Home → Reporting → Reporting to the Pension Fund → Form RSV-1

Payers of insurance premiums who make payments to individuals provide the RSV-1 form and individual information (so-called personalized reporting) to their territorial branch of the Pension Fund.

Full name of the RSV-1 form - Calculation of accrued and paid insurance contributions for compulsory pension insurance to the Pension Fund of the Russian Federation, insurance contributions for compulsory medical insurance to the Federal Compulsory Medical Insurance Fund and territorial compulsory medical insurance funds by payers of insurance premiums making payments and other remuneration to individuals.

The RSV-1 calculation reflects the accrued and paid amounts for: – SPP (insurance part of the pension) – PPP (funded part of the pension) – FFOMS (Federal Compulsory Medical Insurance Fund) – TFOMS (territorial compulsory health insurance funds)

The calculation period for RSV-1 is a calendar year. Reporting periods are the first quarter, half a year, nine months, and a year. RSV-1 is submitted quarterly, the data is cumulative from the beginning of the year.

Deadline for submitting DAM-1: until the 15th day of the second month following the reporting period: due date for submitting DAM-1 for the 1st quarter is until May 15; the deadline for submitting RSV-1 for the six months is until August 15; the deadline for submitting RSV-1 9 months is until November 15; The deadline for submitting RSV-1 for the year is February 15.

Organizations created in the middle of the year submit their first reports after the end of the quarter in which the organization was created.

For example, if an organization was created on April 14 (this is the second quarter), then the first reports to the Pension Fund are submitted half a year before August 15. Please note: despite the fact that the organization was created on April 14, reporting is submitted for six months: from January 1 to June 30.

RSV-1 is provided to the territorial office of the Pension Fund in paper form (in 2 copies) with simultaneous provision of information on electronic media (on a floppy disk or flash drive).

RSV-1 and personalized accounting are submitted to the Pension Fund at the same time. You cannot submit RSV-1 separately without submitting personalized records. Exception: delivery of zero RSV-1. In this case, fund employees do not require zero individual information.

Deadline for submitting RSV-1

The RSV-1 PFR report is submitted 4 times a year, that is, it is a quarterly report:

| On paper | Electronic | For what period |

| Until 15.02 | Until 20.05 | Last year's report |

| Until 15.05 | Until 20.05 | Report for the 1st quarter of the current year |

| Until 15.08 | Until 20.08 | Report for the 2nd quarter of this year |

| Until 15.11 | Until 20.11 | Report for the 3rd quarter of this year |

Attention: if the date falls on a holiday or day off, the deadline is postponed to the next working day.

Deadlines for submitting calculations for insurance premiums in 2020

We present the deadlines for submitting the DAM in the table:

| Period | Deadline |

| 2019 | 30.01.2020 |

| 1st quarter 2020 | 30.04.2020 |

| Half year 2020 | 30.07.2020 |

| 9 months 2020 | 30.10.2020 |

| 2020 | 01.02.2021* |

*The deadline for submitting a report that falls on a non-working day (weekend or holiday) is postponed to the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

The calculation is also presented by the heads of peasant (farm) farms based on the results of the year (clause 3 of Article 432 of the Tax Code of the Russian Federation):

- for 2021 - until 01/30/2020;

- for 2021 - until 02/01/2021.

Calculation of insurance premiums is submitted electronically if the average number of employees at the end of the previous period (reporting or settlement) exceeded 25 people. If the staff is smaller, you have the right to choose whether to report electronically or on paper (Clause 10, Article 431 of the Tax Code of the Russian Federation).

We tell you where to submit RSV here.

Fines for late submission of RSV-1 calculations

The following penalties are established for late submission of the RSV-1 form:

- 1000 rubles for failure to meet deadlines for payment of due amounts;

- if the money is not transferred, the amount of penalties depends on the amount of non-payment:

- 5% of contributions due for mandatory transfer for the last quarter;

- not less than 1000 thousand rubles;

- guilty officials (managers and chief accountants) are separately fined in the amount of 300 to 500 rubles (Article 1.33 of the Code of Administrative Offenses of the Russian Federation).

Where is the RSV-1 calculation submitted?

Important!!! Starting from the 1st quarter of 2021, calculations for insurance premiums must be submitted to the Federal Tax Service at the location of the company, in the form approved by Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551.

Starting from 2021, not only the government body that controls the issue of calculation and payment of various insurance premiums is changing, but also the format of the report provided. From this period, such a form as RSV-1 is abolished, as well as some other forms of reports, and a single reporting form for insurance payments is introduced.

Who takes the RSV in 2021

The calculation form includes data on the calculation and payment of insurance premiums for compulsory pension insurance (OPI), compulsory medical insurance (CHI) and compulsory social insurance (OSS) - except for contributions for injuries remaining under the jurisdiction of the FSS, reflected in the 4-FSS report.

The DAM is submitted by payers making payments to individuals no later than the 30th day of the month (Clause 7, Article 431, Article 423 of the Tax Code of the Russian Federation) following the end:

- reporting period (1st quarter, half year, 9 months);

- billing period (calendar year).

In what form is it served?

The law requires filing RSV-one in two versions:

- On paper you need to prepare two copies:

- one remains in the fund;

- the second is marked with receipt;

- The electronic version has the following features:

- mandatory for organizations employing more than 25 people;

- must be certified by an electronic digital signature.

Important!!! If the number of employees of the enterprise exceeds 25 people, then it is allowed not to submit a calculation on paper.

General requirements for filling out RVS-1

When filling out the RVS-1 form, you must follow the established requirements, namely:

- Each page must contain a registration number. It is placed at the top of the page.

- Only one indicator can be entered in a cell.

- The columns for which there are no indicators are filled in with dashes. The exception is the sixth section. There are no dashes in it.

- Corrections, errors and adjustments are not allowed.

- Each sheet must be signed and the date stamped next to it.

- The seal impression (if any) is placed on the title page. Where "M.P" is indicated

- You can fill out the form manually using blue or black ink.

Important!!! Important: the title page must indicate the reporting type and period code.

Filling rules

The methodology for entering this into RSV-one was approved by Resolution of the Pension Fund of the Russian Federation Board No. 2P dated January 16, 2014. In addition, changes and additions were made to it. When filling out reports, you must strictly follow these guidelines.

The reporting consists of six sections. In each, you need to enter the appropriate data, focusing on the name of the cells.

Important: the information entered into the form is coded. It is necessary to study the instructions for filling out so as not to make mistakes. Download for viewing and printing:

Resolution of the Board of the Pension Fund of the Russian Federation dated January 16, 2014 N 2p (as amended on June 4, 2015) “On approval of the form of calculation for accrued and paid insurance premiums...”

General requirements for entering data

When filling out the form, you should follow the general rules. They are:

- Each page must contain a registration number. It is placed at the top of the page.

- Only one indicator can be entered in a cell.

- The columns for which there are no indicators are filled in with dashes. The exception is the sixth section. There are no dashes in it.

- Not allowed:

- corrections;

- errors;

- adjustments.

- Each sheet must be signed. The date is placed next to it.

- The seal impression (if any) is placed on the title page. It says "M.P"

Important: the title page must indicate the reporting type and period code.

Filling Features

The RSV form one contains information about:

- personal data of each worker;

- insurance premium made for him in: Pension Fund;

- MHIF;

Attention: corrective information is submitted only on forms that are valid at the time of reporting.

Reporting in the form described is collected from sections, some of which are not filled out by individual groups of payers. The following pages are required:

- title;

- sections: 1;

- 2.1;

- 2.5.1;

- 6.

- Parts 2.2, 2.3 and 2.4 are intended for payers applying additional rates.

- If an enterprise uses reduced rates in accordance with Law No. 212, then Part 3 must be completed.

- Enterprises that employ students are required to complete the fifth section.

- Corrective information is included in parts 2.5.2 and 4.

Download for viewing and printing:

Federal Law of July 24, 2009 N 212-FZ (as amended on December 19, 2016) “On insurance contributions to the Pension Fund, Social Insurance Fund, Compulsory Medical Insurance Fund” (lost force on January 1, 2021 due to the adoption of Federal Law No. 250)

Latest changes in filling rules

The changes affected the procedure for entering data into the updated form in 2021. They are:

- Organizations are required to provide updated data before mandatory reporting (after the first day of the fourth month following the reporting month). In this case, parts 2.5 and 6 are not included in the additional form.

- If there is an overpayment, then the values of lines 150, 100, 140 and 130 are checked:

- the indicator from column 5 of line 150 must be equal to the sum of the values in columns 3 and 4 (of the same line).

- The use of codes has been clarified:

- “CHILDREN” means that a person is on parental leave for one and a half years;

- if the child is already 1.5 years old, but not three years old, then the code “DLCHILDREN” is entered;

- "CHILDREN" is used to refer to carer's leave granted to: a carer;

- grandmother or grandfather;

- another relative (not a parent).

- “NEOPL” is used to identify periods of leave without pay or forced downtime due to the fault of the worker;

- the period of advanced training is coded with the sign “QUALIFICATION”;

- if a citizen is involved in the performance of state or public duties, then “SOCIETY” is indicated;

- donor days are shown as "SDKROV";

- standstill associated with suspension from work is coded with the sign “SUSPENDED”.

What to do if no activity was carried out

Enterprises and entrepreneurs that have not accrued earnings are still required to submit the form to the Pension Fund. In this case, the title and the first two sections are filled out. Failure to submit a zero report is equivalent to a violation of the deadline for its submission.

Attention: along with the zero form, you must provide an explanatory note describing the reasons for not transferring funds to the funds

Filling out the RVS-1 form

The PFR RVS1 report contains a title page and five main sections. Not all forms are required to be filled out.

Let's consider filling in the form of a table:

| Section title | When filled |

| Title page | Information about the organization and individual entrepreneur is reflected - details, codes, the period for which the submission is submitted is reflected. |

| Section 1 | Data on accrued and paid insurance premiums for pension and health insurance is reflected. |

| Section 2 | Section 2.1 – This subsection indicates the amounts of payments to employees, as well as the insurance premiums calculated from them for compulsory health insurance and compulsory medical insurance. Column 3 reflects the value obtained on an accrual basis from the beginning of the year. In columns 4, 5 and 6 - the corresponding value for the last three months of the reporting period. Subsections 2.2-2.3 – If the payer has employees for whom the rates of additional contributions to the Pension Fund are applied, then these sections must be completed. |

| Section 3 | To be completed when using a reduced tariff rate for calculating insurance premiums. |

| Section 4 | information is entered on additional payments that were made after self-identification of understated amounts or when they were discovered by PF inspectors. |

| Section 5 | Fill out only those enterprises where university students or students of secondary vocational educational institutions performed work during practical training or as part of student work teams. And at the same time, a civil or employment contract was drawn up, according to which insurance premiums were paid. |

| Section 6 | contains personalized accounting information for each employee who received payments in the reporting period. If there were no payments to the employee, then there is no need to fill out the sixth section for him. |

Procedure for filling out RSV-1

We have decided that the document is filled out by employer-insurers. And everyone determines for themselves which sections need to be filled out. As a rule, standard filling consists of the following sections of RSV-1:

- first page (title page);

- section 1;

- subsection 2.1;

- section 6.

Other sections are filled in if additional charges have been made for insurance premiums.

Thus, the RSV-1 form will be filled out according to the data that was accrued and paid in the organization.

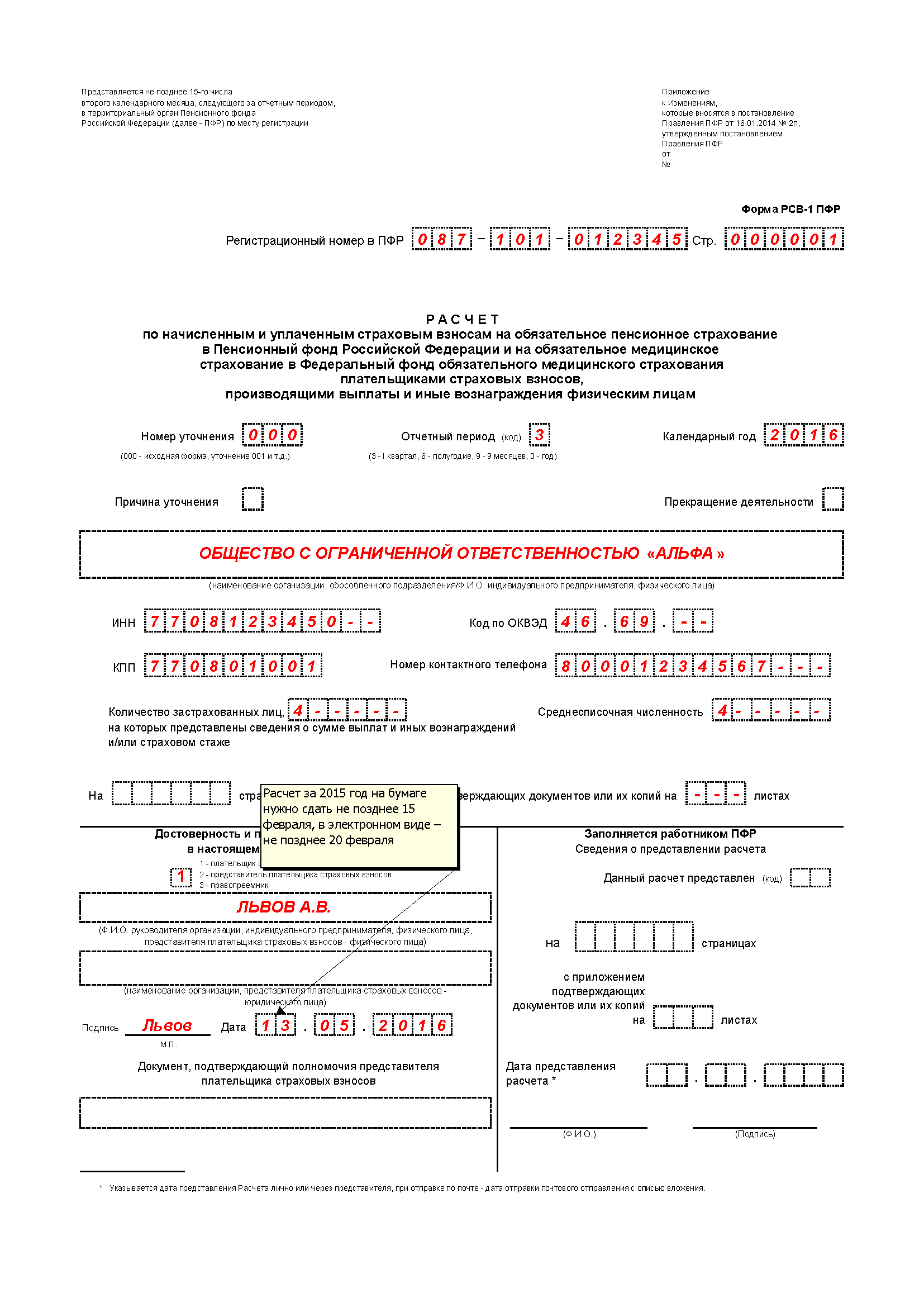

Title page

Before you begin filling out the main sections of the document, you need to fill out the first page (title page). It must indicate the following employer information:

- Full name of the policyholder;

- employer's tax identification number and checkpoint;

- registration number issued by the Pension Fund;

- OKVED. This code is issued by the NO when registering a company or merchant;

- telephone.

Further, the RSV-1 document indicates the period for which the calculation is submitted and the year. The average number of employees must be indicated. Date and signature are added.

All fields on the title page must be completed. If something is missed, it will already be considered a violation.

First section - Calculation of accrued and paid insurance premiums

When filling out the first section of reporting, responsible persons usually do not experience any difficulties. The main thing is to enter the correct numbers.

So, in the first section of the form you will need to indicate the total amounts that were accrued and paid for all employees. All data entered into this section is taken from section 6. Therefore, before filling out the first sheet, you can enter data in the sixth section.

Section six - Information about the insured persons

Individual data for each employee is entered here. The following information is required when filling out RSV 1:

- Full name of the insured persons;

- SNISL employee;

- contributions accrued to specialists;

- the amount of contribution that was paid for the employee.

Each calculation sheet is signed by the head of the company.

Title page

| Correction number | “000” – for initial supply, “001”, “002”, etc. – with subsequent changes |

| Reporting period | "03" for the first quarter, "06" - for half a year, "09" - for 9 months, “12” - when submitting calculations for the year. |

| Year | The year to which the reporting period belongs is indicated. |

| Termination of activities | “L” – indicated when liquidating an organization or closing an individual entrepreneur |

| Name | The basic details, codes, legal address for the organization and registration address for the individual entrepreneur are indicated |

| OKATO field | Indicated by OKATMO |

| Insured persons | The number of employees for whom insurance premiums are paid is indicated. |

| Average headcount | calculated based on the results of the year, based on the requirements of the Federal State Statistics Service. |

Filling out the settlement form begins with the second section, then, if necessary, enter data into all subsequent ones. Work on the reporting document is completed by filling out the first section. The title page is completed last.

Zero reporting RSV-1

If an individual entrepreneur or organization is registered with the Pension Fund as an employer, then the RSV-1 form must be submitted in any case, even if no activity was carried out.

In this case, the Title Page, Section 1, Subsection 2.1 of Section 2 are required to be completed.

Results

Fill out the DAM for the 1st quarter of 2021 on a new form, by order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11/ [email protected] as amended on October 15, 2020. Submitting it is mandatory for all employers, including those who did not pay income during the reporting period. The deadline for submitting the report for the 1st quarter of 2021 is 04/30/2021.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Typical mistakes when filling out

- All cells of the title page of the RSV-1 Pension Fund form are subject to mandatory completion. On the title page, the policyholder should indicate the OGRN, INN or KPP. If this information is missing, the Pension Fund will not accept calculations using the RSV-1 Pension Fund form.

- Invalid SNILS. Section 6 should contain SNILS of all employees for whom individual information is filled out. But there are often errors in the props themselves, including those that are not the fault of the company. For example, an employee’s SNILS has changed, but the accounting department does not know about it. Another situation is that the accounting department entered the SNILS number of another person. If the pension certificate number in the RSV is not the same as in the fund’s database, the inspectors will not accept the report. To avoid such errors, it is necessary to double-check the numbers of employee pension certificates in advance, before sending reports.

- Incorrect insurance premium rate code. It is indicated on the title page. Often this field is either forgotten or filled in incorrectly. For example, organizations that pay insurance premiums according to the basic tariff indicate tariff code 01, and those that use a simplified tax system indicate 05.