Working conditions on weekends and holidays

Weekly rest and holidays free from work are an inalienable right of employees, but sometimes the production process requires their presence at the workplace on weekends and holidays.

According to Parts 2 and 4 of Art. 113 of the Labor Code of the Russian Federation, the employer can involve employees in work, subject to their consent and taking into account the opinion of the trade union (if there is one), if there is a need to perform unforeseen urgent work and the further functioning of the organization depends on this. In some situations, employees’ consent to work on weekends and holidays is not required - these are listed in Part 3 of Art. 113 Labor Code of the Russian Federation:

- An accident or disaster is a complex situation that may require the help of a large number of people. An employer can involve employees on days off both to prevent a dangerous situation and to eliminate its consequences.

- The need to prevent accidents and property damage, which requires coordinated and prompt work of the team.

- A threat to the life and well-being of the people, an emergency situation or a military threat.

Important! By virtue of Part 7 of Art. 113 of the Labor Code of the Russian Federation, even in such difficult situations, hiring disabled people and mothers of young children to work on weekends is permissible only on the condition that this does not affect their health. In this case, the employer must obtain a medical certificate and notify each employee in writing of the right to refuse work on a day off.

What is it regulated by?

The issue of obtaining an additional free day is regulated by the labor legislation of the Russian Federation, and specifically Article 262. This document states that parents or guardians of disabled children can receive additional free days. At the same time, they are paid by the federal insurance service. Additional days off are provided for the above category of citizens to fulfill their parental responsibilities. The basis for their provision is considered to be a written statement from the employee.

Article 262 of the Labor Law states that those who have custody of a disabled child are given 4 additional free days per month. Not only parents, but also trustees or guardians can get an extraordinary day off. If there are several latter, then the weekends can be divided at their discretion. Women who work in the village are entitled to one extraordinary day off from work per month. We'll talk about how to pay for additional days off later.

Features of payment for work on weekends

If they are required to work at odd hours, that is, on a legal day off or holiday, employees can choose one of the compensation options: increased wages or an additional unpaid day off (Article 153 of the Labor Code of the Russian Federation).

We wrote more about working on a day off here

The procedure for calculating wages at an increased rate is described in Art. 153 Labor Code of the Russian Federation. The minimum wage for work during rest periods is double the normal wage. At the same time, the employer has the right to set the amount of payment independently in the local acts of the legal entity, taking into account the opinion of the trade union and not forgetting the requirements of Art. 8 of the Labor Code of the Russian Federation, according to which local regulations cannot worsen the situation of workers in comparison with federal legislation.

You can find out all the nuances of arranging and paying an employee time off for previously worked time on a weekend or holiday in the ready-made solution from ConsultantPlus. If you don't already have access to the system, get a free trial online. You can also get the current K+ price list.

Judicial practice shows that the employer is not obliged to pay for voluntary attendance at work on weekends and holidays. As an example, we can cite the appeal ruling of the judicial panel for civil cases of the Irkutsk Regional Court dated August 10, 2012 in case No. 33-6529/2012. The court refused to satisfy the plaintiff's demands for compensation for working on weekends, since in this case the initiative of the employee took place. The Judicial Collegium for Civil Cases upheld this decision and confirmed the findings of the Kuibyshevsky District Court of Irkutsk.

Calculation of wages for holidays and weekends depends on the wage system used by the employer. The features of each system are described in Art. 153 Labor Code of the Russian Federation.

Days off for women workers in rural areas

As described above, rural workers are provided, upon written request, with 1 additional day off per month without pay. Moreover, an employee may demand an additional day off under the Labor Code without specifying a reason. Since a priori it is assumed that this day will be dedicated to family and children. According to the law “On urgent measures to improve the situation of women, families, protection of motherhood and childhood in rural areas,” an employer does not have the right to refuse an employee.

An order is issued on additional days off.

You can negotiate the procedure for granting an additional day off either by drawing up an application monthly or by determining the number of additional days required at the beginning of the year, half-year, quarter, etc. Denial of an employee’s legal right to have a day off from work may serve as a reason to contact the labor commission for further proceedings, including judicial proceedings. After all, such a refusal is an illegal infringement of the rights of employees.

Calculation of wages for weekends and holidays with a piecework wage system

The law requires piece workers to be paid double rates on weekends. Here is an example of calculating payment on weekends.

For example, seamstress V.P. Mikhailova sewed 50 men's suits in April. At the same time, she went to work twice on Saturday and once on Sunday, making 7 suits during these days. Her earnings for one finished suit is 500 rubles.

First of all, it is necessary to calculate the seamstress’s earnings for April without taking into account work on weekends:

(50 – 7) × 500 = 21,500 rub.

Next, we calculate the payment for work on weekends:

500 × 7 × 2 = 7000 rub.

Now you can calculate the seamstress’s earnings for April:

21,500 + 7000 = 28,500 rub.

Characteristic features of receiving days off in certain industries

There are some sectors of the economy that have certain features in receiving days off and paying for them. For example, this applies to the civil aviation sector of the Russian Federation. For example, if a dispatcher was brought to work on a legally free day, he will certainly be offered another day to rest, since there is a legally regulated regime for the distribution of working time and rest for employees who manage air traffic.

Women working in the field of mechanical engineering and raising a child under the age of sixteen are given one extraordinary free day per month without pay. The same applies to women working in the field of transport construction.

Additional payment on holidays and weekends with a salary payment system

The amount of wages for work on weekends and holidays for salaried employees depends on three factors:

- salary size;

- the amount of time worked by the employee;

- the size of the daily or hourly rate (part of the salary).

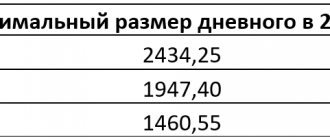

Methods for calculating daily/hourly rates

An important indicator necessary for correct payment on weekends and holidays is daily and hourly rates. The method for calculating them is not defined by law, but in practice several methods are used.

Detailed information on how to calculate and record wages for work on a non-working holiday for employees whose labor is paid at an hourly rate can be found in the ConsultantPlus material. If you don't already have access to the system, get a free trial online.

Examples of salary calculations when using a salary system at an enterprise

If an employee worked during rest periods in excess of normal working hours in the current month, his earnings include double the rate for a day or hour of work on weekends and a monthly salary. Let us give an example of calculating wages in this case.

For example, the salary of mechanic P.B. Tkachev is 35,000 rubles. In November he worked 174 hours, of which 24 he worked on the holiday of November 4, Saturday and Sunday. The standard working time this month was 150 hours. The actual labor time exceeded the norm by 24 hours. In this case, the compensation amount is doubled.

First of all, you need to calculate the employee's hourly rate. To do this, the salary is multiplied by 12 (according to the number of months) and the resulting product is divided by the annual standard of working hours. In this case, the annual rate is 1920 hours.

We calculate the hourly rate:

(35,000 × 12) / 1920 = 218.75 rubles.

Based on this figure, you can calculate the amount of the surcharge:

24 × 218.75 × 2 = 10,500 rubles.

Now you can calculate the amount for November:

35,000 + 10,500 = 45,500 rub.

The additional payment is calculated differently in the case where the employee worked on weekends, but the total number of working hours did not exceed the standard time for the month. In such a situation, in addition to the salary, the employee receives compensation in the amount of a single daily or hourly rate.

For example, employee Samsonov P.R., working for a salary of 40,000 rubles, worked 150 hours in August, 16 of which were on Saturday and Sunday. At the same time, during the month he took 2 days of vacation at his own expense. Thus, he did not exceed the monthly labor standard during this period and is entitled to payment of a single tariff rate in addition to his salary.

The first stage of calculating the salary of Samsonov’s employee is determining the hourly rate:

(40,000 × 12) / 1920 = 250 rubles.

At the next stage of calculations, you can determine the amount of the surcharge:

16 × 250 = 4000 rub.

The employee's full salary in August will be:

40,000 + 4000 = 44,000 rub.

Additional days off to care for a disabled person

Among the nuances regarding the documents required when applying for an extraordinary holiday, it should be taken into account that in addition to the child’s disability certificate itself, you will also need to obtain a certificate from the local social protection authorities with information that the child is not being held in special custody. institution, that is, not under the care of the state. However, this rule does not apply to detention in five-day and six-day boarding schools.

If one of the parents is not officially employed or is providing himself with work independently (for example, in the case of an individual entrepreneur), then the second working parent submits a certificate stating that his spouse is unemployed or provides himself with work independently. Only if such paper is provided will the working parent be allocated and paid for the required 4 days off from work per month. If one of the spouses takes part of the weekend, the other can take the remaining paid days off upon presentation of the certificate described above. If one of the parents is on vacation or maternity leave, then the second parent can use the right to provide additional free days.

Average earnings are calculated by dividing wages accrued for the billing period by the number of working days in this period based on the average working hours, in accordance with the legislation of the Russian Federation.