06.07.2019

0

684

4 min.

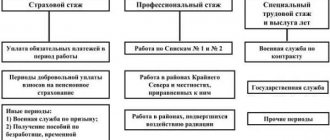

The basis of the social insurance system is monthly contributions that working citizens make in the form of contributions. In the future, these amounts will be used to cover the costs of compensation for temporary disability and time spent on maternity leave (BIR). As a rule, this function is performed by the employer, transferring a percentage of employee income (2.9%) to the Social Insurance Fund (SIF) and covering the period of loss of ability to work with compensation from the SIF funds. The amount of maintenance depends on the insurance period - the time intervals during which deductions from wages were made to the Social Insurance Fund accounts.

What does it include?

The main thing here is Federal Law No. 400, or to be more precise, Article 12 of this law.

According to this document, non-insurance periods include:

- The period of removal from office in accordance with the Procedural and Criminal Code. Even if the citizen was later rehabilitated, points are no longer awarded.

- Operational search activities.

- Residence abroad of spouses of those who work as diplomats and ambassadors.

- Care provided for disabled people of group 1, minor children or persons over 80 years of age.

- Detention, even for unjustified reasons.

- Receiving unemployment benefits, participating in paid public works. Relocation periods according to civil service requirements.

- The care of one parent for the children until each reaches one and a half years of age.

- A period of temporary disability during which compulsory social insurance benefits were paid.

- Military and other service with equal values.

Total experience

The indicator represents the number of years that a person has been engaged in labor and socially useful activities. The total length of service under the new law also includes another period specified by the current regulatory legal act.

The indicator influences:

- payments assigned to citizens on disability;

- financial support in old age;

- long service pension.

When studying the concept and included periods of activity, it is necessary to take into account that the total length of service will be accrued only if during this period wage contributions were made to the Pension Fund.

This is important to know: What is included in the preferential medical experience

Please note: A person has the right to ask for the period of work performed outside the country to be taken into account. However, such length of service will be taken into account only if this was specified in the international employment contract. In other cases, only activities that were carried out on Russian territory are taken into account.

However, if a person worked at a Soviet enterprise located on the territory of the USSR, the period will also be taken into account when calculating length of service.

The total length of service includes a whole list of periods, the list of which includes:

- participation in public works, if they were paid;

- service in the army of the Russian Federation and other activities equivalent to it;

- child care until he reaches 1.5 years of age. However, the law sets limits. Only 3.5 years that parents spent on maternity leave can be included in the total length of service. Previously, the figure did not exceed 3 years. If the pension was established before January 1, 2014, the citizen has the right to count on recalculation by decree;

- the amount of time that military contractors could not work due to living in places where there was no such opportunity. In total, no more than 5 years of work experience can be taken into account;

- the period during which the employee was on sick leave;

- time to care for a disabled person of the 1st group or a pensioner over 80 years of age. The indicator is taken into account if assistance to the person was provided by an able-bodied citizen;

- the amount of time that the person was in custody if criminal prosecution was carried out unreasonably;

- the amount of time that spouses of representatives of diplomatic and consular institutions of the Russian Federation lived abroad, but only if the person’s spouse was sent to another country to perform professional activities. In total, no more than 5 years of experience can be taken into account;

- the amount of time that the person was registered with the employment center and received unemployment benefits;

- the period spent moving and relocating for employment in another city or rural area, but only if the action is carried out in the direction of the employment center.

A number of features apply to students who studied full-time at the university. Previously, the amount of time spent on education was taken into account when calculating a pension. However, the current legislation was subsequently changed. As a result, the period of study is no longer counted as work activity, since no contributions are made to the Pension Fund.

All of the above periods will be taken into account when calculating only if the person continued his professional activity after them. At the same time, the legislation does not indicate the amount of time that a person is required to perform work tasks. A separate period is highlighted, which is not included in the accounting of length of service.

This includes:

- the amount of time the person spent studying or taking courses;

- stay in concentration camps or in besieged Leningrad during the Second World War;

- survival in the occupied areas of the USSR during the Second World War;

- time spent caring for parents or legal representatives, HIV-infected, minor children.

Work experience must be confirmed. The procedure can be performed using one of two methods. In the first case, the citizen is required to present a completed work book, which was drawn up in accordance with the model established by law. If the document has been lost, it is acceptable to provide a contract, an order for employment or statements confirming the fact of deductions to the Pension Fund from wages. In practice, it is not always possible to document the total length of service. In this situation, the testimony of two or more witnesses is taken into account. This method can help if the loss of documents occurred, for example, as a result of a large-scale emergency.

Non-insurance periods on sick leave - what is it?

Usually this refers to periods when a citizen served in the following structures:

- FSIN.

- FSKN.

- Ministry of Emergency Situations.

- Ministry of Internal Affairs

- RF Armed Forces.

Service in the RF Armed Forces means any type of service - both urgent conscription and contract. During this time, no fees are paid for the citizen.

Moreover, any type of activity must have documentary evidence. This rule applies equally to all structures listed above.

The following are most often used as identification documents:

- Certificates from government agencies.

- Labor contracts.

- Work books.

- Military IDs.

The manager himself must obtain confirmation that during the specified time period the citizen associated his activities with one of these structures. If there is no evidence in writing, then the periods are simply removed from the insurance record. Because of this, temporary disability benefits are smaller.

Definition of continuous service

As a general rule, the indicator does not have any effect on the size of the pension. However, in some cases it may be. So, if the total length of service is less than continuous, the benefit is determined according to the last indicator. The law allows you to maintain continuous service.

This is important to know: Is industrial practice included in work experience?

This happens in the following situations:

- the person moved to another place of work, and the break between work activities did not exceed 1 calendar month;

- the person was forced to terminate the employment contract due to the fact that his spouse was transferred to another location for professional work or retired;

- a woman is carrying a child, is the parent of a disabled minor under the age of 16, or has offspring under the age of 14;

- the person terminated the employment contract on his own initiative, and the amount of time that elapsed before employment at another company did not exceed 3 weeks.

In some situations the indicator is not saved. This is possible if a person was fired due to being drunk at work, failure to appear for an unexcused reason, systemic failure to fulfill work duties, or the entry into force of a court verdict on the basis of which the person is deprived of liberty.

Additional nuances

If the same time is associated with several places that are being counted, only one is chosen. To do this, the citizen draws up a written application. Breaks in work for calculating sick leave are practically irrelevant.

Any confirmation documents must include the following information:

- Work period.

- Description of the position.

- Address where duties were performed.

- Date of birth of the employee.

- FULL NAME.

- Number and date of issue.

The papers are usually transferred to the accounting department. Or another regulatory authority.

If the exact date is not indicated in the documents, then the countdown starts from the 15th. The average amount of compensation for temporary disability depends on the length of service during previous periods. The higher it is, the larger the payments. The highest rates are among those who, even with non-insurance periods, have worked for 5 years or more.

In any case, 100% will be paid to women who had maternity leave.

The more non-insurance periods, the lower the final amount of compensation will be.

Opening sick leave becomes an important point if your vacation coincides with illness. Without documents, it is impossible to confirm temporary disability. The validity of the documents begins from the first day of contacting doctors. And it doesn’t end until the issue itself is finally resolved.

Payment for sheets involves the following procedure:

- Calculate average earnings per day. We need to take the base for the previous two years, divide by the number 720.

- Next, calculate how much insurance experience you have.

- Benefits are being accrued, in a maximum of 10 days.

Basic Concepts

When determining rights to a pension benefit, not only the length of time a person worked officially throughout his life is taken into account, but also the periods when an enterprise or individual entrepreneur paid contributions to the Pension Fund, deducted from his earnings. These periods are called insurance period.

Expert opinion

Novikov Oleg Tarasovich

Legal consultant with 7 years of experience. Specializes in criminal law. Member of the Bar Association.

The total duration of the insurance period also includes periods when a citizen did not work due to certain circumstances, but received insurance benefits and made contributions to the Pension Fund during:

- military service, this also applies to family members of military personnel, when due to the conditions of being in a military unit they could not work (a period of no more than 5 years can be considered an insurance period);

- temporary disability due to illness;

- maternity leave until the age of 1.5–3 years, and when caring for the third and subsequent children, the length of service will not be considered insurance;

- transfer to a place of work remote from the previous one (another city, region, country);

- participation in public works;

- the period when the citizen(s) were fired or laid off, were temporarily unemployed and were registered as unemployed;

- stay in places of deprivation of liberty;

- cared for disabled people (disabled people, elderly parents, children over 3 years old).

The insurance period also includes a period called special, when citizens work in conditions harmful to health, which is associated with the peculiarities of performing work duties, climatic and other circumstances. In this case, insurance contributions to the Pension Fund must be deducted.

Work experience refers to the period when an individual was officially engaged in labor or social activities. Having official work experience is a necessary condition for receiving social benefits, such as insurance payments and pensions, as provided for by the Labor Code of the Russian Federation. The basis for the beginning and end of work experience is the conclusion between the employer and the employee of a contract or agreement on the basis of which labor duties or public work will be performed.

Despite the fact that there are differences between insurance and work experience, there are exceptions when the period can be called insurance experience, but at the same time the person did not work

The state may consider these reasons valid and will add this period of time to the total length of service if:

- No work was carried out, and contributions to the Pension Fund were deducted.

- The citizen was in public service. This includes the entire period of time when he (s) was actively working in a government agency. In this case, the employee is entitled to a bonus for length of service, as well as additional time for rest and other benefits.

- Special experience, which will be considered insurance and labor at the same time. This is the time when a citizen was engaged in labor activities associated with harmful conditions, which gives them the right by law to retire early.

The legislator believes that a total work experience of 5 years is sufficient to calculate a pension, but you should not count on large pension payments that the Pension Fund will assign. Each subsequent officially worked year of work can potentially increase the amount of pension accruals.

To know exactly how to calculate the length of service for sick leave in 2021, you should decide on the type of length of service, this directly affects the calculations.

You can find out which periods are counted towards the insurance period from this article.

When calculating pension payments, there are still exceptions when continuous and insurance periods are compared with each other, and if it turns out that the insurance period is less than continuous, then the pension benefit will be calculated on a continuous basis.

This is important to know: Is part-time work included in your work experience?

This happens in cases where:

- the break period between the new and old place of work is less than 30 days according to the calendar;

- the employee quit of his own free will for no apparent reason and got another job, the break between work activities is no more than 3 weeks;

- the citizen resigned due to the transfer of the spouse to a place of work located in another city, region, or country;

- a woman is forced to care for a disabled child until he reaches the age of 16;

- a woman takes out maternity leave;

- the woman decided to care for the child until he reaches 14 years of age and she has a supporting document in the form of a medical certificate.

When will refusal of payment for disability be legal?

In some situations, there is no payment for disability. usually due to the following situations:

- If the disease appeared during the validity of another document. For example, related to caring for a child or a sick relative.

- When problems arose during a vacation at your own expense.

- When illness coincided with maternity leave.

- When applying for sick leave. Then you can count on compensation in just a couple of days. This also applies if problems arose immediately after completion of training.

The main thing is to fill out all the cells on the sheet without going beyond the boundaries. Start with the first available free space. Use only black ink and block letters, even when filling out by hand. Or you can use modern technology.

Typically, information on non-insurance periods is filled out only by employers or their authorized representatives. It is important to prepare supporting documents correctly. The main requirement is that it can be seen that the information is related specifically to a specific citizen.

Entries in the work book must also comply with the rules and requirements of the law. The condition applies to any securities that continued to be valid for a specific period of time.

What to pay attention to

What to do if an error was made when filling out?

Letter No. 14-03-11/15-11575 of the Federal Social Insurance Fund of the Russian Federation dated September 30, 2011 explains what to do if an error was made when filling out a sick leave certificate.

According to the text of the Letter, if there are technical defects in the form filled out by hand (in other words, an error or typo), there is no need to reissue the form.

At the same time, it is impossible to refuse to assign and pay benefits if there are errors on the form.

The above rule applies only if all entries on the sheet are clearly legible and readable.

So, non-insurance periods include periods of labor activity in the Ministry of Internal Affairs, the Federal Drug Control Service, the Federal Penitentiary Service and other government agencies, as well as the period of military service or contract service in the army. Only service in the relevant structures starting from January 1, 2007 is recognized as non-insurance periods.

“Non-insurance” periods are considered to be periods during which insurance premiums for compulsory insurance were not paid from the employee’s income.

According to clause 66 of the Procedure for issuing certificates of incapacity for work, approved. by order of the Ministry of Health and Social Development of Russia dated June 29, 2011 No. 624n, in the line of the sick leave “incl. non-insurance periods”, filled out by the employer, indicates the number of full years and months of military service performed by the employee, as well as other service provided for by the Law of the Russian Federation of February 12, 1993 No. 4468-1 “On pension provision for persons who served in military service, service in internal affairs bodies, State Fire Service, authorities for control over the circulation of narcotic drugs and psychotropic substances, institutions and bodies of the penal system, and their families” (hereinafter referred to as Law No. 4468-1) from January 1, 2007. Thus, other “non-insurance” periods , in addition to the above, are not taken into account on the certificate of incapacity for work.

Please note, firstly, the line in question indicates the number of full years and months of military and other service, without any rounding; secondly, periods of service are taken into account starting from January 1, 2007, that is, periods of service up to 1 January 2007 are not taken into account

Thus, the line “incl. non-insurance payments" is filled in only if the service fell on the period after January 1, 2007 and was at least one month.

Periods of military and other service provided for by Law No. 4468-1, on the one hand, are recognized as “non-insurance” periods, on the other hand, according to the legislative changes that have occurred, from January 1, 2010, they are counted towards the insurance period. Therefore, they must be taken into account, including when filling out the line “Insurance period” of the new form of certificate of incapacity for work.

What else to consider

If the periods of employment that relate to the insurance period coincide, you should choose one of them and report this in writing

The form is arbitrary, but it is important to accurately indicate the dates that must be taken into account when calculating

Foreign citizens working officially, as well as citizens of the Russian Federation, also have the right to form an insurance period, subject to the employer paying contributions and deductions to the relevant payroll funds. However, for a number of countries there are exceptions in which it is possible to use the work experience that a citizen of another country had in his home country. It will also be taken into account on the territory of the Russian Federation.

An important document in the calculation is the work book. This is a mandatory document that confirms not only payments and sick leave, but at the end of your career it guarantees and confirms the right to receive a pension.

The registration of the work book occurs in accordance with the procedures of labor legislation adopted in the Russian Federation. However, the main conditions for foreign documents are mandatory translation into the state language at the place of presentation.

The employee’s main document to prove the insurance period is the work book

It is important for the applicant to know that this document is his guarantee of receiving any payments provided for by the current legislation of Russia. The work book records all places of work and periods that were worked there.

If the necessary information is missing or inaccurate, it makes sense to draw up a work permit, which will give you the basis for the right to receive sick leave, various certificates and documents from the employer. If the experience cannot be documented, witness testimony (from 2 people) can be used.

You also always have the right to create a duplicate document if it is lost. The restored labor record is taken into account as an official document. You have the right to invite former employers or other individuals and legal entities who can provide and, if necessary, confirm the necessary information.

Registration of non-insurance experience is a common practice among employees of any enterprise. The procedure for receiving financial payments is standard, as when preparing other documents related to payments for sick leave. Therefore, the package of documents that an employee must submit is typical. The employee must also provide extracts from the work record book as proof of length of service and grounds for receiving compensation.

Post tags: , sick leave, news

Nuances of filling

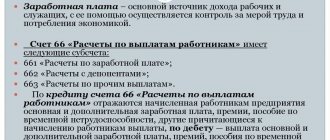

Each certificate of incapacity for work has several sections, some of which are filled out by a medical professional, and others by the employer immediately before transferring the document to the Social Insurance Fund. On the left side of the form, the columns are signed “to be filled out by the employer.” All points in this section are related to the description of the terms of general length of service and insurance, as well as the indication of the patient’s identifying information as a taxpayer to the state. Data on the employee’s average income for the previous two years is also filled in here. This is the figure on the basis of which the amount of monetary assistance from both the employer and the Social Insurance Fund is calculated.

Near the “total length of service” field, 4 cells are separately marked to mark the term of non-insurance periods. Marks are made under the columns that only years and months are indicated (two cells for each date). When filling out this column, you should remember that only full years and months of work, including annual leave, are taken into account.

Correctly indicating non-insurance periods in payment documents is the responsibility of the firm's accountant, but he is not required to make formal inquiries or otherwise seek confirmation of the performance of activities. In order to receive the maximum amount of payments, the employee must independently provide supporting documents from previous places of service.

Legislative framework

The deduction of insurance payments is regulated by Article 12 of Federal Law No. 400 -FZ “On Insurance Pensions”.

Within the framework of this regulatory act, non-insurance periods, including the following, can be counted into the insurance period, along with those periods when labor activity is carried out:

- time allotted for military service, as well as for carrying out activities equivalent to such service - this provision applies to persons who served in military service, service in internal affairs bodies, in state fire protection, in psychotropic substances control agencies, as well as in authorities of the tax and correctional system;

- the period allotted for receiving social benefits within the framework of compulsory insurance - this period is taken into account only during the incapacity of an individual;

- the period allotted for the care of one or both parents for children until they reach the age of 1.5 years - this period cannot be, in total, more than 6 years for all children;

- the period allotted for receiving social benefits for unemployment, the period of participation of an individual in correctional labor;

- the period allotted for the resettlement of a citizen in the direction of the state employment center to another region for employment on a permanent basis;

- the period of detention of citizens who were prosecuted on illegal grounds or who were illegally repressed, but ultimately rehabilitated;

- the period of detention of the above groups of persons in exile.

It is worth noting that the listed non-insurance periods can only be reimbursed if they are not included in the total length of employment to calculate the estimated amount of pension payments.

The amount of compensation for insurance premiums is determined by multiplying the cost of one year by the duration of non-insurance periods. In this case, each specific month is determined in the amount of 1/12 of the year, and 1/30 of the month.

The amount of one insurance year every 12 months is determined by special regulations of the Government of the Russian Federation. They may remain identical to the previous insurance period. And they can be changed depending on many factors, including the current economic situation in the country.

Before submitting documents to the Pension Fund, it is better to understand what a sample certificate of insurance experience looks like, so that there are no problems with registration and execution of the case.

Military service is included in the insurance period or not, experts explain in an article on.

What periods are included in the calculation

The concept of insurance experience is broader than labor experience. In the latter, a properly formalized employment relationship with the employee is accepted. To calculate the insurance period, you need to take into account:

- The time of military and equivalent service. Applicable to the penal system, police service, state drug control, fire service, etc.

- Time of forced incapacity for work with the obligatory condition of issuing sick leave, the payment of which also depends on the calculation of the insurance period.

- Child care (including guardianship) up to one and a half years old. If there are several such leaves, only 4.5 years will be included in the insurance period, even if the total was more.

- Periods of registration at employment agencies and receiving unemployment benefits, as well as periods of moving to a new place of work with a referral from a state employment agency.

- Terms of care for disabled people of group I, children with disabilities, as well as for elderly people aged 80 and older.

- Periods of unjustified detention in places of detention, as well as the time of repression during further rehabilitation.

- Cases when spouses of military personnel stayed at the place of service of the spouse liable for military service, without being able to get a job. Only 5 years of insurance experience are taken into account, even if there are more of them in total.

- Spouses of Russians sent by the state to work in other countries for diplomatic, business or representative purposes have the same rights.

- A maximum period of five years of such stay abroad can be counted in the calculation.

All eight cases presented above will be included in the insurance period under one condition: if immediately before or immediately after the indicated periods, work or other activities were carried out, from which insurance funds were transferred to the Pension Fund.

When can sick leave be taken out during vacation?

A registered sick leave during vacation gives the employee the opportunity not only to take all the required vacation days in peace, but also to receive an insurance benefit paid for sickness. Sick leave and vacation are quite compatible, but only if we are talking about its annual form.

It happens that state benefits for sick leave issued during the vacation period are not paid, although the vacation itself can be extended. Situations are also possible when neither the insurance benefit is paid nor the vacation pay for sick days is increased. It's all about the types of vacations. Read more about these nuances below.