How to calculate travel expenses

Editorial

Promdevelop editorial team

A business trip (SB) is a trip by an employee for the purpose of performing official duties in a territory other than the permanent place of work, by order of the employer.

During the period of stay in the insurance company, the employee retains his position, and the average earnings are calculated for the days spent away from his permanent place of work. Material costs are required to be reimbursed by the legal entity/individual entrepreneur within the framework provided for by the current legislation of the Russian Federation.

Thus, travel expenses (TC) represent costs on the part of the employer associated with the reimbursement of material costs to one or more persons incurred by them while carrying out an official assignment outside the main place of work. Expenses subject to reimbursement are prescribed by law. Below we will discuss how to calculate travel allowances in 2021.

Regulatory framework

- “Labor Code” of the Russian Federation (Articles: 166, 167, 168, 310).

- “Tax Code” of the Russian Federation (Articles: 217, 264, 422).

- Decree of the Government of the Russian Federation “On the peculiarities of referral to the UK” number 749, dated 10/13/2008.

- Decree of the Government of the Russian Federation “On Amendments to Certain Acts of the Government of the Russian Federation” No. 1595, dated December 29, 2014 regarding the amendment to the issue of the need to issue a special certificate for travel.

- Decree of the Government of the Russian Federation “on the specifics of the procedure for calculating the average salary” numbered 922, dated December 24, 2007.

Important! Based on Resolution No. 1595, from January 2015, the issuance of a special certificate confirming the date of arrival at the destination and, accordingly, departure from the destination. Since the beginning of January 2015, a similar confirmation is a ticket confirming travel on public transport (plane, bus, train), which indicates the date and time of arrival/arrival.

Ministry of Labor: terms of payment of average earnings during a business trip

The Ministry of Labor of Russia, in letter No. 14-1/OOG-4422 dated June 27, 2019, notes that the terms for payment of average earnings for seconded employees should be similar to the terms for payment of wages under an employment contract.

Average earnings during the business trip

A business trip is an employee’s trip to another location to carry out an official assignment outside the place of his permanent work by decision of the employer.

In accordance with Articles 167 and 168 of the Labor Code, an employee sent on a business trip is entitled to a number of compensations. The employer must:

- maintain a permanent job;

- pay remuneration;

- pay expenses associated with the trip (per diems, rental costs, travel expenses, etc.).

For the period of a business trip, the employee is paid the average salary (clause 9 of the Regulations on business trips, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749).

In this case, the calculation is carried out only for working days according to the schedule established at his permanent job.

In any work mode, an employee’s average earnings are calculated based on the actual accrued salary and actual time worked for the previous 12 months. At the same time, all types of payments provided for by the remuneration system and used by the company are taken into account, regardless of their source.

Example. Calculation of average earnings for the period of business trip

An employee of JSC "Intern" Petrov was on a business trip from September 16 to 20, 2021 (5 days).

Petrov’s salary is 70,000 rubles.

In addition, in January, March and June of this year, Petrov received bonuses (5,000 rubles each) provided for in the Regulations on Bonuses.

The calculation period for calculating average earnings will include September-December of last year and January-August of the current year. Petrov worked out the entire billing period.

Let's assume that the total number of working days in the period was 249. The total amount of payments to Petrov for the billing period will be:

(RUB 70,000 × 12 months) + RUB 15,000 = 855,000 rub.

Petrov’s average daily earnings for the billing period will be equal to:

375,000 rub. : 249 days = 3433.73 rub.

For 5 days on a business trip, Petrov was accrued:

RUB 1,506.02 × 5 days = 17,168.65 rub.

The Labor Code of the Russian Federation and the Regulations on Business Travel do not provide for the procedure for paying average earnings during a business trip.

Since the terms for payment of average earnings are not established by law, they need to be specified in local regulations. For example, in the regulations on business trips. And you need to take into account that these terms should be similar to the terms for paying wages under the employment contract. This is what officials from the Russian Ministry of Labor note in their commented letter.

Salary payment terms

Specific deadlines for payment of wages (days of the calendar month) are not defined by the Labor Code. The date of payment of wages is established by internal labor regulations, a collective agreement or an employment contract.

But Article 136 of the Labor Code of the Russian Federation defines the maximum permissible period of time after which part of the salary must be paid. It is prohibited to issue salaries to employees with a break of more than 15 days. The gaps between the first and second parts of the salary should not be longer than 15 days.

This rule should also be followed when paying average earnings during a business trip. After all, while on a business trip, an employee performs his job function, so the average earnings retained for him during the business trip can be considered part of the salary.

Thus, the average salary retained by an employee for the period of a business trip must be paid by the employer within the time limits established for payment of wages. That is, the average earnings must be paid along with the salary.

List of allowable travel expenses

The list of permissible material costs while on a business trip is given in Article 168 of the Labor Code of the Russian Federation and is supplemented by Article 264 of the Tax Code of the Russian Federation:

- Related to the payment of travel to the destination and back to the permanent place of work.

Important! Travel on public transport is paid, with the exception of taxi costs.

- For accommodation: renting housing for the period of being away from a permanent place of work.

Important! Payment of living expenses is carried out on the basis of the provided free-form invoice from the hotel or rental agreement indicating the cost of living.

- Daily allowance.

- Preparation of documents necessary for the trip: visa, passport, etc. (see Travel documents).

- Mandatory fees (consular, airfield, transit, etc.).

- Other expenses incurred with the permission of the employer: for communication services, additional expenses when renting residential premises, and so on.

The procedure for determining the amount of vacation pay

Art. 114 of the Labor Code of the Russian Federation regulates the employee’s right to annual leave, during which he is guaranteed the retention of his position and payment of the average salary. The calculation of the average daily earnings in this case is in many ways similar to its calculation for business trips. The calculation period is also the last 12 months. The periods specified in paragraph 5 of Resolution No. 922 associated with payment based on average earnings and social payments are removed.

Formula for calculating average earnings per day:

SZP = DRP / 12 / 29.3,

Where:

DRP - income for the billing period;

12 - number of months;

29.3 is the average number of days in a month.

But this formula is applicable only in the absence of partially worked months. If an employee was absent from work for part of the days, the number of actual days worked is calculated separately for each partial month.

See an example of vacation calculation. Better yet, use our vacation pay calculator.

However, the question remains: are travel allowances included in the calculation of vacation pay or should they be excluded from the calculation period?

Daily allowance when traveling within Russia and abroad

The norm for daily travel expenses in 2021 is established by law. The daily allowance for government organizations is 100 rubles . The minimum allowable daily allowance for travel expenses for commercial organizations should not be less than the daily allowance paid by government organizations, that is, also equal to 100 rubles.

The maximum daily allowance for commercial organizations is established on the basis of the permanent internal Regulations on the Kyrgyz Republic (travel expenses) or a one-time order issued. But in accordance with the current tax legislation of the Russian Federation, the maximum amount of expenses per day not subject to personal income tax (personal income tax) is: the amount of business trips in 2021 in Russia - 700 rubles per day , travel expenses abroad in 2021 - 2,500 rubles per day . Payment is made for each day, including if weekends and holidays fall during this period.

The limit on travel expenses for 2021 in Russia is not limited by law, but if the maximum values of 700 and 2,500 rubles are exceeded, respectively, the amount exceeding these maximum values is subject to personal income tax.

Tariff system

With a tariff system of remuneration, the employer most often sets an hourly or daily tariff for an employee, that is, a rate per hour or day worked. Based on these indicators, the accountant must determine the estimated monthly rate, which can be roughly called an analogue of salary.

If an hourly rate is established, then the estimated monthly rate is equal to the hourly rate multiplied by the number of working hours in a year and divided by 12 months.

If a daily rate is established, the estimated monthly rate is equal to the daily rate divided by 8 hours, multiplied by the number of working hours per year and divided by 12 months.

Next, you need to determine your average daily earnings. To do this, in the case of a business trip, you need to divide the estimated monthly rate by the number of working days in the month (meaning the month when the employee got a job and went on a business trip). If you're on vacation, take your estimated monthly rate and divide it by 29.3.

Example 2

In September 2021, the company hired a new employee and set him a tariff rate of 375 rubles. at one o'clock. From the first day of work, the employee is granted leave for 10 calendar days.

When calculating vacation pay, the accountant took into account that in 2021 the number of working hours (with a forty-hour work week) is 1974 hours.

Thus, the estimated monthly rate is RUB 61,687.5. (375 rubles x 1974 hours: 12 months). The average daily earnings is 2,105.38 rubles. (RUB 61,687.5: 29.3). The amount of vacation pay is 21,053.8 rubles. (RUB 2,105.38 x 10 days).

Example 3

In September 2021, the company hired a new employee and set him a tariff rate of 2,000 rubles. in a day. From the first day of work, the employee went on a business trip for 10 working days.

When paying for the business trip, the accountant took into account that in 2021 the number of working hours (with a forty-hour working week) is 1974 hours, and in September 2021 there are 22 working days.

Thus, the estimated monthly rate is 41,125 rubles (2,000 rubles: 8 hours x 1974 hours: 12 months). The average daily earnings is 1,869.3 rubles. (RUB 41,125: 22 days). During the business trip, the employee received 18,693 rubles. (RUB 1,869.3 x 10 days).

Procedure for calculating travel allowances

The official basis for referral is the order of the employer. In most cases, the order is issued in the form of an Order. There is an official form of the Referral Order numbered T-9 (for one person) or T-9A (for a group of people). The use of this form is not necessary, since the order form developed in the given organization can be used.

The order contains the following information:

- Employer details (full name, position) and organization details.

- Employee details (full name, position).

- Destination.

- Duration. As a rule, the date of departure and the date of arrival at a permanent place of work are indicated.

Important! The beginning is considered the day of departure of transport to the destination, and the end is considered the day of arrival of transport at the place of permanent work. Until 23:59 the current day is considered, and from 00:00 - the next day.

- Target.

Formulas

Government Decree No. 922 of December 24, 2007, average earnings are calculated using the following formula:

Formula:

Sz = Brp/Krd, where

Sz - average earnings;

Brp – accrual base for the billing period;

Крд – number of days worked in the billing period.

In this case, the accrual base is calculated as follows:

Formula:

Brp = N-Is, where

N – all accruals;

Is – amounts excluded from the calculation.

The base for the billing period includes accruals to the employee for the last twelve months. Moreover, if the employee did not work for the full 12 months, then a shorter period is taken.

Example

Initial data:

Let's look at a specific example of how an accountant calculates the average earnings to pay an employee on a business trip.

Suppose an employee was sent on a business trip for 4 days. Over the past 12 months, the employee has been on sick leave for fourteen days.

Therefore, they need to be excluded from the billing period. In just 12 months, the employee was credited with 237 thousand rubles. Of these, the benefit amounted to 10 thousand rubles.

Calculation:

Let's calculate average earnings using the formula presented above:

- Base for the billing period = 237,000 – 10,000 = 227,000 rubles.

- The number of days worked, for example, is 227.

- Average daily earnings = 227,000/227 = 1000 rubles.

For 4 days the employee will be credited: 4*1000 = 4000 rubles. At the same time, the accountant will deduct 13% income tax (personal income tax) from the accrued amount. That is, the employee will receive in hand per day: 1000 – 1000*13% = 870 rubles. in one day.

However, payment is required for the entire period of the business trip. Therefore, the accountant will multiply the resulting amount by the number of working days on a business trip.

How to calculate correctly if an employee has just got a job?

When an employee just gets a job and goes on a business trip, average earnings are calculated based on wages accrued for actual working time.

Formula:

Sz = Zfod/Code, where

Zfod – income for actually worked days;

Code – the number of days actually worked.

If the employee has not yet received any accruals, the formula for calculating average earnings will look like this:

Formula:

Сз = О/Кдм, where

O- salary;

Kdm – number of days in the current month.

Example calculations for a new employee who has no income

Let's look at a specific example of how to correctly calculate the average salary of an employee if he just got a job and was sent on a business trip in the first month of work.

Initial data:

Suppose an employee gets a job and is immediately sent on a business trip in the same month. The salary of a seconded person is 25 thousand rubles. there are 20 working days in a month.

Calculation:

Average earnings are:

Average earnings = 25,000/20 = 1,250 rubles.

Initial data:

If an employee has already worked for a month before being sent on a business trip, then to calculate average earnings you need to take the accrued salary for the previous month. Let’s assume that over the past month an employee was credited with 17 thousand rubles and worked for 17 days.

Calculation:

The calculation of average earnings in this case will be as follows:

Average earnings = 17000/17 = 1000 rubles.

Initial data:

If an employee gets a job and a week later he is sent on a business trip, for the calculation you need to take the actually worked days in the current month. For example, in a week he actually worked 5 days, for which he will be credited 4,000 rubles.

Calculation:

Average earnings will then be calculated as follows:

4000/5 = 800 rubles.

The resulting figure is multiplied by the number of working days on a business trip. Moreover, if a working day is considered a day off or a holiday, payment is made in double amount (800*2=1600).

Payment of travel allowances on days off.

Return or Refund Procedure

Payment for travel allowances in 2021 is carried out on the basis of the provided payment documents. Payment documents confirming expenses are provided to the accounting department. This category includes the following: travel cards (tickets, receipts), invoices from the hotel (or an analogue confirming the fact of payment for accommodation), checks and receipts confirming other expenses.

Important! When traveling in a personal vehicle, upon prior agreement with the employer, an official and explanatory note must be attached to the payments.

Calculation of salary amount

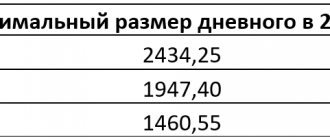

Salaries in the insurance company are calculated based on the average daily earnings during the year. When an employee is on sick leave, the period of illness is not taken into account in calculating the average daily earnings. The table below is provided as an example:

Average salary in Russia. And also in Moscow, St. Petersburg and in the regions!

For example, an employee has 257 working days. in a year. Of these, he was on sick leave for seven days. Thus, when calculating average daily earnings, 250 days will be taken into account. The employee’s earnings for each month are added up (the amount of funds received while the employee was on sick leave is also not taken into account). The resulting total income of the employee for the year must be divided by 250. The result will be the average daily earnings that must be paid for each day of the business trip.

Salary system

This is the simplest of all possible options. To find the average daily earnings to pay for a business trip, the accountant must divide the salary by the number of working days in the month (meaning the month in which the employee got a job and went on a business trip). In case of vacation, you need to take the salary and divide it by 29.3.

Calculate your salary and vacation pay for free, taking into account all current indicators for today

Example 1

In September 2021, the organization hired two new employees: Ivanov and Petrov. The salary of each of the “newcomers” was 40,000 rubles. per month.

From the first day of work, Ivanov was granted leave for 7 calendar days.

The accountant determined that Ivanov’s average daily earnings were 1,365.19 rubles (40,000 rubles: 29.3). The amount of vacation pay is 9,556.33 rubles (1,365.19 rubles x 7 days).

On the first day of work, Petrov went on a business trip for 5 working days.

When calculating Petrov’s average daily earnings, the accountant took into account that there are 22 working days in September 2021. Thus, the average daily earnings amounted to 1,818.18 rubles (40,000 rubles: 22 days). During the business trip, Petrov received 9,090.9 rubles. (RUB 1,818.18 x 5 days).