Medical insurance contributions are transferred to the budget by all persons who conduct business activities with the help of hired employees, and therefore the current legislation establishes fairly clear rules for calculating these payments.

In particular, the law stipulates not only how payments are transferred, but also how payment documentation must be drawn up so that the payment ultimately reaches the desired addressee.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

In this regard, in order not to encounter any problems from control authorities, when making a transfer, it is best to use a standard sample payment order for payment of health insurance premiums in 2021.

Destination

Starting from January 1, 2021, medical insurance premiums are under the control of the Tax Service, and therefore these amounts must be transferred in accordance with the rules prescribed in the current Tax Code.

Health insurance premiums must be transferred through separate payment orders to the Tax Service, but, as mentioned above, the best option is to use a special payment order template.

Field 101

In field 101, during the process of registering medical insurance premiums, you must indicate a certain status characteristic of the company or private entrepreneur who is making this transfer. In particular, officials recommend entering code “14” when preparing payment orders for medical contributions.

If we are talking about the transfer of medical insurance premiums by private entrepreneurs for themselves, and not for hired employees, then in this case it is better to indicate code “09” in this field.

Recipient details

In 2021, the vast majority of insurance premiums must be transferred not to the funds that were used previously, but to the Tax Service. Thus, the only type of contributions that must be transferred to the Social Insurance Fund are contributions in the event that an employee suffers any injury or occupational disease due to an accident at work.

All other contributions must already be paid directly to the Tax Service, and in particular this applies to the following payments:

- pension insurance contributions;

- health insurance contributions;

- social insurance contributions in case of maternity or temporary disability.

Thus, for those insurance premiums that are transferred to the Tax Service, you need to write the details of the branch in which the private entrepreneur underwent the registration procedure.

KBK

Insurance contributions must be made every month, and must begin on January 16, when the amounts for December of last year are paid. Budget classification codes must be indicated in field 104 of the payment document, and for insurance premiums that are transferred to the tax office, these codes have changed slightly, and first of all, this concerns the first three digits, which should now indicate the Tax Service, and not various funds, as it was before. At the same time, accordingly, contributions for injuries can continue to be charged to the same codes that were indicated last year.

The codes themselves are as follows:

| Category | Payment | Fine | Penya |

| Pension insurance | 18210202010061010160 | 18210202010063010160 | 18210202010062110160 |

| Health insurance | 18210202101081013160 | 18210202101083013160 | 18210202101082013160 |

| Social insurance | 18210202090071010160 | 18210202090073010160 | 18210202090072110160 |

| Contributions for injuries | 39310202050071000160 | 39310202050073000160 | 39310202050072100160 |

| Additional pension insurance at tariff 1 |

| 18210202131063000160 | 18210202131062100160 |

| Additional pension insurance at tariff 2 |

| 18210202132063000160 | 18210202132062100160 |

Sample payment order for payment of health insurance premiums in 2021

BCC values used from 2021 when preparing payment invoices for the payment of general mandatory contributions

The new BCCs, used by policyholders in settlement documents since 2017, were put into effect by Order of the Ministry of Finance of the Russian Federation No. 230n dated December 7, 2016. The procedure for their application in accordance with the introduced ministerial regulations has also undergone changes.

Since 2021, 3 initial numbers of the BCC have changed. Now instead of the previously used “392” you need to specify “182”. It is these new numbers that mean that the transfer is addressed to the Federal Tax Service. The exception is insurance payments for injuries. For them, the KBK remained the same, since the addressee has not changed - policyholders transfer, as before, these contributions to the Social Insurance Fund.

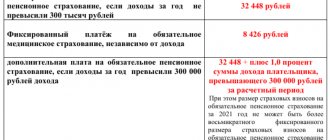

For generally obligatory insurance payments at additional rates, four BCCs are provided instead of two. Their use depends on working conditions and special assessment. A single BCC value has been introduced for fixed pension payments of individual entrepreneurs for themselves and for a percentage of annual profit exceeding 300,000 rubles.

| BCC values of general compulsory contributions applied starting from the current year | Type of mandatory contributions |

| 182 1 0210 160 | OPS |

| 182 1 0210 160 | OPS in a fixed amount for individual entrepreneurs, as well as for 1% of annual profit over the limit of 300,000 rubles. |

| 182 1 0213 160 | Compulsory medical insurance |

| 182 1 0213 160 | Compulsory medical insurance in a fixed amount for individual entrepreneurs |

| 182 1 0210 160 | OSS regarding VN and M |

| 182 1 0210 160 (additional rate 9%, no assessment); 182 1 0220 160 (the rate is affected by the assessment); | Compulsory health insurance payments at an additional tariff for working citizens in hazardous conditions (according to Federal Law No. 400 of December 28, 2013, Article 30, Part 1, Clause 1) |

| 182 1 0210 160 (6% rate, no assessment required); 182 1 0220 160 (assessment required) | Compulsory pension insurance payments at an additional tariff for working citizens in difficult conditions (in accordance with Federal Law No. 400 of December 28, 2013, Art. 30, Part 1, Clauses 2-18) |

| 393 1 0200 160 | OSS (for injuries) |

By order of the Ministry of Finance, “transitional” BCCs were also introduced. Their policyholders used them to display insurance payments for the December period of 2021. Thus, the current BCC, which must be entered into the payment slip, consists of 20 digits, with the initial three indicating the code of the payment addressee - the Federal Tax Service.

What has changed in the document

The payment order in 2021 is filled out in accordance with the new rules. In particular, the Tax Code includes relevant amendments, and a new chapter is planned to be introduced in the near future to ensure control over insurance premiums. Reporting and transfer of contributions is carried out to the nearest branch of the Tax Service located at the place of registration of the payer.

In 2021, the period for preparing and submitting the report was extended by 5 days. That is, the SZV-M for December 2020 can be submitted until January 15, 2021 inclusive. Find out details about mandatory medical insurance contributions to the Federal Compulsory Compulsory Medical Insurance Fund in 2021 from our article.

The Ministry of Finance has approved new reporting, which will completely replace the existing and previously used calculations in form 4-FSS and RSV-1. New budget classification codes are also beginning to be used, with the help of which payers are given the opportunity to charge contributions to the FFOMS.

How to make a payment for a fine to the tax office

The fine is paid to the same branch of the Federal Tax Service as the tax itself. This means that the name of the recipient, his BIC, correspondent account and current account will remain “standard”. If the transfer is made for the first time, the details can be clarified at the tax office or on its official website.

Art. 114 of the Tax Code of the Russian Federation states that, based on the results of control measures carried out, the Federal Tax Service has the right to impose monetary sanctions on taxpayers who do not fulfill their obligations properly. If they are not transferred voluntarily, the fiscal authorities will direct the collection to the accounts of the company or citizen, and then to his property. To avoid disputes and problems, you need to know how to fill out a payment form for a fine to the tax office according to the current 2020 sample.

Sample payment order for payment of health insurance premiums in 2021

There are several important fields in the new payment order when sending contributions to the health insurance fund that will need to be completed in accordance with the new rules. Line 16 must be filled out by the payer with information about the UVK in accordance with the standards adopted in a particular region, after which indicate in brackets the branch of the Social Insurance Fund or the Pension Fund.

Now, as already mentioned, all contributions must be paid directly to the Tax Service, and therefore the corresponding territorial tax authority will need to be indicated in parentheses.

In principle, lines 106-109 do not need to be filled in with any data, since field 106 indicates the specific basis for the payment.

This section must contain a double letter code:

| TP | Current fee. |

| ZD | Voluntary debt repayment. |

| TP | Repayment of debt in accordance with the received requirement. |

Information is indicated in fields 108 and 109 only if the relevant information is available (in particular, the number and date of the received request for payment of debt).

In paragraph 107, you need to indicate the transfer period, and in this case, your own numbering is also provided. First of all, the tax period is prescribed, that is, for what period of time reporting is submitted - month, quarter, half-year or year, and this is done with the appropriate designations MS, CV, PL and GD.

Next, write the number of the tax period in the form of a serial number of the month from “01” to “12”. If we are talking about a quarter, then it will be necessary, accordingly, to indicate the serial number of each of them - “01”, “02”, “03” and “04”, while the half-year is about and “02”. When calculating contributions for the full year, you will need to indicate it in full.

In field 101, which indicates the category of the payer of insurance premiums, until 2021 the code “08” is indicated, indicating the payer involved in calculating insurance premiums. Starting from 2021, when paying health insurance premiums, you must indicate “14” as the payer status.

Feature 3 – field 107 “Tax period”

Depending on what served as the basis for the payment, filling out this field will vary:

- In case of voluntary payment of penalties (the basis of the PP), there will be 0 here, because penalties do not have a frequency of payment, which is inherent in current payments. If you are listing penalties for one specific period (month, quarter), it is worth indicating it, for example, MS.02.2019 - penalties for February 2021.

- When paying at the request of tax authorities (basis of TR) - the period specified in the request.

- When repaying penalties according to the verification report (the basis of the AP), they also put 0.

If an error is found

It often happens that if incorrect details are specified in the “Payee” or “KBK” fields, the payment is classified as unclear, and many accountants and private entrepreneurs do not know how best to proceed in such a situation.

Today, there is an agreement between the Treasury and the Tax Service that they will process outstanding payments themselves. Thus, outstanding payments are processed by Treasury staff while the Internal Revenue Service handles the recoding.

If an accountant fills out the “Payment recipient” field with any errors (for example, indicating an old recipient or a new one with an error in the TIN, KPP or KBK), then in this case it is not necessary to do anything in principle. During the recoding process, Treasury employees will have to determine the recipient of the specified payment in accordance with the specified payer details. The first four digits correspond to the branch of the Tax Service in which the specified company underwent the registration procedure, and the KBK undergoes automatic recoding in accordance with the comparison table.

If an accountant makes a mistake when filling out OKTMO, clarification of the payment will also not be required, because this detail is, in principle, not used by Treasury officials to distribute insurance premiums between several funds. Information about this is indicated in the letter of the Tax Service No. 3Н-4-1 / [email protected] , which was published on February 3, 2021.

Payment clarification can be carried out completely independently in a situation where the Tax Service's BCC must be written in the payment document, but instead of the code for current payments, the code for debts or something else is indicated.

In such a situation, you can file an appeal to the Tax Service in order to clarify the payment or decide to take into account the overpayment of penalties against possible contributions. In the vast majority of cases, such applications can be submitted in any form.

Where to send payments (recipient)

The recipient of payment in 2021 for all types of contributions (except for contributions for injuries) are the tax inspectorates:

- at the address of the organization or its separate division;

- at the place of residence of the individual entrepreneur.

Fill out this field according to the rules prescribed in the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n. In the “Payment recipient” field, indicate the name of the Federal Treasury authority and the name of your Federal Tax Service in brackets. If you make a payment “for injuries”, then in brackets there will be an indication of the branch of the Federal Social Insurance Fund of Russia.

Deadlines

The standard deadline for calculating any insurance premiums is the 15th of the month following the reporting month. If the deadline falls on a weekend, then the transfer of contributions is carried out on the next working day. Taking this into account, dues for December, March, June and September will have to be paid one or two days later.

Joint reconciliation of payments with the Pension Fund of the Russian Federation should be carried out jointly with the regulatory authorities, Pension Fund or National Tax Service, at the request of the payer, when the initiative comes from him. Is it possible to pass the SZV-M early? Find out from the article.

Here you can find out everything about the pension fund's annual report for 2020.