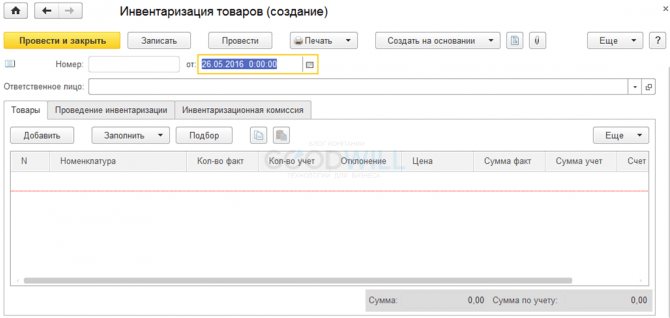

Creating a document “Inventory of goods”

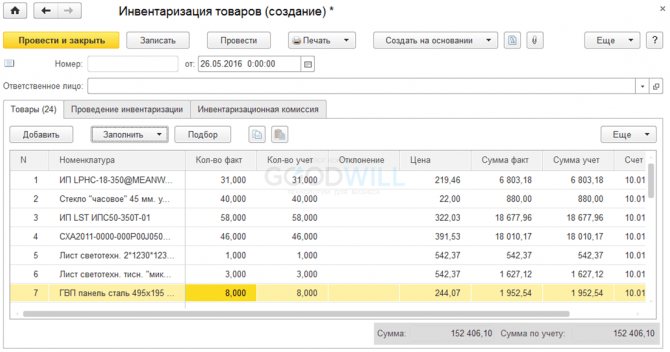

Let's create a document “Inventory of goods”. Go to the “Warehouse” menu, then click on the “Goods Inventory” link. In the list form, click “Create”. You should see something like this:

You can add positions with one “Add” button, or you can use the “Fill” button. In this case, the program will prompt us to fill out the document with the balances in the warehouse (those listed in the system). Initially, the “Actual Quantity” column will contain the same number as the “Accounting Quantity” column.

The deviation, accordingly, is zero by default:

Get 267 video lessons on 1C for free:

Articles on the topic (click to view)

- Criminal Lawyer

- How to pay your internet or TTK TV bill without commission?

- Conditions for bankruptcy of individuals

- Article 1484. Civil Code of the Russian Federation. Exclusive right to a trademark

- Sale of apartments at bankruptcy auctions in St. Petersburg

- Trademark cost calculator How much does it cost to register a trademark:

- Who can begin bankruptcy proceedings for a legal entity, what stages does bankruptcy include, and how long do such stages last?

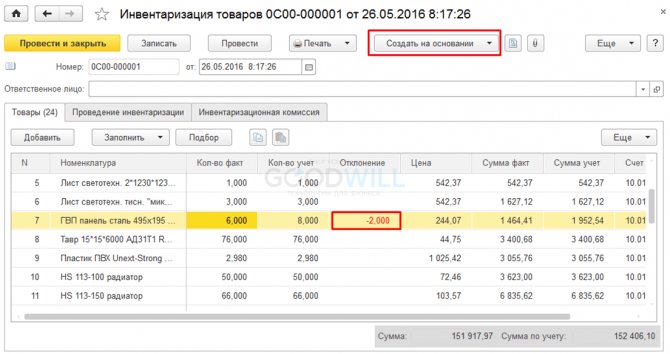

Now let’s assume that we went to the warehouse, counted our goods and discovered that for some reason we were short of the product “GVP panel steel 495x195 diodes 2 baguettes” in the amount of two pieces.

The responsible persons together with the storekeeper will find out why there are not enough of them, but our task is to equalize the balances in the program and in the warehouse, that is, write off two units of material.

We put 6 pieces in the “Actual Quantity” column. We will immediately have a deviation of -2 pieces.

You can record the “Goods Inventory” document and print it.

For detailed instructions on inventory in 1C, see our video: