Legal grounds and package of documents

The right to go on a second maternity leave without leaving the first is based on Article 255 of the labor legislation. It establishes the possibility of obtaining maternity leave.

When carrying one child, sick leave before birth is issued for 70 days. In case of multiple pregnancy, sick leave can be increased to 84 days. The sick leave period after the birth of a child is 70 days.

Sick leave may last longer, but not more than 86 days, if during childbirth there is a risk to the life of the mother or child. The basis for payment of financial assistance is Article 255 of the Federal Legislation. According to this document, maternity insurance for temporarily disabled women is mandatory.

To receive payments, the expectant mother must write an application to the employer at her place of employment. You must have with you:

- Statement upon interruption of parental leave.

- Sick leave from a medical institution.

- Application for receiving funds for the period of sick leave before childbirth.

If the expectant mother applied to the antenatal clinic before the 12th week of pregnancy, a certificate of early registration should be attached to the general package of documents. It will allow the pregnant employee to receive additional payment. In 2021 it is 702 rubles.

After the birth of your second child, to receive financial assistance you must provide:

- Birth certificate of the second child.

- A certificate from the registry office confirming the purpose of this type of payment.

- Application for receiving payments.

After a woman receives all the payments due to her from her employer, she can apply for monthly financial support. This type of payment depends on the period of maternity leave.

What maternity benefits are available for a second child in 2021?

State support for families with children consists, in particular, of financial assistance. After all, it’s no secret that in our difficult times it is very difficult to collect the required amount of money even for important and necessary things.

This cash payment can be received by families with children born in 2007 and later, in particular:

- The child must have Russian citizenship;

- For the second, third and subsequent children born or adopted - if the baby was born later than January 1, 2007;

- For the first child born after January 1, 2021.

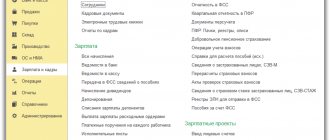

In order to be able to manage maternity capital, parents must obtain a special certificate from the Pension Fund (hereinafter PF) of the Russian Federation.

This document (from April 2021) is issued electronically and does not require an application from parents or adoptive parents. A simplified registration option became possible due to the fact that after receiving the child’s birth certificate and based on the unique SNILS number, the Pension Fund automatically begins issuing the certificate.

In most cases, you do not even need to submit an application to obtain a personal document. The Pension Fund of the Russian Federation will send the certificate electronically to the parents’ personal account. This will happen 15 days after the Pension Fund receives the relevant information from the Civil Registry Office, and from January 2021, the period for reviewing documents has decreased to 5 days.

If the document does not appear in your personal account at the specified time, parents need to submit an application.

It can be done:

- On the website of the Pension Fund;

- On the State Services portal;

- At the territorial office of the Pension Fund at your place of residence.

According to the Federal Law, Article No. 13, the person caring for the baby (father or mother, close relatives, guardians) can apply for a subsidy for the baby. If care is provided by several family members, then only one of them can receive benefits.

The amount of the benefit is calculated based on the average earnings of the person who took parental leave and is about 40% of the actual salary.

Working parents receive financial assistance from the moment they take leave from work until the child reaches one and a half years of age, and non-working parents - from the moment the documents are submitted.

For pregnancy and childbirth. Minimum - 58,878.4 R, maximum - 340,795 R for 140 days.

Care for up to one and a half years. Minimum - 6,752 R, maximum - 29,600.48 R per month.

Sick leave. Minimum - 412.65 R, maximum - 2434.25 R per day.

Up to 3 years and from 3 to 7 years. The income of unemployed parents is taken into account; the maximum per capita income and the amount of payment depend on the cost of living for the second quarter of 2020.

You can receive sick leave payments even when caring for a child. There are restrictions on the duration of paid care, but social insurance will pay money to insured parents. For example, for a child under 7 years old with sick leave with code “09”, no more than 60 days a year are paid, with code “12” - up to 90 days.

Since 2021, the Direct Payments project has been launched in all regions. The money will come from the Social Insurance Fund, and the employer will only transfer the documents there.

Minimum allowance. The minimum benefit depends on the minimum wage. In 2021, sick pay for a full month cannot be less than RUB 12,792. Now this condition has been made permanent. One day of sick leave costs at least 412.65 RUR.

Maximum benefit. Sick leave depends on length of service and average daily earnings. If a certificate of incapacity for work is opened to a parent in 2021, payments for 2021 and 2020 are taken into account. And regardless of the actual salary, there is a limit on the amount for calculating contributions. Therefore, temporary disability benefits cannot exceed 2434.25 R per day. In 2020, the payment limit was 2301.37 R per day.

The final amount depends on the length of service; 100% of the average earnings can only be obtained with at least 8 years of experience.

When caring for a child, there is one more feature: regardless of length of service, from the 11th day of outpatient treatment, a benefit is paid in the amount of 50% of the average daily earnings. But the entire amount is paid by the Social Insurance Fund, and if the employee himself is sick, then the first 3 days are paid by the employer. If a child is treated in a hospital, the benefit is calculated as usual - you can receive 100% of the average earnings.

In 2021, for 10 days of illness of a child, you can receive a maximum of 24,342 RUR. Even if the salary for the same period would be 40 thousand.

This financial assistance is paid for a certain period. The law provides for 3 cases.

- For a normal pregnancy that proceeds without complications, the amount is calculated for a period of 140 days.

- If a woman is pregnant with twins, the payment period increases and is 194 days.

- For difficult births, the period is 156 days.

The determining factor in deciding how many days a woman will receive funds is the doctor’s medical report.

In 2021, the amount of this benefit is at least 12,615 rubles per month (with an estimated indexation of 4%). But since funds are transferred for a certain number of days, this amount is divided by 1 day and multiplied by the number of paid days.

This type of state support includes 2 payments:

- when registering at a clinic (namely, at a antenatal clinic);

- at the birth of the second baby.

The amount charged when visiting an antenatal clinic is small. For 2021 it will be approximately 700 rubles.

This amount will be paid in Moscow, along with other regions, in the amount of 700 rubles.

But at birth in 2021 they will pay much more. The law provides for about 19 thousand. This also includes cases related to the adoption of a child. Those families who have adopted a second child into the family are entitled to the same amount.

This subsidy is awarded to parents on maternity leave. Usually it's mom. But there are times when the father stays with the child.

Watch until the end! — How much will pensions increase in 2021, latest news

For families whose children (including the second baby) were born after 2021, V. Putin has appointed an additional subsidy.

Those units of society whose average per capita income for each family member (and child) is lower than twice the subsistence level in the region are entitled to this subsidy.

To clarify the cost of living in each specific region, and, accordingly, the right to receive this financial assistance, you need to refer to local legislative documents. Next, make calculations, collect documents and submit an application.

The cost of living is determined by place of registration. For example, if a family member works in Moscow, and the Moscow region is indicated in the passport, the calculation will be made according to the PM of the region. Accordingly, in the capital the cost of living is much higher.

For the second child in the family, Putin's subsidies are paid from maternity capital. The amount of this financial assistance is equal to the minimum subsistence level for the child in the region of his residence.

The state is obliged to pay a number of benefits to women who have left their official place of work on maternity leave. The first of these is maternity benefits. It is issued to women who are officially employed or receiving full-time education. This benefit is only available to working women.

You can apply for it at the 30th week of pregnancy. Funds are issued for two periods of maternity leave: 70 days before childbirth and 70 days after. In case of complicated pregnancy: 70 days before birth and 86 days after. The benefit amount is 100% of the salary for the last 2 years. For 156 days (if the birth occurs with complications) 57,852 rubles are issued, and for 194 days - 71,944 rubles. Amounts that can be paid within 140 days:

- 51918, 90 rub. – minimum;

- 301095 rub. – maximum.

A one-time benefit is a payment due to mothers at the birth of each child. It is subject to annual increase and as of 02/01/19 it is 17,328 rubles. However, if the child was born in January, the mother is entitled to a slightly smaller benefit - 16,759 rubles, since indexation has not yet been carried out.

A woman can also count on a regional bonus. Unlike federal ones, such payments depend on the region, its location and climate. The issuance of funds is carried out on the basis of laws in the region. An application for payment must be submitted to the Social Insurance Fund, where the final payment amount is determined.

Maternity capital, provided once, can only be received by the mother of the 2nd child. The payment amount is 453,026 rubles. The money cannot be cashed out unless the family has low-income status. In this case, the family can receive a monthly payment equal to the subsistence level. Usually this amount is about 10,000 rubles.

This type of payment must be paid by the employer upon official employment. The money is given to an employee going on maternity leave in one payment, and the amount varies depending on how long the maternity leave will be. In 2021, the amount is calculated from the employee’s average earnings for 1 day (RUB 2,150). To calculate the maximum amount, you need to multiply your earnings by the number of vacation days.

The result is the following amounts:

- 140 d. = 301 thousand rubles.

- 156 d. = 335,400 rubles.

- 194 d. = 417,100 rubles.

The father or mother of the child has the right to receive benefits for caring for him up to 1.5 and 3 years. The amount is calculated and paid by the employer. For 2021, the payment is 40% of the employee’s monthly earnings, so it will be different for everyone. You can calculate the minimum payment using the minimum wage, which is currently 11,280 rubles in the Russian Federation.

The smallest amount that is issued monthly for child care is 4,512 rubles. For the second and subsequent children they give 6284.65 rubles.

The amount paid to mothers has not changed in 2021, i.e. the state steadily continues to issue 453,026 rubles. The specified amount will be increased at the next indexation, which will be carried out in 2021. The amount is expected to increase to 470,241 rubles. (this figure corresponds to the explanatory note to the law on the PF budget 2021). Although maternal family capital (MSC) has not been increased, the payment amount will increase in accordance with inflation. This is provided for by the Federal Law on maternity capital (Part 2, p. 6).

Periods of maternity leave

Parental leave is divided into three periods.

The first is sick leave. Usually comes out after 30 weeks of pregnancy until the day of birth. This period is paid separately based on the official income of the expectant mother. Depends on the average daily earnings for 2019-2020. Minimum 56959 rub. , maximum 340328 rub. in 140 days

The second is child care . It can last up to one and a half years and is also accompanied by receiving financial assistance. Child support benefits are issued by the Social Insurance Fund and amount to 40% of average monthly earnings for 2021-2021.

The third period lasts until the child turns three years old.

Payments for women giving birth who work part-time

For those who, in addition to their main official job, are employed part-time, there is the possibility of receiving maternity leave from two enterprises. In this case, each of the employers is obliged to make payments for sick leave and child care.

Important . The expectant mother can choose a convenient format for receiving sick leave.

Current legislation allows for the possibility of providing this document both in written and electronic form.

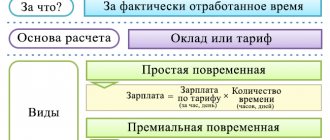

What is taken into account when calculating the payment amount?

When calculating payments, only the time actually worked, the number of shifts or hours are taken into account. Average income during this time consists of all payments that were issued to the employee and were subject to taxes or insurance fees. Thus, vacation pay, bonuses and all compensation are taken into account. For clarity, let's look at how the calculation is done using a real life example.

A woman pregnant with her second child has returned to her place of employment since her first maternity leave ended. By the time she went on sick leave at 30 weeks of her second pregnancy, she had only 15 shifts worked.

According to all standards, the amount of payments for her should be calculated taking into account the years spent on the first maternity leave. However, in this case, the woman will receive minimum payments. If this does not suit her, she has the right to write an application to postpone the billing period. Thus, payments will depend on the time worked before the first maternity leave.

In another case, if a woman worked for a year between the first maternity leave and the second one, it is not beneficial for her to postpone the pay period. Since from the moment of restoration to the workplace, the level of wages could increase.

If it is difficult for you to make preliminary calculations on your own, you can contact the company’s accountant. It will help you make a preliminary calculation of payments. Then it will be clear whether it is worth writing an application to postpone the billing period.

Financial assistance in 2021

For everyone who leaves work on sick leave due to pregnancy and childbirth, payments are calculated taking into account the average income for the last two years of official employment. Moreover, if a woman has been on maternity leave for the previous two years, she can write an application with a request to replace these two years for calculating payments with the previous ones, when she was still working.

If a woman did not return to work upon completion of her first maternity leave and receives monthly child benefits, she may refuse these payments in favor of those that will be provided for maternity leave, as they may be significantly higher. Thus, it is necessary to weigh all the pros and cons and choose which type of benefit will be more profitable to receive.

Important . In addition to these payments, a woman receives state material support in the form of maternity capital upon the birth of her second child.

Since 2021, the amount of maternity capital payments for the second child has increased and amounts to

- 155550 rub. - if a second child was born, and the first child was born. capital was paid;

- RUB 639,432 - at the birth of a second child, if mat. the capital was not registered in the first name.

These funds can be spent on improving living conditions, a child’s education, or a pension for the mother.

In addition, women are entitled to one-time payments in the amount of 702 rubles. for early application for pregnancy registration (up to 12 weeks).

Maternity payments in 2021 for the second child of a working mother

Working and non-working mothers can count on such payments. The peculiarity of this option of state support is that any family member caring for a child under the age of one and a half years can apply for benefits.

As in the case of maternity benefits for a second child, the amount of care compensation is determined by the minimum wage, as well as the average daily earnings and the maximum base for calculating contributions to the Social Insurance Fund.

- The amount of maternity payments for working women is set in accordance with the level of income for the previous two years of pregnancy and is 100% of earnings.

- Employees of an enterprise/company with low earnings cannot receive less than the minimum established by law, except for workers who worked part-time shifts, as well as those whose work experience is less than six months.

- The maximum benefit is a fixed amount and does not depend on the minimum wage.

In the table, we will consider what payments you can receive for the birth of a second child in 2021 and their size.

Payments for a second child in 2021

| Payments for the second child | Benefit amount | Conditions of receipt |

| maternity benefit | from 55,830 to 322,191 rubles. | availability of official employment and women going on maternity leave |

| early registration benefit | RUB 675.15 | it is necessary to register for pregnancy in gynecology for up to 12 weeks |

| lump sum benefit at birth | RUB 18,004 | paid to one of the parents |

| child care allowance | from 6,751 to 27,984 rubles. | accrued to a non-working parent who cares for a child |

| coronavirus support | 5,000 rub. for each child | one-time payments in April, May, June 2021 |

| maternal capital | RUB 616,617 | assigned if the second child was born later than 2021 |

| monthly payment up to 7 years | ½ living wage per child | assigned if family income is below the subsistence level |

President Vladimir Putin decided to pay families with children under 7 years old five thousand rubles for the New Year. If the family has previously submitted an application for payment due to coronavirus, there is no need to write a new application; the money will be transferred without a request. If previously a payment for up to three years or a lump sum payment for up to 16 years was not prescribed, then until April 1 you can submit an application on the State Services portal or at the Pension Fund.

Despite the fact that the concept of maternity leave does not exist legally in the Russian Federation, it is called that way. Officially, the usual maternity leave is called the period of incapacity for work during pregnancy and childbirth (BiR). For this reason, there is no special piece of paper indicating specifically the patient’s B&R - information about going on maternity leave is provided on a regular sick leave sheet.

According to certain laws, there is a maximum payment limited to a specific amount of average daily earnings. Its value is regularly indexed, but for a number of highly paid positions the indicator is frankly not enough. However, the vast majority of working women still fall within the maximum allowed accrual limit. Moreover, the majority of recipients, even in a year, sometimes earn less than the highest available maternity benefits.

To understand the process of calculating subsidies for B&R, you need to know its main features. In particular, many women do not have full information that the duration of maternity leave varies, although for the majority of expectant mothers, sick leave is issued at the 30th week of pregnancy.

The standard payment is made in a lump sum for the entire period of the required vacation of 140 days. There is another duration of sick leave - 156 or 194 days. In the latter case, sick leave also has an initially fixed duration, because This is the number of days required for a multiple pregnancy, which is usually known to doctors in advance. The duration of sick leave of 156 days is determined for complicated childbirth. In this case, a separate certificate of incapacity for work is issued for an additional 16 days.

Applying for a second maternity leave

There are no special rules for writing an application for going on parental leave. You can compose it in any form or use a sample approved by the enterprise.

Important . The application should indicate the end of the first maternity leave and the beginning of the next one.

If the pregnancy is short, and the expectant mother must go to work, but cannot do this due to an unstable health condition, she can contact a medical institution and ask for sick leave. You can also take the annual leave provided for all employees of the enterprise.

Second maternity leave after going back to work for a short time

Sick leave for pregnancy and childbirth is issued no earlier than 30 weeks of pregnancy. Thus, if the first maternity leave has ended, the pregnant woman must go to work. As sick leave approaches, the woman must write an application for sick leave and all related payments.

The calculation of payments for sick leave and upon the birth of a child is calculated taking into account the past average income for 2 years. Thus, the actual time worked during this period may be very little. Then the woman can contact the employer with a statement, which contains a request not to take into account the time of the last maternity leave when calculating payments.

An application is also drawn up to receive benefits and payments upon early registration at the antenatal clinic. Later, a separate application for receiving a lump sum payment upon the birth of a child is drawn up.

Paperwork

The 30 week mark is approaching. With a sick leave certificate, which must be issued by a doctor, and an application for maternity leave, you need to contact the accounting department. By the way, if you didn’t manage to get your usual vacation this year, you can take it before maternity leave - pregnant women have the right to use it out of turn. So you can start resting as early as 28 weeks. Monetary compensation must be accrued within ten days, starting from the date of writing the application, and paid during the nearest date of payment of wages. In case of delay, you have every reason to contact the labor inspectorate.

Editor's choice: Consequences of impaired blood flow during pregnancy: causes and how to treat

Extraordinary leave before going on second maternity leave

Pregnant women, upon completion of their first maternity leave, have the right to take annual paid leave from the company. To do this, it is worth discussing this possibility in detail with the employer and writing an application two weeks before going on vacation.

Important . When providing paid leave, the amount of vacation pay depends on the person’s income for the past year.

Since the employee was on maternity leave last year, a calculation will be made for her based on the results of the previous year. If the company has experienced an increase in wages, it would be a good idea to go to work for a short period of time before going on vacation. In this case, the amount of vacation pay will be set depending on the person’s increased salary.

If the annual leave is spent, but the woman cannot go to work for health reasons, she can receive additional sick leave or discuss the possibility of receiving free leave.

Possible timing

Usually people go on maternity leave 30 weeks before the expected date - if the fetus is developing normally and there is no need to go to the hospital or for preservation. For cases of multiple pregnancies, it is possible to leave two weeks earlier. There are other exceptions in the legislation: living in a radiation-contaminated area, medical prescription, and others.

Editor's choice: I want to become a mother or what to do to get pregnant

If desired, a woman can continue to work if it is beneficial to her from a financial point of view and there is no need to be at home. But it is better to issue a certificate of incapacity for work on time - this will protect both the employer from possible complaints to the labor safety inspectorate and the employee herself in the event of unexpected situations. At the same time, you do not have the right to be asked to work overtime, at night and on weekends, or to be sent on a business trip. There is no talk of dismissal, since this is considered a strict violation of the law.

Payments for the unemployed

For the unemployed there are no payments accrued from the enterprise. But all officially unemployed women can receive material assistance and social support from the state in the form of a monthly allowance and free food for a child.

A one-time payment that is allocated at the birth of a child is 18,700 rubles.

Until the second child turns one and a half years old, mothers will receive a monthly payment of 7022 + regional coefficient. In addition, an unemployed woman also has the right to receive maternity capital.