Today you can find a lot of different information in newspapers, on websites on the Internet, in online legal databases, which can help an accountant calculate vacation pay for employees in the appropriate form for one reason or another. This material will be useful to employees themselves who do not understand all the nuances of the rules for calculating vacation pay and amounts paid, because it is not easy to understand all this.

We will also try to clearly explain all the vicissitudes of the system for postponing weekends and how they differ from holidays, and also talk about how vacation pay and wages are paid along with vacation pay.

How vacation pay and salary are paid along with vacation pay

Theory

The vacation system is allocated a separate chapter in the Labor Code under number 19 with the same name - “Vacations”.

The first thing you need to know is that vacation is allocated to the employee annually. An employee has the right to take advantage of the opportunity to take leave after six months of continuous work. However, if there is an agreement, then leave can be issued earlier than six months (Article 122 of the Labor Code of the Russian Federation).

Important ! As stated in Article 125 of the Labor Code of the Russian Federation, by agreement between the employee and the organization, vacation can be divided into parts. In this case, one part should not be less than 14 calendar days.

Article 125 of the Labor Code of the Russian Federation

As stated in Article 114 of the Labor Code of the Russian Federation, personnel are given paid vacations every year with the right to retain their place of work and salary.

The number of days of paid leave annually, according to Article 115 of the Labor Code of the Russian Federation, reaches 28 days. It turns out that for a year of work an employee receives 28 days of vacation.

If you try to calculate everything, it turns out that 2.33 vacation days are given monthly for work (we divide 28 days by 12 months).

The employee has the right to receive 28 days of paid leave

Please note that work experience that provides leave with pay does not include the following:

- days of absence of a person without a good reason;

- vacation days that were used to care for children;

- days of vacation “at your own expense”, which exceeded fourteen days per working year.

Important ! Remember that according to the law, salary is a reward for the work on which you spend your time, which can be converted into working days.

This nuance hides the difference between salary and vacation pay:

- the salary is given for the time you worked and is calculated by working days.

- Vacation pay is given for calendar days and is calculated based on average income.

Vacation must be paid

Salary calculation procedure

To understand why vacation pay is less than salary, you need to understand the process of calculating the salary itself. Let's consider this example. The employee receives 40,000 rubles per month, of which 24 days are working days. It turns out that in 1 working day he earns 1666 rubles (40,000/24=1666). This includes:

- remuneration for the position stipulated by the employment contract;

- allowances for irregular work hours or night shifts;

- accruals for harmfulness, length of service, rank;

- bonuses and other additional payments provided by the employer.

Each of these points is specified in the agreement between the employee and the boss, and is also discussed when applying for a job. The main indicator of how wages will be calculated is the number of working days per month.

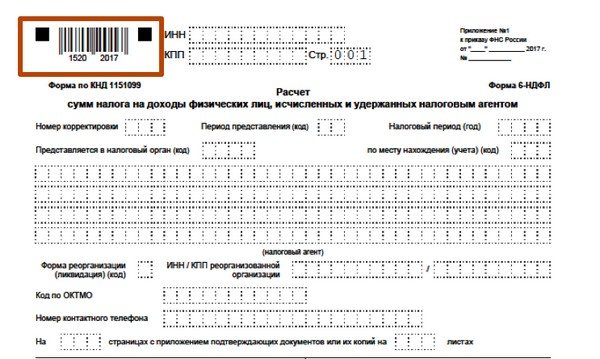

Information about 6-NDFL

Form 6-NDFL was introduced into the circulation of tax reporting documents not so long ago. Since the beginning of 2021, all companies and entrepreneurs who have hired employees are required to report in the form of this form.

6-NDFL must be filled out so that the organization can provide the income of employees and send it to the Federal Tax Service.

Important ! This declaration is submitted to the tax authorities quarterly by all companies that have entered into agreements with individuals.

Form 6-NDFL

6-NDFL must be completed if you need to pay your salary in installments. Moreover, if income tax was deducted from an employee twice in parts, then the information must also be provided twice. Similar actions must be taken for issuing vacation pay. How to properly fill out this declaration? When is it not necessary to issue it? And what should you pay special attention to when sending a report to the tax office?

Basic moments

Citizens who live on the territory of the Russian Federation and receive wages must pay taxes. The amount of taxes depends on the salary and status of the citizen.

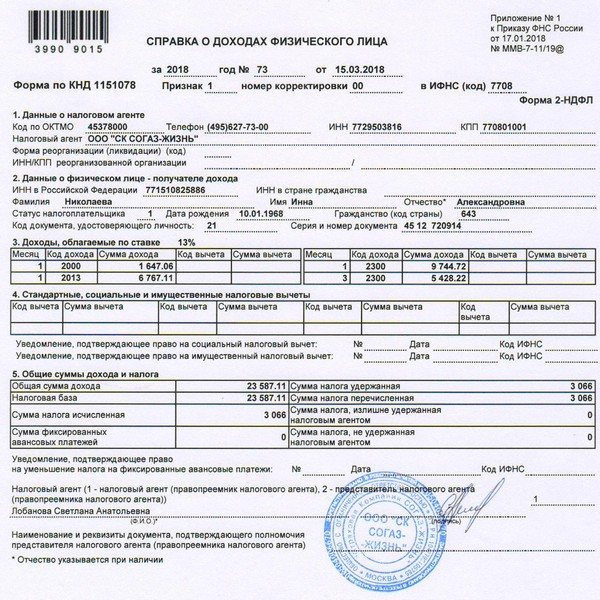

The 2-NDFL certificate is already known to everyone and has become a reporting standard. This certificate is issued by both individuals and legal entities.

Important ! If it is not, then a fine will be charged.

2-NDFL

Last year, the Federal Tax Service introduced another form, which is submitted by companies and organizations every quarter. Declaration 6-NDFL shows special nuances that are associated with income and taxes.

This declaration is filled out by employers for the total payroll tax of employees who are individuals and working in the state, and the 2-NDFL certificate refers to reporting for a specific employee.

The declaration can be submitted:

- electronic;

- on paper.

If the declaration is submitted on paper, then this method is more suitable for organizations with no more than 25 employees.

Important ! If there are many employees, then the 6-NDFL certificate must be sent electronically.

Form 6-NDFL is completed by employers

Income that is subject to personal income tax is indicated in the above certificate. This includes, in addition to salary, bonuses, incentives and vacation pay.

How to indicate wages along with vacation pay in 6-NDFL?

When filling out this declaration, it is important to remember that it is not necessary to indicate non-taxable income. The document must contain all information about the tax agent and his obligations to the tax authorities.

In the 6-NDFL declaration, vacation pay and wages are required to be indicated, as are bonuses along with sick leave. These types of returns are taxed at a rate of 13 percent and must be reported on tax documents.

In addition to income received by individuals, the following data must also be displayed:

- date of sending money to the employee’s account (actual);

- date of withholding of personal income tax;

- the day the tax is sent to the tax authorities of the Federal Tax Service.

Form 6-NDFL indicates taxable income

One of the main requirements when submitting a certificate is the mandatory compliance with all deadlines set by the Federal Tax Service. The first certificate is sent to the authorities no later than May, and the last one – before April of the following year.

Important ! Moreover, the latest report must be submitted together with the first certificate for the next year that has begun, but no later than May.

In order not to delay the submission of 6-NDFL certificates, you should personally go to the tax authorities to submit the certificates. If the documentation is sent by mail, you must require official confirmation of receipt of the letter.

If the declaration is submitted electronically, then all dates will be indicated automatically and there is no need to worry about them.

You can submit the 6-NDFL declaration electronically

All information on employee income must be indicated in the document for a specific date. For example, if an employee took a vacation, but not a full one, but wanted to divide it into parts, then, accordingly, payments are indicated separately. Similar actions are performed with salaries: the date of the advance and the date of the main payment are indicated, which are written separately from each other.

Important ! In the case where wages and vacation pay were paid together, the company indicates this in the certificate, otherwise an error will occur, which will lead to various sanctions, including a fine.

Does an employer have the right not to pay vacation?

The first option is the most compromise and most adequate, you simply explain to the employer that by refusing to pay vacation pay, he violates Article 136 of the Labor Code of the Russian Federation and, accordingly, the rights of the employee. Invite the employer to pay you vacation pay, and if they refuse, you can move on to the next step, or you can send the employer a request in writing where you demand payment of vacation pay either by card or in cash, you can send such notice to the employer by mail with an inventory attachments and notification of delivery, or prepare 2 copies and hand them over to the employer, but here the employer must put an acceptance mark on the second copy and give it to you, but they may refuse to accept it, so it’s best to send the notification by mail and you’ll have an inventory in your hands and a little later you will receive notification of delivery. Before answering this question, you must first look at Article 114 of the Labor Code of the Russian Federation, this article states that the employer must provide the employee with annual leave during which the employee’s place of work (his position), as well as his average earnings, is preserved.

Please note => Which cost item should an employee undergo a psychiatrist visit to?

Payment period

By law, salaries must be paid twice a month. The employee receives first an advance and then the principal amount. Along with the salary, temporary disability benefits are also paid.

Excerpt from Article 136 of the Labor Code of the Russian Federation

Employees have the right to leave once a year while maintaining their job and average salary. An employee must receive vacation pay 3 days before going on vacation.

It is also not prohibited to pay these funds ahead of schedule. Many employers do not particularly want to pay funds after the vacation has begun, since sanctions and fines are possible in the event of an audit.

There are special schedules indicating vacations. This is done in order to notify the employee in advance about the start of the vacation and prepare the money for him.

Vacation pay must be paid to the employee no later than three days before the start of the vacation.

Important ! If the period before the vacation falls on a holiday, weekend or any other day when the employee should not be at work, then vacation pay is paid on the working day that falls before the weekend or holiday.

The same rule applies to salary transfers. Banks and other organizations do not make payments on weekends, which means that funds will be transferred on a working day and before the start of the vacation.

Responsibility for violation

In 2021, the following types of liability may be applied to negligent employers who do not pay vacation pay on time:

- material;

- administrative;

- criminal

In the first case, they are obliged to pay the employee compensation for all days of delay if he did not contact the labor inspectorate.

In cases where this organization began an inspection at the request of an employee, then, in addition to financial liability, fines will also be imposed on the employer and those responsible for paying vacation pay in the amounts established by current legislation.

Repeated delays in payment of benefits during the rest period increase the amount of fines.

Find out when vacation pay is paid under the Labor Code. Are you interested in holiday pay in 2021 under the new law? Read here.

How to calculate compensation for unused vacation in 2020? Detailed information in this article.

In cases where an employer delays vacation pay for a long time or pays it partially, criminal liability may be applied to him, as a result of which his freedom may be limited by the state for up to five years.

Which fund is it paid from?

Temporary disability and maternity benefits come from the Social Insurance Fund and the employer.

These benefits are a guarantee of a social level in case of short-term disability. Vacation funds are paid by the employer, that is, at his expense.

An employee cannot be insured if he loses the opportunity to go on vacation every year. An employee can also refuse to go on vacation and receive funds for this in the form of compensation.

Article 126 of the Labor Code of the Russian Federation

Important ! It is necessary to take out insurance only when a person may lose his usual income. In such cases, the state undertakes to support citizens.

Only the employer is responsible for paying vacation pay. Each organization has special reserve funds for payment, as this is a legal requirement. The amount of money in reserves depends on the organization's initial capital.

Important ! In the case when reserve funds are greater than the authorized capital, the organization can use this money for other purposes and increase the authorized capital.

Employers may have different motivations for creating reserve funds. This may include costs to cover losses, pay off debts and provide benefits to employees. This fund is created to pursue only one goal - to pay various funds to employees, regardless of the income of the organization.

The enterprise must create a reserve wage fund

Important ! This reserve is created through payments for working hours, payments for unworked hours, incentives, allowances for food, apartments, and fuel. Salaries and vacation pay are paid from a single reserve.

Who pays for vacation pay: the state or the employer?

Calculating vacation in 2021 should traditionally begin with determining the calculation period. For most employees working in an organization for more than a year, this is 12 calendar months preceding the month the vacation begins (clause 4 of the Regulations, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922). Those. When calculating vacation pay, you will need to use the employee’s income received during these 12 months. Today the state is desperately fighting to increase the birth rate. The year 2008 was declared the year of the child, this year is the year of the family. The government is trying in every possible way to encourage new additions to families, promising all sorts of rewards and benefits, but the employer still does not like the pregnant woman, trying in every possible way to rid himself of problems with her.

What sizes?

The legislation of the Russian Federation acts as a guarantor of the right to rest while maintaining a job every year. In addition to the workplace, wages are also maintained. The amount of funds and compensation for untaken vacation depends on the amount of income.

The following types of calculations are used:

- the duration of the settlement period is calculated;

- the employee’s income for this period is calculated;

- average income is calculated;

- the amount of vacation pay is formed.

When an employee goes on another paid leave, he retains his workplace and SDZ

The rules for calculating the average salary are unified, and they include all types of income. The settlement period depends on the duration of work in the organization.

The specified period cannot exceed one year. Estimated time is calculated in calendar days and months.

Excerpt from Article 139 of the Labor Code of the Russian Federation

Important ! A calendar month is the time from 1 to 30 or 31. In February it is 28 or 29 days.

The calculation period will always be the year that elapsed before the start of the holiday. If an employee worked less than this period, then the calculation takes into account the time based on documents indicating his working time in the organization.

The table below will show the difference between calculations of income and expenses for vacation pay.

| When calculating the amount of vacation pay, it is necessary to deduct | When calculating income for vacation pay, they exclude |

| periods when the employee received average income; | vacation pay, income for business trips and other income established on the basis of average earnings; |

| days when the employee was temporarily disabled; | income for the time when the employee could not work temporarily and was on maternity leave; |

| days when the employee was on vacation without retaining his salary. | payment for caring for disabled children. |

When calculating earnings for calculating vacation pay, periods when the employee did not perform work for any reason are not taken into account.

After all the calculations, you need to calculate the average income per day.

What is this according to the Labor Code?

However, the concept of compensation for this period is not directly disclosed there. That is why such payments as vacation pay can be characterized according to the meaning of their implementation, taking into account the peculiarities of calculation. What are vacation pay and how are they calculated? This is compensation for the period of absence of an employee from the workplace for a reason provided for by the legislation of the Russian Federation and allowing every employed citizen to receive the right to rest.

Such payments are provided before the employee goes on vacation and allow him to rest without serious financial losses due to non-performance of work. Providing vacation pay on time and in full is the responsibility of the employer, as is ensuring the possibility of paid rest for each employee.

Vacation pay is transferred in different ways and must be provided strictly at the time specified by law.

Vacation pay calculation

According to Article 139 of the Labor Code of the Russian Federation, the average salary allocated for vacation pay (and payments for vacations that were not used) is calculated for the previous twelve months. If you add up the salary and other payments issued monthly, you can get the total amount of income, and it is further divided by twelve months and multiplied by 29.4 (the average number of days in the calendar).

Important ! Using this method, you can calculate the “cost of one day” for vacation pay.

It is worth remembering: in the contract, internal rules or other internal document there may be other intervals for calculating the average salary.

As a rule, SDZ is calculated based on data from the previous 12 months

It follows that when determining other intervals for calculating SDZ, accountants must carry out operations as required in the Labor Code of the Russian Federation and as specified in the rules of the organization, and then compare the results.

Important ! These calculations are needed to provide reasoned confirmation that the situation of employees is not worsening.

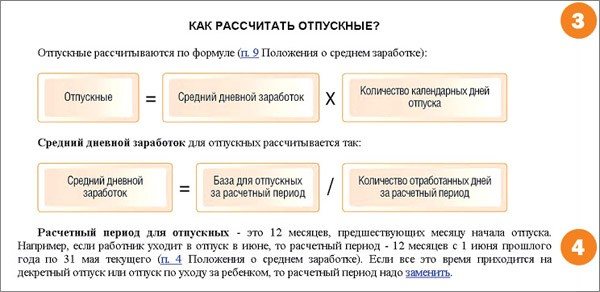

There is the following formula for calculating the average salary when determining vacation pay.

Vacation day price = Amount of payments that is taken into account to calculate the average income for 12 months/12/29.3.

Vacation pay is calculated according to certain formulas

The amount of vacation pay is calculated using the formula:

Amount of vacation pay = cost of a day of vacation * number of days on vacation.

Calculation example.

Employee N. went to work at organization “E” on June 1, 2013. The employee wants to go on vacation from July 1, 2021 to July 28, 2019.

This period is taken from the period from July 1, 2019 to June 30, 2021. As a result, employee N.’s monthly salary will be 7,856 rubles.

In addition, the employee also received a bonus of 15 thousand. All this is included in the annual income, which will be 109,272 rubles.

Important ! If you have information about the billing period and total salary income, it will be possible to determine how much the employee received on average per day.

To do this, you need to perform the following calculations: 109272:12:29.3=311. The result is an average daily income of 311 rubles. The amount of vacation pay will be 8,708 rubles.

When calculating vacation pay, the price of the vacation day is taken into account

Vacation pay calculator

Go to calculations

What are the correct names?

Transfers for the rest period are often called vacation pay. The Labor Code of the Russian Federation provides the wording “vacation payment”. The correctness of the terminology is not of significant importance, since when defining such payments as “vacation pay”, anyone will understand what we are talking about. In addition, there is no clear formulation in the Labor Code of the Russian Federation, so the use of different definitions is possible.

Dear readers! To solve your problem right now, get a free consultation

— contact the on-duty lawyer in the online chat on the right or call:

+7

— Moscow and region.

+7

— St. Petersburg and region.

8

- Other regions of the Russian Federation

You will not need to waste your time and nerves

- an experienced lawyer will take care of solving all your problems!

The issue of payment of vacation pay along with salary

Legislatively, salary payments and all the nuances are enshrined in Article 136 of the Labor Code of the Russian Federation, which also stipulates the deadlines. Funds are paid twice a month, unless there are other conditions in the employment contract.

In addition, the employee has the right to receive funds for temporary disability and other compensation, including for not using legal leave. It is worth remembering that, as a rule, it is impossible to receive money for annual leave along with your salary, but this is not prohibited by law. In this case, however, all funds for vacation pay and salaries are calculated from the organization’s single reserve.

Important ! It is clear that it is better for accountants to deduct funds up to three days before the employee goes on vacation. This is due to the fact that documentation may be delayed and if funds go through the cash register, then it is better to pre-pay the required funds to the employee.

As a rule, wages and vacation pay are not paid together

Vacation pay is not a constant amount - everything is calculated based on the duration of the settlement period, total income, payments, average earnings per day and the number of vacation days.

The amount of vacation pay varies for everyone. These funds are not paid as a lump sum with the salary. Three days are specifically provided before the start of the vacation.

Who pays vacation pay to the employee - the employer or the state?

In this article we will take a closer look at who pays maternity benefits, the state or the employer. When receiving maternity payments, many do not think about who they owe the nth amount of money to. Officially employed women are guaranteed to receive their payment, so there is no need to worry about where the funds come from. The question becomes relevant only in non-standard situations. Secondly, the employer wastes time and suffers losses when hiring a new employee. He trains her, waits for her to understand all the intricacies of production, and over time the employee leaves him, and he needs to find a temporary replacement for her and start all over again with new employees. One day the time will come, and it will be necessary to resolve the issue with the maternity leaver, return her, again give her time to devote herself to current affairs, or fire her.

What is the correct way to pay vacation pay: together with the salary or immediately

The law does not prohibit paying salary with vacation pay. As was written above, an employee can only ask for salary and vacation pay to be paid on the same day. Vacation pay is paid three days before the actual start of the vacation, and salary is paid twice a month.

Important ! Accordingly, payment days may not coincide.

The employer has the opportunity to pay vacation pay ahead of schedule. This is not prohibited by law.

The employer can issue vacation pay earlier

How to receive vacation pay along with salary? If the employer has such an opportunity, then he can pay the funds to the employee along with vacation pay. In addition, an employee can receive funds for temporary disability and funds for not going on vacation. All these funds are paid to the employee from the fund according to the salary.

Important ! In the case when the money comes from the bank, it is worth remembering that the funds will arrive only the next day.

The amount of vacation pay will be different for everyone. When employees have the same salary, even then they may end up receiving different amounts. It all depends on the number of days that are considered worked per year. Not subject to accounting:

- days of receiving average salary income;

- days when the employee is sick;

- days when the employee takes vacation at his own expense.

Important ! At such moments, accounting employees should be especially vigilant when working with documents and reports, and monitor each payment to a specific employee.

You can ask the employer to pay salary and vacation pay immediately

In the event that an employee has not received a salary while on vacation, he will have the opportunity to receive funds on the day of settlement of the salary. If it is possible to make calculations and accrue salary during vacation, the employee will be able to receive it.

FAQ

Is the company obliged to pay wages along with vacation pay for the days worked in a given month? An employee goes on vacation in the middle of the month.

According to the law (Article 136 of the Labor Code of the Russian Federation), 3 days before going on vacation, only the vacation itself is paid. The law does not provide for the payment of vacation pay along with payment for days actually worked.

It follows from this that the day before the vacation, the employer must pay the employee only the average earnings for the vacation period. The salary for employees on vacation for the period of work before going on vacation is paid within a single set time frame - on a day determined by the regulations within the enterprise and the contract.

However, the Labor Code of the Russian Federation allows for an improvement in the employee’s situation - salary can be accrued more often than twice a month.

Salary can be paid more than twice a month

Consequently, the company can pay the employee funds before the start of the vacation, immediately with vacation pay, i.e. before the due date for salary deduction. In this case, all the nuances of salary payment are agreed upon with the employee.

If the preliminary payment of the salary was a one-time payment, then it will be enough to write a statement indicating the desire to issue the salary earlier than the deadline.

If employees wish to continue to receive salaries earlier than the established period, we would recommend discussing this condition in the employment contract and other documents.

Vacation and insurance premiums

Vacation pay amounts must be included in the base for calculating insurance premiums paid to the Social Insurance Fund, the Pension Fund of the Russian Federation and the Federal Compulsory Medical Insurance Fund (Part 1, Article 7 of Federal Law No. 212-FZ[1], Clauses 1, 2, Article 20.1 of Federal Law No. 125-FZ[ 2]).

Employers determine the base for calculating insurance premiums separately for each individual from the beginning of the billing period at the end of each calendar month on an accrual basis (Part 3, Article 8 of Federal Law No. 212-FZ).

Payment of contributions to the Pension Fund, FFOMS and Social Insurance Fund accrued on vacation pay amounts is made no later than the 15th day of the month following the month in which vacation pay was accrued (Part 5, Article 15 of Federal Law No. 212-FZ, Clause 4, Art. 22 of Federal Law No. 125-FZ).

For your information

The calculation of insurance premiums from vacation pay amounts is carried out by the payer of insurance premiums - the organization in the period in which the specified amounts were accrued, regardless of the period of their actual payment to employees (letter of the Ministry of Labor of the Russian Federation dated September 4, 2015 No. 17-4 / Vn-1316, 17 -4/B-448).

Monthly mandatory payments for insurance premiums are calculated during the billing (reporting) period based on the results of each calendar month based on the amount of payments and other remunerations accrued from the beginning of the billing period until the end of the corresponding calendar month, and the tariffs of insurance premiums minus the amounts of monthly mandatory payments calculated from the beginning of the billing period to the previous calendar month inclusive. This procedure is established in Part 3 of Art. 15 of Federal Law No. 212-FZ.

What is the period for reporting vacation pay amounts in the reporting of insurance premiums if they are accrued and paid to the employee in June, and his vacation begins in July? In the Letter of the Ministry of Labor of the Russian Federation dated August 12, 2015 No. 17-4/OOG-1158, a reference is made to clause 1 of Art. 11 of Federal Law No. 212-FZ, according to which for organizations the date of payments and other remunerations in favor of employees is defined as the day of accrual of these payments and remunerations. Taking into account this norm, the calculation of insurance premiums is carried out by the payer of insurance premiums - the organization in the period in which payments were accrued. Consequently, when vacation pay is accrued to an employee in June of the current year, their amount is included in the reporting of insurance premiums for the six months.

Similar clarifications were presented in Letter No. 17-4/B-298 of the Ministry of Labor of the Russian Federation dated June 17, 2015, which discussed the issue of reflecting vacation pay amounts in a situation where vacation begins in April and payments are made in March. The Ministry of Labor recommended including vacation pay accrued to an employee in March of this year in the reporting of insurance premiums for the first quarter.

Who pays vacation pay to the employee - the employer or the state?

Since cash payments related to the provision of paid leave to employees are subject to insurance contributions to extra-budgetary funds, the amount of the recognized provision must also include the corresponding amount of insurance contributions. Since in accounting, expenses in the form of vacation pay paid to an employee, as well as insurance premiums accrued for vacation pay, are recognized at the time of recognition of the corresponding estimated liability, and tax accounting reflects the actual costs incurred, in accounting, when recognizing estimated liabilities, deductible temporary differences (DTD) and their corresponding deferred tax assets (DTA).

Please note => Does length of service affect sick leave?

What is a correction factor and when to apply it?

But in the reporting period, the level of income may be different. For example, an employee could be demoted or promoted. Accordingly, his salary or tariff rate will change. Wages could also be indexed.

In order for the amount of the cash payment to be comparable to the salary in the month the employee went on vacation, his income for the previous 12 months is multiplied by an adjustment factor. The value of this indicator is calculated for each month of the reporting period.

Use the following formula: K=O2/O1, where:

- O2 is the salary after the increase;

- O1 is wages before indexation, changes in salary or tariff rate.

Why is an employer required to pay for vacation?

This is labor law. I think this is good. The employer usually receives more benefit than he pays, so it’s quite fair. True, the economic model around the world is changing now, and many employers are trying to register people differently. To pay less taxes and not have to pay for vacation. The worker receives a salary for his work. To motivate his work, the employer pays him bonuses, regular annual leave, and, if necessary, educational leave. additional, etc. all this is provided for by labor legislation and all payments are included in the wage fund.

Is it possible to pay before the due date?

In contrast to delays in the provision of wages, transferring funds to a bank account or issuing cash at the cash desk earlier than the regulated period is not punishable by law. This fact takes into account the linking of transactions for transferring funds to employee cards to banking days.

For this reason, banks transfer salaries to company employees not on Saturday or Sunday, but on Friday, since the last two days of the week are not banking days.

And if the payment is made on Monday, it will be possible to talk about a delay, which will mean additional expenses for employers.

Also, an employee can receive a salary ahead of schedule

- when going on vacation;

- under special circumstances in the life of the employee himself;

- ahead of the long holiday period;

- before a long business trip.

Example 1.

If we are talking about an employee who works 5 working days a week and at the same time:

- goes to work regularly and does not take long unpaid leaves.

- does not take sick leave (or very few of them).

- does not go on business trips (or they are rare and short-term).

- receives the same salary every month.

then in order to understand how much vacation pay he will receive, he just needs to take the amount of his salary and divide by 29.4, and then multiply by the number of vacation days.

Let’s say the salary of such an employee is 50,000 rubles. “clean”, i.e. this is the amount that he receives monthly “in hand” (the salary in this case will be 57,471.26 rubles)

Then the price of a vacation day will be 1,700.68 rubles. (50,000 / 29.4), and the amount of vacation pay for 7 calendar days is 11,904.76 rubles. (1,700.68 * 7).

If an employee saves vacation pay (not all companies provide this opportunity to employees), then he can take 5 days of vacation (from Monday to Friday) and then the amount of vacation pay will be 8,503.40 rubles. Thus, an employee can “save” vacation days, but at the same time lose in payments.

Below in Table No. 1 we calculate the price of a working day and the difference between a working day and a vacation day in accordance with the production calendar for 2013.

Table No. 1

| year 2013 | Number of working days | Net salary amount | Working day price | Vacation day price | Difference |

| January | 17 | 50 000,00 | 2 941,18 | 1 700,68 | 1 240,50 |

| February | 20 | 50 000,00 | 2 500,00 | 1 700,68 | 799,32 |

| March | 20 | 50 000,00 | 2 500,00 | 1 700,68 | 799,32 |

| April | 22 | 50 000,00 | 2 272,73 | 1 700,68 | 572,05 |

| May | 18 | 50 000,00 | 2 777,78 | 1 700,68 | 1 077,10 |

| June | 19 | 50 000,00 | 2 631,58 | 1 700,68 | 930,90 |

| July | 23 | 50 000,00 | 2 173,91 | 1 700,68 | 473,23 |

| August | 22 | 50 000,00 | 2 272,73 | 1 700,68 | 572,05 |

| September | 21 | 50 000,00 | 2 380,95 | 1 700,68 | 680,27 |

| October | 23 | 50 000,00 | 2 173,91 | 1 700,68 | 473,23 |

| november | 20 | 50 000,00 | 2 500,00 | 1 700,68 | 799,32 |

| December | 22 | 50 000,00 | 2 272,73 | 1 700,68 | 572,05 |

In Table No. 2, we calculate how much an employee will receive if he takes a week’s vacation in each month in 2013. From the number of working days for each month, we subtract 5 working days that the employee would normally miss when taking a 7-day vacation and calculate the amount of payments (salary + vacation pay) he will receive.

Table No. 2

| year 2013 | Number of working days worked | Salary amount for time worked | Vacation pay | Total "on hand" |

| January | 12 | 35 294,12 | 11 904,76 | 47 198,88 |

| February | 15 | 37 500,00 | 11 904,76 | 49 404,76 |

| March | 15 | 37 500,00 | 11 904,76 | 49 404,76 |

| April | 17 | 38 636,36 | 11 904,76 | 50 541,13 |

| May | 13 | 36 111,11 | 11 904,76 | 48 015,87 |

| June | 14 | 36 842,11 | 11 904,76 | 48 746,87 |

| July | 18 | 39 130,43 | 11 904,76 | 51 035,20 |

| August | 17 | 38 636,36 | 11 904,76 | 50 541,13 |

| September | 16 | 38 095,24 | 11 904,76 | 50 000,00 |

| October | 18 | 39 130,43 | 11 904,76 | 51 035,20 |

| november | 15 | 37 500,00 | 11 904,76 | 49 404,76 |

| December | 17 | 38 636,36 | 11 904,76 | 50 541,13 |

As can be seen from Table No. 2, the most “profitable” months for a vacationer are:

- April,

- July,

- August,

- October,

- December.

In September, the employee will remain “with his own people”, while vacation during all other months promises losses.

May holidays

Let's take a closer look at the upcoming May holidays.

According to the Decree of the Government of the Russian Federation dated October 15, 2012. No. 1048 “On the transfer of days off in 2013”, due to the coincidence of non-working holidays on January 5 and 6 with Saturday and Sunday, and February 23 with Saturday, the transfer of days off is provided from Saturday, January 5 to Thursday, May 2, from Sunday 6 January to Friday May 3 and from Monday February 25 to Friday May 10.

Thus, in the coming May we are closed from May 1 to May 5 inclusive and from May 9 to May 12 inclusive.

May 6, 7 and 8 are working days.

In total, May has 31 calendar days, 18 working days, 2 holidays and 11 weekends.

Two holidays are May 1 and May 9 (Article 112 of the Labor Code of the Russian Federation). All other days are a transfer of weekends and are not considered as holidays from the point of view of labor legislation. This circumstance is important, since in accordance with Article 120 of the Labor Code of the Russian Federation, non-working holidays falling during the period of annual paid leave are not included .

Weekends are a completely different matter. They are included in the number of calendar days of vacation. Accordingly, if an employee writes an application for vacation from May 1 to May 10, then he uses 8 calendar days of vacation (May 1 and 9 will not be included in the number of vacation days). Of these, 3 days will be on weekdays and 5 on weekends.

From the point of view of vacation payments, this is a more pleasant option. However, it is completely unsuitable for the majority of workers who value the vacation days themselves. Thus, to save vacation days, a vacation application can be written for May 6, 7 and 8 - 3 days.

In Table No. 4 we present the calculation of “losses” for this choice, using the data from Example No. 1 (salary 50,000 rubles “net”, price of a vacation day 1,700.68 rubles).

Table No. 4

| year 2013 | number of working days in a month | salary amount | working day price | number of working days worked | Salary amount for time worked | Vacation pay (1,700.68*3) | Total "on hand" | Difference (salary - total "in hand") |

| May | 18 | 50 000,00 | 2 777,78 | 15 | 41 666,67 | 5 102,04 | 46 768,71 | 3 231,29 |

As can be seen from the table above, the “cost” of a May vacation for 3 working days will be 3,231.29 rubles.

Now let’s consider another option for combining a short vacation and the May holidays - 2 days of vacation are taken at the end of April (29 and 30). Thus, the last 2 weekends in April are added to 2 vacation days and to the 5 days of the first May holidays. The result is a 9-day vacation, as well as saving money and 1 vacation day.

The calculation of the “cost” of such a vacation is presented in Table No. 5.

Table No. 5

| year 2013 | number of working days in a month | salary amount | working day price | number of working days worked | Salary amount for time worked | Vacation pay (1,700.68*2) | Total "on hand" | Difference (salary - total "in hand") |

| April | 22 | 50 000,00 | 2 272,73 | 20 | 45 454,55 | 3 401,36 | 48 855,91 | 1 144,09 |

As can be seen from Table No. 5, the “cost” of an April vacation for 2 working days will be 1,144.09 rubles. (plus one vacation day is saved at a cost of 1,700.68 rubles), which is much more profitable than the May vacation:

- savings on payments RUB 2,087.20. + vacation day savings RUB 1,700.68. = 3,787.88 rub. saving everything.

Choose your vacation dates to your advantage!

Who, according to the law, pays maternity benefits - the employer or the state?

But it is wrong to think that the Social Security Fund simply returns money to everyone. Documents submitted for reimbursement are strictly checked. Therefore, not only a correctly issued sick leave, but also a correctly calculated benefit calculation is of great importance.

- the employee’s education is not appropriate for the position;

- the salary is disproportionately high for such a position;

- introducing the position into the staffing table before the employee arrives;

- a significant increase in salary before going on maternity leave;

- accrual of benefits for the period when the employee actually worked.