How to extract the regional coefficient from the amount

Relocation may be grounds for cancellation of allowances.

But the following employee income cannot be included in the base for applying the coefficient:

- business trips;

- vacation pay;

- material aid;

- one-time bonuses;

- "northern" allowances.

The regional coefficient for northern citizens is calculated monthly. From the amount that will be obtained after its accrual, the employer already makes contributions to funds, including the Pension Fund, and deducts personal income tax. Therefore, the pension for northerners is already increased from the very beginning. But it persists only if pensioners continue to live in such climatic conditions.

The reason for this may be various factors, the economic well-being of the country, the average level of wages, the complexity of the work performed due to certain factors. But the greatest influence on the amount of wages is exerted by natural and climatic conditions, and the more severe they are, the more effort and finances must be spent on performing the work.

Which is expressed in monetary terms as an increase to the average salary for a particular region. In order to more fairly determine the amount by which it is necessary to increase the salary of an employee in these climatic and natural zones, it is necessary to use the appropriate tool.

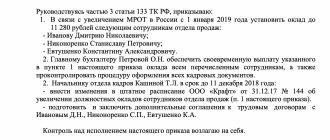

Labor Code of the Russian Federation).

And ordinary organizations can apply such coefficients (Article 1 of the Law of February 19, 1993 No. 4520-1). That is, companies have the right to choose which size to use – federal or higher regional (local).

The decision is fixed in a collective or labor agreement.

Who is charged the regional coefficient?

Both main employees and part-time employees have the right to the regional coefficient (Article 285 of the Labor Code of the Russian Federation). And this does not depend on the location of the employer himself.

For example, a Moscow organization entered into an employment contract with an employee from Murmansk. He will work from home.

The salary of such an employee will be calculated taking into account the regional coefficient (letter of the Ministry of Finance of Russia dated November 13, 2010 No.

The final salary will be 25,200 rubles.

How to calculate the northern coefficient of wages

Take the values of regional coefficients from the regulations of the former USSR and the Government of the Russian Federation for the regions of the Far North and equivalent areas. For example, in a locality they set a regional coefficient of 1.15, and to understand how much this is in the form of a bonus, an accountant will multiply the salary by 1.15.

Example 3: how to calculate a salary with the northern coefficient

The employee works for Alpha LLC, which is located in the fishing area in the Sea of Okhotsk. The employee's salary ratio is 1.80. Salary – 45,000 rubles.

The monthly income of an employee, taking into account the northern coefficient, is 81,000 rubles. (45,000 rub.

Most popular vacancies

When considering the possibility of earning money in the Far North of Russia, job applicants, in most cases, are guided by the size of the salary, as well as the demand for the specialty. The oil and gas, construction and forestry industries are actively developing and operating in this region, which has a huge impact on the labor market. Rail transport, which is one of the main means of transporting extracted raw materials, is also of great importance .

In order to clearly understand how much representatives of a number of professions earn in the north, it is advisable to analyze the most popular ones along with the minimum wage:

- Oil and gas sector: vacancies for the oil industry, driller, assistant driller (driller), excavator operator, geologist and engineer - from 60,000 to 100,000 rubles.

- Construction industry: vacancies for installer, welder, mason, argon worker, builder and finisher. The average salary can reach 50,000 rubles monthly.

- Transport: special equipment drivers, crane operators, excavator operators and motor grader operators. The salary fluctuates around 50-60 thousand rubles.

Thus, finding a suitable vacancy is quite possible, especially if the candidate meets a number of requirements that companies set for applicants, for example, has the skills to drive an excavator. In quite high demand from employers are support staff, who are most often recruited from local residents - these are cooks, security guards, maids and cleaners.

A doctor’s salary can be up to 60 thousand rubles, a driver’s salary can be 80 thousand rubles, teachers’ salaries can be up to 40 thousand rubles.

About the experience of working in the north - in the video.

Since such work is located in hard-to-reach parts of the North, located far from cities and other populated areas, personnel in the north receive salaries only at the end of their shift. Shift drivers are considered one of the most in-demand professions. The vast majority of companies make payments to employees on bank cards, which makes it difficult to receive funds, despite high minimum wages.

How to extract the regional coefficient from the sum

For this area, this parameter is 1.25.

Then you need to figure out what types of payments it is accrued for.

Of the above payments, only the employee’s salary, monetary remuneration and compensation for sick leave should be taken into account.

And only now can you use the proposed formula for calculation. We substitute all the numbers and accordingly determine the amount of payment for the northerner, taking into account the premium coefficient:

1.25 x (39,500 + 10,000 + 7,750) = 1.25 x (57,250) = 71,562 rubles.

However, this amount does not include personal income tax.

Important Residents of the Far North and areas that have a similar status work in extremely difficult climatic conditions. In addition, prices for food and vital services are much higher than in the Central region of Russia. That is why they have a regional coefficient, which makes a significant increase in wages.

The regional coefficient is calculated taking into account the following factors:

- climatic conditions;

- employer's field of activity.

The maximum coefficient is used in the oil and gas industry, and the minimum in the non-production sector.

The territories for which a fixed regional coefficient is assigned are enshrined in Resolution of the Ministry of Labor dated May 11, 1995 No. 49. In Art.

In this case, if the enterprise for which the employee works is not located in harsh climate conditions, and the business trip requires the presence of the employee in these places, then the payment of a percentage-type cash bonus is not provided.

How to increase your chances of getting hired

Since landing a suitable position can be quite difficult, and there are many applicants for it, the candidate must meet a number of requirements. First of all, they relate to the qualifications of personnel, as well as work experience in the chosen field. In addition, the climatic features of the region also influence the list of requirements for those wishing to earn money.

Among the main requirements for candidates are the following:

- At least 2 years of experience in the specialty;

- excellent health;

- willingness to live and work in difficult conditions.

The last factor, oddly enough, is considered the last factor by applicants. Such negligence can have serious consequences, because the terrain and climate make the Far North one of the most difficult regions of the country to develop.

A higher education can be a good advantage if it coincides with the specialty of the enterprise specified in the contract.

Since employers most often do not look for candidates directly, those who want to earn money will have to deal with numerous intermediaries. This poses a certain danger, which is due to the huge number of scammers in this area. They often charge for insurance, uniforms and transportation to their future place of work, but in reality they do not provide any services in return.

The health status of the candidate is subject to a serious check by the medical staff, and in this case, doctors take a very responsible approach to finding various contraindications and other problems that prevent the candidate from obtaining the desired position.

How to calculate the regional coefficient from the amount

Employee Neklyudov has “northern” experience, which allows him to calculate salaries with northern allowances to the maximum.

This month, employee Neklyudov received:

- salary – 30,000 rubles;

- one-time bonus – 15,000 rubles;

- sick leave payments – 8,400 rubles;

- financial assistance – 2,500 rubles.

How much money will he receive? In the formula for calculating the northern allowance, in this case, only the “bare” salary is used.

Minimum wage approved by law.

That is, at the legislative level, based on the real subsistence level of the working population, a certain amount of material support is established, thanks to which the worker will be able to provide himself with everything necessary and below which the employer has no right to pay.

Moreover, if an employee performs his duties in conditions deviating from normal conditions, for example, in difficult climatic conditions, which is important for the northern regions, a regional coefficient is also added to the already guaranteed minimum wage in accordance with the norms enshrined in Article 316 of the Labor Code RF and in the amount approved by Law No. 4520-1.

And in accordance with Article 317 of the Labor Code of the Russian Federation, northern workers are also entitled to a bonus, calculated in proportion to the length of service in areas belonging to the far north or equivalent to it.

Approximately the same meaning is given by law to the northern bonus in accordance with Article 137 of the Labor Code of the Russian Federation, which, in essence, is financial gratitude at the state level for work experience in the northern regions. After all, working for 15 years in low temperatures with excessive physical exertion is not so easy, which is why the agreed bonus is paid to northerners.

That is, following the direct interpretation of the law, wages are remuneration for a certain amount of work performed within the normal hours per month, while the coefficient and bonus are compensation for living in special climatic conditions, implying excessive expenditure of both physical strength and material resources.

- Benefits paid in connection with the birth of children.

- Payments for professional holidays and anniversaries.

- Compensation for the use of an employee’s personal property for the employer’s purposes.

- Payments associated with awarding an honorary title to an employee, and some others.

As for the procedure for applying the regional coefficient to wages, it is strictly regulated by the labor legislation of the Russian Federation and is calculated from the very first to the last working day of the employee, provided that all working days he worked in the region to which the “northern bonus” is applicable.

There are nuances

According to the requirements of the labor legislation of the Russian Federation, all employers, without exception, are required to apply regional coefficients when calculating wages of employees who work in the Far North or in regions equivalent to it.

An employee of an organization with a salary of 30,000 rubles.

sent to field work: in September - to an area equated to the regions of the Far North, where the coefficient was set to 1.7; in October - to the Chelyabinsk region, where the regional coefficient is 1.15. The traveling nature of the work is not specified in the employment contract.

The accountant calculated the salary taking into account the coefficients as follows: - in the month when the employee worked in Irkutsk, 30,000 rubles. x 1.3 = 39,000 rubles; – in September: 30,000 rub. x 1.7 = 51,000 rub.;

Accommodations

The high salaries typical for this region are due to a number of negative factors that local workers have to face. First of all, this concerns everyday inconveniences related to housing and food issues. As a rule, the applicant does not know in advance where exactly the work site will be located, where he will be employed, and what the living conditions will be.

Most often, the practice is to place personnel in special dormitories in areas of the Far North, located near large factories. However, if the place of work is located far from large cities, laborers and other personnel will share a kind of residential trailer with a large number of colleagues.

The climate is typical for the Far North: in summer, the soil is more like a swamp, which requires constant efforts by workers to prepare sites for work and traffic. The number of sunny days here is extremely small, which has a serious impact on the health of staff. In winter, you have to live and work in constant and severe frost, which creates additional difficulties, coupled with the natural features of the area.

Calculation example

An example of calculating the northern allowance and the regional coefficient: employee V.D. Neklyudov works in the city of Syktyvkar, Komi Republic. His salary is 42,000 rubles. According to Resolution No. 49, the regional coefficient for this territory is 1.25. The maximum size of the northern surcharge for this area is 50%. Employee Neklyudov has “northern” experience, which allows him to calculate salaries with northern allowances to the maximum.

This month, employee Neklyudov received:

- salary – 30,000 rubles;

- one-time bonus – 15,000 rubles;

- sick leave payments – 8,400 rubles;

- financial assistance – 2,500 rubles.

How much money will he receive? In the formula for calculating the northern allowance, in this case, only the “bare” salary is used. That is, the amount of the premium will be 30,000 * 50% = 15,000 rubles. The size of the “coefficient” bonus is equal to (30,000 + 15,000 + 8,400) * 1.25 = 66,750 rubles. Thus, the amount of his earnings for the current month before tax will be 66,750 + 15,000 = 81,750 rubles. After taxation, Neklyudov will receive 81,750 - (81,750 * 13%) = 71,122.5 rubles

The percentage calculator allows you to make any calculations with percentages: finding a percentage of a number, what percentage is the number “X” from the number “Y”, adding a percentage to a number, subtracting a percentage from a number

To calculate, you need to enter data into the fields of the calculator, then click the “Calculate” button to get the result.

Finding the percentage of a number. To find the percentage of a number, enter the percentage value you want to find in the first field. In the second field, enter the number from which you want to find the percentage.

Percentage Calculator – Finding Percentage of a Number What is % of a Number

What percentage is the number “X” of the number “Y”. In the first field you need to enter the number whose percentage we are looking for. In the second field you need to enter a number from which we will find the percentage of the first number.

What percentage is the number "X" from the number "Y" What percentage is the number from the number

Adding a percentage to a number. To add a percentage to a number, you need to enter the percentage value that you want to add in the first field. In the second field, enter the number to which you want to add the percentage.

Adding a percentage to a number Add a percentage to a number

Subtracting a percentage from a number. To find the result, enter in the first field the number from which you want to subtract the percentage. In the second field, enter the percentage value you want to subtract from the number.

Subtracting a percentage from a number Subtract a percentage from a number

Percent (lat. per cent - per hundred) - one hundredth. Indicated by the "%" sign. Used to indicate the proportion of something in relation to the whole. It is generally accepted that 100% = 1, so 25% is equivalent to 0.25 or 25/100.

Example. In order to calculate the percentage of a number, you need to indicate in the first field the percentage that you want to calculate, for example “20”. In the second field you need to specify the number from which the percentage will be calculated, for example “60”. After entering the data, click the “Calculate” button, the desired result is “12”.

Guarantee of payments - is there one?

Shift work in the North has many nuances regarding the conclusion of the contract and the fulfillment of the conditions specified in it by each of the parties. It is almost impossible to sign a contract with an employer directly and work for Gazprom, which means you have to deal with numerous agencies that may turn out to be fraudulent.

New rules governing the relationship between employer and staff in this region provide that work can be accepted for up to 120 days, which makes payment delays completely legal and systematized.

Also, if you count, a huge number of private companies, which are much easier to get a job in than in the public sector, often leave people without pay at all, trying to reduce the cost of paying staff in a similar way.

If you plan to get a job in a private company, you need to be prepared for the fact that the payment will be significantly lower than the amount stated by the intermediary.

If there is no payment, leaving the region will become a big problem, because most of the jobs are located far from large cities and civilization in general, not to mention the lack of funds to pay for transport. That is why the Gazprom North shift seems to be the most reliable option.

However, if the applicant managed to get a job with the police or Gazprom, where the salary is slightly higher, or similar state corporations, there are reliable guarantees that the employer will fulfill his obligations. There is also a social package, which is noticeably wider in the case of employment in the police. A police officer earns 15% more here than in other regions.

How to calculate the coefficient

April 12, 2011 Author KakSimply! Typically, coefficients are presented as dimensionless quantities. Sometimes it is convenient to express them as a percentage. As an example, we can consider how return on sales is calculated - one of the coefficients characterizing the profitability of an enterprise. Instructions 1 Find data on the company's net profit for the period under review. For example, this value is equal to 900 thousand rubles. All necessary data can be obtained from the accounting department or viewed in the financial statements of the organization. 2 Request data on the company's sales volume. You must get the figure for the same time period, otherwise calculating the coefficient will have no practical meaning. Let's say the sales volume is 156 million rubles. Be sure to express this figure in the same units as the figure obtained in step 1. As a result, we have 156,000 thousand rubles. 3 Calculate return on sales. To do this, divide your net profit by your sales. We divide 900 thousand rubles by 156,000 thousand rubles, we get 0.005769. This is the profitability of the enterprise for the period under review. 4 Express return on sales as a percentage. To do this, multiply the resulting coefficient by 100%. We multiply 0.005769 by 100, we get 0.58%. Please note: In a similar way, you can calculate the liquidity, capitalization, activity and profitability ratios of any organization. Keep in mind that in practice, specialists use dozens and hundreds of different financial ratios. Don't be confused - they are basically all derived from the coefficients of the above categories and are calculated in the same way. Helpful advice: Practice calculating profitability ratios for any other data from the company's income statement. You can also use data from the company's balance sheet as a basis. Is the advice useful?

Support staff

To ensure the proper functioning of worker settlements located near the facilities, a fairly impressive staff of support staff is used, receiving additional payments and allowances. This could be an interesting opportunity for a job seeker, especially if they are not well qualified for the job openings.

Such personnel should include vacancies:

- security guard - 35 thousand rubles;

- cooks - 25 -30 thousand rubles;

- nurses up to 27 thousand rubles;

- maid - 20 thousand rubles;

- cleaner - 25 thousand rubles;

- general workers 35 thousand rubles;

- driver 45 thousand rubles;

- flaw detectorist - up to 40 thousand rubles.

Naturally, working in such conditions will be noticeably more profitable than in other regions of the country. This is explained by the fact that the minimum wage of a security guard or cook consists of a salary and an allowance due to extreme working conditions. Such bonuses reach 25% in some cases, and salaries are higher than elsewhere , so it is not difficult to calculate the expected salary for each profession.

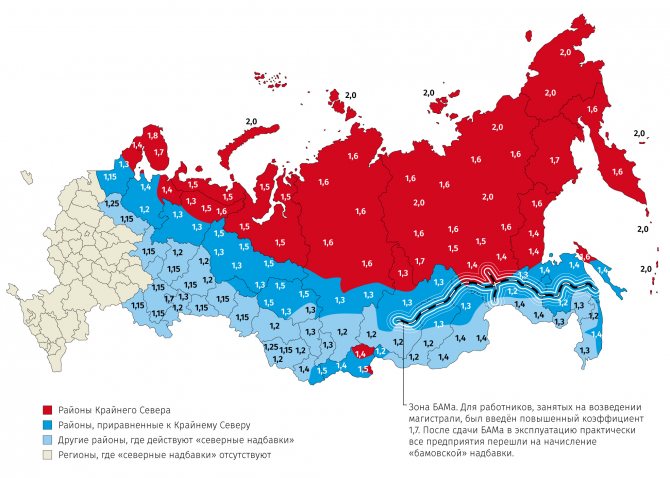

Territories equivalent to northern ones

The Northern coefficient is calculated in many regions, taking into account the following factors:

- Climate – very cold, or vice versa, hot climate significantly worsens working conditions;

- Infrastructure in the region, how easy it is to get to it, availability of transport;

- Environmental situation in the region;

- Scope of activity of the enterprise.

The main regions where additional earnings coefficients will be awarded are the Far North, Far East and the south of the East Siberian region.

Coefficient size by region (clickable):

A region is classified as the Far North if there are no major roads along which one can easily reach this region, and the climate in these areas is very cold. Therefore, employees who agree to work in such difficult conditions are offered an increase of 2, and in some places even 3 times.

For example, Murmansk is located in the North-West of the Russian Federation beyond the Arctic Circle, and although it is considered one of the warmest northern cities, the working conditions here are still difficult - cold changeable weather, cool summers, and most importantly - the polar night, which is 40-50 days the city is covered in darkness. Therefore, the northern coefficient here is 1.5.

The Trans-Baikal Territory is one of the few where the northern coefficient applies throughout the entire region, and not in selected cities. The coefficient here is 1.4.

Severodvinsk is located in conditions equivalent to the Far North; it rains or snows almost all year round, and it is very rarely sunny and warm. It is quite difficult to work in such conditions, so the regional coefficient here is 1.4.

Many cities in the Krasnoyarsk Territory belong to the cities of the Far North or are equivalent to them; winters here are cold and long, and summers are quite short.

The average regional coefficient in the Krasnoyarsk Territory is 1.5; in more severe areas, for example, Norilsk, it can reach 1.8.