Online calculator for calculating vacation pay in 2021 to help an accountant

If a person has a concluded employment contract, then regulations guarantee him the right to receive leave, provided that he has worked at the enterprise for a certain amount of time.

This period is subject to mandatory payment by the company administration. This payment can be determined by specialists in the company or using the vacation pay calculator service in 2020.

The online calculator is most often used by small businesses.

Based on what documents are vacation pay calculated?

The following forms are distinguished, on the basis of which the amounts of vacation pay for an employee are determined:

Attention! Having these documents in hand, a company representative can use an online vacation pay calculator and calculate these amounts.

Calculation of vacation pay (calculation formulas)

The annual paid leave calculator can be used when you need to determine not only the amount of vacation pay, but also for such accrual as compensation for unused vacation upon dismissal.

On your next vacation

The first step is to decide on the billing period for which the salary indicators will be sampled. The methodology for calculating average earnings for vacation is based on using a period of 1 year. However, a business entity has the opportunity to apply calculations for a quarter, six months, etc.

Attention! The main limitation of the last option for calculating vacation pay is that the calculated result for a specified period must be greater than or equal to when shorter periods are applied.

The online calculator calculates vacation pay based on the calculation method for the year.

First, the employee’s average earnings for the selected billing period are determined. It can be determined using the following formula:

SZday = (ZP1+ZP2+…+ZP12)/12/29, 3

When monthly salaries are sampled from salary sheets, benefits for sick leave, calculated accruals for previously granted vacations, as well as other payments that are excluded from the calculation on the basis of Resolution No. 922 are excluded from the amounts taken into account.

It is necessary to take into account the periods of previously granted vacations and illness when the calculation is made. They cannot be excluded from the calculation. In these cases, the coefficient 29.3 must be recalculated to the ratio of days actually worked according to the calendar in a month to the total duration of the corresponding month.

| The article describes typical situations. To solve your problem , write to our consultant or call toll-free: 8 ext. 217 – Moscow – CALL 8 (812) 309-52-81 ext. 768 – St. Petersburg – CALL 8 ext. 507 – Other regions – CALL |

| Coef. calc. | = | Number of days related to the work period (including weekends) | / | Number of days in a month according to the calendar | * | 29,3 |

The amount due to the employee for vacation is determined by the formula:

SUMOTP = SZday * Number of days on vacation

Attention! To determine the accrual for additional leave, the same formulas can be used. It is allowed to combine the calculation of vacation pay for the main and additional vacations into one.

The report is filled out as follows. Columns 100 and 110 record the date on which vacation pay was paid. Column 120 records the last day of the month in which the issuance was made - according to the law, it is on this day that the tax must be transferred to the budget. then the amount of vacation pay and the amount of tax withheld from it are entered in columns 130 and 140.

Contributions to the Pension Fund and compulsory medical insurance from vacation pay

After the accountant has calculated the vacation pay that is due to the employee, he must also calculate social security contributions on it.

This must be done for the following types of charges:

- Main labor leave;

- Additional leave, which is given for special working conditions;

- Study leave if the employee both works and receives education at a higher institution at the same time;

- Other similar types of leave that are established by labor legislation or internal regulations of the company.

There are also several types of vacations for which contributions do not need to be counted:

- An additional period of rest for victims of the Chernobyl accident and liquidators of the accident;

- Leave provided for recovery after an occupational illness or injury at work.

In general, the amounts received from vacation pay must be included in the base for calculating contributions. This must be done in the same month in which vacation pay was accrued. This amount must be transferred to the budget before the 15th day of the month following the month of the calculation.

Source: https://buhproffi.ru/servisy/kalkulyator-otpusknyh.html

Study leave

The right to continue education for working people is possible and secured by law. The exam period is a reason to take a special type of leave - educational (student) leave.

Providing study leave in 2021

Study leave is a temporary and, in some cases, paid release from work for persons who are simultaneously receiving education while working. Leave is given for:

- closing the study session;

- passing exams;

- preparation, defense of final work;

- defense of a candidate's or doctoral dissertation.

The right to work simultaneously with study is enshrined in Federal Law No. 273 “On Education in the Russian Federation.”

Attention, if you have any questions, you can ask them to a lawyer on social issues by phone or ask your question in a chat to the lawyer on duty. Calls are accepted 24 hours a day. The call is free! Call and solve your problem!

Students of secondary general or special educational institutions, as well as higher educational institutions, have the right to vacation days:

- full-time;

- correspondence;

- evening forms of education.

Student leave can only be given at the main place of work. If a student combines work activities in several organizations, then rest days without pay may be a solution at other places of work.

The Labor Code (Articles 173-177) speaks of the possibility of taking leave during training for those who:

- Receives any level of education for the first time.

- In an educational organization that has passed state accreditation.

It also talks about successful learning. The laws do not disclose this provision, but one can make the assumption that this means education without debt. At least, the Labor Code does not allocate .

to go on student leave while receiving a second degree .

The deadlines vary and are set by the Labor Code. They are as follows in 2021:

| Level | Assignment of vacation days | Duration (days) |

| Higher | Interim certification | 40 (I, II courses)50 (III and IV courses) |

| Higher | State certification | 4 months |

| Average professional | Midterm exams | 30 (1st, 2nd year)40 (next) |

| Average professional | State exams | 2 months |

| Basic general | 9 | |

| Average overall | 22 | |

| Higher postgraduate | 30 | |

| Preparation for defense: candidate dissertation work | 3 months | |

| Doctoral | 6 months |

The Labor Code regulates the provision of 15 unpaid days for entrance examinations at the request of an employee.

It is important to note that student leave does not affect the employee's taking of regular leave. The latter must be provided according to the organization’s schedule, in full and with proper payment.

Decor

You can get vacation days with a certificate from your educational institution. Its type is approved by Order of the Ministry of Education and Science No. 1386. It contains:

- name of the company where the student works;

- information on the legislative basis for leave (Federal Law, Labor Code article);

- Full name of the student, indication of the course of study and its form;

- vacation dates, how many days the student is called on;

- information about the educational organization, including information about accreditation;

- space for the seal of the educational organization and the signature of the dean of the faculty.

The help is divided into two blocks . The lower one - tear-off - is a confirmation certificate. It is filled out in the dean’s office of the university after the session and confirms that the student actually spent his vacation on education. It states:

- Full name of the student;

- name of the educational organization;

- the duration of the student's studies.

What are the deadlines for submitting a certificate to the personnel service at the place of work? TK doesn't talk about it. Possible options:

- Before going on vacation.

- During.

- After him.

All options oblige the employer to register absences from work as vacation pay and pay for them.

An exception is the release from work to complete a doctoral dissertation. Its period is 6 months and the applicant is obliged to notify the employer about this 1 year in advance . This allows you to adjust the company’s plans in advance and free up the employee.

For documentation you will need:

- help-call;

- application for study leave. You can view and download here: [sample application];

- Based on the submitted documents, an order is issued.

Leave to prepare and defend a dissertation is issued upon admission to defense.

How is it paid?

Payment is made for:

- part-time students;

- receiving general education.

The basis for payment is the provided summons certificate and employee application, as well as the order issued on them.

The calculation is made in the same way as for regular vacations - based on the average salary. Annual earnings are divided by the number of months in a year and by 29.3 - the accepted average number of days in a year (Article 139 of the Labor Code). The resulting average daily earnings are applied to the number of vacation days as a multiplier.

You can receive payment for your vacation 3 days before it starts.

Example: Anna submits an application and a certificate from the University for January 13 – February 1, 2017. As a part-time student, she receives paid leave. The accounting department calculates vacation pay:

- the girl’s annual earnings until she leaves for the session are 460 thousand rubles;

- per month: 460,000 / 12 = 38,333.3 rubles;

- per day: 38333. 3 / 29.2 = 1,308.3 rubles;

- vacation pay amount: 1308.3 * 20 = 26,166 rubles .

Anna must receive payment for study days no later than January 10, since the girl submitted an application to the personnel department in advance.

Not allowed on study leave

When a summons certificate filled out according to the rules and an application are provided, the vacation periods in which do not exceed the data from the certificate, the employer does not have the right to refuse . The absence of an employee from the workplace is not regarded as absenteeism, as it is documented by passing the session.

Refusal in such a situation is the reason for contacting the Labor Activities Supervision Inspectorate.

Special cases

Let's look at some specific situations:

- Partial day. All guarantees of student leave and their payment are fully preserved.

- Being on another leave, for example, until the child reaches three years of age. To receive study leave, you must interrupt all other leaves.

- Temporary disability. Sick leave will be paid only for dates that do not fall on vacation dates.

- Probation. All of the above provisions of the Labor Code are applicable if the employee is working on a probationary period.

- An employment contract with a specific term. If the study leave overlaps with the expiration date of the contract, it is terminated. The law only prohibits the dismissal of persons on vacation or sick leave.

Leave for study is provided for contract servicemen . The Federal Law “On the Status of Military Personnel” lists some nuances:

- if a military man has a specialized higher military education, then obtaining a higher civilian education is, from the point of view of the law, the first;

- if training is in the direction, then the count of specialties already obtained is not kept.

Leave for military personnel is not given during combat operations, field training, or peacekeeping missions. The head of the educational organization is notified of this and must reschedule the session for the military student.

Conclusion

- Studying while working allows you to take advantage of study leaves.

- The rights of workers receiving education are enshrined in the Labor Code of the Russian Federation.

- An important document for such vacation days is a summons certificate.

- Payment is calculated based on average daily earnings.

- The vacation periods are specified in the Labor Code of the Russian Federation.

The most popular question and answer regarding study leave

Question: I got a job 5 months ago. At the same time, I am studying part-time. At the time of employment, the director was notified about my studies and promised that he would let me go during the session. But according to a certificate from the university and my application, I was told to take days at my own expense . How to get paid study days?

Answer: We recommend writing an application for study leave in two copies and adding a reference to the Labor Code, namely Art. 173-176 , which oblige the employer to provide employees with leave for training. Both copies are signed by management, one remains with you.

To be sure that the director has received your applications, you can send them by post with the delivery type in person and signed. Refusal in such situations is a violation of labor legislation and allows you to contact the Labor Inspectorate.

It is also necessary to remember that the opportunity to demand payment for these days in court will last 3 months from the moment it begins and the organization is notified about it.

Samples of applications and forms

You will need the following sample documents:

- Sample application for study leave

The following articles will be useful to you:

Attention, if you have any questions, you can ask them to a lawyer on social issues by phone or ask your question in a chat to the lawyer on duty. Calls are accepted 24 hours a day. The call is free! Call and solve your problem!

Source: https://social-benefit.ru/deti/socialnaya-podderzhka-shkolnikov-i-studentov/uchebnyj-otpusk/

If the student's one coincides with the next one

The conditions for providing educational days off are accreditation of the educational institution, successful training of the employee in the specialty acquired for the first time and a certificate of call from the school.

A day devoted to study may be paid or provided without pay, if not all of the above conditions are met. Rest is assigned at the request of the student, the number of days is determined by the call certificate. Labor Code Ch. 26 limits the duration of leave depending on the type of education.

The difference between educational and regular rest lies in the order in which they are provided: the latter is regulated by Ch. 19 TK. An employee goes on compulsory leave on the basis of a schedule, which is approved by the head of the enterprise at the beginning of each year. In such a situation, overlaps of one rest with another may occur.

If the study leave coincides with the next leave, the following provisions are followed:

- Art. 124 of the Labor Code instructs the employer to postpone the employee’s annual vacation “... in other cases provided for by law” for a period agreed with the employee. Study leave is taken into account. 26 of the Labor Code and falls under the provision on the transfer of rest, and can also be extended at the expense of the main one;

- The addition of annual paid leave to additional student days off is enshrined in Art. 177 TK. This is done by agreement of the parties;

- from Art. 114 and 173 of the Labor Code it follows that an enterprise must pay a working student for both vacations - main and study. You can use the next rest only for a break from work, and not for other purposes.

The employer’s responsibility is to provide the student with basic and student rest. Payment is due before the start of the session.

Expert opinion

Irina Vasilyeva

Civil law expert

Recommendation: When two holidays overlap, the employer and the student must work together to find a mutually acceptable solution. Unilateral actions of a leader are unacceptable.

Calculation of vacation pay in 2021: online calculator

Vacation pay calculator in 2021 is a convenient automatic online solution for calculating the amount of vacation pay for free.

Vacation amounts are calculated by the organization’s accounting department on the basis of internal regulations and for each calendar day of vacation. In this case, the rules of Article 139 of the Labor Code and the Regulations for calculating average earnings, approved by Government Decree No. 922 of December 24, 2007, are applied.

How to calculate if there is nothing complicated in the calculation formula, but a number of nuances arise that need to be taken into account. These are not only holidays that fall within the vacation period (New Year holidays, public holidays), but also other moments:

- the employee has not previously worked anywhere (when calculating vacation pay, the amount of income for the previous 12 months is included);

- part-time worker;

- official non-working day;

- study leave for the session;

- additional leave for a disabled person or donor, etc.

Due to the increase in the federal minimum wage after January 1, 2021 to 12,130 rubles, the vacation pay calculator in 2021 calculates in a new way. See below for an example calculation.

How to calculate vacation pay? In this matter, an online vacation calculator will come to the rescue, which will calculate the amount as accurately as possible according to the given parameters. Since it is based on all legally approved rules, we can confidently say that its operation is correct. The main thing on the part of the accountant is to enter the correct data.

This calculator can also calculate vacation pay, taking into account the increase in salary and payment of bonuses during the billing period.

An example of calculating vacation pay using this calculator

The online calculator calculates vacation pay sequentially in two sections, where the initial parameters are set and a summary table of monthly earnings is filled out. As a result, the amount of vacation pay will be calculated and displayed.

Practical examples will help you understand how the online calculator works. We'll show you the steps step by step.

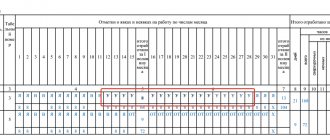

Example 1. Calculation of vacation pay while maintaining wages

An employee of the enterprise is scheduled to take his next paid vacation, which is scheduled from August 1 to August 14, 2021, which is 14 calendar days. During the previous 12 months, he had not been on sick leave, but took 2 days without pay from May 10 to May 11, 2021.

In the first part of the calculator, enter the specified data and click on the “Next” button to the page for entering salary amounts.

If the employee was absent from the workplace, namely when:

- business trip;

- sick leave;

- maternity leave and without pay;

- other periods described in clause 5 of the Russian Federation Regulations No. 922 dated December 24, 2017;

When calculating average earnings in the billing period, these days are not taken into account.

To enter data, check the box “There are exclusion periods” and select the desired dates. If several are required, then click “Add another period”.

In the next window, we begin to enter salary data for the last 12 months, which will participate in the calculation of vacation amounts. Let's assume that the employee received 25,000 rubles monthly. The days worked, annual earnings are automatically summed up and the average daily earnings are calculated.

After clicking the “Next” button, we proceed to the results of calculating vacation pay. The calculator displays the calculation formula and the resulting vacation pay amount. Additionally, personal income tax will be calculated from it at a rate of 13%. The amount of the due payment minus tax will be reflected below.

Example 2. Calculation of study leave

The employee is sent on a planned study leave. All data remains the same, it is only necessary to clarify what percentage of the salary is retained by the employee. (See Articles 173-176 of the Labor Code of the Russian Federation). In our example, let’s assume that he is entitled to 50%, but not less than the minimum wage.

We fill in all the fields as in the previous example.

In the “Type of leave” field, select “Educational” and mark the desired ...% of salary retention. We note the exclusion period for study leave, in our case it turned out to be 2 days.

We get the amount to be paid for vacation pay with personal income tax and without calculation.

Note that some fields are marked with a question mark. These are tips that are useful for an accountant of any level of training. You should also pay attention to such a point as the amount of personal income tax calculated by the calculator. She is exemplary. For a more accurate calculation, it is necessary to take into account charges, the amount of tax and deductions from the beginning of the year.

Example 3. Calculation of vacation pay taking into account the increase in salaries in the billing period

When increasing the salary or tariff rate for indexing vacation pay, you must be guided by clause 16 of the Regulations on average wages. It states that a worker should not receive less money due to going on vacation.

CI – indexing coefficient. Calculated as: New salary / Old salary.

In this case, vacation pay is considered according to certain rules if:

- in the billing period, the salary was increased - all previous accrued amounts are adjusted;

- after the calculated one, but before the start of the vacation, the average earnings are adjusted.

- during vacation, the CI is multiplied by the remaining vacation pay after the salary increase.

Important: These conditions apply when the salary increase has occurred throughout the enterprise. If amounts without CI are calculated for one employee or department.

Let's look at an example when:

- the employee goes on vacation in 2021 from 13.06 – 10.07;

- from February 1, 2018, all employees’ salaries were increased from 14,000 to 17,500 rubles, KI – 1.25;

- there were no other charges;

Source: https://trudtk.ru/raschet-otpusknyh-kalkuljator-onlajn/

Are student days off included in the length of service that entitles you to annual leave?

The regulations on how to calculate length of service for calculating the duration of annual paid rest are given in Art. 121 TK. Here you can find out whether study leave is included in the calculation of vacation days.

The first half of the standard establishes the periods included in the length of service:

- working hours according to the time sheet;

- up to 14 days of permitted time off without pay;

- involuntary absenteeism entered on the report card when the dismissal was illegal;

- period of inadmissibility to work due to failure to undergo a medical examination for extenuating circumstances;

- the time when a worker retained his place and position while he was legally absent.

Further, the last point is specified: the time of the main paid vacation, weekends and non-working holidays, other days of rest that are given to the employee are included in the length of service. In accordance with Art. 107 of the Labor Code, any additional types of leave are counted as rest time.

Part two art. 121 of the Labor Code, which deals with periods that cannot influence the calculation of length of service, does not contain any mention of study leave, from which we can conclude that it is legal to include weekends for study in the length of service for calculating days of main rest.

Vacation pay calculator

Date updated: July 20, 2020

In accordance with the labor code, after a certain period of time, the employer is obliged to provide paid leave to its employees.

An employee who has performed his or her job duties for at least six months can count on a well-deserved rest. In subsequent years, leave is granted to him in accordance with the schedule.

A very good way to calculate vacation pay at any time, including this year, is an online calculator, which contains all the formulas necessary for the calculation.

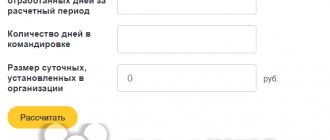

Instructions for calculating vacation pay using an online calculator

Calculation of vacation payments when using the online calculator program is carried out in several stages. The user must provide the following information in the form provided:

- vacation start date;

- period of work after the end of the last vacation;

- average salary;

- income for each month;

- exclusion periods (i.e. breaks from work if available, for example, sick leave).

Initially, you need to enter data about the start of your vacation into the calculator. After this, the user must note the duration of the working period. If an employee recently got a job in a new organization, then you should indicate how much time has passed since being hired.

At the next stage, the average salary is indicated. Additional windows indicate earnings for each month. After filling out the form, vacation payments are automatically calculated for issuance to the employee. In this case, the amount of personal income tax must be taken into account.

-instructions on how to use the calculator when calculating vacation pay:

Calculation of payments

The formation of vacation pay is carried out taking into account many different factors. The most significant of them is the average salary, which includes basic and additional payments:

- wages;

- allowances;

- bonuses;

- additional pay for length of service;

- additional payment for complexity;

- surcharge for harmfulness.

When making the corresponding calculations, subject to the accrual of bonuses, it should be remembered that monthly bonuses are included in the total amount only if the period for their accrual is included in the calculation period. A situation in which bonus salaries were accrued multiple times within one month obliges the accountant to indicate only one of them.

Calculation of vacation pay upon dismissal

The calculation of vacation pay upon dismissal is carried out according to a certain formula and takes into account unused days for rest. If there are such, according to Article 127 of the Labor Code of the Russian Federation, they are entitled to monetary compensation in the event that the employee does not want to take them off before dismissal.

All income that was accrued to the employee during his work is divided by the number of months worked.

After this, the resulting average daily earnings must be divided by a factor of 29.3.

This constant value reflects the number of calendar days of the year, reduced by the number of non-working holidays according to the law and divided by the number of months in the year - 12.

Unlike the calculation for working employees, upon dismissal it is necessary to carry out another operation, multiplying the resulting figure by the number of days that were not used for rest.

Compensation for unused vacation is calculated using two possible formulas:

- When vacation is calculated in calendar days. Amount of compensation = average daily earnings × number of calendar days off.

- When vacation is calculated in working days. Compensation = average daily earnings × number of working days only.

How to calculate vacation pay for six months?

Provided that the employee has worked in the new organization for less than a year, then the length of the vacation period should initially be determined.

This indicator will be one of the fundamental ones in the final calculation. To determine the coefficient, the number of allotted vacation days should be divided by 12.

The resulting figure is multiplied by the number of months that the employee has fully worked for the company.

It is important to take into account that there is a nuance when calculating the number of months worked. If an employee has worked for less than half a month, he will not be counted in the calculation at the time of dismissal. For a month of 31 days, this is 16 days, for a 29-day month - 15 days. And at the final stage, the number of days worked is multiplied by the average daily earnings.

The procedure for calculating vacation pay is regulated by law, so the mechanism for carrying out work in public and private organizations will not differ. Thanks to this, the rights of employees are reliably protected.

Also in the calculators section you can:

— calculate sick leave online; — calculate the date of maternity leave.

Source: https://socstrah24.ru/kalkulyator-otpusknyx/

Procedure for applying for study leave

In order to receive study leave, you must first write a corresponding application at your place of work. The Labor Code does not provide for deadlines for filing an application for study leave. This way it can be served just before it starts. In addition, the application must be accompanied by a certificate of summons from the educational institution, the form of which is approved by Order of the Ministry of Education and Science of Russia dated December 19, 2013 No. 1368.

It should be noted that, according to Article 287 of the Labor Code of the Russian Federation, appropriate guarantees and compensation when going on study leave are provided only at the main place of work. If you work part-time in another organization, you will have to take leave without pay.

Important! Rules for passing the Unified State Exam (USE)

By the way, find out how to write a letter of guarantee?

How to calculate study leave 2021: procedure for calculating average earnings and examples

Study leave is a guarantee provided to a worker under the Labor Code of the Russian Federation, which exempts him from performing official duties for the period of study. The absence of an employee must be paid - payment procedure.

The procedure for calculating average earnings for payment for study leave is determined by the Regulations on average earnings (clause 9), approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922.

Step-by-step procedure for calculating payment for student leave

Calculation of student leave is carried out on the basis of an order in the following order:

- establishing a billing period;

- calculation of total earnings for the selected period;

- identifying months partially worked and counting days worked;

- determination of the total number of days (calendar);

- calculation of average daily earnings;

- accrual of vacation pay for school weekends.

According to general standards, the calculation period is 12 months preceding the month of registration of student leave.

Example:

If the session begins in September 2021, then the accountant makes all calculations for the period from September 2021 to August 2019.

The calculation base includes the employee’s salary and additional incentive payments for actual time worked, regulated by the remuneration system.

But not all payments are included in the base.

The following payments are not taken into account in average earnings:

- social benefits (maternity, sick leave);

- payment for business trips;

- vacation pay;

- other accruals based on average earnings upon release from labor functions;

- material aid;

- compensation for food and travel, cellular communications.

We recommend reading: how to arrange a study leave?

Formulas for determining average earnings

Compared to last year, the algorithm for calculating study leave has not changed; it is similar to the procedure for calculating vacation pay for annual leave. The employee's average income for one day is taken as a basis. Funds for study leave are paid for each day of rest, including weekends (holidays).

General formula for calculation:

Vacation pay for study leave = SD * n,

where: SD - average daily earnings, n - number of days of student leave.

The average salary per day is calculated using the formula:

SD = Base / RD

where: Base - payments in favor of the employee for the previous 12 months, RD - number of days worked for the selected period.

The base includes: wages, additional payments for length of service, allowances for special working conditions, bonuses based on work results.

Formula for calculating days worked:

RD = 29.3 * months. + slave/cd * 29.3, where:

- months — the entire number of months worked;

- slave - the number of days worked in an incomplete month;

- kd - calendar days in partial months.

If there are several partial months in the billing period, then the days worked are calculated separately for each. The month in which there was a business trip, sick leave, vacation, maternity leave, absenteeism, or downtime is considered incomplete.

Example for 2021

Initial data:

S.N. Kozlov, an employee of Svoboda LLC, who is a first-year student at an accredited university through correspondence education, is sent to the session from June 24, 2021 for 21 days.

For the previous 12 months (from June 1, 2021 to May 31, 2019), he was accrued 425,000 rubles, which, in addition to salary, included:

- vacation pay - 18,000 rubles;

- sick leave benefit - 8,500 rubles;

- financial assistance - 10,000 rubles,

- travel compensation - 3000 rubles,

- one-time bonus on the occasion of the employee’s anniversary - 5,000 rubles.

The leave was issued in July 2021 for 14 calendar days from the 9th, a certificate of incapacity for work was issued in February 2021 for 7 days from February 11.

During the billing period, only 10 months or 293 days (10 * 29.3) were fully worked.

Calculation:

Calculation base = 425000 - 18000 - 8500 - 10000 - 3000 - 5000 = 380500.

The number of days worked for July 2021 is 16.07 = (29.3 / 31 days * (31 - 14 days), and for February 2021 - 21.98 = (29.3 / 28 days × (28 days - 7 days)).

The total number of days worked in the billing period is 331.05 = 293+16.07+21.98.

SD = 380500 / 331.05 = 1149.37.

Vacation pay to the student was accrued in the amount of 1149.37 * 14 days = 16091.18.

If an employee, by agreement with management, leaves for a session this year after working for less than 1 month, then payment for educational leave is calculated based on the time actually worked.

Example, if worked less than 1 month

Store administrator of Onyx LLC Potapov S.L. was hired on June 3, 2019 with a salary of 25,000 rubles.

From June 24, in accordance with the summons certificate, the student is sent to 14-day training, and he is issued a study leave at work.

Guided by clause 7 of the Regulations (Resolution No. 922), the accountant takes the accrual amount for days worked in June 2021 to calculate the average income for calculating educational leave.

For June 2021, the salary accrual amounted to 25,000 / 20 * 15 = 18,750 rubles.

The duration of the work period for calculating vacation pay was 21 (calendar days from June 3 to June 23) / 30 * 29.3 = 20.51.)

Average daily earnings = 18750 / 20.51 = 914.19.

Amount of vacation pay = 914.19 * 14 days. = 12798.66.

More information about paying for school days off:

Conditions for granting study leave

The conditions for granting study leave at work are established by the provisions of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation).

Currently, labor legislation provides for three conditions upon the occurrence of which study leave may be granted. Let's look at each of them. First, you must be graduating for the first time. However, there is an exception to this rule, which is provided for in Part 1 of Article 177 of the Labor Code of the Russian Federation. Thus, study leave may be granted to a person receiving a second higher education if this is provided for in the employment contract. In this case, all guarantees and compensation for a person going on study leave to obtain their first higher education are established by default. If leave is granted to obtain a second higher education at the initiative of the employee, then in this case guarantees and compensation must be secured by a personal or collective labor contract.

Important! Rules for passing the Unified State Exam (USE)

Secondly, in accordance with Articles 173, 174 and 176 of the Labor Code of the Russian Federation, in order to receive study leave, the university where you are receiving your education must have state accreditation. A complete list of accredited educational institutions can be found on the official website of the Federal Service for Supervision of Education and Science. If you are receiving education at an educational institution without state accreditation, then study leave and all guarantees and compensation can only be provided on the basis of the provisions of a personal or collective employment contract.

Third, you must demonstrate successful completion of the program. When determining this condition established by Articles 173,174 and 176 of the Labor Code of the Russian Federation, the most questions arise, because labor legislation does not provide a clear definition of the concept of successful completion of the curriculum. As a general rule, successful completion of training is considered to be the absence of debt for the previous semester. In other words, if a student is not expelled from the university, then he successfully completes the educational program, and, therefore, he is entitled to study leave.

If these conditions are met, you will be granted study leave.

It is useful to learn how to write an application for vacation compensation, a sample document.