In today’s article we will tell you how to determine the duration of paid leave for a municipal employee. Let us briefly look at the procedure for determining the amount of salary for the vacation period. In addition, let's talk about unpaid leaves.

Municipal employees are subject to labor legislation, taking into account the specifics provided for by the Law on Municipal Service in the Russian Federation[1], other federal laws and regulatory legal acts of the Russian Federation and constituent entities of the Russian Federation on municipal service.

That is, the issues of granting and paying for vacations are regulated first of all by special legislation, and then by labor legislation.

In accordance with Art. 21 of the Law on Municipal Service in the Russian Federation, a municipal employee is granted annual leave while retaining the position of the municipal service being filled and salary, the amount of which is calculated in the manner established by labor legislation for calculating the average salary. Annual paid leave consists of:

- from the main paid leave;

- from additional paid vacations.

Annual additional paid holidays

A municipal employee is provided with the following additional paid leaves:

- for length of service;

- for irregular working hours (if the employee has such a work schedule);

- for working under harmful and (or) dangerous working conditions (if any);

- for work in the Far North and equivalent areas;

- in other cases provided for by federal laws;

- in cases established by the laws of the subject of the Russian Federation.

Let's look at each of these types of vacations separately.

Long service leave

The federal legislator has established the maximum duration of additional leave for long service - 10 calendar days. The specific procedure and conditions for granting such leave are determined by the laws of the constituent entities of the Russian Federation. Here are excerpts from some regional laws.

| Name and norm of the document | Procedure for granting leave |

| Clause 5 of Art. 28 Law of Moscow dated October 22, 2008 No. 50 “On municipal service in the city of Moscow” (hereinafter referred to as Law No. 50) | The duration of annual additional paid leave for long service is calculated at the rate of 1 calendar day for each year of municipal service |

| Clause 2 of Art. 15 of the Law of St. Petersburg dated February 15, 2000 No. 53-8 “On the regulation of certain issues of municipal service in St. Petersburg” (hereinafter referred to as Law No. 53-8) | In addition to the annual basic paid leave, a municipal employee is granted an additional annual paid leave for long service at the rate of 1 calendar day for 3 full calendar years of municipal service, but not more than 10 calendar days |

| Clause 4 art. 20 Law of the Nizhny Novgorod Region No. 99-Z dated August 3, 2007 “On Municipal Service in the Nizhny Novgorod Region” (hereinafter referred to as Law No. 99-Z) | Municipal employees are provided with annual additional paid leave for length of service lasting: 1) with municipal service experience from 1 to 5 years - 1 calendar day; 2) if the municipal service experience is from 5 to 10 years - calendar days; 3) with municipal service experience of 10 to 15 years - 7 calendar days; 4) with municipal service experience of 15 years or more - 10 calendar days |

If the law of a subject of the Russian Federation or a regulatory act of a municipality does not stipulate the procedure for determining the duration of paid leave for long service, then the rules established by clause 5 of Art. 46 of the Law on State Civil Service in the Russian Federation[2]. Since, through the correlation of the basic conditions of remuneration and social guarantees of municipal and state civil servants, the relationship between the municipal service and the state civil service of the Russian Federation is ensured (clause 5 of article 5 of the Law on municipal service in the Russian Federation, clause 5 of article 7 of the Law on state civil service in the Russian Federation RF).

In accordance with this law, the duration of additional leave for long service is:

- with municipal service experience from 1 to 5 years - 1 calendar day;

- with municipal service experience of 5 to 10 years - 5 calendar days;

- with municipal service experience of 10 to 15 years - 7 calendar days;

- with 15 years or more of municipal service experience - 10 calendar days.

Algorithm for assigning vacation to municipal employees

The procedure for assigning and paying leave to municipal employees is practically no different from the process of taking leave for ordinary employees in commerce. Going on vacation is accompanied by the following procedures:

- The organization must have an approved vacation schedule, according to which employees go on vacation. The schedule in form T-7 is approved 2 weeks before the start of the year

- The employee must write an application for all vacations he wishes to go on.

- After the application is signed by the head of the organization, two weeks before the start of the vacation, an order is created in the T-6 form. There are as many orders created as the number of employees going on vacation, that is, for each of them

- Unlike the commercial sector, a municipal employee receives his vacation payments 10 days before the start of his vacation

If during the year there is a need to adjust vacation periods, then separate orders are issued.

Leave for work under harmful and (or) dangerous working conditions

The Law on Municipal Service in the Russian Federation does not contain special provisions on granting municipal employees additional leave for work under harmful and (or) dangerous working conditions. Consequently, the general provisions established by the Labor Code apply.

Annual additional paid leave is provided to employees whose working conditions at their workplaces, based on the results of a special assessment of working conditions (SAL), are classified as hazardous conditions of the 2nd, 3rd or 4th degree or hazardous working conditions.

The minimum duration of such leave is 7 calendar days. The duration of the annual additional paid leave of a particular employee is established by an employment contract on the basis of an industry (inter-industry) agreement and a collective agreement, taking into account the results of the special labor camp (Article 117 of the Labor Code of the Russian Federation).

Vacation for a municipal employee: how many days is it and what is the size of the lump sum payment?

Persons in the civil service in municipal enterprises and organizations have the right to basic and additional leave. The number and duration of additional leaves are determined by local legislation and directly depend on the length of stay in the municipal service.

Conditions for granting vacations

According to Art. 21 of Law No. 25 “On Municipal Service in the Russian Federation”, there are the following types of leave for civil servants of municipalities:

- basic;

- additional for length of service;

- additional for irregular working hours;

- vacation at your own expense;

- maternity leave.

The main vacation of a municipal employee is 30 days a year; when it is divided, the minimum duration of one of the parts is 15 days.

Additional leave for long service lasts a maximum of 10 days, while regional and local authorities independently determine how many days of leave are due for a certain period of service.

In most cases, each new year of service entitles you to 1 additional day of vacation..

For example, in the Bryansk region, 1 day of vacation is added for 5 years of service, 5 days for 10 years, and 10 days of additional vacation for service longer than 15 years.

It is important to know that in 2021, additional leave for municipal employees for long service was reduced from 15 to 10 days, and those employees who did not manage to use their additional leave or part of it in 2021 can take advantage of this right until the end of 2021.

If an employee works on an irregular schedule, he has the right to an additional three days of annual leave; it can be used separately or added to long service leave, basic leave, etc.

Basic and additional vacations can be transferred to the next calendar year or you can receive monetary compensation instead of using them, but no more than 2 years in a row.

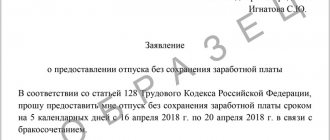

Maternity leave and payments are provided to municipal employees on a general basis. Unpaid leave is granted for a period of up to 12 months at the request of the employee (clause 6 of Article 21 of the 25-FZ), while he retains his position, salary, and continuous length of service.

All types of vacations can be divided into parts and combined in agreement with the head of the unit, but the use by municipal employees of their rights to vacations should not lead to a violation of the operating procedures of municipal institutions.

Procedure for assigning leave

Registration of leave for a municipal employee occurs as follows:

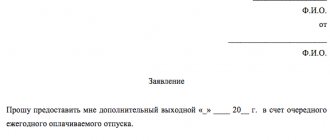

- The employee submits an application to use his allotted vacation next year , indicating the desired periods.

- Personnel department employees and the head of the department draw up a vacation schedule taking into account the applications of all employees.

- The vacation schedule (form T-7) is signed 2 weeks before the new year.

- 2 weeks before each employee goes on vacation, a separate order is drawn up in form T-6 and adjustments are made to the working time sheet (form T-13).

- 3 days before vacation, employees are paid vacation pay.

If it is necessary to make changes to the vacation schedule during the year, this is done by a separate order by agreement of management and ordinary employees.

Payments

When going on vacation, municipal employees can count on the following types of payments:

- vacation pay;

- lump sum holiday allowance;

- social benefit.

Vacation payments are calculated and made before each departure on paid leave according to the general rules defined by labor legislation.

One-time payment

A one-time vacation allowance refers to incentive bonuses and is paid in accordance with the terms of the collective agreement and local government regulations.

To receive a one-time benefit, the employee must satisfy the following conditions:

- had a service life in this place of at least 1 year;

- had no disciplinary actions;

- had no other restrictions on receiving benefits provided by law.

Each municipality determines the period of service for receiving additional vacation pay independently; in most cases it ranges from 1 to 5 years. Payment of benefits occurs 3 days before the start of one of the parts of the vacation at the request of the employee.

If an employee has not exercised the right to payment before going on vacation during the year, he can receive this payment before the new year upon application, but transferring the payment to the next year is not allowed.

Lump sum payment amount

The amount of the payment is determined by the municipal enterprise and is usually a percentage of the monthly salary, but a system of coefficients depending on the number of years of service may also be used. For example, the vacation allowance for municipal employees in Moscow is two monthly salaries, and in a number of regions the monthly salary is multiplied by a coefficient equal to:

- 1,05 – for 3 years of service;

- 1,15 – for 5 years of service;

- 1,25 – for 8 years of service;

- 1,3 – for 10 years of service;

- 1,5 - for 15 years of service.

Social benefit

A social payment is an alternative to an incentive payment and is made if there are good reasons - for example, if the leave is related to a funeral or illness of close relatives, the employee has the right to receive a social payment even if there are disciplinary sanctions and lack of the required length of service.

To receive this type of payment, you must present documents confirming the presence of a valid reason: certificates of illness of family members, death certificate of a relative, etc.

The procedure for providing vacation payments

Receipt of vacation pay occurs in the following order:

- The employee submits an application addressed to the head of the department.

- The manager reviews the application , signs it and sends it to the HR department.

- The HR employee calculates the payment amount and draws up an order.

- The order is signed by the manager, employee (for review) and sent to the accounting department.

- Accounting department pays benefits to employee.

If a person going on vacation is entitled to several types of payments, they are made in the accounting department simultaneously 3 days before the start of the vacation.

In the application for payment you must indicate:

- name of the institution and full name of the head;

- Full name, rank and position of the employee;

- basis for receiving payment;

- duration , start and end dates of vacation;

- date and signature of the employee.

If the payment is assigned not in connection with vacation, but for another valid reason, you must indicate the reason and serial numbers of supporting documents.

The order for the assignment of benefits provides the following information:

- date and order number;

- name of the structure and full name of the head;

- Full name and position of the employee;

- name and number of the regulatory act that is the basis for receiving the payment (internal order of the organization or government resolution);

- start and end dates of vacation.

Sample documents: an application for payment of vacation pay can be viewed here, an order for the assignment of benefits here.

The calculation of the full vacation pay for a municipal employee is carried out depending on the income for the last year using the formula O = P + D / 12 / 29.3 * N ,

where P is a one-time vacation allowance determined by local authorities or the management of the organization, N is the number of days of vacation, and D is the total estimated income of the employee for the last year, including income for actual days of service and nominal average daily income for public holidays, illegal removal from service, forced absence from service, etc.

Vacation pay calculator

Municipal employees are entitled to basic leave of 30 days, additional leave for length of service - up to a maximum of 10 days, and a year's unpaid leave with retention of position if desired. The size of the one-time vacation allowance depends on local legislation and the overall length of service in the municipal service.

Leave for work in special climatic conditions

By virtue of Art. 116, 321 Labor Code of the Russian Federation, art. 14 of the Law of the Russian Federation of February 19, 1993 No. 4520-1 “On state guarantees and compensation for persons working and living in the regions of the Far North and equivalent areas”, in addition to the established additional leaves provided on a general basis, to persons working in the northern regions of Russia , additional annual leave of the following duration is also provided as compensation :

- in the Far North - 24 calendar days;

- in equivalent areas - 16 calendar days;

- in other regions of the North, where the regional coefficient and percentage increase in wages are established - 8 calendar days.

According to Art. , additional guarantees and compensation may be established for persons living in the named areas, laws of constituent entities of the Russian Federation, regulatory legal acts of local governments, collective agreements, and agreements

Other additional leaves provided for by federal legislation

Municipal employees, like other citizens of the Russian Federation, are subject to the provisions of other federal laws providing for the provision of additional paid leave. We are talking primarily about citizens exposed to radiation.

| Category of citizens | Duration of additional leave | Name and norm of the document |

| Citizens exposed to radiation as a result of nuclear tests at the Semipalatinsk test site | 14 calendar days | Clause 15 of Art. 2 of the Federal Law of January 10, 2002 No. 2-FZ |

| Citizens exposed to radiation as a result of the Chernobyl nuclear power plant disaster | 14 calendar days | Clause 5 of Art. 14 Law of the Russian Federation of May 15, 1991 No. 1244-1 |

Dividing vacation into parts

In accordance with Art. 125 of the Labor Code of the Russian Federation, by agreement between the employee and the employer, annual paid leave can be divided into parts. In this case, at least one of the parts must be at least 14 calendar days.

The laws of the constituent entities of the Russian Federation may provide municipal employees with additional guarantees, for example, the possibility of dividing vacation into parts at the request of the employee . Here are excerpts from regional laws.

| Name and norm of the document | Procedure for granting leave |

| Clause 6 of Art. 28 Law No. 50 | At the request of a municipal employee, annual paid leave may be provided in installments. In this case, the duration of one part of the granted leave cannot be less than 14 calendar days. |

| Clause 3 of Art. 15 Law No. 53-8 | Annual basic paid leave and annual additional paid leave are summed up and, at the request of the municipal employee, can be provided in parts. In this case, the duration of one part of the annual paid leave cannot be less than 14 calendar days. |

Vacation for municipal employees

All employees have the right to annual paid leave and municipal employees are no exception. They are also provided with a type of leave during which their jobs are retained and vacation pay is accrued. Until recently, the length of vacation for municipal employees depended on the position the employee held. In addition, such categories of workers were provided with more additional days of rest.

Important! Law No. 25-FZ regulates the labor relations of municipal employees, according to which the duration of regular vacations, additional days of rest, as well as an allowance for vacations for irregular days are determined.

The new version of this law has reduced the allowance for employees for length of service. If previously it was 15 days, then from May 2017 it is only 10 days. All vacations are planned in advance, for which a vacation schedule is drawn up at the end of the year, determining the duration and order of vacation for employees for the next year. Such a schedule is being developed based on the requirements of the Labor Code of the Russian Federation. As with other categories of citizens, municipal employees have the right to take their vacation in parts, one of which must be at least 14 days.

Replacement of vacation with monetary compensation

In accordance with Art. 126 of the Labor Code of the Russian Federation, part of the annual paid leave exceeding 28 calendar days, upon a written application from the employee, can be replaced by monetary compensation.

When summing up annual paid leave or transferring annual paid leave to the next working year, monetary compensation can be replaced by a part of each annual paid leave exceeding 28 calendar days, or any number of days from this part.

However, it must be remembered that the replacement of annual additional paid leave granted to persons employed in work with harmful and (or) dangerous working conditions is carried out in a special manner (Article 117 of the Labor Code of the Russian Federation, Letter of the Ministry of Labor of the Russian Federation dated June 27, 2017 No. 14-2/ OOG-5299):

- it is not allowed to replace with monetary compensation the minimum established duration of the annual additional paid leave provided to employees employed in harmful and (or) dangerous working conditions (7 calendar days);

- replacement of additional paid leave exceeding the minimum established duration of such leave (7 calendar days) is possible provided that this is provided for by an industry agreement and a collective agreement, as well as on the basis of the written consent of the employee, formalized by concluding a separate agreement to the employment contract.

It is not permitted to replace annual basic paid leave and annual additional paid leave with monetary compensation:

- pregnant women;

- workers under 18 years of age.

The procedure for calculating vacation pay

A municipal employee is granted annual leave with retention of salary, the amount of which is calculated in the manner prescribed by labor legislation for calculating the average salary (Article 21 of the Law on Municipal Service in the Russian Federation).

According to Art. 139 of the Labor Code of the Russian Federation, for all cases of determining the amount of average wages (average earnings) provided for by the Labor Code of the Russian Federation, a single procedure for calculating it applies. The specifics of the procedure for calculating average wages are established by Decree of the Government of the Russian Federation of December 24, 2007 No. 922 (hereinafter referred to as Regulation No. 922).

For reference

The rules for calculating the salary of federal government civil servants, including the procedure for calculating salary for the period the civil servant is on annual paid leave, are established by Decree of the Government of the Russian Federation of September 6, 2007 No. 562.

Paragraphs 2, 3 of Regulation No. 922 indicate that to calculate average earnings, all types of payments provided for by the remuneration system applied by the relevant employer are taken into account, regardless of the sources of these payments, with the exception of social payments and other payments not related to remuneration ( financial assistance, payment of the cost of food, travel, training, utilities, recreation, etc.).

Let us recall that the work of a municipal employee is paid in the form of salary, which consists (Article 22 of the Law on Municipal Service in the Russian Federation):

- from the official salary of the employee in accordance with the position he fills;

- from the monthly and other additional payments of the employee, determined by the law of the subject of the Russian Federation.

Local governments independently determine the amount and conditions of remuneration for municipal employees. The amount of the official salary, as well as the amount of monthly and other additional payments and the procedure for their implementation are established by municipal legal acts issued by the representative body of the municipality.

Thus, different constituent entities of the Russian Federation (municipalities) have their own rules for determining the amount of salary for municipal employees. Therefore, it is difficult to give universal advice on how to determine the amount of vacation pay. Let us highlight only some basic points.

To calculate average earnings, all types of payments provided for by the remuneration system and applied by the relevant employer are taken into account, regardless of the sources of these payments. In accordance with clause 2 of Regulation No. 922, in relation to municipal employees, such payments, in particular, include:

- salary accrued to the employee for time worked (clause “e”);

- allowances and additional payments to official salaries for professional skills, class, length of service, knowledge of a foreign language, work with information constituting state secrets, combining positions, expanding service areas, increasing the volume of work performed, etc. (paragraph “k”);

- payments related to working conditions, including those determined by regional regulation of wages (in the form of coefficients and percentage bonuses to wages), increased wages for heavy work, work with harmful and (or) dangerous and other special working conditions, for work at night, payment for work on weekends and non-working holidays, payment for overtime work (paragraph “l”);

- bonuses and remunerations provided for by the remuneration system (clause “n”);

- other types of wage payments used by the relevant employer (clause “o”).

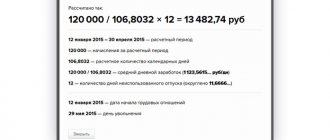

The amount of salary for the period that a municipal employee is on annual paid leave is calculated as follows:

1) the average daily earnings are determined by dividing the amount of salary actually accrued to the employee for the 12 calendar months preceding the vacation by 12 and by the average monthly number of calendar days (29.3) (clause 10 of Regulation No. 922);

2) the amount of vacation pay is determined by multiplying the average daily earnings by the number of calendar days of vacation.

Accountants often have a question: is it necessary to include this or that payment due to an employee in the calculation of average earnings? Let's look at this question in detail.

Additional payments for vacation. As a rule, when municipal employees go on vacation, they are entitled to additional vacation payments.

| Name and norm of the document | Procedure for granting leave |

| Clause 10 of Art. 20 of Law No. 99-З | When a municipal employee is granted annual paid leave, a lump sum payment in the amount of two official salaries is made once a year. |

| Clauses 1, 2 of Law No. 50 | Local government bodies independently determine the amount and terms of remuneration for municipal employees, including the amount and procedure for making a lump sum payment for the next annual paid leave |

Let us remind you that clause 3 of Regulation No. 922 establishes that social payments are not accepted into the calculation of average earnings to pay for the next vacation. The current legislation does not contain a direct indication of the procedure for taking into account the lump sum payment for vacation when calculating the average salary for a municipal employee. At the same time, the absence of a rule for municipal employees approved by federal legislation does not prevent its establishment by a regulatory legal act of a constituent entity of the Russian Federation.

Material aid. Difficulties also arise with financial assistance. The fact is that in Regulation No. 922, material assistance is classified as social payments, which are not taken into account when calculating average earnings. However, for municipal employees, financial assistance is often included in the wage system and, in fact, is not a social benefit.

An analysis of arbitration practice shows that the majority of judges believe that the above payments should not be taken into account when determining average earnings.

| Document details | Judges' findings |

| Appeal ruling of the Novosibirsk Regional Court dated 04/04/2017 in case No. 33-3195/2017 | A one-time payment when providing leave and financial assistance should not be taken into account when calculating average earnings |

| Appeal ruling of the Supreme Court of the Komi Republic dated February 24, 2014 in case No. 33-834/2014 | Financial assistance for vacation refers to social payments that are not taken into account as part of earnings when calculating average daily earnings |

| Appeal ruling of the Court of the Yamalo-Nenets Autonomous District dated September 10, 2012 in case No. 33-2190 | A one-time payment when providing annual leave refers to payments of a social nature, since it is not related to the performance of functional duties by a municipal employee, and is not taken into account when calculating average earnings |

To be fair, it should be noted that there are also opposing decisions of the judges. For example, in the Ruling of the Rostov Regional Court dated January 26, 2012 in case No. 33-1042, it is stated that since, according to the law of a constituent entity of the Russian Federation on municipal service, an employee is paid monthly financial assistance as an additional payment, it is not a social payment, but refers to the salary of the employee , therefore, should be taken into account when calculating average earnings. We emphasize that there are much fewer such solutions. In any case, when deciding whether to take into account the disputed amounts when calculating average earnings or not, you need to focus on the wording of regional legislation on municipal service regarding the procedure for determining the salary of municipal employees.

Article 21. Vacation of a municipal employee

Article 21 of Law 25-FZ is devoted to vacations for municipal employees. In total, the following types of leave are distinguished:

- Annual: main and additional

- Additional: for irregular work, the presence of harmful factors, work in the Far North and similar territories

- Without saving payment

Each of these vacations is granted in calendar days. Let us briefly consider each type of vacation in the table.

| Type of vacation | Explanation | |

| Annual | Basic | Vacation is granted to all municipal employees, its duration is 30 days. |

| Additional for length of service | Leave for long service is granted for a maximum of 10 days and is regulated, among other things, by Law No. 79-FZ of July 27, 2014. The period of work of an employee in a municipal position is determined by his work book. This type of vacation will be discussed below. | |

| Additional holidays | According to clause 5.1 of Article 21 of Law No. 25-FZ, for those who work on irregular working hours, it is necessary to provide an additional 3 days of vacation

| |

| Without salary | Each employee, if necessary, can submit an application to management with a request to go on vacation at his own expense. The duration of such leave cannot exceed 12 months. In this case, the employee is on such leave at his own expense. |

https://www.youtube.com/watch{q}v=ytpolicyandsafetyru

It should also be noted here that all payments that will be recognized as income are reflected in Resolution No. 562 of 09/06/2007.

The specificity of the calculation is that bonuses for special assignments and financial assistance are taken into account in the amount of 1/12 of their total amount. In general, the calculation scheme coincides with how vacation pay is calculated for employees of a commercial organization.

Let us give a practical example of calculating vacation payments to an employee.

Municipal employee Petrov will go on vacation from June 1, 2021 for 15 days. His monthly salary is 20,000 rubles, monthly payment is 5,000 rubles. Over the past year, the employee received 10,000 rubles as a bonus and financial assistance in the amount of 3,000 rubles.

- 20000 5000 (10000 3000) / 12 = 26083.33 rubles

- The amount of vacation pay will be: (26083.33 / 29.3) * 15 = 13353.24 rubles

- Below we will take a closer look at long-service leave.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

This payment is stimulating. It can be obtained in accordance with the terms of the collective agreement and local legislation. This payment is not available to every employee, but only to those who meet certain criteria:

- The period of work in a particular organization must be at least 12 months. Usually the framework is 1-5 years

- The employee must not be subject to disciplinary action during his or her employment.

- Sometimes legislation sets restrictions on the payment of benefits. Those who want to receive a lump sum payment should not have such restrictions.

Please remember that payment is made 3 days before the start of the vacation.

If the employee did not use the right to a lump sum payment before the vacation, then it must be received before the start of the new year. This is due to the fact that the payment is not carried over to another year.