Current as of February 13, 2021

If the overpayment was made for pension, medical or compulsory social insurance, then the application must be sent to the tax office.

A separate application must be completed for each type of contribution.

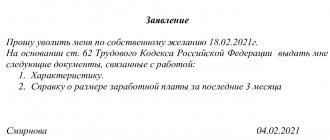

The application form may be as follows:

- paper - by personal delivery, mail

- electronic – through TKS, taxpayer’s personal account

If an overpayment of insurance premiums for accidents and injuries at work is established, then the application must be sent to the Social Insurance Fund. For return, form 23-FSS , for offset - 22-FSS .

The Social Insurance Fund has the right to unilaterally offset the overpayment against current debt or future payments.

Since 2021, the administration of contributions is carried out by the Federal Tax Service. To return amounts overpaid in 2021, you must contact the Inspectorate at the place of registration of the organization or registration of the individual entrepreneur. Until 2021, control over the calculation and payment of contributions to pension, health and social insurance was carried out by the Pension Fund and the Social Insurance Fund.

Refunds of contributions overpaid before 2021 are carried out by extra-budgetary funds. The exception is for contributions transferred in excess of accrued contributions to the compulsory pension insurance system. Before transferring the balances to the Federal Tax Service, the Pension Fund distributed the amounts to the personal accounts of the insured persons. Refunds of overpayments of pension insurance contributions are not made.

| Types of contributions | Until 2021 | From January 2021 |

| OPS | Pension Fund | Inspectorate of the Federal Tax Service |

| Compulsory medical insurance | Pension Fund | Inspectorate of the Federal Tax Service |

| FSS | FSS | Inspectorate of the Federal Tax Service |

| FSS for injury insurance | FSS | FSS |

Contributions for insurance from NS and PZ continue to be regulated by the FSS. Receipt of payments, offset of overpayments against arrears, return of overpayments and other settlement operations in 2021 are still carried out by the fund.

Documents of the Federal Social Insurance Fund of the Russian Federation for the transition period in 2021

Overpayment amounts incurred by the enterprise are subject to refund within established periods, depending on additional conditions:

- For overpayments in 2021, a period of one month has been established from the date of application to the Federal Tax Service for contributions and to the Social Insurance Fund for contributions to insurance from personal injury and personal injury.

- For contributions made to the funds before 2021, a refund period is established within 10 days from the date of application.

- For contributions until 2021 that were overpaid for VN and M, a refund is made after 10 days.

The company has 3 years from the date of payment to return the contribution.

Information on insurance premiums is consolidated on account 69 in the context of subaccounts opened by type of compulsory insurance.

- Dt 69 Kt 51 when paying the insurance premium. Amounts of overpayments at the enterprise are recorded as debit.

- Dt 51 Kt 69 upon return of the overpaid contribution.

Amounts of overpayments not taken into account in expenses when determining the taxable base are not included in non-operating income of the enterprise.

If there is a delay in the return of contributions from the Federal Tax Service or the Social Insurance Fund in terms of deductions for insurance from personal injury and personal injury, the enterprise has the right to present the amount of interest calculated on the amount of the overdue amount.

The amount of interest is calculated according to the standard formula for calculating penalties. To clarify the amount, you can use a calculator. Interest for late repayment of overpayments is calculated after the amount is received in the company's bank account. The amount of interest due to the company is not counted against subsequent payments or arrears.

Interest calculation example ⇓

- The number of days overdue for the refund of the overpayment is 10 days.

Interest is calculated from the day following the date of collection until the day of actual receipt. If the amount of contributions paid by the enterprise before 2021 is not returned on time from the funds, there is no possibility of claiming interest for the delay.

When a company has overpaid insurance premiums, it has the right to return the overpayment. However, the procedure for returning the overpayment will depend on the specific year in which the payments were made.

If the overpayment arose before 2021, then the payments were transferred to the Pension Fund and the Social Insurance Fund. And from 2021, the Federal Tax Service is responsible for insurance premiums.

Accordingly, if it is necessary to return an overpayment paid before 2021, then you will need to contact the funds, and if the overpayment arose for payments made from January 1, 2021, then you will need to submit an application to the tax authority.

Depending on the type of payment, it also depends where you should contact:

| Payment type | Until 2021 | From 2021 |

| OPS, compulsory medical insurance | Pension Fund | Federal Tax Service |

| FSS | FSS | Federal Tax Service |

Act of reconciliation of settlements with the Social Insurance Fund (form, sample application)

The purpose of forming a request is to agree on a reconciliation act for mutual settlements between the parties.

For reconciliation acts between counterparties, decryption is requested:

- In order to confirm business transactions, any of the interacting parties can request to sign a reconciliation report. Since the ability to make transactions without meeting with the counterparty, to send payments without visiting the bank, forms a significant volume of documents received by mail or courier. When preparing accounting and tax reporting, the document allows the accountant to be sure that all documents are reflected in the accounting.

- In order to comply with the accounting rules (PBU), adopted by Order No. 34 of the Ministry of Finance of the Russian Federation on July 29, 1998 (as amended on March 26, 2007 No. 26n), which oblige organizations to clarify the volume of property and liabilities before submitting annual reports. Calculations are classified as mandatory for inventory.

- To confirm the fact of the counterparty's debt. Every creditor wants to be sure that the debtor remembers the debt and is ready to pay. According to the judges, the reconciliation act is not unambiguous evidence of the existence of a debt, but it can become an additional resource in a dispute with the debtor. In addition, the act extends the limitation period - if it exists, the limitation period begins to be calculated not from the date of the transaction, but from the date of signing the act (Resolution of the Presidium of the Supreme Arbitration Court, No. 13096/12 of 02/12/2013).

A request for the current status of settlements with the Federal Tax Service and extra-budgetary funds is made in order to:

- Return of excess funds transferred and stored in the accounts of the inspection or fund of the organization.

- Identification of arrears in taxes and contributions in order to pay off the debt and eliminate the possibility of accrual of fines and penalties.

- Identifying discrepancies in the accounting data of the organization and the fund or inspection in order to identify and correct errors of one of the parties.

The certificate in question reflects:

1. General information about the document, the payer of contributions:

- full name of the territorial structure of the Social Insurance Fund that issued the document;

- name of the certificate;

- date of preparation, document number;

- name of the company paying the contributions, its registration number, subordination code, INN, KPP, address.

2. Formulations reflecting the essence of the FSS response: that as of the date requested by the policyholder, there is one or another state of the insurer’s settlements.

The corresponding indicators are reflected in the table, which indicates:

1. Names of payments. They can be presented:

- contributions to compulsory insurance, which pays sick leave and maternity leave;

- contributions to compulsory insurance, which pays compensation for incidents at work and occupational diseases;

- fines and penalties for violations of the requirements of the legislation of the Russian Federation on insurance.

2. Total amounts of payments listed above.

3. BCC for each of the payments indicated above.

4. Indicators reflecting the state of mutual settlements between the employer and the Social Insurance Fund for each payment. These mutual settlements are considered in the context of:

5. The total amount of debt or, conversely, overpayment of penalties, fines and contributions to the Social Insurance Fund as of the date of sending the request to the Social Insurance Fund.

The certificate is certified by the head of the territorial structure of the Social Insurance Fund or his deputy, as well as its seal. The full name and telephone number of the specialist who compiled the document are indicated.

The required application details are:

- Name and details of the organization sending the request (TIN, address, telephone numbers).

- Purpose of payments and period of their making, which are subject to reconciliation.

- It is a desirable option to receive a prepared report (the applicant can receive a paper version of the report in person or by mail).

- Date of the application.

- Full name and contact details of the official responsible for the request and reconciliation.

The procedure for submitting a request to the FSS is regulated by Federal Law No. 243 of July 3, 2016. The request form can be arbitrary, or it can be focused on the application form to the Federal Tax Service (Appendix No. 8 to Order of the Ministry of Finance of the Russian Federation dated July 2, 2012 No. 99n).

The tax office for policyholders is the same counterparty as other third-party organizations. Consequently, you will have to reconcile mutual settlements with the Federal Tax Service as often as with business partners. However, sending a reconciliation report to the Federal Tax Service or the Social Insurance Fund (for contributions for injuries) is not enough. To obtain information from state and extra-budgetary bodies, you should act differently:

- Prepare your request in the prescribed form. The current application form for the provision of information about SV is available for download below.

- Submit your request to the Federal Tax Service. It is acceptable to submit the application in person, by mail, or by sending a request through the taxpayer’s personal account.

- Get an answer: a certificate about the status of insurance premium payments (the document form is presented below).

- Conduct an independent data check: compare the indicators of the certificate received and the accounting and reporting data for the reporting period.

- Identified errors in the organization's accounting should be corrected in the prescribed manner. If there are disagreements, you should contact the Federal Tax Service for advice and clarification.

Note that the organization of settlements for the Pension Fund of the Russian Federation is carried out in a similar manner. However, the form of the request to the Pension Fund of the Russian Federation differs from the form sent to the Federal Tax Service.

A written request is drawn up in accordance with the rules of record keeping: in an official style, in a respectful manner, indicating regulations and details of the parties.

- The request letter is drawn up on the organization’s letterhead, containing the name and all details.

- An already prepared reconciliation report may be attached to the letter. In this case, the letter must indicate the attachments.

- The presence of data from the second party in the letter will allow you to uniquely identify the addressee.

- A polite address to the head of the organization (indicating the position) will increase the degree of trust and loyalty of the counterparty.

- The essence of the request should be stated clearly and in detail.

- The applicant’s request will sound more convincing if the letter contains a link to the contract, its specific clause indicating the obligation to sign the reconciliation report.

- Specifying a time frame for responding to a request may be of particular importance. This is important in 3 cases:

- when the presence of a reconciliation report is specified in the accounting policy;

- the contract specifies the periods for reconciliation;

- There are industry regulations for reconciliations.

- The appeal is signed by the manager (or the official replacing him with reference to the relevant order), since only the manager is vested with the right to conduct correspondence on behalf of the legal entity.

Example of a letter text for a business partner:

Due to the need to carry out an inventory of payments (Regulations on accounting and financial reporting in the Russian Federation), we are sending to you a reconciliation report No. 267 dated 04/02/2018. for the period from January 1, 2018 to January 31, 2018.

We kindly ask you:

- until April 10, 2021, confirm the debt of Rassvet JSC under agreement No. 15/18 dated January 12, 2017. in the amount of 15,477.60 rubles by letter addressed to the General Director of Perekrestok OJSC;

- sign the act of reconciliation of mutual settlements;

- before April 10 inclusive, return the document to the address: Kolomna, Pervomaiskaya St., 16, office 402.

In accordance with the Civil Code of the Russian Federation, in the absence of a response and declared disagreements, the settlement balance will be considered confirmed.

Appendix 1. Reconciliation report of mutual settlements No. 267 between Rassvet JSC and Perekrestok JSC for the period from January 1, 2018 to March 31, 2018.

Application to the Social Insurance Fund for reconciliation of calculations - sample

As noted above, the application to the Federal Tax Service for reconciliation of calculations is drawn up in free form, but for the convenience of its execution, we can recommend using the same application that is sent to the tax office for reconciliation of tax payments. The form of this application was approved by order of the Ministry of Finance of the Russian Federation dated July 2, 2012 No. 99n, but certain adjustments can be made to it and sent to the Social Insurance Fund. Thus, the application should reflect the following:

- information about the territorial body of the Social Insurance Fund;

- information about the organization that pays insurance premiums;

- text of the request (what exactly is required from the FSS);

- date, signature, contact details.

For clarity, we offer you statements on our website.

The deadline for responding to such a request, like the form itself, is not fixed by any legislative act of the Russian Federation. However, as a rule, FSS specialists do not delay the reconciliation for long and carry out it within 10 days. This is due to the fact that for such an action as informing the payer about the presence of an overpayment, the above period is allotted, and therefore they also try to reconcile calculations during this period.

After carrying out the work processes for the operation in question, employees of the FSS body send a statement of reconciliation of calculations to the organization according to the form established by the FSS order dated February 17, 2015 No. 49.

Reconciliation report with the Social Insurance Fund: how to submit an application and its sample

In accordance with Federal Law dated July 3, 2016 N 250-FZ, the powers to administer insurance contributions to the FFS and the Pension Fund of the Russian Federation have been transferred to the tax inspectorate .

There is no approved form for requesting a reconciliation with the Social Security Fund. When drawing up an application, it is allowed to use any similar document as a sample, including the application form on the status of settlements with the Federal Tax Service of the Russian Federation, which is contained in Appendix No. 8 to Order of the Ministry of Finance of the Russian Federation dated July 2, 2012 No. 99n.

The draft order on new forms contains 20 annexes. Some document forms are intended to be filled out by policyholders, others are provided for the Social Insurance Fund. Employers are already familiar with most of them. The forms and the procedure for filling them out have simply been modified to take into account current and new rules. They are expected to be more convenient to use.

Three appendices to the draft order set out the procedure for filling out the corresponding register form:

- No. 16 – for benefits for temporary disability, for pregnancy and childbirth, a one-time benefit for women who registered for pregnancy in the early stages;

- No. 18 - on payments of benefits at the birth of a child;

- No. 20 - for information for assigning a monthly child care allowance.

First of all, employers who transmit information for the assignment of benefits electronically will be faced with the new rules for registering.

According to the draft order, for employees the list of documents required for payment of benefits will remain the same, with the exception of the application. If the proposed version of the order is approved in published form, the employee will no longer write an application for benefits. The employee will only need to provide documents or information that the employer does not have, but is necessary to assign the payment.

And for employers, the documents for paying benefits in 2021 will change if the draft FSS order with new forms is approved.

Below we will consider the forms proposed by the project.

The employer fills out a form with information about the insured person (Appendix No. 2), which actually replaces the previous application. This is a new form that indicates:

- personal data of the benefit recipient (full name, date of birth, TIN, SNILS, identification document details, registration address and actual place of residence);

- the method of receiving the due amount of benefits (to a bank account, by postal order or through another organization), account or card details.

After checking the accuracy of the information, the applicant (employee) puts his signature and date of completion. Next, the information is certified by a representative of the organization (employer) with his signature, with a description of the position and indicating the date, phone number and email. policyholder's mail.

What documents should the policyholder submit to the Social Insurance Fund:

- when sent electronically, the appropriate register is submitted - for disability benefits, pregnancy and childbirth and in case of early registration in connection with pregnancy (Appendix No. 15 to the draft order), at the birth of children (Appendix No. 17), or for child care before 1.5 years (Appendix No. 19), filled out according to the data from the form/forms for the insured person/persons;

- for paper documents - an inventory (Appendix No. 3), information about the insured person (Appendix No. 2) and supporting documents (sick leave, certificates, work book or extract from the ETC).

Documents must be transferred to the Fund as before - within 5 days from the date of receipt of them from the employee.

The FSS, having reviewed the documents for the benefit, will transfer the accrued amount to the recipient within 10 days. Or, if there are grounds, it will send to the employer:

- notice of submission of missing documents and information (Appendix No. 6);

- notice of amendments to the certificate of incapacity for work (Appendix No. 7);

- decision to refuse to grant temporary disability benefits (Appendix No. 8).

The policyholder is given 5 working days to provide the missing information to the Social Insurance Fund.

Refund of overpayment of insurance premiums in 2021: sample application for 2021

If it is necessary to recalculate the previously accrued amount, an application must be filled out indicating the reason for the corrections (according to the form from Appendix No. 1). It is signed by both the recipient of the benefit and the representative of the policyholder. This is a new form for employers.

If the right to child care benefits is terminated, the company is obliged to notify the Fund about this in the form from Appendix No. 4.

10:47 July 11, 2011 The Social Insurance Fund launched a system of direct transfer of benefits

- Balance sheet

- Certificate of average earnings to determine the amount of unemployment benefits (scholarships)

- Tax return for tax paid in connection with the application of the simplified taxation system

- Income statement

- Calculation of insurance premiums

- Payment statement

- Receipt cash order

- Certificate confirming the main type of economic activity

Since 2021, the fiscal service has assumed responsibilities for monitoring the accrual and payment of insurance premiums, and therefore the amounts of contributions accrued for reporting periods after 01/01/2017 are subject to payment to the accounts of the Federal Tax Service.

The FSS bodies retained the right to control the repayment of debt on contributions accrued for reporting periods up to December 31, 2017 inclusive. Also, fines and penalties accrued for debts before 01/01/2017 should be paid to the Social Insurance Fund accounts.

Due to innovations in legislation, the procedure for reconciling mutual settlements with regulatory authorities on insurance premiums depends on the period of such reconciliation.

If the payer is reconciled regarding discrepancies in the period before 01/01/2017, then in this case the reconciliation report should be requested from the FSS authority (form 21-FSS). Reconciliation of calculations after 01/01/2017 is carried out on the basis of the Federal Tax Service Regulations, approved by Order No. SAE-3-01/444 dated 09/09/2005.

Below is an algorithm of actions according to which a business entity can carry out a reconciliation with the Social Insurance Fund based on calculations for the period before 01/01/2017.

Reconciliation of insurance premiums in 2021

If the payer is reconciling payments accrued for the period from January 1, 2017, then to obtain a reconciliation report, the organization should contact the Federal Tax Service at the place of registration.

The procedure for reconciliation with the fiscal service corresponds to the mechanism for reconciling settlements with the Social Insurance Fund:

- Before reconciliation begins, the payer submits an application to the Federal Tax Service.

- Based on the application, the Federal Tax Service generates a reconciliation report in 2 copies and sends it to the payer (the form for a reconciliation report with the Federal Tax Service can be downloaded here ⇒ Reconciliation report with the Federal Tax Service (form) ).

- After receiving the act, the payer enters his data into it and transfers one copy to the fiscal service.

- If there are discrepancies, the parties continue reconciliation based on supporting documents.

- After eliminating the discrepancies, the parties sign an updated act, after which the reconciliation is considered completed and the calculations are approved.

How to return overpayment of insurance premiums from the tax office in 2021

The first stage of mutual settlements with social insurance authorities is the payer’s request for a reconciliation report by drawing up a corresponding application.

The current legislation does not contain an approved form, in accordance with which a business entity must submit a request to the Social Insurance Fund. Therefore, the payer of contributions can fill out an application in free form, indicating the following information:

- name of the Social Insurance Fund body, address, full name and position of the head in whose name the application is submitted;

- information about the applicant (name of organization, legal address, TIN, KPP, registration number, full name, position of manager);

- date of reconciliation of balances (“Please reconcile as of ____);

- the desired form of receiving the reconciliation report (postal delivery/receipt at the FSS office through a personal visit by the payer);

- date of application.

After registration, the document is signed by the head and sealed with the seal of the organization. Also, a request to the FSS for reconciliation can be issued in the form of a letter with an outgoing registration number and date.

To carry out reconciliation, the payer of contributions should submit applications to the territorial body of the Social Insurance Fund with which the organization is registered (in the general order - Social Insurance Fund in accordance with the legal address).

The application can be submitted to:

- personally visiting the FSS;

- by mail, having issued a letter with notification and an inventory of the attachment at the nearest Russian Post office.

The date of the payer’s application to the Social Insurance Fund is the date indicated by the Fund employee at the time the application was accepted.

Responsibilities for monitoring budget payments are usually assigned to the chief accountant. It is necessary to have information about debts on taxes and fees in order to:

- Avoiding the accrual of penalties, fines, blocking of bank accounts and other tax administration measures. It is known that even a minor error in a payment order (for example, an incorrectly specified BCC) leads to arrears.

- Providing information to counterparties, founders, investors and other interested parties.

- Reimbursement of overpaid amounts.

The request is made in the following forms:

- reconciliation act (expanded document);

- certificate on the status of settlements with the budget;

- discharge;

- certificate of fulfillment of the obligation to pay taxes.

The document indicates all taxes that the company accrues and pays. So, if you need to make a request to provide a reconciliation report to the tax office for property tax, order a general report or an extract of transactions for settlements with the budget indicating the BCC of this tax.

The application is drawn up on paper in the form of a letter, which indicates the details of the company and the date on which it is required to generate data on the debt. The more common format is electronic, when the request is created in the data exchange program with the Federal Tax Service. The response will be sent within five working days. The Inspectorate does not have the right to refuse to provide such information.

The request contains the required details:

- name of company;

- TIN, checkpoint;

- legal address;

- date of generation of the debt report;

- type of document (extract, certificate of settlement status, certificate of fulfillment of obligations to pay taxes and fees, or reconciliation report);

- FULL NAME. and signature of the manager;

- seal.

For electronic document management, you only need to indicate the response form code in the appropriate field or select a type from the list.

Reconciliation with the Social Insurance Fund: how to complete it, reconciliation report form

Due to innovations in legislation, the procedure for reconciling mutual settlements with regulatory authorities on insurance premiums depends on the period of such reconciliation.

If the payer is reconciled regarding discrepancies in the period before 01/01/2017, then in this case the reconciliation report should be requested from the FSS authority (form 21-FSS). Reconciliation of calculations after 01/01/2017 is carried out on the basis of the Federal Tax Service Regulations, approved by Order No. SAE-3-01/444 dated 09/09/2005.

Below is an algorithm of actions according to which a business entity can carry out a reconciliation with the Social Insurance Fund based on calculations for the period before 01/01/2017.

Step 1. Drawing up an application for reconciliation

The first stage of mutual settlements with social insurance authorities is the payer’s request for a reconciliation report by drawing up a corresponding application.

The current legislation does not contain an approved form, in accordance with which a business entity must submit a request to the Social Insurance Fund. Therefore, the payer of contributions can fill out an application in free form, indicating the following information:

- name of the Social Insurance Fund body, address, full name and position of the head in whose name the application is submitted;

- information about the applicant (name of organization, legal address, TIN, KPP, registration number, full name, position of manager);

- date of reconciliation of balances (“Please reconcile as of ____);

- the desired form of receiving the reconciliation report (postal delivery/receipt at the FSS office through a personal visit by the payer);

- date of application.

After registration, the document is signed by the head and sealed with the seal of the organization. Also, a request to the FSS for reconciliation can be issued in the form of a letter with an outgoing registration number and date.

Step-2. Submitting an application to the FSS

To carry out reconciliation, the payer of contributions should submit applications to the territorial body of the Social Insurance Fund with which the organization is registered (in the general order - Social Insurance Fund in accordance with the legal address).

The application can be submitted to:

- personally visiting the FSS;

- by mail, having issued a letter with notification and an inventory of the attachment at the nearest Russian Post office.

The date of the payer’s application to the Social Insurance Fund is the date indicated by the Fund employee at the time the application was accepted.

Step-3. Formation of a reconciliation report and its transfer to the payer

Within 5 working days from the date of application, FSS employees are required to generate a reconciliation report and submit it to the payer.

The mutual settlement act is drawn up on form 21-FSS and contains the following details:

- full name of the FSS body;

- information about the payer (full name of the organization/full name of the individual entrepreneur, registration number of the payer in the Social Insurance Fund, code of subordination, location of the organization/address of the individual entrepreneur);

- Full name of officials from the Social Insurance Fund and the payer;

- reconciliation period (“from ___ to ___, as of _____”).

Refund of overpaid insurance premiums in 2021

Without exception, all issues directly related to the formation of the type of reconciliation report under consideration are reflected in the legislative norms.

To understand and correctly interpret, some terms used in regulatory documents should be clarified. In the absence of understanding of basic concepts, there is a high probability of misinterpretation.

As a result, errors are made in the formation of appropriate insurance premiums. The list of terms includes:

- body for monitoring the payment of insurance premiums;

- petitioner;

- registration number;

- Act of reconciliation;

- payer of insurance premiums;

- reporting period;

- method of obtaining documents.

| "Body of control over the payment of insurance premiums" | This usually means the Social Security Fund in the situation under consideration. But at the same time, it is important to remember that the specific coordinates of a certain regional unit must be indicated directly in the act. This point must be indicated in the header of the act in question. |

| "The Petitioner" | It is necessary to indicate in the document exactly the name of the specific enterprise, legal entity/individual making the data request. Moreover, it is necessary to indicate the corresponding legal name of the enterprise. It is important to indicate data from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs |

| "Registration number" | This is a specific code that is necessarily assigned to each enterprise that makes regular contributions to the Social Insurance Fund for its employees. The fund itself has a specific register of such enterprises. Typically, such information (registration number) is available from the company making the payments. If it is not available, you must contact the regional Social Insurance Fund at the place of registration of the legal entity, individual entrepreneur |

| "Act of reconciliation" | A special document that includes information about all kinds of contributions to the Social Insurance Fund. Such an act allows you to simultaneously solve an extensive list of various problems. |

| "Insurance premium payer" | An employer making appropriate contributions to the Social Insurance Fund for its employee |

| "Reporting period" | A certain period of time for which the insurance payment is calculated. It is this period of mandatory deduction that is indicated in the reconciliation report |

| "Method of obtaining documents" | This section is present directly in the act itself. Indicates the method of receiving the corresponding deductions. This action can be carried out by mail or in person by visiting the relevant FSS branch |

Today, the FSS reconciliation act allows you to simultaneously solve a large number of different problems.

First of all this:

| It is possible to check reports | Financial for the presence of any errors by reconciling data from the act and directly from the documents of the payer himself |

| Streamlining reporting | Data systematization |

| Troubleshooting | — |

That is why it is necessary to familiarize yourself in advance with all the nuances of calculating the base for contributions to the Social Insurance Fund. Late payments or underpayments may be grounds for imposition of a fine or other administrative liability.

Figuring out how to request the balance of the reconciliation report with the Social Insurance Fund is not difficult. But it is advisable, if possible, to first study the regulatory documents regarding the work of this institution.

It includes the following main sections:

| station No. 3 | Which institutions are responsible for monitoring deductions of this type? |

| station No. 4 | What is the procedure for calculating the duration of deadlines? |

| station No. 5 | Who exactly is obliged to make contributions to the Social Insurance Fund, the main characteristics of the payer |

| station No. 6 | The algorithm for accounting for contribution payers of this type is reflected. |

| station No. 7 | What is meant by object for calculating the amount of insurance deduction |

| station No. 8 | What is included in the calculation base |

| station No. 9 | What amounts should not be included in the base for the relevant calculations? |

| station No. 10 | What do reporting and billing periods mean? |

| station No. 12 | What does the tariffing of basic contributions look like? |

| station No. 18 | Fulfillment of obligations to pay contributions of this type |

| station No. 19 | How and when will collection of arrears take place? |

| Art. No. 28 | What rights and responsibilities do insurance premium payers have? |

| station No. 33 | The process of checking the contribution payer, all possible procedures related to this |

| station No. 34 | How and when a desk audit is carried out |

There are many different nuances associated with the procedure for drawing up a reconciliation report with the Social Insurance Fund databases. There are some features.

At the moment, in contrast to the reconciliation act itself, an application for its receipt can be drawn up in free form. Moreover, the document itself can be either written by hand or printed using technical means.

: reconciliation report, if the supplier and buyer are one person

The easiest way is to download a ready-made format from the Internet and enter the appropriate data in the fields. But it is important to remember some significant nuances. First of all, a certain list of data must be present in this act.

Required details include the following:

| Full name of the enterprise | Applicant – indicated in the relevant register |

| Registered | individual tax number; budget classification code; reason code for registration |

| In whose name the corresponding application is written | position of a specific person; name of the fund, regional unit; last name, first name and patronymic of the official; name of the petitioning enterprise; registration number of the insurance premium payer; permanent location address; contact information (phone number, email, etc.) |

| Individual outgoing number | — |

| departure date | The statement itself |

| Title of the document | Request for reconciliation of accounts based on the act |

| In the body of the document | The request is generated directly |

| Signatures of officials are affixed with a transcript | director (executive/general); chief accountant |

It is important to remember that the list of persons entitled to send relevant documents is limited. They are indicated in the list above.

Moreover, along with the power of attorney, you will need to submit a document certifying the identity of the specific representative. Otherwise, the application for the submission of the relevant act will simply not be accepted.

All the nuances associated with submitting an application for an act to the Social Insurance Fund must be studied in advance. Otherwise, you will need to compose it again. Which threatens to waste time.

How to request a reconciliation report of mutual settlements with the Social Insurance Fund (SIF)?

It is important to understand that this kind of document does not have a specific form in law. This means that payers will fill it out on their own. A sample document can be downloaded here ˃˃˃

In order to obtain information from the fund, you need to request the following documents from it:

Get 267 video lessons on 1C for free:

- A certificate of existing insurance premiums and fines. Here you can see whether the company has an overpayment or debt to the fund;

- The settlement status will tell you about all payments made.

To carry out reconciliations, you must first write an application. Its structure is not provided for by law, but must contain certain columns. In other words, the application for reconciliation with the Social Insurance Fund does not have a specific sample, but it must contain some information:

- Contributions and codes for them must be written down. Otherwise, the verification will be carried out in full on all available contributions;

- the application must also contain information about the payer: full name, tax identification number, checkpoint, registration number, subordination code;

- inside the application the request itself and the requirement for reconciliation are described;

- Such a document must be signed either by the head of the organization or the chief accountant:

Instead of providing information about contributions that need to be verified, you can add an appendix with this information to your application. It is thanks to it that the reconciliation process can be significantly simplified and accelerated.

You need to know that to submit this type of document, the payer must contact the Social Insurance Fund at the location of the organization. You must bring the application in person to the fund’s employees or send it electronically.

There is no specific deadline for the transfer of information in the legislation. But if a debt is discovered from a company, the FSS is obliged to notify the payer about it within ten days. The answer is provided in the form of a Reconciliation Report:

This document contains all the information on contributions to the Social Insurance Fund. Fund employees have the right to send the act by mail or hand it over personally to the payer.

Then, when all the information matches the data from the payer and the Social Insurance Fund, the reconciliation is considered completed. If there are differences, the organization faces a lengthy process of rechecking and correcting its data.

According to the legislation regulating the sphere of insurance premiums, it is possible to reconcile settlements with the Social Insurance Fund.

IMPORTANT! This event is carried out in order to identify the presence of overpayments or underpayments of insurance payments in terms of contributions for temporary disability and in connection with maternity (VNiM), as well as contributions for industrial accidents (AS).

This check can be initiated by any of the parties - both FSS specialists and employees of the organization responsible for performing this work. According to the unspoken rule, such reconciliation is carried out quarterly immediately after submission of reports (4-FSS).

From January 1, 2021, the function of administering insurance payments in terms of VNIM contributions was transferred to the tax authorities, and therefore all issues regarding the reconciliation of such calculations must be resolved with this department. However, reconciliation for 2016 is still carried out with the Social Insurance Fund, which is what the tax authorities pointed out, recommending that this exercise be carried out in order to avoid unnecessary questions.

A sample application to the Social Insurance Fund for reconciliation of calculations will be presented below, but it is worth immediately noting that its form is not approved by law, and therefore such a document is drawn up in free form. To reconcile calculations, it is enough to send an application to the appropriate branch of the Social Insurance Fund.

As noted above, the application to the Federal Tax Service for reconciliation of calculations is drawn up in free form, but for the convenience of its execution, we can recommend using the same application that is sent to the tax office for reconciliation of tax payments. The form of this application was approved by order of the Ministry of Finance of the Russian Federation dated July 2, 2012 No. 99n, but certain adjustments can be made to it and sent to the Social Insurance Fund. Thus, the application should reflect the following:

- information about the territorial body of the Social Insurance Fund;

- information about the organization that pays insurance premiums;

- text of the request (what exactly is required from the FSS);

- date, signature, contact details.

For clarity, we offer you statements on our website.

The deadline for responding to such a request, like the form itself, is not fixed by any legislative act of the Russian Federation. However, as a rule, FSS specialists do not delay the reconciliation for long and carry out it within 10 days. This is due to the fact that for such an action as informing the payer about the presence of an overpayment, the above period is allotted, and therefore they also try to reconcile calculations during this period.

After carrying out the work processes for the operation in question, employees of the FSS body send a statement of reconciliation of calculations to the organization according to the form established by the FSS order dated February 17, 2015 No. 49.

Why do they reconcile settlements with the Social Insurance Fund?

According to the legislation regulating the sphere of insurance premiums, it is possible to reconcile settlements with the Social Insurance Fund.

IMPORTANT! This event is carried out in order to identify the presence of overpayments or underpayments of insurance payments in terms of contributions for temporary disability and in connection with maternity (VNiM), as well as contributions for industrial accidents (AS).

This check can be initiated by any of the parties - both FSS specialists and employees of the organization responsible for performing this work. According to the unspoken rule, such reconciliation is carried out quarterly immediately after submission of reports (4-FSS).

From January 1, 2021, the function of administering insurance payments in terms of VNIM contributions was transferred to the tax authorities, and therefore all issues regarding the reconciliation of such calculations must be resolved with this department. However, reconciliation for 2016 is still carried out with the Social Insurance Fund, which is what the tax authorities pointed out, recommending that this exercise be carried out in order to avoid unnecessary questions.

A sample application to the Social Insurance Fund for reconciliation of calculations will be presented below, but it is worth immediately noting that its form is not approved by law, and therefore such a document is drawn up in free form. To reconcile calculations, it is enough to send an application to the appropriate branch of the Social Insurance Fund.