Every employer has the right to send his subordinates on compulsory business trips, and it does not matter what type of cooperation is concluded between the parties. Business travel for part-time work and the main place of work is a common procedure regulated by legal provisions. However, when sending an employee employed by several different employers on a business trip, a number of specific questions arise regarding who will fulfill official duties for him at the second place of work. We will discuss these and other features of the design of this procedure in more detail.

A business trip is understood as the departure of a citizen to an organization located in another locality, at the request of a manager, to perform a specific work task. At the same time, an employee cannot refuse a business trip if such a provision is fixed in the employment contract and was agreed upon with the person before employment. However, every employer is obliged to comply with the requirement of the Law, which states that not all employees are allowed to be posted. It is prohibited to arrange official trips for:

- Employees who are in a “situation”;

- Workers who have not reached the age of majority;

- Persons employed by the company on the basis of an apprenticeship contract.

In addition, some socially vulnerable categories of workers can be sent on a business trip solely with their written consent; the sole desire of the employer will not be enough.

The main features of secondment of part-time workers, enshrined in RF PP No. 749, include:

- When leaving on a trip, each employee must retain his place of work (at each job), the amount of earnings and his position. In addition, upon returning back, a citizen has the right to demand from the employer reimbursement of personal funds spent on business needs, subject to the provision of appropriate evidentiary documentation: checks, receipts, etc.;

- If, due to certain circumstances, an employee is sent on a business trip by both of his managers, then the terms of the business trip should not coincide. The employer for whom the person works part-time must adjust the travel dates of the subordinate;

- When sent on a business trip to an additional place of work, the employee must coordinate his absence with the main employer. This measure is taken due to the fact that an official may not release his subordinate, and unauthorized absence from work will be classified as absenteeism.

Sending an internal part-time worker on a business trip

If the combination of positions is carried out with the same employer, then the procedure for sending on a business trip will not have any difficulties, since everything is approved by the same person. As a rule, it is advisable to send an internal part-time worker whose positions are similar, since in this case there will be no additional questions from the inspection authorities. When on a business trip, an internal part-time worker has certain guarantees that the employer must provide him with:

- Firstly, upon returning from the trip, the amount of his monthly earnings should remain the same;

- Secondly, the manager is obliged to reimburse the subordinate from the organization’s budget for all expenses incurred by the person while traveling for official needs. At the same time, compensation is carried out for the main position, and not for the additional one.

As a rule, sending a citizen who combines two positions in one organization on a business trip is carried out for the purpose of:

- Performing several assigned labor tasks in another organization for both positions held;

- The need to send a qualified employee of the relevant professional field on a business trip.

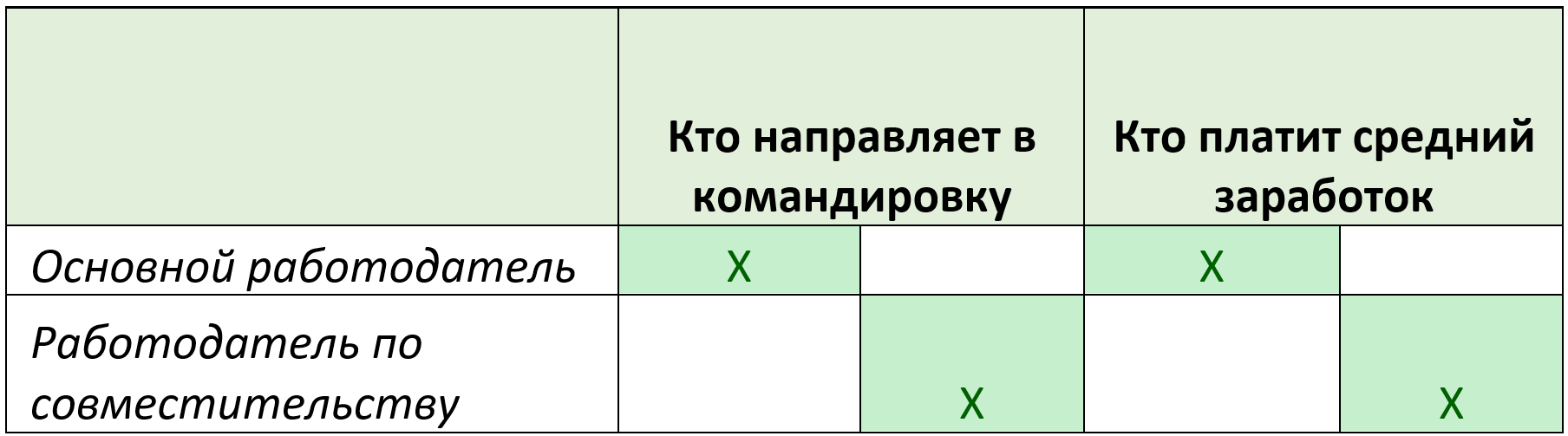

Trip to the main place and part-time place at the same time

It may happen that business trips from two organizations may coincide in time.

This is a great opportunity for employers to “save” on travel expenses. After all, you can agree and distribute among yourself the costs of travel, accommodation and daily allowances.

It will not be superfluous to know that the daily allowance is over 700 rubles. are taxed. And if two organizations divide the daily allowance, then personal income tax will not be paid.

The average salary remains the same in both organizations.

What difficulties may arise?

When traveling from two organizations, difficulties may arise in determining the time worked. After all, the work of a part-time worker cannot last more than 4 hours a day (Article 284 of the Labor Code of the Russian Federation).

The second employer must reflect the work schedule on a business trip in the order.

The employee must obtain written consent to work overtime.

Then the code “C” (or 04) is written on the report card along with the travel notes. Since the number of overtime hours is reflected in the order, payment is made according to the tariff (or salary).

How is it processed and paid?

With such a double business trip, an employee, having two official assignments, must draw up two reports on the execution of the assignment.

If travel expenses were divided by agreement of the sending parties, then the documents are attached to the expense reports accordingly, with copies provided for the missing ones.

For example, if travel documents were paid for by the main employer, then the second employer is provided with copies necessary to confirm the date of arrival and departure from the place of business travel.

Naturally, the average wage will be maintained for the two jobs, respectively.

The opportunity to work while combining two positions is an additional source of income. And it allows employers to more effectively use the labor potential of their employees by sending them on business trips.

Sending an external part-time worker on a business trip

Secondment of an employee working for several different employers at once is possible only with the consent of the main boss. To be released from the assigned labor obligations at the first place of work, a citizen will have to take either leave without pay, or use part of the annual vacation period (if you do not want to lose financial resources). Any of the options must be approved in writing by the main employer.

If a business trip is successfully completed, the external part-time worker receives financial compensation to cover expenses from the boss who actually sent him on business trip. If the employee was unable to peacefully agree with another manager about leaving on a business trip, then his unauthorized absence from the place of work will be regarded as absenteeism, which is a serious violation of labor legislation and, as a result, may be accompanied by termination of the contract.

In the event that an external applicant nevertheless has a conflict with the main employer, who decided to fire an employee, the person has the right to go to court. If you provide strong evidence of your failure to return to work, the cancellation of the agreement may be declared invalid and the plaintiff will be reinstated to his previous place.

Regulation of payment for business trip time of part-time workers

The Labor Code of the Russian Federation does not regulate the procedure for preserving the earnings of part-time workers during a business trip, but a separate section of the Government of the Russian Federation of October 13, 2008 No. 749 is devoted to this issue. Thus, paragraph 9 of this document states that during the period of execution of the employer’s instructions outside the place of work, the employee the average earnings for all working days according to the schedule of the company that sent him on the trip are preserved.

You can send an external part-time worker on a business trip only after reaching an agreement on his absence with the main employer.

Accordingly, this time is paid for by the sending organization in which the employee is employed part-time, and at his main job, upon his written application, leave without pay is granted.

If an employee is sent on a business trip by both employers (at the main place and part-time), then each of them must calculate the average salary, but the procedure for distributing expenses between them is determined by mutual agreement.

Sent on a business trip for two positions at once

Not so often, but you can still encounter situations where an employee is sent on a business trip by two enterprises at once. Workers need to understand that the guarantees provided for them in the provisions of legislative acts apply both to the main place of work and to the employer with whom cooperation is carried out on a part-time basis. Thus, when leaving on two coincident business trips, the person must retain both jobs and both monthly earnings.

If a subordinate is sent from two enterprises at the same time to different localities, then the person is obliged to discuss the possibility of shifting the established dates with his employers. In any case, the manager with whom the person cooperates on a part-time basis will have to adapt, since it is impossible to refuse a business trip to the main place of work.

Each employer is obliged to provide his subordinate with an advance amount to cover the necessary expenses for the trip: travel, accommodation and food. The amount of required transfers is established directly by the head of the company and is fixed in the provisions of local acts. Documentation of the business trip must also be carried out by each of the employers. Upon arrival from trips, the person is required to submit two separately completed advance reports on the finances spent, attaching the necessary supporting documentation.

In Russia, the one who knows his rights wins

If you want to know how to solve your specific problem, then ask

our duty

lawyer online

.

It's fast, convenient and free

or by phone:

Moscow and region:+7

St. Petersburg and region:+7

Federal number:+7

If the employee refuses

According to the law, only a small part of the organization’s employees can refuse a business trip, since they have not only the right not to travel on assignment, but also the employer’s obligation to protect such categories of employees from this type of performance of official duties.

Employees who cannot be sent on business trips include:

- pregnant women and mothers of young children under three years of age;

- minor workers;

- disabled people;

- employees working in an organization under an apprenticeship contract.

Management has the right to send the rest of the employees, including those on probation, on business trips.

An employee may refuse to carry out an order to go on a business trip if he has valid and compelling reasons for this, for example, in case of temporary disability or illness, which is documented by extracts from the hospital record.

The procedure for registering a part-time business trip

The procedure for sending an employee on a business trip from one of the organizations has a number of features. On the one hand, a boss who dispatches his subordinate must adhere to the standard algorithm of actions prescribed by the legislator. On the other hand, the second employer is also required to document the legal absence of the person at the place of work.

So, the official who sends the employee on a business trip must:

- Issue the appropriate Order. The document is developed in the form T-9 or T-9a, depending on the number of persons sent on business. This form is unified, however, the employer is allowed to use its own order template, developed for use exclusively within the organization;

- Based on the Order, accounting staff calculate the amount of money due to the person to cover business expenses during the trip. At the same time, the accountant must pay attention to the country where the employee is sent, since the currency in which the finances should be provided will depend on this fact. The advance is issued to a person in any way convenient for him, either in cash or by bank transfer to a card;

- Currently, issuing a business trip certificate is no longer necessary, however, in the internal documentation of some organizations such a need still exists. If the employer practices issuing this document to subordinates, then it is subject to mandatory registration in the relevant Enterprise Register;

- It is necessary to make an appropriate note on the working time sheet indicating that the employee is absent from his actual place. To indicate the departure of a person on a business trip, it is customary to use the code: “K”;

- Upon returning from a trip, the employee is required to fill out advance reporting in Form AO-1. The document is accompanied by all checks/receipts and other supporting documents confirming that all funds received were spent by the person for their intended purpose.

The second employer is obliged to issue unpaid leave to the employee.

To do this, the worker will be required to fill out an appropriate application indicating the period of absence and the reason contributing to the absence from work. On behalf of the manager, a corresponding Order is issued, on the basis of which a citizen may not appear in the organization within a specified time frame. No rating yet

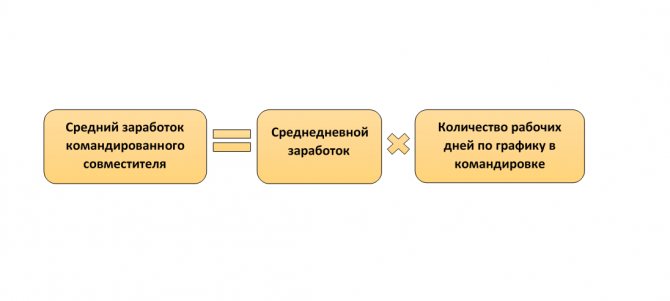

How to calculate the average earnings of a part-time worker during a business trip

The average earnings for calculating part-time business trips should be determined according to the general rules, taking into account the requirements of Art. 139 of the Labor Code of the Russian Federation and Decree of the Government of the Russian Federation dated December 24, 2007 No. 922. If an employee’s trip is initiated by both companies, then the calculation is carried out separately for each position - both the main one and the combined one.

Average daily earnings are calculated for the 12 months preceding the month the employee was sent on a business trip using the formula:

(PAYMENT IN THE 12 MONTHS BEFORE THE MONTH OF THE PART-TIME TRAVEL) / (NUMBER OF DAYS ACTUALLY WORKED IN THE 12 MONTHS BEFORE THE MONTH OF THE PART-TIME TRAVEL) |

To determine the average earnings for calculating a business trip, only accruals related to the performance of official duties and provided for by the company’s remuneration system are taken. This is the tariff part of earnings, additional payments and allowances accrued on it, bonuses, additional payments for working conditions and other charges approved by the company’s local regulations.

The payments taken into account do not include accruals that have a social orientation, as well as the amount of average earnings previously saved for various reasons .

The days of the calculation period accepted in the denominator of the formula exclude the time of release from work with or without pay: vacations, sick leave, periods of performing government duties, downtime, etc. If there is a moving business trip, the calculation of average earnings does not change.

Example

If the employee was on a business trip from 10.25.20 to 11.07.20, that is, it moves from one month to another, the billing period will be the period from 10.01.19 to 09.30.20. Since the employee's absence will be general and will begin in October.

The question of whether business travel allowances are included in the calculation of average earnings in terms of payment for days off on a business trip is still controversial. On the one hand, they are not part of the average earnings and should be recognized as part of accruals (Decision of the Moskovsky District Court of St. Petersburg dated October 8, 2018 in case No. 2-1472/2018). On the other hand, the entire period of a business trip is the time of release from the main job, and it is excluded from the calculation according to clause 5 of Resolution No. 922 (Letter of the Ministry of Labor of Russia dated August 13, 2015 No. 14-1 / B-608).