How to calculate vacation pay in 2021: according to the new law or the old one

The new law for calculating vacation pay in 2021 has not been adopted. Therefore, payments for vacation must be calculated according to the rules from Article 139 of the Labor Code of the Russian Federation and paragraph 4 of the Regulations approved by Decree of the Government of the Russian Federation dated December 24, 2007 No. 922. The general formula is as follows:

| Vacation pay amount | = | Average daily earnings for vacation pay | X | Number of calendar days of vacation |

The number of vacation days is indicated in the manager’s order on its provision. You must pay for all calendar days that fall during your paid vacation. But do not include non-working holidays in the number of calendar days of vacation (Article 120 of the Labor Code of the Russian Federation). Accordingly, do not accrue vacation pay for these days.

But for a day off that falls during the rest period, regular vacation pay should be accrued. Those days off that are postponed by the Government due to the fact that they coincide with holidays are also paid (Article 112 of the Labor Code of the Russian Federation).

For example, in 2021 such a day off is April 30, it was moved from Saturday April 28. Therefore, April 30 is a non-working day, but not a holiday. If an employee has a vacation on April 30, you must pay for this day

As for the average daily earnings, its size depends on the payments accrued to the employee and the number of days in the billing period.

What payments should be included in the calculation of average daily earnings for vacation pay in 2021

When calculating vacation pay in 2021, take all payments provided for by the wage system, both in kind and in cash. For example, such payments include wages, additional payments, and allowances for special working conditions.

There are no restrictions on the amounts of payments taken into account. But there is an exception for quarterly and annual bonuses. If they are paid for a period that has not yet been worked, then the amount must be divided in proportion to the days worked.

However, there are still payments that are not taken into account when calculating average daily earnings. These include amounts accrued from average earnings, as well as those not related to wages (clauses 3 and 5 of the Regulations). For example, financial assistance, payment for business trips, sick leave, vacation pay, travel allowance.

HIGHLIGHTS OF THE WEEK

05/24/20213:39 Business organization

The rules for issuing passports are changing - from July 1

24.05.202115:11

Personnel

We calculate salaries and advances for May 2021, taking into account non-working days

24.05.202110:00

Personnel

Foreign worker: when is a patent not needed?

24.05.202113:33

Business organization

Will compensation be paid for damage during forced evacuation of a car?

26.05.202111:04

Personnel

New rules for calculating sick leave will be introduced - from 2022

PODCAST 4.12.2020

What has changed in taxes and reporting since 2021?

All episodes

Comments on documents for an accountant

Do I need to take into account non-working days when calculating severance pay when reducing the number of employees?

05/31/2021 Upon termination of an employment contract due to the liquidation of an organization or a reduction in the number of...

Is a contract for the provision of medical services required for a deduction for treatment?

05/31/2021 To receive a social deduction for personal income tax, it is necessary that the medical organization that provided medical...

Federal Tax Service: compensation for food and housing for employees is subject to insurance contributions

05/30/2021 If I pay compensation for food and expenses for renting residential premises (apartments) for employees...

‹Previous›Next All comments

Calculation of sick leave in 2021

Example:

The employee is going on vacation for 7 calendar days from March 19, 2018. The amount of payments accrued to the employee for the billing period is 390,000 rubles, including travel allowances - 8,000 rubles, sickness benefits - 5,500 rubles. The accountant will calculate the average earnings from all payments, except for travel allowances and benefits. He will include 376,500 rubles in the calculation. (390,000 rub. – 8,000 rub. – 5,500 rub.).

How to determine the number of days in a billing period

The calculation period for calculating vacation pay in 2021 is 12 calendar months preceding the month the vacation starts. For example, if an employee goes on vacation in June 2021, the payroll period is from June 1, 2021 to May 31, 2021.

If the employee has not yet worked this full time because he was recently hired, the calculation period is from the date of his employment until the last day of the month that precedes the vacation.

The company can also set its own pay period if this does not lead to a worsening of the employee’s situation.

If the employee was not sick, did not go on vacation, etc., then the payroll period is considered to have been fully worked out.

If the employee was absent from the workplace or had excluded periods that were paid according to average earnings, the billing period was not fully worked out. In this case, the total number of calendar days in the billing period is calculated as follows:

| Number of days worked in the billing period | = | Number of calendar days in fully worked months | + | Number of calendar days in months not fully worked |

Determine the number of calendar days in months worked in full using the formula:

| Number of calendar days in fully worked months | = | Number of months fully worked | X | 29,3 |

Calculate the number of calendar days in incompletely worked months of the billing period as follows:

| The number of calendar days in a month that is not fully worked out | = | 29,3 | : | Total number of calendar days of the month not fully worked | X | number of calendar days worked in a given month |

Round the result to two decimal places. After this, add up the number of days in a fully worked month and the number of days in incomplete months.

Please note: if vacation is provided in working days, then vacation pay is different. The amount of payments for the billing period is divided by the number of working days according to the calendar of a six-day working week (Article 139 of the Labor Code of the Russian Federation).

Examples of calculating vacation pay in a new way in 2021

See examples of how to calculate vacation pay in 2021 if the employee worked the pay period fully or partially. Also look at how to calculate vacation pay if bonuses were given or salary increased during the billing period.

Calculation of vacation pay in 2021, if the billing period is fully worked out

When the billing period has been fully worked out, the average daily earnings should be calculated using the following formula:

| Average daily earnings for calculating vacation pay in 2018 | = | Amount of accounted payments accrued in the billing period | : | 12 | : | 29,3 |

Then the resulting value should be multiplied by the number of calendar days of vacation.

Example:

From July 9, 2021 A.V. Solovyova goes on vacation for 14 days. The billing period - from July 1, 2021 to June 30, 2021 - has been fully worked out. The amount of payments taken into account for the billing period is RUB 546,000. We will calculate vacation pay in 2021. Average daily earnings are 1552.9 rubles. (RUB 546,000: 12: 29.3). Thus, the amount of vacation pay will be 21,740.6 rubles. (RUB 1,552.9 x 14 days).

Calculation of vacation pay in 2021 if there were breaks in the billing period

If the employee did not work the entire pay period, calculate his average daily earnings as follows:

| Average daily earnings | = | Amount of payments accrued in the billing period | : | Number of days worked in the billing period |

Then multiply the resulting value by the number of calendar days of employee vacation.

Example:

From August 6, 2021 Y.S. Petrova goes on vacation for 14 calendar days. The billing period is from August 1, 2021 to July 31, 2021. Petrova did not work fully, as she was on leave without pay (from October 2 to October 8, 2017). The amount of payments for the billing period is 520,000 rubles. Let's calculate the amount of the employee's vacation pay. Petrova worked for 11 months in full, and for part of October. The number of calendar days worked in October is 24. The total number of days that the employee worked in the reporting period is 344.98 days. [(29.3 x 11 months) + (29.3: 31 days x 24 days)]. The average daily earnings for calculating vacation pay in 2018 is 1,507.33 rubles. (RUB 520,000: 344.98 days). The amount of vacation pay is 21,102.62 rubles. (RUB 1,507.33 x 14 days).

Calculation of vacation pay taking into account bonuses

If the calculated one is equal to a calendar year, no more than 12 monthly, four quarterly and two semi-annual bonuses can be included in the calculation of average earnings (if all bonuses were awarded for the same indicator).

If the bonus is paid for months that are not included in the billing period, then it will need to be distributed in proportion to the time worked in the billing period:

| Part of the prize | = | Full award amount | : | Number of working days in the billing period | X | Number of working days worked in the billing period |

Example:

The employee is going on leave in August 2021. From March 20 to March 30, 2018 (9 working days) he was sick. In the billing period, the accountant awarded the employee a bonus for fulfilling the plan in the 2nd quarter of 2018 in the amount of 3,000 rubles.

In the billing period from 08/01/2017 to 07/31/2018 - 247 working days. Of these, the employee did not work 9 working days. The part of the bonus proportional to the time worked is 2890.69 rubles. [3000 rub. : 247 workers days × (247 work days – 9 work days)].

Calculation of vacation pay taking into account salary increases

If salaries were increased during the billing period, vacation pay must be calculated according to special rules. A special provision for the calculation of vacation pay prescribes the indexation of earnings accrued before the salary increase. The point of indexation is that the employee should not lose money due to vacation.

If salaries or tariffs were increased during the billing period, all amounts accrued earlier must be adjusted. If after it, but before the start of the vacation, adjust the average earnings.

If changes occur while the employee is on vacation, the coefficient is applied to the portion of vacation pay accrued to him for the days after the promotion.

Please note that such rules only apply when salaries or rates increase throughout the organization. When rewarding one, several employees or a department, the actual accrued amounts are entered into the calculation of average earnings without adjustments.

Calculation example

From June 14, 2021, the employee goes on vacation for 28 calendar days. At the same time, from January 1, 2021, the salaries of all employees were increased. The employee's salary increased from 15,000 rubles. up to 18,000 rubles, that is, the conversion factor will be 1.2 (18,000 rubles: 15,000 rubles). The employee had no other payments other than wages. The billing period will include the time from June 1, 2017 to May 31, 2021. Moreover, during the billing period, the employee was already on vacation for 28 calendar days in the period from August 2 to August 29, 2021, inclusive. Thus, this month she worked three days, for which she was credited 1,400 rubles. The number of days to be taken into account will be 325.14 days. (11 months × 29.3 days + 29.3 days: 31 days × 3 days). The amount of vacation pay will be 17,195.79 rubles. [(RUB 15,000 × 6 months × 1.2 + RUB 1,400 × 1.2 + RUB 18,000 × 5 months): 325.14 days. × 28 days].

Vacation after six months of work: is it possible?

If an employee, having worked continuously for six months, demands to be allowed on paid leave, the employer does not have the right to refuse him . Since an employee can use his right to rest after six months of work.

But this case has its own characteristics:

- Each company has its own algorithm for employees to submit vacation requests, and usually a schedule is drawn up before this. Therefore, when requesting unscheduled leave after working for six months, you need to be prepared for the employer’s refusal. After all, another employee may have scheduled vacation.

- The usual length of leave is 28 days. But often the manager divides this figure into parts. This issue must be discussed with employees and agreed upon by both parties.

- If an employee quits after working for six months, the manager’s responsibility is to compensate him for unused vacation in cash.

- In the case where an employee, after working for six months, goes on vacation, and then quits without working for a year, upon dismissal he must compensate for the amount of vacation that was provided to him in advance.

- A minor employee can apply for leave without waiting for the expiration of 6 months.

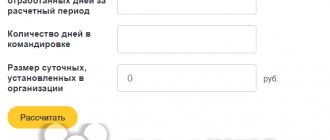

Vacation pay calculator from 2021

Vacation pay calculator is an online service with which you can quickly calculate the amount of vacation pay for your company's employees.

The vacation pay calculator makes calculations according to the rules of Article 139 of the Labor Code of the Russian Federation and the Regulations on the specifics of the procedure for calculating the average salary, approved. Decree of the Government of the Russian Federation dated December 24, 2007 No. 922.

If during the pay period the employee’s salary was increased or a bonus was paid, the calculator will help calculate vacation pay, taking these nuances into account.