What documents are issued upon dismissal?

The list of documents that must be given to an employee on the day of dismissal is strictly regulated. It includes:

- work book – on paper or STD-R form;

- certificate of income and paid tax (formerly 2-personal income tax);

- extract from the SZV-M report;

- extract from the SZV-STAZH certificate;

- extract from section 3 of the RSV;

- Certificate in the form of the Social Insurance Fund upon dismissal - about earnings for 2 years before the year of leaving;

- Certificate of average earnings for the last 3 months - in case of dismissal due to layoffs or liquidation.

There are situations when an employee does not show up at work on his last day of work. In this case, he is sent a notice of the need to appear for documents or agree to have them sent by mail. To do this, use the option of a registered letter with acknowledgment of delivery.

Procedure for issuing an extract

The employer provides the dismissed employee with SZV-M and SZV-Stazh. The period of time indicated in the statements is:

- According to SZV-M, the month in which the dismissal was made. At the employee's request, the statement covers earlier periods. Due to the start of document formation in 2021, the employer can provide data only from the specified period.

- According to SZV-Experience, the period is from the beginning of the year of dismissal. Employees hired during the year receive an extract from the date of employment. Data is provided from 2021.

Documents are provided simultaneously with the settlement on the day of dismissal or termination of the GPC agreement. When an employee applies for statements after dismissal, accountants are given 5 days from the date of application to prepare the forms.

The purpose of the documents is to provide employees with personal information that allows them to determine the state of pension savings. Additionally, the information of insured persons is reflected in the personal accounts of the Pension Fund of the Russian Federation, allowing one to obtain data on length of service, points, and employer contributions. Despite the official registration of statements, the documents are not used for submission to the Pension Fund. The Pension Fund determines the calculations and savings of individuals based on the reporting of employers (

How to fill out SZV-M and SZV-STAZH for a dismissed person

In the event of termination of an employment contract with an employee, he is given the following personalized accounting information in the Pension Fund:

- SZV-STAZH – for the current year ;

- SZV-M – for the current month .

Important

Both forms are issued only with data on the resigning employee.

The SZV-STAZH form is filled out according to the usual rules - in accordance with the resolution of the Pension Fund Board of December 6, 2018 No. 507p. It must contain sections 1, 2, 3. Blocks 4 and 5 are completed only in case of a pension.

The registration procedure is as follows:

- Section 1 provides the policyholder’s identification data – TIN, KPP, registration number in the Pension Fund of the Russian Federation, company name;

- in section 2 indicate the year for which the form is submitted;

- in section 3 in the table indicate full name. the dismissed person, his SNILS, the period of work in the current year - starting from January 1 and ending with the date of dismissal.

In the SZV-M form, in accordance with the resolution of the Pension Fund Board dated 02/01/2016 No. 83p, all sections are filled out. It states:

- Section 1 – identification information about the policyholder;

- section 2 – month number and year for which the report was compiled;

- form type code in section 3 – ISHD;

- in section 4, in the tabular section, the full name, SNILS and TIN of the dismissed person are given.

If an employee requests in writing copies of other reports (for example, for earlier periods), the employer does not have the right to refuse him and is obliged to provide them.

How to submit information

Throughout the employee’s entire employment and until the employee’s dismissal, the company must regularly provide each employee with a copy of the individual information that was sent to the Pension Fund for the reporting periods during his employment.

This is interesting: Transfer to 18-digit Sberbank card numbers

It is important to remember that the following forms are used to submit information about insurance premiums:

- until 2014 and earlier - SZV-6-1, SZV-6-4;

- for 2014 - form RSV-1 PFR section 6.

On the day of dismissal, you must provide information for the reporting period up to the date of dismissal. If individual information for past periods has not been issued before, then it must be generated and provided to the employee for all past reporting periods.

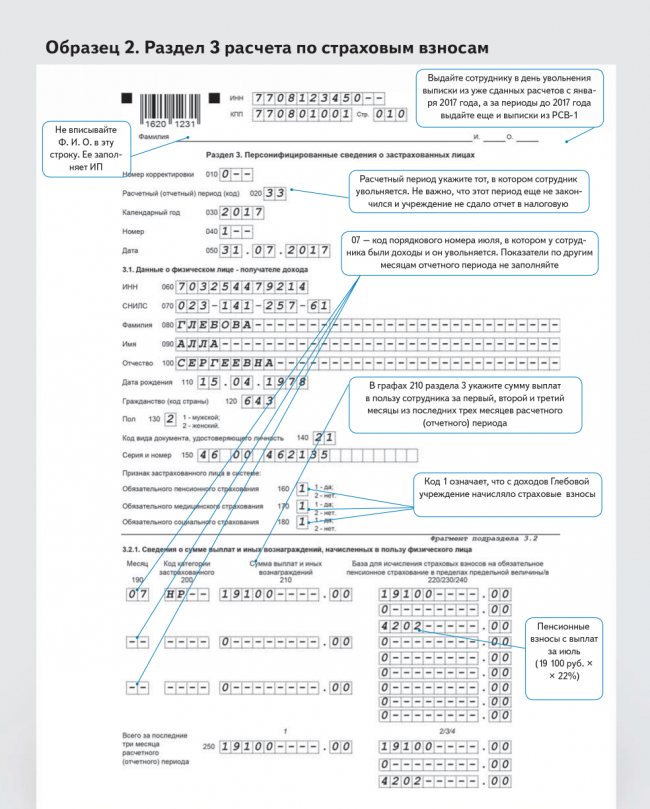

Registration of RSV upon dismissal

Upon separation, the worker is given a certificate of insurance premiums upon dismissal in the form of an extract from section 3 of the insurance premium calculation form.

Section 3 includes subsections 3.1 and 3.2. The first shows the employee’s identification data. And in subsection 3.2 - the amount of taxable income and the amount of contributions accrued to the Pension Fund - both at the basic and at the additional rate for the worked months of the current quarter.

Confirmation of document issue

The employer, in order to avoid questions from control authorities, must have documentary evidence of the fact that an extract of calculated and transferred contributions was issued. To confirm the issue, use any of the available options:

- Drawing up an extract in 2 copies. The recipient puts a corresponding mark on the employer’s copy of the document upon receipt.

- Maintaining a log of documents issued to an employee upon dismissal. The journal contains a column with the signature of employees confirming receipt.

- Acceptance of receipts from the dismissed employee indicating the documents received by the person from the employer.

Either the employee himself or a person with a notarized power of attorney has the right to receive documents upon dismissal. Other persons do not have the right to access personal information and receive documents upon dismissal, including statements of insurance premiums.

How to issue a certificate of earnings for 2 years

Another document that is provided to the leaving employee is a certificate in the Social Insurance Fund form upon dismissal about earnings for 2 years. It is drawn up on a form approved by Order of the Ministry of Labor dated April 30, 2013 No. 182n. It is necessary to calculate disability benefits for maternity leave at the next place of work.

It indicates in sections 1 the identification data of the policyholder and the insured (dismissed), respectively. In addition, section 3 provides the total amount of income from which contributions to VNiM are calculated. And in section 4 - information about periods of release from work with and without preservation of earnings, which are excluded from the calculation of average earnings for benefits.

Filling rules

All figures in the calculation are given for the reporting period on an accrual basis. Therefore, when filling out section 3, contributions transferred to state funds, even for dismissed employees, must be indicated. Indicators about such specialists previously had to be reflected in all quarterly reports for the year in which the employment relationship with the citizen was terminated.

Information about dismissed citizens is contained in the following columns:

- subsection 1.1 of Appendix 1 includes information on all accrued insurance payments from the beginning of the period represented by the calendar year;

- section 3, containing personal data about all persons for whom the head of the enterprise pays funds to the funds.

But after the dismissal of any person, transfers of funds to extra-budgetary funds stop. Therefore, in section 3 there is no need to fill out information about these specialists. Previously, representatives of the Federal Tax Service insisted that enterprise managers include information about former employees in subsection 3.1 by the end of the year.

But in 2021, the Federal Tax Service published letter No. BS-4-11/ [email protected] containing explanations about the rules for filling out the calculation. It is stated here that section 3 is intended to indicate data on all persons to whom funds were transferred during the reporting period.

For example , a citizen wrote a letter of resignation in March, but based on the results of the first quarter, he was awarded a bonus paid in April. Therefore, for the second quarter, when drawing up documentation, you need to indicate information about this specialist. This is due to the fact that he received income from the employer, and insurance premiums were also paid for him.

If a person is officially fired in March, and also does not receive any remuneration from the head of the company in the second quarter, then when filling out the DAM during this time, you do not have to indicate personal information about this employee. If an organization’s accountant makes mistakes when preparing a calculation, he will have to create updated forms.

What is the liability for failure to submit a zero report on insurance premiums?

In general cases, failure to submit or delay in sending a contribution calculation may result in the imposition of various sanctions by the tax authorities. But what happens if you don’t submit a zero calculation on time? Will a person be able to do without a fine in this case, since there are no charges involved? Answer: no, he can’t. The fine will be mandatory, the tax authorities will simply impose it in the minimum amount - 1000 rubles, as provided for in paragraph 1 of Art. 119 of the Tax Code of the Russian Federation.

Taking into account the above, an organization that does not pay any remuneration to individuals, like all others, must report to controllers on time. In addition, if you are more than 10 days late in submitting your report, the tax authorities will block the organization’s account—they have the right to do so.

Sources

- https://buhguru.com/strahovie-vznosy/strah-vznosy-razdel-3.html

- https://nalog-nalog.ru/strahovye_vznosy/edinyj_raschet_po_strahovym_vznosam/kak-zapolnyat-razdel-3-nulevogo-rascheta-po-strahovym-vznosam/

- https://www.klerk.ru/buh/articles/473528/

- https://nalog-nalog.ru/strahovye_vznosy/edinyj_raschet_po_strahovym_vznosam/kak_zapolnit_razdel_3_formy_rsv_po_uvolennym_sotrudnikam/

- https://reg-jurist.ru/bez-rubriki/kak-razolnit-rsv-s-dekretnitsami-v-2020-godu

Penalty for failure to provide documents upon dismissal

The government has already prepared large-scale tax changes for the 2nd half of 2021. Subscribe so you don't miss any changes:

When dismissing an employee, the employer is obliged to issue a significant list of documents, which include an extract on insurance premiums. The obligation to submit to the Pension Fund information about employees, length of service and other data necessary for granting a pension is established in Federal Law No. 27-FZ dated April 1, 1996. In paragraph 4 of Art. 11 of the Law provides for the issuance of information to an employee upon his dismissal.

What does the Federal Tax Service say?

The Federal Tax Service in letter No. ГД-4-11/ [email protected] dated 04/02/2018 reminded that all organizations without exception must submit the DAM no later than the 30th day of the month following the billing (reporting) period.

At the same time, the Tax Code does not provide for exemption from the obligation of the payer of insurance premiums to submit calculations in the event of the organization’s failure to carry out financial and economic activities. If the payer does not have payments and other remuneration during a particular billing period in favor of individuals subject to compulsory social insurance, such payer is obliged to submit to the tax authority within the prescribed period a calculation with zero indicators .

The same explanations were previously given by the Ministry of Finance in letter dated March 24, 2017 No. 03-15-07/17273.

In its latest letter, the Federal Tax Service explained specifically about section 3. It should exist!

Regardless of the activity being carried out, the following are required for completion by all payers of insurance premiums in accordance with the procedure for filling out the DAM: title page, section 1, subsections 1.1 and 1.2 to section 1, appendix 2 to section 1 and section 3 “Personalized information about insured persons” .

In personalized information about insured persons that does not contain data on the amount of payments and other remuneration accrued in favor of an individual for the last three months of the reporting (calculation) period, subsection 3.2 of section 3 of the calculation is not filled in .

In addition, the Federal Tax Service clarified some aspects of filling out section 3.

What is section 3 for and who fills it out?

In 2021, a new form of calculation for insurance premiums will be used. The form was approved by order of the Federal Tax Service. “Form for calculating insurance premiums from 2021.”

This reporting form includes section 3 “Personalized information about insured persons.” In 2021, section 3 as part of the calculation of contributions must be filled out by all organizations and individual entrepreneurs that have paid income (payments and rewards) to individuals since January 1, 2017. That is, section 3 is a mandatory section.

Who is required to report on insurance premiums and how?

Calculation of insurance premiums is submitted to the tax authorities by all organizations, without exception, and individual entrepreneurs who have concluded at least one employment contract or civil servants' agreement with individuals. It shows the amounts of contributions accrued for wages and other payments in favor of employees.

Reporting for periods starting from the 1st quarter of 2021 should be on the form put into effect by Order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11/ [email protected] The same order also establishes the Procedure for filling out the calculation. For periods up to and including 2021, the form from the Federal Tax Service order dated October 10, 2016 No. ММВ-7-11/551 was used.

The due date falls on the 30th day of the month following the reporting period. These include: first quarter, half year, 9 months, year.

You can send the report to the tax authorities on paper (in person, through an authorized representative, by mail) or electronically via TKS.

IMPORTANT! The choice of delivery method depends on the average number of employees of the policyholder. If it does not exceed 10 people, then you can choose any form of delivery. If the SSC is more than 10 people, then there is no choice - you need to submit the calculation electronically. This number limit is valid from 01/01/2020. Previously there were 25 people.

When is the zero calculation for insurance premiums due?

As already noted, the calculation is filled in with data on insurance premiums accrued from wages and other payments. However, it happens that salaries are not paid, for example, due to the suspension of activities. What to do in such a situation?

- Organizations must submit calculations in any case - whether they have payroll accruals or do not have them. It is believed that the company always has one insured person - the director. When the salary is not accrued or paid even to him, the report is filled in with zero indicators and sent to the tax authorities.

- Individual entrepreneurs working alone are not required to submit a zero calculation. However, if they have at least one unterminated employment contract, then they will have to report on contributions. At the same time, the entrepreneur’s employees may be on unpaid leave.

Based on all of the above, there may be several options for submitting zero settlements. Next, let's look at how to correctly draw up zero payments for contributions.

What sections should be included in the zero contribution sheet?

In the absence of payments in favor of individuals under employment contracts, civil process agreements, copyright, etc. and, accordingly, in the absence of digital indicators for insurance premiums, policyholders must include the following sections in the calculation:

- title page;

- Section 1 indicating code 2 in the “Payer Type” field - without any attachments to it;

- section 3 with zeros and dashes.

This is directly indicated in the order of filling out the calculation (clause 4.2) and is confirmed by the Ministry of Finance (see letter dated 10/09/2019 No. 03-15-05/77364).

Until 2021, there were more mandatory sheets. Subsections 1.1 and 1.2 of Appendix 1 to Section 1 and Appendix 2 to Section 1 were also required (letters of the Ministry of Finance dated April 16, 2019 No. 03-15-05/27074, dated February 13, 2019 No. 03-15-06/10549, Federal Tax Service dated November 16. 2018 No. BS-4-21/ [email protected] ). Now you can do without them.

The title page contains the details of the policyholder (TIN, KPP, name/full name, OKVED code, telephone numbers), and the tax authority accepting the settlement (code). It also reflects whether the original form or the corrective one is submitted (if necessary, the adjustment number), the reporting period and the year to which it relates.

All data is certified by the signature of an authorized person indicating the date of preparation or submission of the report.

Section 1 with all the subsections and appendices we have indicated will contain zeros on all lines with summative and quantitative indicators and dashes on the remaining familiarities. It is best to register the BCC in the fields provided for this in order to avoid problems with the generation of electronic reporting.