Wage indexation is a procedure for periodically increasing the level of real income of an enterprise's employees by a certain coefficient. This is a statutory guarantee in the field of wages associated with rising prices for goods and services. The obligation to periodically index wages applies to both commercial and budgetary enterprises. If in the case of budgetary organizations the indexing procedure is determined by legislative acts, then in commercial firms it is regulated by their own local documents.

What it is?

Indexation is usually understood as an increase in the wage coefficient associated with an increase in prices for services, as well as goods.

This procedure is carried out in order to rehabilitate the ability to purchase. There are two indexing methods:

- Expected – occurs taking into account the price increase.

- Retrospective is an increase in wages that takes into account the already existing situation with the price level.

Many employers do not see the differences between indexing and salary increases , but there are differences, and significant ones. When the salary increases, this may affect one or more employees.

At the same time, the percentage of increase in financial remuneration for each employee may be different. Some were lucky and their wages were increased by fifty percent, while others were increased by only ten.

When indexing, an increase in wages occurs for all categories of employees working in the organization by the same factor.

Indexation depends on the minimum wage , inflation rate and other external factors.

Read all about the minimum wage in our article.

Article 134 of the Labor Code of the Russian Federation gives a clear concept that remuneration for labor activities should be indexed due to rising prices for purchased services and various categories of goods. If an employee works in a budgetary institution, indexation is carried out on the basis of the relevant law and municipal legal acts.

Another document establishing a mandatory procedure for carrying out general indexation is the letter of Rostrud dated 04/19/2010 No. 1073-6-1 . If an employee is registered in a commercial organization, then the right to perform indexation belongs to the manager. It establishes the indexing procedure in local acts of the enterprise.

If this does not happen, then the commission may present him with another article regulating this issue. This is article 5.27 of the Code of Administrative Offenses of the Russian Federation.

Differences between salary increases and salary indexation

Many employers mistakenly believe that if they annually increase salaries at the enterprise, then there is no need to index wages.

The fact is that increasing salaries and indexing earnings are two different things. After all, the salary can be increased for one or all employees. Some will receive an increase of 10% of their salary, while others will receive a 50% increase. When the salary is increased, an order is issued, a new staffing table is approved, and additional agreements to employment contracts are signed. The purpose of increasing the salary is to interest a specific employee in further cooperation.

The purpose of wage indexation is to bring workers’ earnings into line with current consumer prices and thereby, at a minimum, maintain their quality of life at the same level.

Wage indexation, in contrast to salary increases, is carried out at the same time for all employees by the same factor.

Is this process the responsibility of the employer?

The employer makes a personal assessment of the increase in prices for food and services, and on the basis of this he must make periodic indexations.

If the head of an enterprise is in no hurry to index wages or generally denies all the demands made on him by his employees, such actions must be appealed in court.

In addition to going to court, an employee has the right to write a complaint to the Labor Safety Inspectorate and report that the employer is not interested in employee requests regarding indexation. In an appeal, an employee may refer to Article 353 of the Labor Code of the Russian Federation .

There is no fixed indication in the legislation on salary indexation, but one should take into account the fact that if local regulations do not stipulate indexation periods, then, according to Letter of Rostrud dated 04/19/2010 N1073-6-1, appropriate changes must be made to the documents.

How to calculate the indexation coefficient?

In the Russian Federation, there are several government services to obtain indices for salary recalculation:

- State budget. Provides a recalculation index for organizations that are supported by the budget.

- Social Insurance Fund and the Federal Budget. Provides indexes for the recalculation of benefits of any type.

- Pension Fund of the Russian Federation. Coefficient for recalculation of pensions.

- Private business. Decides on the coefficient that will be applied to recalculate salaries.

How exactly to index and how much to raise wages depends on the indicator chosen by the employer and fixed in the documents specified by law. It is permissible to use it as:

- consumer price index, which is established in a specific region or throughout the country (according to official data from Rosstat);

- inflation rate included in the federal or regional budget;

- the cost of living for the population;

- any objective indicator of rising prices for goods and services.

Ki = I1 × I2 × I3 / 3,

- Ki is the coefficient of wage change in 2021;

- I1, I2, I3 – price growth indices for the past quarter based on Rosstat data.

Commercial organizations can independently establish the order and size of indexation, without correlating it with statistical data. In this case, all conditions must be reflected in the collective or employment agreement. Correct wording will help avoid penalties if the procedure is not followed. For example, the phrase “Indexation is carried out subject to the availability of additional financing” is a reason to refuse a salary increase if the company’s financial result is negative.

In budgetary organizations, indexation is carried out on the basis of the relevant order. It indicates its size (percentage) based on the increase in consumer prices. This requirement is enshrined in Art. 130 Labor Code of the Russian Federation.

Organizations independent of the state. budget, has the right to set its own coefficient or apply the same as for public sector employees.

The indexation coefficient can be calculated using the previously given formula based on statistics for the past quarter.

At the same time, not only the salary increases, but also other types of payments: bonuses, compensation, etc. With an increase in the minimum wage, wages are also adjusted, the amount of which is less than this amount.

Thus, most organizations take the 1st of February as the date, when official figures for consumer price growth become known. They have the right to set other dates by local regulations, but, as a rule, this is the first day of the month.

The calculation will depend on the parameter to which it is linked. Minimum indexation usually corresponds to the level of core inflation and is carried out either quarterly or semi-annually.

Let's give an example of wage indexation, carried out at the end of the quarter, for the second quarter of 2021. Inflation in April was 0.33%, in May 0.37%, and in June 0.61%. If the employee’s salary was 35,000 rubles, then for April it should be 100.33% of this amount, that is, 35,000 x 1.0033 = 35,115.5 rubles. For May 35,115.5 x 1.0037 = 35,245.43 rubles. For June 35,245.43 x 1.0061 = 35,460.42 rubles.

As a result, wages should rise by a little more than 460 rubles. It is worth noting that inflation in 2021 is low, and at the end of the year it will probably be in the range of 2–2.5%, but if calculated for some previous years, when it was 4–5 times higher, the figures would be significantly more impressive .

This is retrospective indexation, now we will give an example of what is expected: for example, the consumer price index from the Federal Statistics Service is used for calculation. Thus, the forecast for 2021 was 3.2%, which means that the expected indexation should have been carried out as follows: at the end of 2021, perform a recalculation and, if the employee’s salary was the same 35,000 rubles, raise it by 3.2%: 35 000 x 1.032 = 36,120 would be wages from the beginning of 2021.

An important nuance is taking into account indexation in the calculation of vacation pay. If it was carried out during the billing period, then all payments should be increased in accordance with the conversion factor. So, if wages are raised by 3.2% from the previous example, then the conversion factor will be the same (1.032). All payments made during the billing period must be adjusted to the indexed one.

We invite you to familiarize yourself with: Payment order for salary in 2020: sample

For example, if an employee is on vacation from June 1 to June 30, and indexation took place on June 21, then for the period June 1-20 he will receive regular payments, and for June 21-30 - with the coefficient applied to them. Salary indexation can also be approximately calculated if you use an online calculator, of which you can now find many on the Internet.

Rules for indexing

Before carrying out indexation, it is important to know that it is carried out in relation to all employees carrying out activities for the benefit of the company on the basis of an employment contract.

Unfortunately, those categories of citizens who work under civil contracts do not fall under such indexation provided for by the Labor Code.

Managers themselves must understand that it is necessary to carry out such a procedure in a timely manner in order to show special loyalty to those people who devote a lot of time and effort to the benefit of the organization. The frequency of indexations must be specified in advance in the local regulatory framework of the enterprise.

Indexation must begin when the price index for market products exceeds 101 percent . The calculation is carried out from the beginning of the month after the current published figure. Calculations are carried out by Goskomstat.

If the decision was made in favor of indexing, then some documents need to be completed. If its presence was not specified in the local regulations of the enterprise, then this point must be added immediately. When prescribing indexing, you need to carefully consider such details as:

- What frequency will be indicated for the procedure. This could be a month, six months or a year.

- What payments will be affected by the change? This could be a salary, bonus or additional payment.

- The procedure for choosing the indexing coefficient.

The procedure for indexing wages taking into account the regional coefficient

| Regional coefficients for 2021 |

In some regions of Russia, there are increasing regional coefficients designed to compensate for work in difficult climatic conditions.

The Ministry of Social Health Development of the Russian Federation, in paragraph 5 of its letter No. 169-13 dated February 16, 2009, discloses the list of payments for which an increasing coefficient is applied for certain territories of the Russian Federation:

- salary (or payment at a tariff rate);

- allowances;

- additional payments to salaries or rates established by local regulations, collective or labor agreements;

- additional payment for work outside school hours, with special working conditions, etc.;

- bonuses provided for by the employer’s internal regulations.

Interest bonuses that are accrued when working in the same areas with special climatic conditions are not included in the base for the application of regional coefficients.

The regional coefficient does not apply to the following types of payments:

- material aid;

- vacation pay;

- payments based on average earnings (for example, on idle days);

- daily allowance;

- bonuses not related to the direct performance of job duties and not included in the remuneration system;

- compensation for housing, transportation expenses, etc.;

- allowance for shift work;

- other payments not directly related to the performance of official duties.

What influences wage indexation?

There are situations when indexation work was carried out after the end of the billing period, but in the interval before the start of payments of the average salary. In this case, the salary is increased by the amount of the average salary for the given pay period.

If indexation occurred during the payment period, then an increase should be made by the amount of the average earnings coefficient from the moment of indexation to the moment when the calculation should occur.

When carrying out actions to set indexation in the billing period, payments will increase by the coefficient that begins from the first stage of the period until the month when indexation occurs.

Where to get funds for indexation

How can regular salary increases be carried out in conditions of inflation? For this, there are official sources, different for certain areas of activity:

- budgets of different levels - for public sector workers;

- Pension Fund of the Russian Federation - for calculating pensions;

- Federal budget, social insurance funds - for social payments;

- own funds - for commercial entrepreneurship and the private sector of the economy (current income or retained earnings of past years).

We suggest you familiarize yourself with: Salary indexation. Procedure and registration

Regulations and order of procedure

The regulation on wages consolidates the process of carrying out the indexation procedure at the enterprise. Sometimes there are cases when a new employee comes to get a job, but the Regulations on remuneration have changed, then an additional agreement must be concluded to regulate such issues.

The Regulations must stipulate:

- deadline for indexing;

- the formula by which this procedure is carried out;

- period for accepting the new amount.

Download a sample of the Regulations on the procedure for indexing wages here for free.

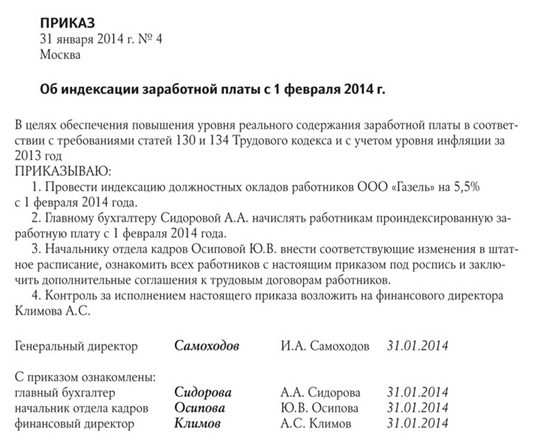

The manager consolidates the innovation with an order and changes the staffing table, where he indicates new amounts for salaries or other payments to existing employees. An increase in an employee’s salary significantly affects the amount of payments related to this issue.

The document necessarily contain the following parameters:

- Date and order number.

- Name of the organization.

- Information about the production of indexing.

- The coefficient by which payments will be increased.

The following may be involved in drawing up an order:

- secretary;

- legal advisor;

- personnel officer;

- accountant.

The main condition for such an employee is clear knowledge and ability to draw up such orders.

After the drafting procedure, the document is submitted to the manager for signature. There is no specific sample that could be taken as the basis for the order. The main thing is that it is drawn up within the framework of the law and the general policy of the company.

the basis for indexing and links to articles regulating this procedure.

The contents of the document must indicate the persons responsible for carrying out the indexing. It is recommended to include their initials and positions. The paper that will be used to create the document is not significant. This can be a simple white sheet of A4 format or an organization’s letterhead, but the main thing is that this document must bear the signature of the main manager or a person who has the authority to sign such documents.

The order can be certified by a seal, but this requirement is not fundamental. All employees affected by this innovation should familiarize themselves with the issued order

After review, the order for indexing is transferred to a folder with special documents. Since this document is classified as administrative, access to it should be limited .

After losing its relevance, it is placed in the archive. There it is for a period established by law or local regulations. This period cannot be less than three years . After its storage period has expired, it is recommended to dispose of the order.

Which payments are indexed and which are not?

By virtue of the provisions of Art.

134 of the Labor Code of the Russian Federation, ensuring an increase in the level of real wages includes indexation of wages in connection with the increase in consumer prices for goods and services. State bodies, local government bodies, as well as state and municipal institutions index wages in the manner established by labor legislation and other regulatory legal acts containing labor law standards, other employers - in the manner established by the collective agreement, agreements, and local regulations. The Ministry of Labor in Letter No. 14-1/OOG-9076 dated October 11, 2016 noted that currently the labor legislation of the Russian Federation does not provide for a uniform wage indexation for all workers. The rules for its indexation are determined depending on the source of financing of organizations either by laws and regulations (for government bodies), or by a collective agreement, agreement, or local regulation (for other organizations).

At the federal level, wage indexation was last carried out on January 1, 2018: by virtue of the Order of the Government of the Russian Federation dated December 6, 2017 No. 2716-r, wages for employees of federal institutions and bodies were increased by 4%.

In 2021, by Order of the Government of the Russian Federation No. 415-r, federal government bodies and the State Budgetary Service of the Federal Budget are ordered to take measures to increase wages provided from the federal budget by 4.3% from October 1, 2019. In pursuance of the instructions, individual ministries and departments issued departmental regulations, for example:

- Order of the Federal Tax Service of the Russian Federation dated June 4, 2019 No. ММВ-7-5/ [email protected] “On increasing the salaries of employees of territorial bodies of the Federal Tax Service carrying out professional activities in the professions of workers”;

- Order of the Federal Penitentiary Service of the Russian Federation dated May 28, 2019 No. 369 “On increasing salaries (official salaries, tariff rates) of civilian personnel of federal budgetary and government institutions of the penal system”;

- Order of the FSO of the Russian Federation dated July 29, 2019 No. 107 “On amendments to the amounts of official salaries (salaries, wage rates, tariff rates) of employees of federal government institutions under the jurisdiction of the FSO of Russia, approved by Order of the FSO of Russia dated August 2, 2021 No. 383 “On remuneration of employees of federal government institutions under the jurisdiction of the Federal Security Service of Russia” (Appendix 2 to the order)”;

- Order of the FSB of the Russian Federation dated August 26, 2019 No. 419 “On increasing official salaries, monthly tariff rates (salaries) of civilian personnel of the Federal Security Service, hourly wage rates applied in the Federal Security Service.”

As for the civil service, in accordance with parts 11, 12 of Art. 50 of the Federal Law of July 27, 2004 No. 79-FZ, the official salary and salary for the class rank of a state civil servant are subject to annual indexation taking into account the level of inflation based on:

- decrees of the President of the Russian Federation and the law on the federal budget for the corresponding year - in relation to the remuneration of federal civil servants;

- the law on the budget of a constituent entity of the Russian Federation for the corresponding year - in relation to the remuneration of civil servants of a constituent entity of the Russian Federation.

The last increase was on January 1, 2018, then the salaries of federal civil servants increased by 1.04 times (clause 1 of Decree of the President of the Russian Federation dated December 12, 2017 No. 594).

According to Decree of the President of the Russian Federation No. 463, from October 1, 2019, the monthly salaries of the named persons will be increased by 4.3%.

In relation to employees of state institutions of the constituent entities of the Russian Federation and state civil servants of the constituent entities of the Russian Federation, the decision to increase (indexation) wages (salary) is made by regional authorities. For example, from 01/01/2019, the salaries (official salaries, wage rates) of employees of government institutions in Moscow, which are not subject to the decrees of the President of the Russian Federation regarding the implementation of measures to bring wages to the appropriate level, increased by 4.9%. This event was financed by city budgetary allocations (Moscow Government Decree No. 1680-PP dated December 24, 2018).

In relation to employees of municipal institutions and municipal employees, the decision on indexation is made by local authorities.

Additionally, we provide an excerpt from paragraph 10 of the Review of Judicial Practice of the RF Armed Forces No. 4, approved by the Presidium of the RF Armed Forces on November 15, 2017. Based on the literal interpretation of the provisions of Art. 134 of the Labor Code of the Russian Federation, indexation is not the only way to ensure an increase in the level of real wages. The obligation to increase the real content of workers' wages can be fulfilled by the employer by periodically increasing it, regardless of the indexation procedure, in particular, by increasing official salaries and paying bonuses.

As a result of indexation, salaries (official salaries, wage rates) of employees of institutions and civil servants increase. Amounts are subject to rounding upward to the nearest whole ruble. After indexation, all payments established for the salary are recalculated based on the new salary, taking into account its increase. Thus, the amount of compensation and incentive payments increases.

When increasing wages in an institution, it must be taken into account that the average earnings for paying vacation pay, compensation for unused vacation, and paying for days on a business trip are also subject to indexation. The procedure for its indexation is set out in clause 16 of the Regulations on the specifics of the procedure for calculating average wages, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922.

As follows from this norm, average earnings are adjusted only in the case when tariff rates, salaries (official salaries), and monetary remuneration are increased for all employees of an organization, branch, or other structural unit.

When increasing average earnings, tariff rates, salaries (official salaries), monetary remuneration and payments established to tariff rates, salaries (official salaries), monetary remuneration in a fixed amount (interest, multiple) are taken into account. An exception is payments established in relation to tariff rates, salaries (official salaries), and monetary remuneration in a range of values (interest, multiple).

Thus, when indexing wages from October 1, 2019, the average earnings for calculating vacation pay are adjusted in the following order. If the salary is increased:

We suggest you read: Dismissal upon expiration of the employment contract

- during the billing period – payments accrued in the billing period for the months preceding the increase are indexed;

- after the billing period before the start of vacation – payments for the entire billing period are indexed;

- while the employee is on vacation - the average daily earnings determined for the entire pay period are indexed for the days after the salary increase.

As Article 134 of the Labor Code states, employers should increase wages along with rising consumer prices. This is called indexing. Letter of Rostrud No. 1073-6-1 indicates that the regulations of the employing organization must establish the procedure for its implementation, which each such organization is free to establish independently.

And although the legislation clearly indicates that indexation is mandatory, it does not provide specific instructions on how often the procedure should be carried out, or how to calculate the amount of indexation. Thus, this is left to employers, which allows unscrupulous management not to take this norm into account and not carry out indexation for 2-3 years in a row.

How to calculate - indexing example

Let's assume that the price inflation index for 2021 based on the 2015 situation was:

February period -103.8%; June period -106.1%; August period -105.9%; November period -104.7%.

If we give an example taking into account the daily rate, then it turns out that taking into account the daily rate of one thousand rubles by the end of December 2015, the rate was recalculated.

Then the result will be like this:

- 1250 daily value in rubles × 103.8% = 1298 rubles;

- 1250 daily value in rubles × 106.1% = 1326 rubles;

- 1250 daily value in rubles × 105.9% = 1324 rubles;

- 1250 daily value in rubles × 104.7% = 1309 rubles.

An example on how to calculate the indexation of wages in the salary part. The salary at the end of December 2015 was 20,000 rubles/month. Svet LLC carried out the indexation procedure, and the rate for each day was recalculated. It turned out like this:

- 18,500 monthly norm in rubles × 103.8% = 19,203 rubles from March 1, 2015;

- 18,500 monthly norm in rubles × 106.1% = 19,629 rubles from July 1, 2015;

- 18,500 monthly norm in rubles × 105.9% = 19,592 rubles from September 1, 2015;

- 18,500 monthly norm in rubles × 104.7% = 19,370 rubles from December 1, 2015.

LEGAL BASIS FOR INDEXING

The issue of wage indexation is regulated by the norms of the Labor Code of the Russian Federation:

• Article 22 - obliges the employer to comply with the provisions of labor legislation;

• Article 46 - indicates the possibility of including in the agreement obligations regarding wages, including the establishment of a procedure for wage indexation;

• Article 130 - establishes types of guarantees for the remuneration of workers, including measures to ensure an increase in the level of real wages;

• Article 134 - obliges the employer to index wages.

Stages of calculating the coefficient for remuneration

The calculation of the coefficient is carried out in several stages:

- Indexing the average salary level by a coefficient for increasing the salary. It is calculated by dividing the salary after the increase by what it was before the new indexation.

- The second stage is to index average earnings by a free coefficient for increase. This method is used if the employee had bonuses, additional payments and extra payments.

In order to calculate the increase factor, you need to divide the total amount of allowances and bonuses after the increase by the amount that was before indexation.

The use of one or another method is applied individually .

Failure to comply with a court decision - indexation of monetary amounts:

Not all participants in legal proceedings pay the obligations assigned to them. The courts must control these processes. In practice, court decisions are very often not implemented. Over time, one of the parties may resubmit the application, providing documents confirming that the debt has not been paid. In this case, the chances of receiving funds increase. The plaintiff can count on indexation of the awarded debt amounts taking into account the increased level of inflation over the past period. The amount of debt to the recipient of funds is constantly growing.

Index of real and nominal wages

In order to calculate such dynamics, you need to use special indices.

For nominal payment, the calculation is made using a certain formula, which determines the ratio of the current salary to last year’s payments:

Ind n = Salary tek g / Salary pr g x 100 (%)

Ind n is the index value for nominal wages, expressed as a percentage.

Salary tek g is labor payment during the current year.

Salary pr g is the salary for the last year’s period.

This simple formula indicates a direct proportionality between the index value and the growth of nominal payments, which do not depend on the economic situation in the country.

Nominal earnings for an average month are set by enterprises based on statistical reporting.

In order to calculate the activity level of real income, you need to use a calculated value - an index. For these purposes, use the formula:

Ind r = Ind n / Ind pot c (%)

Ind p is the value of the income index in real form. Ind n is a fixed income index of a nominal type. Ind pot c is the value of the price index for consumers.

By comparing the levels of nominal and real wage indices, we can find out:

- current unemployment rate;

- the presence of a qualified staffing shortage;

- inflationary processes;

- identify the need for action.

Formula for calculating indexation of awarded amounts of money

To calculate indexation, the following parameters are required:

- amount of debt (SZ);

- indexation period (PI) to determine the consumer price index (CPI);

- region and CPI in relation to the previous month (used in calculations of both the CPI of the Russian Federation and the CPI of a specific subject of the Russian Federation);

- indexation amount (SI)

- The formula will be like this:

- SI = SZ*(CPI1/100*CPI2/100 -1)

Or

SI = SZ * CPI1 * CPI2 - SZ

Dividing by 100 is necessary to get rid of percentages.

Example:

The amount of debt is 5,000 rubles, the decision was made on September 18, 2021, the debt was paid on January 24, 2019.

CPI in the Sverdlovsk region:

- CPI October 2021 by September 2021 – 100.45% (100.45%/100=1.0045)

- CPI November 2021 by October 2021 – 100.46% (100.46%/100=1.0046)

- CPI December 2021 by November 2021 – 101.0% (101.0%/100=1.01)

- CPI January 2021 by December 2021 - 101.0 (101.0%/100=1.01)

- CPI February 2021 by January 2021 – 100.6% (100.6%/100=1.006)

Calculation of the indexation amount:

177,90 = 5000*(1,0045*1,0046*1,01*1,01*1,006-1)

Or

177,90 = 5000*1,0045*1,0046*1,01*1,01*1,006 — 5000

Why do you need a lawyer in the procedure of indexation of awarded amounts?

To achieve a positive court decision, you need to seek help from lawyers in civil cases. Lawyers specializing in litigation know all the intricacies of domestic legislation. Using their knowledge, they can turn the litigation in their favor by representing the client's interests.

It is not uncommon for lawyers to propose additional actions aimed at speedy collection of awarded amounts from the debtor: actions within the framework of enforcement proceedings, as well as consideration of the issue of bringing the perpetrator to criminal liability for malicious evasion of payment of receivables.

Indexation is calculated by court decision after a full consideration of the previous case. Often the defendant does not appear at court proceedings when a second claim is filed against him. The following types of obligations can be recovered in this way:

- child support;

- material and moral damage caused as a result of failure to comply with the terms of the official contract;

- credit and borrowing obligations.

The list of types of financial responsibility is not limited to this. The above types of damages are the most common.