Account 52 “Currency accounts” is used by companies and individual entrepreneurs to collect information on transactions carried out in foreign currency on accounts opened in credit institutions of the Russian Federation and abroad

Account 52 in accounting is the concentration of information on mutual settlements with the company's counterparties through non-cash transfers in foreign currency, the collection of information on the availability and movement of currency across the organization's accounts.

Attention! To summarize information on mutual settlements in the currency of the Russian Federation in accounting, account 51 is used.

Account 52 provides for the opening of additional sub-accounts:

52.1 – displays information on the movement of non-cash funds on accounts opened on the territory of the Russian Federation;

52.2 – information about the presence of accounts outside the Russian Federation.

Attention! According to the legislation of the Russian Federation, companies are required to independently provide information to the controlling Federal Tax Service on openings, closures, changes in the details of foreign currency accounts opened outside the Russian Federation no later than a month from the date of the event.

Account 52 in accounting is active, that is, the debit shows non-cash receipts of funds (payments from customers, returns from suppliers) in correspondence with the corresponding accounts (62, 60, etc.), and the credit shows write-offs of payments to repay loans , loans, accounts payable and more.

Count 62 – active or passive

Account 62 is included in section VI “Calculations” of the Chart of Accounts.

This is a synthetic accounting account. Analytics on account 62 is carried out in relation to each buyer and each contract. Accounting account 62 is used quite often, since every organization has clients. An accountant needs to regularly monitor client debts in order to timely identify overdue debts. For this purpose, he has the right to open any number of sub-accounts for account 62.

Standard subaccounts that an accountant works with:

- 01 “Settlements with buyers and customers.”

- 02 “Calculations for advances received.”

- 03 “Bills received.”

In addition to these, you can add a subaccount for retail customers, for settlements in foreign currency, overdue debts, settlements between dependent parties, and so on.

Is count 62 active or passive? As we see from the essence of accounting for transactions on account 62, the balance on it reflects both positive and negative debt, that is, both our debt to customers and their debt to us. Thus, the balance on account 62 can be either a credit or a debit. This means that count 62 is active-passive. In the balance sheet, account 62 should be reflected in detail, that is, the debit balance is in the asset, and the credit balance is in the liability.

If you analyze account 62, it becomes clear that this is an active-passive account, that is, the balance of payments can be included in both the asset balance sheet and the liability side - the data is entered in expanded form. In this case, the debit of account 62 shows the amount of shipments made during the period. Correspondence is carried out with income accounts - 90, 91.

Detailed account card 62 allows you to obtain detailed information on the relationship with the client - the document displays all shipments and payments in chronological order. Retail traders have the right not to use account 62 in accounting - sales are recognized immediately in the account. 90 with wiring D 50 K 90. But you can work in the usual way - the choice is made by the enterprise independently.

Need 62 positions

On its credit side, the organization reflects the resulting debt to customers. In turn, the debit part contains information about the buyer’s obligations to the organization.

Analytics for this position is carried out for each invoice that was issued to the customer. If we are talking about mutual settlements through scheduled payments, then analytics should be carried out for each customer.

Debit shows the debt of counterparties to us

The debit of account 62 shows, as the name suggests, accounts receivable, that is, the amount of debt of counterparties to our organization. If we consider the subaccounts to account 62 of accounting, we can find out details about accounts receivable. For example, the debit of subaccount 62.01 reflects the amounts of shipments made.

The debit of subaccount 62.02 shows advances offset against shipments made. The debit of subaccount 62.03 includes bills received on account of shipments made. That is, we see that any debt of the buyer (in the form of goods (work, services) received but not paid for, a bill issued, an offset, previously paid advance) will be reflected in the debit of any subaccount of account 62.

Account credit 62 shows the amount of debt to clients, that is, accounts payable. By analogy, let's turn to the subaccounts to account 62. On the loan, subaccounts 62.01 reflect payment for shipments of goods (work, services). Moreover, payment can be made not only in money to a current account or to the cash register, but also by a bill of exchange or by offset.

The credit of subaccount 62.02 shows advances received against future shipments of goods. The credit of subaccount 62.03 records the amounts received from debtors in payment of bills received from them. That is, similar to the situation with the debit of the account, any debt incurred by our organization to clients (payment by the buyer of his bill or purchased goods) is reflected in the credit of account 62.

In order to obtain information on all customer debts and see at the same time all sub-accounts opened for the account, it is necessary to create a balance sheet for account 62. This report helps the accountant assess the overall picture of the state of settlements with clients of the organization. As its name implies, it displays the turnover and balance at the beginning and end of the counterparties for the selected period.

You will see an example of a balance sheet in our figure.

Analytical accounting of settlements with clients

Analytical accounting involves the use of personal and material accounts. They bring together detailed information about operations. Let's consider the postings within the framework of analytical accounting:

- DT62 KT90/1. Debt on goods that have been shipped.

- DT62 KT90/1. Reversal of the amount of shortages detected upon acceptance of goods.

- DT62 KT76/2. Collection by the client of the shortfall amounts.

- DT62 KT91/1. Buyers' debt for materials, fixed assets, securities, etc.

- DT62 KT90/1. Calculation of lease payments.

- DT50-52 KT62. Receipt of money from counterparties.

- DT50, 51 KT62. Advance payment against future delivery of goods.

- DT52 KT62. Advance in foreign currency against future delivery.

- DT62 KT68. Accrual of VAT on advance payment.

- DT68 KT62. Crediting VAT on advance payment upon release of goods that have been paid for.

- DT51 KT62. Receipt of money as payment for goods sold.

- DT52 KT62. Receipt of currency for goods sold.

- DT62 KT50, 51. Refund from clients of funds paid in excess.

- DT62 KT50, 51. Refund of advance payment to clients.

- DT62 KT90/1. Accrual of commissions.

- DT76 KT62. Settlement of remuneration.

- DT62 KT62. Assignment of claims.

The basis for postings is an accounting statement, a commission agent's report, etc.

Account 62 correspondence

| by debit | on loan | ||

| 46 | 50 | ||

| 50 | 51 | ||

| 51 | 52 | ||

| 52 | 55 | ||

| 55 | 57 | ||

| 57 | 60 | ||

| 62 | 62 | ||

| 76 | 63 | ||

| 79 | 66 | ||

| 90 | 67 | ||

| 91 | 73 | ||

| 75 | |||

| 76 | |||

| 79 | |||

As noted above, the debit part of the designated position reflects the resulting receivables from customers, which is corresponded to the credit part of such accounts as 90, 91, etc.

1) Dt 51,52, 55

Kt 62.

1) Dt 51,52, 55

Kt 90.

Subaccounts of account 62

You can open six sub-accounts for account 62:

- 62-1 “Settlements under government contracts”;

- 62-2 “Settlements with procurement and processing organizations of the agro-industrial complex”;

- 62-3 “Settlements on bills received”;

- 62-4 “Calculations for advances received”;

- 62-5 “Intra-group settlements of interrelated organizations”;

- 62-6 “Settlements with other buyers and customers.”

Subaccount 62-1 - to summarize data on settlements with government agencies for sold products and livestock. As sales are recognized for the fulfillment of government orders, the debt of authorized bodies is reflected in the debit of this subaccount in correspondence with account 90 “Sales”. If the shipment of agricultural products was made to repay a previously received commodity loan, then at the same time an entry is made in the debit of accounts 66 “Settlements for short-term loans and borrowings”, 67 “Settlements for long-term loans and borrowings” and the credit of subaccount 62-1 “Settlements for government contracts."

Subaccount 62-2 - to summarize information on payments for sold agricultural products, animals and services provided for their delivery, in the order of fulfillment of contracts. As sales to procurement organizations are recognized, the debt is reflected in the debit of this subaccount in correspondence with account 90 “Sales”, subaccount 1 “Revenue”.

Subaccount 62-3 reflects information about the debt of buyers and customers, secured by bills received. If interest is provided on the received bill of exchange securing the debt of the buyer (customer), then as this debt is repaid, an entry is made to the debit of account 51 “Currency accounts” or 52 “Currency accounts” and the credit of account 62 “Settlements with buyers and customers” (on amount of debt repayment) and 91 “Other income and expenses” (by the amount of interest).

Subaccount 62-4 is used to reflect information on settlements for advances received in accordance with contracts for the supply of inventories or for the performance of work performed for customers on partial completion. The amounts of advances and prepayments received are reflected on the credit account 62-4 in correspondence with the cash accounts.

Subaccount 62-5 reflects information on settlements of interrelated organizations (holdings, financial and industrial groups, etc.) for products sold, animals, work performed and services provided. The information from this sub-account is used to determine the adjustments necessary for the preparation of summary (consolidated) statements.

Subaccount 62-6 reflects information with other buyers and customers (legal entities and individuals) on transactions for the sale of finished products, goods, animals, as well as the performance of work and provision of services not provided for in other subaccounts of account 62. In particular, on the specified subaccount The following calculations may be reflected:

- with an individual entrepreneur without forming a legal entity for the products sold by him and the work performed;

- with agricultural organizations for services provided (processing of customer-supplied raw materials, work performed by auxiliary production, etc.).

When shipping products, animals, materials; For the execution of work and provision of services, the corresponding primary documents are drawn up: invoices, acceptance certificates for completed work, etc. The main documents for the emergence of settlement relationships between agricultural and procurement organizations are acceptance receipts.

The form of receipts depends on the type of products sold: grain, milk, livestock, etc. In accordance with tax legislation, the information reflected in the listed documents is subject to registration in invoices of the established form. When receiving funds in the form of advances or other payments for upcoming deliveries of animal products (performance of work, provision of services), the organization also draws up an invoice.

- Account 62 01 – used to reflect data according to general rules, with payment in the current mode.

- Account 62 02 - used to reflect data on received advances.

- Account 62 03 – used when paying for shipments with bills of exchange.

Enterprises can also open other sub-accounts to the account. 62 “Settlements with buyers and customers”, depending on the specific features of the activity.

On the credit side of the designated position, the accountant reflects the funds received from the sale of shipped products, as well as advance resources received for goods and services. In this case, the funds received as part of the payment are accounted for in various sub-accounts:

- 01 account – funds received in accordance with the general procedure;

- 02 – advance funds from customers;

- 03 – accounting for bills received.

Instructions 50 count

Instructions for using the chart of accounts for accounting the financial and economic activities of organizations in accordance with Order No. 94n dated October 31, 2000

Account 50 “Cashier” is intended to summarize information about the availability and flow of funds in the organization’s cash desks.

Sub-accounts can be opened for account 50 “Cashier”:

50-1 “Organization cash desk”,

50-2 “Operating cash desk”,

50-3 “Cash documents”, etc.

Subaccount 50-1 “Cash of the organization” records the funds in the cash desk of the organization. When an organization carries out cash transactions with foreign currency, then corresponding sub-accounts must be opened to account 50 “Cash” for separate accounting of the movement of each cash foreign currency.

Subaccount 50-2 “Operating cash desk” takes into account the availability and movement of funds in the cash desks of commodity offices (piers) and operating areas, stopping points, river crossings, ships, ticket and baggage offices of ports (piers), train stations, ticket storage offices, ticket offices post offices, etc. It is opened by organizations (in particular, transport and communications organizations) if necessary.

Subaccount 50-3 Cash documents records postage stamps, state duty stamps, bill stamps, paid air tickets and other cash documents in the organization's cash desk. Cash documents are accounted for on account 50 “Cash” in the amount of actual acquisition costs. Analytical accounting of monetary documents is carried out by their types.

The debit of account 50 “Cash” reflects the receipt of funds and monetary documents at the organization’s cash desk.

The credit of account 50 “Cash” reflects the payment of funds and the issuance of monetary documents from the organization’s cash desk.

Typical postings for account 62

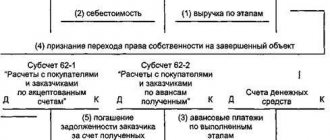

- credited in correspondence with cash accounts, settlement accounts for the amounts of payments received (including the amounts of advances received), etc. In this case, the amounts of advances received and prepayments are taken into account separately.

- debited in correspondence with accounts 90 “Sales”, 91 “Other income and expenses” for the amounts for which settlement documents were presented.

Analytical accounting is maintained for each invoice presented to buyers (customers), and for settlements using scheduled payments - for each buyer and customer. At the same time, it should show data on:

- buyers and customers on payment documents for which the payment deadline has not yet arrived;

- buyers and customers on payment documents not paid on time;

- advances received;

- bills for which the due date for receipt of funds has not yet arrived;

- bills discounted (discounted) in banks;

- bills for which funds were not received on time.

Accounting when paying with bills of exchange requires reflecting the debt to the counterparty on the credit of account 62 “Settlements with buyers and customers”.

If interest is provided on the received bill of exchange securing the debt of the buyer (customer), then as this debt is repaid, an entry is made in the debit of account 51 “Currency accounts” or 52 “Currency accounts” and the credit of account 62 of accounting (for the amount of debt repayment) and 91 “Other income and expenses” (percentage).

Accounting for settlements with buyers and customers within a group of interrelated organizations, about the activities of which consolidated financial statements are prepared, is kept separately on account 62.

| Debit | Credit | Operation |

| 62 | 46 | Write-off of the cost of completed stages of work. The cost must be paid by the customer and all work on the project is completed. |

| 62 | 50 | Return from the cash register to the buyer of overpaid funds |

| 62 | 50 | Refund from the cash register to the buyer of the advance payment |

| 62 | 51 | Return of overpaid funds from the current account to the buyer |

| 62 | 51 | Refund from the current account to the buyer of the advance payment |

| 62 | 52 | Return from a foreign currency account to the buyer of overpaid funds |

| 62 | 52 | Refund from a foreign currency account to the buyer of the advance payment |

| 62 | 55 | Return from a special account to the buyer of overpaid funds |

| 62 | 55 | Return from a special account to the advance buyer |

| 62 | 57 | Postal order to the buyer |

| 62 | 62 | Advance from the buyer is offset against debt repayment |

| 62 | 76 | Settlement of counterclaims of the same type |

| 62 | 90 | Reflection of revenue from the sale of goods (services) |

| 62 | 91 | Inclusion of the amount of advance payment from the buyer into other income due to the expiration of the statute of limitations |

| 62 | 91 | Inclusion of positive exchange rate differences in foreign currency in other income |

| 62 | 91 | Reflection of proceeds from the sale of fixed assets and other property |

Credit 62

| Debit | Credit | Operation |

| 50 | 62 | Posting of proceeds - cash received from the buyer - to the organization's cash desk |

| 50 | 62 | Depositing an advance payment from the buyer to the cash register |

| 51 | 62 | Crediting cash from the buyer to the organization's current account |

| 51 | 62 | Transfer of advance payment by the buyer to the organization's bank account |

| 52 | 62 | Crediting funds from the buyer to the organization's foreign currency account |

| 52 | 62 | Transfer by the buyer of an advance payment to the organization’s foreign currency account |

| 55 | 62 | Transferring funds from the buyer to a special account of the organization |

| 55 | 62 | Transfer by the buyer of an advance payment to a special account of the organization |

| 57 | 62 | Transfer of funds by the buyer through a post office or savings bank |

| 60 | 62 | Settlement of counterclaims of the same type |

| 63 | 62 | Debt write-off from the reserve for doubtful debts upon expiration of the statute of limitations |

| 66 | 62 | Repayment of debt on a short-term loan through offset of similar counterclaims |

| 67 | 62 | Repayment of debt on a long-term loan through offset of counter similar claims |

| 73 | 62 | Debt of the organization's employees for products sold to them |

| 75 | 62 | Offsetting the claims of the founders for the payment of income to them through the repayment of debt for the products supplied to them |

| 76 | 62 | Settlement of counterclaims of the same type |

| 91 | 62 | Inclusion of negative exchange rate differences in foreign currency as part of other expenses |

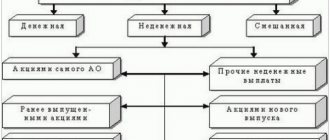

The figure below shows the main transactions of account 62 “Settlements with buyers and customers”.

Typical transactions for account 62

| The organization Alpha LLC received an advance payment from the Beta LLC company for the shipment of finished products in the amount of 236,000 rubles. A week later, I shipped part of the finished products worth 47,200 rubles. (including VAT RUB 7,200) How to account for these transactions? |

In fact, account 62 “Settlements with buyers” reflects the buyer’s debt to the seller, that is, accounts receivable. Postings to account 62 are made at the time the sale is made, that is, at the time the goods are shipped.

Thus, account 62 reflects settlements with customers and 3 sub-accounts can be opened on it: (click to expand)

- subaccount 1 – to reflect settlements for regular sales;

- subaccount 2 – to account for the advance received;

- subaccount 3 – for accounting for bills received.

In the next article we will look at how to carry out accounting of accounts payable: “Accounting for short-term and long-term loans and borrowings (accounts 66 and 67)“.

- D 51 K account 62.2 – an advance payment has been received from the buyer to a bank account.

- D 76.AV K 68 – VAT is charged to the budget on the amount of the received prepayment.

- D 62.1 K 90.1 – reflects the shipment of goods to the purchasing company.

- D 62.2 K 62.1 – advance payment is credited as payment for the goods.

- D 68 K 76.AV – the amount of previously accrued VAT has been restored.

- D 62.1 K 08 – the amount of receivables from the acquired organization was capitalized.

- D 50, 51, 52, 55, 57 K 62.1 – received at the cash desk, to a ruble settlement account, to a foreign currency settlement account, to a special account, payment from customers by transfer.

- D 62.2 K 50, 51, 52 – the advance payment previously received from the buyer was returned.

- D 60 K 62 – reflects the settlement with the purchasing company.

- D 62 K 91.1 – receipts from the sale of inventory items and fixed assets are reflected in other income.

- D 63 K 62 – bad receivables were written off against the existing reserve for doubtful debts of the company.

- D 91.2 K 62 – written off receivables are included in other expenses.

1) Dt 62

Kt 08 – accounts receivable accounting;

2) Dt 62

Kt 46 – write-off of the paid contract price;

3) Dt 62

Kt 50 – return of advance funds to the buyer;

4) Dt 62

Kt 76 – accounting for debt received from the customer;

5) Dt 62

Kt 90 – revenue from sales of goods;

6) Dt 51

Kt 62 – accounting for advance payments received by non-cash means, etc.

In accordance with the current chart of accounts approved by Order of the Ministry of Finance No. 94n, the special account BU 62 should reflect settlements with buyers and customers for goods, works, and services that were sold in the reporting period.

This accounting account accumulates information about mutual settlements for products sold without taking into account their organizational and legal form. That is, on the account. 62 take into account settlements with legal entities, entrepreneurs and individuals.

Accounting account 62 for dummies is used to collect and summarize information on mutual settlements for sold, provided, shipped, completed goods and works of the company in favor of third parties - buyers and customers.

Account 62 is a mirror image of accounting account 60 “Settlements with suppliers and contractors”. The key difference between these accounting accounts is that for 62 accounts. reflect their GWS sold to other companies, and on the account. 60 - purchased from third parties.

| Operation | Debit | Credit |

| An advance or payment has been received from the buyer | 50 – cash 51 — cashless payment 52 — payments in foreign currency | 62-02 |

| VAT is charged on the advance received | 76 | 68 |

| The shipment of goods is reflected | 62-01 | 90-01 |

| The advance received has been offset | 62-02 | 62-01 |

| The amount of accrued VAT has been restored | 68 | 76 |

| Reflects mutual offset between organizations | 60 | 62 |

| Uncollectible receivables were written off against the created reserve for doubtful debts | 63 | 62 |

| Written off accounts receivable are written off to other expenses | 91-02 | 62 |

In settlements with customers, the main transactions consist of recognizing income from the sale of goods, works or services and receiving payments to repay accounts receivable, as well as advance receipts.

Debit of account 62 - Credit of account 90 “Sales”, 91 “Other income and expenses”

The use of accounts 90 and 91 depends on whether the income recognized is income from ordinary activities or other income.

In retail sales, the fact of sale can be recognized bypassing account 62, when the following posting is made: Debit account 50 “Cash” - Credit account 90.

Debit of accounts 50 “Cash”, 51 “Cash accounts”, 52 “Currency accounts”, etc. – Credit of account 62.

In this case, separate accounting of advances is kept on account 62, as a rule, by opening an additional sub-account.

Debit account 91 “Other income and expenses” - Credit account 63.

Postings to account 62 are drawn up in correspondence with the accounts specified in Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n.

Receipt of money to the cash register: posting Dt 50 Kt 51 and others

According to the Chart of Accounts, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 34n, account 50 “Cash” is active. In this case, cash receipts are reflected in the debit of account 50.

There may be several sources of replenishing the organization's cash register with funds. One of them is withdrawing money from a bank account. In such cases, the transaction is traditionally recorded by the following entry: Debit 50 Credit 51 .

But there are often situations where time gaps arise between the debiting of cash from one cash source of the company and its capitalization on another. For example, if the collector received funds from the bank at the end of the working day, it may not be possible to post the necessary amounts to the organization's cash desk to account 50 on the same day. In such cases, it is possible to use account 57 “Transfers in transit”:

- Dt 57 Kt 51 - receipt of funds based on a bank receipt to the responsible person (as of the date the cash collector received the cash);

- Dt 50 Kt 57 - posting of received cash to the cash desk (on the date of receipt of cash at the cash desk).

If the operation of withdrawing cash and crediting it to the cash register can be completed within 1 business day, then in accounting it will find a reflection that is already familiar to us: Dt 50 Kt 51.

The return of unused funds to the cash desk by accountable persons is accompanied by the following posting: Debit 50 Credit 71 - recording of unused amounts, balances of funds after the accountant purchases materials and pays for services.

You will find other information about the actions of accountable persons, including when returning funds, in the article “Features of advance reports in accounting.”

If cash comes from customers, then the replenishment of the organization’s cash desk is as follows: Dt 50 Kt 62.