Purpose of KM-3 when working with an online cash register

An accounting document registered by the State Statistics Committee of Russia by Resolution No. 132 of December 25, 1998 under the code KM-3, at online cash registers, is intended to reflect transactions for the transfer of money for purchased goods to the buyer.

Inspecting structures demanded from the accounting department a package of documents and the KM-3 act in all cases when money was transferred from the cash register for goods sold, as well as when revenue decreased by the amount of erroneously punched cash receipts.

The document was required in the following cases:

- the customer returned the purchased product;

- The seller mistakenly charged more than necessary.

In the process of switching to online equipment, the opinion of the Federal Tax Service has changed. Since 2021, tax officials have clarified that the KM-3 form is not mandatory when working with the new cash register. Organizations now have the right to decide independently which form to use:

- proposed by law;

- developed in the organization and enshrined in the accounting policy.

The transition to online cash registers is regulated by amendments to law 54-FZ. The timing and stages of transition are being postponed for various types of business and economic activity.

What details will be required when drawing up the KM-3 act

To fill out a statement of return of funds, you need to prepare and fill out the required details:

- name of the selling organization;

- Taxpayer Identification Number, checkpoint, retail address, contact phone number;

- registration number, model type, KKM firmware version;

- day and place of sale;

- date, number and amount of the check;

- Full name of the person responsible.

The document must have continuous numbering and be certified by the signature of the manager. The fact of return is confirmed by members of the commission. An odd number of people is recommended whenever possible.

The seller (or cashier) accepts the punched check from the client, attaches it to a blank sheet of paper, and attaches it to the document. At the end of the working day, all documents (the first purchase receipt, act, application from the client) are transferred to the accounting department for operational accounting of business transactions.

In order to justify the fact of returning the money, you can obtain a statement from the buyer requesting the return of the goods. It is worth indicating the reasons why the client requires the payment of the amount paid.

Km 3 act

When the buyer returns the goods, the seller using the online cash register, based on the buyer’s application, must issue a check with the “return of receipt” sign (see letter of the Ministry of Finance of the Russian Federation dated July 4, 2017 No. 03-01-15/42312, 03-01-15/42315 ). In addition to the check with the sign “return of receipt”, it is also necessary to issue a cash receipt order for the amount of the refund (Article 1.1, Clause 1, Article 1.2, Clause 1, Article 4.7 of the Law of May 22, 2003 No. 54-FZ, Clause 6.2 of the Bank’s instructions Russia dated March 11, 2014 No. 3210-U).

The use of cash registers is closely related to tax legal relations. The cashier's explanatory note is a valuable source of data during a tax audit of a store (and a possible legal dispute), since it allows the Federal Tax Service inspector (or the court) to establish the circumstances of the non-use of cash registers in the manner prescribed by law.

You may like => Rospotrebnadzor Moscow official inspection website 2021

However, a receipt is not always available. What should you do if you don’t have a cash receipt? According to the requirements of the law, the seller must return the goods even if the buyer does not have a sales receipt. Accordingly, in this situation, the package of documents that must be transferred to the accounting service will consist of:

- The “header” of the document is drawn up in the upper right corner. The following is indicated here: the name of the employer along with the organizational and legal form;

- position and initials of the manager to whom the document is intended. As a rule, this is the head of an organization or a structural unit.

- date of incident;

Appendices to the act

As an annex to the act, it is necessary to attach an incorrectly executed check, signed by the head of the enterprise, the head of the department (section), and stamped “cancelled”. The absence of a receipt may be interpreted by a tax representative as non-receipt of the proceeds, which could result in a significant fine. In this case, certain circumstances should be taken into account in which there was a return of funds or a discrepancy between the amount of the check and the actual amount of cash in the cash register.

Example 1

The buyer did not provide a receipt to the store when returning the product or item. This situation is stipulated by the Consumer Rights Protection Law. In this case, the buyer’s statement for the return of the funds paid must be attached to the act, with a mandatory note stating that the check was lost. Upon application, the head of the enterprise issues a visa and makes a note that he agrees with the requirements and is ready to return the funds. A significant addition to the application from the buyer can be printed cash register information about the purchase, if such a technical possibility exists.

Example 2

A check with an incorrect (larger) amount was posted incorrectly:

- The cashier does not have it in stock, since it was left with the buyer who paid the correct amount;

- the unsold receipt was lost by the cashier.

A shortage at the cash register in such a situation will become an irrefutable fact, for which all responsibility falls on the cashier. However, it can be documented that money was received in full for goods sold during the day. In this case, the manager will consider it possible not to shift responsibility to the cashier-operator, taking an explanatory note from him. The KM-3 act may be accompanied by a product report and an explanatory note from the employee.

Features when drawing up a return certificate

Form KM-3 is drawn up in a single copy at the end of the work shift and before the receipt of revenue for the current day.

The return act is approved by the director of the organization or another person vested with appropriate authority, and signed by a commission, which includes:

- head of the enterprise (or entrepreneur);

- Department head>;

- senior cashier>;

- cash register operator issuing a refund.

If there were several cases of returned or erroneously issued checks within one business day, all of them must be indicated in one report. A separate KM-3 form is not compiled for each case.

Entering data into the columns of the KM-3 form

The form header indicates:

- name and details of the organization (or its structural unit);

- information about the cash register (manufacturer, model, registration number);

- surname and initials of the cashier who issues the return.

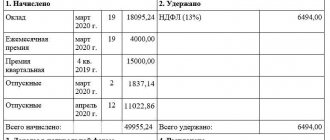

The table of the act includes the numbers and amounts of each individual check for which the goods were returned, as well as the position and full name of the authorized employee of the enterprise who issues permission to the cashier, accepting responsibility for the fact of the return of the amount of money.

Form KM-3 can be filled out either by hand or using a computer type.

How to correctly fill out an act in form KM-3

The header of the act states:

- name of company;

— data about the cash register (model, registration number and manufacturer number);

— Full name of the cashier issuing the return;

The tabular part of the act indicates the number and amount of each check for which the return was made. They also indicate the position and full name of the employee who authorized the refund of the check.

All listed checks must be attached to this act. The total number of checks is written in words in the “Attachment” line.

Note! The act in form KM-3 is drawn up in one copy, signed by the members of the commission and approved by the head of the organization. Next, it is sent to the accounting department along with the attached canceled checks. The certificate is kept for five years.

The cash register's revenue is reduced by the amount specified in the act and entered into the cashier-operator's journal (form No. KM-4).

How to fill out the form

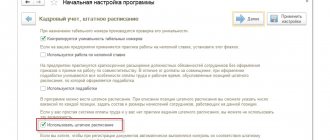

To fill out the KM-3 form, the participation of a commission of employees is necessary, and not just the cashier-operator himself, who cannot make such a decision arbitrarily. As a rule, a representative of the store administration and/or a senior cashier is present (as well as an administrator, shift manager, etc. - depending on the internal rules of the company).

The procedure is as follows:

- The possibility of a refund for a product or unused service is assessed (for example, medicines, home textiles cannot be returned).

- If a positive decision is made, the buyer draws up an application, the cashier – an explanatory note (if necessary).

- A full settlement is made with the buyer, for which he is given a refund check.

- On the same day, the KM-3 form is printed and filled out. All responsible persons sign.

- The document is sent for storage to the accounting department.

NOTE. The act must be certified by the signature of the director (or the person acting as him). After this, a stamp is affixed and the act is stored in the accounting department for at least 5 years.

The act does not have to be sent to the tax office for verification. However, it is shown at the first request of the inspector (or sent to the tax office if it requests confirmation).

Several rules for filling out the act

The km-3 form is drawn up in one copy. In this case, the commission consists of 4 positions:

- executive officer of the company (director, deputy);

- head department;

- senior cashier;

- cashier.

A form is filled out for all checks and receipts returned by customers for the return of products. Thus, revenue is reduced by the amount returned. All this information is recorded in KM-4. It is not always possible to compile KM-3. If the client pays with a bank card, then the issuance of funds to him is not provided for by the current legislation (pay attention to paragraph 2 of the Bank of Russia instructions dated June 20, 2007 1843-U “On the expenditure of cash funds...”). You can download km-3 forms on the website.

Procedure for processing refunds to customers

You need to understand that almost all monetary transactions carried out by various companies are strictly controlled by supervisory authorities. That is why all refunds are accompanied by correct registration. The act is drawn up in a unified form, which confirms the fact of return.

Conventionally, the process of returning money can be divided into several stages:

- Buyer's request. According to the law, the buyer has the right to return the purchased goods. To do this, you need to contact the seller, asking him to accept the product back and return the money for it.

- The director of the organization that acts as the seller must sign the check. This will confirm that the money return process is carried out with his consent.

- This check becomes the basis for the cashier or operator to return the funds to the buyer. In this case, o. is indicated on the check.

- At the end of the shift, the responsible person must draw up the KM-3 act. Information about the check for which the refund was made is indicated here. If there are many such checks per day, all of them must be indicated in the act.

- The fact of returning money taken from the cash register must be additionally reflected in the cashier's journal.

As already mentioned, such an algorithm of actions is only possible if the return is made on the same day when the check was issued. If the proceeds have already been handed over, and the buyer has asked to return the money, then this procedure will take place in a slightly different order.

When is a certificate of return of funds to the buyer drawn up?

As a rule, the need to prepare this document arises in situations where the seller entered the payment amount incorrectly, for some reason the invoice was not delivered, and the buyer returns the goods.

Moreover, the main thing you need to pay attention to is that the KM-3 act is filled out only if the money will be returned on the day of the transaction. Accordingly, the buyer returns the goods. If it is not possible to return the funds on the same day, then instead of an act, a cash receipt order is issued. After drawing up the act, its limitation period is two months. After the end of this period, neither party has the right to make any claims, for example, in case of incorrect completion of the document. After the funds are returned, the document is sent for storage to the organization’s archives. He must stay here for at least five years.

( Video : “How to properly issue a refund to a buyer for a product?”)

Who draws up the act

The head of the selling company must appoint a commission that will deal with the transaction and, accordingly, filling out the document. Typically, committee members are approved by the director. It is this group that is responsible for drawing up the act. As a rule, this includes the head of the department, cashier, and senior cashier. At the discretion of the manager, the commission may include other employees.

The document drawn up in the KM-3 form must be submitted in one copy. This is where detailed information about the transaction is entered. This is especially true for information about checks that were issued for the returned goods. Accordingly, after the return of funds, the daily revenue will be reduced by the returned amount. This must be noted in the cash register.

Results

If the seller has not yet switched to the online checkout and the buyer purchased the goods for cash, and then changed his mind and decided to return it, then the seller needs to fill out the KM-3 act. In the case of using an online cash register, when returning money, a form in the KM-3 form may not be issued, but issuing a check with the sign “return of receipt” and cash settlement is required.

Sources

- https://onlainkassy.ru/info/akt-km-3.html

- https://mirblankov.ru/forma-km-3/

- https://zakonguru.com/zpp/tovary/forma-km-3.html

- https://class365.ru/blanki-dokumentov/forma-km-3-akt/

- https://blanki.biz/kkt/km-3/

- https://aktinfo.com/forma-km-3/

- https://assistentus.ru/forma/km-3-akt-o-vozvrate-denezhnyh-summ/

- https://nalog-nalog.ru/buhgalterskij_uchet/dokumenty_buhgalterskogo_ucheta/unificirovannaya_forma_km3_blank_i_obrazec/

Form KM-3. Form and sample for 2021

The act in form KM-3 is used to document the fact of the return of funds to the buyer.

In practice, KM-3 is associated with an incorrectly entered amount, return of goods or unsold invoices. The completed document must be accompanied by a receipt (cash or sales receipt), as well as other materials, including statements and explanatory notes from the employee. All erroneously issued checks must be marked “Canceled” and signed by either the head of the enterprise or the senior cashier. Refund checks and settlement checks are not generated for such cases.

A prerequisite for filling out KM-3 is return on the day of surgery. If the Z-report for the shift has already been withdrawn, then instead of the indicated act, an expense and cash order is filled out.

Sample filling and blank form of KM-3 form

FILES Blank form according to the KM-3 form .xls Sample of filling out the KM-3 form .xls Form and sample of the KM-3 form in the .zip archive

Filling out the fields of the KM-3 form

In the header of the form, fill in the company details. If it is not a structural unit and does not have them, we leave this field empty. However, in cases where several stores are united into a network, it is advisable to indicate the name and address of a specific outlet.

Be sure to indicate the name of the cash register.

The application program and type of operation need not be specified. The cashier responsible for the return can be indicated by full name or personnel number.

The clarification “including on erroneously punched checks” should be understood as follows: the basis for filling out KM-3 is an error made by the cashier when the amount is greater than the actual cost of the goods and the company returns the “difference” that arose as a result of this.

Using an example: let’s say that the cashier Svetlova, when making a purchase of a book, did not take into account the promotion for which the new price is 159 rubles. As a result, a check for 1,749 rubles was punched.

The buyer discovered the error and pointed it out, as a result of which 1,590 rubles were returned to him. According to the regulations, the buyer submitted an application for a refund. Senior cashier Efremov O.A.

requested an explanatory note from the cashier, which was also attached to KM-3 dated August 26. 2021.

If several checks have been knocked out incorrectly, the form provides details for each of them. However, the report on the return of funds in KM-4 will only show the final figure.

Filling out the table in KM-3

The KM-3 act, as a rule, is filled out by hand, but there is no reference to the fact that it cannot be completed using a computer. In any case, the document must be certified by the signatures of the commission, otherwise the audit may determine it as incorrectly drawn up.

Data can be reduced - this is especially true for positions in column 6.

When to draw up the KM-3 act

Since this document is completed only in certain cases, the form does not need to be submitted daily. However, if several returns occurred during the day, then only one KM-3 is issued. This happens at the end of the shift after the Z-report is taken. Data from KM-3 is used for forms KM-4 and KM-7.

The limitation period for a document is 2 calendar months . After this time, the inspection cannot make a claim against the incorrectly executed act. KM-3 is stored in the accounting archive .

Source: https://assistentus.ru/forma/km-3-akt-o-vozvrate-denezhnyh-summ/