In the context of globalization and open borders, foreign business trips of employees of Russian government agencies and commercial companies have long ceased to be an extraordinary phenomenon. Foreign business trips are governed by essentially the same rules as domestic business trips. But there are a number of nuances associated specifically with sending an employee to another state.

Who can be sent on business trips abroad and who cannot?

The restrictions regarding employee business trips abroad are the same as for domestic trips.

It is strictly prohibited, as in the case of business trips within Russia, to send the following employees abroad:

- pregnant women;

- employees under 18 years of age, except for creative workers and athletes;

- employees on an apprenticeship contract, if the foreign business trip is not related to apprenticeship;

- disabled people if the business trip contradicts their individual rehabilitation program;

- registered candidates for elections during the latter period.

An employee who has a child under three years old can be sent on a business trip abroad only with her written consent

Written consent for foreign or domestic business trips is required from the following categories of workers:

- women raising children under three years of age;

- single mothers, fathers or guardians of children under five years of age;

- parents or guardians of disabled children;

- workers caring for sick relatives based on a medical report.

All other employees can be sent on business trips, including foreign ones, without any restrictions.

Necessary documents to confirm daily allowance

According to the government decree, from January 8, 2015, some previously required documents were canceled, such as: a job description describing the purpose of the trip, a travel certificate, and there is no need to fill out a report on the work performed. Although the use of these documents is not required, they can continue to be used for internal purposes. Now questions arise: how to take into account daily allowances?

If previously, notes about visiting the organization were put down on the travel certificate, now this can be written down in a memo with the necessary documents attached. The amounts of expenses incurred are reflected in the employee’s advance report within 3 working days upon return from the trip.

An example of a memo can be downloaded from the link.

If the employee traveled by public transport, then the departure dates, in addition to the order, will be confirmed by the dates on the travel tickets (Printed electronic and boarding tickets). Receipts from places of accommodation and meals at the places of travel will also be useful.

If the employee went in a company or personal car, then it is necessary to attach receipts from gas stations; it is advisable to refuel on the day of departure, at the place of stay and upon return in order to attach the receipts to the service note.

As has already been said, when traveling abroad, confirmation will be a border crossing mark in the foreign passport, and when traveling in the CIS countries, it is calculated based on travel tickets, due to the fact that marks may not be placed.

Example An employee goes on a business trip to the territory of Belarus on the evening of March 1, and returns on March 4, and will be there on the 2, 3 and 4.

To calculate the border crossing date, it will be necessary to take the departure dates according to travel documents. So, on March 1 and 4, payments will be made based on Russian standards, and on March 2 and 3, according to foreign standards.

Duration of business trip abroad

The legal requirements for business trips both in Russia and abroad in 2021 are the same and do not have a clearly defined framework. By default, a business trip cannot be less than one day and must have a deadline. If it cannot be established, it is determined approximately.

For example, if an employee goes on a business trip that can last either a week or a month, it is advisable to initially arrange a business trip for a week, and subsequently extend it as necessary.

Even if the business trip is issued for a hundred years, with all the absurdity of such a decision, there is nothing to complain about from the standpoint of the law. However, it is doubtful that such an option would be in the interests of the company. After all, she must pay the advance to the employee immediately and in full.

During the Soviet period, central newspapers could send their employees abroad to work as their own correspondents. For example, in Komsomolskaya Pravda the standard period for such a business trip was three years.

The main document that stipulates the duration of a trip abroad is a business trip order. It is on this basis that the advance payment is calculated, which must be paid to the posted worker before departure.

Results

Despite the apparent complexity of calculating daily allowances for business trips abroad, usually accountants quickly get the hang of it and make virtually no mistakes.

The main thing is to correctly fix the required payment rates, correctly calculate the amounts to be issued and accurately maintain documentation. In this case, the tax authorities will have nothing to complain about. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Payment and confirmation of expenses on business trips abroad

Along with the standard set of expenses for business trips in Russia, including compensation for travel there and back, costs of renting accommodation, daily allowance and other expenses agreed upon with the employer, when traveling abroad the following expenses of the business traveler are subject to additional compensation:

- production of a foreign passport;

- costs for obtaining a visa (consular, visa fees, visa center services, etc.);

- airport and port taxes.

The biggest difficulty is always compensation and confirmation of expenses in foreign currency incurred by the employee directly while staying abroad. For example, expenses for hotels, telephone conversations, travel around the country of destination, if the employee was sent to several cities, or to different countries, when to several countries, purchases made for the needs of the company (for example, the employee was sent to an international exhibition and there purchased the employer is interested in product samples), etc.

There are two ways to confirm such expenses:

- The advance is paid to the employee in rubles, he exchanges this amount for foreign currency and submits a certificate of exchange to the accounting department in the package of reporting documents for the business trip. Expenses are then recognized in the currency in which they are reflected in the foreign supporting documents and converted into rubles at the rate specified in the exchange certificate. For example, an employee received an advance of 55 thousand rubles and purchased dollars at the rate of 1:60. His confirmed foreign exchange expenses amounted to one thousand dollars. At the exchange rate from the exchange certificate, it will be 60 thousand rubles. Since he already received 55 thousand before leaving, the company still owes him five thousand rubles. The disadvantage of this method is that when traveling to countries where currencies other than the dollar or euro are used, it may be problematic to purchase the necessary currency units, for example, Kazakh tenge, Belarusian rubles, Polish zlotys, Swedish crowns or British pounds sterling. especially outside Moscow.

- When the employee does not have a certificate of currency exchange (and the advance can be given to him immediately in foreign currency - the law allows this), expenses are recognized in the currency in which they were incurred, based on primary supporting documents (invoices, tickets, checks, etc.) . p.) and are converted into rubles at the Bank of Russia exchange rate on the date of approval of the advance report.

Daily allowances for trips abroad are calculated in the currency in which they are stated in the company’s Business Travel Regulations.

For example, an employee was posted to the Czech Republic. Before the trip, he prepared a passport and applied for a visa using the services of a visa center. He incurred all these expenses in rubles. He also paid for the round-trip plane ticket in rubles. Daily allowances in the Business Travel Regulations are indicated in dollars. And in the Czech Republic he paid for a hotel with crowns. The advance for the business trip was transferred to the employee’s card in rubles; he did not make an exchange, only withdrew cash or paid by card, including abroad.

In this case, the calculation is carried out according to the following scheme:

- All expenses that the employee, according to supporting documents, incurred in rubles are recognized in rubles.

- Hotel costs according to the invoice are converted from Czech crowns into rubles at the Bank of Russia exchange rate on the day the advance report is approved.

- Daily allowances are also converted from dollars into rubles at the Bank of Russia exchange rate on the day the advance report is approved.

- The total amount of confirmed expenses in rubles is compared with the advance payment issued.

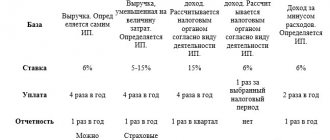

Main changes in 2018-2019

This year, no innovations in the field of regulation of business trips, including business trips abroad, were adopted.

It is important not to forget that in order to include travel expenses, including daily allowances, it is necessary to correctly draw up all the necessary documents.

Currently, all administration of these amounts, both for calculating personal income tax and insurance contributions, is carried out by tax authorities on the basis of the provisions of the Tax Code of the Russian Federation.

Attention: in 2018-2019, when calculating travel expenses, you also need to take into account existing standards for business trips abroad.

The company has the right to develop its own daily allowance rates for foreign business trips. However, if they are greater than the amounts approved at the legislative level, then for the purposes of calculating personal income tax and social contributions, the amounts exceeding the standards must be taken into account in the base of these mandatory payments.

They are not taxed only in relation to contributions to the Social Insurance Fund for injuries, since their calculation is regulated by social insurance, and not by the tax authorities.

Attention: during the periods under review, the same rules continue to apply to reimbursement of expenses for one-day business trips.

Daily allowance for business trips abroad in 2018

The Tax Code of the Russian Federation sets the maximum amount of daily allowance for business trips abroad, which is not subject to taxation, at the level of 2.5 thousand rubles per day. But this does not mean that it is impossible to pay them in excess of the stated amount. It is possible, but there will be tax costs.

The employer himself is free to pay his employees at least 1 million rubles or even dollars per day. As long as he doesn't end up going broke.

The legislation stipulates only one requirement for the company regarding daily allowances, including for business trips abroad - their amount must be indicated in the local regulations. Usually, the Regulations on Business Travel are used for this, but it can also be done with a separate order approving the amount of daily allowance.

At the same time, the company has the right to differentiate the amount of daily allowance depending on the rank of the employee. For example, 20 dollars a day for an ordinary specialist, 35 for a middle manager and 50 for a top manager. A similar policy is appropriate if daily allowances are calculated in rubles.

There is unofficial information that when one of the deputies of the State Duma of previous convocations traveled abroad, the people’s choice himself was paid a daily allowance at the rate of $500 per day, and ordinary members of his retinue were paid $100 each.

It seems logical to differentiate these compensations depending on the country of destination. After all, if we designate the same daily allowances for the UK and Tajikistan, then in light of the difference in prices between these countries, there will be no end to those who want to go to Dushanbe and get a chance to bring the lion’s share of the allocated amount back without the obligation to return it to the cash register, but to London, where those You won’t run away with the money, no matter how much you have to send it as punishment.

Various foreign business publications, for example, the British The Economist, regularly publish ratings of the most expensive countries and cities in the world. Based on these data, large international companies determine the amount of compensation for their employees sent to different cities and countries, both for long periods and for short business trips.

It should also be taken into account that daily allowances, according to the standard approved by the company for foreign business trips, are paid exactly for those days that the employee actually spends outside of Russia. So, if he went on a foreign business trip, for example, by train or personal car and crossed the border not on the day of departure, during the time he was traveling around the country, he is entitled to daily allowance, but according to the norm for business trips in Russia.

Daily allowances at the rate for foreign business trips are accrued to the business traveler from the moment he crosses the border according to the stamp in the international passport. Even if he drove around Russia all day, and entered a foreign country at 23:59, this rule still applies. But on the way back, starting from the date of entry into Russia, daily allowances are already accrued within Russia.

For example, on January 10, an employee left Moscow on a business trip to Finland by train. He crossed the border in the morning of the next day, spent five days in Helsinki, and on the evening of January 16 he went back by train and entered the Russian Federation on the morning of January 17. It turns out that he spent a total of eight days on a business trip - from January 10 to January 17 inclusive (on a business trip abroad, as well as when traveling around Russia, the days of departure and arrival are considered the calendar days of departure and arrival of the employee from/to the starting point). Of these, two days - January 10 and 17 - are paid per diem according to the standard for domestic trips, and the remaining days - at the rate approved by the company for Finland.

Let’s assume that the daily allowance for trips around the Russian Federation in a company is 500 rubles per day, and for Finland - 2000 rubles.

This means that the calculation must be carried out according to this scheme:

- 2x500=1000 - daily allowance for days of departure and arrival.

- 6x2000=12000 - daily allowance for the time spent in Finland.

- 12000=1000=13000 - total amount of daily allowance.

In total, the employee is entitled to 13 thousand rubles in daily allowance.

Let's consider another option. A Moscow company sent an employee to Bratislava and Vienna. He flew from Moscow by plane to Bratislava, spent three days there, in the evening of the third day he went by train to Vienna, where he arrived on the same day, spent the night in a hotel and spent three days in the Austrian capital, flying to Moscow at lunchtime on the third day. The daily allowance for Slovakia in the company is 40 dollars per day, for Austria - 50, for trips around Russia - 500 rubles per day.

So, our employee crossed the border with Slovakia on the day of departure. This means that he is entitled to daily allowance for the first day of his business trip according to the Slovak norm. The picture is similar for the next day, which he spends entirely in Slovakia.

But on the evening of the third day he went to Vienna and on the same day he was already there (the drive from one capital to another is no more than two hours). This means that he is entitled to daily allowance at the Austrian rate. The same schedule for the next two days.

The exception is the last day of the business trip - having departed from Vienna by plane, he flew by plane that day, our employee was in Moscow on the same day. And since this happened on the way back, he has the right to count only on domestic Russian daily allowances for the last day of his business trip.

So, let's start the calculation:

- 40x2=80 - daily allowance according to the Slovak norm.

- 50x3=150 - daily allowance for the stay in Vienna.

- 500x1=500 - daily allowance for the last day of a business trip, calculated at the domestic Russian rate.

- 80+150=230 - total daily allowance in foreign currency for the duration of your actual stay abroad.

- In total, we owe the employee 230 dollars and 500 rubles. Further calculation depends on the currency in which we gave him the advance and whether he has a certificate of exchange, if in rubles. Conversion of dollars into rubles for final reconciliation with the amount of the ruble advance is carried out at the rate indicated in the exchange certificate, or the rate of the Bank of Russia on the day of approval of the advance report.

A standard ticket on most European railways only entitles you to stay on any train on a certain day on a paid section of the route. This means that it cannot serve as confirmation of crossing the border, because the time of arrival is not indicated in it. A foreign passport will not help us either, since Slovakia and Austria are part of the Schengen zone, and there is no passport control at the border between them. To solve the problem, you can recommend that the employee make a reservation for a specific seat on a specific train, which is done for a fee (but these are also travel expenses that the company is obliged to reimburse him) or travel by bus - tickets are sold for a specific flight indicating the departure time and arrival.

In the last example considered, it will be more profitable for the company if the employee spends the night not in Vienna, but in Bratislava, where there are cheaper hotels, and goes to Austria in the morning. This would save $10 on his per diem. But no one has the right to force an employee to do exactly that.

An example of calculating daily allowance for a business trip abroad

Let's consider an example when an organization establishes and pays daily allowances for business trips abroad in rubles.

In March 2021, the company sent three employees on a business trip to Italy. Sidorov S.S. was on a trip from March 6 to March 13. He performed work duties only on weekdays, and did not go to work on weekends and holidays - from March 8 to March 11, 2021.

Attention! additional expenses associated with living outside the place of residence (per diems) are reimbursed to the employee for each day he is on a business trip, including weekends and non-working holidays, as well as for days on the road. This is directly stated in paragraph 11 of the Regulations on Business Travel (approved by Government Resolution No. 749 of October 13, 2008). Therefore, despite the fact that, while on a business trip, the employee rested on a weekend or holiday, he is equally paid daily allowance for that day .

Two other employees (Petrov P.P. and Ivanov I.I.) were sent on a work trip from March 26 to 30.

In accordance with local regulations, the company has approved standards for the payment of daily allowances for trips abroad in the amount of 2,500 rubles. for Sidorov and Petrov and 3000 rubles. - for Ivanov. The daily allowance limit in Russia for everyone is 1000 rubles.

The calculation of the daily allowance for a trip to Italy will be:

- For Sidorov: March 6 is the day of crossing the border, March 7 is a working day, March 8–11 is weekends and holidays, March 12 is a working day, March 13 is the day of crossing the border in the Russian Federation. Thus, the payment amount will be:

2,500 rub. × 7 days + 1000 rub. × 1 day = 18,500 rub.

- For Petrov: all working days, from March 26 to 29 at a rate of 2500 rubles. and 1 day to cross the border. It turns out:

2,500 rub. × 3 days + 1000 rub. = 8,500 rub.

- for Ivanov: from March 26 to March 29 at a rate of 3,000 rubles. and 1 day to cross the border. It turns out:

3,000 rub. × 3 days + 1000 rub. = 10,000 rub.

Exceeding the limits on which taxes will need to be paid will be: according to Sidorov and Petrov - 300 rubles. for each (excess in the Russian Federation: 1000 - 700 rubles), and for Ivanov 1,800 rubles. (excess of the norm for a foreign trip: 1,500 rubles (3,000 – 2,500) × 3 days + excess in the Russian Federation 300 rubles).

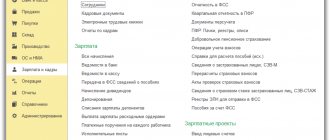

How to reflect expenses for a business trip abroad in 2018 in an accounting report

The need to reflect currency payments in the accounting department is the biggest headache for employees of the relevant departments of a company sending workers abroad.

Recommendations from experienced professional accountants will help them cope with this difficult task.

...As for an advance in cash, Law No. 173-FZ does not establish a direct permission or prohibition on the issuance of such an advance from the cash register. On this basis, the Presidium of the Supreme Arbitration Court of the Russian Federation, in Resolution No. 10840/07 of March 18, 2008, concluded that such an operation is not a violation of currency legislation. The advance amount issued is reflected in accounting in rubles at the official exchange rate of the Central Bank of the Russian Federation on the date of issue of the advance (clauses 4, 5, 6 PBU 3/2006 “Accounting for assets and liabilities, the value of which is expressed in foreign currency”, approved by Order of the Ministry of Finance of Russia dated November 27, 2006 N 154n). The amount of currency in accounting will be reflected both at the Central Bank exchange rate and at the denomination of the currency (this can be organized by introducing an additional accounting register, recording it as a fraction). Exchange rate differences between the purchase rate and the Central Bank rate are reflected as part of other income and expenses (clause 11 of PBU 10/99 “Expenses of the organization”, approved by Order of the Ministry of Finance of Russia dated 05/06/1999 N 33n, and clause 7 of PBU 9/99 “Income organization", approved by Order of the Ministry of Finance of Russia dated 05/06/1999 N 32n) on the date of acquisition of currency, as well as on the date of preparation of financial statements (at least once a month). An organization can establish in its accounting policy more frequent “revaluations” of currency. In tax accounting, exchange rate differences relate to non-operating expenses (clause 6, clause 1, article 265 of the Tax Code of the Russian Federation) or non-operating income (clause 2, article 250 of the Tax Code of the Russian Federation). In accounting, transactions related to the issuance of a foreign currency advance to an employee and overexpenditure will be reflected in the following entries (all amounts in rubles at the Central Bank exchange rate on the date of the transactions, using the example of currency transactions in euros): Debit 50, subaccount “Euro”, Credit 52 - currency was received from a foreign currency account in a bank to the cash desk; Debit 71 Credit 50, sub-account “Euro” - a foreign currency advance was issued to the employee for reporting (the same entry is used to issue the amount of overexpenditure in foreign currency); Debit 50, subaccount “Euro”, Credit 71 - the balance of unspent accountable funds was returned to the cash desk; Debit 91, subaccount 2 “Other expenses”, Credit 71 - reflects the negative exchange rate difference on travel expenses (clauses 11 and 13 of PBU 3/2006). Or: Debit 71 Credit 91, subaccount 1 “Other income” - reflects the positive exchange rate difference on travel expenses. Please note that subaccounts to account 50 “Cashier” are opened for each currency used.

Mosbukhuslugi

https://www.mosbuhuslugi.ru/material/zagranichnye-komandirovki-uchet-zatrat

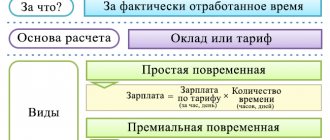

Features of calculating daily allowances for trips abroad

The standard formula for calculating daily payments looks like this:

Amount of daily allowance for the period = Number of days × Daily allowance standard

But in practice there are some peculiarities. So, if in 2021 a business trip falls on a Saturday, Sunday or holiday, then the daily allowance will have to be paid for these days, as well as double wages, but only if the employee will be performing work duties at that time. Such rules are fixed in Art. 153 Labor Code of the Russian Federation.

However, this formula is valid only for ruble payments. Can a company set standards in foreign currency? It turns out yes.

Thus, the enterprise must independently decide which currency it will use when setting limits and transferring daily allowances for trips abroad: Russian or foreign. For example, daily allowances are set in foreign currency. In this case, options are possible.

- Payments to employees are made in Russian rubles and are equivalent to the currency limits fixed in the collective agreement or local act. The conversion rate into rubles is taken on the actual date of payment.

- Payments are made in the currency of the visiting country. Then, to control ruble limits in accordance with the Tax Code of the Russian Federation, the exchange rate on the last date of the month of approval of the advance report is used (letter of the Ministry of Finance of Russia dated March 21, 2016 No. 03-04-06/15509).

Read about the specifics of accounting for payment for hotel services on business trips abroad.

Daily allowance for business trips in Russia

The New Year did not bring the abolition of daily allowance expected by many employers. Currently, employee travel must be accompanied by payment. In addition, these amounts must be paid for one-day trips, as well as when the employee performs labor functions, if his employment contract specifies the traveling nature of the work.

Amount of daily allowance – norms for Russia

The company administration, as before, determines the amount of daily allowance independently, fixing it in the Collective Agreement, Regulations on Business Travel or other local regulations of the company. There are no upper limits limiting these sizes.

Attention! When assessing personal income tax and calculating insurance premiums, a standard of 700 rubles applies. Above this amount, daily allowances are subject to income tax.

One day business trip

Since the previously effective Resolution was canceled, and the new norms do not establish a minimum duration of a business trip, a one-day trip is also recognized as such. The Labor Code of the Russian Federation establishes that registration of a business trip must be accompanied by the payment of daily allowances.

Registration of a business trip in 2021

Employees must confirm all their expenses at the end of their trip. Checks, plane tickets, etc. can be used for this. The accounting department must accept the advance response and then reimburse the existing expenses. The advance payment issued before the business trip is first deducted from the amount of expenses.

Daily allowance amount

The amount of daily allowance is calculated taking into account the number of days of travel through the territory of Russia and the number of days spent abroad. The amount of daily allowance is determined on the basis of Article 217 of the Tax Code of the Russian Federation. In particular, this is 700 rubles per day for a business trip within Russia and 2,500 rubles for trips abroad.

IMPORTANT! The employer has the right to increase the daily allowance at his own request. The premium is set by local regulations of the company. Personal income tax is withheld from the difference.

Let's look at the accounting entries used:

- DT71 KT50-1. Issuance of daily allowances on the basis of a collective agreement.

- DT20 KT71. Reflection of all amounts in the advance report.

- DT70 KT68. Withholding personal income tax from the daily allowance allowance.

ATTENTION! There is no need to pay insurance premiums. If this is a one-day business trip, the daily allowance can be reduced to 50% of the established amount.

Before sending an employee on a business trip, you need to draw up an estimate to determine the amount of the advance. It may include the following areas of expenditure:

- Directions

- Accommodation.

- Payment of daily allowances.

- Issuance of insurance.

- Transporting luggage.

- Telephone conversations.

- Registration of a foreign passport.

- Expenses when exchanging currency.

The estimate must be attached to the expenditure slip.

IMPORTANT! Currency exchange in the employee’s country of residence is difficult and involves additional expenses. Therefore, it is recommended to issue an advance in the currency of the state to which the employee is sent.

The employee himself must apply for a foreign passport. The associated fee is reimbursed by the company's accounting department. The employee must first present the appropriate receipt, as well as a copy of the passport. The costs of obtaining a foreign passport can be included in travel expenses. However, this point must be included in local acts.

Let's consider all the lists of costs, as well as the features of their taxation:

- Daily allowance. Must be recorded as an expense. If their amount does not exceed 2,500 rubles, the daily allowance will not be subject to personal income tax.

- Accommodation. Expenses will be included as expenses. Exception - the amount is highlighted as a stand-alone line in the invoice. An amount not exceeding 2,500 rubles per day will not be subject to personal income tax. Insurance premiums are not charged.

- Directions Expenses supported by documentation will be taken into account. If documents are missing, the amount will not be subject to personal income tax. Insurance premiums are also not charged.

- Taxi expenses. If taxi costs are justified and supported by papers, they are included in expenses. Expenses are not subject to personal income tax. Insurance premiums are charged.

- Medical insurance. Expenses for it will also be included in expenses. The amount will not be subject to personal income tax. Insurance premiums are charged.

These rules may change, and therefore you need to monitor all innovations in the Tax Code and related acts.

We calculate daily allowances in foreign currency...

Each company decides for itself what amount to pay per diem. There are no maximum or minimum restrictions. Regulations exist solely for tax purposes. The amount of daily allowance, as stated in Article 168 of the Labor Code of the Russian Federation, can be established by an organization by a collective agreement or a local regulatory act (order, regulation on business trips, etc.).

Daily allowances are paid for each day of a business trip according to the standards provided for the state where the employee is located at that moment. Moreover, per day of crossing the border when leaving Russia, per diem must be paid according to the standards established for the country to which the employee is sent, and when returning - according to Russian standards. The calculation becomes more complicated when an employee must visit several states at once during a business trip. Then the daily allowance for the days of crossing borders between these countries must be calculated according to the standards established for the state to which the business traveler is sent (letter of the Ministry of Labor of Russia and the Ministry of Finance of Russia dated May 17, 1996 No. 1037-IH).

For the day of crossing the border when leaving Russia, daily allowance must be paid according to the standards established for the country to which the employee is sent, and when returning - according to Russian standards

Before the trip, the business traveler is usually given an advance to cover upcoming expenses. To calculate the amount that needs to be issued for reporting, the accountant draws up an estimate of business trip expenses. The amount of daily allowance is determined based on the planned duration of the business trip and the expected dates of crossing the border.

The companies themselves decide in what currency and how to pay the advance. Some organizations give rubles to an employee so that he, as an individual, can buy currency at an exchange office. Others pay an advance in cash foreign currency. Still others issue the business traveler a corporate bank card. Please note: the Bank of Russia, in letter dated December 18, 2006 No. 36-3/2408, indicated that issuing money on account to employees by non-cash transfer of funds to their bank accounts is not provided.

Our information

Is an advance in foreign currency legal? The current version of the Federal Law of December 10, 2003 No. 173-FZ “On Currency Regulation and Currency Control” classifies as permitted currency transactions between residents for payment and (or) reimbursement of expenses of an individual associated with a business trip outside of Russia, as well as to repay the unspent advance issued to the business traveler (Clause 9, Article 9). But legislators have not made any additions to Article 14 of this law, which lists situations where organizations, as an exception, can make payments in foreign currency bypassing a bank account. The Bank of Russia, however, believes that companies can issue foreign currency to a business traveler in cash, since all irremovable doubts, contradictions and ambiguities of currency legislation must be interpreted in favor of residents and non-residents (letter dated July 30, 2007 No. 36-3/1381).